At its core, the formula of profit and loss is beautifully simple: Profit = Selling Price – Buying Price, and Loss = Buying Price – Selling Price. Getting a real handle on these basic calculations is the first, most crucial step toward taking control of your trading performance.

Why the Profit and Loss Formula Is Your Most Powerful Tool

Let’s be real — trading can feel like a total rollercoaster. One day you’re on top of the world after a great trade, and the next you’re second-guessing your entire approach. This emotional churn is exhausting, and worse, it often pushes you into making impulsive moves that sabotage your account.

But what if you could step off that rollercoaster and trade with more clarity?

This is where truly understanding profit and loss becomes your secret weapon. It’s not about memorizing complex equations; it’s about having an honest, unbiased scorecard for every single trade you make. When you stop relying on gut feelings and start looking at the hard numbers, you empower yourself to see what’s actually working and what’s not.

Building a Foundation for Discipline

Every trader has their struggles, but the ones who stick around are the ones who build a rock-solid foundation of discipline. Calculating your profit and loss (P&L) is the bedrock of that foundation. It forces you to look at the cold, hard facts of each trade, stripping away the emotional highs and lows.

Instead of just celebrating a win, you start asking smarter questions:

- How did this profit stack up against my average winner?

- What was my actual percentage return on the capital I risked?

- Did hidden costs like fees or slippage eat into what I thought I made?

These questions shift your focus from the short-term thrill to long-term strategic thinking. It’s this disciplined mindset that separates casual traders from those who build lasting success.

By consistently tracking your P&L, you transform raw data into actionable intelligence. It’s no longer just a number; it’s a direct reflection of your strategy, discipline, and decision-making skills.

Key P&L Concepts We Will Explore

Throughout this guide, we’re going to break down the core calculations every trader needs to know. Don’t think of these as chores — think of them as essential tools for sharpening your edge in the market. We’ll dive into:

- Gross P&L: The raw profit or loss of a trade before any costs are factored in.

- Net P&L: The real profit or loss — what actually hits your account after all fees and commissions are paid.

- Percentage P&L: This gives you the return on your investment, making it easy to compare the performance of trades of different sizes.

Before we get into the details, here’s a quick look at the core formulas we’ll be covering.

Core Profit and Loss Formulas at a Glance

This table provides a quick reference to the essential P&L formulas every trader needs to know, serving as a foundational summary for the concepts detailed in this guide.

| Formula Type | Calculation | What It Tells You |

|---|---|---|

| Profit | Selling Price – Buying Price | The gross gain on a successful trade. |

| Loss | Buying Price – Selling Price | The gross loss on an unsuccessful trade. |

| Net P&L | (Selling Price – Buying Price) – Trading Costs | Your true profit or loss after all fees. |

| Percentage P&L | (Net P&L / Cost Price) * 100 | The return on investment for a trade. |

These formulas are the building blocks of performance analysis.

A dedicated trading journal like TradeReview is the perfect tool for this, as it automates these calculations and helps you visualize your performance over time. By mastering these concepts, you’ll be far better equipped to analyze your strategy, spot your weaknesses, and build a more resilient trading plan.

Calculating Your Basic Profit and Loss

If you want to build discipline, you have to start with the fundamentals. Before we can even think about analyzing complex strategies, we need to lock down the basic formula of profit and loss. This is the absolute first step to seeing your trading performance with total clarity.

Think of it like building a house — you wouldn’t start putting up walls before pouring a solid foundation. These simple calculations are that foundation.

The Core Profit and Loss Formulas

At its simplest, profit is just the money you make when you sell something for more than you paid for it. A loss is the opposite — selling for less. There are no gray areas here; it’s just pure arithmetic.

Let’s walk through a straightforward, practical example. Say you buy 10 shares of Company XYZ at $100 per share. Your total initial investment, or Cost Price, is $1,000.

A few weeks go by, the stock price climbs, and you decide to sell all 10 shares at $120 per share. Your total Selling Price is $1,200.

To figure out your profit, you just use this basic formula:

Profit = Selling Price – Cost Price

In this case, your profit is $1,200 – $1,000 = $200. Simple as that.

Now, let’s flip the script. What if the stock dropped and you sold your 10 shares at $90 each? Your Selling Price would only be $900.

Here, you’d calculate the loss:

Loss = Cost Price – Selling Price

Your loss would be $1,000 – $900 = $100. This simple math gives you the raw, unfiltered outcome of your trade.

Why Percentage P&L Is a More Powerful Metric

Knowing you made a $200 profit feels great, but that number by itself lacks context. Was that $200 earned on a $1,000 investment or a $50,000 one? The difference is huge.

This is where percentage P&L becomes so important for honest performance tracking. It standardizes your results, allowing you to compare trades of different sizes on a level playing field.

The formula for profit percentage is:

Profit % = (Total Profit / Cost Price) x 100

Using our winning trade from before:

- ( $200 / $1,000 ) x 100 = 20%

This tells you that you generated a 20% return on your capital for that trade. That single number is way more insightful than the dollar amount alone.

It works the same way for a loss. The loss percentage formula is:

Loss % = (Total Loss / Cost Price) x 100

Looking at our losing trade:

- ( $100 / $1,000 ) x 100 = 10%

You took a 10% loss on your capital. Getting into the habit of tracking these percentages is absolutely critical for understanding if your strategy is actually effective over the long run.

For a deeper dive, check out our guide on calculating trading profit. Mastering these basics is the first real step toward disciplined, long-term analysis.

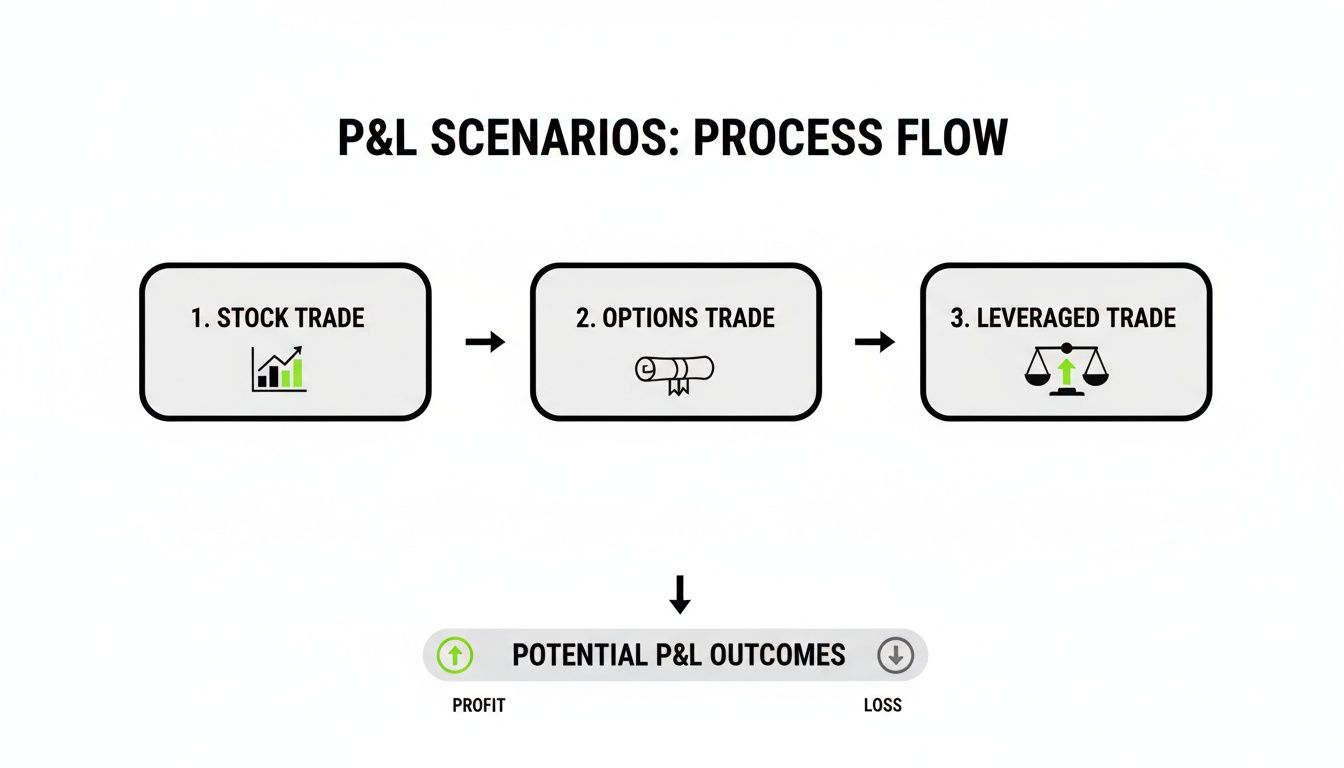

Putting P&L Formulas to Work in Real Trades

Knowing the profit and loss formula is one thing. Applying it when the market is moving and the pressure is on? That’s a whole different ball game. The numbers on your screen can change in a blink, and it’s surprisingly easy to lose sight of your actual performance. This is where theory has to meet reality.

Let’s close that gap. We’re going to walk through three different, real-world trading examples. Think of this as a mental workout — reps that will help you nail down your P&L calculations with confidence when it truly counts. These scenarios are designed to show you exactly how the formulas work with different assets and trading styles.

Example 1: The Multi-Buy Stock Trade

Most traders don’t just jump into a full position all at once. A common approach is to “scale in,” buying shares at different prices as the trade develops. This makes the P&L math a bit trickier because you don’t have one single cost price. The key is to find your average entry price.

Let’s say you’re building a position in Apple (AAPL):

- You start by buying 10 shares at $170.

- The price dips, and you see another opportunity, buying 15 more shares at $165.

To figure out your true cost basis, you need to calculate a weighted average.

- Total Cost: (10 shares * $170) + (15 shares * $165) = $1,700 + $2,475 = $4,175

- Total Shares: 10 + 15 = 25 shares

- Average Entry Price: $4,175 / 25 shares = $167 per share

Now, let’s say your thesis plays out and you sell all 25 shares at $180. Your total sale amount is 25 * $180 = $4,500.

Your total profit is $4,500 (Selling Price) – $4,175 (Total Cost) = $325. This simple process ensures you’re working from an accurate cost basis, not just guessing based on your first or last buy price.

Example 2: The Options Trade

Trading options brings a new variable into the mix: the premium. This is what you pay upfront for the contract, and it’s the single biggest factor in determining your break-even point and final profit. Forgetting to account for the premium is a classic — and costly — rookie mistake.

Imagine you’re bullish on Tesla (TSLA) and decide to buy one call option contract (which represents 100 shares) with a strike price of $200. The premium for this contract is $5.00 per share.

- Total Premium Paid (Your Cost): $5.00/share * 100 shares = $500

For you to even break even, TSLA doesn’t just have to hit the $200 strike price. It needs to climb high enough to cover the premium you already paid.

Break-Even Price = Strike Price + Premium Paid Per Share

In this case: $200 + $5.00 = $205

If TSLA rallies to $212 by the time the option expires, your contract is now worth $12 per share ($212 stock price – $200 strike price). Your total proceeds from selling the option would be $12 * 100 = $1,200.

Now, let’s calculate the net profit:

- Net Profit: $1,200 (Proceeds) – $500 (Premium Cost) = $700

Getting this right is absolutely critical for any options trader trying to understand the real risk and reward of a position.

Example 3: The Leveraged Trade

Leverage is a powerful tool. It lets you control a much larger position with a smaller amount of your own capital. But it’s a double-edged sword that magnifies both your profits and, just as easily, your losses. This is where disciplined P&L math becomes non-negotiable.

Let’s say you’re trading a forex pair like EUR/USD and use 2:1 leverage. You want to control a $20,000 position, but you only need to put up $10,000 of your own money as margin.

If the trade moves 5% in your favor, the total value of your position grows to $21,000. That’s a $1,000 profit.

But here’s the magic of leverage. Because you only committed $10,000 of your own capital, your actual return is much higher:

- Return on Capital: ($1,000 Profit / $10,000 Capital) * 100 = 10%

Leverage effectively doubled your return from 5% to 10%. But what happens if the trade goes against you by 5%? Your $20,000 position is now worth only $19,000 — a $1,000 loss. That entire loss is deducted from your $10,000 margin, which means you’ve suffered a 10% loss on your capital. A small market move can create a big dent, which is exactly why precise P&L tracking is vital when you’re trading on margin.

Uncovering the Hidden Costs That Erode Your Profits

Ever close a trade for what you thought was a solid profit, only to check your account balance and wonder where the money went? It’s a frustratingly common experience, and it points to a massive blind spot in basic P&L math. The simple formula of selling price minus buying price only gives you the gross profit — it doesn’t tell you what you actually get to keep.

This is where true trading discipline begins. To build a sustainable path in trading, you have to obsess over your Net P&L. This is your real, take-home profit after all the small costs that quietly chip away at your returns are accounted for. Ignoring them is like trying to fill a bucket with a hole in it. You’re working hard, but your efforts are constantly being undermined.

The reality is that different trading scenarios — from simple stock trades to complex leveraged positions — are all hit by these underlying costs.

Each type of trade has its own unique cost structure. A one-size-fits-all P&L calculation just won’t cut it for tracking your performance accurately.

The True Formula for Net Profit

To get an honest picture of your performance, you need to expand that basic formula to include every single deduction.

Net P&L = (Selling Price – Buying Price) – All Trading Costs

These “trading costs” are the hidden expenses that so many traders overlook until it’s too late. They always include a few usual suspects:

- Brokerage Commissions: The fee your broker charges for executing each trade. This can be a flat rate or a percentage of the total trade value.

- Transaction Fees: Think of these as the operational costs of the market. They can include exchange fees, clearing fees, and regulatory fees that are often bundled into your trade confirmation.

- Slippage: This is the difference between the price you thought you were getting and the actual price your trade executed at. In fast-moving markets, slippage can easily turn a small win into a loss. We break this down further in our complete guide on what is slippage in trading.

- Capital Gains Taxes: While not deducted from your account immediately, taxes on your profits are an inevitable cost that you have to factor into your long-term planning.

How Costs Can Flip a Winner Into a Loser

Let’s walk through a simple, practical example to see the real-world impact. Imagine you buy 100 shares of a stock at $50 and sell them at $50.50. On paper, your gross profit is $50. A nice little win.

But now, let’s inject some reality by adding in some typical costs:

- Commission to Buy: $5.00

- Commission to Sell: $5.00

- Slippage on Entry: $0.02 per share ($2.00 total)

- Total Costs: $12.00

Suddenly, your Net P&L shrinks to $50 (Gross Profit) – $12 (Costs) = $38. You lost nearly 25% of your profit to these “minor” expenses. It’s this net figure that truly matters and dictates whether your strategy is viable.

How to Analyze Your P&L for Continuous Improvement

Calculating your profit and loss on a trade-by-trade basis is a fundamental skill, but let’s be honest — it’s just the starting line. The real growth, the kind that builds a lasting edge, comes from stepping back and analyzing the story your P&L data tells over time. This is where a simple log of numbers becomes your roadmap for improving strategy.

The whole process kicks off with a critical distinction: unrealized vs. realized P&L. An unrealized profit is the potential gain you see on an open position. It’s incredibly tempting to count that money as yours, but that’s a classic psychological trap. That profit isn’t real until you close the trade and lock it in as realized P&L. True discipline means focusing only on what’s actually in your account.

From Raw Data to Actionable Metrics

Once you have a history of realized trades, you can start digging into key performance metrics that reveal the true health of your trading. These numbers take you beyond the emotional high or low of a single trade and show you the patterns in your performance.

- Win Rate: Simple enough — it’s the percentage of your total trades that were profitable. While a high win rate feels great, it doesn’t automatically mean you’re making money.

- Average Win vs. Average Loss: This one’s a big deal. It compares the average dollar amount of your winners to your losers. For any strategy to be healthy long-term, your average win needs to be significantly larger than your average loss.

- Profit Factor: This is calculated by dividing your total profits by your total losses. A profit factor above 1.0 means your strategy is profitable. Anything below 1.0 shows it’s a losing game over time.

These metrics are the bedrock of any professional performance review. For a deeper dive on these and other key stats, check out our in-depth guide on advanced profit and loss analysis.

Visualizing Your Performance for Better Insights

Staring at a spreadsheet of numbers is enough to make anyone’s eyes glaze over. This is where modern trading journals really shine, transforming that raw data into visual tools that make analysis intuitive. A perfect example is an equity curve, which is just a graph that plots the growth of your account over time. It gives you an instant visual summary of your progress — or lack thereof.

Here’s a look at a performance dashboard that pulls all these key metrics into one clear view.

A dashboard like this instantly highlights your net P&L, win rate, and profit factor. It lets you assess your performance at a glance and spot trends without having to sift through hundreds of individual trade logs.

Embracing the Cycles of Profit and Loss

Getting into a rhythm of consistent analysis does more than just fine-tune your strategy; it builds the mental resilience you need to navigate the market’s natural cycles. Looking back at historical data, it’s clear that drawdowns are just part of the game. A study by Bank of America found that since 1929, the S&P 500 has experienced a drop of 5% or more an average of three times per year.

Understanding that losses are inevitable helps you focus on executing your long-term plan instead of getting spooked by short-term noise.

Ultimately, the goal of P&L analysis isn’t just to see if you’re making money. It’s to understand how you’re making it and, more importantly, why you’re losing it. This continuous feedback loop is what separates struggling traders from those who achieve lasting success.

Common Questions About Profit and Loss Answered

Even after you get the hang of the basics, the real world of trading always throws a few curveballs. Knowing how to apply the core profit and loss formulas in unique situations is what separates disciplined traders from the rest. Let’s tackle some of the most common questions that pop up.

What Is the Difference Between Gross and Net Profit in Trading?

Think of gross profit as the raw, unfiltered number — it’s simply your selling price minus your buying price. It’s a nice starting point, but it’s dangerously incomplete because it ignores the real costs of placing a trade.

Net profit, on the other hand, is the only number that truly matters. This is what’s left after you subtract all the pesky costs like commissions, fees, and slippage. Serious traders live and die by their net profit because it paints an honest picture of whether a strategy actually works in the real world.

How Do I Track P&L for a Position That Is Still Open?

The profit or loss on a trade you haven’t closed yet is called unrealized P&L. You figure it out by comparing your entry price to where the asset is trading right now. For instance, if you bought a stock at $50 and it’s currently at $52, you have an unrealized profit of $2 per share.

But here’s the critical part: that money isn’t yours until you hit the sell button. Treating unrealized gains like cash in the bank is a classic psychological trap that leads to sloppy, emotional decisions.

Why Is My Account Balance Lower Than My Total P&L?

This is a head-scratcher for a lot of traders, but the answer is usually simple. The gap often comes from things that aren’t directly tied to your trading P&L, like account withdrawals, platform subscriptions, or fees for market data.

To get a true read on your growth, your tracking system has to account for all cash moving in and out of your account, not just the results of your trades. This is the only way to ensure your performance curve actually matches your real account balance over time.

Big numbers can be misleading without context. Even the largest corporate profits in history require analysis to be truly understood. For instance, Berkshire Hathaway once reported nearly $40 billion in quarterly earnings, while Microsoft recently saw over $25 billion. For traders, this highlights that nominal figures need context; factors like inflation and profit margins give deeper insight into true performance. You can read more about record-breaking corporate profits on Wikipedia.

What Is a Good Profit Factor to Aim For?

Your Profit Factor is a simple but powerful metric: just divide your total profits by your total losses. Any number above 1.0 means your strategy is profitable. While there’s no single magic number, many disciplined traders aim for a profit factor of 1.5 to 2.0 or higher.

If your profit factor dips below 1.0, it’s a clear red flag that your strategy is bleeding money. This metric becomes even more powerful when you look at it alongside your win rate and average win vs. loss to get the full story of your performance.

Stop letting valuable insights slip through the cracks. TradeReview automatically calculates your Net P&L, Profit Factor, and other critical metrics, transforming your trade history into a clear roadmap for improvement. Ditch the manual spreadsheets and start making data-driven decisions today. Create your free trading journal at TradeReview.