Ever heard of a flight simulator for the financial markets? That’s the easiest way to think about paper trading. It’s the practice of buying and selling stocks, options, or other assets using virtual money in a live market environment. You get all the real-world experience without risking a single dollar of your hard-earned capital.

A Flight Simulator for the Financial Markets

Jumping straight into live trading without any practice is like trying to fly a 747 with no flight hours. The fear of making a costly mistake is real, and it can paralyze even the most determined beginner. We’ve all been there. This is exactly where paper trading becomes a game-changer.

It gives you a safe, structured space to learn the ropes.

Imagine a trading account pre-loaded with a virtual $100,000. You can use that “money” to execute trades based on real-time market data, letting you build genuine confidence and practical skills in a controlled setting. It’s all the action with none of the financial risk.

To give you a clearer picture, here’s a quick rundown of what paper trading involves.

Paper Trading at a Glance

| Feature | Description |

|---|---|

| Account Type | Simulation account using virtual (fake) money. |

| Market Data | Uses live, real-time data from actual financial markets. |

| Risk Level | Zero. You cannot lose real money. |

| Primary Goal | To practice trading mechanics, test strategies, and build confidence. |

| Best For | New traders learning the basics and experienced traders testing new ideas. |

This table shows just how powerful paper trading can be as a learning tool – it’s a perfect sandbox for any trader.

From Physical Notes to Digital Platforms

This concept isn’t some new tech fad; it has a long, proven history. Before everything went digital, traders would literally write down their hypothetical trades on paper to track how their strategies would have performed. You can discover more insights about its history on quadcode.com.

Today, that old-school method has evolved into sophisticated digital platforms that give everyone access to a powerful training ground.

A paper trading account is more than just a practice tool; it’s a place to forge discipline, test theories, and understand your own psychological reactions to market movements before your money is on the line.

Ultimately, paper trading serves a few critical purposes for anyone serious about finding long-term success:

- Learning the Mechanics: It’s the best way to master your trading platform. You can learn how to place different order types, use charting tools, and navigate the software without the pressure of losing money.

- Strategy Development: Think of it as your personal laboratory. You can build, test, and tweak your trading strategies against real-world price action to see what actually works.

- Building Confidence: There’s nothing like seeing your strategies succeed in a simulated environment. Managing a virtual portfolio helps build the self-assurance you need to trade live with a clear, disciplined mindset.

The True Benefits of Trading with Virtual Money

Sure, the most obvious perk of paper trading is that you can’t lose real money. But that’s just scratching the surface. The real value is in building the skills and mental toughness that separate successful traders from those who treat it like a casino – all without the gut-wrenching pressure of having your own capital on the line.

Think of it as your personal trading gym. It’s the perfect place to master the mechanics of your platform, from placing a simple market order to setting a complex stop-loss. This hands-on practice makes sure that when real money is involved, you won’t make a costly mistake just because you clicked the wrong button.

Developing and Testing Your Strategy

Paper trading is where your brilliant trading plan meets the cold, hard reality of the market. It lets you rigorously test your strategies against live data to see if they actually work. For example, if your strategy is to buy a stock when its 50-day moving average crosses above the 200-day moving average (a “golden cross”), paper trading lets you execute dozens of these trades to see if it consistently works in different market conditions.

This process isn’t just about finding a winning strategy; it’s about building unbreakable discipline. It forces you to define your rules for entry, exit, and risk management – and then stick to them.

This trial-and-error phase is absolutely essential for developing a long-term mindset. It helps you nail down your strategy’s real-world performance metrics, like its win rate and average risk-to-reward ratio. This data-driven approach is what separates the pros from the amateurs. You can learn more about why tracking this stuff is so critical in our guide on why every trader needs a trading journal.

The Psychological Training Ground

Beyond the technical skills, paper trading is a powerful psychological training ground. It helps you build the routines and discipline you need before emotional stress can cloud your judgment. So many traders fail not because their strategy is bad, but because fear and greed make them abandon their plan at the worst possible moment.

By practicing in a risk-free zone, you can focus on what truly matters:

- Consistent Execution: Can you follow your trading plan for 50 consecutive trades without letting your emotions take over?

- Routine Building: Developing a pre-market checklist, reviewing your trades daily, and sticking to a consistent schedule.

- Emotional Awareness: Noticing how you react to a string of virtual losses or a big virtual win.

And this isn’t just a tool for beginners. Seasoned pros constantly use paper trading to test new ideas or adapt to changing market conditions. It’s a professional’s secret weapon for staying sharp and ensuring their strategies keep their edge over time.

Paper Trading vs Live Trading: The Emotional Gap

Paper trading is a fantastic way to learn the ropes and test-drive your strategies, but it comes with one massive caveat – it can’t prepare you for the emotional rollercoaster of having real money on the line. This is what traders call the “emotional gap,” and understanding it is crucial to getting the most out of your practice.

When a trade is just numbers on a screen, making logical, clear-headed decisions is easy. But the second your own capital is at risk, powerful emotions like fear and greed crash the party. This psychological pressure is, without a doubt, the single biggest difference between simulated and real trading.

It’s easy to see how this can be a problem. A string of virtual wins might build a false sense of security, making you overconfident. On the flip side, a simulated loss doesn’t sting nearly as much as a real one, meaning you never learn to manage the genuine anxiety that hits when a trade goes against you.

To get a clearer picture, let’s break down the core differences between a simulated environment and the real deal.

Key Differences Between Paper and Live Trading

| Aspect | Paper Trading | Live Trading |

|---|---|---|

| Psychological Impact | Low emotional stress. Decisions are often logical and detached. | High emotional stress. Fear, greed, and anxiety are constant factors. |

| Risk | Zero financial risk. You can’t lose real money. | Real financial risk. Every trade impacts your actual capital. |

| Decision-Making | Easier to stick to the plan and let trades play out. | Difficult to remain disciplined; emotions can lead to impulsive actions. |

| Learning Outcome | Excellent for learning technicals, platform mechanics, and strategy rules. | The ultimate test of emotional control, risk management, and discipline. |

| Slippage & Fills | Orders are typically filled instantly at the ideal price. | Real-world delays (slippage) can result in less favorable entry/exit prices. |

As you can see, the leap from paper to live trading is less about strategy and more about mastering your own psychology.

Bridging the Psychological Divide

So, how do you make your practice sessions feel as real as possible? The goal is to build the right habits from day one. Start by treating your virtual portfolio with the same seriousness you would a live one. That means setting strict rules for yourself and sticking to them, no excuses.

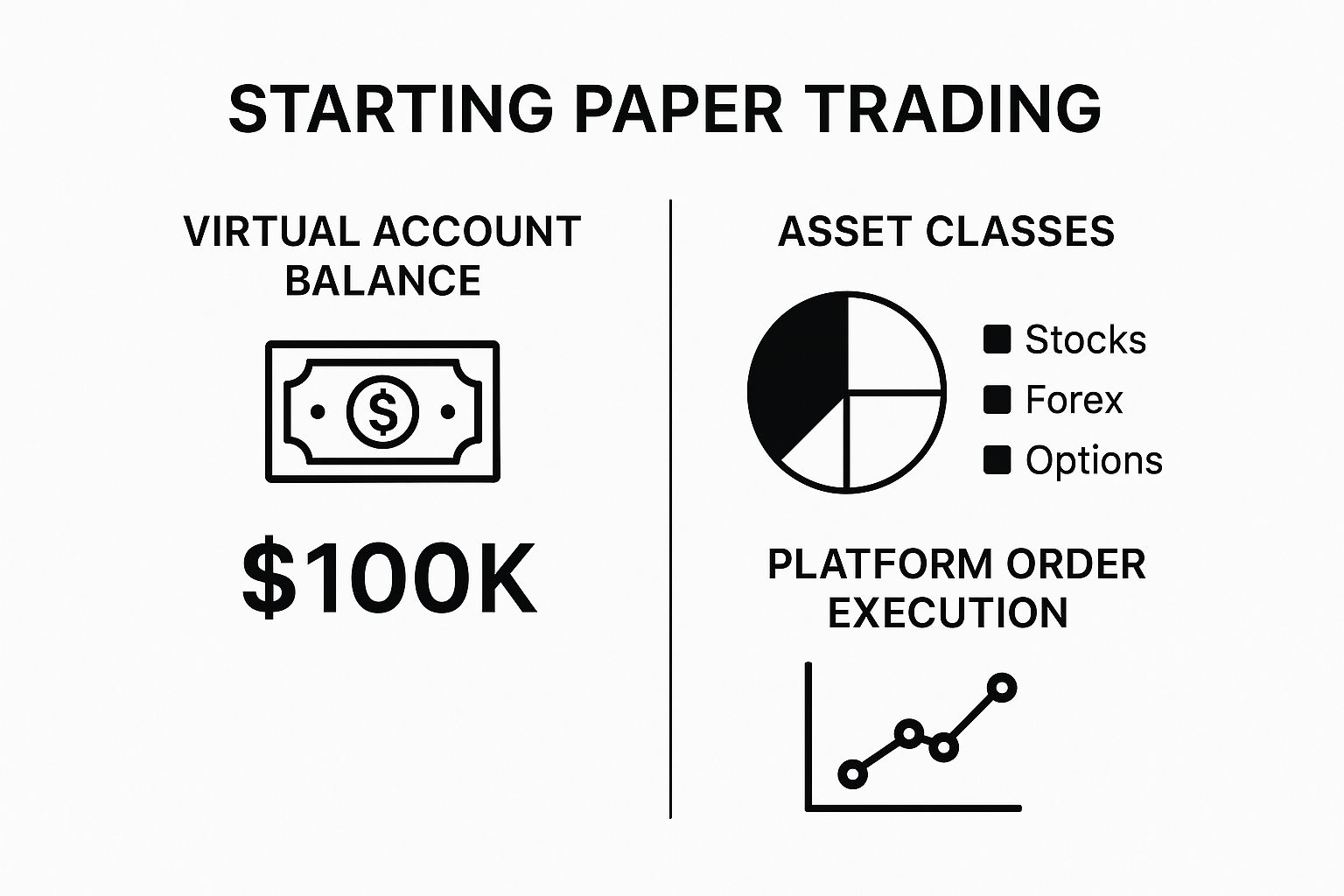

This infographic breaks down some key things to look for when you’re getting started, helping you pick a platform that sets you up for a realistic trading experience.

As the visual shows, different platforms offer varying starting balances and asset types. It’s important to choose one that mirrors what you plan to do in the real world.

To really close that emotional gap, you need to document everything in a detailed trading journal. Don’t just log the trade details; write down how you felt. Were you anxious placing the trade? Impatient while you waited for it to play out? This kind of self-analysis is absolutely critical for building emotional discipline.

By practicing this way, you’re not just clicking buttons – you’re training your mind to follow a logical process, a skill that will be your best friend in live trading. For those looking to take logic to the next level, you can explore other data-driven approaches in our guide on what is algorithmic trading.

The most important lesson from paper trading isn’t just finding a profitable strategy; it’s proving you have the discipline to execute that strategy flawlessly when your emotions are trying to take control.

How to Start Paper Trading the Right Way

So, you’re ready to jump into paper trading? It’s easy to get started, but doing it right is another story. This isn’t just about clicking buttons; it’s about building the discipline and skills you’ll need when real money is on the line. The goal is to make your practice environment feel as close to the real thing as possible.

The first step is picking a platform that matches where you want to go as a trader. Most online brokers offer fantastic, free paper trading accounts that pull in real-time market data. You’ll want to find one that gives you access to the assets you’re actually interested in, whether that’s stocks, options, or crypto.

Setting Up for Realistic Practice

Once you have a platform, it’s time to set up your account for a simulation that actually teaches you something. Most paper trading accounts will start you with a massive default balance, often something wild like $1,000,000. You need to change this immediately.

Adjust that virtual balance to an amount you realistically plan to fund your live account with. If you’re aiming to start with $10,000, then your paper trading account should be set to $10,000. This simple tweak forces you to learn proper risk management and position sizing – skills that are absolutely critical for survival in the live markets. Trading with a million fake dollars won’t teach you a thing about managing a real-world portfolio.

The point of paper trading isn’t to get a high score. It’s to build habits you can carry directly into a live trading environment. Starting with realistic capital is the bedrock of that process.

Your First and Most Important Tool

Before you even think about placing your first virtual trade, you need a trading journal. Get this set up from day one. A journal is what turns random clicking into a structured learning process. It’s how you get better, faster.

Your journal needs to track more than just your wins and losses. For every trade, you should be noting:

- Your Rationale: Why did you take this trade? What was the specific setup you saw?

- Your Strategy: What rules did you follow for your entry, exit, and stop-loss?

- Your Emotions: How did you feel when you entered? What about when the trade started moving against you? Did you get nervous?

This is what separates serious traders from hobbyists. This kind of detailed record-keeping lets you go back, review your performance, find the weak spots in your strategy, and understand your own psychological triggers.

This is exactly where a tool like TradeReview comes in. It’s built specifically for this, helping you analyze your trades with hard data instead of just relying on emotional guesswork.

Common Mistakes to Avoid in Paper Trading

Paper trading is a fantastic tool, but let’s be honest – it can build some seriously bad habits if you don’t approach it with the right mindset. The goal isn’t just to practice clicking buttons. It’s to forge the discipline and emotional control you’ll need when your own money is on the line.

Avoiding a few common pitfalls is the key to making sure your practice actually translates into real-world success.

One of the biggest mistakes is treating virtual money like it’s a video game. With no real consequences, it’s incredibly tempting to take massive, high-risk bets you’d never dream of with your life savings. This “monopoly money” effect teaches you absolutely nothing about managing the very real emotions of fear and greed that show up in live trading.

Developing Unrealistic Habits

Another major trap is over-trading. Most simulators don’t have commissions or fees, so it’s easy to fire off dozens of low-quality trades you wouldn’t touch in a live environment. This builds a terrible habit of impulsive decision-making instead of patient, strategic execution.

To fight back against these tendencies, you have to impose realistic constraints on yourself.

- Apply a Strict Risk Rule: Never risk more than 1% of your virtual capital on a single trade. For example, on a $10,000 account, never risk more than $100 per trade. This rule forces you to think carefully about every single position.

- Set a Realistic Starting Balance: Forget the default $1 million. Adjust your account to an amount you actually plan to trade with, like $5,000 or $10,000.

- Track Everything: Document every trade – your reasoning, your emotions, the outcome. A detailed log keeps you honest and accountable. You can get a deeper dive into this process by learning about what a trading journal is and why it’s vital for your success.

The purpose of paper trading is not to see how much fake money you can make. It’s to prove you can consistently follow a disciplined trading plan, regardless of the outcome of any single trade.

This disciplined approach is what makes the difference. Data shows that around 60-70% of new traders use paper trading to test their strategies, which leads to a 40% higher efficiency in refining their methods compared to those who don’t. Discover more insights about paper trading statistics on corporatefinanceinstitute.com. By treating practice seriously, you’re not just playing a game – you’re building a foundation for a long-term trading career.

Frequently Asked Questions About Paper Trading

As you start exploring paper trading, you’re bound to have some questions. It’s a fantastic tool, but understanding its quirks and limitations is key to getting the most out of your practice. Let’s clear up some of the most common questions new traders ask.

How Long Should I Paper Trade Before Using Real Money?

This is probably the most asked question, and the honest answer is: there’s no magic number. It’s about consistency, not the calendar. While many suggest 3-6 months, the real milestone is when you can prove to yourself that you can follow your trading plan without deviation for an extended period, say 50 or 100 trades.

The real goal isn’t just to be profitable in a simulation. It’s about proving you can stick to a well-defined strategy, even when you hit a losing streak. When you can execute your trading plan without letting emotion take over and you truly understand your performance stats, that’s when you might be ready to move to a small, real money account.

The moment you’re ready for live trading is when your process becomes more important than your profit and loss. It’s when you can trust your system, not your gut feelings.

Are Paper Trading Platforms Truly Accurate?

For the most part, yes. Reputable platforms use real-time or slightly delayed market data, so the price action you see is a very accurate reflection of the live market. You get a genuine feel for how assets move and how your strategies might play out.

That said, they can’t perfectly mimic every single aspect of live trading. For instance, order fills are usually instant in a simulation. In the real world, you’ll run into slippage, which means the price can change in the split second between when you click “buy” and when your order is actually filled. Think of a paper trading platform as a 99% accurate simulation – it’s perfect for strategy development, but it won’t prepare you for every friction of the live market.

Can I Paper Trade Different Markets Like Crypto and Forex?

Absolutely. The world of paper trading has grown way beyond just stocks. Most modern brokers and specialized trading apps now offer virtual accounts for a whole range of asset classes.

This includes:

- Stocks and ETFs: The classic starting point for most new traders.

- Options: A great way to practice complex strategies without risking a dime.

- Forex: Trade major and minor currency pairs in a 24/5 market.

- Cryptocurrencies: Test your ideas on volatile assets like Bitcoin and Ethereum.

Just make sure to check that the platform you choose offers a virtual environment for the specific markets you want to trade live down the road.

Ready to turn your practice into performance? TradeReview provides the analytical tools you need to track every trade, understand your habits, and build a data-driven strategy. Start journaling for free and transform your trading today at https://tradereview.app.