Weekly options offer exciting opportunities with quick returns and fast premium collection. However, they also come with risks, where small mistakes can lead to large losses quickly. Many are tempted by the prospect of easy money but find the rapid time decay and volatile prices challenging. Success in this area isn’t about finding a single perfect strategy. Instead, it’s about having a range of strategies for different market conditions and sticking to them with discipline.

This guide goes beyond simple promises and presents practical strategies for trading weekly options. It covers seven strategies, including the Iron Condor and Covered Call for generating income, and the Bull Put Spread for directional trades. Each strategy includes clear entry and exit points, risk management tips, and real-world examples. The aim isn’t to pursue unlikely big wins but to equip you with the knowledge to make informed decisions, manage risk, and gain an advantage in the weekly options market.

1. Iron Condor

The Iron Condor is a cornerstone strategy for traders looking to profit from low volatility and time decay. It is a defined-risk, four-leg options strategy that involves simultaneously selling a bull put spread and a bear call spread on the same underlying asset with the same expiration date. This creates a “profit zone” between the two short strikes, allowing traders to generate income as long as the underlying stock price remains within that range at expiration.

This strategy is a popular choice among weekly option trading strategies because it thrives on the rapid time decay (theta decay) inherent in short-term options. The goal isn’t to predict a big price move; rather, it’s to predict a lack of a significant move. It’s a game of probabilities, not prognostication.

How an Iron Condor Works

An Iron Condor is constructed by:

- Selling an out-of-the-money (OTM) put option and buying a further OTM put. This is the bull put spread.

- Selling an OTM call option and buying a further OTM call. This is the bear call spread.

You receive a net credit for opening the position, which represents your maximum potential profit. The maximum loss is limited to the difference between the strikes in one of the spreads, minus the credit received. The strategy profits as the options decay over time, ideally expiring worthless.

Practical Example: Let’s say the SPY ETF is trading at $545 and appears to be consolidating. A trader might put on a weekly Iron Condor by:

- Selling the $535 put / Buying the $530 put (the Bull Put Spread)

- Selling the $555 call / Buying the $560 call (the Bear Call Spread)

- Let’s assume this brings in a net credit of $1.50 per share ($150 per contract).

If SPY closes anywhere between $535 and $555 at expiration, the trader keeps the entire $150 premium. The maximum loss is capped at the width of the spread ($5) minus the credit ($1.50), which equals $3.50, or $350 per contract.

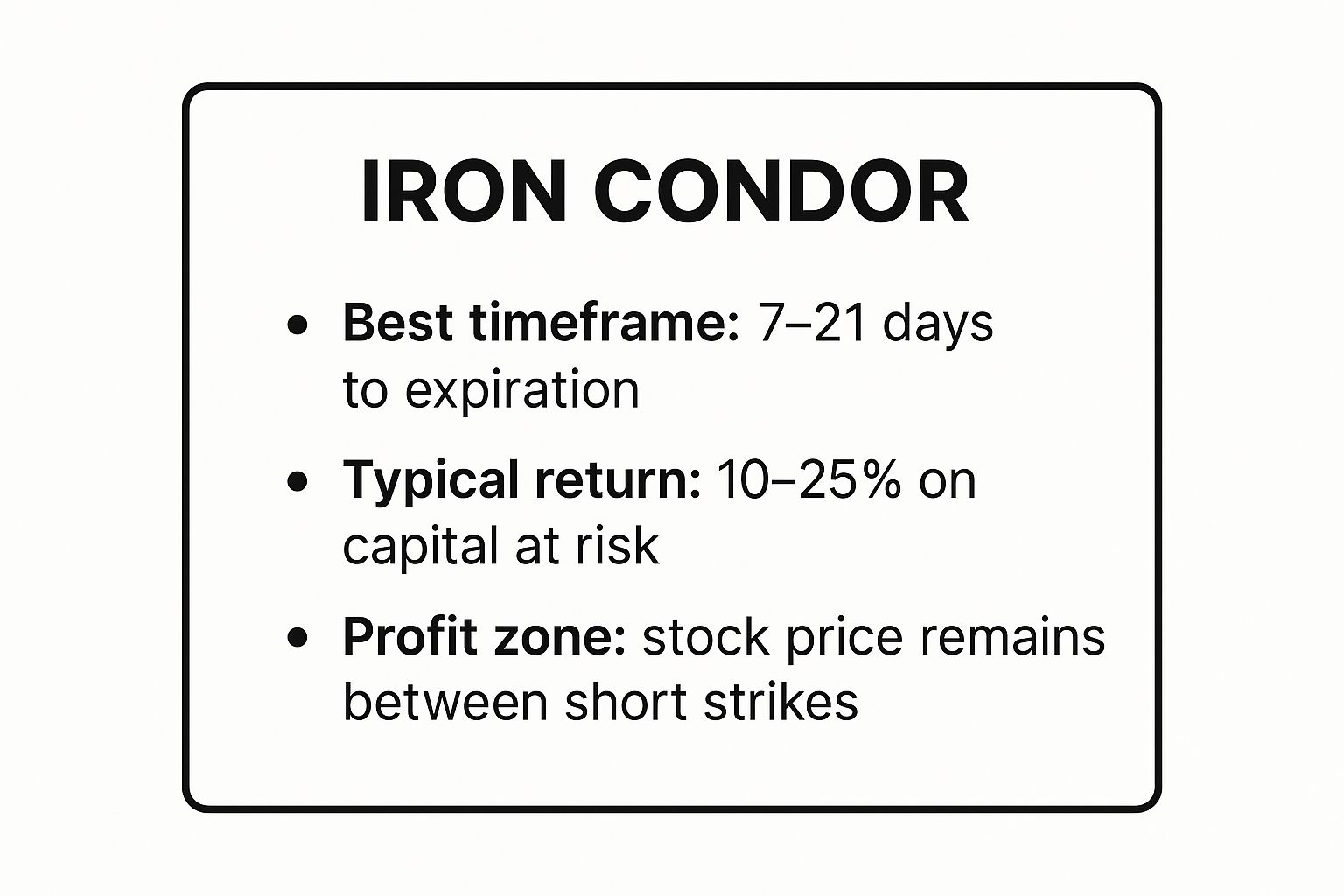

Key Strategy Metrics and Implementation

Understanding the ideal parameters is crucial for consistent implementation. This quick reference summary box highlights the core metrics for a typical weekly Iron Condor setup.

As the data shows, the strategy is optimized for short timeframes to maximize theta decay while targeting a realistic return on the capital at risk, all while the stock cooperates by staying within a predictable range.

Actionable Tips for Trading Iron Condors

To enhance your chances of long-term success, discipline is key. Many traders fail by chasing high premiums on volatile stocks without a clear plan, turning a high-probability strategy into a gamble.

- Entry Signal: Look for liquid underlying assets like SPY or QQQ in a consolidation phase. Target an implied volatility (IV) rank above 30 to ensure you are receiving adequate premium for the risk. The higher IV is your compensation for taking on the “stay-in-the-range” bet.

- Exit Strategy: Don’t be greedy and wait for expiration. A common best practice is to close the position when you’ve captured 25-50% of the maximum profit. This reduces your risk exposure and frees up capital for the next well-planned trade.

- Risk Management: Your max loss is defined. Respect it. If the underlying price challenges one of your short strikes, have a pre-defined plan. This could mean adjusting the untested side or, more simply, closing the entire position to prevent a maximum loss.

For a deeper visual dive into setting up and managing an Iron Condor, the video below from projectfinance provides a clear, step-by-step walkthrough.

2. Cash-Secured Put

The Cash-Secured Put is a foundational bullish strategy ideal for investors looking to generate consistent income while potentially acquiring stock at a discount. It involves selling a put option while simultaneously setting aside enough cash to buy the underlying stock at the strike price if the option is exercised. This approach essentially pays you to wait to buy a stock you genuinely want to own.

This strategy is highly effective as one of the go-to weekly option trading strategies because it allows traders to collect premium from the rapid time decay of short-term options. Instead of speculating on a huge upward move, you are simply stating a price at which you are a willing buyer, and getting paid for that commitment.

How a Cash-Secured Put Works

A Cash-Secured Put is constructed by:

- Selling an out-of-the-money (OTM) put option on a stock you are willing to own long-term.

- Holding enough cash in reserve to purchase 100 shares of the stock at the option’s strike price.

You receive a net credit (the premium) for selling the put, which is your maximum profit on the trade. If the stock price stays above the strike price at expiration, the option expires worthless and you keep the full premium. If the stock price falls below the strike, you may be assigned the shares at the strike price, effectively buying the stock at a discount to where it was trading when you initiated the position.

Practical Example: You’ve been watching Microsoft (MSFT) and would love to own it, but you feel its current price of $455 is a bit high. You see strong technical support at $440. You could sell a weekly put with a $440 strike price and collect, for instance, a $2.00 premium ($200 per contract). To secure this, you must have $44,000 in your account.

- Outcome 1: MSFT stays above $440. The option expires worthless, and you keep the $200. You’ve made a small return without owning the stock.

- Outcome 2: MSFT drops to $438. You are assigned 100 shares at $440. Your actual cost basis is $438 per share ($440 strike – $2.00 premium), which is lower than the price you originally wanted.

Actionable Tips for Trading Cash-Secured Puts

Discipline is the key to successfully using this strategy for income and stock acquisition. The goal is to be a willing buyer, not just a premium collector. To learn more about how the Cash-Secured Put fits into a broader toolkit, you can explore various options trading strategies.

- Entry Signal: Only use this on high-quality, fundamentally sound stocks you would be happy to own. Look for established support levels to sell your put against, increasing the probability the stock will stay above your strike.

- Exit Strategy: Decide your goal beforehand. If seeking income, let the option expire worthless or close it for a profit (e.g., 50% of the premium) to redeploy capital. If the stock drops and you are assigned, you transition from an options trader to a shareholder.

- Risk Management: Your primary risk is owning the stock at a price that continues to fall. Never sell a put on a company you wouldn’t want in your portfolio. If the trade goes against you but you no longer want the stock, you can often “roll” the option down and out to a lower strike price and a later expiration, collecting another credit and buying more time.

3. Covered Call

The Covered Call is a foundational income-generating strategy favored by investors and traders alike. It involves selling (writing) a call option against a stock position of at least 100 shares that you already own. This creates an obligation to sell your shares at the strike price if the option is exercised, in exchange for receiving a premium upfront.

This strategy is one of the most popular weekly option trading strategies because it allows you to generate a consistent cash flow from your existing stock holdings. Instead of just waiting for capital appreciation, you can actively reduce your cost basis or create an additional income stream, especially effective on stocks that are moving sideways or in a slow uptrend.

How a Covered Call Works

The mechanics of a Covered Call are straightforward:

- Own at least 100 shares of a stock or ETF.

- Sell one call option contract for every 100 shares you own. The call should be out-of-the-money (OTM).

You immediately receive a credit (the premium) for selling the call. This premium is yours to keep, regardless of the outcome. Your potential profit is capped at the strike price plus the premium received, but the strategy provides a small buffer against a minor decline in the stock’s price.

Practical Example: You own 100 shares of Apple (AAPL) currently trading at $210. You believe it might trade sideways or slightly up over the next week. You could sell a weekly call option with a $215 strike price and receive a premium of $1.50 per share ($150 total).

- Outcome 1: If AAPL stays below $215 by expiration, the option expires worthless. You keep the $150 premium and your shares.

- Outcome 2: If AAPL rallies to $218, your shares will be “called away,” meaning you sell them for $215 each. Your total gain is the $5 appreciation per share plus the $1.50 premium.

Key Strategy Metrics and Implementation

Success with covered calls hinges on selecting the right strike and managing the position actively. This summary box highlights the core metrics for a typical weekly Covered Call setup.

| Metric | Ideal Range/Target | Purpose |

|---|---|---|

| Days to Expiration (DTE) | 7-21 days | Maximizes weekly income through rapid theta decay. |

| Delta | 0.20 to 0.30 (20-30 Delta) | Balances premium income with the probability of the stock staying OTM. |

| Implied Volatility (IV) Rank | Above 20 | Ensures you are being paid a fair premium for selling the option. |

| Trade Management | Close at 80% profit or roll | Locks in profits efficiently and avoids assignment risk near expiration. |

As the data shows, the strategy is optimized for short-term expirations to systematically generate income while allowing for capital appreciation up to the short strike.

Actionable Tips for Trading Covered Calls

Discipline is crucial to avoid having your shares called away unexpectedly or missing out on a significant rally. Avoid selling calls on stocks you believe are poised for a breakout.

- Entry Signal: Identify a stock you own that is in a consolidation phase or a slow uptrend. Check that IV Rank is above 20 to ensure the premium is worthwhile.

- Exit Strategy: A disciplined approach is to close the position when you’ve achieved 80% of the maximum profit. Alternatively, if the stock price rises and challenges your strike, you can “roll” the option up to a higher strike price and out to a later expiration date to collect more premium and avoid assignment.

- Risk Management: Your primary risk is the stock price falling significantly, as the premium received only offers a small downside cushion. The main opportunity cost is the stock rallying far beyond your strike price, capping your upside. Only use this strategy on stocks you are comfortable holding long-term.

4. Short Straddle

The Short Straddle is an advanced, undefined-risk strategy designed for traders who believe an underlying asset will experience minimal price movement. It involves simultaneously selling a call option and a put option with the same strike price and expiration date, positioning the trader to profit from time decay and a decrease in implied volatility.

This is one of the most direct ways to capitalize on a stagnant market and is a staple among weekly option trading strategies, particularly around events like earnings announcements where volatility is high but expected to collapse. The goal is simple: predict a lack of movement and let the options’ value erode as the expiration date approaches.

How a Short Straddle Works

A Short Straddle is constructed by:

- Selling an at-the-money (ATM) call option.

- Selling an at-the-money (ATM) put option.

You receive a significant net credit for opening the position, which represents your maximum potential profit. This profit is realized if the underlying asset’s price closes exactly at the strike price at expiration. However, the risk is theoretically unlimited if the stock makes a large move in either direction. The break-even points are the strike price plus or minus the total premium received.

Practical Example: A stock is trading at $100 right before an earnings report, and volatility is extremely high. You believe the report won’t cause a major move. You sell the $100 strike call and the $100 strike put expiring in one week for a total credit of $5.00 ($500 per contract).

- Your profit zone: The position is profitable if the stock stays between $95 (100-5) and $105 (100+5) at expiration.

- The risk: If the stock gaps up to $115, your loss would be substantial. This is why this strategy is for advanced traders with strict risk controls.

Actionable Tips for Trading Short Straddles

Due to its unlimited risk profile, discipline and a strict management plan are non-negotiable. This is not a “set and forget” strategy and can lead to devastating losses if mismanaged.

- Entry Signal: Only implement this strategy in high implied volatility (IV) environments, ideally with an IV Rank above 30-50. This ensures you are paid a sufficient premium to compensate for the significant risk.

- Exit Strategy: A widely accepted best practice is to close the position early once you have captured 25-50% of the maximum profit. Waiting for the full premium invites unnecessary gamma risk (the rate of change of an option’s delta), which can cause your position’s value to swing wildly as expiration nears.

- Risk Management: Have a clear plan for managing the trade if the underlying price moves against you. If the stock price breaches one of the break-even points, you must be prepared to close the position to prevent catastrophic losses. Consider using this on liquid ETFs like SPY or QQQ, which tend to be less volatile than individual stocks.

5. Bull Put Spread (Credit Put Spread)

The Bull Put Spread is a high-probability, defined-risk strategy ideal for traders with a moderately bullish or neutral outlook on an underlying asset. It involves selling a put option and simultaneously buying a further out-of-the-money (OTM) put with the same expiration date. This creates a credit spread that generates immediate income and profits as long as the underlying stock price stays above the short put strike at expiration.

This strategy is a favorite in the world of weekly option trading strategies because it leverages rapid time decay. Instead of needing a large upward price move to be profitable, a trader simply needs the stock to not fall significantly, allowing the short-term options to lose value quickly and expire worthless.

How a Bull Put Spread Works

A Bull Put Spread is constructed by:

- Selling an out-of-the-money (OTM) put option. This is the higher-strike put and generates the premium.

- Buying a further OTM put option. This is the lower-strike put and serves as protection, defining the maximum risk.

You receive a net credit for opening the position, which represents your maximum potential profit. The maximum loss is limited to the difference between the two strike prices minus the initial credit received. The strategy wins if the underlying asset’s price closes above your short put strike at expiration.

Practical Example: QQQ is trading at $480 and you expect it to hold above a key support level at $475. For the upcoming weekly expiration, you could:

- Sell the $475 put.

- Buy the $470 put.

- Let’s say this nets you a credit of $1.00 ($100 per contract).

As long as QQQ remains above $475, you keep the entire $100 premium. Your max loss is defined as the spread width ($5) minus your credit ($1), which is $4, or $400.

Actionable Tips for Trading Bull Put Spreads

Discipline and proper position sizing are paramount for long-term success with this strategy. Many traders get into trouble by being overly aggressive with strike selection just to collect a higher premium, which significantly increases their risk.

- Entry Signal: Identify an underlying asset in an uptrend or consolidating above a clear technical support level. Use that support level as a guide for placing your short put strike.

- Exit Strategy: A key to consistency is not holding until expiration. Aim to close the position for a profit when you have captured 50% of the maximum premium received. This significantly improves your win rate and reduces risk exposure.

- Risk Management: Your maximum loss is defined on entry, a crucial component of any sound trading plan. Robust risk management techniques are non-negotiable for preserving capital. If the underlying price breaches your short strike, it’s often best to close the position to prevent a maximum loss.

6. Bear Call Spread (Credit Call Spread)

The Bear Call Spread, also known as a credit call spread, is a straightforward, defined-risk strategy designed for traders who are neutral to moderately bearish on a stock’s short-term price movement. This strategy involves simultaneously selling a call option and buying another call option with a higher strike price but the same expiration date. The primary goal is to generate income from the premium collected while the underlying stock price stays below the short call strike.

This approach is one of the most popular weekly option trading strategies because it profits from three factors: the stock price falling, moving sideways, or even rising slightly, as long as it stays below the short strike. The rapid time decay associated with weekly options works in the trader’s favor, eroding the value of the spread each day.

How a Bear Call Spread Works

Constructing a Bear Call Spread is a two-step process:

- Selling an out-of-the-money (OTM) call option. This is the “short” leg and generates a credit.

- Buying a further OTM call option. This is the “long” leg, which defines the risk and reduces margin requirements.

The net credit received when opening the position is the maximum potential profit. The maximum loss is limited to the difference between the two strike prices minus the initial credit received. The strategy is profitable if the underlying asset’s price is at or below the short call strike price at expiration.

Practical Example: You are bearish on NVDA, which is trading at $120 and approaching a strong resistance level at $125. You could enter a weekly Bear Call Spread by:

- Selling the $125 call.

- Buying the $130 call.

- Assume this nets you a credit of $0.80 ($80 per contract).

If NVDA closes below $125 at expiration, both options expire worthless, and you keep the full $80 premium. Your maximum loss is defined and limited to $420 per contract ($5 spread width – $0.80 credit).

Actionable Tips for Trading Bear Call Spreads

Success with this strategy requires careful selection of the underlying asset and a disciplined approach to managing the trade. Avoid implementing this strategy on stocks in a powerful, confirmed uptrend just because you “feel” it’s overbought.

- Entry Signal: Identify a stock showing signs of weakness or trading near a significant resistance level. High implied volatility (IV) is beneficial, as it increases the premium you collect. Target a short strike delta of around 10-15 for a higher probability of success.

- Exit Strategy: A disciplined exit plan is crucial. Rather than holding until expiration, aim to close the position once you have captured 50% of the maximum profit. This practice, widely endorsed by options educators, helps lock in gains and reduces the risk of the trade turning against you.

- Risk Management: Your maximum loss is defined from the start. If the stock price rallies and breaches your short strike, it’s often prudent to close the position to prevent a maximum loss. Never let a small, defined-risk trade turn into an unmanaged disaster.

7. Iron Butterfly

The Iron Butterfly is a neutral, defined-risk strategy that aims to profit from a stock experiencing minimal price movement. It is structurally similar to an Iron Condor but has a much narrower profit range, as it involves selling a put and a call at the same strike price, creating a sharp “peak” of maximum profit right at that price.

This strategy is highly effective among weekly option trading strategies because its profitability is supercharged by rapid time decay (theta). The goal is to pinpoint a stock that will trade in a very tight range, allowing the short options to decay quickly and expire worthless. An Iron Butterfly is a bet on stillness in the market.

How an Iron Butterfly Works

An Iron Butterfly is constructed by combining two spreads at a single short strike price:

- Selling an at-the-money (ATM) put and buying an out-of-the-money (OTM) put.

- Selling an ATM call and buying an OTM call, using the same short strike as the put.

The position is opened for a net credit, which is the maximum potential profit. The maximum loss is limited to the width of the wings (the difference between the short and long strikes) minus the credit received. The strategy profits most when the underlying asset’s price is exactly at the short strike price at expiration.

Practical Example: A stock is trading at $150 and you expect it to be very stable for the next week. You could construct an Iron Butterfly by:

- Selling the $150 put and the $150 call.

- Buying the $145 put and the $155 call for protection.

- Let’s say this generates a net credit of $3.50 ($350 per contract).

If the stock closes precisely at $150 at expiration, you realize the maximum profit of $350. The profit range is between the break-even points of $146.50 and $153.50.

Actionable Tips for Trading Iron Butterflies

Discipline is crucial with this strategy due to its narrow profit window. It’s easy to get frustrated if the stock moves even slightly outside your intended range.

- Entry Signal: Look for liquid stocks or ETFs like SPY trading in a clear, tight consolidation range. Target an implied volatility (IV) rank above 40 to ensure the premium collected justifies the risk. The ideal setup is when you expect near-zero price movement.

- Exit Strategy: Because the profit zone is so small, it’s wise to take profits early. A common rule is to close the position once you’ve captured 25% of the maximum profit. This proactive approach helps lock in gains and avoids the risk of the stock moving against you. Understanding different profit-taking strategies can significantly improve your outcomes.

- Risk Management: Your short strikes are your break-even points. If the underlying price moves significantly toward one of your long strikes, it’s often best to close the position to prevent a maximum loss. Never let a small, manageable loss turn into a large one.

Weekly Option Strategies Comparison Guide

| Strategy | 🔄 Implementation Complexity | ⚡ Resource Requirements | 📊 Expected Outcomes | 💡 Ideal Use Cases | ⭐ Key Advantages |

|---|---|---|---|---|---|

| Iron Condor | Moderate (4 legs, 2 spreads) | Margin required for spread + commissions | 10-25% typical return on capital at risk | Low volatility, sideways markets, 7-21 days expiry | Limited risk, defined max loss, profits from time decay |

| Cash-Secured Put | Low | Significant cash to cover stock purchase | 1-3% monthly on capital deployed | Bullish, want stock ownership at discount, 7-30 days expiry | Conservative, generates income, potential lower cost basis |

| Covered Call | Low | Must own 100 shares per contract | 1-2% monthly income enhancement | Uptrend or sideways stocks, 7-45 days expiry | Income from owned stock, downside protection, reduces volatility |

| Short Straddle | High | Large margin due to unlimited risk | High premium; very high risk | High IV stocks, earnings events, 7-30 days expiry | High premium, profits from time decay & volatility crush |

| Bull Put Spread | Moderate | Margin for spread width, margin account | 5-15% typical return on capital at risk | Neutral to bullish markets, 7-21 days expiry | High probability, limited risk, immediate income |

| Bear Call Spread | Moderate | Margin for spread width, margin account | Limited profit, risk-reward ~1:3 to 1:4 | Bearish or sideways markets, 7-30 days expiry | Income in declining markets, limited max loss, volatility contraction |

| Iron Butterfly | High | Margin for multiple legs + commissions | Narrow profit zone, high probability | Tight trading ranges, high IV stocks, 7-14 days expiry | Lower margin than straddle, profits from time decay & vol contraction |

From Theory to Practice: Your Next Steps to Smarter Trading

We’ve journeyed through a powerful lineup of weekly option trading strategies, from the range-bound precision of the Iron Condor and Iron Butterfly to the directional conviction of Bull Put and Bear Call Spreads. We explored income-generating workhorses like the Covered Call and Cash-Secured Put, and the high-octane, volatility-capturing Short Straddle. Each strategy offers a unique tool for navigating the fast-paced world of weekly options, but the tool is only as effective as the trader wielding it.

The common thread weaving through all these approaches isn’t a secret formula for guaranteed profits—which doesn’t exist. It’s the unwavering necessity of discipline, risk management, and continuous learning. The allure of quick gains with weeklys can just as easily lead to rapid losses if not treated with respect. Your success will ultimately be defined not by a single winning trade, but by your ability to consistently apply your chosen strategy, manage your risk parameters, and learn from every outcome, both positive and negative.

Your Path Forward: From Knowledge to Mastery

Simply knowing these strategies isn’t enough. The real growth begins when you transition from theoretical understanding to practical application. Here are your actionable next steps to integrate these weekly option trading strategies into your own system:

- Start with Paper Trading: Before risking a single dollar, use a trading simulator to practice. Execute each strategy across different market conditions to build an intuitive feel for how they perform. Focus on your entry triggers, adjustment tactics, and exit criteria. This is your free education—take it seriously.

- Specialize Before You Diversify: Instead of trying to master all seven strategies at once, choose one or two that align with your market outlook and risk tolerance. Become proficient in executing a Bull Put Spread or managing a Covered Call portfolio before adding more complex strategies.

- Define Your “Why”: For every trade you consider, you must be able to clearly articulate why you are entering it. Is it based on technical analysis, a volatility contraction, or a fundamental belief in the underlying asset? Trading without a clear thesis is simply gambling.

- Develop a Rigorous Trading Plan: Your plan is your constitution. It must explicitly state which strategies you will use, your maximum risk per trade, position sizing rules, and what market conditions must be present to even consider a trade. Stick to your plan, even when your emotions scream otherwise.

The Ultimate Goal: Consistent, Informed Decision-Making

Mastering weekly option trading strategies is less about predicting the future and more about managing probabilities. The strategies we’ve discussed are designed to put the odds in your favor when your market thesis is correct. The goal is to build a robust, repeatable process that allows you to extract consistent returns over the long term while protecting your capital from catastrophic loss.

This journey requires patience and an honest assessment of your performance. Every trade, win or lose, offers a valuable data point. Are you cutting winners too short? Are you letting losers run too far? Is your timing off? Answering these questions with data, not emotion, is the true key to elevating your trading from a hobby to a professional endeavor. Embrace the process, commit to your education, and you will be well on your way to navigating the markets with greater confidence and skill.

The most effective way to improve your performance with weekly option trading strategies is to meticulously track and analyze your results. TradeReview is a powerful trading journal designed to give you the data-driven insights you need to identify your strengths, pinpoint your weaknesses, and refine your approach. Stop guessing what works and start knowing by visiting TradeReview to see how journaling can transform your trading.