A trading time frame is the specific duration you use to analyze the market and execute your trades. This could be anything from a few frantic seconds on a one-minute chart to a calm, multi-year outlook on a monthly chart. This single choice is the foundation of your entire trading strategy, influencing everything from the charts you watch to the stress you feel at the end of the day.

Why Your Trading Time Frame Defines Your Success (or Failure)

Choosing a trading time frame is one of the most critical decisions a trader makes, yet so many people jump in without a second thought, often leading to frustration and burnout. We’ve all been there – feeling like we’re constantly a step behind the market.

Think of it like choosing your gear for a race. A sprinter wouldn’t wear heavy marathon shoes, and a long-distance runner wouldn’t waste energy on explosive starting blocks. Each athlete is equipped for a specific objective. Trading is no different.

Forcing yourself into a time frame that clashes with your personality or daily schedule is a recipe for disaster. It leads to missed opportunities, forced trades, and a whole lot of unnecessary stress. If you’re a patient person with a full-time job, trying to scalp the five-minute charts during your lunch break is a path to emotional exhaustion and poor decisions, not profit.

This guide is built on one simple truth: there is no single “best” trading time frame. The only one that matters is the one that aligns perfectly with you.

Finding Your Personal Market Rhythm

Lasting success in trading doesn’t come from a secret indicator or a perfect chart pattern. It comes from achieving a sustainable balance between your strategy, your lifestyle, and your own mind. It’s about building a disciplined, long-term approach, not chasing quick wins.

The goal is to find a rhythm that feels natural, not one that leaves you second-guessing every move. And that requires some honest self-assessment.

Think about these core elements:

- Your Personality: Are you patient and analytical, or do you thrive on quick, decisive action?

- Your Schedule: Can you dedicate hours to the screen each day, or do you only have time for a quick check-in after work?

- Your Goals: Are you looking for supplemental income, or are you trying to build long-term wealth?

The market doesn’t care about your schedule or temperament. It’s your job to find a time frame that allows you to engage with the market on your own terms, not the other way around.

Ultimately, self-awareness is your greatest trading asset. This guide will set the foundation for discovering your ideal fit, helping you move from a place of confusion to one of clarity and confidence.

To get started, let’s quickly break down the most common trading styles and the time frames they typically use. This table is a great reference point to see where you might fit in.

Trading Styles and Their Time Frames at a Glance

| Trading Style | Typical Time Frame | Holding Period | Commitment Level |

|---|---|---|---|

| Scalping | 1-minute to 5-minute charts | Seconds to minutes | Very High (hours per day) |

| Day Trading | 5-minute to 1-hour charts | Minutes to hours | High (several hours per day) |

| Swing Trading | 4-hour, daily, and weekly charts | Days to weeks | Medium (a few hours per week) |

| Position Trading | Daily, weekly, and monthly charts | Weeks to years | Low (minutes per week/month) |

As you can see, the shorter the time frame, the more active you need to be. Now, let’s dive into the specifics of each of these approaches to figure out which one makes the most sense for you.

The Fast Pace of Short-Term Trading

For traders who thrive on action, intraday trading is where the magic happens. It’s a world where decisions are made in minutes, not months. The whole game is about getting in and out of positions within a single trading day, using a short-term trading time frame to capture small, quick price moves.

This high-energy style isn’t for everyone. It demands your full attention, unwavering discipline, and a very specific mindset. Within this fast-paced world, two main styles stand out.

Scalping The Quickest Moves

Scalping is trading in its most raw and rapid form. We’re talking about making decisions based on charts as short as one to five minutes. A scalper’s entire goal is to capture tiny, fleeting profits, often getting in and out of a trade in just a few seconds or minutes.

For example: A scalper might see a stock like TSLA briefly stall at $180.50 on a 1-minute chart, then notice a surge of buying volume. They might jump in at $180.60 and aim to exit at $180.90, capturing a 30-cent profit per share in under 90 seconds. It’s a game of volume and speed.

This style is not for the faint of heart. It takes intense focus, lightning-fast reflexes, and an almost intuitive feel for the market’s pulse. If you’re curious about this high-octane approach, you can dive deeper into our guide on what scalping trading is to see if it matches your personality.

Classic Day Trading

Classic day trading is a little slower, but it’s still incredibly active. Day traders typically work with time frames ranging from 15 minutes to one hour. They might analyze the morning’s action to form a bias, then hold a position through lunch to catch a more significant part of an intraday trend.

While still confined to a single day’s session, their decision-making process is a bit more analytical than a scalper’s pure-reflex approach.

The appeal of short-term trading is obvious. You get instant feedback on your strategy and maybe most importantly – you eliminate overnight risk. When the closing bell rings, you’re flat. No worries about what happens while you sleep.

The constant activity of short-term trading can feel exhilarating, but it’s a double-edged sword. Every tick of the chart presents a new decision, creating a high-pressure environment that can quickly lead to emotional exhaustion if not managed with discipline.

The Realities of High-Frequency Trading

If you choose a short-term trading time frame, you must be ready for serious challenges. The mental toll is immense. The stress of making constant, high-stakes decisions can be completely draining, and there are no guaranteed profits.

On top of that, transaction costs like commissions and slippage (the difference between your expected price and the price you actually get) are a much bigger deal. When you’re executing a high volume of trades, those small fees can quickly eat away at your bottom line.

The intensity is reflected right in the market data. Shorter time frames dramatically impact market volume and liquidity. Historical data consistently shows huge spikes in trading activity on 1-minute, 5-minute, and 15-minute charts, especially around the market open and close. This is where high-frequency algorithms and institutional orders are most active.

To truly thrive in the short-term arena, you need more than just a good strategy. It demands unwavering emotional discipline, a serious time commitment, and a rock-solid understanding of how to manage risk when the market is moving at its fastest.

Finding Your Balance with Swing Trading

If the breakneck pace of day trading feels overwhelming, but the slow burn of long-term investing isn’t quite your style, then swing trading might be the perfect fit. It’s a popular approach that offers a powerful middle ground, focusing on a trading time frame designed to capture market “swings” that unfold over several days or even weeks.

Instead of being glued to the 5-minute charts, swing traders step back and look at the bigger picture. Their go-to tools are the 4-hour and daily charts, which help filter out the chaotic noise of tiny, intraday price moves. You’re not chasing every tick; you’re riding the bigger waves of momentum.

If you’re weighing the pros and cons of these two popular styles, our guide on swing trading vs. day trading breaks down the key differences.

How a Swing Trader Thinks

So, what does this look like in practice?

A practical example: A trader spots that a well-known tech stock is in a solid, confirmed uptrend on its daily chart. The direction is clear. But instead of just jumping in, they zoom into the 4-hour chart to pinpoint a smarter entry, perhaps waiting for the price to pull back to a key moving average before pulling the trigger.

This is multi-time-frame analysis at its best aligning a tactical entry with a much larger, strategic trend. The goal isn’t to nail every little wiggle but to ride a more significant, sustained move.

Perhaps the biggest advantage here is freedom. Swing traders don’t need to be chained to their desks all day. A quick check-in once or twice a day is usually all it takes to manage positions, making it a fantastic option for people with full-time jobs.

Swing trading is a test of calculated patience. The real challenge isn’t just finding the trade; it’s having the discipline to hold it through minor bumps to capture the bigger, more meaningful move.

Embracing the Psychological Game

Of course, no style is without its challenges. Holding trades overnight immediately exposes you to “gap risk” – the chance that news causes the market to open way higher or lower than its previous close. This requires a strong stomach and, more importantly, well-placed stop-loss orders.

From a research perspective, understanding how prices behave over different time frames is key to managing that risk. Early studies on daily stock returns showed that prices don’t always follow a neat, predictable curve. They have “fat tails,” a term meaning that extreme price swings happen more often than you’d think. This is a critical insight for anyone holding positions through multiple trading sessions.

The other major hurdle is purely psychological. You have to develop the discipline to let your winners run, trusting your analysis even when daily noise tries to shake you out. For traders coming from shorter time frames, this can be a real struggle.

The Patient Approach of Position Trading

If the constant noise of daily market swings sounds exhausting, position trading offers a much calmer alternative. This is for the traders who prefer to play the long game, looking at the big picture instead of the minute-by-minute chaos. This approach emphasizes long-term thinking and discipline above all else.

Position traders operate on a completely different trading time frame. They’re not glued to their screens. Instead, they rely on weekly and monthly charts to spot major trends that can unfold over several months or even years.

Think of yourself as the captain of a massive cargo ship. Your job isn’t to react to every little wave that rocks the boat. Your focus is on the final destination, guided by major ocean currents and long-range weather forecasts. Minor squalls are just part of the journey.

This style demands a total shift in mindset. You’re not hunting for quick flips. You’re aiming to capitalize on huge economic, industrial, or corporate shifts that take a long time to play out.

A Practical Example of Position Trading

Let’s say a trader believes the renewable energy sector is on the verge of a multi-year boom, thanks to new government policies and technological breakthroughs.

- Analysis: They dive deep into fundamental research, confirming the long-term growth potential. This involves reading industry reports and company earnings, not just looking at charts.

- Entry: Using a weekly chart, they spot a major solar energy ETF that just broke out of a year-long sideways pattern. This signals the start of a potential new uptrend, so they enter a position.

- Management: For the next 18 months, they hold on, completely ignoring the minor weekly dips and pullbacks. Their eyes are on the monthly chart, which continues to confirm a healthy, long-term uptrend. Their discipline is their greatest asset.

The secret here is an unshakeable belief in your initial homework. It’s all about letting a massive trend do the work for you, which requires an incredible amount of patience.

Position trading is the ultimate test of trusting your own research. It’s less about reacting to market noise and more about having the conviction to hold a solid position through the inevitable ups and downs.

This long-term view lines up with how major market cycles, often called “regimes,” have historically worked. Just look at the S&P 500 – you can see distinct multi-decade periods with wildly different personalities, from the “Great Bull Market” of the 80s and 90s to the frustrating “Lost Decade” of the 2000s. A position trader’s success often hinges on understanding these big-picture rhythms. You can find more insights on historical S&&P 500 price cycles to see how these long-term trends take shape.

The Trade-Offs of a Long-Term View

So, what’s the appeal? For one, the time commitment is incredibly low – maybe just a few hours a month. The day-to-day stress is almost non-existent compared to other trading styles.

But it’s not all easy sailing. This trading time frame means your capital is tied up for long stretches, and you might miss out on other opportunities that pop up. Plus, to ride out those big trends, you have to use wider stop losses to avoid getting shaken out by normal market volatility. That means you’re often risking more capital on any single trade.

How to Choose Your Ideal Trading Time Frame

Knowing the different trading styles is one thing, but figuring out where you truly fit in is another challenge entirely. Choosing the right trading time frame isn’t about chasing what’s popular – it’s a deeply personal decision that has to click with your actual life.

Getting this wrong is one of the biggest reasons traders burn out. They try to force a style that clashes with their personality and daily schedule, which just leads to stress and bad decisions. Let’s avoid that trap by building a personal profile based on three key pillars.

Assess Your Personality and Psychology

First things first: you need a moment of honest self-reflection. Your own psychological wiring has a massive say in which time frame will feel natural versus which one will feel like a constant uphill battle.

Ask yourself a few tough questions:

- How do you handle stress? Short-term charts with prices flashing red and green can be a recipe for anxiety. If you find yourself panicking at every little market swing, a longer time frame like swing or position trading will feel much calmer.

- Do you need instant gratification? If you’re the kind of person who thrives on quick feedback, the slow-and-steady pace of position trading might feel agonizing. Day trading, on the other hand, gives you that immediate hit of knowing if you were right or wrong.

- Are you patient or impulsive? Patience is non-negotiable for swing and position traders, who often have to wait days or even weeks for a setup to fully play out. If you’re more impulsive, you’ll probably do better in a short-term environment where you can act on your ideas right away.

There’s no right or wrong answer here. The whole point is to match the market’s tempo to your own internal rhythm.

Evaluate Your Real-World Availability

Your trading schedule has to fit into your life, not the other way around. Be brutally honest about how much time you can actually dedicate to the markets without it costing you your job, family, or sanity.

Think about your daily commitments:

- Got a 9-to-5 Job? Day trading is likely a non-starter unless you can focus exclusively on the market open or close. Swing trading on daily charts is a far more realistic option, since you can do all your analysis after work.

- Have a Flexible Schedule? If you have more freedom during the day, you have the option to explore day trading. But just because you can doesn’t mean you should. You might find you prefer the freedom that swing trading offers over being chained to your desk.

- What’s Your Screen Time Tolerance? How many hours can you stare at charts before your brain turns to mush? Day trading demands intense, sustained focus, while position trading might only need an hour of your time per week.

Define Your Trading Goals

Finally, what are you actually trying to accomplish here? Your financial goals are a huge piece of the puzzle and will point you toward the right trading time frame.

Your trading time frame isn’t just a technical setting on a chart; it’s a commitment to a specific lifestyle. Choose the one that reduces stress and complements your life, not complicates it.

Are you looking for a side hustle or building long-term wealth?

- Supplemental Income: If you’re looking to generate smaller, more frequent returns, day trading or short-term swing trading is where you’ll likely land. These styles, like those often used in momentum trading, are all about capitalizing on frequent price moves. You can learn more about how traders find and ride these waves in our guide to momentum trading.

- Wealth Building: If your goal is to grow your capital significantly over many years, position trading is a perfect match. It’s designed to capture major market trends and feels a lot more like long-term investing.

To bring this all together, here’s a quick-glance table to help you match your profile to a time frame.

Matching Your Profile to a Trading Time Frame

This table breaks down how your personality, schedule, and goals align with the most common trading horizons. Use it to find your best fit.

| Factor | Short-Term (Day Trading) | Medium-Term (Swing Trading) | Long-Term (Position Trading) |

|---|---|---|---|

| Personality | Thrives on action, decisive, high stress tolerance, needs instant feedback. | Patient but not passive, analytical, comfortable with overnight risk. | Extremely patient, big-picture thinker, unbothered by short-term noise. |

| Time Commitment | 2-5+ hours daily, requires intense focus during market hours. | 30-60 minutes daily, analysis can be done after market close. | 1-2 hours weekly, perfect for a “set and forget” approach. |

| Stress Level | Very High. Constant decision-making and real-time P&L swings. | Moderate. Decisions are less frequent but trades can last days or weeks. | Low. Focus is on the long-term trend, daily volatility is ignored. |

| Ideal Goal | Generating active, supplemental income. | Growing a smaller account or creating consistent monthly returns. | Long-term wealth accumulation and capital appreciation. |

Once you’ve identified a potential fit, the next step is crucial: test it out in a demo account. This is your risk-free sandbox. Treat it like real trading to see if the pace and psychological demands actually work for you. This journey is one of self-discovery, not a race to the finish line.

Common Questions About Trading Time Frames

Even after you’ve got the basics down, picking the right trading time frame can leave you with some nagging questions. It’s one thing to understand the theory, but it’s another to apply it to your own trading plan. Don’t worry, that’s completely normal. Many traders struggle with these same points.

Let’s tackle some of the most common sticking points traders run into. The goal is to give you clear, direct answers so you can move forward with confidence.

Can I Use Multiple Time Frames at Once?

Absolutely. In fact, you should. This isn’t just a neat trick; it’s a powerful technique known as multiple time frame analysis. Think of it like using both a satellite view and a street-level map to plan a road trip – you need both to see the big picture and the immediate details.

The core idea is to get a more complete story of what the market is doing. A popular top-down approach is:

- The Big Picture (Daily Chart): Start with a longer time frame to identify the market’s main direction. Is it trending up, down, or just moving sideways? This is your strategic map.

- The Setup (4-Hour Chart): Drop down to an intermediate chart to spot opportunities that align with that larger trend. This is where you might find a perfect pullback or a classic consolidation pattern.

- The Entry (1-Hour Chart): Finally, zoom into a shorter time frame to pinpoint your exact entry and exit. This is your tactical execution, helping you time your move with precision.

This layered analysis helps make sure you’re swimming with the current, not fighting against it. It’s a simple way to add a layer of confirmation that can seriously upgrade your decision-making.

Which Time Frame Is the Most Profitable?

This is the million-dollar question, and frankly, it’s a trap. The hunt for a single “most profitable” trading time frame is a myth, one that distracts traders from what actually matters. There is no magic chart that guarantees profits.

Profitability isn’t tied to a time frame. It’s the result of a solid strategy that fits your personality, your schedule, and how much risk you’re comfortable with.

A scalper can be successful on a 1-minute chart, just as a position trader can build wealth on a monthly chart. Their success comes from mastering a system that works for them through discipline and consistency, not from finding some secret, superior time frame. Stop searching for the “best” chart and start focusing on finding the best fit for you. Profitability follows discipline.

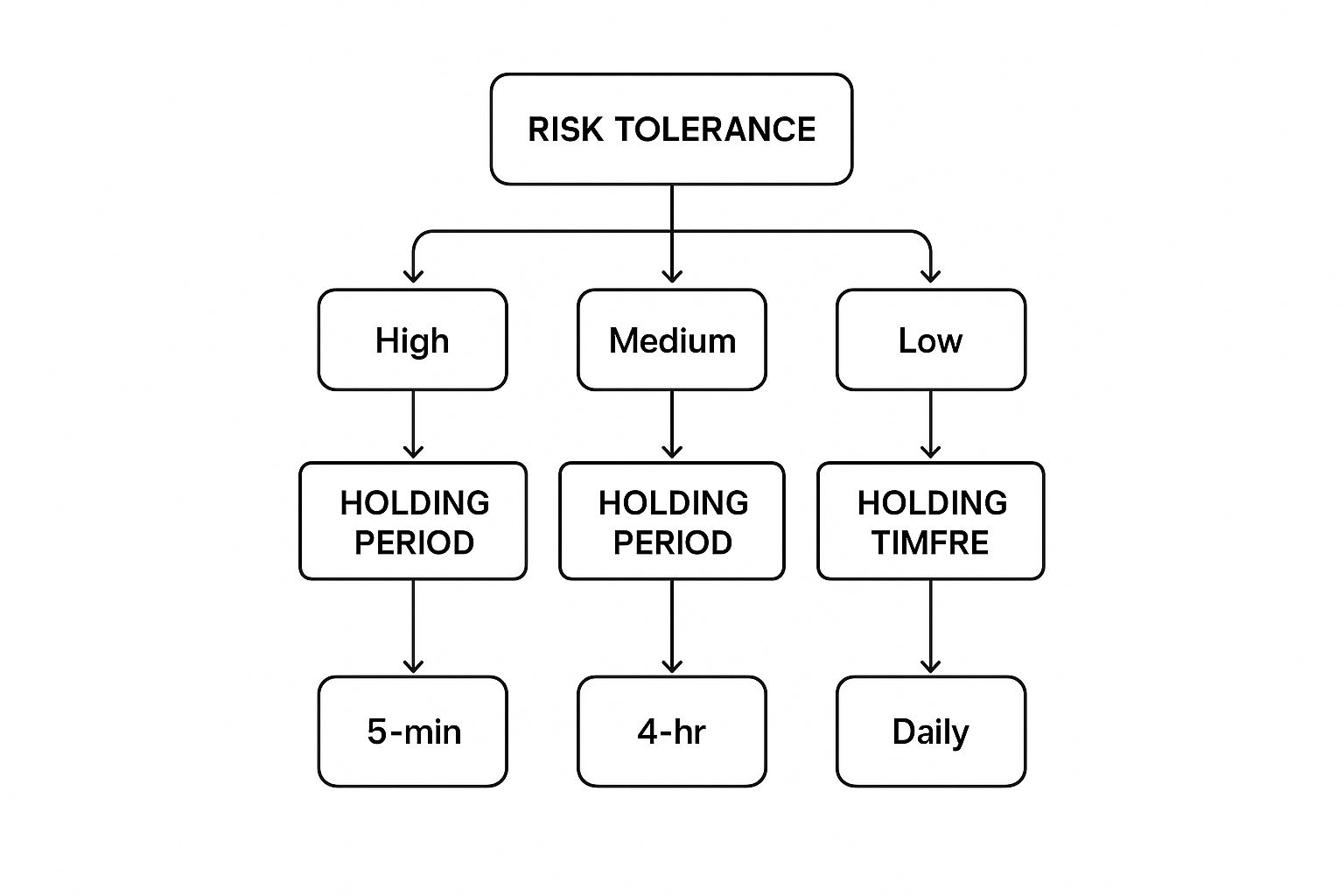

This decision tree can help you see how your personal risk tolerance connects to a suitable trading style.

Use this as a guide to connect your comfort with risk to a chart that naturally supports your approach.

What If Different Time Frames Give Conflicting Signals?

This happens all the time, and it’s a huge source of frustration and “analysis paralysis.” You spot a beautiful buy signal on the hourly chart, but a quick glance at the daily chart makes your stomach drop – it looks like the price is about to fall off a cliff. What now?

The rule of thumb is simple: the longer time frame always wins.

Think of it this way: the daily chart is a massive ocean liner setting a course across the sea. The hourly chart is just a little speedboat zipping around it. The ocean liner dictates the real direction, while the speedboat just bounces on the surface waves.

If your daily chart is in a clear downtrend, that buy signal on the hourly is probably just a temporary bounce a “sucker’s rally.” It’s more likely a good place to exit a short trade than a reason to go long and fight the dominant trend. Always defer to the bigger picture. It’s a core principle of disciplined, long-term thinking in trading.

Ready to figure out what works for you? A trading journal is the single best tool for discovering which trading time frame truly fits your style. Start tracking your trades with TradeReview and let data – not guesswork – guide your decisions. Get started with TradeReview today.