Think of a forex trading simulator as a software tool that drops you into a live trading environment without any of the real-world financial risk. It’s a powerful platform that lets you practice buying and selling currencies using virtual money, making it the perfect training ground to test strategies, get the hang of a platform, and build discipline before putting your actual capital on the line.

We know how challenging it can be to start. The forex market can feel overwhelming, and the fear of losing money is real. This guide is designed to walk you through how a simulator can help you build confidence and competence, step by step.

Why a Trading Simulator Is Your Most Important Tool

Jumping into the forex market with no experience is a bit like a pilot trying to fly a 747 on their first day. The cockpit is complex, conditions are always changing, and one wrong move can lead to disastrous financial consequences. This is exactly where a trading simulator forex platform becomes your indispensable co-pilot.

It’s your personal flight simulator. It provides a safe, realistic space to learn the controls, understand how the market breathes, and make all the rookie mistakes without the gut-wrenching stress of losing real money. That fear is often the biggest mental block for new traders, and a simulator helps you work through it constructively.

Building Your Foundation Without Financial Risk

At its core, a simulator is all about building a solid foundation of skills and good habits. It’s not about randomly clicking “buy” and “sell”; it’s a dedicated training ground for developing the instincts that support a long-term trading career. When you practice, you’re not just reading theory — you’re building practical, repeatable skills.

Here’s what you really gain from putting in the hours:

- Mechanical Competence: You build muscle memory for executing trades quickly and correctly. This means setting stop-loss orders, take-profit targets, and understanding different order types without fumbling when the pressure is on.

- Strategic Refinement: It’s your sandbox for testing and tweaking your trading strategies against real market data. You get to see what works and, just as importantly, what doesn’t.

- Emotional Discipline: With no real money on the line, you can focus on executing your plan without fear or greed clouding your judgment. This is how you cultivate the patience and discipline needed for long-term success.

A trading simulator empowers you to turn raw ambition into confident competence. It’s where you learn to follow a plan, manage risk, and understand the rhythm of the market before your capital is ever on the line.

Ultimately, using a trading simulator forex account is a direct investment in your trading education. The lessons you learn here are priceless, bridging the gap between what you read in a book and what happens in the real world. For a deeper look at this idea, you can learn more about what paper trading is and how it helps build that solid foundation.

This structured practice ensures that when you do decide to fund a live account, you show up prepared, confident, and armed with a tested strategy — ready to navigate the markets with skill, not just hope.

Exploring the Different Types of Forex Simulators

Not all simulators are created equal, and the one you choose can make a huge difference in your development as a trader. Your goals should dictate your tools. Think of it like a pro athlete’s training regimen: sometimes you need live sparring, and other times you need to review game film. Both are critical, but they solve different problems.

We can break down forex simulators into three main camps, each with its own strengths. Knowing which one to use — and when — is key to making your practice time as productive as possible and avoiding frustration.

Demo Accounts: The Live Sparring Partner

A demo account is the most common type of trading simulator forex tool you’ll find, offered by nearly every broker. It’s a carbon copy of a live trading account but funded with virtual cash. You get access to the same platform, the same live price feeds, and the same real-time market data.

This setup is perfect for getting your hands dirty. It’s like a boxer stepping into the ring for a sparring session; you’re reacting to a live opponent in real-time. A demo account is where you build the muscle memory for placing orders, setting stop-losses, and just getting comfortable with your broker’s software under live fire.

- Best For: Learning a broker’s platform and practicing trade execution in a live, moving market.

- Key Advantage: It perfectly mirrors the real experience of market volatility and platform quirks.

But its biggest strength is also its biggest weakness. Because it runs in real-time, you can only practice when the market is open, and you can’t fast-forward to see how a strategy would have played out over an entire month in just a few minutes.

Backtesting Software: The Game Film Review

If a demo account is your sparring partner, then backtesting software is your game film. This is a seriously powerful tool that lets you take a trading strategy and test it against months or even years of historical market data. It’s a way to compress time and see how your system would have held up through all kinds of market conditions.

Want to see how your strategy handled the 2008 financial crisis? Or the Brexit vote? With backtesting, you can. This is where you graduate from simply practicing your clicks to rigorously testing whether your trading ideas have a statistical edge. For example, you could test a simple strategy like “buy EUR/USD when the 50-day moving average crosses above the 200-day moving average” and see its performance over the last decade.

Backtesting lets you answer the most important question a trader can ask: “Would this strategy have actually made money over the last five years?” It’s a purely data-driven way to build real confidence in a system before risking a single cent.

This process is absolutely essential for developing a long-term mindset. Instead of getting excited about one or two wins, you can analyze hundreds or thousands of historical trades to see if you’ve truly found something that works.

Algorithmic Simulators: The Automated Strategy Lab

For traders who like to get a bit more technical, algorithmic simulators are the next frontier. These platforms are built specifically for creating, testing, and fine-tuning automated trading systems — you might know them as expert advisors (EAs) or trading bots.

Here, you’re not just testing a manual strategy; you’re building a program that executes trades for you based on a set of rules you define. For example, you could code a bot to automatically buy EUR/USD every time the price crosses above the 50-period moving average while the Relative Strength Index (RSI), an indicator that measures momentum, is below 30.

This kind of trading simulator forex platform is a specialized lab. It does require some coding know-how, but the power it gives you is immense. According to NVIDIA, using accelerated computing can speed up these kinds of financial simulations by over 100x. It’s the ultimate tool for traders aiming to take human emotion and execution errors completely out of the equation.

Forex Simulator Types Compared

To help you choose the right tool for the job, here’s a quick breakdown of the main simulator types.

| Simulator Type | Best For | Market Data | Key Advantage |

|---|---|---|---|

| Demo Account | Platform familiarity & live practice | Real-Time | Replicates the live trading experience exactly. |

| Backtesting Software | Strategy validation & refinement | Historical | Allows for rapid testing across years of data. |

| Algorithmic Simulator | Building & testing automated bots | Historical & Real-Time | Removes emotion and enables systematic testing. |

Each simulator has its place. Start with a demo account to learn the ropes, move to backtesting to prove your strategies, and explore algorithmic simulators if you want to automate your edge.

The Unseen Hurdle: Why Live Trading Feels So Different

Let’s be clear — a trading simulator forex account is an incredible practice tool, but it comes with a massive blind spot. It can’t prepare you for the gut-wrenching, heart-pounding feeling of watching your own money vanish (or multiply) with every tick of the market. This emotional chasm is the real test between practice and performance.

Think about it this way. Practicing a speech in an empty room is a breeze. You’re confident, articulate, and everything flows perfectly. But the moment you step onto a stage in front of a live audience, your palms get sweaty and your mind goes blank. The words are the same, but the pressure changes everything.

That’s exactly what happens when traders switch from a simulator to a live account. A strategy that looked foolproof on paper can completely unravel once real money — and real emotions — are on the line.

When Fear and Greed Crash the Party

In a simulator, you’re a cold, calculating machine. You follow your rules, execute your plan, and treat losses as simple data points for improvement. It’s easy to be disciplined when a bad trade just means a smaller number on a screen.

But the second you’re trading with your own cash, two powerful emotions sneak in and try to take over your decision-making:

- Fear: After a few losses, fear starts whispering in your ear. It makes you second-guess a perfect setup, causing you to miss out on a winner. Or it convinces you to snatch a tiny profit off the table way too early, just to escape the anxiety of watching the trade play out.

- Greed: A winning streak can make you feel invincible. Greed tempts you to take on too much risk, bend your rules, or hold onto a winner for way too long, hoping for that one monster move — only to watch it all come crashing down.

The real challenge in trading isn’t about outsmarting the market; it’s about outsmarting yourself. The simulator is where you build the mechanical foundation you’ll need to stand on when your emotions try to knock you over.

These feelings are perfectly human, but they’re a primary reason why many traders who excel in a demo account end up struggling when they go live. Your brilliant trading plan is worthless if you ditch it at the first sign of emotional pressure.

Forging Your Psychological Armor

So, how do you prepare for this? You can’t just switch off your emotions, but you can build a system that keeps them in check. This is where your time in a trading simulator forex platform becomes absolutely essential.

The goal isn’t just to practice clicking buttons. It’s about building rock-solid, automatic habits. By executing your strategy over and over again — following your rules on every single trade — you’re burning a disciplined process deep into your brain. You’re creating a strategic foundation so strong it can weather the emotional storms of live trading.

This kind of deliberate practice builds a default mode for your trading. When fear and greed start screaming for attention, your ingrained habits can take the wheel, helping you stick to the plan. The simulator is your training ground for building this psychological armor. It ensures that when you finally step into the live market, you’re relying on your tested system, not on destructive, knee-jerk emotions.

How to Maximize Your Practice in a Forex Simulator

It’s tempting to jump into a demo account and start clicking ‘buy’ and ‘sell’ like you’re playing a video game. We’ve all been there. But that kind of random clicking won’t help you build sustainable skills. To get real value from a trading simulator forex platform, you have to treat it like a real business from day one.

Forget about hitting a virtual jackpot. The real goal here is to build the habits and routines that will protect your capital when actual money is on the line. Every single move you make in the simulator should be intentional, designed to build a professional trading process. This mindset shift is the single most important step you can take.

Start with Realistic Trading Capital

One of the biggest mistakes new traders make is funding their demo account with a fantasy number, like $100,000. Sure, it feels great to place huge trades, but it teaches you absolutely nothing about managing risk with the capital you actually plan to use. If your goal is to go live with $2,000, then your simulator needs to start with $2,000.

Trading with a realistic amount forces you to face the hard truths of position sizing and leverage right away. A $200 loss feels a lot different when it’s 10% of your account versus a measly 0.2%.

By mirroring your real-world financial situation, you train your brain to respect the value of every dollar and make decisions based on sound risk management, not fantasy capital. This simple change makes every simulated trade more meaningful.

This approach keeps you grounded. It ensures the psychological lessons you learn are directly transferable to a live account, focusing you on sustainable growth instead of reckless gambling.

Implement a Non-Negotiable Risk Plan

Next up: you need a strict, non-negotiable risk management plan. This isn’t a friendly suggestion — it’s the foundation of any sustainable trading career. The best place to start is with the 1% rule, a time-tested guideline in the trading community.

The rule couldn’t be simpler: never risk more than 1% of your account balance on any single trade.

- On a $2,000 account, your maximum risk per trade is $20.

- On a $5,000 account, your maximum risk per trade is $50.

Think of this rule as an emotional circuit breaker. It stops one or two bad trades from wiping you out, which allows you to survive the inevitable losing streaks that every single trader faces. Your job in the trading simulator forex platform is to follow this rule on every trade, no exceptions, until it becomes second nature.

Keep a Detailed Trading Journal

Practice without review is just mindless repetition. If you want to actually improve, the single most powerful habit you can build is keeping a detailed trading journal. This is how you turn random trades into a data-driven feedback loop, letting you learn from your wins and your losses. A journal is your personal performance coach.

For every trade you take in the simulator, you should be logging these key details:

- Entry and Exit Points: The exact prices where you got in and out.

- Strategy Used: What setup or signal prompted you to take the trade?

- Risk vs. Reward: Your predefined stop-loss and take-profit targets.

- Your Rationale: Why this trade? What did you see in the market that made you act?

- Emotional State: Be honest. Were you feeling confident, anxious, or just plain bored?

Writing this stuff down forces you to think critically about each decision. Over time, you’ll start spotting patterns you’d otherwise miss. Maybe you’ll discover you’re way more profitable during the London session, or that a certain indicator is consistently costing you money. This kind of systematic analysis is how you find and sharpen your edge. For traders wanting to take this a step further, learning how to backtest trading strategies is the perfect next step to validate what your journal is telling you.

By diligently tracking your trades, you move beyond guesswork and into a world of data. You start to truly understand your own strengths and weaknesses as a trader, all from the safety of a simulator. That data-backed self-awareness is what separates aspiring traders from consistently profitable ones.

A Proven Workflow for Analyzing Simulated Trades

Practice without review is just repetition. It’s easy to place hundreds of trades in a trading simulator forex account, but unless you stop to analyze the outcomes, you’re just spinning your wheels and reinforcing bad habits. To actually get better, you need a system for turning your trading data into powerful, actionable insights.

This is about more than just checking your account balance. The real goal is to become your own performance coach, using hard data to find your edge, systematically weed out your weaknesses, and sharpen your strategy until it’s ready for the live market.

From Raw Data to Actionable Insights

First things first: you have to log every single trade meticulously. This isn’t just about noting the profit or loss; it’s about capturing the full story behind each decision you made. Think of it like a scientist recording every variable in an experiment — a great trading journal is the foundation of this entire process.

Your log should capture these vital statistics for every single trade:

- Entry and Exit Points: The exact price levels for your entry, stop-loss, and take-profit.

- The Rationale: Why did you take this trade? Write down the specific setup, technical signals, or fundamental reasons that prompted your action.

- Strategy Used: Give the strategy a name (e.g., “London Breakout,” “Trend Pullback”).

- Emotional State: Be brutally honest with yourself. Were you feeling confident, impatient, fearful, or just bored? Your emotions are data, too.

For traders just getting started, using a structured format is key. If you need a hand, you might be interested in our guide on creating a comprehensive trading journal template in Excel to help build this critical habit.

The goal isn’t just to record what happened. It’s to understand why it happened. This detailed record is the raw material you’ll use to uncover the patterns that truly define your trading performance.

With this data in hand, you can start asking the deeper, more meaningful questions that lead to real improvement.

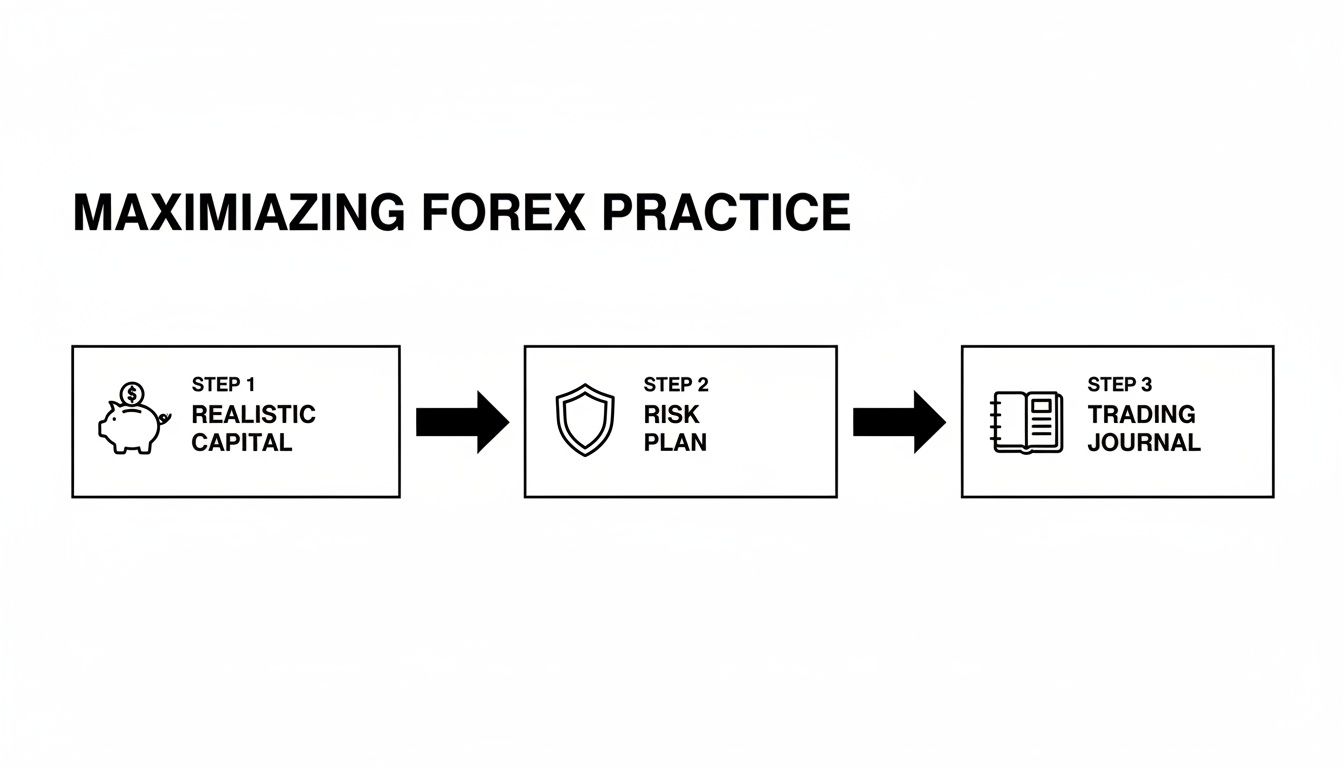

This process flow shows the core steps for making your forex practice count, hammering home the importance of realistic capital, a solid risk plan, and a detailed trading journal.

This visual is a great reminder that successful analysis starts with disciplined practice. Without quality inputs like a proper risk plan and a thorough journal, your data won’t tell you anything useful.

Answering the Questions That Matter

Once you have a few weeks of consistent data in your journal, the real work begins. This is where you put on your analyst hat and start digging for gold. Your journal is no longer just a log; it’s a database you can slice and dice to find your unique trading edge.

Filter and sort your trades to answer critical questions like these:

- Which currency pairs are my most profitable? You might discover you have a natural feel for EUR/USD but consistently lose money trading GBP/JPY. That insight alone can dramatically shift your focus.

- What time of day do I perform best? Break down your results by trading session (e.g., London, New York, Tokyo). Many traders find their strategy works far better during specific hours of market volatility.

- Which trading setups consistently fail? Pinpoint the strategies or market conditions that lead to your biggest losses. Sometimes, the key to profitability isn’t finding more ways to win — it’s finding what you need to stop doing.

- How do my emotions impact my results? Look for correlations. Do trades taken out of boredom or “revenge trading” after a loss always underperform? Seeing the hard data can be the wake-up call you need to tighten up your discipline.

This analytical workflow transforms your trading simulator forex practice from a passive activity into an active feedback loop. You aren’t just trading; you’re systematically testing hypotheses, identifying what works, and ditching what doesn’t. Each trade becomes another data point that refines your approach, helping you build a robust, data-backed strategy that gives you genuine confidence when you finally decide to trade with real capital.

Making the Leap From Simulator to Live Account

Making the jump from a simulated trading environment to a live account is a huge step, both mentally and financially. This isn’t a finish line you rush to cross. Think of it as the next, more serious stage of your trading education — one that demands a slow, deliberate approach.

The real question is, how do you know you’re ready? The answer can’t come from a gut feeling. It has to be backed by cold, hard data from your trading simulator forex account. Without objective proof of your performance, you’re not trading; you’re just gambling.

Defining Your Go-Live Criteria

Before you even dream of funding a live account, you need to set some clear, non-negotiable benchmarks for yourself. This simple act takes the emotion out of the decision and turns it into a data-driven choice. Your only goal here is to prove you have an edge that you can repeat consistently.

Here’s what a solid readiness checklist should look like:

- Consistent Profitability: You need to show a net positive return for at least three consecutive months. One great week or a lucky month doesn’t cut it. You have to prove your strategy can handle different market moods.

- Sufficient Trade Sample: Your results must be built on a meaningful number of trades — think 100 or more. This ensures your profitability isn’t just a fluke from a couple of big wins.

- Strict Rule Adherence: Most importantly, you need a proven track record of following your trading plan to the letter, especially your risk management rules, with zero exceptions.

Moving to a live account isn’t a reward for being a good student. It’s a promotion you give yourself only after the data proves you’ve mastered the curriculum.

Starting Small and Staying Humble

Once you’ve ticked all those boxes, the transition should be slow and steady. Fight the temptation to jump in with a huge chunk of your capital. Instead, start with a small, manageable live account — an amount you are genuinely prepared to lose without it wrecking your finances or your peace of mind.

This first live trading phase isn’t about making life-changing money. It’s about getting used to the intense psychological pressure that comes with having real skin in the game. Even with a tiny account, the emotional weight feels completely different than it does in a simulator.

And remember, your practice days are never truly over. Even seasoned pros circle back to a trading simulator forex platform to test out new ideas or fine-tune their strategies without putting capital at risk. The journey is a constant cycle of learning, testing, and executing. This final step is all about building a sustainable, long-term approach to the markets, not chasing a short-term prize.

Still Have Questions? Let’s Clear Them Up

Diving into the world of forex simulators is a smart move, but it’s natural to have a few questions before you start. Let’s tackle some of the most common ones traders ask.

How Much Virtual Money Should I Use in a Simulator?

This one’s simple: start with an amount that you’d actually trade with.

If you’re planning to go live with a $2,000 account, then set your trading simulator forex balance to $2,000. Trading with a wildly unrealistic sum like a million dollars is fun, but it teaches you absolutely nothing about real-world risk management and position sizing. Keep it real from day one.

Is a Forex Simulator the Same as Backtesting?

Not quite — they’re two different tools for two different jobs. Think of it like this:

A simulator (like a demo account) is your sparring partner. It lets you practice your moves and execute trades in a live market, right now, without getting financially hurt.

Backtesting software, on the other hand, is like reviewing game footage from past seasons. It lets you run a specific strategy against years of historical price data to see how it would have performed. One is for practice, the other is for research.

Can You Lose Money in a Forex Simulator?

Only virtual money. You will never lose a single cent of your real capital in a simulator.

That’s the whole point! It’s a completely risk-free sandbox designed for you to make mistakes, learn from them, and hammer out the kinks in your strategy without any of the real-world financial pain.

The forex market is tough, and many people jump in unprepared. According to an analysis on BestBrokers.com, a significant percentage of retail traders struggle to achieve consistent profitability, which is why a simulator isn’t just a nice-to-have; it’s an essential training ground.

By committing to practice on a trading simulator forex platform, you’re already putting yourself ahead of the curve. You’ll be one of the few who show up on day one with a tested strategy and the discipline to follow it.

Ready to turn those practice trades into powerful, actionable insights? Start logging and analyzing your simulated trades with TradeReview — the data-driven trading journal that helps you find your edge. Get started for free at tradereview.app.