To backtest a trading strategy, you’re essentially time-traveling. You take a clear, defined set of trading rules and run them against historical market data to see exactly how they would have played out. We all know the feeling of a strategy that seems brilliant in our heads but falls apart in live markets. Backtesting is the bridge between a promising idea and a data-proven edge.

The process hinges on getting your hands on quality data, pinning down your strategy’s exact entry and exit rules, and then digging into the simulated performance to see if it actually has potential over the long haul.

Building Your Foundation for a Solid Backtest

Jumping into backtesting can feel like a huge task, but it’s the single most important step you can take to move from gut-feel trading to a data-driven approach. Too many traders get stuck in a frustrating cycle of inconsistent results, hopping from one “hot” strategy to the next without ever knowing if any of them had a real, provable edge.

Backtesting is the antidote.

Think of it as a full-dress rehearsal for your capital. It’s a simulation that shows you how your strategy would have weathered past market storms — before you put a single dollar on the line. The goal isn’t to find some mythical “holy grail” that never loses. It’s about building discipline and proving, with cold, hard data, that your approach has a positive expectancy over the long run. There are no “guaranteed profits” in trading, only probabilities you can try to stack in your favor.

This structured process gives you the confidence to pull the trigger without hesitation when the market gets chaotic. Without it, you’re just guessing.

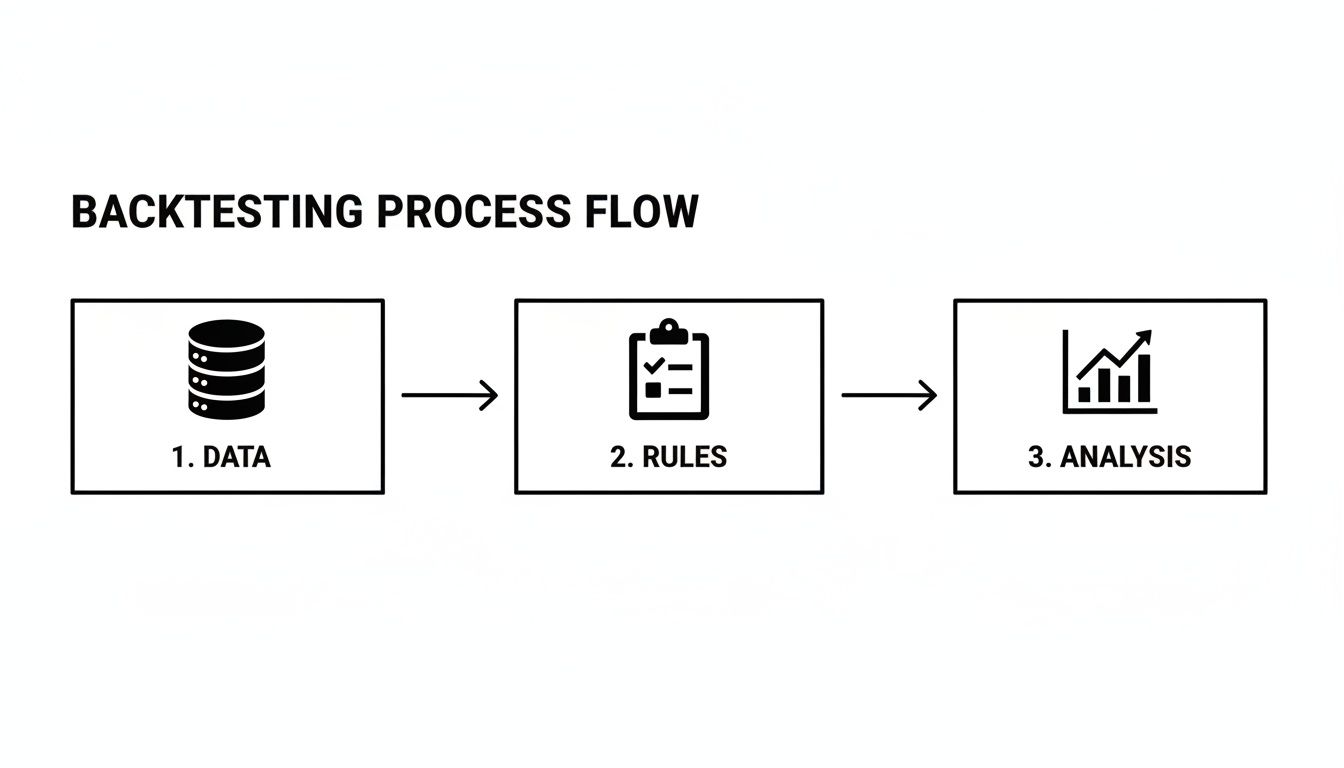

The Core Backtesting Workflow

The whole backtesting process can be broken down into three fundamental stages. Each one builds on the last, making sure your final analysis is grounded in a solid, repeatable method.

This flow diagram lays it out perfectly: gather your data, apply your rules, and analyze what happened. Simple, yet incredibly powerful.

Getting this workflow down transforms your trading from hopeful guesswork to objective analysis. It’s the bedrock of any successful trading career.

Before we dive deeper, it’s crucial to understand the non-negotiable pillars of a comprehensive backtest. These components ensure your results are reliable and not just a product of wishful thinking.

Essential Components for a Successful Backtest

| Component | Description | Why It Matters |

|---|---|---|

| Clean Historical Data | High-quality, accurate market data (prices, volume) for the assets and timeframe you intend to trade. | “Garbage in, garbage out.” Flawed data leads to flawed conclusions and false confidence. |

| Specific Trading Rules | Unambiguous, code-able rules for every entry, exit, stop-loss, and take-profit. No room for interpretation. | Ensures the test is repeatable and objective, removing emotional bias from the simulation. |

| Realistic Cost Simulation | Accounting for real-world costs like commissions, slippage, and potential spreads. | A strategy might look great on paper but be unprofitable once trading friction is factored in. |

| Rigorous Performance Metrics | A comprehensive set of statistics beyond just net profit, including drawdown, Sharpe ratio, and profit factor. | Gives you a 360-degree view of the strategy’s risk, reward, and consistency profile. |

| Out-of-Sample Testing | Validating the strategy on a separate dataset that was not used during the initial development and optimization. | This is the ultimate test to see if your strategy is truly robust or just curve-fitted to past data. |

Mastering these components is what separates a professional, data-backed approach from a hobbyist’s gamble.

Why This Process Matters More Than the Strategy Itself

It’s a common trap to think that trading success comes from finding the perfect indicator or a secret set of rules. The truth? Long-term profitability is built on process and discipline. A trader with a decent strategy but a rock-solid backtesting and risk management process will almost always beat a trader with a “brilliant” strategy they don’t truly understand.

A robust backtest does a few critical things for you:

- It Quantifies Your Edge. It turns a vague idea (“buy dips”) into a statistical reality (“this setup has a 65% win rate with a 2:1 average reward-to-risk ratio over the last 500 trades”).

- It Builds Psychological Resilience. Knowing your strategy’s historical drawdown profile helps you ride out the inevitable losing streaks without ditching your plan. When you know a 15% drawdown is normal, you don’t panic when it happens.

- It Reveals Hidden Flaws. Your simulation might uncover that your strategy falls apart in low-volatility markets or that transaction costs completely devour its profits. These are things you need to know beforehand.

The goal of backtesting isn’t to find a flawless strategy; it’s to deeply understand the behavior, strengths, and weaknesses of the strategy you have. This understanding is what allows you to trade with conviction when real money is on the line.

Ultimately, learning how to backtest a trading strategy is an investment in your own decision-making. It’s about building the patience and analytical rigor that separates pros from the crowd, ensuring every move you make is backed by evidence, not emotion.

Sourcing and Preparing High-Quality Historical Data

Your backtest is only as reliable as the data you feed it. We’ve all heard the old saying, “garbage in, garbage out,” and in trading, it’s painfully true. Before you even think about running a simulation, you have to get your hands on a clean, accurate historical dataset. This first step is tedious, I know, but skipping it makes everything else you do completely worthless.

It all starts with picking the right data granularity for your specific strategy. Not all data is created equal, and the type you choose will have a massive impact on your results. A long-term investor looking at weekly trends can probably get by just fine with end-of-day data. But a scalper trying to capture tiny price movements? They need something far more precise.

Choosing Your Data Granularity

Understanding the different data types is critical. If you get this wrong, you’ll end up with a dangerously misleading picture of your strategy’s performance.

- Daily Data: This gives you one data point per day — usually the open, high, low, and close (OHLC) prices. It’s a good fit for long-term swing or position trading strategies where all the intraday wiggles are just noise.

- Minute-by-Minute Data: Here, you get a much clearer picture of intraday price action, with OHLC data for every single minute. For most day trading strategies, this is the bare minimum you should be using.

- Tick Data: This is the most granular data you can get, recording every single trade that happens. It’s absolutely essential for high-frequency strategies or for accurately modeling real-world costs like slippage and the bid-ask spread.

Don’t underestimate the difference this makes. For example, a backtest of a day trading strategy on the S&P 500 using only end-of-day data might look great, but it completely ignores intraday price movements and slippage, which could easily add significant costs per trade during volatile times. Using more granular data reveals a much more realistic picture of potential performance.

Cleaning and Adjusting Your Historical Data

Once you’ve got your data, the real work begins. Raw historical data is almost never perfect. It needs to be scrubbed and adjusted to reflect the actual market conditions your strategy would have faced. Without these adjustments, your backtest is just running on a fantasy version of the past. Plenty of platforms offer tools for this — you can see some options in our guide on the best backtest software.

You have to be meticulous here and account for several common data integrity issues.

Your goal is to create a historical landscape that honestly reflects the market’s reality. Any unaddressed flaw in your data is a hidden weakness in your strategy that will be ruthlessly exploited by live markets.

Here are the big ones you absolutely have to address:

- Survivorship Bias: This is a classic trap. It happens when your dataset only includes companies that “survived” to the present day, completely ignoring all the ones that went bankrupt or were delisted. This paints an overly rosy picture of the market. You must use a dataset that includes these delisted stocks to get a true sense of risk.

- Stock Splits: When a company splits its stock (like a 2-for-1 split), you have to adjust the historical price data backward. If you don’t, it will look like the stock price suddenly crashed, which would incorrectly trigger sell signals all over your backtest.

- Dividends and Distributions: Dividends directly affect a stock’s price, causing it to drop on the ex-dividend date. Your data has to be adjusted for these payments to accurately reflect the total return of holding the stock. An unadjusted chart can create all sorts of false signals for price-based indicators.

Prepping your data properly is a non-negotiable part of learning how to backtest a trading strategy like a professional. It takes discipline and a sharp eye for detail, but it’s the only way to build a simulation you can actually trust. A clean dataset is what gives you the honest feedback you need to refine your rules and build a truly robust trading plan.

Running Your Backtest without Fooling Yourself

Alright, your data is clean and ready. Now for the moment of truth: running the simulation. This is where your carefully crafted strategy goes head-to-head with the harsh reality of historical price action. It’s exciting, but it’s also where a lot of traders unknowingly set themselves up for failure.

The basic idea is simple. Your backtesting software will churn through your historical data, bar by bar, executing your strategy’s rules as if it were all happening in real time. It logs every simulated buy, sell, stop-loss, and take-profit, building a performance record from scratch.

But here’s a rookie mistake: running a single test across your entire dataset. This is a fast track to overfitting — the cardinal sin of strategy development. You end up with a strategy perfectly tuned to past market noise that completely falls apart the second you try to trade it live.

To do this right, we have to split our data.

In-Sample and Out-of-Sample Testing

The professional way to approach this is by dividing your historical data into at least two distinct periods. Think of it as a practice session and a final exam.

- In-Sample Data: This is your training ground. You’ll use this dataset (say, 2015-2020) to build and test your strategy. Go ahead and tweak your parameters here to see what works best.

- Out-of-Sample Data: This is the test. It’s a chunk of completely unseen data (like 2021-2023) that you use to validate the strategy you perfected on the in-sample set.

If your strategy crushes it on the in-sample data but tanks on the out-of-sample data, congratulations — you’ve overfit. Your model learned the quirks of the past instead of a real, durable market edge. This two-step process is your best defense against launching a strategy built on false hope.

A backtest that performs well on both in-sample and out-of-sample data gives you a much higher degree of confidence. It shows your strategy’s logic is robust enough to handle market conditions it wasn’t explicitly designed for.

A Look at the Logic (Pseudo-Code)

Let’s make this more concrete. Imagine a simple trend-following strategy using a 14-period Relative Strength Index (RSI) on the daily chart for the SPY ETF. The logic is dead simple, which is perfect for showing how a backtesting engine “thinks.”

Here’s what the pseudo-code, which is a plain-language description of the code’s steps, might look like:

// Strategy Parameters

RSI_PERIOD = 14

OVERSOLD_LEVEL = 30

OVERBOUGHT_LEVEL = 70

// Main Loop

FOR each day in historical_data:

// Calculate Indicators

current_RSI = calculate_RSI(day, RSI_PERIOD)

// Entry Logic

IF position is flat AND current_RSI crosses BELOW OVERSOLD_LEVEL:

execute_buy_order(next_day_open)

// Exit Logic

IF position is long AND current_RSI crosses ABOVE OVERBOUGHT_LEVEL:

execute_sell_order(next_day_open)

// End Loop

This is a simplified view, but it nails the core concept. The engine never “peeks” into the future; it only makes decisions based on the data available at that moment.

It’s also critical to model your costs. For every trade, the engine must subtract commissions and account for slippage — the inevitable difference between your expected price and your actual fill price. You can get a much deeper understanding of what slippage is in trading in our detailed guide.

Is Your Test Statistically Significant?

One last thing before you hit “run.” A strategy that looks incredible over 15 trades could easily be a fluke. To actually trust your results, you need a large enough sample size of trades.

Most pros agree that a backtest needs at least 100-200 trades across different market conditions to be considered reliable. Anything less, and your results could be due to random luck rather than a genuine edge. A small sample size can easily make a strategy look much better — or much worse — than it actually is over the long term.

This part of the process isn’t just about pushing a button. It’s about designing a fair test that gives you an honest look at your strategy’s potential — warts and all.

Analyzing Performance Metrics That Actually Matter

Once your backtest wraps up, the software will spit out a report loaded with numbers. It’s so tempting to just find the total profit, give yourself a pat on the back, and call it a day.

That’s a huge mistake. The real story of your strategy’s health is buried in the details. Learning to read between the lines is what separates traders who are just hopeful from those who are systematic professionals.

We have to dig deeper than the flashy, surface-level numbers. A sky-high win rate or a massive net profit can easily hide fatal flaws that will absolutely wreck your account in a live market. The whole point of this exercise is to understand the true character of your strategy — its risks, its consistency, and the psychological toll it’ll take to trade it.

This is how you build a real scorecard to evaluate any strategy with a critical, objective eye.

Reading the Story of Your Equity Curve

The first thing to look at isn’t a number at all — it’s a picture. The equity curve is a running visual of your account balance over the entire backtest.

A perfectly smooth, straight line sloping up to the right is the dream, but let’s be real, it’s a fantasy. What we’re actually looking for is a reasonably steady upward climb.

Is the curve choppy and erratic, with massive swings up and down? Or does it grind higher with small, manageable pullbacks? The shape of this curve tells you more about the strategy’s personality than almost any other metric. A jagged, volatile curve suggests an inconsistent strategy that might be psychologically brutal to trade, even if it ends up profitable. A smoother curve points to more predictable performance and a more sustainable edge.

Uncovering the Real Risk: Maximum Drawdown

If there’s one number that tells you how much pain a strategy can inflict, it’s the maximum drawdown (MDD). This metric shows the largest peak-to-trough drop your account balance suffered during the test. It’s the absolute worst losing streak, measured as a percentage.

You need to pay serious attention to this number. It’s a direct preview of the financial and emotional stress you will have to endure to trade this strategy.

If your backtest shows a 35% maximum drawdown, you have to ask yourself one simple, honest question: Could I stick to the plan while my account is down by a third? If the answer is no, the strategy isn’t viable for you, no matter how good the profit looks on paper.

Beyond Profits: Measuring Risk-Adjusted Returns

Net profit is a vanity metric. What truly matters is how much risk you took to get that profit. This is where risk-adjusted return metrics come in, and they are non-negotiable for any serious evaluation.

The table below breaks down the key metrics you absolutely need to analyze.

Key Performance Metrics for Strategy Evaluation

This table breaks down the essential backtesting metrics, what they measure, and what to look for when assessing a trading strategy’s real-world potential.

| Metric | What It Measures | What to Look For |

|---|---|---|

| Sharpe Ratio | The classic measure of risk-adjusted return. | A ratio above 1.0 is generally considered good. It means you’re being well-compensated for the volatility you’re taking on. A ratio below 0.5 suggests the returns might not justify the risk. |

| Profit Factor | Your total gross profit divided by your total gross loss. | A profit factor of 2.0 means you made twice as much on your winners as you lost on your losers. Anything below 1.5 warrants serious caution. |

| Win Rate | The percentage of trades that were profitable. | Don’t look at this in a vacuum! A high win rate is meaningless without considering the size of your average wins and losses. |

| Avg. Win vs. Avg. Loss | The average profit on winning trades compared to the average loss on losing trades. | This is the other half of the win rate story. Your average win should be significantly larger than your average loss, especially if your win rate is around 50%. |

A high win rate feels great, but it can be a siren’s call. Imagine a breakout strategy with a 70% win rate. Sounds amazing, right? But if the average winning trade is $100 and the average losing trade is $300, you are on a slow road to ruin. You must always analyze your win rate in the context of your average reward-to-risk ratio.

By building a complete picture with these metrics, you move beyond the surface-level results. This deep analysis is a core part of learning how to backtest a trading strategy effectively. It ensures the system you take into the live market is one you truly understand and, more importantly, one you can stick with when the pressure is on.

Stress-Testing Your Strategy for Real-World Conditions

Getting a profitable backtest report is a huge rush. It’s the first real sign that your idea might have a genuine edge. But this is where so many traders trip up — they stop right here. A green backtest isn’t the finish line; it’s the starting gun for you to become your strategy’s biggest critic.

Now the real work begins. We need to deliberately try to break the strategy. The goal is to figure out if that great-looking performance was just a lucky coincidence or if it’s built on something solid. Being brutally honest at this stage is what protects your capital and helps you build a trading plan that can actually survive in the wild.

Accounting for the Unseen Costs

Your first backtest was probably done in a “perfect” world, free from the frictions of live trading. Now it’s time to add back the real-world costs that can quietly bleed a winning strategy dry.

- Commissions: Every single trade costs money. While many brokers now offer zero-commission stock trading, anyone trading futures or options knows these costs are very real. You have to subtract your broker’s commission from every single simulated trade.

- Slippage: This is the pesky difference between the price you wanted and the price you got. It happens, especially when markets are moving fast or you’re trading bigger sizes. Factoring in a small, realistic amount of slippage for each trade is non-negotiable.

For a long-term swing trading strategy, these costs might not seem like a big deal. But for a scalper hitting the market dozens of times a day, they can easily be the difference between profit and loss. Forgetting this is a rookie mistake that almost guarantees underperformance when you go live.

For instance, some academic studies on trading strategies have shown that gross returns can be significantly reduced, sometimes by several percentage points, after factoring in realistic transaction costs.

How Sensitive Are Your Parameters?

Next up is what’s known as a parameter sensitivity analysis. That’s just a fancy way of asking: is this strategy only profitable because I stumbled upon one exact magic number?

Let’s say your backtest crushed it using a 14-period moving average. That’s awesome. But what happens if you run it again with a 12-period, a 13-period, a 15-period, and a 16-period moving average?

- A robust strategy will still be profitable across this range of similar inputs, even if the numbers dip a little. This tells you the core logic is sound.

- An overfit strategy will completely fall apart the second you change that number from 14 to 15. This is a massive red flag. It means you didn’t find a market edge; you just perfectly curve-fitted your rules to historical noise.

A truly robust strategy doesn’t hang by the thread of a single, hyper-specific setting. Its core logic should hold up under slightly different conditions, giving you confidence it can adapt as markets inevitably change.

Visualizing Your Strategy’s Resilience

This whole stress-testing process can feel a bit abstract, but it’s all about building a deep, intuitive understanding of how your strategy behaves under pressure. The goal is to see how that equity curve bends — or breaks — under different assumptions.

Getting a hands-on feel for this is incredibly valuable. For a practical approach, check out our guide on using an equity curve simulator to model and visualize these potential outcomes.

By running these robustness checks, you’re doing the hard, tedious work that most aspiring traders skip. You’re moving beyond a simple “pass/fail” result and developing a professional-grade understanding of your system’s real strengths and weaknesses. This disciplined approach is what separates hopeful traders from consistently profitable ones. It’s not about finding a perfect system, but about building one you can actually trust when your real money is on the line.

From Backtest to Live Trading: A Disciplined Approach

A profitable backtest is a great start, but it’s not the finish line. Think of it less as a trophy and more as a blueprint. The real test is bridging that gap between a promising simulation and actual, real-world execution.

This is where discipline comes in. To have any chance of replicating your backtested results, you need a methodical approach that turns your findings into a non-negotiable set of rules. It all starts with a rock-solid trading plan.

This plan needs to be brutally specific. Write down the exact entry criteria, the specific rules for taking profit, and your hard stop-loss triggers. Define your position sizing model. Leave zero room for interpretation, because when the market is moving and your money is on the line, ambiguity is your worst enemy.

From Plan to Practice

Once your trading plan is set in stone, it’s time to see how it behaves in the wild — without risking a single dollar. This is what paper trading (or forward performance testing) is for. It’s an absolutely essential step.

Paper trading your strategy for a while lets you:

- Confirm its behavior with live data feeds and see how it handles real market dynamics.

- Practice your execution until following your plan becomes second nature.

- Build psychological resilience by feeling the rhythm of your strategy’s wins and losses in real time.

This phase is your final quality control check. It’s where you prove to yourself that you can actually stick to the plan when it counts.

A backtest shows you what the strategy did. Paper trading shows you if you can do what the strategy demands. That distinction is everything.

Finally, you need to keep meticulous records in a trading journal. Log every single trade — paper or live — and regularly compare your performance to the backtested benchmarks. Is your live drawdown matching the historical one? Is your win rate holding up?

This creates a powerful feedback loop. You can monitor your performance, spot any deviations from your plan, and make informed, data-driven adjustments. This is how you turn a static historical report into a dynamic tool for your growth as a trader.

Common Questions About Backtesting Trading Strategies

Even with a solid process, a few nagging questions always seem to pop up. We’ve all been there — stuck on a detail that holds up the whole show. Let’s clear the air on some of the most common sticking points so you can get back to testing with confidence.

Think of this less as a rigid rulebook and more as a practical guide to help you make smart decisions for your own trading style.

How Much Historical Data Is Enough for a Backtest?

The honest answer? It depends entirely on how often you trade.

If you’re a day trader, hitting the market multiple times a day, a few years of clean intraday data (like 1-minute bars) can give you a massive sample size. The action is fast, so you rack up trades quickly.

But for a swing or position trader holding for days or weeks, you need a much longer view. I’d start with 10 to 20 years of daily data, minimum. Why so much? Your goal is to see how your strategy weathers different storms: roaring bull markets, gut-wrenching bear markets, and those long, boring sideways grinds. You need to know it’s not just a one-trick pony that only works when the sun is shining.

My rule of thumb: No matter your timeframe, shoot for enough data to generate at least 100-200 trades. This gives you a statistically meaningful sample, making it much less likely your great results were just a fluke.

What’s the Difference Between Backtesting and Forward Testing?

This one is absolutely critical.

Backtesting is your strategy’s history lesson. You’re using past data to see how it would have performed. This is your lab — the place where you validate ideas, tweak parameters, and find the fatal flaws before they cost you real money.

Forward testing, or paper trading, is the dress rehearsal. You trade the strategy in the live market, with real-time data, but without real capital on the line. This is where the rubber meets the road. You’ll see how it handles real-world fills, data feed quirks, and the sheer unpredictability of an open market.

- Backtesting: Proves the theory based on the past.

- Forward Testing: Validates the practice in the present.

Skipping forward testing is like studying for a final exam but never doing a single practice test. Don’t do it.

Can a Good Backtest Guarantee Future Profits?

Let me be crystal clear: absolutely not. A great backtest is a non-negotiable first step, but it is not a crystal ball.

Markets change. They evolve. New events happen that have no historical precedent. A solid backtest simply proves your strategy had a statistical edge in the past. It stacks the odds in your favor, but it can never, ever eliminate risk.

Real, lasting success comes from what happens after the backtest: disciplined execution, rigorous risk management, and constantly monitoring your performance in the live market to make sure your edge is still there.

Ready to bridge the gap between backtesting and disciplined live trading? TradeReview gives you the tools to log every trade, measure your live performance against your backtested benchmarks, and make decisions driven by data, not emotion. Sync trades from your broker automatically and get the clarity you need to stay on track. Start journaling for free at TradeReview.