A good trading journal template in Excel gives you a solid framework to log your trades, dissect your performance, and spot those hidden patterns — all without the monthly fees or getting locked into a third-party app. It’s way more than just a spreadsheet; it’s your personal tool for turning raw data into insights that actually make you a better trader.

Why a Trading Journal Is Your Most Important Tool

Let’s be real. Trading often feels like you’re just reacting to the market, taking whatever it throws at you. You have some wins, some losses, but when you look at your account at the end of the month, you’re not sure why you’re stuck in the same place. It’s a frustrating cycle, leaving you guessing about what’s working and what’s silently bleeding your account dry.

This is exactly where a trading journal steps in and becomes your most valuable asset. It shifts trading from a series of emotional, gut-driven decisions to a data-backed business. By consistently tracking what you do, you build an undeniable, objective record of your performance. It’s not about finding a magic formula for guaranteed profits; it’s about building the discipline and self-awareness that lead to long-term consistency.

Moving Beyond Wins and Losses

A journal forces you to look past the simple P/L of any single trade. It makes you ask the tough questions that spark real growth:

- Why did I take this trade? Was it a textbook setup from my trading plan, or was I just chasing a hot stock out of FOMO (Fear Of Missing Out)?

- How did I manage it? Did I honor my stop-loss and take-profit, or did I let fear or greed move my goalposts?

- What was my mindset? Was I calm and focused, or was I on tilt trying to win back money from the last loser?

Answering these questions consistently is how you build the discipline that separates successful traders from the rest. A journal isn’t just for logging numbers; you can dive deeper into its importance in our guide on why every trader needs a trading journal.

Your trading journal is the ultimate accountability partner. It doesn’t care about your excuses or market theories; it only shows you the cold, hard facts of your decisions and their outcomes.

The Power of Data-Driven Insights

The real magic of a trading journal template in Excel is its ability to uncover patterns you’d never see otherwise. For example, a trader might notice after a few months of journaling that while their breakout strategy feels exciting, it’s actually losing money. In contrast, their “boring” mean reversion trades — where they bet on a price returning to its average — are quietly building their account.

This is a perfect, practical example of how simple data analysis can lead to massive improvements in your strategy. Without the journal, they might have continued forcing the losing strategy, guided by emotion instead of evidence. You can find more stories of traders using journaling templates to their advantage on chartswatcher.com.

Setting Up Your Core Trading Log

Alright, this is where we get our hands dirty. A truly powerful trading journal is built on a foundation of clean, relevant data. Just logging your P&L is a start, but it won’t ever tell you why you’re winning or losing. We need to capture the full story of each trade.

Think of each column in your spreadsheet as a different lens for viewing your performance. The columns you choose right now will directly impact the quality of the insights you can pull from your data later on. The goal is to build a robust trading journal template in Excel that’s tailored to your unique style of trading.

The Essential Data Columns

First up, let’s cover the non-negotiables. These are the absolute core fields every single trader needs to track for even a basic analysis. Without these, your journal is just a random collection of numbers.

Your trading log is only as good as the data you put into it. The columns you choose will determine the depth of your analysis. Here’s a look at the essential fields to start with, plus some more advanced options for when you’re ready to dig deeper.

Essential Data Fields for Your Trading Log

| Column Name | Data Type | Purpose & Example |

|---|---|---|

| Date | Date | Logs when you entered the trade. Essential for tracking monthly or weekly performance. |

| Symbol | Text | The ticker of the asset you traded (e.g., AAPL, TSLA, BTC/USD). |

| Direction | Text | Did you go Long (buy) or Short (sell)? Crucial for seeing if you favor bull or bear markets. |

| Entry Price | Number | The exact price where you entered the trade. |

| Exit Price | Number | The exact price where you closed the trade. |

| Position Size | Number | How many shares, contracts, or units you traded. |

| Strategy | Text | The specific setup that prompted the trade (e.g., “Breakout,” “Mean Reversion,” “Earnings Play”). |

| Risk/Reward (R/R) | Ratio/Number | Your planned profit target vs. your stop loss before entering (e.g., 2:1 or 3). |

| Emotional State | Number/Text | A rating (1-5) or a word (“Focused,” “Anxious”) to describe your mindset. |

These fields give you an objective, clear-cut record of your trading activity. But to really find your edge, you need to go deeper.

Columns for Deeper Insights

This is where you graduate from simply recording what happened to analyzing why it happened. Adding just a few extra columns can unlock game-changing insights into your strategy and, more importantly, your psychology.

Consider adding these:

- Strategy: What was the specific setup? A “Breakout”? “Mean Reversion”? “Earnings Play”? Tracking this reveals which strategies are actually making you money and which ones are just noise.

- Risk/Reward Ratio (R/R): Before you clicked “buy,” what was your plan? A trade might be a winner, but if you’re consistently risking $3 to make $1, your long-term prospects are grim. This column keeps you honest.

- Emotional State: On a scale of 1-5, how did you feel? Were you calm and focused (5) or anxious and chasing a loss (1)? This column often exposes the hidden psychological patterns that sabotage your best-laid plans.

A common mistake is focusing only on the outcome (profit or loss). The real gold is in the process. Tracking your strategy and emotional state tells you why you got that outcome, which is the key to consistent improvement.

By adding these fields, you’re no longer just logging trades; you’re building a comprehensive tool for serious performance analysis. In fact, you can see how most pros structure their Excel journals on kinfo.com to include these kinds of data points. This detailed approach is what separates casual traders from those who treat trading like a real business.

Using Excel Formulas to Automate Your Analysis

Let’s be honest, manually calculating your wins, losses, and other key stats after every single trade is a surefire way to burn out. It’s tedious, takes way too much time, and, worst of all, it’s incredibly easy to make a mistake. This is where a proper trading journal template in Excel really starts to shine — automation.

By plugging in a few simple formulas, you can turn a static spreadsheet into a dynamic analysis machine that does all the heavy lifting for you. This frees you up to focus on what actually matters: analyzing the results to find an edge, not just crunching the numbers. The whole point is to get instant, reliable feedback on your performance.

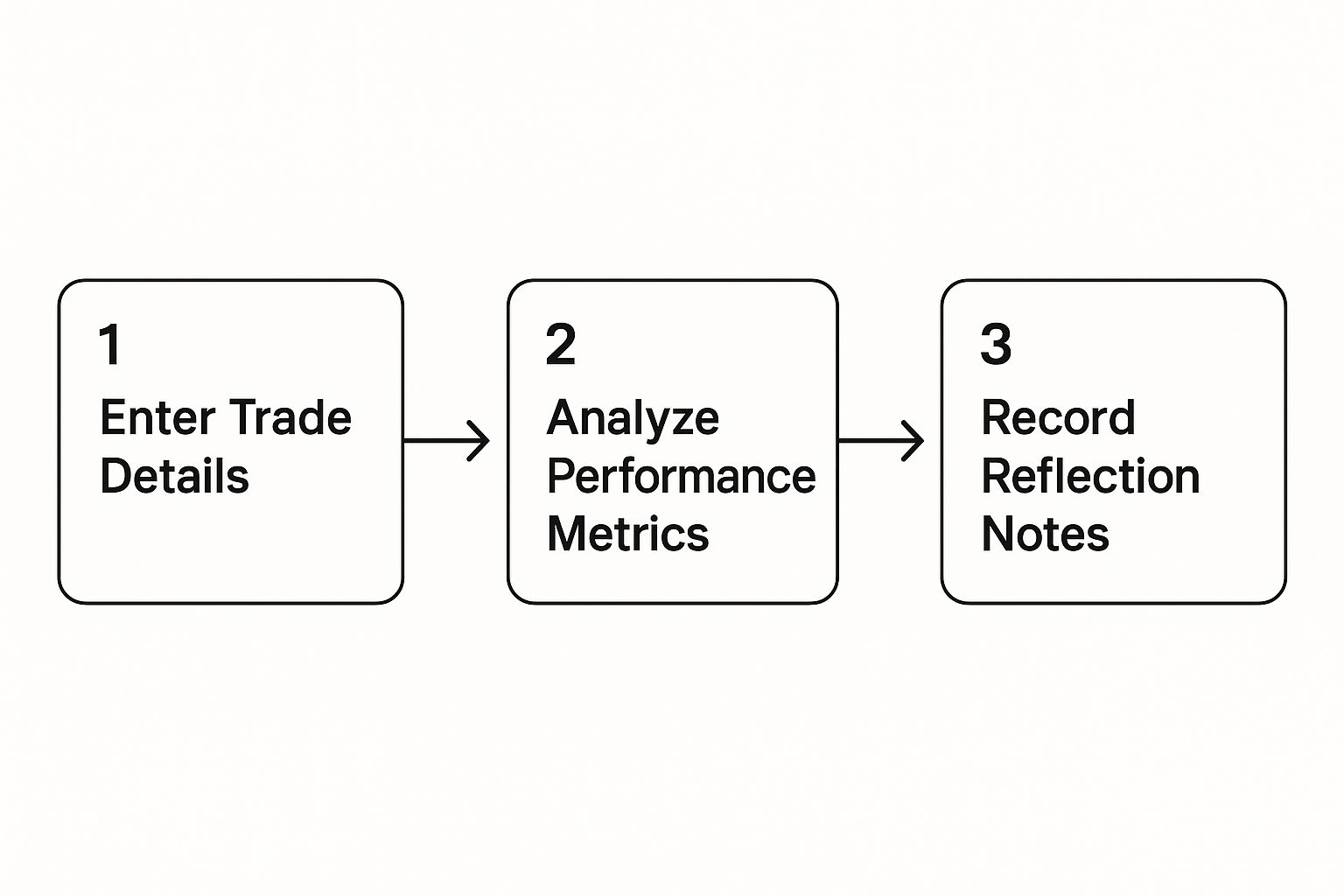

Building a data-driven trading system is really just a continuous loop. You enter the data, analyze it, and reflect on what you can improve.

This simple cycle ensures every trade becomes a lesson, turning raw data into real, actionable improvements for your strategy.

Essential Formulas for Instant Insights

Okay, let’s dive into the formulas that will give you the most bang for your buck. These are incredibly easy to set up and will immediately start automating your most important calculations.

For these examples, let’s assume your trade data is laid out like this:

- Direction (Long/Short) is in column C

- Entry Price is in column D

- Exit Price is in column E

- Position Size is in column F

1. Calculate Profit and Loss (P/L)

This is the big one. The most fundamental metric. A simple IF statement is all you need to handle both long and short positions without any extra work. An IF statement in Excel checks if a condition is true, then does one thing if it is, and another if it isn’t.

=IF(C2="Long",(E2-D2)*F2,(D2-E2)*F2)

So, what’s this doing? It just checks if the trade was “Long.” If it was, it calculates the P/L as (Exit - Entry) * Size. If it wasn’t a long (meaning it was a short), it flips the calculation to (Entry - Exit) * Size. Done.

2. Automatically Tag Wins and Losses

Stop manually typing “Win” or “Loss.” That’s a waste of time. Let another IF formula handle it by looking at your P/L column (we’ll say that’s column G).

=IF(G2>0,"Win","Loss")

This quick check instantly categorizes every trade, which is essential for things like calculating your win rate. If you want to dig deeper into that metric, check out our guide on how to properly calculate your trading win rate.

Ensuring Clean Data with Dropdown Menus

Inconsistent data will absolutely wreck your analysis. If you log a strategy as “Breakout” one day and “breakout” the next, Excel sees them as two completely different strategies. Your results will be skewed, and you won’t even know it.

The fix is easy: Data Validation. This feature lets you create dropdown menus to enforce consistent entries.

Here’s how to set it up:

- Select the entire column where you log your strategies (let’s say it’s column H).

- Go to the Data tab in Excel and find Data Validation.

- In the settings, under “Allow,” pick List.

- For the “Source,” just type your strategies separated by commas. For example:

Breakout,Mean Reversion,Earnings Play - Click OK.

Just like that, the entire column now has a clean dropdown menu with only the options you defined. This tiny step is huge for keeping your data clean, consistent, and ready for reliable analysis.

Key Takeaway: Spending a few minutes setting up formulas and data validation will save you hours of manual work and prevent countless errors down the road. It’s a small investment in the integrity of your data and the clarity of your insights.

Building Your Personal Performance Dashboard

Your raw trade log is full of valuable data, but let’s be honest — staring at rows of numbers is a surefire way to miss the bigger picture. This is where a dedicated performance dashboard comes in. By creating a separate tab in your trading journal template in Excel, you can turn all that noisy data into clear, visual feedback.

Think of a dashboard as an instant health check for your trading. It’s the difference between reading a dense financial report and seeing a simple, powerful chart that tells you in seconds if you’re on the right track. This kind of visual clarity is everything when it comes to making quick, informed decisions and sticking to your plan.

Visualizing Your Key Performance Indicators

First things first, let’s pull out your most important Key Performance Indicators (KPIs). These are the headline numbers that give you a high-level summary of how you’re doing. You can calculate these with some simple Excel functions that point right back to your main trade log.

I’d recommend starting with these four essentials:

-

Total P/L: The bottom-line number. Just use the

SUM()function on your P/L column to get your total net profit or loss. -

Win Rate: What percentage of your trades are profitable? A formula like

=COUNTIF(TradeLog!H:H, "Win")/COUNTA(TradeLog!H:H)works perfectly, assuming your Win/Loss tags are in column H of a sheet named “TradeLog”. -

Average Win vs. Average Loss: This one’s a biggie. Are your winners bigger than your losers? Use the

AVERAGEIF()function to calculate the average P/L for your wins and losses separately. Honestly, this comparison is often way more insightful than your win rate alone. - Profit Factor: This is simply your total gross profit divided by your total gross loss. Any value over 1.0 suggests you’re running a profitable system over the long term.

Get these KPIs displayed prominently at the top of your dashboard. They’re your at-a-glance snapshot, no digging required.

Charting Your Progress and Strategies

Numbers are great, but charts tell a story. Visuals make it incredibly easy to spot trends, outliers, and patterns that are practically invisible in a spreadsheet. For any trading dashboard, there are two charts I consider absolutely non-negotiable.

The Equity Curve is a line chart plotting your cumulative P/L over time. This is the ultimate visual scorecard of your progress. A steady, upward-sloping curve is what you’re aiming for — it shows consistency. If you see a volatile, jagged curve, it might be a sign that discipline is slipping or a strategy is broken.

A Strategy Performance Chart is usually a bar chart breaking down your total P/L by each strategy you use. This chart instantly answers the crucial question: “Which of my setups is actually making money?” You might be shocked to discover that the strategy you feel is your best is actually a consistent loser.

Uncovering Deeper Insights with PivotTables

What if you want to ask more complex questions? Things like, “Am I more profitable on Tuesdays?” or “What’s my win rate on short trades versus long ones?” This is where Excel’s PivotTables become your secret weapon.

A PivotTable is an interactive tool that lets you slice, dice, and summarize huge amounts of data in seconds — without writing a single formula. It’s like having a data analyst built right into your spreadsheet.

The magic of a great Excel trading journal template lies in this balance between detailed data logging and easy analysis. Many experienced traders embed tools like PivotTables and charts directly into their workbooks to quickly assess performance. You can see more examples of how these visual tools are used in trading journals on templatearchive.com. This approach helps you calculate key stats like reward-to-risk ratios, which are vital for building disciplined strategies.

With a PivotTable, you can just drag and drop different fields — like ‘Day of the Week’ or ‘Strategy’ — to instantly reorganize your performance data and uncover hidden patterns you never even knew were there.

Advanced Journaling Techniques for a Deeper Edge

Once your dashboard is set up, it’s time to upgrade your trading journal template in Excel from a simple logbook to a professional analysis tool. These next few techniques are what really help you connect the dots between your data, your mindset, and the live market action.

Ultimately, the goal is to add layers of context that numbers alone just can’t provide. This is how you start seeing the why behind your wins and losses, not just the what.

Add Instant Visual Feedback with Conditional Formatting

Staring at a wall of P/L numbers is draining. Instead, let Excel do the heavy lifting and highlight what really matters. Conditional Formatting is a fantastic feature that automatically color-codes your cells based on their values, giving you immediate visual cues.

You can set up a simple rule:

- If P/L > 0, color the cell green.

- If P/L < 0, color the cell red.

This small change is surprisingly powerful. At a glance, you can immediately spot winning and losing streaks, helping you identify periods where you were dialed in with the market — or when you were really struggling. It’s a simple trick that makes reviewing your journal far more intuitive.

Link Your Data to Market Context with Screenshots

Your spreadsheet tells you the outcome, but it doesn’t show you the chart setup that led to your decision. Was the breakout clean? Was there a key level of support you completely missed? This is where adding a column for chart screenshots provides crucial context.

Just create a new column in your log and hyperlink to a screenshot of your chart right at the moment of entry. I like to store these images in a dedicated folder on my computer or in cloud storage. This practice of reviewing the visual setup alongside the hard data is a cornerstone of effective backtesting and strategy refinement. If this is new to you, understanding the fundamentals of backtesting trading strategies will completely change how you analyze your past performance.

Numbers tell you what happened. Chart screenshots remind you of why it happened. Combining both creates a complete picture of your trading decisions.

Track Psychological Metrics to Connect Mindset and Results

Sooner or later, most traders discover that their biggest enemy isn’t the market — it’s their own mindset. We all battle with fear, greed, or a lack of discipline. Quantifying these feelings is the first step toward actually managing them.

Add a column titled something like “Discipline Score” and rate each trade on a scale of 1-5. A 5 means you followed your plan to the letter, while a 1 might mean you revenge-traded or impulsively moved your stop-loss.

Over time, you can filter your trades by this score to see exactly how much undisciplined trading is truly costing you. The results are often a sobering — but incredibly necessary — wake-up call. For example, you might find that your “1-star” discipline trades have an average loss of -$250, while your “5-star” trades have an average gain of +$150. Seeing that in black and white provides a powerful incentive to stick to your plan.

Got Questions About Your Trading Journal?

Even with a perfect template, getting into the habit of journaling can feel like a chore at first. That’s completely normal. You’re building a new muscle, and it’s okay to have questions as you work this powerful routine into your trading day. Pushing through those initial hurdles is what separates break-even traders from profitable ones.

A lot of traders get bogged down in the beginning, viewing it as just more admin work. But try to reframe that thinking. Every single entry is a dot on the map of your trading career, slowly revealing your habits, your edge, and your blind spots. It’s a direct investment in your future self.

How Often Should I Be Updating My Journal?

Ideally, you should log your trades the moment you close them. This is when the details are freshest — your exact reasons for getting in, why you got out, and how you were feeling. Just a few hours later, hindsight bias can creep in and completely change your memory of the trade.

If you can’t log in real-time, then make it a non-negotiable part of your end-of-day routine. Set aside 15 minutes after the market closes to fill out your trading journal template excel. Consistency is what turns a simple logbook into a goldmine of performance data.

What’s the Single Most Important Metric to Track?

Profit/Loss is what everyone looks at first, but if you ask seasoned traders, they’ll tell you that Expectancy is the number that truly matters. It’s a single metric that tells you, mathematically, what you can expect to make or lose on average for every trade you take.

The formula is: (Win Rate x Average Win) – (Loss Rate x Average Loss). A positive expectancy is the statistical proof that your strategy has a positive edge over the long haul, even when you hit a string of losses. It moves your focus from short-term wins to long-term system viability.

A high win rate is a vanity metric if your average loss is wiping out all your gains. Expectancy gives you the brutally honest truth about your system’s profitability.

Can I Use This Template for Crypto or Options?

Absolutely. That’s the beauty of using Excel — it’s incredibly flexible. The core principles of tracking your entry, exit, position size, and P/L are universal, no matter what market you’re trading.

- Options traders: You can easily add columns for ‘Strike Price,’ ‘Expiration,’ and ‘Strategy’ (like Iron Condor or Vertical Spread).

- Crypto traders: You might want to add an ‘Exchange’ column or a field to track transaction fees (gas fees, etc.).

All you have to do is customize the columns to capture the data that’s most relevant to your specific asset class and strategy.

Ready to stop guessing and start analyzing with real data? While an Excel journal is a fantastic start, TradeReview is built to give you a more seamless experience. With features like auto-sync with your broker, deep performance analytics, and a visual trade calendar, you can spend your time finding insights, not punching in numbers. Track your progress on web, iOS, and Android — all for free. Create your free TradeReview account today and take real control of your trading performance.