The whole swing trading vs. day trading debate really comes down to your time and lifestyle. Day trading is an intense, full-time commitment focused on small price moves within a single day. On the other hand, swing trading offers more breathing room, letting you hold positions for days or weeks to catch larger market trends.

The right choice isn’t about which one promises “guaranteed profits” – because nothing in trading does. It’s about finding the style that aligns with your personality, schedule, and how much risk you can stomach without losing sleep. This is a long-term journey, and picking a sustainable path from the start is your first real test of discipline.

Choosing Your Path: Swing Trading vs. Day Trading

Feeling stuck between swing trading and day trading is completely normal. It’s a classic crossroads every new trader hits. The internet is a firehose of conflicting advice, with gurus promising quick riches from both styles, making it hard to know which way to go. It’s easy to feel paralyzed, worried about making the wrong call before you’ve even placed a trade. We’ve all been there.

This confusion often stems from treating this like a permanent, life-altering decision. It’s not. Think of it as choosing the right tool for the job – and that job is defined by your life. The goal isn’t to chase the most hyped-up style but to find one you can stick with consistently, day in and day out, building your skills over the long haul.

The Fundamental Difference Is Your Time Horizon

At its core, the main distinction between these two styles is the holding period. This single factor changes everything, from your daily routine and stress levels to the strategies you’ll use.

- Day Trading: You open and close all your positions within a single trading day. A day trader might hold a stock for a few minutes or a couple of hours, but they never hold anything overnight to avoid after-hours risk.

- Swing Trading: You hold positions for more than a day. This could be anywhere from a couple of days to several weeks as you try to profit from a sustained price “swing” or a short-term trend.

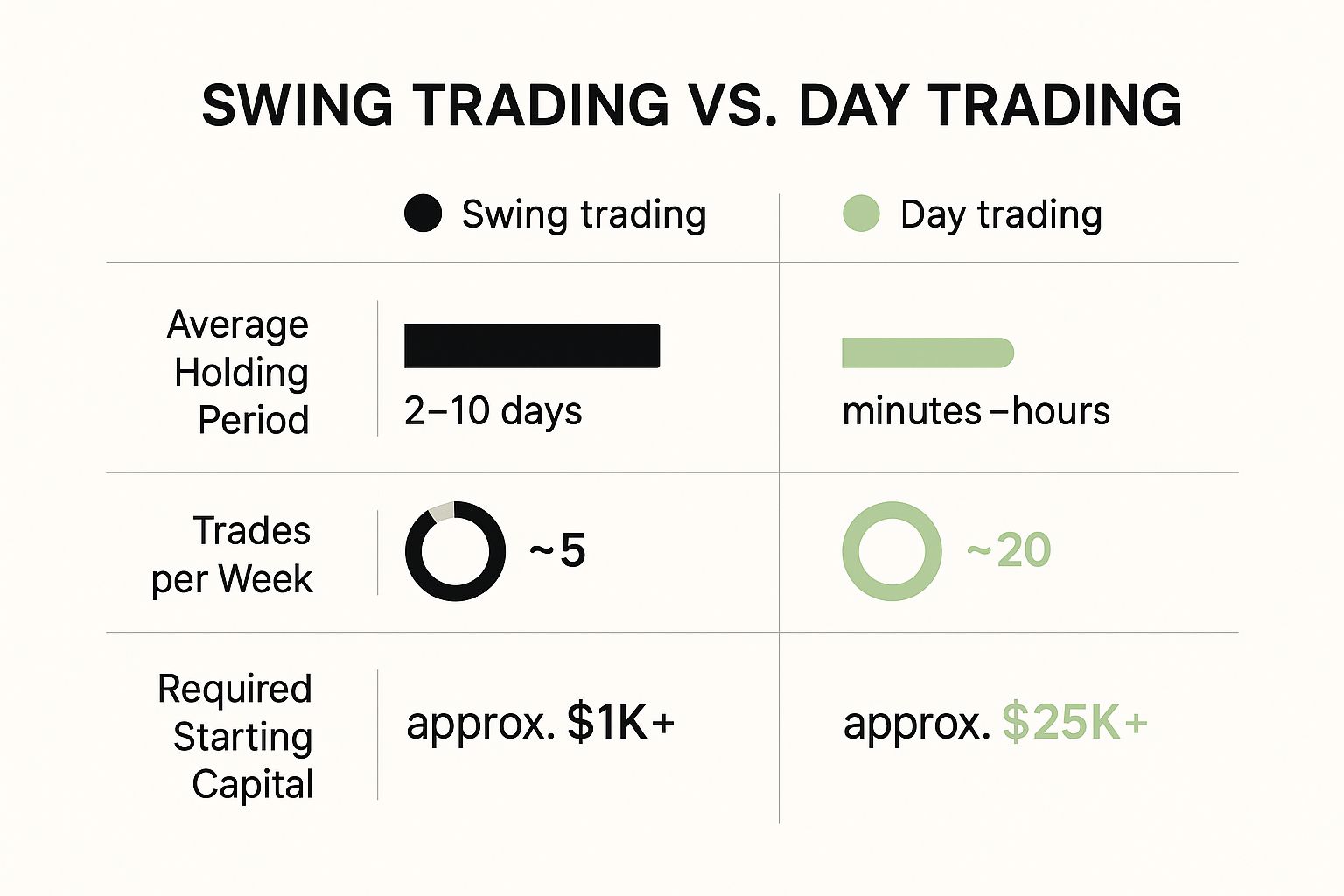

This graphic gives a great visual breakdown of how the holding period, trade frequency, and even capital requirements differ.

As you can see, the day-to-day reality of each style is worlds apart. Day trading is a high-volume, high-attention game, while swing trading demands more patience and a measured, long-term approach.

The best trading style isn’t the one that promises the fastest money. It’s the one that fits so seamlessly into your life that you can actually follow your plan without burning out.

To make the choice a little clearer, here’s a quick side-by-side comparison of their defining features.

Key Differences at a Glance

This table breaks down the core characteristics of each approach to give you a quick, at-a-glance understanding.

| Characteristic | Day Trading | Swing Trading |

|---|---|---|

| Time Commitment | Full-time focus during market hours | Part-time; analysis can be done after market close |

| Holding Period | Minutes to hours; positions closed daily | Two days to several weeks |

| Risk Exposure | No overnight risk, but high intraday volatility risk | Overnight and weekend risk from after-hours news |

| Capital Minimum | $25,000 minimum account balance in the U.S. | No specific minimum, accessible with smaller accounts |

| Ideal Mindset | Decisive, disciplined, and thrives under pressure | Patient, methodical, and comfortable with delayed gratification |

Ultimately, this table highlights how different the operational and psychological demands are. One requires you to be glued to your screen, while the other allows you to step back and let trades play out over a longer timeframe.

How Time Commitment Shapes Your Trading Style

Putting theory aside, the single biggest factor in the swing trading vs. day trading debate is your real-life schedule. Trying to force a trading style that doesn’t fit your lifestyle is a fast track to frustration and costly mistakes. You have to be brutally honest about how much time you can actually dedicate to the markets each day.

Many aspiring traders are drawn in by the idea of quick profits but completely misjudge the hands-on time required. This mismatch is where most people fail first. You can have the world’s best strategy, but if life gets in the way and you can’t be there to execute it, it’s worthless.

The Day Trader’s Intense Daily Routine

Let’s be clear: day trading isn’t a casual hobby you can dip in and out of. It’s a demanding job that requires your full, undivided attention whenever the market is open. The commitment bleeds into the hours before and after the bell, creating a highly structured and often stressful – daily grind.

A typical day in the life of a day trader looks something like this:

- Pre-Market (Before 9:30 AM EST): This is pure prep time. You’re scanning the news, hunting for stocks with unusual volume or big pre-market moves (these are often called “gappers”), and building a tight watchlist of potential plays for the day.

- Market Open (9:30 AM – 11:00 AM EST): Go time. The first 90 minutes are often the most volatile, offering what many consider the best opportunities. A day trader is glued to their screen, making split-second decisions and executing trades based on live price action.

- Post-Market (After 4:00 PM EST): The work isn’t done when the market closes. This is when you review every trade, figuring out what went right and what went wrong. This is where diligent performance tracking becomes essential, which is why every trader needs a trading journal to spot patterns in their performance.

This kind of intense schedule makes day trading nearly impossible for someone working a traditional 9-to-5. It’s built for people who have complete control over their day, like a full-time trader or a business owner with significant flexibility.

The Swing Trader’s Flexible Schedule

Swing trading, on the other hand, is practically designed for people who can’t or simply don’t want to watch the market all day long. It allows for a much more balanced approach, letting you fit your trading around your other commitments.

A swing trader’s biggest asset is time. They can let a trade breathe for days or weeks, making decisions based on end-of-day data instead of reacting to every little flicker on the screen.

The swing trader’s routine is far less demanding hour-to-hour. Most of the heavy lifting and analysis happens after the market is closed, which allows for calm, rational decisions without the pressure of a live, moving chart.

A Simple Swing Trading Workflow:

- Evening Analysis: Spend 30-60 minutes after the close scanning daily or weekly charts for promising setups. A setup is a specific pattern or condition you look for before entering a trade.

- Set Alerts & Orders: Instead of screen-watching, you place your entry orders (like limit or stop orders) and set price alerts for key levels you’re interested in.

- Periodic Check-Ins: Glance at your positions once or twice during the day, or just review everything at the end of the day to manage your stops or take profits.

This structure is a perfect match for a professional with a standard job. You can do your research in the evening, set your trades up for the next day, and let the market do its thing without derailing your career. The timeframes and frequency are what truly separate these two styles. Day traders might make dozens of trades in a day to scalp small profits, while a swing trader might only find a few high-quality setups in an entire week, demanding far less screen time.

Navigating Risk and Realistic Profit Potential

Sure, profit is what we’re all after, but your survival in the market hinges entirely on how you handle risk. When we break down swing trading vs day trading, we’re looking at two very different landscapes of risk and reward. Neither is a get-rich-quick scheme, and both demand an iron will to protect your capital above all else.

It’s tempting to focus only on the upside, but turning a blind eye to the downside is the quickest way to zero out your account. The real skill isn’t just making money – it’s keeping it. That means taking a hard, realistic look at what can go wrong and having a solid plan to deal with it.

The Day Trader’s High-Frequency Gamble

Day trading is all about compounding small, frequent wins. The idea is to catch tiny price swings all day long, hoping the little victories stack up. But this high-volume approach comes with its own intense set of dangers.

The constant need to make snap decisions is a recipe for emotional mistakes, like revenge trading after a frustrating loss. On top of that, transaction costs are a huge factor. Every single trade shaves a little off your potential profit, and with dozens of trades a day, those commissions and fees add up fast.

A day trader’s biggest enemy isn’t one catastrophic loss. It’s the slow, grinding death by a thousand cuts. A string of small losses, magnified by commissions, can bleed an account dry before a trader even realizes what’s happening.

Practical Example: A day trader aims for $50 wins per trade but has a $30 stop-loss. They make 10 trades: 6 winners (+$300) and 4 losers (-$120). On paper, that’s a $180 profit. But if commissions are $5 per round trip, that’s another $50 in costs, reducing their net profit to $130. A few more losses, and the day is easily negative. This is the daily grind.

The Swing Trader’s Test of Patience

Swing traders are playing a different game. They’re hunting for bigger profits from bigger price moves over several days or weeks. This lets them tune out the intraday noise and avoid the emotional rollercoaster of minute-by-minute charts, but it introduces a whole other kind of danger: overnight and weekend risk.

Once you hold a position after the market closes, you’re at the mercy of anything that happens in the outside world.

- Bad Earnings Reports: A company drops a disappointing report after hours, and the stock could gap down 10-20% at the next day’s open, blowing past your planned stop-loss.

- Surprise News Events: A sudden geopolitical crisis, an industry scandal, or unexpected economic data can create a massive price gap against you before you can react.

- Shifts in Market Sentiment: Sometimes, a negative event hits the entire market, dragging your stock down with it no matter how strong its fundamentals were.

Practical Example: You’re holding a promising tech stock over the weekend, feeling good about its prospects. Then, a major regulatory story breaks on Saturday. You’re completely stuck, unable to exit until Monday morning, by which time a huge chunk of your position’s value might have vanished. That’s the price you pay for chasing those larger, multi-day trends.

At the end of the day, your profit potential in either style comes down to how well you can manage these very different risks. If you push the day trading concept to its extreme, you get scalping, which dials up the intraday risks even more. To see how that compares, you can learn more by checking out our guide on what scalping trading is.

Strategies and Mindsets of Successful Traders

Success in trading isn’t about finding some magic formula. It’s about matching the right strategy to the right timeframe. When it comes to swing trading vs day trading, the analytical approaches couldn’t be more different. One demands lightning-fast decisions on patterns that vanish in minutes, while the other calls for a patient, thoughtful mix of technical skill and fundamental insight.

It’s a classic rookie mistake: applying the wrong tools for the job. Think of it like using a microscope when you really need binoculars. The first step to building a consistent, winning approach is learning which lens to look through.

The Day Trader’s Toolkit: Precision and Speed

Day traders live and die by their intraday charts and real-time data feeds. Their world operates in seconds and minutes, so their strategies have to be built for pure speed and accuracy. They aren’t worried about a company’s five-year plan; their focus is entirely on what’s happening right now.

Their analysis is almost purely technical, zeroing in on indicators that can predict immediate price action. A day trader’s decision-making is a rapid-fire cycle: spot a pattern, execute the trade, and manage the position, all in the blink of an eye.

Common Day Trading Tools:

- Level II Data: This gives you a peek into the order book, showing the immediate supply and demand for a stock. It helps traders see where large buy or sell orders are sitting.

- Volume Profile: This helps you pinpoint price levels with heavy trading activity, which often act as strong support or resistance zones.

- Intraday Chart Patterns: Think classic formations like flags and pennants, but playing out on 1-minute or 5-minute charts. These are small continuation patterns.

Practical Example: A day trader might see a stock rocketing up on huge volume within the first 10 minutes of the market open. They’re not asking why it’s moving – they’re jumping in to ride that immediate momentum, with a plan to get out before the initial buzz dies down. To get good at this, you have to understand what makes these quick moves happen in the first place. You can learn more in our deep dive on what momentum trading is.

The Swing Trader’s Blended Approach

Swing traders, on the other hand, play a much slower, more deliberate game. This longer timeline gives them the luxury of combining different types of analysis. While the foundation of their strategy is still technical analysis on daily or weekly charts, they’re also often on the hunt for a fundamental reason – a “catalyst” – that could push a stock’s price over the next several days or weeks.

This blended approach gives their trades a story. They aren’t just trading a random pattern on a chart; they’re trading a narrative that’s unfolding over time.

A swing trader’s edge comes from connecting the dots between a strong chart setup and a real-world event. This combination gives them the conviction to hold a position through minor pullbacks, trusting the larger trend to play out.

Practical Example: A swing trader finds a stock in a solid uptrend that has pulled back to a key support level on its daily chart. Before pulling the trigger, they’ll look for upcoming catalysts, like a major earnings report or good news for the industry. This extra layer of confirmation gives them a reason to believe the stock has the fuel to “swing” higher over the next two weeks.

At its core, the difference is one of mindset. The day trader has to be a disciplined sprinter, comfortable with constant action and immediate feedback. The swing trader is more of a patient marathon runner, able to trust their research and wait for their idea to develop, without needing the market to validate them every five minutes.

Finding the Right Fit for Your Personality

Beyond schedules and strategies, the swing trading vs day trading decision really comes down to you. Choosing a style that clashes with your personality is a fast track to burnout. For any real shot at long-term success, your trading approach has to feel like a natural extension of who you are, not a constant fight against your own instincts.

It’s a struggle I’ve seen countless traders go through. They try to force themselves into the high-octane world of day trading when they’re built for thoughtful analysis, or they attempt to swing trade but can’t handle the lack of constant action. That kind of mismatch creates a ton of mental friction, making discipline feel almost impossible.

The Ideal Day Trader Archetype

Think of a successful day trader like a professional sprinter. They’re built for explosive, short bursts of intense focus and immediate action. This isn’t just about tolerating pressure – they often do their best work when the stakes are high and decisions have to be made in a split second.

A day trader’s mental game comes down to a few key traits:

- Decisiveness: There is zero time for second-guessing. You have to process information instantly, pull the trigger without hesitation, and accept the result, win or lose.

- Emotional Resilience: Losses are just part of the job, and they happen often. A solid day trader can shake off a loss immediately and move on to the next setup with a completely clear head.

- Extreme Discipline: The fast-paced environment is full of traps, like over-trading or revenge trading. A disciplined day trader sticks to their plan with military-like precision, even when their emotions are screaming at them to do otherwise.

If you tend to get flustered, overthink every move, or take losses personally, day trading is going to feel like a constant uphill battle. It demands a level of emotional detachment that, frankly, not everyone has.

The Successful Swing Trader Profile

The swing trader, on the other hand, is more like a chess grandmaster or a marathon runner. Their edge isn’t in lightning-fast execution; it’s in patience, careful planning, and seeing the bigger picture unfold over days or even weeks.

This type of trader is more methodical. They’re perfectly comfortable sitting on the sidelines, waiting for a truly high-quality setup to appear. They trust their analysis and don’t need the constant feedback loop that comes from being in and out of trades all day.

A swing trader’s greatest skill is the ability to sit on their hands. They know that to catch bigger market moves, you have to embrace uncertainty and give a trade room to breathe, without micromanaging every little tick.

The core characteristics of a swing trader look like this:

- Patience: They can wait days for the perfect entry and are comfortable holding a position through minor dips as long as the overall trend is still in their favor.

- Methodical Thinking: Their strategy is built on solid research and analysis, often blending technical chart patterns with bigger-picture fundamental catalysts.

- Comfort with Uncertainty: Holding trades overnight or over the weekend means accepting risks you can’t control. A swing trader has to be psychologically prepared for that.

If you’re a patient person who enjoys digging into research and would rather make a few well-thought-out decisions than a hundred impulsive ones, swing trading is probably a much better fit for your personality. The key is to be honest with yourself. Choosing the path of least psychological resistance gives you the best chance at building the consistency you need to succeed over the long term.

Your Common Trading Questions Answered

Even after you’ve weighed the time commitments, risk profiles, and personality traits, a few questions are probably still bouncing around in your head. That’s completely normal. Let’s tackle some of the most common practical concerns that pop up in the swing trading vs day trading debate.

Think of this as the final piece of the puzzle. We’ll cut through the noise with straightforward answers to help you move forward with clarity and confidence.

Can I Day Trade with A Full-Time Job?

Honestly, it’s incredibly difficult and not something I would recommend for beginners. Day trading demands your full, undivided attention when the market is open. Trying to squeeze in trades between meetings or on a lunch break is a recipe for disaster.

The market moves in a blink, and a few seconds of distraction can flip a great setup into a big loss. You might miss your entry, fail to cut a losing trade, or make a rushed, emotional decision.

Practical Example: You jump into a fast-moving stock during your coffee break. Your boss suddenly pulls you into a surprise meeting. By the time you get back to your screen 15 minutes later, the trade has tanked, blowing past your stop-loss and handing you a much larger loss than you ever planned for.

Swing trading is a far more realistic starting point if you have a 9-to-5. It lets you do your analysis and place orders in the evening when the market is closed and you can actually focus.

How Much Money Do I Need to Start?

The capital you need for these two styles is worlds apart, and for many people, this is the deciding factor. The rules for day trading are firm, while swing trading is much more flexible.

- For Day Traders: In the United States, regulators have a rule for “pattern day traders” (anyone making four or more day trades in a five-day period). You must keep a minimum account balance of $25,000. If your account dips below that, your day trading privileges are suspended until you bring it back up.

- For Swing Traders: There’s no official minimum. This makes swing trading way more accessible. While you could technically start with a few hundred dollars, it’s more practical to begin with at least a few thousand. This gives you enough room to manage risk properly without putting too much of your account into a single trade.

Remember, the goal isn’t just to have enough cash to place a trade; it’s to have enough to survive a string of losses without blowing up your account. Start small and focus on process, not profits.

Is Day Trading or Swing Trading More Profitable?

This is the million-dollar question, but the answer is simple: neither is inherently more profitable. The real profit potential lies with the trader, not the trading style. A disciplined swing trader will always make more money than a reckless day trader, and vice versa.

Profitability comes from consistently executing a solid strategy with tight risk management over a long period. Day trading focuses on smaller, frequent gains that compound, while swing trading targets larger, less frequent wins. It is about building a repeatable process.

The most profitable trading style is the one you can actually stick with. If a style fits your schedule, personality, and risk tolerance, you’re far more likely to master it and see consistent results over the long term.

Chasing the style you think makes more money instead of the one that fits you is a classic rookie mistake. Focus on mastering one first.

Is It Possible to Do Both Styles?

Yes, plenty of experienced traders blend both day trades and swing trades. However, I strongly advise beginners to master one style first. The mindsets, timeframes, and strategies are completely different, and trying to juggle both right away just leads to confusion and sloppy execution.

A great path for new traders is to start with swing trading. It’s a fantastic way to learn market dynamics, chart analysis, and risk management without the intense psychological pressure. You learn patience and how to let a trade play out.

Once you’ve built a track record of consistent profits with swing trading for several months, you can start exploring day trading with a small piece of your capital. This gradual progression helps you build on a solid foundation of discipline instead of just jumping into the deep end. The swing trading vs day trading choice isn’t forever, but picking the right one to start with is crucial.

No matter which path you choose, the key to long-term success is meticulous record-keeping and performance analysis. TradeReview provides the tools you need to log every trade, analyze your strategy’s effectiveness, and identify patterns in your behavior, helping you make data-driven decisions. Start tracking your journey to consistency by signing up for free at https://tradereview.app.