Every trader has felt that sinking feeling when a position goes south. But Maximum Drawdown (MDD) isn’t just about one bad trade — it’s the toughest financial and psychological gut-check you’ll face. It measures the biggest percentage drop your entire account has ever taken from a peak to a subsequent low.

Think of it as the worst-case loss your trading strategy has historically endured. It shows you the maximum pain you would have had to sit through to get the returns you eventually made. Understanding it isn’t just about math; it’s about preparing yourself mentally for the realities of trading.

What Is Maximum Drawdown in Simple Terms

Imagine your trading journey is like climbing a mountain. Every new high your account balance hits is a new peak you’ve reached. A drawdown is any slip or slide backward from that peak. We all have them.

The maximum drawdown is simply the single longest, most painful slide you’ve experienced on that entire climb.

It’s not just any loss. It’s the specific measurement of the largest drop from a high point (peak) to the lowest point that follows (trough) before you start climbing again and make a new peak. This metric gives you a raw, unfiltered look at the risk baked into your strategy.

The Anatomy of a Drawdown

To really get what maximum drawdown is, let’s break it down into its core parts. Once you see the components, it stops being a scary number and becomes a genuinely useful tool.

- Peak: This is the absolute highest value your account has ever reached before a decline started.

- Trough: This is the lowest point your account hits after falling from that peak.

- Recovery: This is the grind back up from the trough to finally surpass your old peak.

The maximum drawdown is just the percentage loss between that specific peak and its following trough. For example, if your account grows to $10,000 (the peak) and then drops to $7,000 (the trough) before recovering, your maximum drawdown for that period is 30%. That single number tells a powerful story about your strategy’s resilience and the mental strength required to stick with it.

A trader’s true test isn’t celebrating the wins; it’s surviving the drawdowns. Knowing your MDD prepares you for the inevitable storm, giving you the mental fortitude to stick with your plan when emotions are running high.

For a quick reference, this table breaks down the core concepts of MDD.

Understanding Maximum Drawdown at a Glance

| Component | What It Represents | Practical Example |

|---|---|---|

| Peak | The highest point your account value has reached. | Your portfolio hits a high of $50,000. |

| Trough | The lowest point your account value falls to after the peak. | A string of losses brings the portfolio down to $40,000. |

| Drawdown | The percentage loss from the peak to the trough. | The drawdown is 20% (($50k – $40k) / $50k). |

| Recovery | The moment your account value surpasses its previous peak. | Your account climbs back up and reaches $50,001. |

This simple breakdown turns a complex metric into something you can quickly understand and apply to your own trading.

Why This Metric Matters So Much

Look, many traders get tunnel vision on potential profits. But the pros? They know that managing risk is the only way to survive long-term. Your MDD is your strategy’s historical “worst-case scenario.”

It answers the one question every disciplined trader needs to ask: “How much could I lose before my strategy starts working again?”

Knowing this helps you in a few key ways:

- Set realistic expectations for how your strategy will perform.

- Avoid panicking and dumping your strategy at the worst possible moment.

- Figure out the right position size to make sure you can actually withstand that kind of drop.

Ultimately, MDD isn’t about predicting the future. It’s about respecting the past so you can build a more disciplined, resilient approach for what’s ahead. It helps you stay in the game long enough to see your strategy pay off.

For more on this, the folks at Wallstreetprep.com have some great insights on this critical risk metric.

Why MDD Is a Trader’s Most Honest Mirror

While metrics like your win rate or average return tell you how a strategy performs when everything is clicking, maximum drawdown shows you how it behaves under fire. It’s the raw, unfiltered truth about your system’s resilience—and more importantly, your own. It strips away the comfort of averages and forces you to stare your worst-case scenario right in the face.

Think of it like this: your win rate is like knowing you can run a marathon. Your maximum drawdown is knowing you can finish the race after falling hard at mile 18, in the pouring rain, with no one around to cheer you on. Which one tells you more about your character as a runner? The same is true for trading.

The Emotional Cost of a Deep Drawdown

Every trader starts with a plan, but a plan that looks perfect on paper can feel impossible to stick to when your account is bleeding. A significant drawdown isn’t just a financial event; it’s a brutal psychological test. This is where the real battle is fought—and where most traders fail.

As your account value drops, fear and panic start to set in. You begin questioning every single decision, doubting your entire strategy, and feeling that overwhelming urge to “just make it stop.” We’ve all been there. This emotional pressure almost always leads to disastrous moves.

- Abandoning a Good Strategy: So many traders throw in the towel on a perfectly sound strategy right at its point of maximum pain—often just before it’s about to recover.

- Revenge Trading: In a desperate scramble to win back losses, you might take oversized or unplanned trades, digging yourself into an even deeper hole.

- Hesitation and Missed Opportunities: After taking a big hit, fear can make you freeze up, causing you to miss perfectly good setups that fit your strategy and sabotaging your recovery.

Understanding your historical MDD helps you mentally prepare for this emotional rollercoaster. It’s not about avoiding losses altogether. It’s about knowing how deep the valley might get so you can build the discipline to stick to your plan when it matters most.

“A trading strategy’s performance is only as good as your ability to execute it without deviation. Maximum drawdown measures the exact point where your psychological resolve will be tested the most.”

MDD Builds Mental Fortitude

Knowing your strategy’s historical MDD turns a terrifying unknown into a calculated risk. For instance, if you know your system has a historical MDD of 20%, seeing a 10% drop feels less like a catastrophe and more like a normal, expected part of the process. You’ve seen this before. You’re prepared for it.

This preparation is what separates disciplined traders from emotional ones. It allows you to operate from a place of logic instead of fear. When a drawdown hits, you can look at your data and remind yourself that this is well within the expected range of performance.

This mental rehearsal helps you build the fortitude needed to:

- Trust Your System: Having confidence in your strategy’s long-term edge is what gets you through the short-term pain.

- Execute Flawlessly: Continue to place trades according to your plan, even when it feels uncomfortable.

- Maintain Proper Risk Management: Avoid the temptation to up your risk to get your money back faster.

It’s a Tool for Realistic Expectations

Ultimately, what is maximum drawdown? It’s a reality check. A strategy with a high average return but a 50% MDD is a completely different animal than one with a moderate return and a 15% MDD. The first one might look incredible on paper, but can you honestly stomach watching half your capital disappear without panicking?

For most people, the answer is a hard no. By choosing a strategy with an MDD that aligns with your personal risk tolerance, you are setting yourself up for long-term success. You’re choosing a path you can actually stick with, which is the most critical factor in trading.

How to Calculate Your Maximum Drawdown

Calculating your maximum drawdown probably sounds more intimidating than it is. The good news? You don’t need a math degree or a complex spreadsheet. It really just comes down to looking at your account history and finding two numbers.

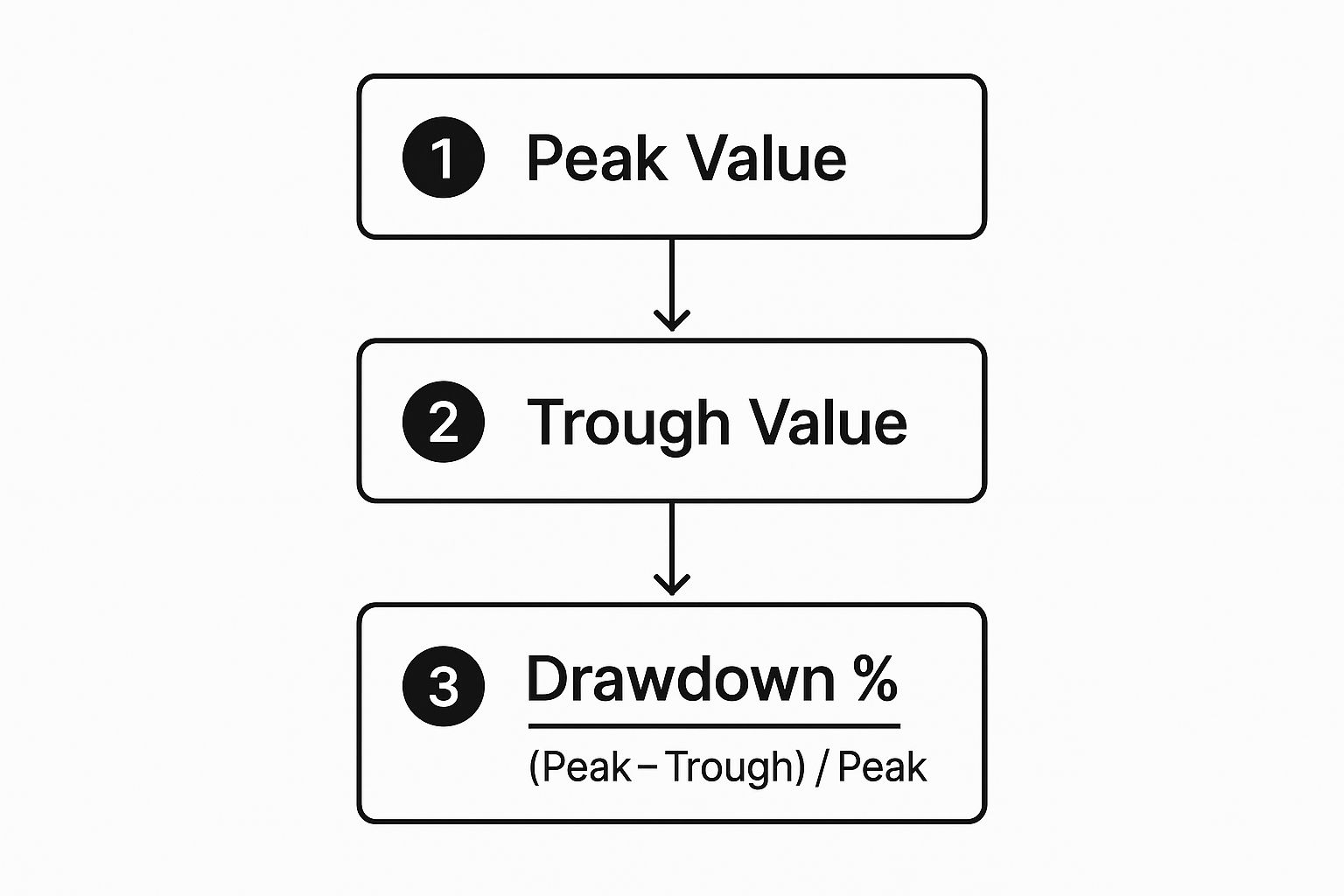

All we’re looking for is the highest point your account ever reached (the peak) and the lowest point it fell to right after that (the trough). Once you have those, the rest is simple.

The formula is just the difference between that peak and trough, divided by the peak. This spits out a percentage that tells you, in no uncertain terms, the biggest hit your strategy has ever taken.

As you can see, it’s a straightforward process: find the high, find the subsequent low, and do the math.

A Simple Example Month by Month

Let’s walk through a quick, practical example. Imagine you start an account with $10,000 and trade it for six months.

Here’s how the account value might look:

- Month 1: Grows to $12,000 (Our first peak).

- Month 2: Dips to $11,000.

- Month 3: Drops to $9,000 (Our first trough).

- Month 4: Bounces back to $11,500.

- Month 5: Rallies to a new high of $14,000 (The new peak).

- Month 6: Ends the period at $13,000.

First, let’s look at that initial drop. The account went from a peak of $12,000 down to a trough of $9,000. That’s a 25% drawdown (($12,000 – $9,000) / $12,000).

Later, it fell from the new $14,000 peak to $13,000, which is just a 7.1% dip. The biggest drop was that first one. So, for this entire period, your maximum drawdown is 25%.

That single number tells you a crucial story: at its worst, your strategy gave back a quarter of its peak value. Knowing that is incredibly powerful for managing your expectations going forward.

A Full Year Trading Simulation

Now for a more realistic scenario. Let’s look at a year-long performance with more of the usual ups and downs you’d expect in the market.

Imagine an account starting with $25,000. Here’s a quarterly breakdown:

- End of Q1: The account hits a new peak of $30,000.

- Mid-Q2: A losing streak brings the balance down to a low of $24,000.

- End of Q2: The account starts to recover, climbing back to $28,000.

- End of Q3: A strong rally pushes the account to a new all-time high of $35,000.

- End of Q4: The year closes with the account at $32,000.

The key moment here happened in the second quarter. The account peaked at $30,000 before falling all the way to $24,000.

Calculation:

Drawdown = (($30,000 Peak – $24,000 Trough) / $30,000 Peak) = 20%

Even though the account hit a higher peak of $35,000 later, the subsequent drop to $32,000 was only 8.6%. The bigger hit was that 20% decline earlier in the year, so that remains the maximum drawdown.

The account finished the year with a solid gain, but the MDD shows you the real psychological test that happened mid-year. This is precisely why calculating your historical MDD is so important. In fact, getting a handle on these numbers is a critical step before you even begin to backtest trading strategies to see how they might hold up under different conditions.

By turning this abstract risk metric into a hard number, you gain a powerful tool. It helps you set stop-losses, figure out your position sizing, and, most importantly, build the mental fortitude to stick with your strategy when it inevitably hits a rough patch.

Theory is one thing, but nothing teaches you about risk like the real world. To truly appreciate what a maximum drawdown feels like when the stakes are high, we only need to look at Wall Street’s history books. These major market meltdowns tested the nerves of even the most experienced investors and showed everyone that drawdowns are a natural — if painful — part of the game.

Studying these downturns isn’t about scaring yourself out of the market. It’s about building respect for risk and understanding why a solid plan is non-negotiable. Seeing a 20% drawdown in a backtest is interesting. Living through a 50% market-wide collapse is a whole different beast.

The Dot-Com Bubble: A Lesson in Hype

The late 1990s were a wild time. The dot-com bubble saw investors throwing money at any company with a “.com” in its name, many of which had no real business plan, let alone profits. When that bubble finally popped in early 2000, the result was a bloodbath.

The tech-heavy NASDAQ Composite index, the star of the show, peaked in March 2000 and then went into a freefall. It suffered a mind-boggling maximum drawdown of nearly 78%, finally hitting rock bottom in October 2002. Can you imagine watching your account lose more than three-quarters of its value? Countless traders who were over-leveraged or just winging it were completely wiped out.

This crash drove home two critical truths about drawdowns:

- Magnitude Matters: The sheer size of the drop showed just how catastrophic a drawdown can be without a risk management plan.

- Duration is a Test of Will: It wasn’t just a quick dip. It took the NASDAQ more than 15 years just to get back to its dot-com peak. That kind of marathon recovery tests your patience like nothing else.

The 2008 Financial Crisis: A Global Gut-Check

Fast forward to 2008, and we got another brutal lesson in systemic risk and the pain of a deep drawdown. The global financial crisis, sparked by the collapse of the subprime mortgage market, sent shockwaves through the entire financial world.

This period became a defining moment for a new generation of traders. The S&P 500 saw a peak-to-trough decline — its maximum drawdown—of about 56.8%. It fell from its high in October 2007 to a gut-wrenching low in March 2009. Outside of the Great Depression, it was one of the worst declines the index had ever seen, reminding everyone just how severe market risk can be. You can discover more insights about this historical drawdown on Trustnet.com.

The real reason to study historical drawdowns isn’t to predict the next crash. It’s to build the mindset you need to survive it. Discipline is forged in turmoil, not tranquility.

The Long-Term Perspective

These moments in history aren’t just scary stories; they’re powerful reminders that massive drawdowns aren’t once-in-a-lifetime events. They are a recurring feature of the market cycle. This is why it’s so important to know your own strategy’s historical MDD and make sure you can actually handle it, both financially and emotionally.

When you study these periods, you learn to respect risk and make protecting your capital a top priority. That historical perspective builds the discipline you need to stick to your plan when everyone else is panicking, which is often the one thing that separates long-term success from failure. Surviving the drawdown is simply the price you pay for being in the market.

Using MDD to Choose a Smarter Strategy

This is where understanding Maximum Drawdown moves from a simple history lesson to a powerful decision-making tool. When you’re comparing trading strategies, looking at the average return only gives you half the story. The MDD is what truly reveals a strategy’s character — it shows you the kind of emotional and financial stress it will put you through.

Think of it this way: you could have two systems that, on paper, deliver similar yearly gains. But if one does it with a gentle 10% MDD while the other takes you on a gut-wrenching 40% rollercoaster ride, they are fundamentally different experiences. Choosing the right one is all about matching the risk profile with your personal pain threshold.

Comparing Two Different Strategies

Let’s walk through a common scenario. Imagine you’re evaluating two strategies, Strategy A and Strategy B, over a five-year period. At first glance, their final performance numbers look pretty close, making it tough to pick a winner.

This is exactly where MDD becomes the ultimate tie-breaker. It cuts through the noise of average returns and exposes the real cost of achieving those gains.

Let’s look at how they stack up.

Strategy A vs. Strategy B: A Maximum Drawdown Comparison

While Strategy B managed to squeeze out a slightly higher average return, it came at the cost of a massive 35% drawdown.

| Metric | Strategy A | Strategy B |

|---|---|---|

| Average Annual Return | 15% | 16% |

| Maximum Drawdown (MDD) | -12% | -35% |

| Psychological Impact | Manageable stress | High anxiety, risk of panic |

| Stick-with-it Factor | High | Low |

Now, be honest with yourself. Could you watch over a third of your account evaporate without panicking and abandoning the plan? For most traders, the answer is a hard no. Strategy A, with its much smaller 12% MDD, represents a far more sustainable and psychologically sound approach.

Beyond MDD: Introducing Risk-Adjusted Returns

Maximum drawdown isn’t just a historical footnote; it’s a practical tool for sizing up investment strategies. It’s well-known that two systems can have similar average returns but vastly different drawdown profiles, which directly impacts whether a trader will actually stick with one through thick and thin.

A quantitative firm, for example, might compare two automated systems. Both average a 1% monthly return, but one sustains a maximum drawdown of just 5%, while the other endures a 20% drawdown during a rough patch. The choice becomes obvious.

This idea is the very foundation of risk-adjusted returns. We don’t just want high returns; we want smooth, consistent returns that don’t force us to endure terrifying drops. This is where metrics like the Calmar Ratio come into play.

The Calmar Ratio is calculated by taking the strategy’s average annual return and dividing it by its maximum drawdown. A higher ratio tells you you’re getting better performance for the amount of risk taken.

Let’s apply this to our example:

- Strategy A Calmar Ratio: 15% / 12% = 1.25

- Strategy B Calmar Ratio: 16% / 35% = 0.46

The numbers don’t lie. Strategy A delivered far better returns for each unit of risk it exposed you to.

Making the Right Choice for You

At the end of the day, the best strategy isn’t the one with the highest theoretical return. It’s the one you can actually execute with discipline, day in and day out, through both the wins and the losses. A deep drawdown can shatter your confidence, leading to emotional decisions that can wreck your account.

By using MDD as a primary filter, you’re putting capital preservation and your own psychological stability first. This builds a foundation for long-term thinking and helps you avoid the boom-and-bust cycle that plagues so many traders.

Before you commit real capital to any system, ask yourself one simple question: “Can I survive its worst historical drawdown?” If the answer is no, it’s not the right strategy for you, no matter how good the backtest looks. Making this evaluation is a core part of developing a good trading strategy that you can truly rely on.

Practical Ways to Manage Your Drawdowns

Knowing your maximum drawdown is the first step. But that knowledge is useless unless you do something with it. While you can’t eliminate drawdowns entirely—they’re just part of the game—you can absolutely control their size. This is where good risk management stops being a defensive move and becomes your best offense for protecting capital.

It all comes down to building a disciplined process that keeps you in the game. You don’t need a secret formula. You just need solid habits that protect your account from a catastrophic loss, ensuring you’re around long enough for your edge to actually play out.

Master Your Position Sizing

The single most powerful tool you have for taming drawdowns is intelligent position sizing. Too many traders obsess over the perfect entry and exit points, but how much you risk on each trade has a much bigger impact on your account’s wild swings and potential MDD.

Instead of just guessing, base your position size on a fixed percentage of your account. A classic rule of thumb is to risk no more than 1-2% of your capital on any single trade.

- On a $10,000 account: A 1% risk rule means you can lose a maximum of $100 on that trade. Simple.

- The benefit: This simple rule automatically adjusts your risk. As your account grows, your position size can get bigger. But if you hit a losing streak and your account shrinks, your position size gets smaller, protecting what you have left.

This mechanical approach takes the emotion out of it and stops one or two bad trades from cratering your account.

Your trading strategy determines your potential profits, but your risk management determines whether you’ll survive long enough to realize them.

Use Stop-Losses Without Exception

A stop-loss order is non-negotiable for any serious trader. Think of it as your safety net—an automated order to get you out of a trade at a specific price, capping your loss. Without one, you’re just hoping a losing trade will magically turn around. And hope is a terrible strategy.

Setting a stop-loss forces you to define your maximum pain point before you even click “buy.” You make this decision when you’re calm and rational, not in the heat of the moment when fear and greed are screaming in your ear. The discipline to stick to your stop-loss plan is what separates amateurs from pros.

Diversify and Stress-Test Your Plan

The old saying is true: don’t put all your eggs in one basket. Relying on a single strategy or asset class can leave you dangerously exposed if the market suddenly shifts against you. Diversification helps smooth out your equity curve by spreading risk across different strategies or markets that don’t always move together.

You also need to regularly stress-test your trading plan. Get tough and ask yourself the hard questions:

- How would my strategy have held up during the 2008 financial crisis?

- What happens if my average losing streak doubles?

- Is the maximum drawdown I’m willing to tolerate still realistic?

This process gets you ready for the worst-case scenarios and helps you build a more robust plan. For a deeper dive, you can explore more advanced risk management techniques for traders that will help you protect your capital even further. At the end of the day, managing drawdowns is an active, ongoing process built on discipline and preparation.

Common Questions About Maximum Drawdown

Let’s wrap up by tackling some of the most frequent questions traders have about maximum drawdown. Getting these answers straight will help lock in the concepts and clear up any final confusion.

What’s the Difference Between a Drawdown and the Maximum Drawdown?

Think of it this way: a drawdown is any time your account equity dips from a recent high. You’ll have countless drawdowns in your trading career — it’s just the natural ebb and flow of the market. Some are small, some are a bit more painful, but they’re all part of the game.

The maximum drawdown (MDD) is the heavyweight champion of all those dips. It’s the single biggest peak-to-trough drop your account has ever taken within a specific timeframe. It shows you the absolute worst-case scenario your strategy has endured.

Is a High Maximum Drawdown a Bad Thing?

Not always, but it’s a massive red flag that demands respect. A strategy with a high MDD can sometimes signal the potential for equally high returns. These are aggressive, high-risk systems that can pay off big—but only if you have the stomach and the capital to sit through a gut-wrenching drop without bailing.

A strategy’s maximum drawdown has to match your personal pain threshold. The most profitable system in the world is useless if you can’t sleep at night or you panic-sell at the bottom.

For most traders, especially when you’re still finding your footing, a lower MDD is a much smoother ride. It keeps your equity curve from looking like a rollercoaster and makes it far easier to trust your system when you hit a losing streak.

How Often Should I Check My Maximum Drawdown?

You should definitely keep an eye on your MDD as part of a regular performance check-up. Doing it monthly or quarterly is a great rhythm to get into. This helps you see if the risk profile of your strategy is starting to creep up over time.

A sudden jump in your MDD is a warning shot. It could mean market conditions are changing, or maybe your strategy just isn’t meshing with the current environment. Staying on top of it helps you fix problems before they get out of hand.

Ready to stop guessing and start knowing exactly how your strategy performs? TradeReview gives you a powerful dashboard to track your equity curve, win rate, and drawdown history automatically. Log your trades, find your patterns, and finally take real control of your risk.

Start journaling for free and begin making data-driven decisions today.