To figure out your trading loss ratio, you have two straightforward options: divide the number of losing trades by the total trades you took, or divide the total dollar amount lost by your total winnings. This key metric gives you an honest, unfiltered look at how frequently or how much you’re losing in the market.

Understanding Your Trading Loss Ratio

Before you get lost in complex analytics, every trader needs to face their loss ratio. It’s a foundational metric, a quick health check for your strategy that reveals how well you’re managing risk and protecting your capital.

Seeing a high loss ratio can be discouraging — especially for new traders. It’s tough to accept that a big chunk of your trades just didn’t work out. We’ve all been there. But here’s the thing: ignoring this number is one of the fastest ways to blow up an account. Truly understanding and analyzing it is the first step toward building the discipline required for long-term survival in the markets.

The Two Core Formulas for Loss Ratio

There isn’t just one “right” way to calculate your loss ratio. The best approach really depends on what you’re trying to measure. Are you more concerned with how often you lose, or how much money you lose? Each question needs a slightly different formula.

- Count-Based Loss Ratio: This formula zeroes in on the frequency of your losing trades. It’s perfect for day traders or scalpers who need to know if their strategy is consistently failing to find winning setups.

- Value-Based Loss Ratio: This one measures the financial damage of your losses against your total gains. It’s a better fit for swing traders or investors who are more concerned with the dollar amount of their drawdowns than the sheer number of red trades.

Knowing which formula to use gives you a much clearer picture of your actual performance. For example, a trader could have a low count-based loss ratio but a dangerously high value-based one if their few losses are absolutely massive.

Confronting your loss ratio isn’t about judgment — it’s about gaining clarity. This number tells a story about your risk management, strategy execution, and psychological discipline. It’s the starting point for meaningful improvement.

To help you decide which formula is right for your analysis, here’s a quick reference guide.

Key Loss Ratio Formulas at a Glance

This table breaks down the two main ways to calculate loss ratio, so you can pick the one that best suits your analytical needs.

| Formula Type | Calculation | Best Used For |

|---|---|---|

| Count-Based | (Number of Losing Trades / Total Number of Trades) x 100 | Assessing the consistency and frequency of losing trades in a high-volume strategy. |

| Value-Based | (Total Dollar Amount Lost / Total Dollar Amount Won) x 100 | Evaluating the financial impact of losses, especially when win and loss sizes vary greatly. |

Ultimately, both formulas offer valuable insights. The count-based ratio tells you about your precision, while the value-based ratio speaks to your risk management. Using both gives you the most complete story.

Calculating Your Loss Ratio with Real Examples

Knowing the formulas is one thing, but actually putting them to work is where confidence is built. Calculating your loss ratio isn’t some complex mathematical chore; it’s a simple, repeatable habit that builds incredible discipline.

Let’s walk through a couple of practical trading scenarios to make the calculations crystal clear and show how different types of traders might approach it.

Example 1: The Day Trader and Trade Frequency

First up, meet Alex. Alex is a high-frequency day trader, executing dozens of trades a week. For Alex, the dollar value of each small loss isn’t the main concern. The real focus is on the consistency of the strategy. How often does the setup fail? That’s the question, making the count-based formula the perfect tool for the job.

Here’s a snapshot of Alex’s stats from a busy week:

- Total Trades Taken: 75

- Number of Losing Trades: 32

- Number of Winning Trades: 43

We’ll use the count-based formula to find the loss ratio:

(Number of Losing Trades / Total Number of Trades) x 100

Plugging in Alex’s numbers, the math looks like this:

(32 / 75) x 100 = **42.67%**

What this tells us is that nearly 43% of Alex’s trades for the week were losers. This figure gives a clear, emotion-free baseline. It’s not the whole story — profitability still depends on the size of the wins versus the losses — but it’s a crucial piece of the puzzle. It also highlights why you should always pair this metric with others, like the ones we cover in our guide on how to calculate win rate.

A trader’s journey is one of continuous self-assessment. Your loss ratio isn’t a grade; it’s a guide. It points you toward what needs adjustment, whether it’s your risk management, your entry signals, or your psychological resilience.

Example 2: The Swing Trader and Financial Impact

Now, let’s look at Maya, a swing trader who holds positions for several days or even weeks. For Maya, the sheer number of losses isn’t as important as their total financial impact on her portfolio. Her wins tend to be large, so she needs to make sure her losses don’t grow big enough to eat away at those gains.

She uses the value-based formula to get a clear picture of the damage. Here’s her performance from last month:

- Total Amount Lost from Losing Trades: $2,100

- Total Amount Won from Winning Trades: $5,500

The value-based formula is:

(Total Dollar Amount Lost / Total Dollar Amount Won) x 100

Let’s run Maya’s numbers:

($2,100 / $5,500) x 100 = **38.18%**

Maya’s value-based loss ratio is just over 38%. This tells her that for every dollar she won, she gave back about 38 cents as losses. This perspective is vital for managing risk and ensuring her overall strategy stays profitable in the long run, even if she hits a string of small losing trades.

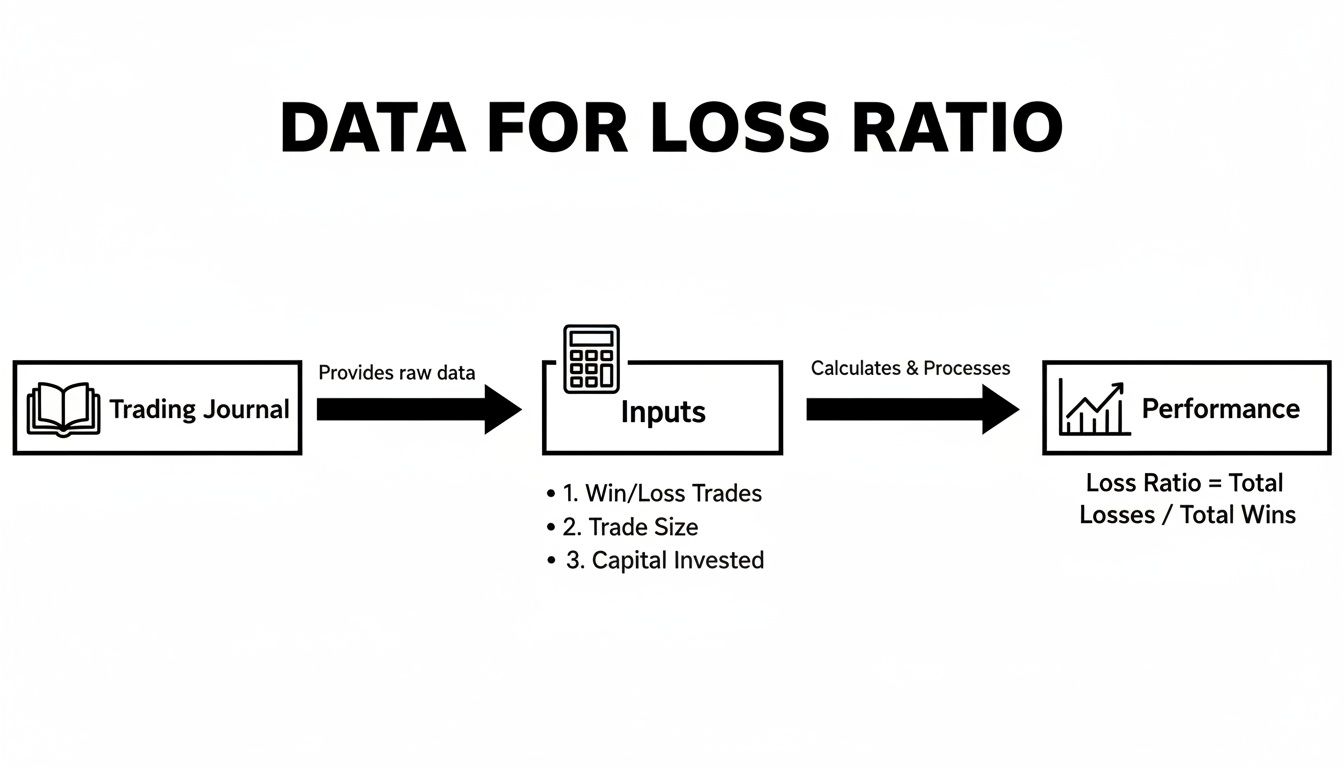

Finding the Data You Need in Your Trading Journal

The formulas for loss ratio are simple enough, but they’re completely useless without clean, accurate data. This is where your trading journal stops being a simple logbook and becomes your most powerful analytical tool. It holds all the raw numbers you need to calculate your loss ratio and uncover the real story behind your performance.

Getting this information should be a seamless part of your review process, not a frustrating scavenger hunt. A well-organized journal makes it easy to pull the exact figures you need for any calculation. Whether you’re logging trades by hand or syncing them automatically, the data is all there waiting for you.

Locating Your Performance Data

If you’re tracking your trades manually in a spreadsheet, the process is straightforward but demands discipline. You’ll need to sum up your columns for total trades, the number of losing trades, and the total dollar value of your losses.

This method works, but it’s time-consuming and prone to costly errors. For traders looking for a better way to structure their manual logs, our guide on building an Excel trading journal offers some great starting points.

But let’s be honest, modern journaling platforms like TradeReview are designed to eliminate all that manual work. The real efficiency comes from features like Auto Broker Sync, which automatically pulls in your entire trade history.

Your trading journal isn’t just for record-keeping; it’s your personal performance database. Disciplined journaling is what turns raw trading activity into actionable intelligence that drives real improvement.

Using Auto-Sync for Effortless Analysis

When you connect your brokerage account to TradeReview, the platform does all the heavy lifting for you. It automatically populates the Performance Analytics dashboard with the key metrics you need to understand your trading habits, no manual entry required. You don’t have to count trades or sum up profits and losses yourself — it’s all done instantly.

The screenshot below shows a typical TradeReview dashboard where this data is clearly displayed.

Here, you can see metrics like your total trades, P&L, and win/loss statistics at a glance. This automation not only saves a tremendous amount of time but also ensures the data is 100% accurate, completely removing the risk of human error from your analysis.

With these numbers readily available, you can calculate your loss ratio in seconds and spend your valuable time interpreting what it means instead of just crunching numbers.

What Your Loss Ratio Is Actually Telling You

Calculating your loss ratio is the easy part. The real skill is learning to read the story that number is trying to tell you.

It’s tempting to see a high loss ratio and immediately think your strategy is broken. But a number that looks alarming on the surface might be perfectly fine for your system, while a “good” one could be hiding some serious flaws. Many traders get tunnel vision, fixating on a single metric. But your loss ratio should never be viewed in a vacuum. Its true power comes out when you pair it with other key stats like your win rate, profit factor, and average risk-to-reward ratio. This is how you avoid making knee-jerk decisions based on incomplete data.

Beyond the Single Number

A high loss ratio doesn’t automatically make you a bad trader. Far from it.

Many consistently profitable trend-following and swing trading strategies have loss ratios well over 50%. How is that possible? Their winning trades are massive compared to their losing ones. That’s the power of a strong risk-to-reward ratio at work.

Let’s look at a couple of scenarios:

- Strategy A: A scalper has a 30% loss ratio, which means they’re winning 70% of their trades. Sounds great, right? But if their average winning trade is only $20 and the average loser is $50, they’re bleeding money over the long run.

- Strategy B: A swing trader has a 60% loss ratio. This might seem discouraging, but if their average winner is $300 and their average loser is just $75, this strategy is actually very profitable despite losing more often than it wins.

Your loss ratio is a diagnostic tool, not a final grade. It tells you what happened, but your trading journal and other metrics tell you why. True improvement starts when you connect the two.

This is exactly why context is king. Understanding the formula is just the beginning; knowing how to interpret the result within your trading system’s framework is what leads to long-term success.

Loss Ratio in Context with Other Trading Metrics

To drive this point home, let’s compare a few different trader profiles. The table below shows how the interplay between loss ratio, win rate, and risk/reward creates wildly different outcomes.

| Trader Profile | Loss Ratio | Win Rate | Avg. Risk/Reward | Result |

|---|---|---|---|---|

| The Scalper | 30% | 70% | 1 : 0.4 | Unprofitable |

| The Gambler | 50% | 50% | 1 : 0.8 | Unprofitable |

| The Swing Trader | 60% | 40% | 1 : 3 | Profitable |

| The Trend Follower | 75% | 25% | 1 : 5 | Highly Profitable |

As you can see, the trader with the worst loss ratio (The Trend Follower) is actually the most successful. They lose often, but their wins are so significant that they more than cover the small, frequent losses. This is the definition of a positive expectancy system.

The Bigger Picture of Performance

To truly get a handle on your performance, you need to see how data flows from your journal into real, actionable insights.

This process — from raw trade data in your journal to a clear performance picture — shows why disciplined record-keeping is the absolute foundation of strategic improvement. It’s about building a system, not just chasing wins.

Sadly, this is where many traders fall short. While specific profitability statistics vary across studies, a common theme in research is that a significant majority of day traders are not profitable long-term. For example, some studies have indicated that over 80% of day traders may lose money over time. These numbers paint a clear picture: many traders are likely operating with unsustainably high loss ratios without the risk-to-reward edge needed to survive. You can dig deeper into these day trading statistics and their implications yourself.

Ultimately, the goal isn’t to chase an impossibly low loss ratio. The goal is to build a trading system where all your metrics work together to produce a positive expectancy over hundreds of trades. That takes patience, discipline, and a commitment to the long game.

Actionable Ways to Improve Your Loss Ratio

So, you’ve crunched the numbers and calculated your loss ratio. If the figure staring back at you feels a little high, don’t sweat it. This is a critical moment for any trader — not a time to panic, but a clear signal that it’s time to take action.

It’s easy to think the answer is to find a brand-new, “perfect” strategy. But the truth is, the most meaningful improvements usually come from refining what you’re already doing. This is where real discipline and data-driven tweaks can transform your trading over the long run.

Dig Into Your Trading Journal for Patterns

Your trading journal is so much more than a simple record of wins and losses; it’s a goldmine of your trading habits and behavioral patterns. Instead of viewing all losses as equal, use your journal to figure out why they’re happening. This is where a tool like TradeReview really shines, with flexible tagging and analytics that make this process incredibly efficient.

Start by asking some focused questions and filtering your trade data to find the answers:

- Time-Based Patterns: Are most of your losses piling up on a specific day, like Mondays? Or maybe they’re concentrated in the first chaotic hour after the market opens?

- Setup-Specific Issues: Is one particular trading setup responsible for an outsized chunk of your losing trades? Maybe that breakout strategy isn’t performing as well as you thought.

- Emotional Triggers: Do you notice a string of losses right after a huge winning trade? That could be a sign of overconfidence leading to sloppy execution.

By pinpointing these weak spots, you can shift from feeling frustrated to creating a concrete, data-backed action plan.

True progress isn’t about eliminating all losses — that’s impossible. It’s about eliminating the unforced errors and systematic mistakes. Your journal is the only tool that can show you the difference.

Refine Your Entry, Exit, and Risk Rules

Once you’ve spotted the patterns, you can start making precise adjustments. This isn’t about throwing out your entire system. It’s about tightening the screws where things are a bit loose. Small, consistent changes are far more powerful than making drastic, emotional overhauls.

For example, if your data clearly shows that Mondays are your worst trading day, your action item might be to reduce your position size by 50% on that day. Or you could decide to avoid trading the first hour altogether. This small change directly targets a weakness you’ve proven with your own data. Our full guide on risk management techniques dives much deeper into these kinds of practical adjustments.

Ignoring your loss ratio can create massive blind spots. It feeds a dangerous survivorship bias in your mind, where you vividly remember the big wins but conveniently forget the dozens of small losses that are slowly draining your account. This is a common psychological trap for traders. Many who quit do so because of unsustainably high loss ratios that they failed to address.

Ultimately, the goal is to build smarter, more resilient trading habits. These habits protect your capital and give your winning strategies the best possible chance to perform over time.

Common Questions About Trading Loss Ratios

Let’s tackle some of the most common sticking points and questions traders have about loss ratios. This metric is a frequent source of confusion, mainly because the “right” answer always depends on your unique trading style, risk tolerance, and what you’re trying to achieve in the long run.

Feeling a bit lost about what your loss ratio really means is a shared struggle. Getting clear on it is key to building the discipline you need to trade with real confidence.

What Is a Good Loss Ratio for a Day Trader?

There’s no magic number here. A high-frequency day trader or scalper might aim for a loss ratio under 40%, thinking it proves their setups are hitting more often than not. But that’s only half the picture.

A low loss ratio is completely useless if the few losses you do take are big enough to wipe out all your small wins. On the flip side, a day trader can be wildly profitable with a 60% loss ratio if their average winner is three or four times bigger than their average loser. It’s all about how your loss ratio works with your risk-to-reward ratio, not about chasing some arbitrary figure.

A “good” loss ratio is simply one that, when paired with your average win and loss size, creates a profitable system over a large number of trades. It’s entirely specific to your strategy.

Can You Be Profitable with a Loss Ratio Over 50 Percent?

Absolutely. Grasping this concept is one of the biggest mental shifts that separates professional traders from amateurs. Many of the most successful trend-following and swing trading strategies are actually designed to lose more often than they win.

Think about it this way: a trader could lose on six out of ten trades, putting their loss ratio at 60%. If they lose $100 on each of those six trades, that’s a $600 total loss. But on the four winning trades, they might catch a huge runner and make $500 each, for a total gain of $2,000. Even though they lost most of the time, their net profit is a solid $1,400. That’s the power of letting your winners run and cutting your losers short.

How Often Should You Calculate Your Loss Ratio?

Checking your loss ratio too often can do more harm than good. It can trigger emotional decisions based on short-term market noise. Obsessing over your numbers after every single trade is a fast track to stress and second-guessing a perfectly good strategy.

The solution is to build a disciplined review schedule. Here are a couple of practical cadences:

- Weekly Review: This is a great starting point for most active traders. It smooths out the daily ups and downs and gives you a clear picture of your performance over a decent sample size.

- Monthly Review: Perfect for swing traders or anyone who trades less frequently. This longer timeframe gives you a more stable and meaningful look at your metrics.

The real goal is to create a consistent routine. This discipline helps you track your progress over time, spot important patterns, and make smart adjustments without getting thrown off by the market’s day-to-day randomness.

Stop guessing and start analyzing. TradeReview automatically calculates your key performance metrics, including win and loss ratios, so you can focus on making smarter, data-driven decisions. Sync your broker and see your real performance today. Find out more at https://tradereview.app.