At its heart, the risk-reward ratio is a simple question every trader must answer before placing a trade: how much are you willing to lose versus how much do you hope to gain?

If you hear a trader talk about a 1:3 ratio, they mean they are risking $1 for a potential profit of $3. This simple metric isn’t just a piece of jargon; it’s the absolute bedrock of professional, long-term trading. It’s about shifting your mindset from “how can I win this trade?” to “is this trade worth the risk?”

Demystifying the Risk Reward Ratio

So many new traders feel this intense pressure to win every single trade. It’s a common struggle; we’re taught that winning is everything. But in trading, believing a sky-high win rate is the only path to profit is a fast track to frustration and emotional mistakes.

This is where understanding the risk-reward ratio completely changes the game. It’s a tool that shifts your focus. Instead of obsessing over being right, you start structuring your trades so your wins are meaningful enough to cover your losses — and still leave you profitable over time. This isn’t about finding a secret formula for guaranteed profits; it’s about building a disciplined, sustainable framework for every trade you even consider.

Why This Ratio Is a Game Changer

Adopting a risk-first mindset is what separates amateurs from professionals. You stop chasing quick, flashy profits and start managing potential outcomes. It’s a subtle shift, but it helps build the patience and emotional grit needed for long-term survival in the markets. Having a predefined ratio is your game plan, keeping you grounded even when a trade goes sideways.

The core benefits are crystal clear:

- Emotional Control: It stops you from panic-selling or making greed-driven moves by setting your exit points before you even enter a trade.

- Long-Term Viability: It ensures your winning trades have a much greater positive impact than your losing ones, which is how you grow an account steadily. This isn’t a get-rich-quick scheme; it’s a get-rich-slowly plan.

- Smarter Decisions: It forces you to evaluate every opportunity logically instead of jumping on a “hot tip” or trading on a whim.

By consistently applying a favorable risk-reward ratio, you can be profitable even if you lose more trades than you win. The goal is not perfection; it’s sustainable consistency built over hundreds of trades.

At a Glance Risk Reward Ratios

To make this even clearer, here’s a quick breakdown of common ratios and what they signal about a trading strategy.

| Ratio | What It Means | Commonly Used For |

|---|---|---|

| 1:1 | Risking $1 to make $1. | Scalping or strategies requiring a very high win rate to be profitable. |

| 1:2 | Risking $1 to make $2. | A balanced approach, often seen in day trading and swing trading. A great starting point. |

| 1:3 | Risking $1 to make $3. | A common target for traders who want their winners to significantly outweigh losers. |

| 1:5+ | Risking $1 to make $5 or more. | Trend-following or long-term position trading where you aim for major market moves. |

This table shows how different ratios align with different trading styles, from fast-paced scalping to patient trend-following.

The risk-reward ratio is a powerful concept, but it’s just one piece of a much larger puzzle. To see how it fits into a complete plan, you can explore more about comprehensive risk management for traders.

A Practical Guide to Calculating Risk Reward

Figuring out your risk-reward ratio isn’t some complex financial modeling exercise. It’s actually just simple arithmetic that gives every single trade a clear, logical foundation.

Getting this right comes down to making three specific decisions before you ever hit the “buy” or “sell” button.

First, you need your Entry Point, which is the price where you plan to get into the trade. Next, you have to decide on a Stop-Loss — the price that tells you your trade idea was wrong. This is your planned exit to make sure you cap your maximum loss. Think of it as your safety net.

Finally, you set a Take-Profit level. This is your target price, the spot where you’ll close the trade and lock in your gains. With just these three numbers, you have everything you need to calculate your ratio.

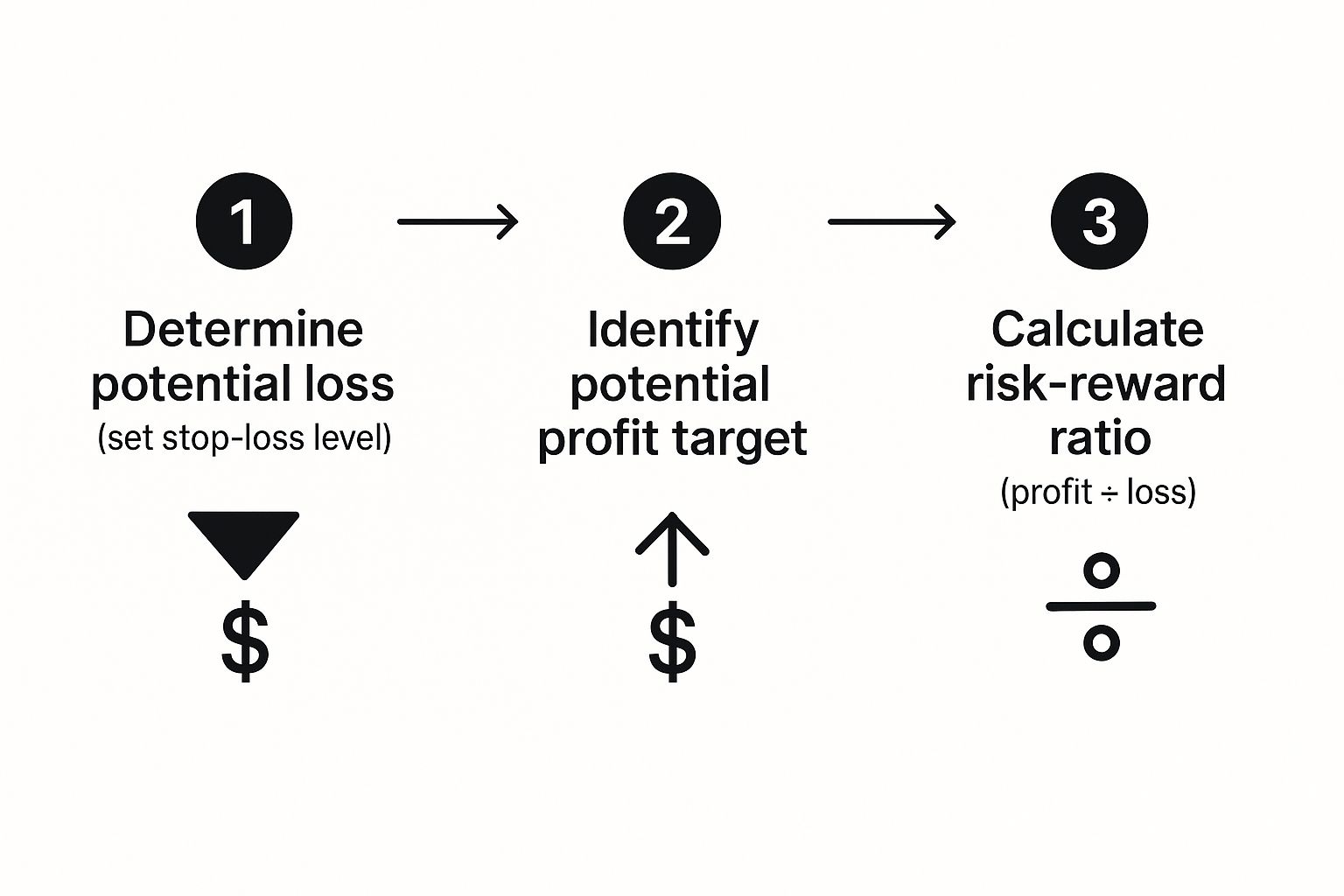

The Three Core Steps

The whole process is pretty straightforward, and it’s a great way to take emotion out of the equation. It forces you to think through all the potential outcomes before a single dollar is on the line.

Here’s a simple visual to break down the steps.

As you can see, the math is just a simple division: your potential profit divided by your potential risk. Let’s walk through how this works with a real-world example.

Putting the Formula into Action

Let’s imagine you’re looking to buy a stock that’s currently trading at $100. Your analysis tells you to place your stop-loss at $95 and set your take-profit target at $115.

- Potential Risk: $100 (Entry) – $95 (Stop-Loss) = $5 per share

- Potential Reward: $115 (Take-Profit) – $100 (Entry) = $15 per share

The formula is simply:

Risk-Reward Ratio = (Take-Profit Price – Entry Price) / (Entry Price – Stop-Loss Price)

Plugging in our numbers: $15 / $5 = 3. This gives you a 1:3 risk-reward ratio. In plain English, you’re risking $5 for the chance to make $15.

Of course, your stop-loss and take-profit levels shouldn’t be random guesses. They need to be based on actual market structure, like key support and resistance zones. While this ratio is a powerful tool, it’s most effective when you pair it with a solid win rate. For more on that, check out our guide on how to calculate win rate to see how these two metrics work together.

How a Good Ratio Protects Your Trading Psychology

The real magic of the risk-reward ratio goes way beyond the numbers on your screen — it’s your psychological shield. We’ve all been there: the heart-pounding stress of a losing trade or the anxious temptation to grab a small profit too early. The biggest battles for traders aren’t with the market, but with two powerful emotions: fear and greed.

A predefined ratio is your best line of defense. It forces you to have a clear, logical plan before a single dollar is at risk. This simple act keeps you from making panicked decisions when a trade goes south or from closing a winner way too early out of anxiety.

Freedom from the Need to Be Perfect

One of the most liberating feelings in trading is realizing you don’t have to be right all the time. A healthy risk-reward ratio, like 1:3, mathematically proves that you can be profitable even if you lose more often than you win.

This is a massive confidence booster. It shifts your goal from the impossible task of perfection to the much more achievable one of consistency. You stop seeing trading as a high-stakes guessing game and start treating it like a business where you manage probabilities over the long haul.

By defining your exit points for both a loss and a profit ahead of time, you remove the emotional guesswork. Your job is no longer to predict the future but to execute your plan with discipline, trade after trade.

This disciplined approach is what builds mental resilience. A trader who sticks to a 1:3 ratio, for example, can still be profitable with a modest 40% win rate. Why? Because the size of their wins more than makes up for their more frequent small losses.

Ultimately, this mental framework helps you stay in the game long enough to find and trust your edge. For traders looking to strengthen their mindset, exploring a curated list of books about trading psychology can provide invaluable strategies for maintaining composure and focus.

Applying Risk-Reward in Different Market Scenarios

Theory is great, but seeing the risk-reward ratio in the wild is what really makes it click. This isn’t some rigid rule; it’s a flexible tool that adapts to your trading style, timeframe, and whatever the market is throwing at you.

Let’s walk through two completely different scenarios to see how real traders put this concept to work.

Example 1: The Stock Swing Trader

Picture a swing trader keeping an eye on a popular tech stock, XYZ. They see it bounce cleanly off a major support level at $150 and decide to jump in. Their analysis suggests the stock has a clear path to its next resistance area around $180 over the next few weeks.

But they’re not just hoping for the best. To protect their capital, they place a stop-loss order just below that support level at $140. If they’re wrong, they’re out with a small, manageable loss.

Here’s how the math breaks down:

- Potential Risk: $150 (Entry) – $140 (Stop-Loss) = $10 per share

- Potential Reward: $180 (Target) – $150 (Entry) = $30 per share

A quick calculation — $30 reward divided by $10 risk — gives them a 1:3 risk-reward ratio. This is a classic setup for a swing trader who has the patience to let a trade play out over weeks.

Example 2: The Forex Day Trader

Now, let’s switch gears to the fast-paced world of a forex day trader. They’re watching the EUR/USD pair and spot a short-term downtrend. They decide to go short (sell) at 1.0750, aiming for a quick profit as the price drops to a nearby support level at 1.0710.

Because they’re in and out of the market so quickly, their risk has to be tight. They set their stop-loss just above a recent minor resistance point at 1.0770.

- Potential Risk: 1.0770 (Stop-Loss) – 1.0750 (Entry) = 20 pips

- Potential Reward: 1.0750 (Entry) – 1.0710 (Target) = 40 pips

In this case, the ratio is 40 pips of reward for 20 pips of risk, which simplifies to a solid 1:2 risk-reward ratio. This fits their intraday strategy perfectly, as they focus on catching smaller, more frequent moves.

As you can see, the core principle is the same even though the numbers and timeframes are totally different. Whether it’s stocks or forex, this ratio is fundamental. Interestingly, data shows that a day trader using a 1:2 ratio can be profitable with just a 55% win rate. Meanwhile, swing traders aiming for 1:3 or better often find they have a higher probability of success over the long haul. You can dive deeper into these trading strategy findings on Tradervue.com.

Common Risk Reward Mistakes and How to Avoid Them

Knowing the math behind the risk-reward ratio is one thing. Sticking to it when your money is on the line is a completely different ballgame. Every single trader, from the greenest rookie to the seasoned pro, has given in to emotional traps that blow up even the most carefully crafted plans.

The key is to see these moments not as failures, but as powerful learning experiences on the path to becoming a consistent trader.

It’s completely normal to feel that gut-punch when a trade starts moving against you. The urge to “give it a little more room to breathe” is incredibly strong, but it’s also one of the most destructive habits you can form.

Let’s break down the two biggest mistakes traders make.

Widening Your Stop-Loss

This is, without a doubt, the most common mistake. You enter a trade, and it immediately goes into the red. Instead of accepting the small, planned loss, you drag your stop-loss further down, hoping for a turnaround.

This single act completely destroys your original plan. What was a calculated, acceptable risk of $100 suddenly morphs into a $200 or $300 loss driven entirely by hope — not strategy. It happens because we are wired to hate being wrong. We’d rather risk a much bigger loss than take a small one and admit a trade didn’t work out.

The Fix: Treat your stop-loss as sacred. Once you set it based on solid, pre-trade analysis, it doesn’t move. Ever. Taking that small, planned loss isn’t a failure; it’s a huge win for your discipline.

Closing Winners Too Early

The flip side of hope is fear. You’re in a great trade, the profit is climbing, and everything is going according to plan. Then, the anxiety creeps in. What if it reverses? What if I give all this back? The fear of losing those unrealized gains becomes so overwhelming that you slam the “close” button, falling way short of your profit target.

This habit is just as deadly to your account as moving your stop-loss. A beautifully planned 1:3 trade becomes a mediocre 1:0.8 in reality. Over time, your small wins will never be big enough to cover your inevitable losses.

- The Problem: Fear of losing profits that aren’t even yours yet.

- The Outcome: Your winning trades get choked out, making it mathematically impossible to be profitable long-term.

- The Fix: Trust the work you did beforehand. You set a take-profit target for a reason, so let the trade do its thing. If you really struggle with holding on, consider taking partial profits at key levels to ease the psychological pressure.

At the end of the day, avoiding these pitfalls comes down to pure discipline. Your trading plan, built around a solid understanding of the risk-reward ratio, is your lifeline in the markets. Trust it, stick to it, and you’ll build the habits you need to protect your capital and thrive.

Putting Your Risk-Reward Ratio to Work in a Real Strategy

Knowing your risk-reward ratio is a huge step, but it’s not a magic bullet. To really succeed long-term, you need to plug this concept into a complete, disciplined trading plan — think of yourself as a business owner, not a gambler. The goal is to stop chasing quick wins and start managing risk like a pro who’s building an edge over time.

Alongside your risk-reward ratio, your strategy needs two other critical pillars to stand on:

- Smart Position Sizing: This answers the question, “How much should I actually risk on this trade?” A good rule of thumb is to risk no more than 1-2% of your total trading account on any single trade. This simple rule is a lifesaver, ensuring that one bad trade — or even a string of them — won’t wipe you out.

- A Detailed Trading Journal: This is non-negotiable. Logging every trade, including your planned risk-reward, what actually happened, and why you made your decisions, gives you priceless feedback. It’s the only way to see if you’re sticking to your plan or letting emotions get the best of you.

Start Thinking Like a Business Owner

When you start treating each trade like a calculated business decision, the emotional rollercoaster of wins and losses flattens out. Your journal becomes your performance report, and your risk management rules become your company policy. It’s this methodical approach that builds consistency.

Sustainable profitability isn’t born from luck or a few heroic trades. It’s the result of patient execution, disciplined risk management, and sticking to your plan day in and day out.

Even the most conservative investment strategies have always been a game of balancing risk and reward. Take the classic 60/40 portfolio — from 1901 to 2022, it delivered an average annual return of 4.89%. Sounds steady, right? But it also saw a peak drawdown of nearly -45%. You can dive deeper into the performance of diversified portfolios to see the data for yourself.

By combining the what is risk reward ratio principle with solid position sizing and a faithful trading journal, you’re not just trading — you’re building a resilient system designed to handle whatever the market throws at it and grow your account steadily over time.

Your Top Questions About Risk-Reward, Answered

As you start working with the risk-reward ratio, a few common questions always pop up. Let’s tackle them head-on so you can start applying this concept with confidence.

What’s a Good Risk-Reward Ratio for a Beginner?

Most seasoned traders will tell you to aim for a minimum of 1:2. Put simply, for every $1 you’re willing to risk, your goal should be to make at least $2 in potential profit.

Why start there? Because it instills discipline right from the get-go. It forces you to hunt for trades where the potential reward is significantly larger than the potential loss, which is a foundational habit for surviving and thriving in the markets. A 1:2 ratio also gives you a psychological cushion, as you can be wrong nearly half the time and still not lose money.

Does a High Risk-Reward Ratio Guarantee I’ll Make Money?

Absolutely not, and this is a critical point. A fantastic risk-reward ratio is just one piece of the puzzle. You have to pair it with a solid win rate. There are no guarantees in trading, only probabilities.

Think about it: a 1:5 ratio sounds great, but it’s completely useless if your strategy only wins 10% of the time. Those small, frequent losses will eat away at your account much faster than your rare, big wins can replenish it. The sweet spot is finding a balance between a good ratio and a strategy that wins often enough to be profitable over the long run.

Should I Stick to the Same Ratio for Every Single Trade?

Not necessarily. While setting a minimum standard (like 1:2) is a smart rule to live by, the ideal ratio often shifts with the market’s personality, the asset you’re trading, and your own personal style.

In a market that’s trending hard, you might easily find setups offering a 1:4 ratio. But in a choppy, sideways market, a logical setup might only present a 1:1.5 opportunity. The key isn’t rigid consistency but rather flexibility — always defining your risk and reward before you even think about clicking the buy or sell button.

Ready to stop guessing and start analyzing? TradeReview offers a powerful trading journal with performance analytics to help you track your risk-reward ratio, win rate, and other key metrics. See what’s working and what’s not with data-driven insights. Start journaling for free today at TradeReview.