At its core, the formula for loss ratio is a simple, powerful tool that tells you a crucial story: it’s your Total Monetary Losses divided by your Total Monetary Wins.

This calculation offers a quick, honest look at whether your winning trades are actually covering the cost of your losing ones. We understand that trading can be a tough journey, filled with emotional highs and lows. This formula helps cut through the noise and gets right to the heart of what matters for long-term survival — your financial health.

Why Your Win Rate Does Not Tell the Whole Story

It’s one of the most common traps in trading — celebrating a high win rate while your account balance slowly withers. We’ve all felt that rush of closing several green trades in a row. But this focus on frequency over magnitude can create a dangerous blind spot.

Think of it like a shop owner who makes 100 small sales but ignores one massive, business-ending expense. That’s exactly what happens when traders obsess over their win rate while their loss ratio spirals out of control. It’s an emotional trap that prioritizes the short-term thrill of being “right” over the long-term discipline of being profitable.

Shifting Your Mindset to Profitability

The loss ratio formula forces a critical shift in perspective. Instead of asking, “How often am I winning?” it makes you ask, “Are my wins actually paying for my losses?” This question is at the heart of sustainable trading and long-term survival in the markets.

Focusing on this ratio helps you build the habits of a professional trader:

- Embracing Asymmetry: The goal isn’t to win every time. It’s to make sure your winning trades are significantly larger than your losing ones.

- Disciplined Risk Management: It gives you a clear, numerical measure of how well you’re cutting your losses and letting your winners run.

- Objective Self-Assessment: It pulls your ego out of the equation, giving you a clear-eyed view of your strategy’s financial viability.

To get a complete picture of your performance, it’s helpful to look at multiple metrics. You can learn more in our guide on how to calculate win rate.

To help break this down, here’s a quick look at the components of the loss ratio and what they tell you about your trading.

Quick Guide to the Trader’s Loss Ratio

| Component | Description | Example |

|---|---|---|

| Total Monetary Losses | The sum of all money lost on unprofitable trades within a specific period. | You had three losing trades totaling $300. |

| Total Monetary Wins | The sum of all money gained from profitable trades within the same period. | You had two winning trades totaling $250. |

| Loss Ratio | The result of dividing your total losses by your total wins. A ratio above 1.0 is a warning sign. | Your loss ratio would be $300 / $250 = 1.2. |

As you can see, a loss ratio greater than 1.0 means your losses are bigger than your wins — a clear signal that your strategy isn’t sustainable in its current form.

The Sobering Reality of Trading Losses

This isn’t just a theoretical concept; it’s the harsh reality that separates successful traders from the crowd. Many traders grapple with a poor loss ratio, which helps explain why so few make it long-term.

While precise, universal statistics are hard to come by, several studies highlight the challenges. For instance, a notable study analyzing eToro accounts between 2010 and 2012, as cited by Quantified Strategies, found that nearly 80% of day traders lost money over a 12-month period. This often happens because large losses from a few trades wipe out the gains from many small wins. This statistic alone highlights just how crucial it is to manage the size of your losses relative to your gains.

Ultimately, your loss ratio is a financial reality check. It tells you if you’re running a profitable trading business or just an expensive hobby. By understanding and consistently tracking it, you take a massive step toward building a trading career grounded in discipline, not just hope.

How to Calculate Your Loss Ratio Step by Step

Knowing the theory is one thing, but putting it into practice is where real discipline is built. Calculating your loss ratio isn’t some complex math problem; it’s a core habit of any serious trader. It gives you a raw, unfiltered look at your performance and helps you build a strategy based on data, not just gut feelings.

The calculation itself is pretty simple. There are two key formulas every trader should have in their back pocket, and each one offers a different but equally valuable angle on your trading.

The Monetary Loss Ratio Formula

This is the big one. The formula for loss ratio based on money is the most direct measure of your financial health as a trader. It cuts right to the chase and tells you if your winning trades are actually strong enough to absorb the financial hit from your losers.

The Formula: Monetary Loss Ratio = Total Monetary Losses / Total Monetary Wins

Let’s run through a practical example with a basic trading log. Say these were your last ten trades for the month:

| Trade # | Ticker | P/L ($) | Win/Loss |

|---|---|---|---|

| 1 | ABC | +$150 | Win |

| 2 | XYZ | -$75 | Loss |

| 3 | ABC | +$220 | Win |

| 4 | DEF | -$100 | Loss |

| 5 | GHI | -$80 | Loss |

| 6 | XYZ | +$300 | Win |

| 7 | JKL | +$90 | Win |

| 8 | ABC | -$50 | Loss |

| 9 | DEF | -$120 | Loss |

| 10 | GHI | +$400 | Win |

Alright, let’s plug these numbers into the formula, step-by-step:

-

Add Up Your Total Monetary Losses:

$75 + $100 + $80 + $50 + $120 = $425 in total losses. -

Add Up Your Total Monetary Wins:

$150 + $220 + $300 + $90 + $400 = $1,160 in total wins. -

Calculate the Ratio:

$425 (Losses) / $1,160 (Wins) = 0.366 or 36.6%.

A loss ratio of 36.6% is a great result. It means that for every single dollar you earned from a winning trade, you only gave back about 37 cents on your losing ones. This is a sign of a healthy, sustainable strategy where your winners are clearly doing the heavy lifting. To see how this fits into the bigger picture, you can learn more about the profit or loss formula in our detailed guide.

The Trade Count Ratio Formula

While the monetary ratio is king, this next one offers a different kind of insight. The Trade Count Ratio ignores the dollars and cents and focuses purely on how often you win versus how often you lose. This can be a great way to understand the psychological rhythm of your strategy.

The Formula: Trade Count Ratio = Number of Losing Trades / Number of Winning Trades

Let’s use that same trading log from before:

- Count Your Losing Trades: A quick count shows 5 losing trades.

- Count Your Winning Trades: And there were 5 winning trades.

-

Calculate the Ratio:

5 (Losing Trades) / 5 (Winning Trades) = 1.0 or 100%.

A ratio of 100% tells us that you lost exactly as often as you won — a 50/50 split. When you put that next to your excellent Monetary Loss Ratio of 36.6%, it reveals a powerful truth about trading: you don’t actually need to win all the time to be incredibly profitable. You just need to make sure your wins are significantly bigger than your losses.

This is why meticulously tracking every trade is the foundation of long-term success. It’s what separates professional trading from gambling. Every number tells a story and helps you make the next right decision.

What Your Loss Ratio Is Actually Telling You

Once you’ve calculated your loss ratio, you’re looking at a single number. But don’t be fooled by its simplicity — that number tells a powerful story about your trading discipline, risk management, and long-term viability. It’s more than just a data point; it’s a direct reflection of your strategy’s real-world profitability.

Simply put, a loss ratio below 100% (or 1.0) means you’re profitable. Your winning trades are successfully covering the cost of your losing ones, and then some. A ratio over 100% is a red flag signaling you’re losing money, even if you feel like you’re winning most of the time. This is a classic trap where traders celebrate frequent small wins, only to have one or two large losses wipe out all their progress.

Uncovering Your True Edge

Your loss ratio doesn’t exist in a vacuum. The real magic happens when you pair it with your win rate. Together, these two metrics reveal your strategy’s expectancy — a term for its long-term statistical edge. A positive expectancy is the mathematical proof that your strategy is built to last.

Think of a baseball slugger. They might strike out a lot, giving them a relatively low “win rate” at the plate. But when they connect with the ball, they hit home runs. Their massive wins more than make up for their frequent strikeouts, resulting in a stellar batting average and a low loss ratio equivalent. This powerful combination makes them an incredibly valuable player.

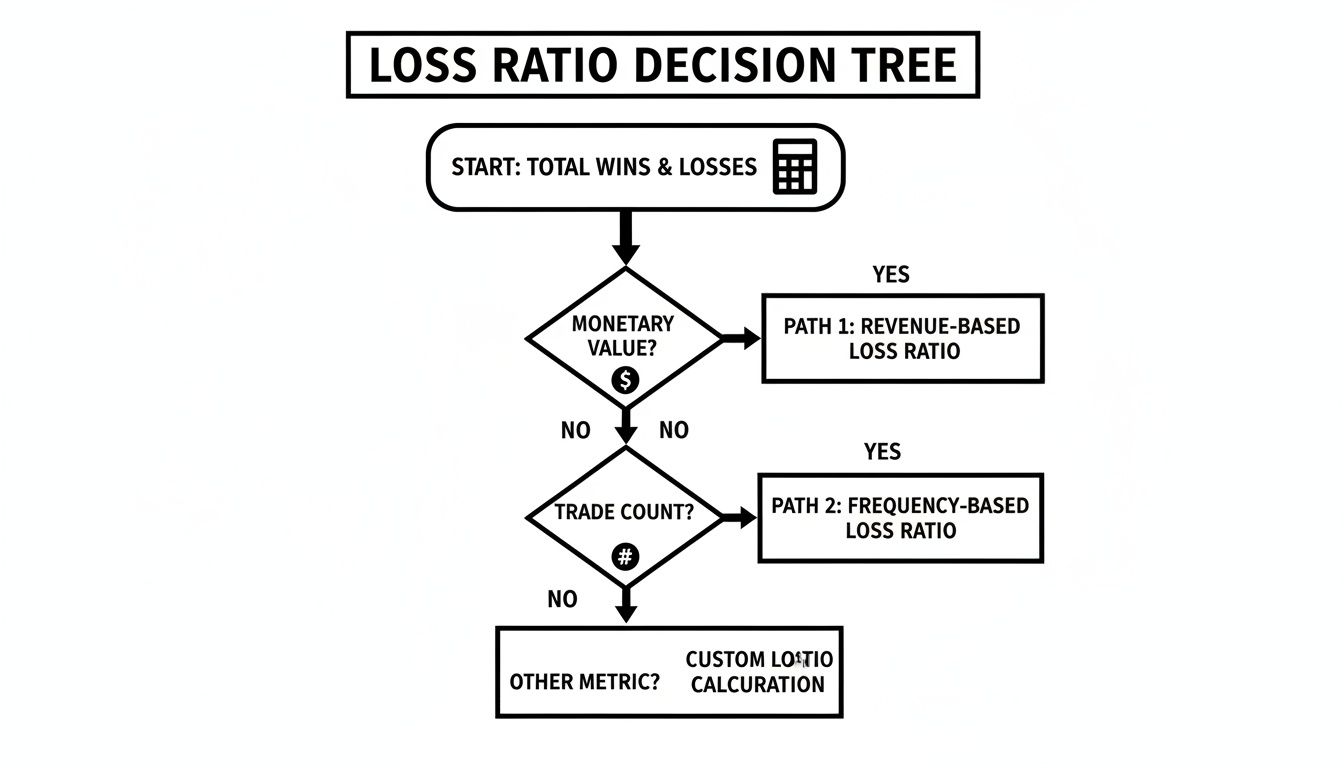

This decision tree helps visualize the two main paths for calculating the data needed to understand your trading performance.

As the flowchart shows, whether you focus on the dollar value of your trades or their frequency, both calculations are essential for a complete picture of your performance.

Loss Ratio Scenarios and Strategic Implications

The interplay between Win Rate and Loss Ratio can reveal a lot about a trading strategy’s health. Here’s a look at a few common scenarios and what they might mean for you.

| Win Rate | Loss Ratio | Outcome | Recommended Action |

|---|---|---|---|

| High (> 60%) | High (> 100%) | Unprofitable | Your wins are too small, and your losses are too big. Focus on letting winners run longer and cutting losers much sooner. This is a classic discipline problem. |

| High (> 60%) | Low (< 100%) | Profitable | This is an effective combination. Your strategy is effective and you manage risk well. Continue to execute your plan and look for ways to optimize. |

| Low (< 40%) | High (> 100%) | Very Unprofitable | Your strategy isn’t working. It’s time to go back to the drawing board to find a new approach or significantly refine your current one. |

| Low (< 40%) | Low (< 100%) | Potentially Profitable | The “home run hitter” strategy. You lose often, but your wins are massive. Focus on identifying high-conviction setups and managing risk tightly. |

Understanding where you fall on this table is the first step toward making meaningful, data-driven adjustments to your trading plan.

The Ultimate Measure of Discipline

At the end of the day, the loss ratio is the ultimate measure of a trader’s discipline. It’s so easy to get swept up in the emotional highs of a winning streak or the gut-wrenching lows of a drawdown. We all fight the temptation to hold a losing position just a little longer, hoping it will turn around. We also feel the fear that makes us cut a winning trade short, terrified of giving back profits.

Your loss ratio cuts right through that emotional noise. It’s the scorecard for one of the oldest and wisest pieces of trading advice you’ll ever hear: cut your losses quickly and let your winners run.

A consistently low loss ratio is never an accident. It is the direct result of a disciplined process where risk is strictly defined, and profitable opportunities are given the room to mature. It proves you are managing your trades, not letting them manage you.

Keeping this number low requires a relentless commitment to your trading plan and a deep respect for risk. It’s a habit that forces you to think like a business owner, where protecting your capital is just as important as generating profits. In the long run, it’s this disciplined approach — measured by your loss ratio — that separates the successful traders from everyone else.

Cautionary Tales of an Ignored Loss Ratio

History is filled with powerful, often painful, lessons about what happens when critical risk metrics are ignored. For traders, a skyrocketing loss ratio isn’t just a red flag; it’s a blaring siren warning of a disaster waiting to happen. Some of the most infamous financial blow-ups are stark reminders that even the biggest players can be brought to their knees when losses are allowed to spiral out of control.

These stories aren’t just for Wall Street. They reveal a destructive pattern that can play out in any trading account, big or small. It’s the classic tale of a long string of manageable wins getting completely wiped out by a few catastrophic, unmanaged losses. This cycle is almost always fueled by the same things: ego, a lack of discipline, and a fundamental failure to respect the simple math behind the loss ratio.

When One Trader’s Losses Bankrupt a Bank

The collapse of Barings Bank in 1995 is a textbook example. In the high-stakes game of professional trading, the loss ratio — often looked at as total losses divided by total capital at risk — has been the smoking gun in some of history’s most spectacular failures. In this case, a single rogue trader, Nick Leeson, managed to rack up an unbelievable $1.4 billion in losses from unauthorized bets on Japanese stocks.

That staggering sum completely obliterated the bank’s entire capital base. It created a devastating loss ratio that far exceeded 100% of the firm’s total worth. This story is a brutal illustration of how a single, unchecked stream of losses can completely annihilate an institution that had been around for centuries. You can find many more examples of large trading losses on Wikipedia.

The Repeating Pattern of Unchecked Risk

Sadly, the Barings Bank disaster wasn’t a one-off event. We saw a similar pattern play out in the 2011 UBS rogue trader scandal, where Kweku Adoboli’s unauthorized trades led to a jaw-dropping $2.3 billion loss. In both situations, the traders desperately tried to hide their mounting losses, praying for a market reversal that never came.

These events aren’t just about rogue individuals; they are about a systemic failure to monitor and act on a spiraling loss ratio. The traders fell into a classic psychological trap — doubling down on losing positions instead of cutting them, a fatal error that their loss ratio would have exposed immediately.

For us individual traders, the lesson hits much closer to home. You don’t need to be managing billions to fall into the exact same destructive mindset. Letting one oversized loss wipe out weeks or even months of your hard-earned gains is just a miniature version of the same catastrophe. It’s a crystal-clear signal that your risk management has failed.

These cautionary tales should instill a deep and healthy respect for risk. A disciplined trader knows that survival isn’t about the thrill of winning. It’s about the boring, consistent, and non-negotiable act of managing losses. Your loss ratio is the primary tool you have to enforce that discipline and make sure you stay in the game long enough to find success.

A Practical Plan to Improve Your Loss Ratio

Let’s be clear: improving your loss ratio has nothing to do with finding a secret indicator or some “holy grail” strategy. It’s all about a disciplined, data-driven look at your own trading behavior. The patterns causing your biggest losses are already hiding in your trading history; your job is to uncover them.

This process is simpler than you might think. It just requires a shift in focus — from chasing wins to systematically dissecting your losses. A detailed trading journal is the single most powerful tool for this, turning your past mistakes into a roadmap for future profitability. The goal is to get beyond the raw formula for loss ratio and understand the behaviors that are driving those numbers.

Step 1: Log Every Trade with Detailed Notes

The foundation for any improvement is meticulous record-keeping. Every single trade, win or lose, needs to be logged with more than just the entry and exit price. This isn’t about making yourself feel accountable; it’s about creating a rich dataset you can analyze later.

Your journal entries should capture the full picture:

- The Setup: What technical or fundamental reason made you take the trade?

- Your Thesis: What did you expect to happen, and why?

- Emotional State: Were you calm, anxious, greedy, or feeling a bit of FOMO? Be brutally honest with yourself here.

This level of detail is what transforms a simple log into a powerful diagnostic tool.

Step 2: Use Tags to Categorize Your Losses

Once you’re logging consistently, the next step is to start categorizing your losses. This is where the patterns begin to emerge from the noise. Using a journaling tool like TradeReview, you can apply flexible tags to each losing trade.

Think of these tags as labels for your mistakes. A few examples could be:

- ‘FOMO Entry’: For trades you chased after a big, emotional move.

- ‘Revenge Trade’: For trades you jumped into right after a loss.

- ‘Broke Rules’: For those times you ignored your own trading plan.

- ‘News Event’: For losses tied to high-impact economic data releases.

Visualizing your data makes it incredibly easy to spot which days, setups, or assets are quietly draining your P&L.

Step 3: Analyze the Data to Pinpoint Costly Mistakes

After a few weeks or months of tagging your data, you can run a simple analysis. Filter your journal to show only your losing trades, then group them by tag. You will almost certainly find that a small number of mistakes are responsible for a huge percentage of your losses.

You might discover that 80% of your losses come from just two or three recurring errors, like revenge trading or holding losers way past your stop-loss. This is your “aha!” moment — the point where you stop guessing and start fixing what’s actually broken.

Step 4: Build Actionable Rules for Your Trading Plan

The final step is turning these insights into specific, non-negotiable rules for your trading plan. This is how you convert analysis into action and directly attack your loss ratio.

For instance:

- If ‘FOMO Entry’ is your biggest issue, create a new rule: “I will not enter a trade if the asset has already moved more than 3% in the last hour.”

- If ‘Revenge Trade’ is your downfall, implement a cooling-off period: “After any losing trade, I will step away from my screen for at least 15 minutes.”

This systematic process — log, tag, analyze, and adapt — is the essence of professional trading. It’s one of the core risk management techniques for traders that separates the pros from the rest. By learning from your own data, you give yourself the best possible chance to build a disciplined and profitable trading career.

Your Loss Ratio Questions, Answered

Getting a handle on trading metrics can feel like learning a new language, but your loss ratio is one term you absolutely need to master. Let’s break down some of the most common questions traders have about this powerful performance indicator.

What Is a Good Loss Ratio for a Day Trader?

There’s no magic number here. The “right” loss ratio is completely tied to your strategy’s win rate. That said, a solid benchmark to aim for is a monetary loss ratio that stays consistently below 80% (or 0.8).

Keeping it under that threshold is proof that your winning trades are meaningfully larger than your losing ones. It shows you have a positive expectancy and are managing your risk like a pro — the absolute foundation of any sustainable trading business.

How Is Loss Ratio Different From Profit Factor?

Think of them as two sides of the same coin. They measure the exact same thing, just from opposite perspectives. In fact, the Profit Factor is simply the inverse of the Monetary Loss Ratio.

- Loss Ratio Formula: Total Monetary Losses / Total Monetary Wins

- Profit Factor Formula: Total Monetary Wins / Total Monetary Losses

So, a loss ratio of 80% (or 0.80) is the same thing as a Profit Factor of 1.25 ($1 / $0.80). Both numbers tell you the same great news: for every dollar you lost, you made $1.25. Your strategy is working.

Can a High Win Rate Hide a Bad Loss Ratio?

Absolutely. This is one of the most common and dangerous traps that developing traders fall into. A high win rate feels incredible, but it can easily mask a fatal flaw in your risk management that leads to a disastrous loss ratio.

Let’s look at a quick, practical example. A trader makes ten trades:

- Nine winning trades: Each one banks a small $50 profit. Total gain: $450.

- One losing trade: They let a single loser get out of hand, and it hits -$500.

On the surface, their 90% win rate looks amazing. It feels like success. But when we plug the numbers into the formula for loss ratio, the brutal truth is revealed: $500 (Losses) / $450 (Wins) = 111.1%.

Despite winning nine out of ten times, this trader still lost money. Their high win rate created a false sense of security, while one undisciplined loss wiped out all their hard work and then some. This is the perfect illustration of why your loss ratio is the ultimate gut check for profitability.

Stop guessing and start analyzing. TradeReview gives you the tools to automatically calculate your loss ratio, track performance analytics, and find the hidden patterns in your trading. Ditch the manual spreadsheets and make data-driven decisions with a journal built for serious traders. Create your free account today.