Every trader knows the sting of a losing streak or the frustration of repeating the same costly mistakes. We’ve all been there. The difference between those who eventually find their footing and those who wash out often comes down to one tool: a meticulously kept trading journal. It’s arguably the single most effective way to move from emotional, reactive decision-making to a data-driven, strategic approach. A journal isn’t just a log of wins and losses; it’s a mirror reflecting your psychological state, your strategic flaws, and your hidden strengths.

This guide is designed to help you find the perfect system for your needs. We will explore a curated list of the best trading journal examples, from sophisticated software platforms to customizable spreadsheet templates. Each entry includes detailed screenshots, a breakdown of key features, and actionable insights to show you how it works. Our goal is to eliminate the guesswork, helping you find a tool that transforms your raw trading data into a powerful feedback loop for long-term growth. By analyzing real-world entries and diverse layouts, you will discover how to track the metrics that truly matter, identify your unique trading edge, and cultivate the discipline required for consistency. Let’s dive in.

1. TradeReview

TradeReview stands out as a powerful, modern, and remarkably accessible platform for traders seeking a comprehensive journaling solution. It’s built on the principle that detailed trade logging and analysis shouldn’t be gated behind a costly subscription. This free-to-use tool offers a sophisticated suite of features that rival many paid competitors, making it an excellent example of a modern digital trading journal for both new and experienced traders who are serious about improving.

The platform’s strength lies in its blend of flexibility and powerful analytics. Traders can log everything from entry and exit points to custom tags and detailed notes, providing the raw data needed for deep self-reflection. For example, you can take a screenshot of your trade setup, attach it to the entry, and write a note about why you took the trade — e.g., "5-minute ORB setup, felt confident, respected stop-loss." Whether you prefer manual entry, importing a CSV file, or automatic syncing with a supported broker, TradeReview streamlines the often-tedious process of data collection.

Strategic Analysis & Key Features

What elevates TradeReview from a simple logbook to a strategic tool is its analytics dashboard. It visualizes your performance with an interactive calendar, equity curve, and key metrics like win rate and profit factor. This is where the real work of improving as a trader happens. You can filter by asset class, strategy, or custom tags to identify what’s truly driving your results.

Actionable Takeaway: Use the custom tag feature to label your trades with the setup (

e.g., "breakout," "mean reversion") and your emotional state (e.g., "impatient," "focused"). Over time, the analytics will reveal which setups are most profitable and how your psychology impacts your P&L.

The multi-platform support is a significant advantage. With native apps for iOS and Android that sync seamlessly with the web version, you can log a trade from your desktop and review your performance on your phone later. This accessibility encourages the kind of consistent journaling that builds discipline.

Why It’s a Top Choice

For traders wrestling with emotional decisions or struggling to find consistency, TradeReview provides the objective feedback needed for growth. It helps you move from guessing what works to knowing what works.

-

Pros:

- Free: Full access to basic features without any subscription fees, only broker sync is under paywall.

- Cross-Platform Sync: Native iOS, Android, and web apps keep your journal updated everywhere.

- Robust Analytics: The dashboard and visual tools make it easy to spot patterns and weaknesses.

- Flexible Data Input: Supports manual entry, CSV import, and auto-sync for supported brokers.

-

Cons:

- Broker-Dependent Auto-Sync: You’ll need to use CSV imports if your broker isn’t on the supported list.

- Evolving Feature Set: As a user-feedback-driven platform, some niche features found in premium tools may not be available yet.

Website: https://tradereview.app

2. TraderSync

For traders who have outgrown basic spreadsheets and crave deep, automated analysis, TraderSync offers a powerful cloud-based platform. It’s designed to minimize manual data entry and maximize strategic insight, serving as an advanced digital home for your trading records. The platform automatically imports trades from a wide range of brokers, making it an excellent step up for those tired of maintaining a manual Excel trading journal template.

TraderSync excels by transforming raw trade data into actionable intelligence. Its AI-powered engine evaluates your performance and provides targeted feedback, helping you pinpoint specific flaws in your strategy. This feature moves beyond simple win/loss tracking, offering a sophisticated look into the “why” behind your results. Instead of just seeing that you lost money, the AI might point out a pattern — e.g., you consistently lose on trades held for less than 10 minutes.

Strategic Breakdown & Unique Features

What sets TraderSync apart is its emphasis on providing real-world trading journal examples through its public sharing feature. This allows users to view and analyze the journals of other traders, offering a unique educational resource.

- Automatic Imports: Connect your broker account for seamless, error-free trade logging. This feature is a game-changer for active traders, saving hours of tedious work.

- Deep Analytics: The platform generates over 20 performance reports, visualizing everything from your performance by market cap to your P&L on specific weekdays. This helps identify subtle patterns you might otherwise miss.

- Trade Replay: Review your trades tick-by-tick on a chart, allowing you to analyze your entry, management, and exit decisions with perfect hindsight. This is invaluable for refining execution skills.

- AI Insights: An AI assistant analyzes your habits and provides feedback, such as “You tend to overtrade on Fridays,” giving you an unbiased look at your behavioral patterns.

Pricing and Accessibility

TraderSync operates on a subscription model with several tiers, ensuring traders only pay for the features they need. All plans come with a 7-day free trial, allowing for a thorough test run.

- Pro: $29.95/month

- Premium: $49.95/month

- Elite: $79.95/month

While the monthly cost can be a consideration, especially for new traders, the depth of analytics can justify the investment by helping to identify and correct costly trading errors. The platform’s advanced tools are geared toward serious traders committed to long-term performance improvement.

You can learn more by visiting the official website at https://tradersync.com.

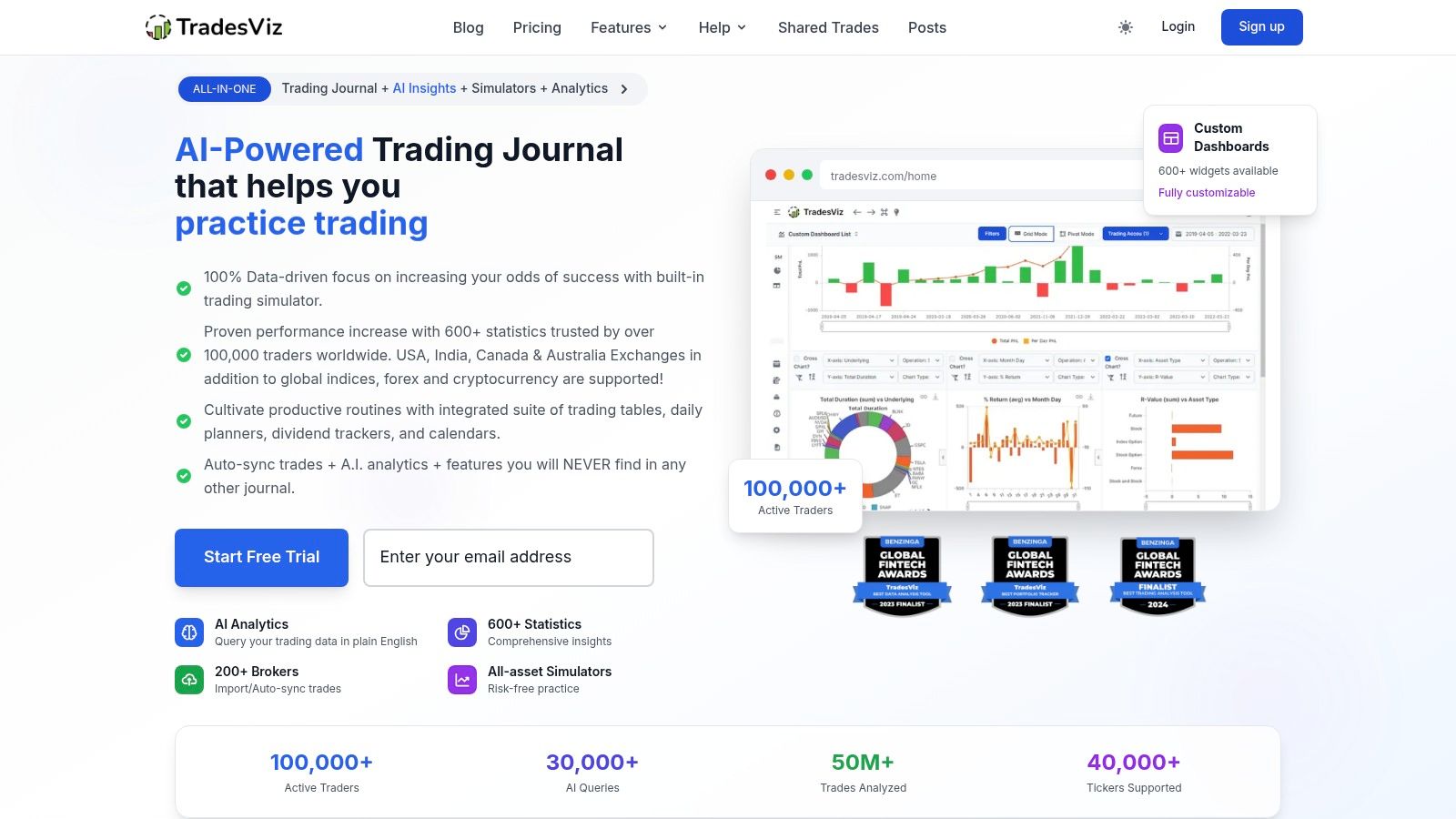

3. TradesViz

For traders driven by data visualization and deep, granular analysis, TradesViz offers a comprehensive suite of tools designed to turn trade history into a powerful learning resource. It functions as an all-in-one trading journal, simulator, and analytics hub, ideal for those who want to explore their performance from every possible angle. With broad broker integrations, it automates the import process, making it a robust alternative for traders seeking more than a manual journal can offer.

TradesViz stands out with its exceptional analytical depth, offering over 400 unique charts and visualizations. Its AI-powered features provide summaries of your trades and even allow you to ask questions about your data, such as “What was my most profitable setup in May?” This transforms your journal from a simple log into an interactive research partner, helping you uncover the subtle habits that define your trading success or failure.

Strategic Breakdown & Unique Features

What makes TradesViz a unique source for trading journal examples is its emphasis on visual storytelling. The platform’s ability to generate multi-chart views and its extensive documentation provide clear examples of how to analyze and interpret complex trading data effectively.

- Extensive Visualizations: Access hundreds of charts covering everything from P&L curves to advanced options analytics. This visual approach helps traders quickly identify strengths and weaknesses that might be hidden in raw numbers.

- AI-Powered Q&A: An AI assistant can generate summaries of your trading days or answer specific questions about your performance, providing personalized and immediate feedback.

- Integrated Trading Simulator: Test new strategies and refine your execution using historical data directly within the platform. This feature allows you to practice without risking real capital, a crucial step in building long-term consistency.

- Generous Free Tier: TradesViz offers a highly functional free plan, allowing new users to explore its core features and workflows before committing to a paid subscription.

Pricing and Accessibility

TradesViz uses a tiered subscription model, with a notable free plan that provides significant value. The best pricing is available with annual billing, which is a consideration for those on a tighter budget.

- Free: $0/month (with execution limits)

- Pro: $14.99/month

- Platinum: $29.99/month

While the interface can feel dense at first due to the sheer number of features, its power justifies the initial learning curve. The platform is geared toward traders who are serious about deep data analysis and continuous improvement, offering professional-grade tools at an accessible price point.

You can learn more by visiting the official website at https://www.tradesviz.com.

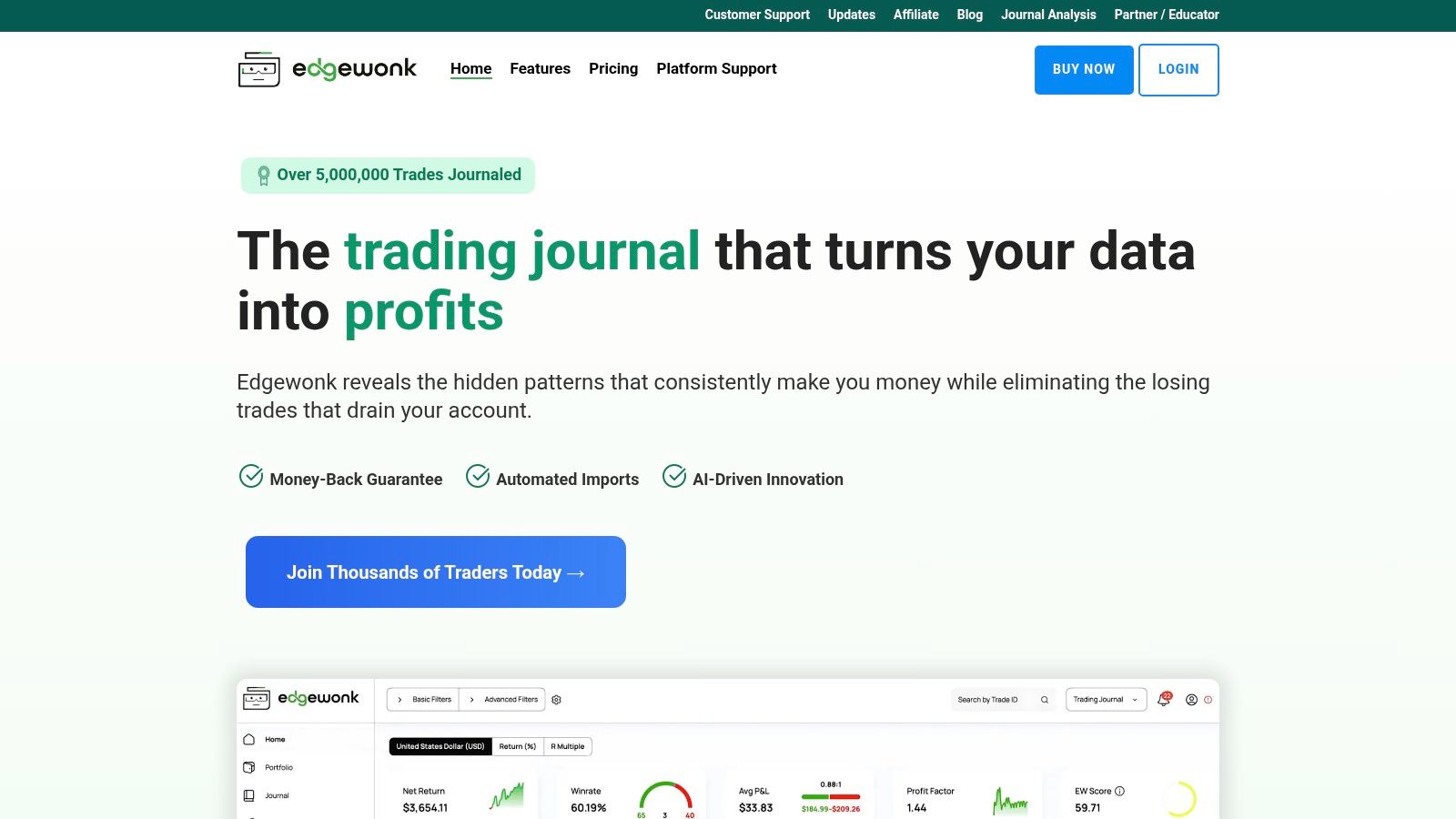

4. Edgewonk

Edgewonk is a premium journaling platform that prioritizes the psychological and process-driven aspects of trading over pure statistics. It’s built for traders who understand that mindset and discipline are just as critical as strategy, offering a structured framework for improvement that goes far beyond simple performance charts. This platform serves as a comprehensive training ground, blending analytics with powerful tools for self-reflection.

Where Edgewonk truly shines is in its ability to help traders identify and correct behavioral flaws. It actively guides you through a review process, encouraging you to analyze your emotional state and decision-making during each trade. For example, after a loss, you might tag the trade with “Revenge Traded” or “Moved Stop-Loss.” Over time, the software shows you exactly how much these emotional mistakes cost you. This makes it an exceptional tool for traders struggling with issues like fear of missing out (FOMO), revenge trading, or inconsistent execution.

Strategic Breakdown & Unique Features

What makes Edgewonk a standout among trading journal examples is its integrated educational approach. It doesn’t just present data; it teaches you how to interpret it for genuine growth, with tools designed to build better habits.

- Psychology Tools: Features like the “Tiltmeter” and mistake tracking help you quantify emotional interference in your trading. By tagging trades with specific psychological errors, you can see exactly how much money your bad habits are costing you.

- Journaling Course: Edgewonk includes a built-in course that teaches a structured approach to journaling. This is invaluable for those new to the practice and provides a solid foundation for how to do a journal entry effectively.

- Best-Exit Analysis: The platform analyzes your trades to show you where the optimal exit would have been, helping you refine your trade management skills and understand when you are leaving money on the table.

- Report Cards: Get customized reports on your performance that highlight your strengths and, more importantly, your weaknesses. This creates a clear, actionable path for improvement.

Pricing and Accessibility

Edgewonk offers a straightforward one-time payment for its desktop-based software, which is a significant departure from the common subscription model. This approach is backed by a 14-day money-back guarantee.

- Edgewonk 3: $169 (One-time payment)

While there is no permanent free tier, the one-time cost can be more economical long-term compared to monthly subscriptions. Edgewonk is ideal for serious traders who are ready to invest in a robust, learning-driven tool that focuses on building a professional trading process from the ground up.

You can learn more by visiting the official website at https://edgewonk.com.

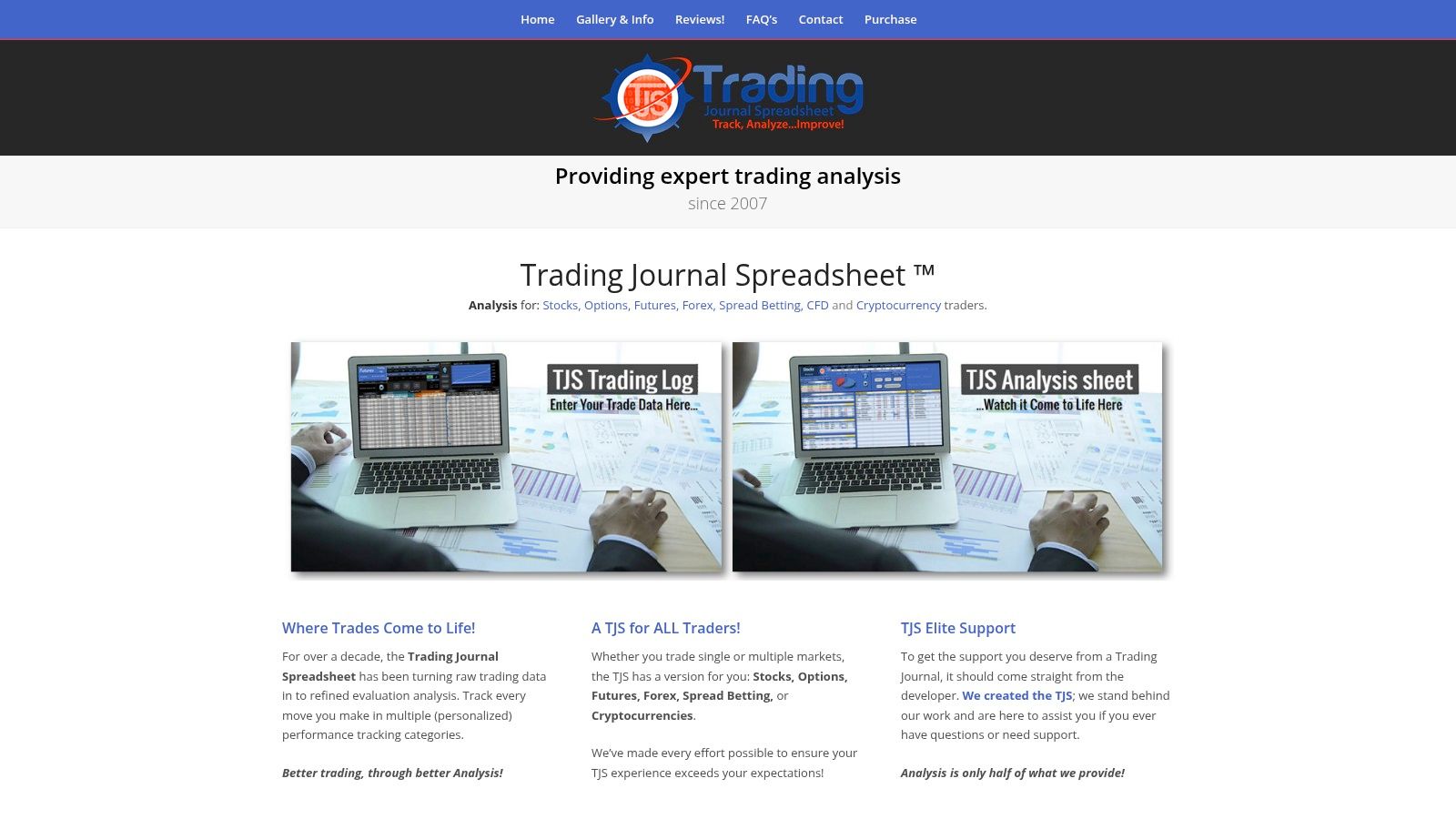

5. Trading Journal Spreadsheet (TJS)

For traders who appreciate the control, customization, and offline access of a traditional spreadsheet, Trading Journal Spreadsheet (TJS) offers a powerful, one-time-purchase solution. It moves beyond a basic template, providing dedicated, feature-rich Excel files for stocks, options, crypto, and more. This approach is ideal for traders who want full ownership of their data without being tied to a monthly subscription or internet connection.

TJS bridges the gap between starting from scratch and using a fully automated platform. It provides the structured analytics of a dedicated service while retaining the flexibility of Excel. The included guides and trading journal examples sheets help users get started quickly, making it a robust choice for those who want to build a deep, personal understanding of their trading habits through hands-on data management. The act of manually entering each trade can itself be a powerful exercise in discipline.

Strategic Breakdown & Unique Features

What makes TJS stand out is its commitment to providing a complete, self-contained system without recurring fees. The pre-built dashboards and market-specific templates save traders the immense effort of creating complex formulas and visualizations from zero, allowing them to focus immediately on analysis.

- Market-Specific Journals: Choose a spreadsheet designed specifically for your asset class (stocks, options, futures, forex, crypto) or an all-markets bundle for maximum versatility.

- Pre-Built Analytics Dashboards: The journal automatically populates detailed dashboards with key metrics like win rate, average gain/loss, and performance by setup, providing an instant visual overview of your trading performance.

- One-Time Purchase: Pay once for lifetime access to the spreadsheet files, updates, and support. This model is highly cost-effective for long-term traders.

- Full Customization & Offline Access: Since it’s an Excel file, you have complete control to modify, add, or remove any element to fit your unique strategy. You can also log and review trades without needing an internet connection.

Pricing and Accessibility

TJS operates on a straightforward one-time purchase model. The price varies depending on the specific journal you choose, with a comprehensive bundle available for multi-asset traders.

- Individual Journals: Typically range from $99 to $159 (one-time fee).

- All-Markets Bundle: Offers the best value for traders active in multiple markets.

While it requires Microsoft Excel and some basic spreadsheet familiarity, the one-time cost provides exceptional long-term value. It’s an excellent fit for disciplined traders who prefer granular control and want to avoid the cumulative expense of subscription-based platforms.

You can explore the different options at the official website: https://trading-journal-spreadsheet.com.

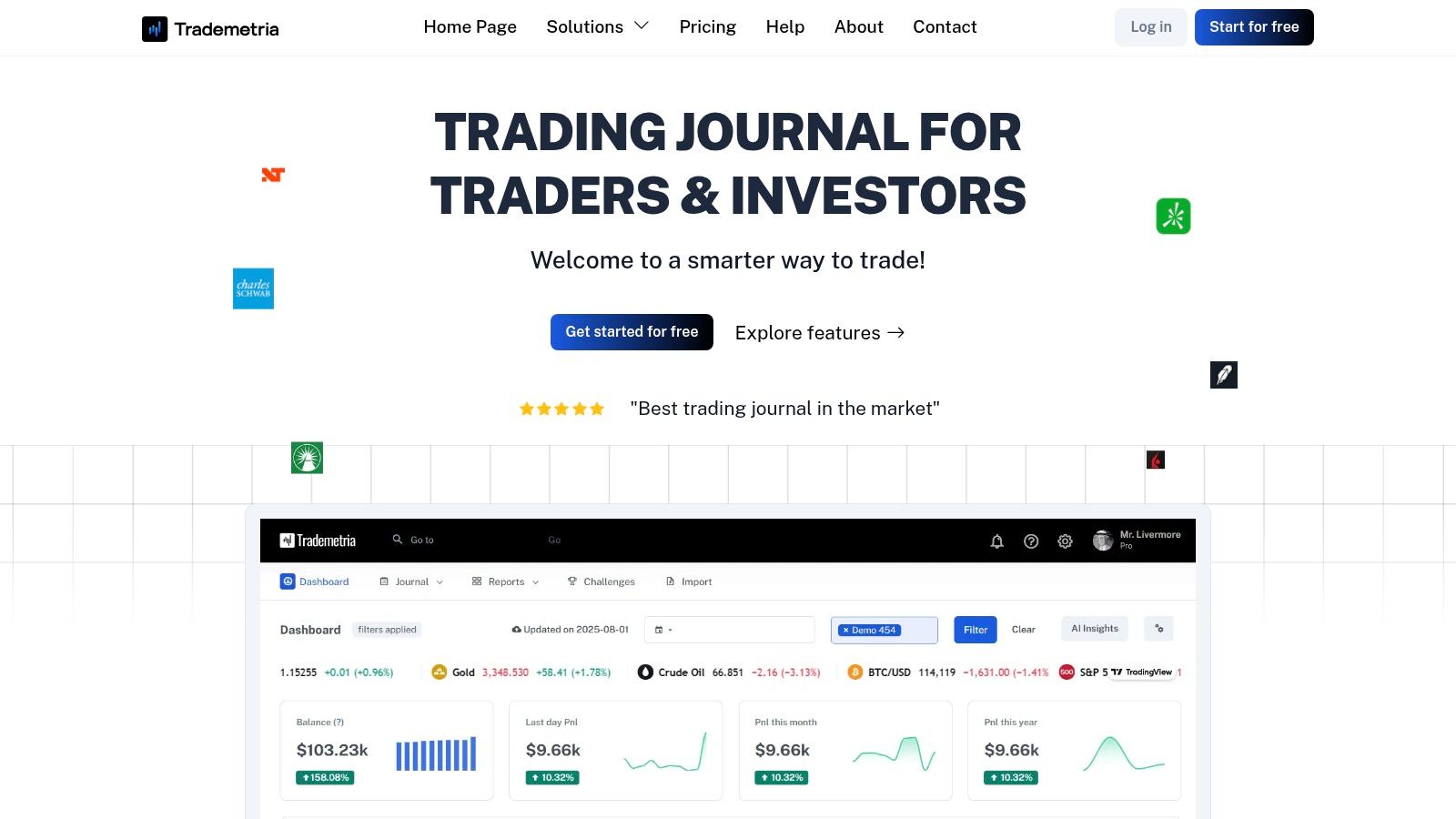

6. Trademetria

For traders seeking a robust yet accessible entry point into digital journaling, Trademetria offers a versatile platform that scales with your experience. It strikes a balance between user-friendliness for beginners and the powerful analytics required by seasoned traders, making it an excellent choice for those who want to start journaling without a financial commitment, thanks to its generous free tier.

Trademetria simplifies the transition from manual logs by supporting imports from over 140 brokers, significantly reducing setup time. Its combination of a daily journal, individual trade notes, and a portfolio tracker creates a comprehensive ecosystem for performance review. This integrated approach allows you to connect your strategic mindset — e.g., your pre-market plan — with your actual trading results in one cohesive space.

Strategic Breakdown & Unique Features

What makes Trademetria a standout choice is its powerful free plan, which provides a comprehensive look into professional trading journal examples and functionality without an upfront cost. It’s also notable for its deep integration of fundamental research tools, allowing you to analyze not just your trading behavior but also the underlying assets you trade.

- Generous Free Plan: Get started with up to 30 trades per month, real-time quotes, and basic analytics. This is perfect for new traders wanting to build the habit of journaling.

- Broad Broker Integration: Automate your trade logging by connecting your accounts or using CSV imports, ensuring your journal is always accurate and up-to-date.

- AI-Powered Insights: The platform’s AI assistant analyzes your trading data to identify behavioral patterns and offers objective feedback, helping you spot weaknesses you might overlook.

- Integrated Research Tools: Access fundamental data and watchlists directly within the journal, bridging the gap between market analysis and trade execution review.

Pricing and Accessibility

Trademetria uses a freemium model, making it highly accessible. The free plan is robust, while paid tiers unlock higher trade limits and more advanced features.

- Free: $0/month (with limitations)

- Basic: $29.95/month

- Pro: $49.95/month

The free tier is an invaluable resource for trialing the platform’s workflow and features. While the lower-tier plans have order and position caps, the feature set on paid plans is competitive, particularly for traders managing multiple accounts across different markets.

You can learn more by visiting the official website at https://trademetria.com.

7. Etsy (trading journal templates)

For traders who prefer a hands-on, customizable approach without the commitment of a monthly subscription, Etsy is a treasure trove of downloadable trading journal templates. This global marketplace connects independent creators with traders seeking ready-to-use solutions for Excel, Google Sheets, Notion, and even printable PDFs. It’s an excellent, low-pressure starting point for building a disciplined tracking habit from scratch.

Etsy’s value lies in its sheer variety and affordability. You can find everything from a simple, one-page P&L tracker to a multi-tabbed behemoth with advanced dashboards and psychological evaluation sections. Because these are one-time purchases, you own the file and can modify it endlessly to suit your evolving trading style — a level of control not offered by software platforms.

Strategic Breakdown & Unique Features

What makes Etsy unique is the community-driven variety, offering countless trading journal examples at very low price points. You’re not just buying a product; you’re often getting a template refined by a fellow trader who understands the daily struggles and data points that matter most.

- Immense Variety: Choose from thousands of templates designed for different needs, including day trading, swing trading, options, or crypto. Formats range from digital files for GoodNotes on an iPad to powerful Google Sheets dashboards.

- Instant Digital Access: After a one-time payment, you get an immediate download link. There are no recurring fees or subscriptions, making it a budget-friendly option for traders at any level.

- User Ratings and Reviews: Each listing includes reviews from other traders, helping you gauge the quality, functionality, and user-friendliness of a template before you buy. This transparency is key to avoiding low-quality products.

- Customization Potential: Since you receive the source file (like an Excel or Sheets document), you have complete freedom to add, remove, or change columns and formulas to perfectly match your strategy.

Pricing and Accessibility

Etsy is arguably the most accessible option, with prices dictated by individual creators. This makes it a fantastic, low-risk entry point for traders new to journaling.

- One-Time Purchase: Most digital templates range from $5 to $30.

- No Subscription: You buy the template once and own it forever.

- Instant Delivery: Digital files are available for download immediately after purchase.

The primary trade-off is the lack of automation and support. Quality can vary significantly between sellers, and you won’t find features like automatic broker imports. However, for the trader who values control and wants an affordable, customizable foundation, Etsy provides an unmatched selection. Want to see what a completed one looks like? You can find an in-depth trading journal example to see how these templates are used in practice.

You can browse the available templates by visiting the official website at https://www.etsy.com/market/trading_journal_template.

Top 7 Trading Journal Comparison

| Product | Complexity 🔄 | Resource & Setup ⚡ | Expected outcomes ⭐ / 📊 | Ideal use cases 💡 | Key advantages ⭐ |

|---|---|---|---|---|---|

| TradeReview | Low — beginner‑friendly UI; quick onboarding 🔄 | Low — free, web + native apps; optional broker sync or CSV ⚡ | Reliable trade logs and clear metrics (win rate, profit factor, equity curve) ⭐📊 | New to intermediate traders wanting synced, no‑cost journaling 💡 | Free + cross‑platform + strong core analytics ⭐ |

| TraderSync | Medium — feature‑rich, tiered features; some learning curve 🔄 | Medium — subscription tiers, 7‑day trial, auto broker imports available ⚡ | Deep replay and strategy validation; sharable entries for review ⭐📊 | Traders needing trade replay, strategy checking and public examples 💡 | Detailed trade replay, auto imports, strategy tools ⭐ |

| TradesViz | High — very dense analytics and many visualizations; steeper learning curve 🔄 | Medium — free tier to test; best value with paid annual plans; many integrations ⚡ | Extensive visual analysis, AI summaries and simulator outputs ⭐📊 | Advanced traders/quant users wanting deep charts and simulation testing 💡 | 400+ visualizations, AI Q&A, integrated simulator ⭐ |

| Edgewonk | Medium — structured journaling focused on process and psychology 🔄 | Medium — premium product (paid); includes courses and support ⚡ | Behavior/process improvement, psychology tracking, MAE/MFE insights ⭐📊 | Traders focused on skill development, discipline and long‑term improvement 💡 | Psychology tools, report cards and journaling course ⭐ |

| Trading Journal Spreadsheet (TJS) | Medium — spreadsheet customization requires Excel skills 🔄 | Low — one‑time purchase, offline Excel files; fully owned data ⚡ | Complete offline control and customizable performance dashboards ⭐📊 | Traders wanting full ownership, offline use and heavy customization 💡 | Lifetime use after one payment; highly customizable ⭐ |

| Trademetria | Low–Medium — beginner‑friendly with scalable features 🔄 | Medium — free tier + paid tiers; imports from 140+ brokers; AI assistant ⚡ | Fast trial workflows, portfolio tracking and fundamentals integration ⭐📊 | Traders who want to trial free then scale, with research tools 💡 | Robust free plan, broad broker support and AI insights ⭐ |

| Etsy (templates) | Variable — templates range from plug‑and‑play to complex 🔄 | Very low — one‑time low cost, instant downloads, manual setup ⚡ | Quick starter journals and customizable layouts; largely manual analysis ⭐📊 | Hobbyists or beginners seeking cheap, ready‑made templates or unique layouts 💡 | Huge variety, low price, instant access to many formats ⭐ |

Your Journal, Your Edge: Turning These Examples into Your Reality

We’ve journeyed through a diverse landscape of powerful trading journal tools, from the advanced analytics of platforms like TraderSync and TradesViz to the customizable depth of Edgewonk and dedicated spreadsheets. Each of the trading journal examples showcased offers a unique path toward the same destination: a deeper, more objective understanding of your own trading behavior.

The ultimate goal isn’t just to find the “best” journal; it’s to build a system that transforms your raw trading data into a distinct, personal edge. Your journal is more than a record-keeper. It’s an accountability partner, a strategic advisor, and the most honest mirror you will ever have in your trading career. It’s where you confront emotional decisions, celebrate disciplined execution, and uncover the subtle patterns that either build your account or slowly drain it.

From Inspiration to Implementation

Merely looking at these trading journal examples is not enough. The real work begins now. To turn these insights into tangible results, you must bridge the gap between inspiration and consistent action. This process is intensely personal, but here are some actionable steps to guide you:

- Identify Your Biggest “Leak”: Where are you losing the most money or feeling the most frustration? Is it revenge trading after a loss? Holding losers too long? Sizing positions improperly? Let the answer to this question guide your initial journaling focus.

- Choose a Tool That Solves That Problem: If you struggle with emotional discipline, a tool with a psychological tagging feature like Edgewonk might be best. If you need to visualize your setup performance across hundreds of trades, a platform with advanced filtering like TradesViz or TradeReview is ideal. If you’re on a budget and love customization, a spreadsheet is your best starting point.

- Commit to a “Minimum Viable” Entry: Don’t try to log 30 data points for every trade on day one. Start with the essentials: Entry price, exit price, position size, setup/strategy, and one or two sentences on your mindset. Consistency is far more valuable than complexity, especially in the beginning. Build the habit first, then expand the details.

Final Thoughts on Forging Your Path

Remember, the perfect trading journal is not one you find; it’s one you build. It evolves with you as you grow from an aspiring trader into a seasoned professional. The examples we’ve explored, from sophisticated software to simple Etsy templates, all serve the same fundamental purpose: to help you stop guessing and start knowing. They provide the framework for you to analyze your past, execute with clarity in the present, and strategically plan for a more profitable future.

Your journal is your private dojo, the place where you refine your skills away from the noise of the market. Embrace the process, be brutally honest with yourself, and commit to the long-term work of self-analysis. The discipline you forge here will become the bedrock of your trading success.

Ready to see one of the most intuitive and powerful trading journal examples in action? TradeReview combines automated trade importing with a clean, visual interface, making it effortless to analyze your performance and find your edge. Start your journey toward consistent profitability by exploring what TradeReview can do for you.