Tracking stock trades is the disciplined act of logging the details of every buy and sell. It means recording key data for every single transaction — like your entry price, exit price, and position size — to build an accurate, objective record of your performance. This isn’t just boring data entry; it’s the foundation for spotting patterns, managing risk, and making decisions based on facts, not fear or greed.

The Untapped Edge of Tracking Stock Trades

Let’s be real — most traders know they should track their trades, but very few actually do it consistently. It feels like a chore, just one more thing to do after a long day staring at charts. But this simple habit is probably the most powerful tool you’re not using. It’s what separates your perceived skill from your actual, data-proven performance.

Without a detailed record, your memory calls the shots, and it’s a terrible bookkeeper. Our minds are hardwired with psychological traps that warp how we see our own trading.

- Recency Bias: You hit a massive win and suddenly feel invincible, ready to take on way too much risk. You completely forget the string of small losses that came right before it.

- Confirmation Bias: You’re stuck in a losing trade, so you desperately search for any scrap of information that confirms your original thesis, all while ignoring the mountain of evidence telling you to get out.

- Selective Memory: We remember our biggest wins in glorious detail but have a funny way of forgetting the dozens of small, undisciplined trades that slowly bleed an account dry.

A trading journal is the ultimate reality check. It’s an objective mirror that doesn’t care about your ego or how you feel — it just shows you the cold, hard data of your decisions.

From False Confidence to Real Improvement

To see what this looks like in the real world, let’s talk about a trader named Alex. Alex was convinced his edge was in fast-paced, high-momentum stocks. He loved the adrenaline rush of quick entries and exits, and his most memorable wins all came from those explosive moves. He thought this was his “bread and butter.”

But after a particularly rough month, he finally buckled down and started logging every trade in a journal. A few weeks later, the data told a story he wasn’t expecting. Yes, his momentum trades delivered a few spectacular wins, but they were also responsible for a steady stream of small, frustrating losses that completely erased those gains and then some.

The real shocker? His journal showed that his most consistent profits were coming from patient swing trades he held for several days. These “boring” trades, the ones he barely even remembered placing, were quietly and methodically growing his account.

This is the entire point of a trading journal: it exposes the gap between what you think works and what actually works. It forces you to replace gut feelings with undeniable proof.

Perception vs. Reality: How a Journal Reveals the Truth

It’s common for our trading reality to be misaligned with our perception. A journal is the tool that brings everything into focus, correcting the biases our brains naturally create.

| Trading Aspect | Common Perception Without a Journal | Data-Driven Reality With a Journal |

|---|---|---|

| Best Strategy | “My scalp trades on tech stocks are my biggest winners.” | “My swing trades on ETFs actually have a 70% win rate, while my tech scalps are break-even at best.” |

| Risk Management | “I’m disciplined. I always stick to my stop-loss.” | “Data shows I move my stop-loss on 40% of losing trades, significantly increasing my average loss.” |

| Trading Times | “I’m a great morning trader; I catch all the opening volatility.” | “My P/L is negative before 10:30 AM. My most profitable trades happen during the lunch lull.” |

| Holding Period | “I make the most money on quick flips.” | “The average hold time for my winning trades is 3 days, while my losers are held for just 2 hours.” |

This table shows exactly why relying on memory is a losing game. The journal provides the objective truth needed to make real, profitable adjustments.

Surviving in High-Speed Markets

In today’s markets, structured trade tracking is more than an edge — it’s a survival tool. The average daily trading volume for U.S. equities recently hit 12.2 billion shares, according to SIFMA. With global equity market capitalization soaring to $126.7 trillion and foreign activity in U.S. securities hitting $134.7 trillion, the sheer speed and complexity can be overwhelming.

Think about it. An active trader taking just 5–10 trades a day is making over 1,000 unique decisions a year. Without a systematic journal, trying to honestly review that much activity to find meaningful patterns is nearly impossible. You can dive deeper into this data with SIFMA’s research.

Ultimately, tracking your trades isn’t just about logging numbers. It’s about treating your trading like a business — transforming random actions into a refined strategy built on a foundation of your own personal data.

How to Set Up Your Digital Trading Journal

Getting your first trading journal up and running is way easier than you might think. You don’t need fancy software or a data science degree. The real goal is just to get something in place today so you can start logging your trades. This is the raw data that will eventually become your edge.

Right off the bat, you have two great options: the do-it-yourself spreadsheet or a more modern, automated tool.

Neither one is “better” — they just serve different needs. A spreadsheet gives you complete, granular control. An automated journal, on the other hand, saves you a ton of time and unlocks powerful analytics. Let’s walk through how to get started with both.

The Do-It-Yourself Spreadsheet Approach

If you love simplicity and want to be hands-on with your data, a spreadsheet is a fantastic place to start. It’s free, you can customize it endlessly, and it forces you to really engage with every single trade you log. Whether you use Google Sheets or Microsoft Excel, you can build one from scratch or find a pre-made template online to speed things up.

The structure is everything. At the bare minimum, your journal needs these essential columns to be useful for tracking stock trades:

- Ticker: The stock symbol (e.g., AAPL, TSLA).

- Entry Date & Price: When you got in and what you paid per share.

- Exit Date & Price: When you sold and the price you got.

- Position Size: How many shares you traded.

- P&L (Profit & Loss): The bottom-line gain or loss from the trade.

These basics will get you a raw P&L, but the real magic happens when you add columns that explain the why behind the trade.

A great journal doesn’t just record what happened; it investigates why it happened. Adding context is how you transform a simple log into a powerful feedback loop for your trading decisions.

To get those deeper insights, you’ll want to add some more advanced fields to your sheet:

- Strategy: The specific playbook you were running (e.g., Breakout, Mean Reversion, Dip Buy).

- Setup: The technical or fundamental reason you pulled the trigger (e.g., Flag Pattern, Earnings Beat).

- R-Multiple: Your risk-to-reward ratio. This measures your profit in terms of your initial risk.

- Emotions: A quick note on your mindset (e.g., Confident, FOMO, Anxious).

- Notes/Screenshot: A quick thought on your execution or a snapshot of the chart at the time of entry.

Putting together a spreadsheet with all of this can take some time. If you want to skip the setup and get right to logging, you can often find comprehensive trading journal templates online for Google Sheets or Excel that already have these fields built-in.

The Automated Journaling Tool

Let’s be honest, the biggest downside to spreadsheets is human error and the time it takes to enter everything manually. For any active trader, this can quickly become a bottleneck that kills consistency.

This is where dedicated journaling platforms like TradeReview really shine.

The game-changer is auto broker sync. Instead of typing in every entry, exit, and commission, you just securely connect your brokerage account. The platform pulls in your entire trade history automatically, which means no more typos and hours saved every single week.

This automation isn’t just about saving time; it’s about making sure your data is 100% accurate. This clean data then fuels built-in analytics dashboards, instantly calculating your win rate, profit factor, and other key metrics without you having to touch a single formula. Setting one up is simple and usually involves a secure, read-only connection that keeps your account info safe and private.

The Anatomy of a High-Impact Trade Log

A great trade log does more than just track numbers; it tells the story behind every decision you make. The basics — entry price, exit price, commissions — are just the skeleton. The real value, the heart and soul of your journal, comes from the qualitative details. This is how you go from simple bookkeeping to building a powerful tool for tracking stock trades.

It’s one thing to know what trade you took. It’s a whole different ballgame to understand why. This is where your journal stops being a simple record and starts becoming a blueprint for your future self. It’s the difference between saying, “I lost money,” and realizing, “I lost money because I chased an overextended stock out of FOMO instead of waiting for my A+ setup.”

Beyond the Numbers: The Qualitative Edge

If you’re serious about improving, you have to start documenting the context around each trade. This means capturing your thoughts, your emotions, and what the market was doing at that exact moment. Think of it as creating a personal case study for every single position you take.

Here are the qualitative details you absolutely need to be logging:

- Your Trading Thesis: Before you even think about hitting the “buy” button, you need a clear, specific reason. Write it down. Was it a technical breakout over a key resistance level? A fundamental catalyst like a surprise earnings beat? Be specific — “I bought because it looked like it was going up” is a hope, not a thesis.

- Your Emotional State: Time for some brutal honesty. Were you calm and confident, executing your plan to a T? Or were you feeling anxious, chasing a stock that was running away from you? Maybe you were even revenge trading after a loss. Tagging your emotions is one of the quickest ways to pinpoint your most expensive habits.

- The Market Environment: What was the overall market doing? Was it a strong uptrend, a choppy mess, or a sea of red? A strategy that works well in a bull market might get you absolutely steamrolled in a sideways grind. Noting this context helps you figure out which strategies work best under specific conditions.

A Real-World Example: An Earnings Play

Let’s walk through a practical example. Imagine a trader, Sarah, decides to trade NVDA after its quarterly earnings report. A basic log would just show the P&L. A high-impact log tells the whole story.

Basic Entry:

Bought 10 NVDA @ $910, Sold @ $900. Loss: -$100.

High-Impact Entry:

- Thesis: “NVDA reported a massive earnings beat and raised guidance. Gapped up but sold off at the open. My plan is to buy the dip if it reclaims the opening price of $910, targeting a move to pre-market highs around $925. Stop-loss is a break below the morning low of $905.”

- Emotional State: “A bit anxious. The stock is moving fast, and I’m feeling some FOMO, worried I’ll miss the real move.”

- Execution Notes: “Jumped in at $910 as planned, but my size was a little too big out of overconfidence. It failed to hold and broke the morning low. I hesitated for a second on my stop before exiting at $900, taking a bigger loss than I planned.”

See the difference? The second entry is a goldmine. Sarah can now see her thesis was solid, but her execution was sloppy due to emotion (FOMO) and poor risk management (hesitating on the stop). This is how you actually learn.

This level of detail is non-negotiable in today’s fast-paced markets. The pressure is on, especially with the explosion in options and derivatives trading. As an example of market volume, Cboe reported a staggering 4.6 billion contracts traded across its U.S. options exchanges in a single year, with an average daily volume of 18.4 million contracts.

In an environment this intense, a detailed journal is your best defense against emotional decisions and overtrading. It forces you to be objective.

By consistently logging this kind of rich, qualitative data, you’re building a personalized playbook from your own experience. It’s what stops you from making the same costly mistakes over and over, turning every single trade — win or lose — into a priceless lesson.

Turning Your Trade Data into Actionable Insights

Your journal is now a goldmine of information, capturing the details of every single trade. But let’s be honest, raw data is just noise. The real reason for tracking stock trades is to find the signal in that noise — clear, actionable insights that will sharpen your decision-making. It’s time to put on your analyst hat.

When you start digging into your own performance, you uncover the patterns that define your unique edge as a trader. You don’t need a degree in statistics for this. It’s about asking simple but powerful questions and letting your trade history give you the brutally honest answers.

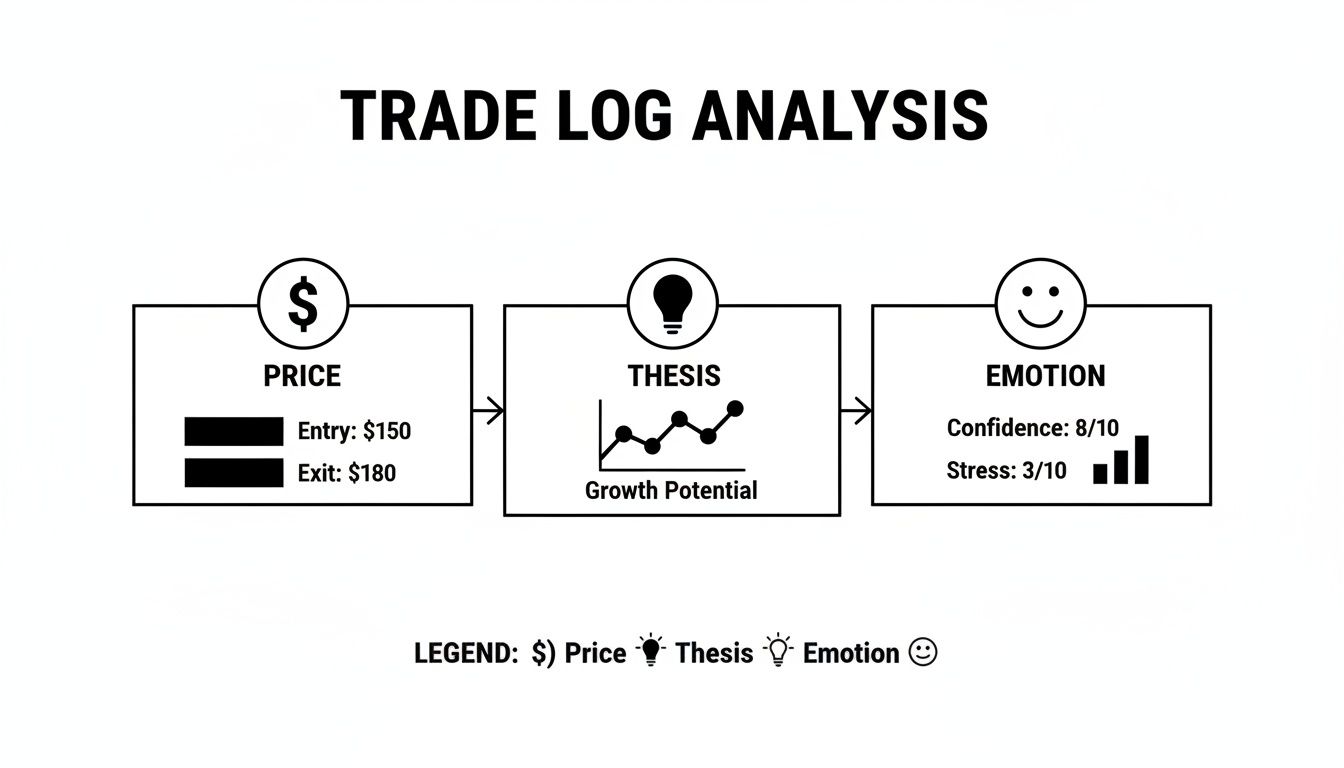

The diagram below breaks down the essential pillars of a great trade log: the price action, your thesis for entering, and your emotional state. These are the building blocks of your analysis.

This serves as a great reminder that a proper review goes way beyond just the final profit or loss. You have to look at the whole picture, from your initial strategy to your state of mind when you clicked the button.

Demystifying Core Trading Metrics

First things first, you need to get familiar with a few key metrics. These aren’t just for show; each one tells a critical part of your trading story. Focusing on just these will give you a surprisingly clear picture of what you’re doing right and where you’re going wrong.

Here’s a quick look at the most important trading metrics and what they can tell you about your performance.

Key Trading Metrics and What They Reveal

| Metric | What It Measures | What It Reveals About Your Trading |

|---|---|---|

| Win Rate | The percentage of trades that end in profit. | Shows how often you’re right, but it’s only half the story. A high win rate can be dangerously misleading without context. |

| Average Gain vs. Average Loss | The average dollar amount of your winning trades compared to your losing trades. | This exposes the real health of your strategy. Are your winners big enough to cover your losers and then some? |

| Profit Factor | Total gross profits divided by total gross losses. | This is your bottom line. A Profit Factor over 1.0 means you’re profitable. The higher the number, the better your edge. |

These metrics work together to paint a full picture. For example, a trader might brag about an 80% win rate, which sounds incredible on the surface. But if their average win is only $50 while their average loss is a painful $400, they are bleeding money fast. Their profit factor is a dismal 0.25.

On the flip side, another trader might only have a 40% win rate. But if their average win is $500 and their average loss is just $100, they have a stellar profit factor of 2.0. That’s a robust, winning strategy.

Your goal isn’t just being right. It’s about making sure your wins are significantly bigger than your losses. Tracking these numbers is the only objective way to know if you’re succeeding.

Visualizing Your Performance with an Equity Curve

If there’s one chart you should live by, it’s your equity curve. This simple line graph plots your account balance over time, and it’s the ultimate truth-teller. In a single glance, it shows your consistency, risk management (or lack thereof), and overall progress.

A smooth, steadily rising curve is the goal — it signals a healthy, consistent strategy. A choppy, volatile curve with deep drawdowns (the drops from a peak to a trough) is a red flag. It tells you you’re either taking way too much risk or your system has serious flaws. The visual feedback is instant and forces you to confront the periods where things went off the rails.

The Power of Filtering and Tagging

This is where all that detailed logging you’ve been doing really starts to shine. The tagging system you built is now a powerful analytical tool, letting you slice and dice your data to answer incredibly specific questions. You can finally stop guessing what works and start knowing.

Now that you have all this tagged data, you can ask things like:

- Does my “Breakout” setup work better on tech stocks or biotechs?

- What’s my win rate on trades I place in the first hour of the market open?

- Am I more profitable on my long positions or my short positions?

- How much money did I lose on trades I tagged with the “FOMO” emotion?

Trying to answer these in a basic spreadsheet can be a bit of work, but the insights are worth their weight in gold. For traders who want to get serious about this kind of analysis, learning how to build a pivot table can be a game-changer for organizing and exploring your results.

By filtering your trade history, you can finally identify with certainty what’s working and — just as importantly — what’s not. From there, the path is simple: do more of what works and cut out what doesn’t.

Advanced Journaling Techniques for Serious Traders

Once you’ve made logging your trades a consistent habit, it’s time to go deeper. This is where you graduate from simply keeping a logbook to using a high-performance analytical tool. For serious traders, this is how you start fine-tuning your strategies and uncovering the subtle patterns that actually define your edge.

We’re not just talking about adding a few more columns to a spreadsheet. Think of it like a pro athlete reviewing game tape — breaking down every single decision to find those small, critical opportunities for improvement.

Standardize Your Performance with R-Multiples

One of the biggest leaps you can make is to stop measuring your trades in dollars and cents alone. Sure, a $500 profit feels great, but what does it really tell you? That number is meaningless without context. Was it a $50 risk or a $490 risk? The answer changes everything.

This is where R-multiples come in. “R” is just your initial risk — the amount of money you’re prepared to lose if your stop-loss gets hit. When you measure your trades in terms of R, you standardize performance across the board, no matter your position size.

It’s a simple but powerful concept:

- You risk $100 and make $300. That’s a +3R gain.

- You risk $100 and lose $100. That’s a -1R loss.

- You risk $100 and get out at break-even. That’s a 0R trade.

Tracking R-multiples helps you answer the most important question: “Is my strategy actually generating rewards that justify the risks?” It strips away the emotional highs and lows of big dollar wins, forcing you to focus purely on the quality of your execution.

Build a Sophisticated Tagging System

A smart tagging system is your secret weapon for finding patterns you never knew existed. Instead of a single “Strategy” tag, you can create layers of tags to dissect your performance under all kinds of conditions. This level of detail in tracking stock trades brings incredible clarity.

Start by thinking in categories for different parts of your trading.

Market Condition Tags

What was the bigger picture when you entered the trade? Context is everything. A strategy that prints money in one market environment might get absolutely crushed in another.

- Bull Trend: The overall market is clearly heading up.

- Bear Trend: The market is in a sustained downtrend.

- Choppy Range: The market is going nowhere, just consolidating.

- High Volatility: The VIX is elevated and price swings are wild.

Psychological State Tags

This is where you have to be brutally honest with yourself. Tagging your emotional state when you took the trade can be one of the most eye-opening things you’ll ever do.

- FOMO Entry: Chased a stock because you couldn’t stand to miss out.

- Revenge Trading: Jumped into another trade to make back what you just lost.

- Peak Confidence: Felt clear, focused, and executed the plan perfectly.

- Hesitation: Waited too long to pull the trigger and got a bad entry.

Your biggest losses almost always have an emotional story attached. By tagging these moments, you create a data-driven map of your psychological triggers, showing you exactly which mindsets cost you the most money. This is the first step toward fixing those expensive habits.

Add Visual Context with Chart Screenshots

Words can only say so much. Nothing beats a picture. Attaching a screenshot of the chart from the moment of your entry and exit provides visual context you just can’t get from text. Be sure to mark up your entry, exit, and stop-loss levels right on the image.

When you’re reviewing your journal weeks or months from now, those charts will instantly bring you back to that moment. You’ll see the exact price action, the setup you thought you saw, and how it all played out. This visual feedback loop is incredibly powerful for refining your entries and exits. It’s a non-negotiable part of a robust process for tracking stock trades, giving you a clear “before and after” snapshot of your decisions.

Building the Discipline for Consistent Journaling

Knowing how to set up a journal is one thing. Actually doing it every day is where the real work begins.

This is where most traders fail. It’s especially tough after a big loss when the last thing you want to do is stare your mistakes in the face. But building this discipline is what separates dedicated traders from everyone else. This is the human side of tracking stock trades.

The trick is to reframe how you think about journaling. It’s not a chore. It’s a non-negotiable part of your trading process, just as critical as finding a setup or executing an order. Think of it as your post-game analysis — the moment you step away from the noise and become an objective observer of your own performance.

Your Daily Game Tape Review

Pro athletes don’t just walk off the field and hope for the best next time. They spend hours poring over game tape, breaking down what worked, what didn’t, and where they can get an edge. Your trading journal is your game tape.

To make this a real habit, you need to schedule it. Block out just 15-20 minutes at the end of each trading day for your ‘game tape review.’ During that window, your only job is to log your trades and jot down your thoughts while the decisions are still fresh.

This simple routine accomplishes a few powerful things:

- It builds structure and takes the guesswork out of when you’ll get it done.

- It brings closure to your trading day, helping you mentally sign off.

- It creates a positive feedback loop that reinforces a professional habit.

Think Like a Business Owner

Your trading is a business, plain and simple. Not a hobby.

No serious business owner would ever operate without a ledger to track revenue, expenses, and performance. Your journal is that exact ledger. It’s the ultimate source of truth for what’s actually working in your business and what’s quietly draining your capital.

Every trade you log, win or lose, is an investment in your own education. It’s a data point that compounds over time, building an invaluable library of your personal trading history. This is your most reliable path to genuine, sustainable growth.

You have to embrace this long-term view. You’re not going to discover some earth-shattering insight after just three trades. But after 50 or 100 trades? The patterns will be impossible to ignore.

That’s when you’ll clearly see your strengths, your weaknesses, and the exact habits costing you real money. The discipline you build today pays dividends for years to come.

A Few Common Questions

Even with the best intentions, building the habit of tracking your trades can bring up a few questions. That’s perfectly normal. Let’s tackle some of the most common hurdles traders hit when they first get started.

How Long Until I See Results from Tracking My Trades?

You’ll probably notice little things almost right away, like realizing you completely forgot to account for commissions on a trade. But the big, actionable patterns? Those usually start to surface after you’ve logged at least 50-100 trades.

That sample size is typically enough to start showing you which setups are actually making you money, where you consistently trip up, and the kind of market conditions you seem to navigate best. The real magic is in consistency — this is a long-term game of steady improvement, not an overnight fix.

Is a Spreadsheet Good Enough, or Should I Use a Dedicated App?

Honestly, starting with a simple spreadsheet is way better than doing nothing. It gets the ball rolling, forces you to engage with your own data, and builds the core habit.

But a dedicated journaling tool like TradeReview brings some serious advantages to the table. Automated broker syncs mean no more tedious data entry (or the typos that come with it). You get instant analytics without having to become a spreadsheet wizard building complex formulas. Plus, features like advanced tagging and attaching chart snapshots give you a much richer, more efficient way to review your trades.

A losing trade isn’t a failure; it’s a data point. Think of each logged loss as a tuition payment to the market — a valuable lesson on what not to do next time.

How Do I Stay Motivated When Logging Losing Trades?

It’s easy to log a huge win and feel great about it. It takes real discipline to sit down and dissect a loss. It’s natural to feel a sting, but this is where a mental shift is absolutely critical.

Instead of focusing on the red P&L number, try to celebrate the act of logging itself. You’re doing the work that most traders won’t. Over time, you’ll discover that your losses contain the most valuable lessons. Each one is a clue, pointing you directly at what you need to fix to become a more profitable trader.

Ready to stop guessing and start knowing what truly works in your trading? TradeReview offers a powerful, automated journal with performance analytics, a visual trade calendar, and multi-platform access to turn your trade data into your greatest asset. Start tracking your trades with precision and clarity.