Picking the right trading platform is one of the first — and most critical — decisions on your trading journey. It’s not about finding a single “best” platform, but the one that’s best for you. We understand the flood of flashy ads promising quick profits can be distracting. The goal here is to help you focus on what truly aligns with your personal trading style and long-term goals.

How to Choose the Right Trading Platform

The sheer number of platforms can feel overwhelming, and nobody wants to make a costly mistake right out of the gate. We get it. Many traders, especially when starting, feel a mix of excitement and anxiety. That’s why we’re cutting through the noise to give you a clear, practical way to decide.

A day trader trying to capture small, quick moves needs speed and low costs above all else. For example, they might execute a trade on a stock like NVIDIA that moves a few dollars in minutes, and a slow platform could turn a potential gain into a loss. In contrast, a long-term investor planning to hold shares of a company like Apple for years will care more about deep research tools and top-notch security. Your goals dictate the tools you need. This guide breaks it down across five essential criteria to help you choose with confidence.

Key Evaluation Criteria

To make a smart, sustainable choice, we’ll be looking at each platform through these five lenses:

- Usability: How does it feel to use? Is it intuitive, or will you be fumbling through menus while the market moves against you? A confusing interface can cause costly execution errors.

- Analytical Tools: Does it have the charting, indicators, and research you need to execute your strategy? Without the right tools, even a great strategy is just a theory.

- Security: How safe is your money and data? We’re talking two-factor authentication (a second layer of security, like a code sent to your phone), insurance, and a solid track record.

- Pricing Structure: What’s the real cost? We’ll look past the “zero-commission” headlines to uncover hidden fees for things like options contracts or data, as well as margin rates.

- Customer Support: When something goes wrong — and at some point, it will — can you get a knowledgeable human on the line quickly?

The online trading world is booming. It’s expected to jump from around USD 10 billion in 2023 to USD 22 billion by 2032. More competition is good, but it also makes your decision more complex. You can dig into these market growth projections to see just how fast things are moving.

The most expensive mistake a trader can make isn’t a single bad trade—it’s committing to a platform that works against their strategy. Discipline starts with choosing the right tools for the job, and success is built on long-term consistency, not one-off wins.

To give you a better idea, here’s a quick look at how different platforms serve different traders. This will set the stage for our deep dive.

| Criteria | Ideal for Day Traders | Ideal for Long-Term Investors | Ideal for Beginners |

|---|---|---|---|

| Primary Need | Speed & Low Costs | Research & Security | Simplicity & Education |

| Key Features | One-click trading, Level 2 data, low contract fees | In-depth reports, portfolio analysis, SIPC insurance | User-friendly interface, paper trading, tutorials |

| Potential Pitfall | High margin rates, poor research tools | High fees for frequent trading, clunky interface | Limited advanced features, high spreads |

This framework is our roadmap. Let’s find you a platform that feels less like a tool and more like a partner in your growth.

Meet the Top Trading Platform Contenders

Before we dive into a side-by-side comparison, it’s worth getting to know the contenders. Each platform was built with a specific kind of trader in mind, and its features and design reflect that. Think of them as having different personalities — once you understand their philosophy, it’s much easier to see which one fits your style and supports a disciplined, long-term approach.

We’re putting four distinct players under the microscope, each with a unique angle:

- TradeReview: The performance analyst, built for traders who know that the key to sustainable success is learning from their own data.

- Interactive Brokers: The pro-level powerhouse, designed for speed, global market access, and complex trading strategies.

- E-TRADE: The friendly giant, focused on making the markets accessible and welcoming for newcomers.

- TD Ameritrade: The versatile all-rounder, striking a balance between powerful tools and deep educational resources.

Understanding this context is the first step. It frames the entire comparison and helps you look past the feature lists to find what really matters for your long-term trading goals. This isn’t a promotional pitch; it’s a guide to help you find the right fit.

Interactive Brokers: The Professional’s Choice

Interactive Brokers (or IBKR) has carved out a reputation as the platform for serious, active traders. It’s not trying to hold your hand. Instead, its entire philosophy revolves around providing direct, lightning-fast access to a massive range of global markets at some of the lowest costs you’ll find anywhere.

Its most obvious strength is its sheer scale. We’re talking stocks, options, futures, and forex across more than 150 markets worldwide. This alone makes it the default choice for anyone managing a diverse, international portfolio or executing sophisticated strategies.

The homepage itself tells you everything you need to know. It’s all about global access and low costs, not flashy graphics.

This is a high-performance engine for traders who already know exactly what they need to do. Function over form is the name of the game.

E-TRADE and TD Ameritrade: The Accessible Giants

At the other end of the spectrum, you have E-TRADE and TD Ameritrade (now part of Charles Schwab). Their mission is built around accessibility and education. E-TRADE has always been a favorite for beginners, with intuitive web and mobile platforms that cut through the complexity and make trading feel straightforward. It’s all about removing barriers to entry.

TD Ameritrade is legendary for its thinkorswim platform—a piece of software so powerful it rivals professional-grade tools, yet it’s still available to everyday retail traders. Its real magic is combining that elite suite of charting and analysis tools with one of the best educational libraries in the business.

It’s the classic trader’s dilemma: power versus usability. A platform packed with features is useless if you can’t navigate it, but a simple interface might leave you wanting more as your skills grow. The key is finding a balance that supports your current needs while allowing room for growth.

TradeReview: The Performance Analyst

And then there’s TradeReview. It’s a different beast altogether. While the others are brokers where you execute trades, TradeReview is a specialized trading journal. Its entire philosophy is built on a single idea: the fastest way to improve is to analyze your own performance with brutal honesty.

It’s designed for the trader who understands that long-term consistency isn’t about chasing hot stocks or relying on luck. It’s about systematically refining your strategy, understanding your emotional triggers, and cutting out the costly, repetitive mistakes. This is a tool for building discipline.

Comparing Platform Usability and Core Features

A platform’s raw power means nothing if it’s clunky, confusing, or slow. Your daily trading experience—the user interface (UI) and user experience (UX)—directly impacts your efficiency, stress levels, and ultimately, your discipline. A frustrating platform can easily lead to execution errors and emotional decisions, which are exactly the pitfalls every serious trader works hard to avoid. We’ve all been there: a moment of panic when you can’t find the “sell” button fast enough.

This is where we go beyond a simple feature list. In this comparison, we’ll dive into how each platform actually feels to use in the real world, from the clarity of its main dashboard to the speed of placing a trade when every second counts.

The User Experience Spectrum

There’s no single interface that’s perfect for everyone. Platforms are typically designed with a specific type of trader in mind, creating a spectrum from beginner-friendly simplicity to professional-grade complexity.

- Beginner-Focused (E-TRADE): These platforms put clarity above all else. They use clean layouts, intuitive navigation, and guided steps to help new traders build confidence without feeling overwhelmed. The trade-off? You’ll often find fewer advanced tools and customization options.

- Professional-Grade (Interactive Brokers): Built for pure speed and information density, these interfaces are incredibly customizable but come with a steep learning curve. They’re designed for seasoned traders who know exactly what they need to see and want it all laid out, often across multiple monitors.

- Balanced Approach (TD Ameritrade, TradeReview): These platforms strike a middle ground. TD Ameritrade’s thinkorswim, for instance, is immensely powerful but organizes its tools into logical, easy-to-navigate tabs. In a similar way, TradeReview offers deep analytics inside a clean, dashboard-style layout that makes complex performance data easy to digest.

Choosing the right one means being honest about your current skill level and where you want to go. A new trader jumping into a professional-grade platform can feel like trying to fly a fighter jet with no training. It’s better to start with a platform you can master and grow from there.

Core Features Tailored to Trading Styles

Let’s look at how core features actually serve different types of traders. A feature is only valuable if it supports your specific strategy.

Scenario 1: The High-Frequency Day Trader

Imagine you need to get in and out of a volatile stock within seconds. Your entire focus is on speed and precision. For you, one-click order execution and customizable hotkeys (keyboard shortcuts for placing trades) aren’t just nice to have—they’re essential. This is where a platform like Interactive Brokers shines, with a desktop platform built to minimize lag and provide direct market access.

Scenario 2: The Options Strategist

Now, think about a trader building complex options strategies like iron condors. They need specialized tools to visualize potential profit and loss, analyze volatility (how much a stock’s price is expected to move), and roll positions with ease. TD Ameritrade’s thinkorswim is a standout here, offering sophisticated options analysis tools that are tough to beat in the retail space.

Scenario 3: The Swing Trader Focused on Improvement

A swing trader holding positions for days or weeks needs great charting tools, but they also need a way to track what’s working and what isn’t over the long run. This is where a platform like TradeReview becomes invaluable. While it’s not a broker, its ability to auto-sync with your brokerage account lets you tag setups, analyze your win rate by strategy, and pinpoint costly behavioral patterns. For example, you might discover you consistently lose money on trades you enter on Friday afternoons, a pattern you’d never spot without disciplined review.

A key differentiator in platform design is its core purpose. Is it built solely for trade execution, or is it designed to help you become a better trader? The latter often leads to more sustainable, long-term success.

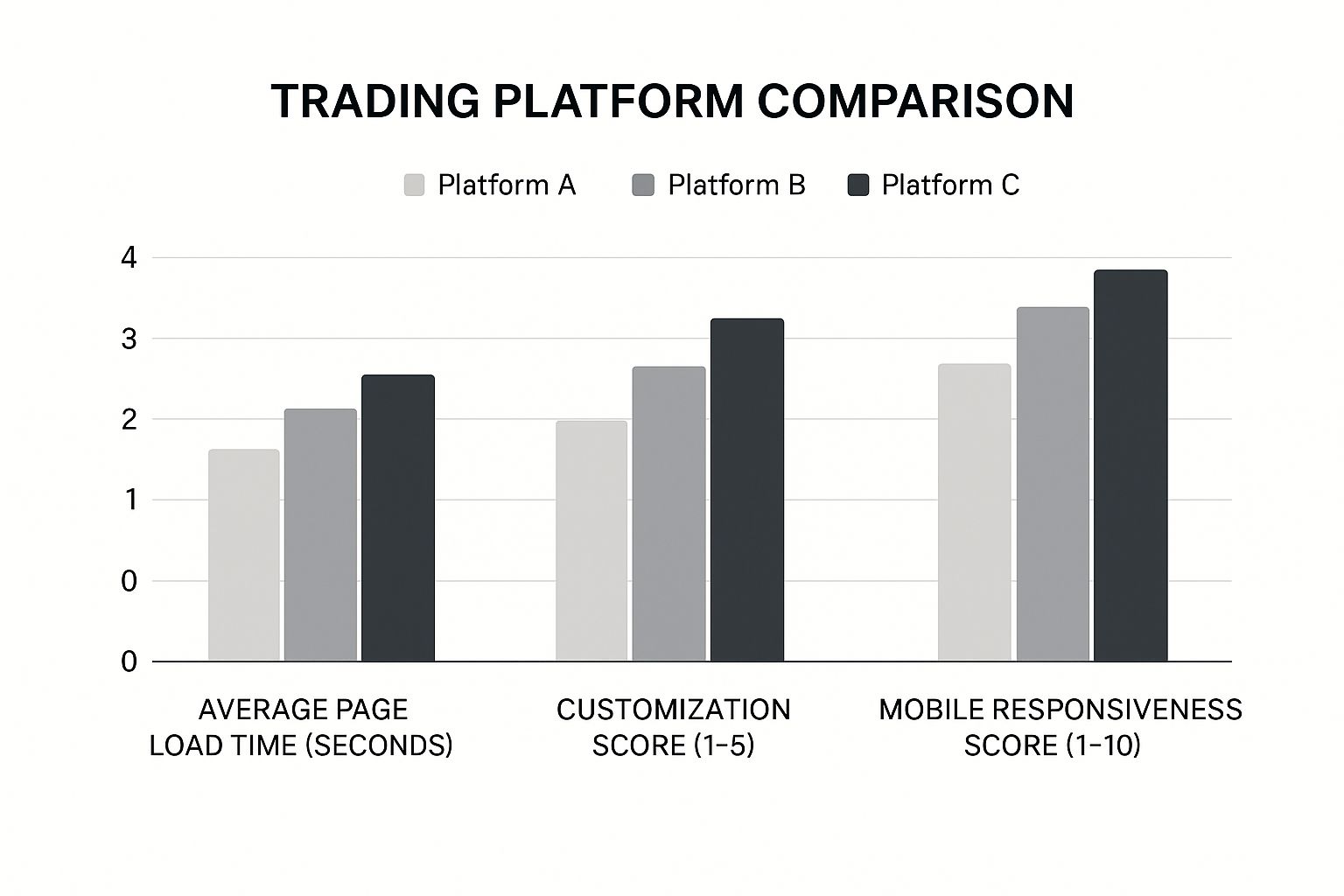

The chart below breaks down some of the key performance metrics that directly shape your daily trading experience on different platforms.

This data shows a clear trade-off between raw speed and deep customization, highlighting how platforms are optimized for different priorities.

Core Feature Comparison For Different Trader Profiles

To make things clearer, let’s break down how these platforms stack up for different types of traders. Think of this as a quick guide to match your trading style with the right toolset.

| Feature/Aspect | TradeReview (Balanced) | Interactive Brokers (Pro) | E-TRADE (Beginner-Friendly) | TD Ameritrade (All-Rounder) |

|---|---|---|---|---|

| Best For | Performance analysis & improvement | High-frequency & pro traders | New investors & long-term holds | Options & advanced charting |

| Order Execution | N/A (Journaling Tool) | Fastest, direct market access | Simple, guided order forms | Advanced, multi-leg orders |

| Charting Tools | Performance-based charts | Highly technical & customizable | Basic, easy-to-read charts | Professional-grade, thinkorswim |

| Learning Curve | Very low | Very high | Very low | Moderate to high |

| Unique Feature | Automated journaling & setup tagging | Lowest margin rates, global access | Large library of educational content | Sophisticated options analysis |

This table shows there’s no single “best” platform—the right choice depends entirely on your needs, from simple execution to deep performance analytics.

Practice Before You Commit

The absolute best way to judge a platform’s usability is to try it yourself. Most top-tier brokers offer a crucial feature: a risk-free demo or paper trading account. This lets you navigate the interface, place simulated trades, and test out the charting tools with real market data, all without risking a dime.

Spending a week in a demo environment is an invaluable investment. Does the order entry process feel natural? Can you find the research tools you need without digging around? This hands-on experience answers questions that no review or comparison chart ever could. To get a better handle on this process, you can check out our guide on what paper trading is and how to use it effectively.

Ultimately, the platform you choose becomes your cockpit for navigating the markets. It should feel like a natural extension of your strategy, not a barrier you have to fight against every single day.

Analyzing Research And Data Tools

Every serious trader knows that success starts with reliable information, not gut feelings. The research and data features a platform provides can make or break your strategy—far beyond just watching tickers or glancing at basic charts. In this comparison, we’ll dive into the analytical strengths that turn a passable platform into one that truly supports a disciplined, long-term approach.

We’ll weigh fundamental versus technical data depth and examine how well third-party research is integrated. It’s tempting to chase every shiny feature, but the real skill lies in aligning the right tools with your trading style. After all, a buy-and-hold investor and a momentum trader need very different data sets.

Fundamental Vs Technical Analysis Tools

When you break it down, research tools split into two camps. No single platform nails both, so knowing your priorities is key.

- Fundamental Analysis dives into a company’s financial health—think financial statements, SEC filings, earnings calls, analyst ratings, and macroeconomic news. Platforms like E*TRADE and TD Ameritrade shine here, offering robust libraries from respected sources like Morningstar and CFRA.

- Technical Analysis focuses on chart patterns, price momentum, and volume. For this, you’ll need flexible charting with dozens of indicators (like Moving Averages or RSI), drawing tools, and even custom scripting. TD Ameritrade’s thinkorswim still leads the pack for pros who live on candlesticks and oscillators.

For example, a value investor might use E*TRADE’s tools to find undervalued companies by screening for a low Price-to-Earnings ratio. By contrast, a technical trader might use thinkorswim to spot a “bull flag” pattern on a chart, signaling a potential upward move.

The Rise Of AI And Automation

Technology keeps reshaping the way we research markets. More platforms are embedding AI screeners, alternative data feeds, and automated alerts to help traders spot potential setups faster.

The best data in the world is useless without a system to interpret it. A platform’s tools should not just provide information; they should help you turn insights into a repeatable, disciplined trading process. Trading is a business of probabilities, not certainties.

Take Interactive Brokers: its news-sentiment scan can flag abrupt shifts in global headlines around your favorite stocks. Other services use machine learning to highlight unusual options activity or auto-detect chart patterns you’d otherwise miss. These aren’t magic bullets that guarantee profit, but they can cut your research time in half and point you to market movements that matter.

For a deeper look at where electronic trading is headed, check out the full analysis of electronic trading trends.

Personal Performance The Ultimate Dataset

Believe it or not, your single most valuable data source is your own trade history. That’s where a journaling tool like TradeReview really shines, helping you move from reactive trading to proactive improvement.

Linking directly to your broker, TradeReview imports every order and lets you tag setups, track your profit and loss by strategy, and drill into metrics like win rate and average hold time. Suddenly, tough questions get clear, actionable answers:

- “Am I taking profits too early on my winning trades?”

- “Do I consistently lose money on Monday mornings because I’m forcing trades?”

- “Which chart pattern is actually profitable for me, and which one keeps failing?”

Standard broker dashboards simply can’t provide this level of insight. To see how you can organize all your trades in one place, read our guide on how to track your stock portfolio for free.

Transforming your trade log into a feedback loop is the secret sauce for sustained improvement. When you know exactly what works—and what doesn’t—you trade with confidence instead of guesswork.

| Analytical Focus | Best Suited Platform | Key Tool Example |

|---|---|---|

| Deep Fundamental Research | E*TRADE | Access to third-party analyst reports |

| Advanced Technical Charting | TD Ameritrade | thinkorswim’s custom scripting engine |

| AI-Powered Insights | Interactive Brokers | News sentiment analysis tools |

| Personal Performance Data | TradeReview | Automated journaling & strategy tagging |

No matter which camp you belong to, the right research toolkit is all about matching features to your plan. Pick a platform that aligns with your approach, and you’ll turn raw data into disciplined, high-probability decisions.

Evaluating Costs Security And Support

Few things derail a solid trading plan faster than hidden fees, weak security, or a support team that vanishes when you need it most. We understand the frustration of discovering an unexpected charge or being unable to get help during a critical market moment. In this section, we dig past the flashy dashboards to examine the real costs, defenses, and customer care that keep you trading confidently over the long haul.

Chasing a $0 commission headline? That’s only half the story. Small fees on options contracts, margin borrowing, and even account inactivity can erode your capital. A disciplined trader never commits without scrutinizing every line of the fee schedule.

Uncovering The True Cost Of Trading

A complete cost comparison goes beyond the sticker price. Your trading style will shape which fees matter most. Below are the critical cost centers to investigate:

- Commissions & Contract Fees: Stock trades might be free, but options and futures almost always carry a per-contract charge. For example, a common fee of $0.65 per contract can add up quickly if you’re an active options trader.

- Margin Interest Rates: Borrowing to increase your position size (trading on margin) can be a powerful tool, but it’s also risky and expensive if rates are high. Some firms charge over 10%, while brokers like Interactive Brokers often offer much lower rates.

- Payment for Order Flow (PFOF): This is how most “zero-commission” brokers make money. They sell your order to large trading firms (market makers) who execute it. While often seamless, it can sometimes result in a slightly worse price (slippage) than you might get with a direct-access broker.

- Miscellaneous Fees: Watch for penalties for low account balances, paper-statement surcharges, and transfer-out costs. Moving your account to another brokerage could cost you $75 or more.

Here’s a quick glance at how these charges compare:

| Cost Center | What to Watch | Typical Impact |

|---|---|---|

| Commissions & Contract Fees | Options/futures per-contract rate | $0.65 per contract |

| Margin Interest Rates | Annual borrowing cost | Varies; sometimes >10% |

| Payment for Order Flow | Execution price slippage | Indirect, hard to track |

| Miscellaneous Fees | Inactivity, statements, transfers | $10–$75+ per event |

TradeReview is committed to transparency. Explore the TradeReview pricing structure to see how each plan fits your budget—no fine print surprises.

Security Your First Line Of Defense

When you’re trusting a platform with your hard-earned capital, security isn’t optional. Every reputable platform must offer industry-standard measures:

- Two-Factor Authentication (2FA): A second code, usually from your phone, makes your login far tougher to breach.

- SIPC Insurance: In the U.S., this protects your securities up to $500,000 if the brokerage firm fails.

- Encrypted Data Storage: Full encryption keeps your personal details and financial information safe.

Security isn’t just a feature; it’s your foundation. Peace of mind is priceless. When you know your assets are locked down, you can concentrate on executing your strategy without worry.

When You Need Help Is Support Available

Even veteran traders hit snags—a trade that won’t execute, a confusing corporate action on a stock you own, or a sudden platform outage. Here’s how to judge a broker’s support before you commit:

- Availability: Can you call or live-chat with a real human during market hours?

- Expertise: Are the agents knowledgeable about complex trading issues, or are they reading from a script?

- Accessibility: Do they offer phone, chat, and email so you aren’t stuck waiting on one channel?

Solid support can turn a stressful situation into a quick solution—rather than a costly mistake.

Finding the Right Platform for Your Trading Style

At the end of the day, a trader’s long-term success often comes down to choosing tools that fit their personal habits and goals. It’s about looking past the flashy marketing and finding a platform that genuinely supports your daily workflow, encourages discipline, and helps you grow.

For the high-volume, multi-asset professionals who need direct market access, Interactive Brokers is the obvious choice. It offers a gateway to over 150 markets across the globe and maintains highly competitive spreads.

On the other hand, if you’re a new investor who values educational resources and a smooth mobile experience, E-TRADE is a fantastic starting point. It provides clear tutorials, guided order forms, and a helpful community forum to get you going.

Match the Platform to Your Persona

The way you trade dictates which features you’ll actually use. It’s worth taking a moment to figure out where you fit.

- High-Frequency Traders live and die by one-click execution and customizable hotkeys.

- Options Strategists absolutely need multi-leg order builders and solid volatility analytics.

- Swing and Position Traders gain a massive edge from performance journals that sync directly with their brokers.

This table breaks down how each platform serves a specific type of trader.

| Trader Persona | Recommended Platform | Key Benefit |

|---|---|---|

| High-Volume Pro | Interactive Brokers | Global access with low fees |

| New Investor | E-TRADE | Intuitive interface and tutorials |

| Strategy Refiner | TradeReview | Automated journaling and tagging |

Seeing it laid out like this makes it easier to connect your needs to the right tool.

Build Discipline with a Long-Term Mindset

Consistency is your best friend in trading. The first step is to create a solid plan, and the next is to pick a platform that helps you stick to it, especially when emotions run high.

“Discipline isn’t a restriction. It’s the framework that turns tools into consistent results and protects you from your worst impulses.”

Follow these steps to make a smart, sustainable choice:

- Always start with a demo account to get a feel for the order entry system and navigation without risking real money.

- Define your rules for trade size and risk before you start using a live account. For example: “I will not risk more than 1% of my account on any single trade.”

- Set a reminder to review your performance weekly. This helps you learn from both wins and losses and adjust your approach based on data, not emotion.

This simple process helps you avoid impulsive decisions that are often driven by market noise rather than your strategy. By pairing the right platform with disciplined habits, you create a powerful feedback loop for continuous improvement.

Don’t Forget to Balance Costs and Support

Nobody likes surprises on their fee statements or getting stuck with unresponsive support during market hours.

Before committing, make sure to:

- Review the commission tiers and see how they stack up against your average trade size.

- Compare margin interest rates if you plan on using leverage.

- Check that live chat or phone support is available during your trading hours.

| Factor | Key Questions to Ask |

|---|---|

| Fees | How much am I really paying per contract or trade? |

| Margin Rates | What is the annual borrowing cost (APR)? |

| Support Availability | Can I reach a real person when the market is open? |

Let’s be honest—the trading journey is hard enough without your own tools working against you. Hidden costs can slowly eat away at your profits and make the learning process much more frustrating.

Unexpected charges can feel like a betrayal from your broker. Transparency is what builds the trust needed for a long-term partnership.

Ultimately, your goal is to find a platform with clear pricing, strong security, and support you can count on. Your platform is a long-term partner, so choose it wisely.

Remember that every feature should support a disciplined routine and help you avoid emotional trades. Start small, learn your tools, and scale up as you gain confidence. Keep your perspective, be patient with the process, and focus on steady growth over time.

Frequently Asked Questions

Finding the trading platform that fits your style means asking the right questions. Below, we dive into the most common concerns traders face when weighing tools, fees, and features—so you can wrap up your research with confidence.

How Important Are Low Fees Compared To Advanced Tools

It really boils down to your personal trading strategy. If you’re a scalper or high-volume day trader, every fraction of a cent counts. Keeping commissions and spreads (the difference between the buy and sell price) to a minimum is crucial when you’re opening and closing dozens of positions each session.

On the flip side, if you’re a swing trader or long-term investor, the quality of your charts and the depth of your research tools can be far more valuable. In many cases, paying a bit more for a platform with robust analytics:

- Pays for itself by helping you find better entry and exit points.

- Allows you to spot high-probability setups more easily.

- Saves you hours of manual research time each week.

A platform’s fee schedule should empower your strategy, not hinder it. Focus on where you get the most value for your specific style, not just the cheapest ticket to trade.

Can I Use Multiple Trading Platforms At Once

Absolutely—many experienced traders use a combination of platforms. A common practical example is using the powerful charting tools on TD Ameritrade’s thinkorswim to analyze the market, while executing trades on Interactive Brokers to take advantage of their lower fees and faster execution.

That said, if you’re just starting out, it’s best to master one interface first. Trying to learn multiple platforms at once can lead to confusion and costly mistakes. Once you’re confident and consistent, adding a second specialized tool can be a powerful next step.

What Is The Best Way To Test A Platform Before Committing

Nothing beats a paper trading account for getting a real-world feel with zero financial risk. Spend at least a week using it just as you would with real money:

- Practice entering and exiting trades based on your strategy.

- Customize your chart layouts and indicators.

- Test the order types you plan to use (e.g., stop-loss, limit orders).

By the end of the trial period, you’ll have a clear sense of whether the platform feels intuitive and supports your workflow—long before you put your capital on the line.

Ready to turn your trading data into a powerful advantage? TradeReview offers an automated trading journal that syncs with your broker to provide deep performance analytics. Stop guessing and start making data-driven decisions by signing up for free at TradeReview.