The gravestone doji is a stark, powerful candlestick pattern that can signal a potential end to an uptrend. Think of it as a warning shot fired by sellers. It tells a compelling story of a single trading session where buyers gave it their all, pushing prices significantly higher, only to have sellers slam them right back down to where they started. This failed rally is a classic sign of buyer exhaustion, but it’s a clue — not a guarantee.

Understanding The Gravestone Doji Candlestick

Imagine a tug-of-war. The bulls (buyers) start the day with a massive surge of strength, yanking the rope far into their territory. For a moment, it looks like a decisive victory. But then, the bears (sellers) dig in their heels and stage an incredible comeback, dragging the rope all the way back to the starting line by the end of the session.

This one candle captures that entire battle. Its unique inverted “T” shape is a visual clue that the market’s mood might be souring. Learning to spot these stories on a chart is a core skill in technical analysis. If you’re new to this, getting familiar with how to read stock charts is the perfect place to start.

Anatomy Of The Pattern

To understand what the gravestone doji is telling you, it helps to break it down piece by piece. Each part of the candle paints a picture of the intense fight that just occurred.

- Long Upper Shadow (Wick): This is the star of the show. It marks the high point of the session and shows just how far optimistic buyers managed to push the price. The longer this wick, the more dramatic and significant the rejection from those highs was.

- No Real Body: This is crucial. The opening and closing prices are either identical or extremely close. This forms a thin horizontal line at the bottom, telling us that despite all the drama, the price ended up right back where it began. The bulls couldn’t hold any of their gains.

- Little to No Lower Shadow: The session low is the same as the open and close. This detail hammers the point home: sellers were in complete control by the end, not even allowing the price to dip below the open.

To make it even clearer, here’s a quick breakdown of what you’re looking for.

Gravestone Doji Key Characteristics

| Component | Description | Market Implication |

|---|---|---|

| Upper Shadow | Long and prominent. | Shows a failed attempt by bulls to sustain higher prices. |

| Real Body | Very thin or non-existent. | Indicates indecision and a stalemate at the session’s open. |

| Lower Shadow | None or extremely short. | Reinforces that sellers dominated the end of the session. |

This table sums it up nicely: the gravestone doji is the footprint left behind by a failed rally.

A gravestone doji is more than just a pattern; it’s a footprint left behind by a significant struggle. It reveals a moment where bullish conviction shattered and bearish pressure took over, signaling the potential “death” of the prior uptrend.

What It Signals To Traders

When you spot a gravestone doji, especially after a healthy run-up in price, it’s time to pay close attention. It’s not a crystal ball predicting a market crash, but it’s a strong hint that the upward momentum is running out of steam. For traders, it’s a clear warning that the balance of power might be tipping from buyers to sellers.

If you’re already in a long position, this could be your cue to tighten your stop-loss or even consider taking some profits off the table. For those hunting for a short entry, the gravestone doji acts as an alert to start looking for confirmation that a new downtrend may be starting. Context is everything here — if this pattern forms at a major resistance level, its message becomes even more powerful.

The Psychology Behind the Gravestone Doji

To really get a feel for the gravestone doji candlestick, you have to look past the shape and dive into the market drama it represents. Think of every candlestick as telling a story. The gravestone doji is a short, brutal tale about a power struggle between buyers (bulls) and sellers (bears) — all packed into a single session.

It starts with optimism, hits a dramatic turning point, and ends with a decisive win for the bears.

The story usually kicks off with confidence. After a solid uptrend, buyers roll into the session feeling good, pushing the price way up. This initial surge, which creates that long upper shadow, is fueled by optimism and FOMO (Fear Of Missing Out). Traders see the price climbing and jump on board, hoping the ride never ends.

The Turning Point

Then, right at the peak of the session, everything changes. The buying pressure that seemed unstoppable just vanishes. Why? It could be a few things:

- Profit-Taking: Smart money that bought lower decides it’s time to cash out and lock in their gains.

- Hitting a Wall: The price runs into a major resistance level, a spot on the chart where a flood of sell orders is waiting.

- Running on Fumes: The buyers simply run out of steam. There’s no one left to keep pushing the price higher.

This is where the bulls are most vulnerable. What started as a confident rally quickly turns into a mad dash for the exits as sellers take over. The once-mighty buyers are suddenly swamped by a wave of selling.

The Bearish Counterattack

Once the sellers grab control, they hammer the price back down. The speed of this reversal is what really matters here — it wipes out every single gain made earlier in the session. This isn’t just a pullback; it’s a massive shift in market sentiment. The morning’s optimism has curdled into fear and doubt.

The gravestone doji captures a complete psychological flip in a single trading period. It’s the footprint of a failed rally where bullish ambition was crushed by bearish force, signaling that the “death” of the uptrend could be right around the corner.

The end result is a candle where the open, low, and close are all basically at the same price. It shows that even though the bulls gave it their best shot, they couldn’t hold any ground. The sellers not only stopped the advance but shoved the price right back to where it started, flexing their newfound muscle.

Understanding this battle between greed and fear is everything. The gravestone doji isn’t just a random pattern; it’s a flashing warning sign that the conviction behind the uptrend is crumbling. This psychological crack is what makes it such a powerful heads-up for traders that the path of least resistance might be about to switch to the downside.

How to Spot and Confirm the Signal

Seeing a gravestone doji candlestick on your chart is one thing. Knowing what to do with it is another entirely. The real skill — what separates disciplined traders from gamblers — is learning how to confirm the signal. Acting on the pattern alone without looking at the bigger picture is a recipe for frustration and financial pain. We’ve all been there.

Think of a gravestone doji as a warning shot, not a guaranteed reason to sell. Its message only becomes powerful when it shows up in the right place and is backed by other evidence. It’s a clue in a detective story; one clue is interesting, but you need more to solve the case.

A Checklist for High-Probability Setups

To build a strong case for a potential reversal, you need to check a few key boxes. Rushing into a trade based on a single candle is one of the fastest ways to burn through your capital. Instead, slow down and run through this mental checklist before you even think about placing an order.

Here are the critical factors to look for:

- Established Uptrend: The gravestone doji is a bearish reversal pattern. For something to reverse, it needs a trend to reverse from. Look for the pattern to form after a clear series of higher highs and higher lows.

- Location, Location, Location: A gravestone doji appearing randomly in the middle of a price range is usually just noise. Its signal is strongest when it forms at a known area of resistance — like a previous swing high, a major moving average, or a big psychological number (like $100).

- Increased Trading Volume: Volume is a fantastic confirmation tool. High volume on the day the gravestone doji forms tells you a real battle took place, and the sellers ultimately won. It adds conviction to the rejection of higher prices.

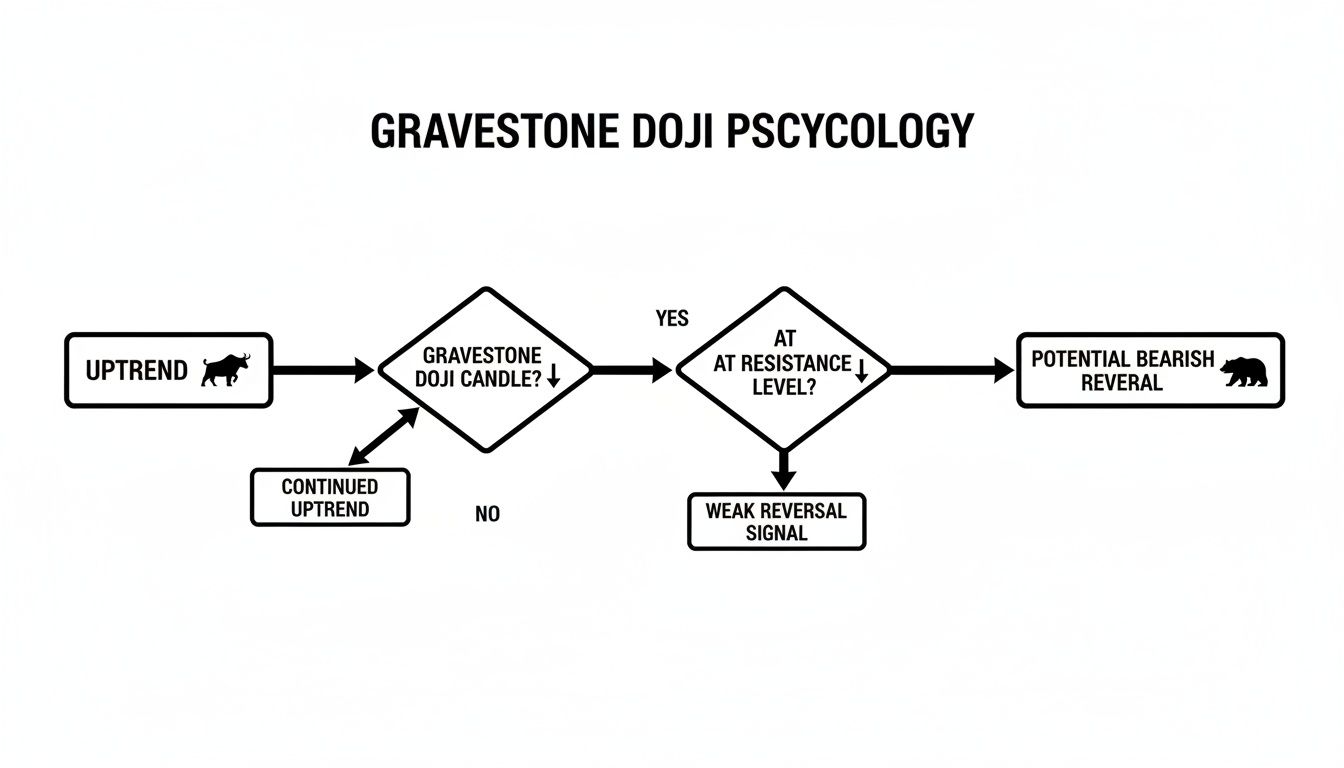

This flowchart breaks down the psychology and context, from the initial uptrend to the potential bearish outcome that follows a gravestone doji.

As you can see, the pattern’s reliability is all about its context within an uptrend and what happens next.

The All-Important Confirmation Candle

The single most important confirmation signal comes from the very next candle. It’s easy to get excited and jump the gun, but patience is a trader’s best friend. Disciplined traders wait to see what happens after the gravestone doji has closed.

The gravestone doji is the warning. The next candle is the trigger. A strong bearish candle that closes below the low of the gravestone doji confirms that sellers have followed through and are now in control.

Without this confirmation, the gravestone doji might just be a brief pause before the bulls take over again. That bearish follow-up candle is your proof that the shift in momentum is real. Understanding how price behaves around key levels can strengthen this analysis even more. For a deeper dive, check out our guide on how to use moving averages.

Practical Trading Strategies for the Gravestone Doji

Spotting a gravestone doji candlestick is a great first step, but that’s all it is — a first step. The real skill lies in turning that observation into a repeatable, disciplined trading plan. Without a plan, you’re just gambling on a pattern.

A solid strategy isn’t about finding a magic bullet that wins every time. That doesn’t exist. Instead, it’s about creating a framework that defines your risk, dictates your exits, and keeps you steady when the market gets chaotic. We’re here to build a rule-based approach that puts the odds in our favor over the long haul.

Building Your Core Trading Plan

Any robust strategy for the gravestone doji needs three non-negotiable parts: an entry trigger, a stop-loss, and a profit target. Figure these out before you even think about placing a trade. This simple habit pulls emotion out of the driver’s seat and forces you to think clearly about risk versus reward.

Let’s walk through a fundamental approach for trading this classic bearish signal.

1. The Entry Trigger

Think of the gravestone doji as a warning shot from sellers. The confirmation candle that follows is your green light. A disciplined entry trigger is to go short only after the price breaks below the low of the gravestone doji candle. This action proves that sellers weren’t just testing the waters; they’re actually pushing the price down.

Never jump the gun and trade the gravestone doji by itself. Always wait for the next candle to confirm that bears are in control. This patience is what separates amateurs from pros.

2. The Stop-Loss Placement

Your stop-loss is your safety net, plain and simple. It’s the point on the chart where your trade idea is officially proven wrong, getting you out with a small, manageable loss. For a gravestone doji, the most logical place for a stop is just above the high of that long upper shadow. That wick represents the absolute peak of buying exhaustion; if the price manages to climb back above it, the bearish story falls apart.

3. The Profit Target

Knowing when to take your money and run is just as critical as knowing when to get in. A pre-defined profit target keeps greed from turning a winning trade into a loser. Here are a couple of popular methods:

- Key Support Levels: Scan the chart to the left for previous areas of support — like a prior swing low — and set your target just above that zone.

- Risk-to-Reward Ratios: Aim for a reward that’s a multiple of your risk. If your stop-loss is $1 away from your entry, you could set a target $2 or $3 away to achieve a 1:2 or 1:3 risk-to-reward ratio.

This framework gives you a clear, systematic process you can follow for every single trade.

Enhancing Your Strategy with Confluence

While the basic plan is solid, you can seriously level up your odds by looking for “confluence” — that’s when multiple, unrelated signals all point to the same outcome. Pairing the gravestone doji with another technical indicator helps filter out the noise and spotlights the A+ setups.

A powerful partner for the gravestone doji is the Relative Strength Index (RSI), a momentum indicator that helps gauge if an asset is “overbought” or “oversold.”

- The Strategy: Look for a gravestone doji to appear at a clear resistance level at the same time the RSI is in overbought territory (usually a reading above 70).

- The Logic: The gravestone doji shows that buyers are exhausted at a key price level. The overbought RSI reading backs this up, confirming that the entire upward move is running on fumes and is vulnerable to a reversal. This double-whammy gives you a much stronger signal than either one would alone.

This kind of layered analysis helps you trade with much greater confidence.

Gravestone Doji Trading Strategy Framework

Of course, not every trader is the same. Some are more aggressive, while others prefer to wait for more proof. The table below outlines a few different ways you might approach trading the gravestone doji.

| Strategy | Entry Trigger | Stop-Loss Placement | Potential Profit Target |

|---|---|---|---|

| Aggressive Entry | Enter as soon as the next candle trades below the gravestone’s low. | Just above the high of the gravestone doji. | The nearest minor support level. |

| Conservative Entry | Wait for the confirmation candle to close fully below the gravestone’s low before entering. | Slightly wider, perhaps above a nearby resistance zone. | A major support level or a 1:3 risk-reward ratio. |

| Indicator-Driven | Enter below the doji’s low only if RSI is overbought (>70) or there’s a MACD bearish cross. | Above the high of the gravestone doji. | Trailing stop-loss to capture a larger move. |

Ultimately, the best strategy is the one that fits your personal risk tolerance and that you’ve validated through your own testing and journaling. Trading is a journey of constant refinement. The gravestone doji is a fantastic tool, but it’s most powerful when used with discipline, context, and a rock-solid plan for managing your risk.

Common Pitfalls and Why Context Is Key

Even the sharpest candlestick patterns can burn you if they’re misinterpreted or traded in a vacuum. The gravestone doji is no different. It’s a powerful warning of a potential bearish reversal, but treating it like a crystal ball is one of the fastest ways for a developing trader to get into trouble.

The path to consistency isn’t about finding a single, perfect signal that never fails. It’s about learning to think in probabilities and realizing that every pattern is just one piece of a much larger market puzzle. Too many traders feel the sting of a failed pattern and either abandon the setup entirely or double down out of frustration — both emotional reactions that wreck performance.

The Danger of Trading in a Vacuum

One of the biggest mistakes traders make is spotting a gravestone doji and hitting the sell button without a second thought for the bigger picture. Context is everything. A signal that looks like a sure thing on a 5-minute chart might be completely meaningless when you zoom out to the daily timeframe.

Here are a few critical mistakes to avoid when it comes to context:

- Ignoring the Overall Trend: Remember, a gravestone doji is a bearish reversal pattern. If there’s no clear uptrend to reverse, the signal loses most of its power. Spotting one in a choppy, sideways market is usually random noise, not an actionable signal.

- Forgetting About Location: Where the pattern forms is just as important as the pattern itself. A gravestone doji appearing at a major, multi-month resistance level carries way more weight than one popping up in the middle of a price range with no significant structure nearby.

- Neglecting Volume Confirmation: Volume is a valuable clue to market conviction. A gravestone doji that forms on weak, low volume suggests there wasn’t a real battle between buyers and sellers. But high volume? That confirms a fierce struggle took place where the rejection of higher prices was decisive and meaningful.

Trading the gravestone doji without context is like hearing a single word from a long conversation and trying to guess the entire story. The word might be important, but without the surrounding sentences, you’re just guessing.

Seeing Patterns as Probabilities, Not Certainties

It’s natural to want a perfect, foolproof signal in trading, but the market runs on statistics and probabilities, not guarantees. The gravestone doji gives you a statistical edge, but it’s far from perfect. It signals a potential shift in momentum — a valuable clue, for sure — but it doesn’t promise a price drop.

This is where a disciplined, long-term mindset becomes your greatest ally. Instead of getting frustrated when a pattern fails, you have to see it as a normal part of the game.

According to backtesting data from Quantified Strategies, the gravestone doji doesn’t guarantee a decline, but it does show a slight negative bias in the days following its appearance. Their analysis of the gravestone doji candlestick pattern on S&P 500 data shows that the average return over the next five days is slightly negative, but the win rate for a profitable short trade is often close to 50-55%.

This highlights a crucial point: the pattern gives you a directional bias, but it’s not strongly predictive on its own. Your job isn’t to find a pattern that never fails. It’s to build a complete trading plan around a pattern that offers a slight edge and then manage your risk flawlessly every single time.

Journaling Your Trades to Refine Your Edge

Learning to spot a high-probability gravestone doji is a fantastic skill, but it’s only half the battle. The real secret to long-term success isn’t just knowing the patterns; it’s analyzing your own performance with them.

Without tracking your trades, you’re essentially flying blind. You’re trading on gut feelings and vague memories instead of hard evidence. The most disciplined traders are obsessive record-keepers. Every single trade — win or lose — is a piece of data that helps them sharpen their edge.

This is where a trading journal becomes your most powerful ally. It turns trading from a series of random bets into a systematic process of constant improvement. By logging your trades, you’re building a personal database of what actually works for you.

Building Your Data-Driven Edge

Your journal is so much more than a simple list of wins and losses. It’s a detailed log of your decision-making process when real money is on the line. For every gravestone doji trade, you should be jotting down a few key details. Over time, these notes will reveal powerful patterns in your own trading.

- Market Context: Was the market trending higher or just chopping sideways? What was the overall mood — fear or greed?

- Confirmation Signals: Did you wait for that bearish follow-through candle? Was there a spike in volume? Was the RSI overbought?

- Entry and Exit Points: Note the exact prices for your entry, your stop-loss, and where you took profits.

- Trade Outcome: Log the final P&L and, most importantly, grab a screenshot of the chart. A picture is worth a thousand words when you’re reviewing later.

After a few dozen trades, you can start answering critical questions with data, not just hunches. What’s your actual win rate with this setup? Do you perform better in the first hour of trading? These are the insights that build a real, quantifiable edge. To dig deeper, check out our guide on why every trader needs a trading journal.

From Pattern Follower to Edge Builder

Using a dedicated tool can make this whole process a lot less painful. A specialized trading journal like TradeReview helps you log these details in seconds and then does the heavy lifting by visualizing your performance for you.

A dashboard like this instantly transforms raw numbers into actionable insights. It makes it obvious where you’re leaking money. Maybe you’re consistently setting your stops too tight or jumping into trades before proper confirmation. This is how you spot those bad habits and make data-backed adjustments.

A trading journal is the ultimate accountability partner. It forces you to confront your mistakes, recognize your strengths, and systematically refine the rules that govern your trading.

This commitment to review is what separates traders who treat this like a business from those who treat it like a casino. It’s a pledge to continuous learning, ensuring that every trade you take — good or bad — makes you a slightly better trader tomorrow. The insights you pull from your own data will always be more valuable than any generic tip you’ll find online.

Common Questions About the Gravestone Doji

Even after you get the hang of spotting the gravestone doji, a few questions always seem to pop up. Let’s clear up some of the most common ones traders ask so you can use this pattern with more confidence.

What’s the Difference Between a Gravestone Doji and a Shooting Star?

Great question. Both are bearish reversal signals that show up at the top of a rally, but the devil is in the details — specifically, the candle’s body.

A true gravestone doji has almost no body at all. The open, low, and close prices are all piled up at the same spot. A shooting star, on the other hand, has a small but noticeable real body at the bottom of its range.

Think of it this way: both patterns tell a similar story of bulls getting rejected. But the gravestone doji is a more dramatic tale. It shows the bulls failed so completely that they couldn’t even hold a tiny sliver of ground by the end of the session.

Does the Gravestone Doji Work on All Timeframes?

Yes, you can find this pattern on any chart, from a one-minute scalp to a long-term weekly view. But — and this is a big “but” — its significance grows with the timeframe.

A gravestone doji on a daily or weekly chart carries a lot more weight. It represents a much bigger, more drawn-out battle between buyers and sellers where the bears ultimately won. These higher-timeframe signals are generally far more reliable than ones you’ll spot on a 5-minute or 15-minute chart, which can often just be short-lived noise.

Can a Gravestone Doji Show Up in a Downtrend?

Technically, yes, it can form anywhere. But if a gravestone doji appears in the middle of a downtrend, it loses its primary job as a bearish reversal signal.

In that context, it usually just signals a bit of indecision or a temporary pause in the selling pressure. The most powerful, actionable gravestone dojis are the ones that appear after a solid uptrend, right where you’d expect sellers to be waiting.

Remember, a gravestone doji’s power comes from its context. A gravestone at a key resistance level after a long rally is a five-alarm fire. One showing up in choppy, sideways action is often just a flicker of market noise.

So, How Reliable Is This Pattern, Really?

Let’s be clear: no single candlestick pattern is a crystal ball, and that includes the gravestone doji. It’s not 100% reliable, and anyone who tells you otherwise is selling something. Think of it as a strong clue, not a conviction.

Its reliability shoots up when it has friends. The pattern becomes much more trustworthy when it:

- Pops up at a major resistance level.

- Forms on higher-than-average trading volume.

- Is followed by a big red confirmation candle on the next bar.

Treat the gravestone doji as a high-probability warning shot — a signal to pay very close attention — not as a guarantee.

Ready to stop guessing and start analyzing? The best insights come from your own data. TradeReview helps you log every trade, analyze your performance with powerful analytics, and discover what truly works for your strategy.

Start journaling for free at TradeReview