Mastering technical analysis and chart patterns isn’t always enough for consistent profits. Often, the key lies in understanding your trading psychology. Emotions like fear, greed, and impatience can undermine even strong strategies. It’s not about secret indicators but building mental discipline and a long-term view. A resilient mindset is as vital as technical skills for success. This guide highlights the best books on trading psychology, offering practical advice and insights to help you manage emotions and trade confidently for sustainable success.

1. Trading in the Zone by Mark Douglas

Often hailed as the definitive guide to mastering the mental game, Trading in the Zone by Mark Douglas is a cornerstone for anyone serious about consistent profitability. Douglas’s core argument is that the primary obstacle to success isn’t a flawed strategy or poor market analysis; it’s the trader’s own mind. He posits that market outcomes are uncertain, and our inability to accept this fundamental truth leads to fear, greed, and hesitation. The book provides a framework for shifting from a “win/loss” mindset to one of pure probability.

This shift involves neutralizing emotional responses to market events. For example, instead of feeling despair after a loss, you learn to see it as a necessary and expected part of your system playing out over time. Douglas teaches that the market is a stream of information, neither threatening nor rewarding. By developing a probabilistic mindset, a trader learns to see each trade as just one instance in a large sample size, making individual losses psychologically insignificant. This is why many professional trading firms and successful day traders cite this as one of the best books on trading psychology, as it fundamentally transforms one’s relationship with risk.

Key Takeaways and Implementation

- Mindset Over Method: The book emphasizes that a winning attitude and disciplined psychology are far more critical than finding a “perfect” trading system. True consistency comes from flawless execution, not from predicting every market move.

- Thinking in Probabilities: Stop viewing trades as “right” or “wrong.” Instead, internalize that your edge will only play out over a series of trades. A loss is not a failure; it is a statistical and expected part of your system.

- Accepting Risk: Truly accept the risk of every trade before you enter. This means acknowledging that any trade can be a loser without any emotional baggage or surprise, freeing you to execute your plan without fear.

Trader Insight: “Before this book, every losing trade felt like a personal failure. Douglas taught me that a loss is just the cost of doing business. It completely removed the anxiety from my trading and allowed me to focus on executing my plan.”

To implement these concepts, start by defining a rigid set of rules for your trading system. Then, use a journal to track not just your P&L, but your emotional state during each trade. Ask yourself: “Did I follow my rules?” This shifts the focus from the outcome to the process, which is the heart of Douglas’s philosophy. This book is essential for traders who find themselves sabotaging good strategies with emotional decisions.

2. The Daily Trading Coach by Brett N. Steenbarger

Where Mark Douglas provides the foundational philosophy, Dr. Brett Steenbarger delivers the practical, actionable roadmap. The Daily Trading Coach is structured as 101 lessons, each designed to be a bite-sized coaching session. As a clinical psychologist and active trading coach for hedge funds and proprietary firms, Steenbarger applies principles from performance psychology and cognitive-behavioral therapy directly to the challenges traders face. We know it can feel isolating, but this book is a hands-on toolkit that reminds you you’re not alone in your struggles.

The core concept is that traders can and should become their own psychologists. Instead of just understanding abstract ideas, the book forces you to engage through concrete exercises, self-reflection, and habit-building routines. It covers everything from managing stress after a string of losses to building the focus required for peak performance. Many professional firms use these lessons in their trader development programs, making it one of the best books on trading psychology for those seeking a structured, therapeutic approach to their mental game.

Key Takeaways and Implementation

- Become Your Own Coach: The book empowers you with the tools to diagnose your own psychological roadblocks and implement targeted solutions. It shifts the trader from being a victim of their emotions to an active agent of change.

- Focus on Process and Habit: Steenbarger emphasizes building positive daily routines and habits. Lasting change comes from small, consistent daily efforts—like a pre-market mindset routine—not from a single moment of insight.

- Practical, Science-Backed Techniques: Each lesson provides a specific tool or exercise, such as mindfulness techniques to handle market volatility or journaling prompts to identify patterns in your behavior.

Trader Insight: “This book is my go-to manual. Whenever I’m struggling with a specific issue like revenge trading, I can turn to the exact lesson that addresses it. The exercises are practical and have genuinely helped me build better habits.”

To implement these teachings, treat the book like a daily workout plan rather than a novel. Work through one lesson each day, completing the associated exercise honestly. Use a journal to document your progress and revisit lessons that target your recurring weaknesses. For more ways to integrate these concepts, explore additional tips for traders on TradeReview.app. This book is essential for the trader who is ready to stop just reading about psychology and start actively working on it.

3. Reminiscences of a Stock Operator by Edwin Lefèvre

Though published nearly a century ago, Reminiscences of a Stock Operator remains one of the most powerful and insightful books on trading psychology ever written. This fictionalized biography of the legendary trader Jesse Livermore offers a raw, unfiltered look into the mind of a market speculator. Rather than presenting a dry psychological framework, Edwin Lefèvre uses Livermore’s dramatic story of immense fortunes won and lost to illustrate timeless truths about fear, greed, patience, and discipline.

The book’s genius lies in its narrative format, which makes profound psychological lessons deeply relatable. We see how Livermore’s biggest losses often came not from bad analysis, but from emotional decisions like impatience, overconfidence after a big win, or revenge trading—mistakes that every trader, new or experienced, has made. His journey, filled with spectacular comebacks and crushing bankruptcies, serves as a powerful cautionary tale and an enduring testament to the mental fortitude required for long-term success. For this reason, it is consistently recommended by trading legends like Paul Tudor Jones as essential reading.

Key Takeaways and Implementation

- The Market is Never Wrong: A core theme is that opinions and ego have no place in trading. Livermore learned the hard way that the market’s price action is the ultimate truth, and arguing with the tape is a recipe for disaster.

- Patience and Pivotal Points: The book masterfully demonstrates the power of patience. Livermore’s greatest successes came from waiting for the market to confirm his thesis at “pivotal points” (key price levels indicating a potential major move) before committing significant capital, rather than trading constantly.

- Emotional Detachment: Follow Livermore’s journey to understand how a single emotional slip can erase months of disciplined gains. The stories provide visceral examples of why a logical, detached process is non-negotiable.

Trader Insight: “This book felt like reading my own trading journal. Livermore made every mistake I’ve made, but on a massive scale. It taught me that the psychological battles of trading are universal and timeless.”

To implement these lessons, treat the book as a case study. As you read, keep a notebook and jot down every psychological error Livermore makes and compare it to your own trading habits. Focus on understanding the why behind his decisions, not just the what. This self-reflection is crucial. By studying the successes and failures of one of history’s greatest traders, you can learn invaluable lessons and find more insights into this and other top books on trading psychology. This book is perfect for traders who learn best through stories and real-world examples rather than abstract theory.

4. The Psychology of Trading by Brett N. Steenbarger

Where other books focus on broad mindsets, Dr. Brett Steenbarger’s The Psychology of Trading takes a clinical, diagnostic approach. As a psychologist and active trading coach, Steenbarger provides a framework for traders to become their own therapists. He argues that trading errors are often symptoms of deeper, unresolved psychological patterns. The book acts as a toolkit to identify these patterns, understand their origins, and implement structured therapeutic techniques to overcome them.

Steenbarger bridges the gap between clinical psychology and real-world trading performance, making it one of the best books on trading psychology for those seeking a more scientific, self-analytical path. He provides diagnostic tools and exercises that help traders pinpoint the root causes of their issues, whether it’s impulsivity stemming from anxiety or risk aversion rooted in past financial trauma. This isn’t a quick fix; it’s a deep, empathetic dive into the “why” behind your trading behaviors, enabling lasting change.

Key Takeaways and Implementation

- Become Your Own Therapist: The book teaches you to observe your trading behavior as a psychologist would. You learn to identify triggers, emotional responses, and the resulting actions, creating a feedback loop for continuous improvement.

- Identify Your Unique Patterns: Steenbarger emphasizes that there is no one-size-fits-all solution. A trader struggling with perfectionism requires a different intervention than one battling impulsivity. The book guides you in creating a personalized plan.

- Emotion as Information: Instead of suppressing emotions, learn to use them as data. A sudden spike in anxiety before placing a trade is a signal to pause and analyze what is happening internally, rather than ignoring it or acting on it rashly.

Trader Insight: “This book was a revelation. I always knew I was an impulsive trader, but Steenbarger’s work helped me trace that impulse back to a specific pattern of anxiety. By addressing the anxiety first, the overtrading just… stopped.”

To implement these concepts, start by using the self-assessment tools within the book to diagnose your primary challenges. Maintain a detailed journal that records not only your trades but also your thoughts and feelings before, during, and after each one. The goal is to find recurring patterns. For example, do you always revenge trade after two consecutive losses? Recognizing this pattern is the first step toward building a specific strategy to break it. This book is ideal for the experienced trader who is ready for serious self-reflection to break through performance plateaus.

5. Mind Over Markets by James F. Dalton, Eric T. Jones, and Robert B. Dalton

While not a conventional psychology book, Mind Over Markets is a profound exploration of the market’s collective psychology through the lens of auction market theory and Market Profile. The authors argue that to master your own mind, you must first understand the behavior of the market as a whole. The book teaches traders to read market-generated information by viewing the market as an auction process that reveals the intentions and emotions of its participants. This framework helps traders move beyond just their own charts and into the mindset of other players.

By understanding concepts like “value areas” (where 70% of a session’s volume occurred) and “points of control” (the price with the highest volume), a trader gains a deep contextual awareness. This knowledge is crucial for reducing uncertainty and emotional reactivity. Instead of reacting to price spikes with panic, you learn to interpret them as signs of market acceptance or rejection of price levels. This makes it one of the best books on trading psychology for those who want a practical framework for interpreting collective market behavior, which in turn calms their own individual trading mindset.

Key Takeaways and Implementation

- Market as an Auction: View price movement not as random noise but as a two-way auction process. The market’s purpose is to find “value” where the most business is conducted, and understanding this provides a logical map for market behavior.

- Reading Market Intent: Learn to identify different market participants (e.g., short-term scalpers vs. long-term institutional players) through their footprint in the market profile. This allows you to anticipate behavior and align your trades with stronger hands.

- Context is King: A trade’s success often depends on the broader market context. Market Profile provides this context, helping you determine if the market is trending (seeking value) or balancing (accepting value), which guides your strategy selection.

Trader Insight: “This book changed everything. I stopped seeing wicks and bars and started seeing a story. Understanding why the market was moving to a certain level gave me the confidence to hold winners and cut losers without hesitation.”

To implement these ideas, start by studying Market Profile charts without placing trades. Focus on identifying the daily value area and point of control. Observe how price reacts when it returns to these areas. Instead of replacing your current system, use auction market theory to add a layer of context to your existing setups. This helps you filter for higher-probability trades based on the market’s current psychological state.

6. The Mental Game of Trading by Jared Tendler

Drawing from his extensive experience as a mental game coach for elite poker players and traders, Jared Tendler offers a highly systematic and actionable framework for conquering psychological flaws. The Mental Game of Trading moves beyond vague advice, presenting a structured process to diagnose and fix the root causes of issues like fear, greed, and discipline breakdowns. Tendler’s core idea is that these are not character defects but rather technical flaws in your mental game that can be mapped, understood, and systematically resolved.

The book introduces powerful concepts like the “Adult Learning Model” and the “A/B/C-Game” framework, which help traders identify the quality of their mental state and execution. Instead of simply trying harder, traders learn to build a detailed “mental hand history” to spot specific triggers for poor performance. This makes it one of the best books on trading psychology for those who want a practical, step-by-step guide to building mental toughness, much like a professional athlete would train for competition.

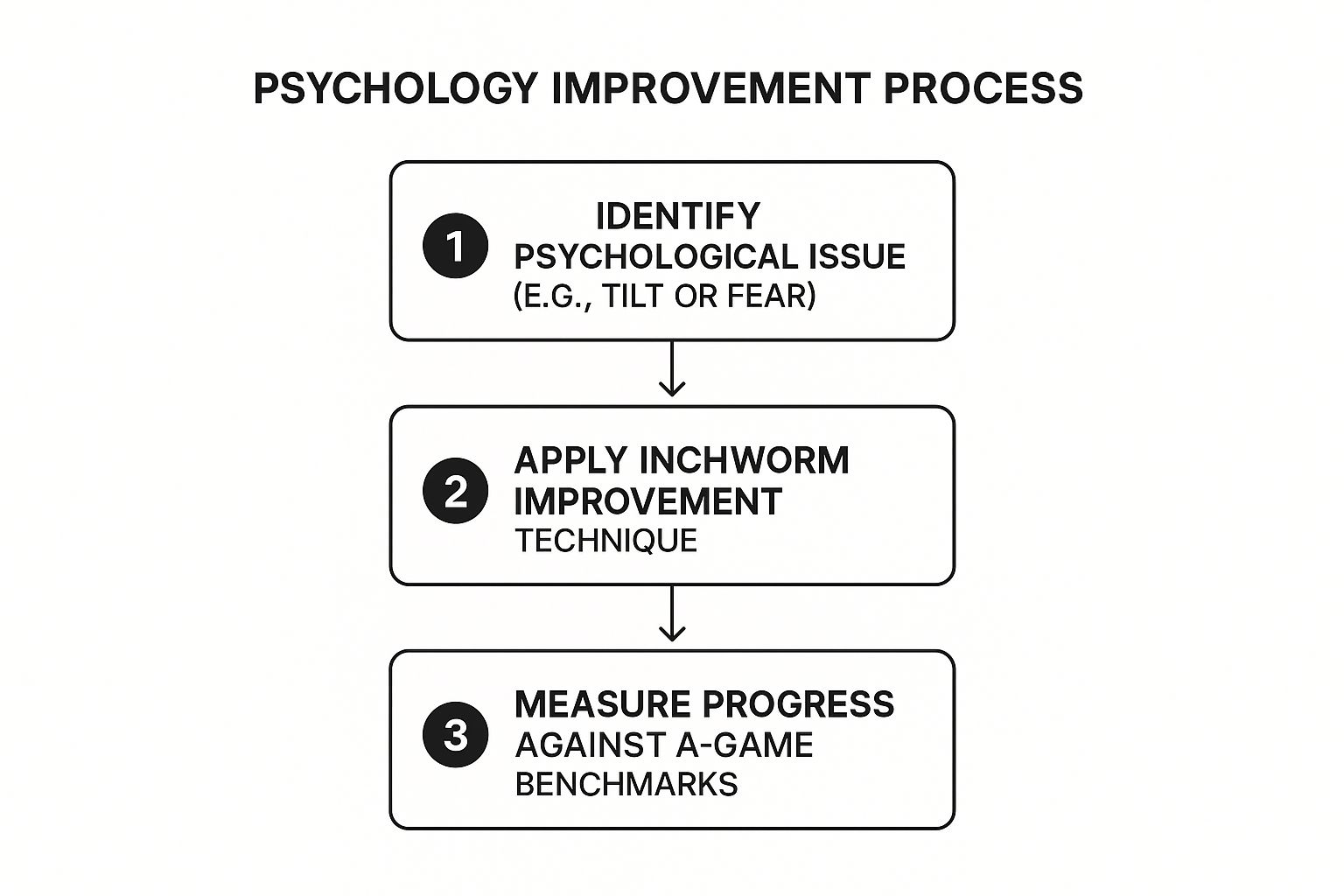

This infographic visualizes the core process flow for tackling psychological issues as outlined in the book.

The process emphasizes that identifying a flaw is only the first step; consistent, incremental improvement is what leads to lasting change.

Key Takeaways and Implementation

- Systematic Problem Solving: Treat psychological issues as technical problems that require a structured solution. Don’t just tell yourself to “be more disciplined”; identify the specific thoughts and situations that cause discipline to break down.

- The A/B/C-Game Framework: Categorize your trading sessions. Your A-game is your peak performance, B-game is slightly off, and C-game is when you are making significant emotional errors. The goal is to make your B-game better and play your C-game less often.

- The Inchworm Process: Focus on making small, incremental improvements. Work on one mental leak at a time, master it, and then move to the next. This prevents you from feeling overwhelmed and ensures progress is sustainable.

Trader Insight: “Tendler’s book gave me a concrete system. I used to get frustrated by revenge trading, but now I know the exact triggers. The A/B/C-game analysis helped me realize my C-game was costing me all my A-game profits.”

To implement Tendler’s methods, start by using his worksheets to create a map of your biggest mental game issue. Document specific examples of when it occurs and what triggers it. Then, define what your A-game looks like in detail. This focus on process over outcome is a powerful tool, and you can visualize its long-term effects by using an equity curve simulator to see how eliminating C-game mistakes impacts performance. This book is essential for traders who are tired of generic advice and want a proven methodology for improvement.

7. The Disciplined Trader by Mark Douglas

As Mark Douglas’s foundational work, The Disciplined Trader lays the groundwork for the concepts he later refined in Trading in the Zone. This book delves deep into the psychological architecture of a trader, exploring how our personal beliefs, childhood experiences, and societal conditioning create a mindset that is fundamentally at odds with the realities of the market. Douglas argues that success in other professions often creates mental habits that lead to failure in trading, such as needing to be right or controlling outcomes.

The book provides a systematic framework for deconstructing these self-sabotaging beliefs and rebuilding a mental framework suited for the uncertain environment of the markets. It is a more academic and dense read than its successor, but it offers profound insights into why traders consistently make the same mistakes. For traders wondering why they can’t seem to follow their own rules, this book provides the deep-seated answers, making it one of the best books on trading psychology for those committed to a thorough self-analysis.

Key Takeaways and Implementation

- Unlearning Harmful Beliefs: The primary goal is to identify and neutralize mental roadblocks. Success isn’t about learning more about the market; it’s about unlearning deep-seated beliefs about risk, loss, and certainty.

- Creating a Mental Structure: Douglas guides the reader in building a mental framework that aligns with market reality. This involves developing an unwavering belief in uncertainty and probabilities, allowing for objective action without emotional interference.

- The Power of Objectivity: The book teaches you to view market information as neutral. A price moving against you is not a personal attack or a sign of failure; it is simply information that requires a pre-planned response.

Trader Insight: “This book was tougher to get through than ‘Trading in the Zone,’ but it explained the ‘why’ behind my bad habits. It made me realize my fear of being wrong was rooted in my upbringing, not my trading strategy. That was a game-changer.”

To implement these ideas, start by journaling your beliefs about money, success, and failure. Actively question how these beliefs manifest when you see a trade moving against you or when you miss a winning opportunity. Use this self-awareness to create specific, rigid rules designed to counteract your emotional tendencies. For instance, if you have a fear of loss, your rules might mandate a hard stop-loss on every single trade, with no exceptions. This book is ideal for the introspective trader who wants to understand the psychological root of their trading problems.

7-Book Trading Psychology Comparison

| Title | Core Features / Focus | User Experience / Quality ★★ | Value Proposition 💰 | Target Audience 👥 | Unique Selling Points ✨ |

|---|---|---|---|---|---|

| Trading in the Zone | Probabilistic mindset, emotional control | ★★★★★ Deep psychological insights | ★★★★ Framework for consistent trading mindset | All traders from beginners to pros | ✨ Focus on mindset over strategy |

| The Daily Trading Coach | 101 practical lessons, CBT techniques | ★★★★ Highly actionable & practical | ★★★★ Daily self-coaching reference | Serious traders for ongoing self-improvement | ✨ Exercises after each lesson |

| Reminiscences of a Stock Operator | Trading history, psychology via storytelling | ★★★★ Engaging narrative form | ★★★ Timeless market psychology lessons | All traders learning from historical trader psychology | ✨ Classic trader biography with timeless insights |

| The Psychology of Trading | Clinical assessment, personality types | ★★★★ Theoretical depth, diagnostic tools | ★★★ Targets root causes of psychological issues | Traders seeking deep psychological self-work | ✨ Combines clinical psychology with trading |

| Mind Over Markets | Market Profile, auction market theory | ★★★★ In-depth market participant focus | ★★★★ Bridges technical & psychological analysis | Intermediate to advanced traders | ✨ Market psychology via price action & auction theory |

| The Mental Game of Trading | Systematic mental game coaching, A/B/C game | ★★★★ Structured, evidence-based | ★★★★ Worksheets & progress tracking | Traders needing structured psychological improvement | ✨ Adult Learning Model & inchworm improvement method |

| The Disciplined Trader | Discipline foundations, limiting beliefs | ★★★★ Foundational & philosophical | ★★★ Addresses mental barriers to discipline | Traders committed to deep psychological discipline | ✨ Early foundational trading psychology work |

From Knowledge to Action: Building Your Mental Edge

We have explored a curated selection of the best books on trading psychology, from the foundational principles in Mark Douglas’s Trading in the Zone to the practical coaching in Brett Steenbarger’s The Daily Trading Coach. Each author offers a unique lens through which to view the market, but they all converge on a single, undeniable truth: sustainable trading success is an internal game. The charts, indicators, and strategies are merely tools; the hand that wields them is guided by your mind.

The common thread woven through these essential works is the critical need for structured self-awareness. It’s not enough to simply read about the five fundamental truths of the market or understand the psychological pitfalls of revenge trading. True mastery comes from identifying these patterns in your own behavior as they happen in real-time. Knowledge without application is just theory, and in the unforgiving environment of the financial markets, theory alone is not enough.

Bridging the Gap Between Reading and Doing

How do you translate the wisdom of these books into tangible improvements in your trading performance? The answer lies in creating a feedback loop between your actions and your mindset. This is where a dedicated practice of journaling and review becomes your most valuable tool.

- Identify Your Triggers: After reading The Mental Game of Trading, you might recognize that FOMO (fear of missing out) is a key issue for you. The next step is to actively log every trade where you felt that specific emotion.

- Connect Mindset to P&L: Use the concepts from Mind Over Markets to analyze your decision-making. Did you enter a trade based on a well-defined plan, or did an emotional impulse take over? Your trade log should connect your psychological state directly to your financial outcome.

- Build Discipline Through Data: Mark Douglas emphasizes the importance of a probabilistic mindset. A detailed journal provides the statistical evidence you need to trust your edge over a series of trades, making it easier to accept individual losses and avoid emotional decision-making.

Reading these books plants the seeds of psychological discipline, but consistent, structured self-reflection is the water and sunlight that allows them to grow. The goal is to move from intellectually understanding a concept to instinctively embodying it in your daily trading routine. This transformation doesn’t happen overnight; it is built one trade, one journal entry, and one review session at a time. The path from a struggling trader to a consistently profitable one is paved with this deliberate practice.

Ready to turn theory into practice? TradeReview is a powerful trading journal designed to help you analyze your psychological patterns alongside your performance data. Start connecting your mindset to your results and build the mental edge you’ve been reading about. Get started with TradeReview today.