Backtesting is how you stress-test a trading strategy using historical data. It lets you simulate your rules against past market movements to see how they would have performed — all without putting a single dollar on the line.

The process involves laying out crystal-clear entry and exit rules, factoring in real-world costs, and then digging into performance metrics like win rate and drawdown to see if your idea holds up.

Why Backtesting Is Your Secret Weapon in Trading

Every trader knows that feeling — the rush of a new idea that feels like a sure thing. It’s so tempting to just dive into the live markets, convinced you’ve found “the one.” But that impulse is a fast track to emotional decisions and painful losses.

This is exactly where learning how to backtest becomes less of a technical chore and more of a core discipline. It’s your personal trading lab, a safe space to test, break, and rebuild your strategies away from the heat of the moment.

Think of it like a pilot’s flight simulator. You’d never want to fly a real plane without hundreds of hours of simulated practice. Backtesting gives you that same critical experience, building the muscle memory and deep understanding you need to navigate the markets with a steady hand.

Shifting from Gambling to Strategic Planning

Let’s be blunt: without data, you aren’t trading — you’re gambling. Backtesting is what provides the hard evidence to shift from gut feelings to a data-driven approach. It forces you to define every last detail of your strategy with absolute clarity.

So, what does that actually look like? At its core, you’re using historical market data to run your trading rules as if they happened in the past, giving you a glimpse into potential profitability. A legitimate test needs a few key things:

- High-Quality Data: Clean OHLCV (Open, High, Low, Close, Volume) data is non-negotiable.

- Crystal-Clear Rules: If your entry and exit signals are fuzzy, your results will be useless.

- Realistic Costs: You have to account for commissions, potential slippage, and any fees.

- Defined Risk Parameters: How much are you risking per trade? What’s your max drawdown tolerance?

By studying metrics like the Sharpe Ratio or Maximum Drawdown, you get an honest look at how your strategy might have performed, warts and all. You can get a deeper dive into this process at TradeWithThePros.com.

Backtesting isn’t about chasing some perfect, no-loss system. It’s about getting to know your strategy’s true personality — its strengths, its weaknesses, and, most importantly, where it breaks under pressure.

This simulation is the critical step before you even think about practicing with fake money in a live environment. To see how these two practices fit together, check out our guide on what paper trading is and why it’s the perfect follow-up to a solid backtest.

Ultimately, this rigorous preparation is what separates the disciplined pros from the hopeful amateurs.

Setting Up Your First Credible Backtest

Alright, this is where the theory ends and the real work begins. A backtest is only as good as what you put into it, and a thoughtful setup is the first step toward getting results you can actually trust. It’s a process that demands precision and a bit of honest self-reflection.

The entire foundation of a useful backtest rests on one thing: high-quality historical data. Without it, you’re just playing with numbers. While free data from places like Yahoo Finance is easy to get, it can sometimes have gaps or errors that throw everything off.

If your strategy is based on daily charts, that might be good enough to start. But if you’re an intraday trader, you’ll quickly find that investing in a paid data provider is pretty much non-negotiable. You need accuracy down to the minute.

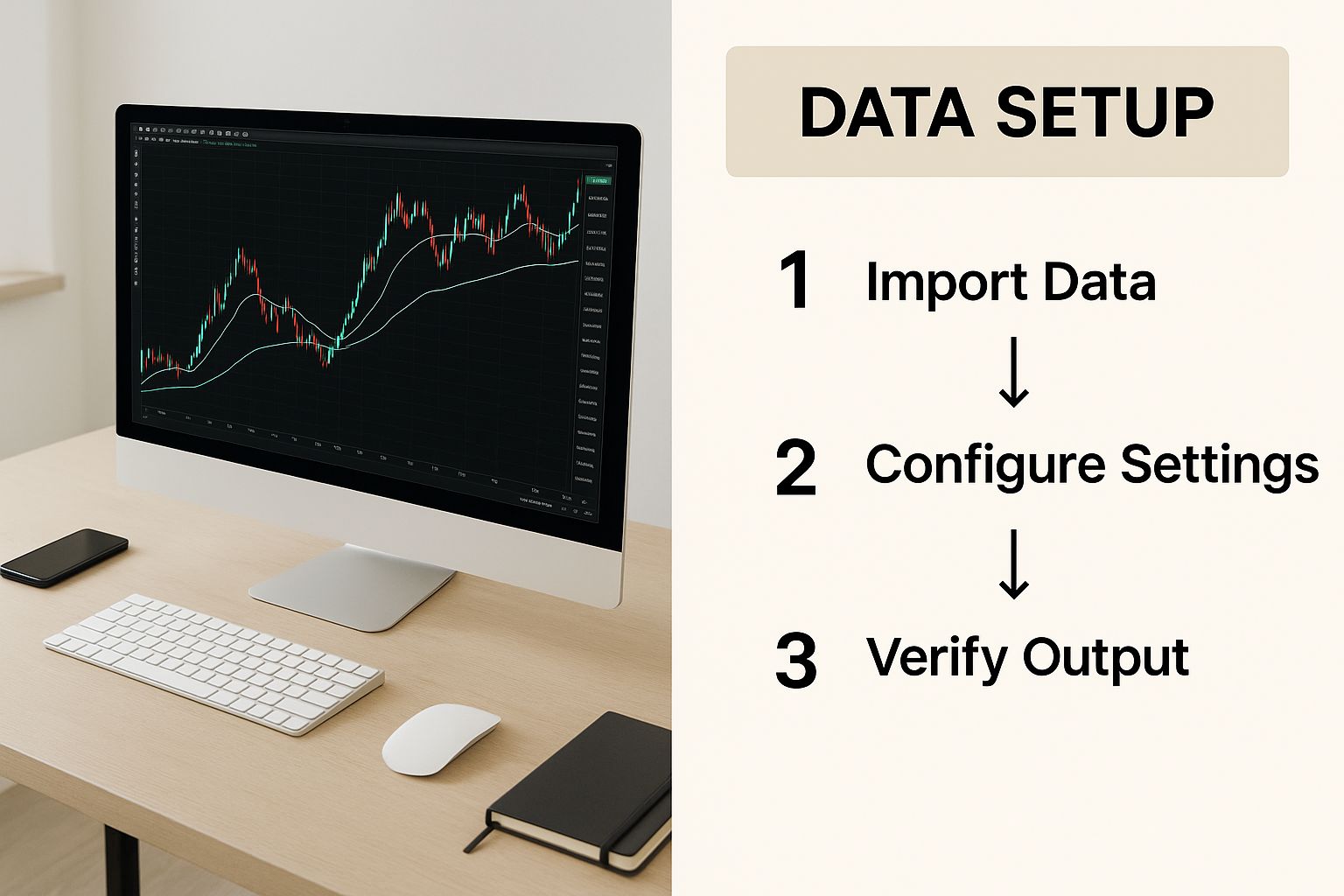

This graphic breaks down the core components of a solid backtest setup.

As you can see, everything from your data source to your strategy rules forms the bedrock of a meaningful test.

Defining Your Strategy Rules with Precision

Once you have your data lined up, it’s time to define your trading strategy with military-like precision. Ambiguity is your worst enemy here. Your rules need to be so clear and objective that a computer could execute them without a single question.

We’re not talking about vague feelings like “buy when a stock looks strong.” We need explicit, quantifiable rules for every single action.

- Entry Signal: What exactly triggers a trade? For example, “Enter a long position when the 50-day moving average crosses above the 200-day moving average.”

- Exit Conditions (Profit): How do you lock in gains? A specific rule might be, “Sell when the price reaches 2x the Average True Range (ATR) above the entry price.”

- Exit Conditions (Loss): Where’s your pain point? Be precise: “Exit the trade if the price closes below the 50-day moving average.”

- Position Sizing Model: How much are you putting on the line? A common rule of thumb is, “Risk no more than 1% of the total account balance on any single trade.”

Getting this granular feels tedious, I know. But it’s what turns a fuzzy idea into a testable hypothesis. It’s the difference between wishful thinking and a systematic edge.

Avoiding Hidden Data Traps

Getting clean data is just the first hurdle. You also have to watch out for hidden biases that can paint a dangerously rosy picture of your strategy’s performance. One of the most common traps is survivorship bias.

This happens when your historical data only includes companies that are still around today. It conveniently leaves out all the companies that went bankrupt, got acquired, or were delisted along the way.

Imagine testing a strategy on the current S&P 500 stocks over the last 20 years. The backtest would completely ignore all the failed companies that were once in the index, making your performance look way better than it actually would have been.

Recognizing and accounting for these data traps is critical. It forces your backtest to reflect the messy reality of the market, not some sanitized version of history. Building on that honest foundation is the only way to gain real confidence in your strategy.

Running Your Simulation With Real-World Costs

Alright, you’ve got your strategy defined and your data lined up. Now for the fun part: running the numbers and seeing how your idea actually holds up against historical market action.

This is where the rubber meets the road. The tools you use can be as simple as a spreadsheet or as complex as custom-coded scripts.

For traders just starting out, a spreadsheet can be surprisingly powerful. It forces you to manually log every trade signal, calculate the P&L, and watch your equity curve grow (or shrink) over time. It’s slow, sure, but that hands-on process builds an incredible intuitive feel for how your strategy behaves.

If you’re a bit more advanced, you’ll probably want to use dedicated backtesting software. These platforms can chew through years of data in minutes and spit out detailed analytics. If you’re looking for the right tool, our trading platform comparison is a great place to start.

Factoring in Trading Frictions

A backtest that produces a perfectly smooth, upward-sloping equity curve is a thing of beauty. Unfortunately, it’s also usually a fantasy. The real world is messy and comes with costs. To get a realistic picture of your strategy’s potential, you absolutely must account for trading frictions.

These are the little costs that relentlessly chip away at your profits:

- Commissions: What your broker charges you for every single trade.

- Slippage: The annoying difference between the price you thought you’d get and the price you actually got. This is a huge factor in fast-moving or thin markets.

- Fees: This bucket can include anything from exchange fees to data subscription costs.

Ignoring these is one of the single biggest mistakes a trader can make. I’ve seen strategies that looked like winners on paper completely fall apart once you subtract a few bucks from every trade.

Think of it this way: a “perfect” backtest is like calculating a road trip’s cost using only the price of gas. You’re completely ignoring tolls, wear and tear on your car, and that expensive emergency coffee stop. Adding frictions makes your forecast realistic.

The Power of Granular Data

The accuracy of your simulation lives and dies by the quality of your data. Back in the day, traders often had to make do with daily data, which meant missing all the crucial price swings that happened during the day.

Thankfully, we’ve come a long way.

Today, serious backtesting relies on historical tick data—a complete record of every single trade and quote, right down to the millisecond. Strategies tested with this level of detail often show a 10-30% lower deviation between the backtest and live results compared to tests using only end-of-day data.

Using more granular data helps ensure your backtest is a true reflection of the market’s chaos, not just a simplified, clean version of it. It’s the difference between guessing and knowing.

So, How Do You Actually Read the Backtest Results?

You’ve run the numbers and now you’re staring at a report full of stats. Getting the data is the easy part. The real skill is learning to read between the lines — to understand what those numbers are really telling you about your strategy.

This isn’t just about seeing if you made a profit. It’s about digging into the personality of your strategy. How does it behave under pressure? Is it a steady earner or a wild rollercoaster? Answering these questions is what separates traders who build lasting success from those who just get lucky once or twice.

Look Past the Total Profit

Naturally, your eyes jump straight to the net profit. It’s a big number, and it feels good to see it in the green. But a profitable backtest doesn’t automatically mean you have a winning strategy. It’s just one piece of the puzzle.

You have to ask how that profit was generated. Was it a smooth, consistent climb, or did one massive, lucky trade skew the entire result? This is where the other metrics come in to provide crucial context.

For example, a strategy might boast a 12% average annual return, which sounds great. But if it also had a 25% maximum drawdown, could you emotionally handle watching a quarter of your account disappear before it recovered? That’s the kind of question you need to answer. To get a better grasp on these statistical measures, resources like the guide on backtesting investment strategies from FinancialModelingPrep.com can offer a deeper dive.

Key Metrics and What They Mean for You

Let’s unpack some of the most important numbers you’ll see in your backtest report. Think of these as your strategy’s vital signs.

A good backtest report is packed with data, but a few key metrics tell most of the story. Here’s a quick breakdown of the most critical ones and why they matter to a real trader.

Key Backtesting Metrics and What They Mean

| Metric | What It Measures | Why It’s Important for a Trader |

|---|---|---|

| Maximum Drawdown | The largest percentage drop from a peak to a subsequent low in your account equity. | This is your gut-check number. It shows you the worst-case losing streak and asks, “Could you stick with the plan through this?” |

| Win Rate | The percentage of total trades that were profitable. | Helps you understand how frequently you can expect to win. A low win rate requires more psychological resilience. |

| Risk-Reward Ratio | The average profit on winning trades compared to the average loss on losing trades. | This determines profitability. A high R:R ratio means your winners are big enough to easily cover your losers. |

| Sharpe Ratio | The strategy’s return adjusted for its volatility (risk). | Measures if your returns are worth the risk. A higher ratio (ideally > 1.0) means you’re being well-rewarded for the bumpy ride. |

| Profit Factor | The gross profit divided by the gross loss. | A simple measure of profitability. A value over 2.0 is excellent, meaning you’re making twice as much as you’re losing. |

| Average Trade Net P/L | The average profit or loss across all trades taken. | Tells you how much you can expect to make (or lose) on a typical trade, helping you manage expectations. |

These metrics work together to paint a complete picture. A high win rate is meaningless without a solid risk-reward ratio, and a high total profit isn’t attractive if the drawdown is unbearable.

Here’s a closer look at a few of the most important ones:

- Maximum Drawdown: I’d argue this is the most critical metric for your psychology. It shows the biggest drop your account took from a peak. If the report says 30% drawdown, it means at some point, your account was down by nearly a third. Could you keep executing your strategy without panicking? Be honest with yourself.

- Win Rate vs. Risk-Reward Ratio: A high win rate feels incredible, but it can be a siren’s song. A strategy with a 70% win rate can still bleed your account dry if the average loss is five times the average win. On the flip side, a system that only wins 40% of the time can be a goldmine if its winners are massive compared to its small, controlled losers. It’s all about the balance, and you can learn more by understanding how to calculate your win rate.

- Sharpe Ratio: In simple terms, this tells you if the returns were worth the stress. It measures your profit per unit of risk. Generally, a Sharpe Ratio above 1.0 is considered good—it means you’re being compensated well for the volatility. A ratio below 0.5 suggests you’re taking on a lot of risk for mediocre returns.

A backtest doesn’t just give you a “yes” or “no” on a strategy. It provides a detailed character profile, revealing its temperament, resilience, and potential breaking points. Your job is to decide if that personality is a good match for your own.

Common Backtesting Mistakes and How to Avoid Them

That rush of excitement when a backtest shows a perfect, upward-sloping equity curve? We’ve all been there. It’s the moment you think you’ve finally cracked it. But this is exactly when the most disciplined traders take a step back and start playing devil’s advocate with their own work.

Even a meticulously built backtest can hide subtle psychological traps and statistical illusions. Learning to spot these pitfalls is just as crucial as learning to backtest in the first place. These errors can make a broken strategy look like a goldmine, setting you up for real losses when you go live.

The Siren Song of Overfitting

The most common — and most destructive — mistake is overfitting, sometimes called curve-fitting. This happens when you tweak a strategy’s parameters so much that it perfectly matches the historical data you tested it on. It looks like a masterpiece in the rearview mirror, but it’s almost guaranteed to fall apart in live market conditions.

Think of it like this: you have a key, and you’re trying to open a specific, old, slightly rusty lock (your historical data). You might file the key’s teeth just so, adding a tiny bend here and a unique groove there until it opens that one specific lock flawlessly.

But what happens when you try that hyper-customized key on any other lock (future market conditions)? It’s useless. By optimizing it for the past, you’ve crippled its ability to adapt.

Overfitting creates a strategy that has memorized history, not one that has learned a durable market principle. A robust strategy should be like a good master key, not a one-of-a-kind custom job.

The best way to combat this is to validate your strategy on data it has never seen before. Split your historical data into two buckets:

- In-Sample Data: Use this chunk (say, the years 2015-2020) to build and do your initial testing. This is your workshop.

- Out-of-Sample Data: Keep this part hidden away (e.g., 2021-2023). Once you think your strategy is ready, unleash it on this unseen data. If it still holds up, you can be much more confident it’s not just an overfitted fluke.

Sneaky Biases That Can Wreck Your Results

Beyond overfitting, other subtle biases can creep into your analysis and make a bad strategy look brilliant. These are often harder to spot but just as damaging.

Lookahead Bias is like getting the answers to a test before you take it. It happens when your simulation accidentally uses information that wouldn’t have been available at the time of the trade. A classic example is using a day’s closing price to trigger a trade at that same day’s market open.

- How to Fix It: Be absolutely ruthless here. Make sure your backtesting code or spreadsheet only ever uses data that was available before the trade signal was generated. Every calculation must be based on information that a real trader would have had at that exact moment in time.

Survivorship Bias, which we touched on earlier, pops up when your dataset only includes the “survivors” — the stocks or assets still trading today. It conveniently leaves out all the companies that went bankrupt, got acquired, or were delisted. This can make your returns look artificially high because you’re only testing on the winners.

- How to Fix It: Use high-quality, professional datasets that include delisted securities. This is non-negotiable for serious backtesting. It ensures your strategy is tested against the full, messy reality of the market — failures and all.

Frequently Asked Questions About Backtesting

Even with a solid plan, it’s completely normal for questions to pop up when you’re learning to backtest. The process can feel a little technical at first, and it’s easy to get hung up on the details. Let’s dig into some of the most common questions traders ask so you can move forward with confidence.

We hear it all the time — traders feel overwhelmed by the setup or aren’t sure how to interpret their results. Just remember, this is a skill you build over time. Every question is a step toward becoming a more disciplined, data-driven trader.

What Is the Best Software for Backtesting?

There’s no single “best” tool out there; it really comes down to your personal needs and how comfortable you are with technology. The right software is simply the one that lets you test your ideas accurately without feeling like a huge chore.

Here’s a quick breakdown of the main players:

- For Beginners: Platforms like TradingView are fantastic. They have incredibly user-friendly backtesting features built right into their charts, letting you test simple strategies without touching a line of code.

- For Coders: If you have some programming skills, Python is the undisputed king of flexibility. Libraries like backtrader or Zipline give you total control to build sophisticated, custom simulations from the ground up.

- For All-in-One Users: There’s a reason paid platforms like MetaTrader or NinjaTrader are so popular. They pack in advanced tools, automation capabilities, and benefit from massive user communities.

The best advice? Start with whatever matches your current skill set and budget. You can always level up to a more advanced tool later on.

How Much Historical Data Do I Need?

While more data is generally better, the relevance of that data is what truly matters. Your goal is to gather enough history to see how your strategy weathers different market environments — bull markets, bear markets, and those long, grinding periods of sideways chop.

A classic mistake is testing a strategy only on a recent bull run. This can give you a dangerously optimistic view of its performance. Any worthwhile strategy has to be robust enough to survive the inevitable downturns.

As a rough guideline:

- For a daily trading strategy, you should aim for at least 5-10 years of data.

- For an intraday strategy (like on a 5-minute chart), you’ll need 1-2 years of high-quality minute — or even tick — data to get a large enough sample size of trades.

The key is to throw a wide variety of market conditions at your system to see if it holds up.

Can a Profitable Backtest Guarantee Future Success?

This is the most critical question of all, and the answer is a firm no. A backtest is a simulation of the past, not a crystal ball. Markets are always evolving, and what worked yesterday is no guarantee it will work tomorrow.

Think of a positive backtest as a prerequisite — it simply proves your strategy had a statistical edge. It’s an essential filter for weeding out bad ideas before they cost you real money. It also builds confidence and helps you internalize your strategy’s risk profile, like understanding its maximum drawdown before you experience it live.

Ultimately, backtesting isn’t about finding a magic money-printing machine. It’s about building a deep, evidence-based understanding of a promising strategy before you ever risk a single dollar in the market.

The perfect way to complement your backtesting is with meticulous journaling of your forward-testing and live trades. TradeReview gives you the tools to track your performance analytics, view your trade calendar, and connect your broker for automatic syncing. Start building a data-driven approach to your trading by signing up for free.