Think of an Excel trading journal as your personal performance database. It’s a custom-built spreadsheet where you log, track, and analyze every single trade, turning a pile of raw data into insights you can actually use. More than just a logbook, it helps you spot behavioral patterns, fine-tune your strategies, and build the discipline every trader needs for long-term thinking. This is not about finding a magic formula for overnight riches; it’s about building a sustainable trading career, one trade at a time.

Why a Trading Journal Is a Trader’s Best Tool

Trading without a journal is like navigating a maze blindfolded. We’ve all been there. You get a few lucky wins, feel invincible, then give it all back — and more — without ever figuring out why. It’s a frustrating cycle that leads straight to emotional decisions, like revenge trading after a painful loss or cutting a winning trade short out of fear. The emotional rollercoaster can be exhausting, and it’s a shared struggle among traders.

An Excel trading journal is the tool that cuts through that emotional fog. It’s not just a list of your entries and exits; it’s an objective, unfiltered record of your decision-making process. By meticulously tracking what you do, you create an undeniable feedback loop that your gut feelings and flawed memory simply can’t compete with.

Gaining Clarity and Building Discipline

The real power of a journal is that it forces you to confront the truth about your trading habits. You have to be accountable for every single action you take in the market, and that practice is what builds the discipline separating developing traders from the rest. The beauty of Excel is its versatility — you can easily adapt your journal to track trades across any market, whether it’s stocks, options, or forex.

This isn’t just about feeling more organized; it can have a direct impact on your bottom line. While there are no guarantees, diligent journaling can significantly improve performance over time, purely by helping you identify and fix your recurring errors.

Your trading journal is your most honest mentor. It doesn’t care about your ego or your hopes; it only shows you the data. Listening to it is how you turn experience into expertise.

From Raw Data to Real Insight

A well-designed spreadsheet does more than just hold numbers. It helps you answer the critical questions about your performance that are almost impossible to solve in your head. For a deeper look at this, check out our article on why every trader needs a trading journal.

Here are just a few of the things a good journal helps you uncover:

- Which of your strategies actually work? You might feel like your breakout strategy is your big winner, but the data could reveal that your simple reversal trades are the ones really carrying your account.

- What are your most common mistakes? Are you constantly moving your stop-loss? Entering trades too early? Over-sizing your positions? The patterns will jump right out of the data. For example, you might discover that 80% of your big losses happen on Friday afternoons when you’re tired and impatient.

- How does your psychology impact your P&L? By adding a simple column to note your mindset, you can quickly see if you trade poorly when you’re stressed, tired, or feeling a little too overconfident after a big win.

Ultimately, building this tool is your first real step toward treating your trading like a business — one focused on growth, solid risk management, and constant improvement.

Laying the Foundation of Your Trade Log

Every powerful analysis starts with good data. And when it comes to your Excel trading journal, the foundation isn’t about logging every metric you can think of — it’s about collecting the right ones.

So many traders fall into one of two traps. They either track too little, leaving them with surface-level insights, or they track way too much. We’ve all been there, staring at a cluttered spreadsheet that creates more confusion than clarity, and abandoning it after a few weeks. The key is to start simple and stay consistent.

The goal is to build a log that captures not just the numbers, but the crucial context surrounding each trade. This means going beyond simple entry and exit prices to document your strategy, your risk, and even your state of mind. Each column needs to serve a purpose, helping you connect the dots between your actions and your results.

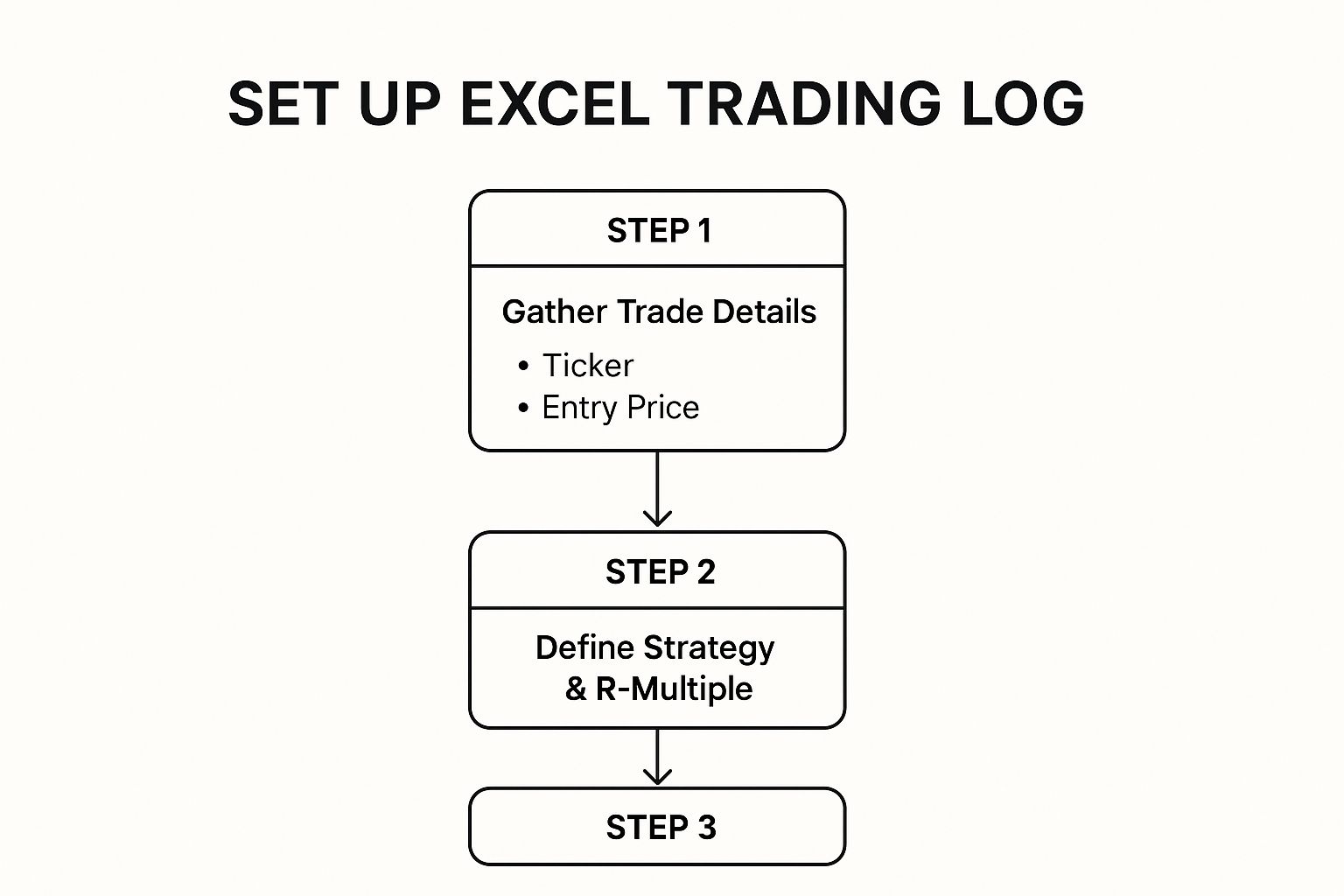

This infographic gives a great overview of that core data flow, from capturing the basic trade details to weaving in the all-important psychological context.

As you can see, a truly robust process blends the quantitative (the hard numbers like prices and size) with the qualitative (the context, like your strategy and mindset). This combination is what turns a simple log into a powerful tool for genuine performance improvement.

Designing Your Core Columns

Alright, let’s get practical. Your primary “Trade Log” sheet in Excel needs a solid set of columns. While you can always add more later, starting with a proven framework is essential. The goal is a structure you can actually stick with, because discipline in data entry is just as important as discipline in your trading.

Here’s a breakdown of the essential columns that provide the most value. Think of these as your non-negotiables—the data points that will give you the most significant insights for a manageable amount of effort.

Essential Columns for Your Trading Journal Log

This table breaks down the critical data points to include in your Excel journal. Each column is designed to provide a specific insight that, when combined, gives you a 360-degree view of your trading performance.

| Column Name | Data Type | Purpose and Insight Gained |

|---|---|---|

| Date | Date | Simple but crucial. Helps you track performance over time and identify patterns related to specific days or market conditions. |

| Ticker | Text | The symbol of the asset you traded (e.g., AAPL, EUR/USD). Essential for filtering and analyzing performance by instrument. |

| Direction | Text | Note whether the trade was Long or Short. This helps you quickly see if you perform better in bull or bear markets. |

| Entry Price | Number | The exact price at which you entered the trade. This is a foundational metric for all performance calculations. |

| Exit Price | Number | The price at which you closed the trade. Along with the entry price, it determines the trade’s gross outcome. |

| Position Size | Number | The number of shares, contracts, or lots. Tracking this helps you understand how your sizing impacts your P/L. |

| Strategy | Text | The specific setup or reason for the trade (e.g., “Breakout,” “Mean Reversion,” “Earnings Play”). This is vital for discovering which of your strategies actually work. |

| R-Multiple | Number | Your profit or loss as a multiple of your initial risk. A game-changing metric that shifts your focus from dollars to risk-adjusted returns. |

| Pre-Trade Mindset | Text | A brief note on your emotional state before entering (e.g., “Confident,” “Rushed,” “FOMO”). Over time, this column will reveal how your psychology directly affects your bottom line. |

| Notes / Screenshot | Text / Link | A space for observations, mistakes, or a link to a chart screenshot. This is where you document your lessons learned from each trade. |

Getting these columns set up correctly from the start is what makes all the cool formulas and dashboard visualizations (which we’ll get to later) possible. Without this solid base, any analysis you try to run will be incomplete at best and misleading at worst.

The goal isn’t just to record what happened, but why it happened. A column for your ‘Strategy’ and ‘Pre-Trade Mindset’ can reveal more about your long-term performance than P/L alone.

Automating Your Analysis with Key Formulas

Entering raw data is a great first step, but the real magic of an Excel trading journal happens when you let the spreadsheet do the heavy lifting. Who wants to manually calculate profit or win rate for every single trade? It’s not just tedious — it’s a recipe for errors. By setting up a few key formulas, you transform your static log into a dynamic analysis tool that updates in real-time.

Think of it this way: a well-placed formula works for you 24/7. It turns basic inputs like your entry and exit prices into meaningful metrics you can actually use. You set it up once, and with every new trade you log, your journal instantly crunches the numbers, giving you immediate feedback on your performance.

Many traders get bogged down by their own data. You might have a log full of trades but no clear idea what it all means. Formulas are the bridge between just collecting data and actually understanding it.

Calculating Your Profit and Loss

Let’s start with the most fundamental metric: your Profit/Loss (P/L). The formula will look a little different depending on whether you’re trading stocks or forex.

For a stock trade, the logic is pretty straightforward. You’re calculating the difference between your selling price and your buying price, multiplied by the number of shares. If your Entry Price is in column D, Exit Price is in column E, and Position Size is in column F, the formula for the first trade (in row 2) would be:

=(E2 - D2) * F2

For a forex trade, it’s a bit different because you often think in pips. If you trade a standard lot (100,000 units) where each pip is worth roughly $10, and you track your P/L in pips in another column (let’s say G2), the formula to convert pips to dollars would be:

=G2 * 10

Setting this up removes all the guesswork and emotion from seeing your results. It’s just the numbers, clear and simple.

Determining Position Size Based on Risk

Consistent risk management is what separates amateurs from professionals. Instead of just picking a random number of shares, your position size should be a direct result of how much you’re willing to risk on a single trade.

You can automate this calculation right inside your Excel trading journal. First, you’ll need to define your maximum risk per trade (e.g., 1% of your account) and your stop-loss distance.

Let’s walk through a practical example:

- Your account size is in a separate cell, say J1 ($10,000)

- Your risk per trade is in cell J2 (1% or 0.01)

- Your entry price for a new trade is D2 ($50)

- Your planned stop-loss price is D3 ($49)

The formula to calculate the correct number of shares would be:

=(J1 * J2) / (D2 - D3)

In this scenario, your max dollar risk is ($10,000 * 0.01) = $100. The risk per share is ($50 – $49) = $1. The formula tells you to buy exactly 100 shares. This kind of automation enforces discipline and helps prevent those oversized positions that can blow up an account.

Tracking Your Running Win Rate

Your win rate is a simple but powerful metric that tells you how often your strategy is right. Keeping a running tally helps you see your consistency over time and spot any worrying trends.

To get this working, you first need a column that flags whether a trade was a win or a loss. If your P/L is in column H, you can use a simple IF statement in column I to label each trade:

=IF(H2>0, "Win", "Loss")

Once that’s set up, you can calculate your overall win rate on your dashboard using the COUNTIF and COUNTA functions. COUNTIF counts cells that meet a condition, and COUNTA counts all non-empty cells. Assuming your “Win/Loss” labels are in column I:

=COUNTIF(I:I, "Win") / COUNTA(I:I)

This formula simply divides the total number of wins by the total number of trades, giving you a clean percentage. If you want to dig deeper into what this metric reveals about your strategy, you can learn more about how to calculate your trading win rate and put it to work.

By automating these core calculations, you free up mental energy to focus on what truly matters — analyzing your strategy, understanding your psychological patterns, and making better trading decisions. Your journal becomes a partner, not just a record book.

Building Your Performance Dashboard

Okay, you’ve got your formulas dialed in and your trade log is humming with raw data. That’s a huge step. But let’s be honest, scrolling through endless rows of trades isn’t going to give you those “aha!” moments. This is where your efforts pay off: your performance dashboard. It’s time to turn all that data into actionable wisdom.

Think of your dashboard as a separate sheet in your Excel file, dedicated entirely to visualizing your performance. It’s the command center that finally answers the critical questions that every trader asks themselves. Which of my strategies is actually profitable? Do I trade better on Tuesdays? Am I just consistently losing money going short?

The goal here isn’t to build something overwhelmingly complex. You don’t need a data science degree. A couple of well-chosen charts and a powerful tool called a PivotTable are all you need to get started. These features do the heavy lifting, turning your log into an interactive report that tells the real story of your trading.

Using PivotTables to Summarize Performance

If you only learn one advanced Excel skill for your journal, make it the PivotTable. It’s Excel’s most powerful tool for crunching large datasets, making it absolutely perfect for an excel trading journal. It lets you drag and drop different data fields from your trade log to see your performance from all kinds of angles — without writing a single new formula.

Let’s walk through a classic example. You want to see the total Profit/Loss for each of your trading strategies.

- First, head over to your “Trade Log” sheet and select all your data (a quick

Ctrl + Ausually does the trick). - Next, navigate to the

Inserttab and clickPivotTable. - Choose to place it on a new worksheet. This new sheet will become your “Dashboard.”

- Now you’ll see the PivotTable Fields pane. Just drag the Strategy field into the “Rows” area and the P/L field into the “Values” area.

Boom. Instantly, Excel spits out a clean table showing the total profit or loss for every unique strategy you’ve logged. It’s a simple but incredibly profound way to get objective feedback on what’s actually working.

To make sure these summaries are meaningful, you need to be confident in your profit calculations. For a deeper dive, you can check out our guide on calculating trading profit to ensure your foundational data is spot-on.

Visualizing Your Trading Data with Charts

Once your PivotTable is set up, creating charts is almost laughably easy. And this is important, because a visual representation of your data often makes patterns and trends jump off the screen in a way raw numbers never will.

The beauty of Excel is how quickly it can create these visualizations. A combination of pivot tables and maybe some conditional formatting (a feature that changes a cell’s color based on its value) can help you spot trends that would otherwise stay hidden. This is a huge edge for active traders who need to make sharp, data-backed decisions.

A dashboard turns your gut feelings into hard facts. You might feel like your breakout strategy is a winner, but the dashboard will show you the unfiltered truth backed by your own data.

Here are two essential charts I believe every trader should have on their dashboard:

- Monthly P/L Bar Chart: This gives you a bird’s-eye view of your performance month by month. It’s perfect for identifying your most consistent periods and tracking your progress over the long haul.

- Strategy Success Pie Chart: This is a quick way to see which of your strategies are contributing the most to your bottom line. It helps you know where to focus your energy and what to cut loose.

Remember, your dashboard is a living document. As you add more trades to your log, you just have to refresh your PivotTables, and all your charts and summaries will update automatically. This commitment to regular review is what separates struggling traders from those who achieve long-term improvement.

Advanced Customization to Refine Your Journal

Once your dashboard is live, the real fun begins. It’s time to add those personal touches that turn a good Excel trading journal into a great one — something that’s faster, more intuitive, and actually a pleasure to use. These aren’t just cosmetic tweaks; they’re smart enhancements that cut down on manual work and give you clearer insights at a glance.

This is all about building the discipline to review your trades long-term, and a well-designed journal makes that habit stick.

One of the most powerful ways to do this is with Conditional Formatting. This feature is an absolute game-changer for getting instant visual feedback. We’ve all felt the sting of a red day, and this tool makes that feedback impossible to ignore.

For instance, you can make your P/L column instantly scannable by lighting up profits in green and losses in red. Just select the entire P/L column, head to Conditional Formatting > Highlight Cells Rules > Greater Than…, type in 0, and pick a green fill. Do it again for values Less Than… 0, but this time, choose red. Simple, right? But the psychological impact is huge.

Ensuring Data Consistency with Dropdown Lists

Good analysis depends on clean, consistent data. If you log a strategy as “Breakout” one day and “BO” the next, your PivotTables won’t group them correctly, and your analysis will be flawed. This is exactly why you need to set up dropdown lists using Data Validation.

It’s surprisingly easy. Just create a new sheet and name it “Lists.” In the first column, list out all your official strategy names—like Breakout, Mean Reversion, Trend Following, etc.

Then, hop back over to your “Trade Log” sheet. Select the whole Strategy column, go to Data > Data Validation, and in the “Allow” dropdown, pick “List.” For the “Source,” just click the little arrow and select the range of strategy names you just created on your “Lists” sheet. Now, that cell will only accept entries from your approved list. No more typos, no more inconsistencies.

A journal that’s difficult to use is a journal that gets abandoned. Small customizations like dropdowns and color-coding reduce friction, making it easier to stick with the habit of daily logging.

Visualizing Your Growth with an Equity Curve

While your dashboard gives you great snapshots of performance, nothing tells the story of your trading journey quite like an equity curve. It’s a continuous, visual plot of your account’s growth over time — and honestly, it’s one of the most motivating (and humbling) charts you can build.

First, you’ll need to add a “Cumulative P/L” column to your trade log. Let’s say your first P/L entry is in cell H2. The formula for the first cell in your new column (I2) is just =H2. Easy.

For the next cell down (I3), the formula will be =I2+H3. This adds the current trade’s P/L to the previous running total. Drag this formula all the way down the column, and you’ll have a running total of your profit.

Now, all you have to do is create a simple line chart that plots this new Cumulative P/L column against your trade dates. This visual becomes a powerful accountability tool, showing you the real, unfiltered impact of your winning and losing streaks on your long-term progress.

Your Excel Trading Journal Questions Answered

Starting any new habit, especially something as detailed as journaling your trades, is bound to bring up some questions. It’s way too easy to get hung up on the “what ifs” and “how tos” before you even log a single trade.

Let’s clear some of those common hurdles traders run into when building an Excel trading journal. That way, you can get started with confidence.

Is an Excel Journal Better Than Paid Software?

This is the big one, and the honest answer is: it depends on your goals and personality. The beauty of Excel lies in its total customization and, of course, the fact that it’s free. For any trader who wants a system built perfectly around their unique strategies and metrics, you just can’t beat the flexibility of a spreadsheet.

On the flip side, paid software often comes loaded with time-saving features like automatic broker syncing. But starting with an Excel trading journal is still one of the smartest first steps you can take. It forces you to get your hands dirty and think critically about what data you actually need to track. This makes you a much savvier consumer if you ever decide to shop for paid tools down the road.

How Often Should I Review My Journal?

Consistency is king. The goal is to log every single trade right after it closes. You want to capture all the details — and more importantly, your emotions — while they’re still fresh. It takes discipline, but it’s a non-negotiable habit for any trader serious about long-term improvement.

As for analysis, a dedicated weekly review is essential. Block out some time every weekend to really dive into your dashboard.

- How are your different strategies performing?

- Are there any patterns emerging in your wins and losses?

- What do your mindset notes say? For example, do you see a pattern of “FOMO” trades on big green market days?

This regular review cycle is where raw data turns into game-changing insights. It’s your scheduled meeting with the CEO of your trading business: you.

What Is the Most Important Metric to Track?

While Profit/Loss (P/L) seems like the obvious answer, ask any seasoned trader and they’ll likely point you to something else: the R-Multiple. This metric measures your profit or loss as a multiple of your initial risk.

Tracking R-Multiples forces you to focus on the quality of your risk management, not just the dollar amount of your wins. A trade making $100 on a $20 risk (a 5R trade) is far superior to a trade making $200 on a $300 risk (a 0.67R trade).

This simple shift in perspective is what builds a durable, long-term trading career. It’s all about managing risk effectively, not just chasing big dollar wins.

While an Excel journal is a powerful starting point, many traders eventually look for a more automated solution. TradeReview offers a comprehensive trading journal with real-time analytics, visual calendars, and broker syncing to eliminate manual data entry. Start for free and take your trade analysis to the next level at https://tradereview.app.