Trying to perfectly time the market is a recipe for stress and a goal that eludes even seasoned professionals. We’ve all been there, agonizing over when to buy, only to watch the price move in the opposite direction. Dollar cost averaging, or DCA, is a simple strategy that takes that guesswork and emotional turmoil out of the equation.

At its core, DCA involves investing a fixed amount of money at regular intervals, no matter what the market is doing. It’s less about chasing the perfect entry point and more about building a position with discipline over time.

The Core Idea Behind Dollar Cost Averaging

Let’s break it down. Instead of trying to nail the “buy low, sell high” mantra on every single trade – a near-impossible task – DCA offers a disciplined, almost automatic approach. It’s designed to combat the biggest enemy of most investors: their own emotions. We know how hard it is to stay calm when markets are chaotic.

When you commit to investing a set amount on a regular schedule, you sidestep the panic-selling that happens during a downturn and the fear of missing out (FOMO) that drives poor decisions during a rally. The paralyzing question of “Is now the right time?” simply disappears.

An Everyday Analogy: The Avocado Method

Think about it like buying avocados at the grocery store. Some weeks they’re pricey, and other weeks they feel like a steal. If you commit to buying two avocados every single Sunday, no matter the cost, you’ll naturally get more of them for your money when they’re cheap and fewer when the price spikes.

Over the year, your average cost per avocado smooths out. You didn’t need a crystal ball to predict the sales; you just stuck to the plan with discipline. DCA applies this exact same common-sense logic to assets like stocks or crypto.

By investing a consistent amount, like $100 every month, you automatically buy more shares when prices are low and fewer when they’re high. Over the long term, this can significantly lower your average cost per share.

This entire strategy is built on a few straightforward principles:

- Consistency is Crucial: The real power comes from investing the same amount on a fixed schedule, whether that’s weekly, bi-weekly, or monthly. Discipline is key.

- It Removes Emotion: You stick to your plan regardless of scary market headlines. This keeps fear and greed from hijacking your decisions.

- Focus on the Long Term: DCA isn’t a get-rich-quick scheme. It’s a powerful method for steadily building wealth over years, helping you manage the unavoidable ups and downs of the market.

How DCA Smooths Out Your Investment Journey

Market volatility can feel like a stomach-churning rollercoaster. For many investors, the gut reaction during a steep drop is to slam the panic button and sell. We’ve seen it happen time and again. This is exactly where dollar cost averaging shines, turning those unpredictable market swings into a potential advantage.

When you invest consistently, you completely reframe how you see the market. Instead of dreading downturns, you can start to see them as discount opportunities – a chance to buy more of your chosen asset while it’s on sale. This simple but powerful mental shift helps you stay disciplined and focused on the long game.

Turning Volatility Into an Opportunity

Let’s say you decide to invest $100 every month into a stock you believe in for the long run. The mechanics are beautifully simple: when the stock price is low, your fixed $100 buys more shares. When the price is high, that same $100 buys fewer shares.

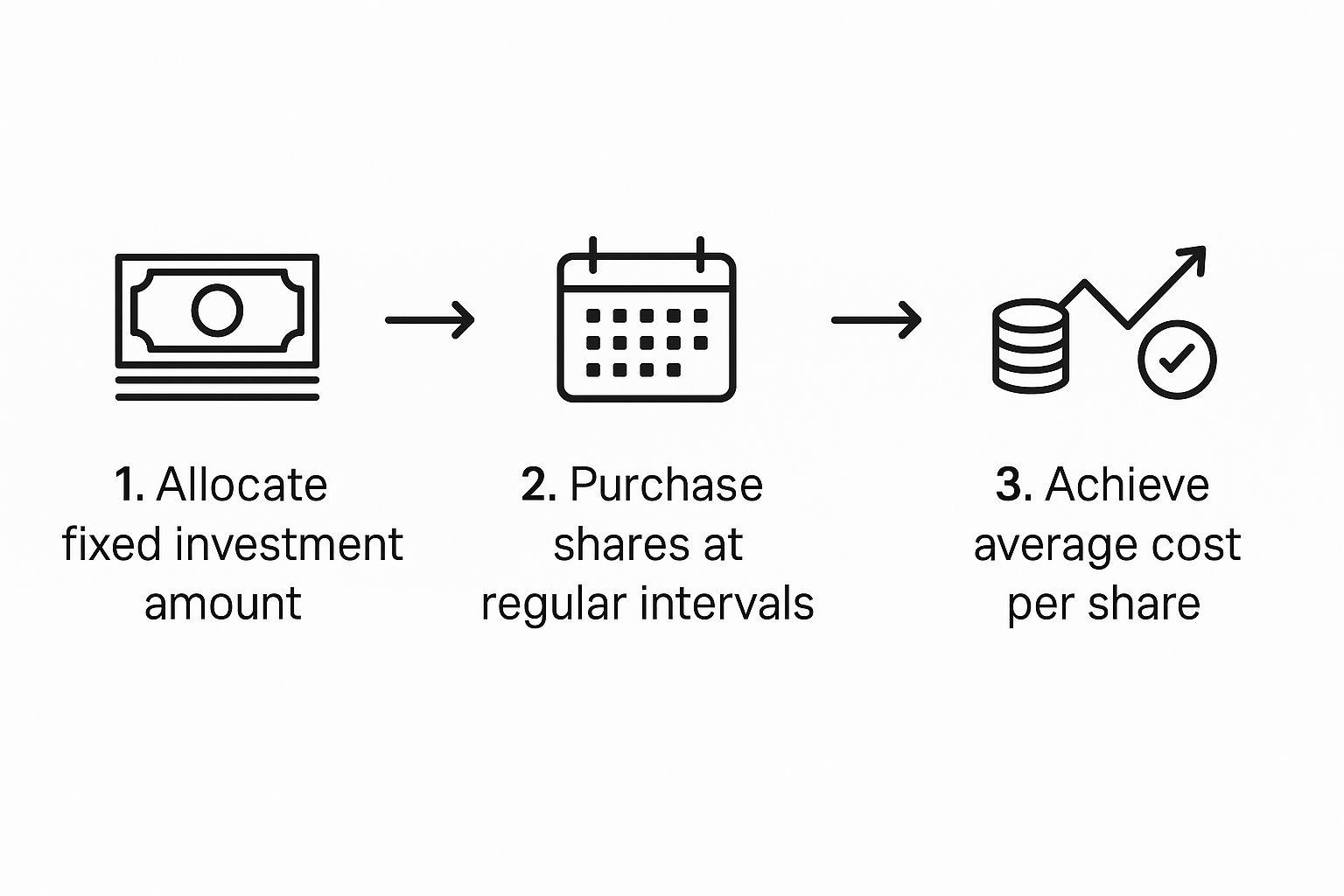

This infographic breaks down that simple, three-step flow.

As you can see, a fixed investment amount plus a regular buying schedule naturally lowers your average cost per share over the long run.

Over several months or years, this automatic process smooths out your purchase price. The result? Your average cost per share is often much lower than if you’d tried to time the market and dumped in a lump sum, especially near a peak. It’s a practical way to lower your risk without needing a crystal ball.

And this isn’t just a feel-good theory; historical data often supports it. For instance, one analysis of S&P 500 data found that while a perfectly timed lump sum investment did better, a badly timed one (at a market peak) performed worse. In contrast, using dollar cost averaging during those exact same periods could improve returns, proving it’s a solid hedge against bad timing.

The real magic of DCA isn’t just financial – it’s psychological. It gives you a structured plan that helps you stay in the market and prevents you from making emotion-driven mistakes, which are almost always the most expensive ones.

By automating your investments, you take the daily stress of market-timing off the table. It’s a disciplined approach, much like the automated strategies in algorithmic trading, where systems run on rules, not emotions.

Seeing Dollar Cost Averaging in the Real World

Theory is one thing, but seeing dollar cost averaging in action is what really makes the concept click. Let’s walk through a couple of practical, real-world scenarios that show how this strategy works for everyday people with real financial goal – and real anxieties.

These stories aren’t about getting rich quick. They’re about the power of discipline and consistency in building a financial future while managing the very human stress that comes with putting your money into the market.

Alex The Steady Saver

First, meet Alex. They’re a young professional just getting started with retirement savings. The whole idea of “timing the market” feels completely overwhelming, so Alex decides to keep it simple: an automatic $200 investment into a stock index fund, scheduled for the 15th of every single month.

Here’s a simplified look at how this plays out over six months in a typical, fluctuating market.

A 6-Month DCA Investment Example

This table shows how Alex’s consistent $200 monthly investment buys a varied number of shares as the price changes. Watch how it ultimately lowers the average cost per share.

| Month | Investment | Share Price | Shares Bought | Total Shares | Average Cost Per Share |

|---|---|---|---|---|---|

| Jan | $200 | $100 | 2.00 | 2.00 | $100.00 |

| Feb | $200 | $110 | 1.82 | 3.82 | $104.71 |

| Mar | $200 | $90 | 2.22 | 6.04 | $99.34 |

| Apr | $200 | $85 | 2.35 | 8.39 | $95.35 |

| May | $200 | $105 | 1.90 | 10.29 | $97.18 |

| June | $200 | $115 | 1.74 | 12.03 | $99.75 |

Notice what happened in March and April? When the share price dropped, Alex’s fixed $200 bought more shares. This is the magic of DCA – it automatically turns market dips into an opportunity, pulling down the average cost per share without Alex having to do a thing.

Ben The Cautious Inheritor

Now let’s look at Ben, who just received a $20,000 inheritance. The thought of investing it all at once is terrifying. What if the market crashes the very next day? This fear, known as timing risk, is a huge hurdle for a lot of people, and it’s completely understandable.

Instead of trying to nail the perfect entry point, Ben decides to use DCA to ease the money into the market over 18 months. That works out to about $1,111 each month. This approach lets Ben get started without the paralyzing fear of investing everything at a temporary peak.

This strategy is more relevant than ever. With an estimated $70 trillion in wealth expected to be transferred in the U.S. over the next 25 years, countless people just like Ben will face this exact situation. DCA offers a sensible, calm way forward.

For Ben, the goal isn’t just about maximizing every penny of profit. It’s about minimizing regret and anxiety. This disciplined method provides peace of mind by taking the impossible burden of predicting the future completely off the table. You can find more great insights on managing a financial windfall on VanEck.com.

The Honest Pros and Cons of DCA

Let’s be clear: no investment strategy is a silver bullet, and that includes dollar cost averaging. It’s not a path to guaranteed profits. This method is brilliant in some situations but comes with real trade-offs in others. Understanding where DCA shines – and where it falls short – is the key to deciding if it actually fits your long-term goals.

At its core, DCA is a powerful tool for building discipline. By putting your investments on autopilot, you sidestep the single biggest hurdle for most people: emotional decision-making. It makes investing feel less like a high-stakes guessing game and more like a simple, repeatable habit.

The Upside of a Disciplined Approach

The real magic of dollar cost averaging lies in risk management and behavioral psychology. It’s a structured approach that forces you to think long-term, which is where sustainable wealth is often built.

- Reduces Emotional Stress: It completely takes the guesswork out of the equation. You no longer have to lose sleep wondering if it’s the “perfect” time to buy. You just buy.

- Lowers Risk of Bad Timing: By spreading out your purchases, you avoid the soul-crushing mistake of putting all your money into the market right before a major crash.

- Builds Consistent Habits: Automating your investments is one of the best ways to build discipline. And keeping a record of these trades can supercharge that process. You can learn more about this in our guide to using a trading journal.

The Downside of Playing It Safe

Of course, this safety-first approach isn’t without its own set of drawbacks. In a strong, rising market (a “bull market,” where prices are generally going up), DCA will almost always be outperformed by a lump-sum investment. The reason is simple: investing all your cash at the start gives it more time to grow and compound.

DCA is fundamentally a risk-management strategy, not a profit-maximization one. Its main purpose is to smooth out your entry into the market and minimize regret, even if that means leaving some potential gains on the table.

Study after study has shown that, historically, investing a lump sum beats DCA about two-thirds of the time because markets tend to rise over the long term. But that same research also points to DCA’s huge psychological edge – it reduces anxiety and helps investors avoid the kind of panic that can derail a strategy after one bad decision. If you want to dive into the data yourself, you can read more about the lump sum vs. DCA debate.

Deciding If DCA Is the Right Move for You

So, is dollar cost averaging the right strategy for your financial journey? The honest answer is: it depends. It all comes down to your long-term goals, your timeline, and most importantly how you feel about the market’s inevitable roller coaster ride.

There’s no single “correct” answer here. It’s about asking the right questions to figure out what fits you.

DCA is practically built for the long-term investor who prefers consistency over chasing spectacular, risky highs. It’s an especially great fit if market swings make you anxious or if you’re just starting out by investing small, regular amounts from your paycheck.

Who Benefits Most from DCA?

This disciplined approach really shines for certain types of investors. You might find DCA is a perfect match if you are:

- Investing for the long haul and have the patience to ride out market cycles.

- Prone to emotional decisions and need a system to prevent panic-selling or FOMO-buying.

- Investing a large windfall (like an inheritance or bonus) and want to ease into the market to avoid bad timing.

- A beginner who wants to build a simple, sustainable investing habit from day one.

On the other hand, if you have a high tolerance for risk and a strong conviction that the market is at a low point, a lump-sum investment might feel more appropriate. A great way to test your nerve without risking real money is to see what paper trading is and how it can help you build confidence in your strategy.

At the end of the day, the most proven path to building wealth is that consistent ‘time in the market’ is far more powerful than trying to ‘time the market.’ DCA is a strategy built entirely around that timeless truth.

It gives you a steady, methodical path forward. DCA removes the paralyzing fear of making the “perfect” move and replaces it with the quiet confidence that comes from taking consistent action.

Frequently Asked Questions About DCA

Now that we’ve covered the what, why, and how of dollar cost averaging, let’s dig into a few common questions. Getting these details straight can make all the difference when you’re putting your plan into action.

How Often Should I Invest With DCA?

Most people default to a monthly schedule because it lines up nicely with their paychecks, but the real secret isn’t the frequency. It’s the consistency.

Whether you decide to invest weekly, bi-weekly, or monthly, the best schedule is the one you can stick to without a second thought. Just set it and forget it. This builds the discipline to keep buying even when the market looks scary which is often when the best long-term opportunities are found.

Does Dollar Cost Averaging Work For Crypto?

It absolutely does. In fact, DCA is almost tailor-made for volatile assets like cryptocurrency. The wild price swings that make crypto investing so nerve-wracking are exactly what DCA helps smooth out.

By investing a fixed amount on a regular basis, you avoid the classic mistake of dumping a huge sum of money into a coin at its peak, right when the FOMO is at its loudest. It’s a sane approach to a sometimes-insane market, promoting a long-term perspective.

Is DCA The Same As Buying The Dip?

Nope, and it’s a really important difference. DCA is a proactive, automated strategy that runs on its own. You’re not trying to predict anything; you’re just following a disciplined, long-term plan.

“Buying the dip,” however, is a reactive, market-timing tactic. It’s all about trying to guess when an asset has hit rock bottom. DCA takes the guesswork out of the equation, while buying the dip is nothing but guesswork.

When Should I Stop Using DCA?

If you’re like most people investing out of your regular income, you don’t really stop. DCA just becomes your long-term method for consistently building your portfolio over your entire investing life.

The main exception is if you’re using DCA to invest a lump sum, like an inheritance or a bonus. In that case, your DCA plan simply ends once you’ve invested the full amount according to your pre-determined schedule.

Ready to stop guessing and start analyzing? TradeReview offers a powerful trading journal to track every move you make, helping you build discipline and refine your strategy with data-driven insights. See how tracking your trades can transform your performance at https://tradereview.app.