Ever wonder what the future might hold for your trading strategy? An equity curve simulator is about as close as you can get to a crystal ball, letting you test-drive your approach through thousands of potential outcomes without risking a single dollar. It’s a tool for building confidence, discipline, and a long-term perspective.

What Is a Trading Equity Curve Simulator?

If you’ve been trading for any length of time, you know the feeling. The high of a long winning streak makes you feel invincible, while a string of losses can leave you questioning everything. We’ve all been there. It’s an emotional rollercoaster, and those highs and lows often lead to poor decisions — like abandoning a sound strategy too early or getting reckless after a few big wins.

This is exactly where an equity curve simulator steps in. It’s a powerful tool that helps you replace fear, greed, and guesswork with a clear, data-driven perspective. Instead of just hoping your strategy will work, you get to see a realistic preview of what your account’s future might look like, both the good and the bad.

A Glimpse into Your Strategy’s Future

Think of it like this: a simulator takes the core DNA of your strategy and runs it through thousands of different lifetimes. It models how your account balance could grow (or shrink) based on inputs like your win rate, risk-to-reward ratio, and the total number of trades.

For example, let’s say your backtesting shows a strategy with a 55% win rate and a 2:1 risk-to-reward ratio, and you risk 1% of your account on each trade. You can run 1,000 simulated sequences of 100 trades each. This won’t show you a single “guaranteed” outcome, but it will show you the range of possibilities. You’ll see how your capital might grow, get a feel for the maximum drawdown you might face, and even see how likely it is you’ll hit a gut-wrenching 10-trade losing streak. You can learn more about how these tools model performance over at ayondo.com.

This process gives you a massive edge by helping you:

- Manage expectations: You’ll quickly learn that even profitable strategies suffer from deep, stomach-churning drawdowns. Seeing it happen in a simulation makes it less scary in real life.

- Build mental toughness: Once you’ve seen a simulation of your strategy survive a 10-trade losing streak and still come out profitable, you’re far less likely to panic when a real one hits.

- Trade with discipline: The simulation gives you the statistical confidence you need to stick with your plan, even on the days it feels like nothing is going your way.

By simulating the future, you gain the long-term perspective needed to execute your strategy with unwavering confidence. It’s about transforming emotional reactions into disciplined, calculated actions.

Understanding Your Simulator’s Core Inputs

To get a clear, reliable picture from an equity curve simulator, you have to start with honest ingredients. Think of it like a recipe: the quality of your inputs directly determines the quality of your results.

Garbage in, garbage out. It’s that simple.

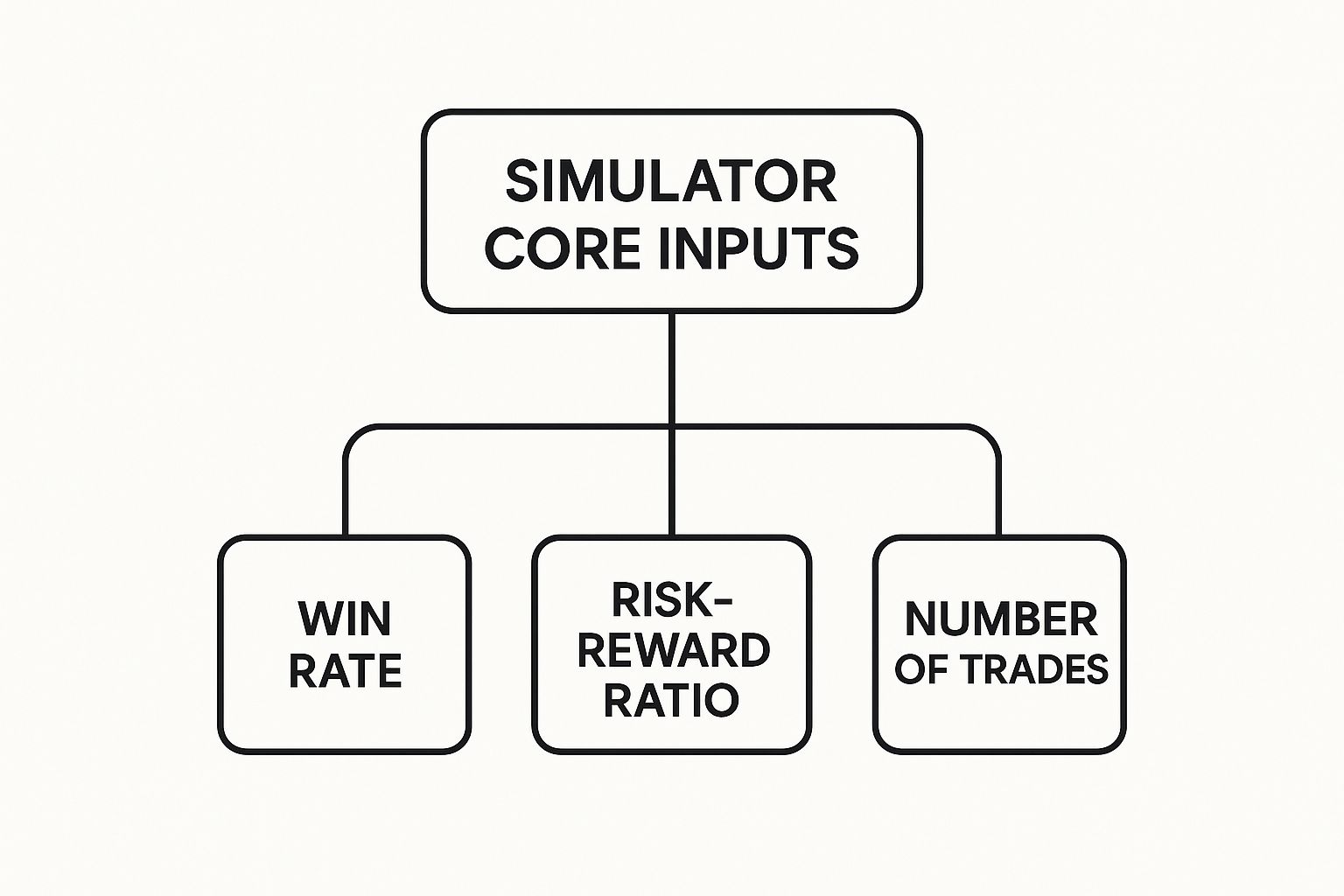

The simulation’s engine runs on a few core metrics pulled directly from your trading journal. These aren’t guesses or hopes; they are the hard facts of your past performance. This is why meticulous trade tracking is so important — it provides the real-world data needed for an accurate projection.

This infographic breaks down the essential inputs that power your simulation.

As you can see, these three elements form the statistical DNA of your trading strategy. Let’s dig into what each one means.

Your Strategy’s Key Metrics

Your primary inputs are straightforward, but they demand complete honesty. It can be tough to look at our real numbers, but it’s the only path to improvement.

This table breaks down what these key inputs are and why they’re so crucial for getting a realistic simulation.

| Parameter | What It Means | Why It Matters |

|---|---|---|

| Win Rate | The simple percentage of your winning trades. | This is the engine of your profitability. A high win rate can offset a lower risk-reward, and vice versa. |

| Risk-Reward Ratio | How much you typically win compared to how much you lose on a given trade. | This defines the size of your wins and losses. A healthy ratio ensures your winners more than cover your losers over time. |

| Number of Trades | The sample size you want the simulation to run. | A larger number of trades gives you a more statistically significant and reliable picture of long-term potential. |

Getting these numbers right is non-negotiable for a simulation that’s actually useful.

- Win Rate: If you’ve won 60 out of your last 100 trades, your win rate is 60%. Be brutally honest here — don’t round up or exclude those small, annoying losses. Every trade counts.

- Risk-Reward Ratio: A 2:1 ratio means your average winning trade is twice as large as your average losing trade. This is a powerful metric that shows the potency of your wins.

- Number of Trades: This is your sample size. Simulating 1,000 trades will give you a far more reliable look at long-term possibilities than just 100. The more data, the better.

Honest data in means realistic projections out. This isn’t about predicting the future; it’s about preparing for the range of statistical possibilities your strategy might encounter.

Gathering this data is a key part of the process. If you want a deeper dive, our guide on how to backtest trading strategies explains how to collect these metrics effectively. Once you have these numbers, you’re ready to see what your strategy is truly capable of.

How to Interpret Your Simulation Results

When the simulator finishes its work, you’re greeted with a web of colorful lines. Each one represents a possible future for your account. It’s natural to fixate on the lines that rocket straight up, but the real gold is hidden in the valleys. This is where you learn to read the true story your strategy is telling.

The first step? Shift your focus away from the final profit number. Instead, look for patterns of risk and volatility that repeat across all the simulations. Adopting this probabilistic mindset is the key to building a trading plan that can actually withstand the test of time.

Beyond Profit and Loss

To really understand the results, you need to dig into the metrics that determine long-term survival. These aren’t just numbers; they reveal the emotional and financial stress your strategy is likely to put you through.

- Maximum Drawdown: This is, without a doubt, the most critical metric. It shows the biggest peak-to-trough drop your account could experience. Seeing a potential 25% drawdown prepares you for the gut-wrenching reality of watching your account shrink before it recovers. It’s a vital concept, and you can learn more in our guide explaining what is maximum drawdown.

- Consecutive Losses: How many losses in a row can you stomach before you lose faith in your system? The simulator shows you the likely number of back-to-back losses, helping you prepare psychologically for the losing streaks that are an inevitable part of trading.

This process isn’t about finding a single “guaranteed” outcome. It’s about understanding the full spectrum of possibilities — the good, the bad, and the ugly — so you can stay disciplined when the market inevitably tests your resolve.

Embracing Probability with Monte Carlo

Run the simulation again, and the results will look a little different. That’s the magic of the Monte Carlo method at work. This is a computational technique that randomizes the sequence of your trades to create thousands of unique potential outcomes based on your inputs.

This approach gives you a probability distribution of what could happen. For example, your results might show that while the average max drawdown is 15%, there’s a 10% chance it could reach 30%. This helps you prepare for the worst-case scenarios, not just the average ones.

By studying this range of possibilities, you stop chasing certainty and start skillfully managing probabilities. And that’s one of the most important leaps any serious trader can make.

Putting Your Simulator to Work

Okay, let’s move past the theory and talk about what this actually looks like in practice. An equity curve simulator isn’t just an analytical tool; it’s a strategic partner that helps you sharpen your edge and make smarter, data-driven decisions before you risk your capital. This is where you can see how tiny adjustments can lead to massive differences over the long haul.

A common struggle for traders is finding the right risk level. Many start out risking 2% of their account per trade. What if you dialed that back to 1%? A practical test in the simulator would likely reveal a much smoother equity curve, dramatically reducing the depth of your drawdowns without sacrificing too much upside. This one simple test could be the difference between surviving a nasty losing streak and blowing up your account.

Stress-Testing Your Edge

Another powerful use is stress-testing small improvements. Let’s say your trading journal shows a consistent 55% win rate. It’s profitable, but you have a hunch that being more selective with your entries could bump that to 60%.

Instead of risking months of live trading to find out, you can simulate it. By changing only that one variable, you can immediately see how a 5% boost in win rate would affect your potential growth, drawdown, and overall consistency.

A simulator is your private trading lab. It lets you isolate variables and test your theories safely, helping you forge a more resilient and profitable strategy.

This kind of testing became a game-changer with the rise of algorithmic trading. Historically, simulators were crucial for backtesting quantitative strategies. In fact, traders who model historical performance and adapt their approach based on the insights have been shown to reduce real-world account drawdowns. You can learn more about how equity curve analysis impacts strategy on BuildAlpha.com.

This process lets you get answers to tough questions:

- Does this new strategy actually hold up over 1,000 simulated trades?

- How does increasing my risk-to-reward ratio impact my account’s volatility?

- Is my strategy tough enough to survive a string of 10 consecutive losses?

By answering these questions in a simulated environment, you’re not just hoping for the best — you’re building a battle-tested plan grounded in statistics.

Building Emotional Discipline Through Simulation

Let’s be honest. The biggest battle in trading isn’t against the market — it’s against the person staring back at you in the monitor. We’ve all felt the fear that grips you during a losing streak or the overconfidence that creeps in after a string of wins. These emotions are powerful, and they can derail even the most solid strategies.

This is where an equity curve simulator becomes your secret weapon. Think of it as a mental gym where you can rehearse your emotional responses without any financial consequences. It’s the key to building the psychological resilience you need for consistent, long-term success.

From Panic to Patience

Imagine your strategy hits a rough patch in the real world — say, a five-trade losing streak. The natural impulse is to panic, ditch the plan, or start “revenge trading” to win it all back. But what if you’d already seen your strategy survive a simulated 15-trade drawdown and still recover to new highs?

That’s a game-changer. This exposure desensitizes you to the very real pain of inevitable drawdowns. When you’ve witnessed the statistical reality of your edge playing out over thousands of simulated trades, you start to build unshakable trust in your plan.

An equity curve simulator transforms abstract statistics into a felt experience. This mental rehearsal forges the discipline to execute your strategy flawlessly when real money — and real emotions — are on the line.

The process builds a deep-seated belief in your system’s positive expectancy (the statistical edge you have over the market). Instead of reacting to every tick of the chart, you learn to think in probabilities. You can execute trades with the calm confidence of a casino owner who knows that while they may lose a few hands, the odds are stacked in their favor over time.

This disciplined mindset is what separates struggling traders from the consistently profitable ones. And remember, simulation works best when paired with diligent record-keeping. To learn more, check out our guide on using a trading journal in Excel. This combination creates a powerful feedback loop for real, measurable growth.

Got Questions About Equity Curve Simulators?

Diving into equity curve simulation for the first time usually brings up a few common questions. It’s an incredibly powerful tool, but understanding what it can — and can’t — do is key to getting the most out of it. Let’s clear up a few of the big ones.

How Accurate Is This Thing, Really?

A simulator is only as good as the data you feed it. Think of it as a mirror reflecting your trading history, not a crystal ball for predicting the future. Its accuracy hinges entirely on how honest and statistically significant your inputs are.

If your win rate and risk-to-reward ratio come from a solid sample of real trades (at least 100, though more is always better), the simulation will give you a very realistic picture of what could happen. But it can’t predict a black swan event or a sudden lapse in your own trading discipline.

The real value of an equity curve simulator isn’t in promising profits — it’s in preparing you for the statistical gut-punches of trading, like long drawdowns and brutal losing streaks. It’s a preparation tool, not a prediction machine.

How Many Trades Should I Use for a Simulation?

When it comes to statistical reliability, more is definitely better. Running a simulation with just 100 trades might give you a rough sketch, but the results could easily be warped by a lucky or unlucky streak.

For a much clearer and more trustworthy picture of your strategy’s staying power, you really want to simulate somewhere between 500 to 1,000 trades. That larger sample size helps smooth out the noise of random chance and gives you a result that truly reflects your edge in the market.

Can a Simulator “Prove” My Strategy Is Profitable?

It can’t offer you mathematical “proof,” but it can give you incredibly strong statistical evidence for or against your strategy’s viability. It’s all about validation, not guarantees.

- Got a Winner? If thousands of simulated equity curves consistently climb upward with drawdowns you can live with, that’s a huge vote of confidence. It strongly suggests your strategy has a real, positive expectancy.

- Back to the Drawing Board? On the other hand, if most simulations crash and burn or hit devastating drawdowns, that’s a massive red flag. It’s a clear signal to refine your strategy before you put real money on the line.

Ultimately, it’s one of the best validation tools you can have. It lets you trade with confidence backed by data, not just blind hope, which is essential for long-term thinking in this business.

Ready to stop guessing and start analyzing? The TradeReview trading journal gives you the performance stats you need to power your equity curve simulator with accurate, real-world data. Start journaling for free and discover your true edge.