Let’s be honest — the allure of trading is often the dream of that one life-changing win. We see stories of traders catching a massive market move and imagine it happening to us. But for anyone who’s actually stepped into the ring, the reality is often a brutal emotional rollercoaster — a dizzying high followed by a crushing low that can shatter your confidence and your account. We’ve all felt that sting.

Risk management in trading is the skill that lets you survive that reality. It’s your strategic rulebook for identifying, analyzing, and minimizing potential losses. Think of it as a set of non-negotiable principles you follow to protect your capital, ensuring that no single bad trade (or even an unavoidable string of them) can knock you out of the game for good. This discipline, not some secret indicator, is the true foundation of long-term success.

Why Risk Management Is Your Most Important Trading Skill

One of the biggest myths in trading is that professionals have a secret strategy that wins 99% of the time. The truth? Even the best traders in the world are wrong — a lot. What separates them from the pack isn’t a crystal ball; it’s their unwavering commitment to risk management in trading. They understand how to lose small so they can stay in the game long enough to win big.

Shifting Your Mindset from Offense to Defense

Imagine you’re building a sustainable business, not just chasing a lottery ticket. A smart business owner would never bet the entire company on a single, high-stakes product launch. They would manage costs, protect their assets, and focus on steady, long-term growth. That is precisely the mindset a trader needs to cultivate to survive and thrive.

Playing great defense with your capital is what keeps you on the field. It allows you to:

- Survive Losing Streaks: Every trader, no matter how skilled, faces them. They’re a natural part of the process. Good risk management turns what could be an account-ending disaster into a manageable, recoverable dip.

- Control Emotional Decisions: When your hard-earned money is on the line, fear and greed can hijack your brain. A solid risk plan acts as your anchor, preventing you from making impulsive, emotionally-charged moves you’ll inevitably regret.

- Stay in the Game: This is the ultimate goal. By protecting your capital, you are buying yourself the most valuable asset in trading: time. Time to learn, time to adapt, and time to wait for the high-quality opportunities that will actually build your account.

“Risk management isn’t a set of rules meant to hold you back. It’s the framework that frees you up, ensuring you always have the capital and the clear head needed to jump on the next great setup.”

Look, the goal isn’t to never lose money — that’s an impossible fantasy. The real, achievable goal is to ensure your winning trades are meaningful and your losing trades are small and insignificant. This guide provides the practical roadmap to build that kind of resilience. There are no guaranteed profits in trading, but these tools give you a fighting chance to survive long enough to earn your success.

The Core Principles of Capital Protection

Before diving into specific strategies, let’s establish the single most important mission in trading: protecting your capital. Think of your trading account as the lifeblood of your business. If it runs dry, the business is over. Period.

The following principles aren’t just helpful suggestions; they are the bedrock of a sustainable trading career. They are what will keep your ship afloat during the inevitable market storms, ensuring you can live to trade another day.

The Survival Rule: The 1% Rule

We’ve all been there. You spot a setup that looks so perfect, so much of a “sure thing,” that you’re tempted to bet big. That single emotional impulse is perhaps the number one cause of blown trading accounts. The 1% Rule is the discipline that saves you from yourself.

The rule is simple: never risk more than 1% of your total account balance on any single trade. If you have a $10,000 account, your maximum acceptable loss on one idea is just $100. It might sound overly cautious, but its power lies in making a catastrophic loss nearly impossible.

Practical Example: You have a $25,000 account. You see a breakout setup in stock XYZ. Instead of getting excited and buying a random number of shares, you know your maximum risk is $250 (1% of $25,000). This immediately grounds your decision-making in logic, not emotion.

Sticking to this one rule dramatically stacks the odds of survival in your favor. You would need to lose 100 trades in a row to wipe out your account — a statistical near-impossibility if your strategy has any real edge. It builds resilience directly into your trading process.

Demystifying the Risk-to-Reward Ratio

Limiting your risk on each trade is a crucial first step, but it’s only half the equation. The other critical piece is ensuring the potential profit is worth the risk you’re taking. This is where the Risk-to-Reward Ratio (often written as R:R) comes into play.

It’s a simple comparison of how much you’re risking versus how much you stand to gain.

Let’s say you risk $100 on a trade (your stop-loss), and your profit target is $300. This gives you a 1:3 risk-to-reward ratio. For every dollar you put on the line, you’re aiming to make three back. This concept is the engine of long-term profitability because it means you don’t have to be right all the time to make money. Far from it.

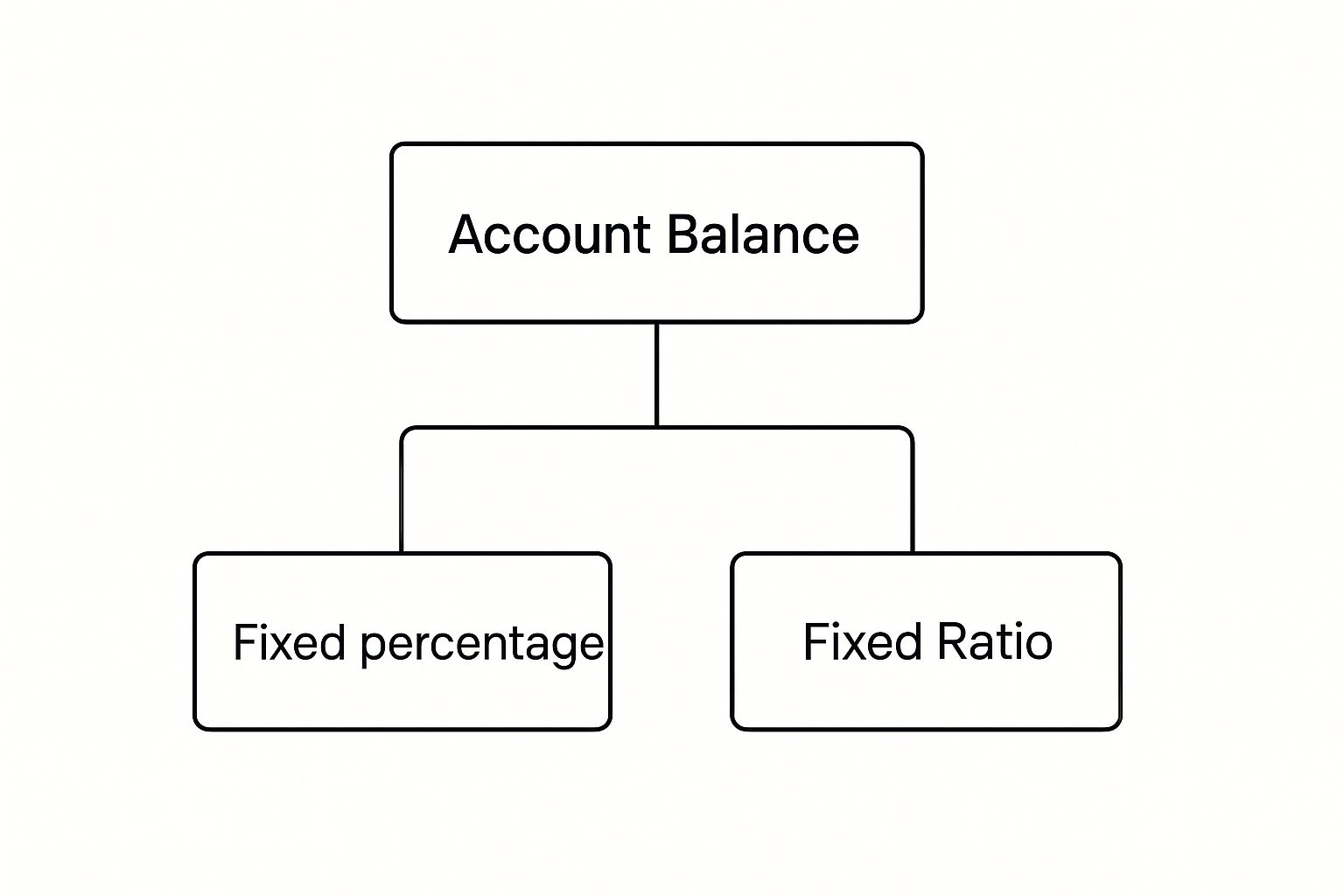

A positive risk-to-reward ratio ensures your winning trades are large enough to more than cover your small, controlled losses. This infographic breaks down how your capital is protected.

As the diagram shows, whether you use a fixed percentage or a fixed ratio, both methods are built on the foundation of protecting your overall account balance first.

Comparing Common Risk-to-Reward Ratios

This table illustrates how different risk-to-reward ratios impact the win rate required to simply break even. It clearly shows why aiming for higher reward ratios provides a powerful mathematical and psychological edge.

| Risk/Reward Ratio | Example (Risk $100) | Breakeven Win Rate | Strategic Impact |

|---|---|---|---|

| 1:1 | Risk $100 to make $100 | 50% | You must be right half the time just to stay flat. This creates immense pressure to be right. |

| 1:2 | Risk $100 to make $200 | 33.3% | Much more forgiving. You only need to win one out of every three trades to break even. |

| 1:3 | Risk $100 to make $300 | 25% | A professional standard. You can be wrong 75% of the time and still not lose money over the long run. |

| 1:5 | Risk $100 to make $500 | 16.7% | Creates massive profit potential. A single winner can erase a string of five losses and put you in profit. |

As you can see, a higher reward-to-risk ratio gives you a significant mathematical advantage and relieves the psychological pressure of needing to win every single trade.

Calculating Your Position Size

So how do we combine the 1% rule and our target risk-to-reward ratio into a practical action? The final piece is position sizing. This simple calculation tells you exactly how many shares or contracts to trade to keep your risk locked in at that 1% level.

To figure it out, you just need three numbers:

- Account Size: Your total trading capital (e.g., $25,000).

- Max Risk per Trade: Your risk in dollars (e.g., 1% of $25,000 = $250).

- Trade Risk (Stop-Loss Distance): The price distance from your entry to your stop-loss, measured per share or contract (e.g., $5 per share).

The formula is straightforward:

Position Size = Max Risk per Trade / Trade Risk

Using our example above:

Position Size = $250 / $5 = 50 shares

By calculating your position size before you even think about hitting the buy button, you transform abstract risk principles into a concrete, repeatable action. It removes emotion and ensures your risk is perfectly controlled every single time. This is a hallmark of professional trading.

Practical Strategies for Managing Every Trade

Alright, we’ve covered the core principles for protecting your capital. Now it’s time to get practical and translate theory into the specific actions you’ll take on every single trade.

Think of these strategies as a pilot’s pre-flight checklist. They aren’t just suggestions; they are the non-negotiable steps that keep you safe when the market gets turbulent. This is where your defensive mindset becomes a set of concrete, repeatable actions.

Your Ultimate Safety Net: The Stop-Loss Order

The single most important tool in your risk management arsenal is the stop-loss order. This is simply an automated command given to your broker to close a losing trade at a predetermined price. Its sole job is to prevent a small, acceptable loss from turning into a devastating one.

Many new traders struggle with this. They fear getting “stopped out” just before the price reverses in their favor. It’s a frustrating experience we’ve all had. But here’s the unvarnished truth: trading without a stop-loss is like driving a race car with no brakes. It feels fine until it isn’t, and by then, the crash is catastrophic.

A stop-loss is the exact point where you admit your trade idea was wrong. It’s not just a random number — it’s your logical escape hatch, taking emotion out of the equation and enforcing discipline right when you need it most.

Choosing the Right Type of Stop-Loss

Not all stop-losses are created equal. The type you choose should align with your strategy and current market conditions. Understanding the options is key to using them effectively. For a deeper dive, check out our guide on how to set stop losses.

Here’s a quick rundown of the most common types:

- Static Stop: A fixed price that doesn’t move. For example, if you buy a stock at $100 because it bounced off a support level at $98, you might place your static stop at $97.50. It’s simple, clear, and enforces a hard limit.

- Trailing Stop: This is a dynamic stop that moves up as your trade becomes profitable, locking in gains. You could set it to trail the price by a certain percentage (e.g., 10%) or dollar amount, protecting your profits while still giving the trade room to grow.

- Volatility-Based Stop: This more advanced approach uses market volatility to set your stop. Indicators like the Average True Range (ATR), which measures the typical daily price movement, help you place a stop wide enough to survive normal market “noise” but tight enough to exit if the move is significant.

Securing Your Wins with Take-Profit Orders

Risk management isn’t just about playing defense; it’s also about having a clear plan to realize your profits. A take-profit order is the counterpart to a stop-loss — an automatic order to close your trade when it hits a predetermined profit target.

This is your defense against greed. It’s a gut-wrenching feeling to watch a great winning trade reverse all the way back to a loss because you got greedy and hoped for “just a little more.” A take-profit order forces you to stick to your original, rational plan.

Here’s how it works in practice:

Imagine you buy a stock at $50, your profit target is $60, and you decide your idea is wrong if it drops to $48. You’re risking $2 per share to make $10 — a solid 1:5 risk-to-reward. You would immediately place two orders:

- A stop-loss order at $48.

- A take-profit order at $60.

Now your trade is fully managed. Fear and greed cannot interfere. Your plan will be executed systematically, regardless of how you’re feeling in the moment.

Diversification Beyond Just Assets

The final piece of practical risk management is diversification. When most people hear that word, they think of owning a mix of different stocks. That’s part of it, but true risk management in trading also means diversifying your strategies.

If you rely on just one trading setup, you become incredibly vulnerable. What happens when market conditions change and your one-trick pony stops working? You face a long, painful drawdown.

Instead, consider spreading your risk across different approaches:

- Timeframes: Mix a long-term trend-following strategy with a shorter-term swing trading strategy.

- Market Conditions: Have a plan for when markets are trending strongly and a different one for when they are stuck in a choppy, sideways range.

- Setups: Don’t just trade breakouts. Learn to identify and trade pullbacks, reversals, and other distinct chart patterns.

When you spread your risk across different, non-correlated strategies, you can smooth out your overall performance. When one strategy is in a slump, another might be performing well, which helps balance your results and, just as importantly, reduces a great deal of emotional stress.

How Trading Risk Management Has Evolved

To truly appreciate the power of today’s risk management tools, it helps to understand how far we’ve come. Trading wasn’t always a game of instant data and automated stop-losses. For much of its history, it was more of an art, relying almost entirely on a trader’s intuition and some basic rules of thumb.

In the past, traders worked with limited information. They would analyze a company’s balance sheet, sketch trend lines on paper charts, and ultimately make a decision based on their experience and gut feeling. There was no practical way to test if a strategy would have worked in the past or to calculate precise risk exposure across a complex portfolio.

From Gut Feel to Quantitative Science

That old-school approach began to change with the rise of technology. The arrival of personal computers and the internet opened the floodgates to data, transforming risk management in trading from a subjective art into a numbers-driven science. This evolution didn’t happen overnight; it was a gradual shift from simple rules to sophisticated analytics.

Before the 1990s, risk management was primarily about fundamental analysis and basic charting. But as markets became more global and technology advanced, the game changed. The 90s and early 2000s saw the first major steps toward quantitative analysis with the adoption of early backtesting software and models like Value at Risk (VaR). You can explore more on the evolution of trading risk management to see how far we’ve come — today, we have AI-powered risk assessment and fully integrated platforms at our fingertips.

The core evolution was this: We moved from asking “Does this trade feel right?” to “Does this trade mathematically make sense within my risk framework?” This is the foundation of modern trading discipline.

Key Milestones in the Evolution of Risk Management

The journey from gut instinct to data-driven decisions was marked by a few game-changing developments. Each one gave traders a clearer, more objective picture of the risks they were taking.

- The Rise of Backtesting: Before powerful computers, determining if a trading idea had merit was mostly guesswork. Backtesting software changed everything, allowing traders to simulate their strategies against years of historical data to identify weaknesses and verify if they had a statistical edge.

- Introduction of Value at Risk (VaR): Large financial institutions needed a standardized way to measure portfolio-wide risk. VaR emerged as the solution — a statistical metric that estimates the maximum potential loss a portfolio might face over a set time period with a certain level of confidence. It helped quantify risk into a single, understandable number.

- Automated Trading and Algos: Algorithmic trading removed human emotion from the execution process. Pre-programmed rules could now enter, manage, and exit trades, ensuring that risk management principles were followed with perfect discipline, free from the influence of fear or greed.

- AI and Machine Learning: Today, we are in the era of AI-powered risk assessment. Sophisticated algorithms can analyze massive datasets in real-time, identifying complex patterns and potential risks that are invisible to the human eye. These systems can model thousands of future scenarios to stress-test a portfolio against almost any imaginable market event.

Understanding this evolution makes it clear why a systematic, data-backed approach to risk management isn’t just a good idea — it’s essential for survival. The markets have become too complex and fast-moving to rely on intuition alone. The tools available today offer a massive advantage, but only if we have the discipline to use them correctly.

The Psychology of Trading: Winning the Battle Between Discipline and Emotion

You can have the most brilliant trading strategy in the world, but it’s completely worthless if you lack the discipline to follow it. The real battlefield isn’t on the charts; it’s the six inches between your ears. This is where a solid risk management plan confronts its greatest adversary: human emotion.

We’ve all felt it. The heart-pounding panic when a trade moves against you. The adrenaline rush of a quick win. That gut-wrenching fear of missing out (FOMO) as you watch a stock rocket higher without you. These feelings are a normal part of being human, but acting on them is the fastest way to destroy your trading account.

The Most Common Emotional Traps

The first step to overcoming these psychological hurdles is to recognize them. Every trader, from novice to seasoned pro, must consciously battle these impulses every single day.

- Fear of Missing Out (FOMO): You see a market taking off and can’t bear to be left behind. You jump in late, often at the worst possible price, abandoning your strategy just to be part of the action.

- Revenge Trading: After a frustrating loss, you immediately rush back into the market to “win your money back.” This isn’t trading; it’s emotional gambling, driven by anger and ego.

- Greed: Your trade hits its profit target, but you get greedy and hold on, hoping for “just a little more.” Greed has a nasty habit of turning perfectly good winning trades into break-evens or, even worse, losers.

- Fear and Premature Exits: The opposite of greed. Fear causes you to snatch a small profit at the first sign of a pullback, leaving a huge amount of potential profit on the table and ruining your risk-to-reward ratio.

These traps are so potent because they are hardwired into our brains. Successful trading requires deliberately rewiring those instincts through relentless discipline and a structured approach.

Forging Discipline with Practical Tools

Discipline isn’t a personality trait you’re born with; it’s a muscle you build through consistent, deliberate practice. The goal is to create a system so robust that it acts as a firewall between your raw emotions and your trading decisions. Your trading plan becomes your anchor in an emotional storm.

This emphasis on structure isn’t just a personal preference; it’s a massive global trend. The risk management market was valued at USD 15.40 billion and is projected to reach USD 51.97 billion by 2033, growing at an impressive 14.6% annually. This boom highlights how critical systematic, unemotional risk control has become. You can learn more about this growing market on grandviewresearch.com.

“The market is a device for transferring money from the impatient to the patient.” – Warren Buffett

This timeless quote says it all. Long-term success in the market isn’t about frantic action; it’s about controlled, disciplined patience. It’s about letting your pre-defined plan — not your fleeting emotions — make the decisions.

Actionable Steps for a Stronger Mindset

Building mental toughness requires real-world actions, not just wishful thinking. Here are a few powerful habits you can start implementing today.

- Create and Follow a Trading Plan: This is non-negotiable. Your plan must define your exact entry criteria, exit rules (for both losses and profits), and position sizing methodology. If a setup doesn’t meet every single one of your rules, you don’t take the trade. No exceptions.

- Keep a Detailed Trading Journal: A journal like TradeReview is your secret weapon. Don’t just log the numbers; write down how you felt when you entered and exited. Over time, you’ll see undeniable patterns, like realizing you almost always revenge trade after two consecutive losses. This self-awareness is priceless.

- Take Mandatory Breaks: After a big win or a painful loss, step away from the screen for at least 30 minutes. Let the adrenaline or frustration subside. This simple “cool-down” period can prevent you from making a string of emotional mistakes.

- Think in Probabilities, Not Profits: Stop obsessing over the outcome of your current trade. Your job is to focus on executing your process perfectly over a series of 100 trades. A long-term, probabilistic mindset smooths out the emotional rollercoaster.

Mastering your psychology is an ongoing journey of self-awareness and improvement. If you’re looking to go deeper, exploring some of the best books about trading psychology can provide invaluable insights from traders who have already conquered their own mental demons.

Building Your Personal Risk Management Plan

All the theory in the world is just noise until you forge it into a concrete, personal plan. This is where you translate abstract concepts into the hard-and-fast rules that will govern your trading career. Don’t view this as a set of restrictions — see it as the business plan for your most important asset: your capital.

We’ve all seen how emotions can derail a perfectly good trading idea. A personal risk management plan is your anchor in that storm, keeping you grounded when the inevitable waves of fear and greed threaten to pull you under. It is your pre-commitment to disciplined action, made by the cool, rational version of yourself.

Defining Your Core Risk Parameters

Your plan doesn’t need to be a long, complicated document, but it must be crystal clear. Vague rules are too easy to bend in the heat of the moment. Start by defining your absolute limits — the lines you will never cross, no matter how tempting a setup looks.

A solid plan is built on a few key pillars we’ve already discussed:

- The 1% Rule: Your primary defense to ensure no single trade can ever cause significant damage to your account.

- Positive Risk-to-Reward Ratios: Your plan must demand that the potential reward always justifies the risk. A minimum of 1:2 is a great starting point for any strategy.

- Calculated Position Sizing: Every trade’s size must be determined by your stop-loss, not a gut feeling about the trade’s potential.

- Mandatory Stop-Losses: Every single trade must have a pre-defined exit point for a loss. No exceptions. Ever.

Your trading plan is your constitution. It lays out what you will and will not do. When you follow it, you’re the CEO of your trading business. When you ignore it, you’re just gambling.

Your Personal Risk Checklist

To make this practical, let’s create a simple checklist. Write these rules down. Print them out. Tape them to your monitor. This is your daily commitment to trading like a professional.

- Maximum Risk Per Trade: I will never risk more than 1% of my total account balance on a single trade.

- Maximum Daily Drawdown: If my account balance drops by 3% in a single day, I will stop trading immediately and walk away. This prevents a bad day from becoming a catastrophic one. For a deeper look at this metric, you can learn more about what is maximum drawdown in our detailed guide.

- Maximum Weekly Drawdown: If my account is down 5% for the week, I will stop trading until the following week and conduct a full review of my trades to identify any issues.

- Consecutive Loss Rule: After three consecutive losing trades, I will take a mandatory one-hour break from the screen to clear my head, interrupt any negative emotional patterns, and reassess market conditions.

This framework isn’t about holding you back; it’s about setting you free. Sticking to these simple principles is the single most reliable way to achieve longevity in the markets. It ensures you stay in the game long enough for your skills and strategy to compound.

Answering Your Top Trading Risk Questions

Knowing the principles of risk management is one thing. Applying them consistently when your money is on the line is a completely different challenge.

It’s perfectly normal to have questions as you start putting these concepts into practice. Let’s address some of the most common ones traders ask, so you can move forward with greater confidence and discipline.

How Do I Figure Out the Right Stop-Loss Level?

Forget picking a random dollar amount you’re willing to lose. Your stop-loss should be placed at the technical level where your original trade thesis is proven wrong. It’s the logical line in the sand that tells you the setup is no longer valid.

Finding that spot is key to effective risk management in trading. Here are a couple of practical ways to do it:

- Look for Support/Resistance: For a long trade (buying), identify a key support level on the chart and place your stop just below it. For a short trade (selling), find a major resistance level and set your stop just above it. This is a simple but robust method.

- Use Volatility Indicators: Tools like the Average True Range (ATR) can be very helpful. The ATR measures the typical price movement over a recent period. Using an ATR-based stop helps ensure your stop is wide enough to avoid being triggered by normal market “noise” but tight enough to protect you from a significant move against your position.

Your stop-loss needs to answer one critical question: “At what price is my reason for entering this trade officially invalid?” Answering that honestly removes emotion and enforces discipline.

Is the 1% Rule Too Conservative for a Small Account?

The 1% rule is the gold standard for a reason — it prioritizes survival. However, traders with very small accounts sometimes find it practical to increase their risk to 2% per trade to allow for more meaningful position sizes.

Going any higher than that, though, dramatically increases your risk of ruin. This is the statistical point where an inevitable string of losses can wipe out your account completely.

With a smaller account, the primary goal isn’t to hit home runs; it’s to build sound habits and prove you can grow your capital consistently. Master the process with small, controlled risk, and you will earn the right to trade a larger account in the future. Long-term thinking is paramount.

What’s the Difference Between Risk Management and Money Management?

These two terms are often used interchangeably, but they address different aspects of your trading business. Think of it this way: risk management is about winning individual battles, while money management is about winning the war.

- Risk Management is your tactical, trade-by-trade defense. It focuses on setting stop-losses, calculating risk-to-reward ratios, and controlling the potential loss on any single open position. It answers the question, “How much can I lose on this trade?”

- Money Management is your long-term, strategic plan for your entire trading capital. It covers the bigger picture, such as how you size your positions, how much capital to allocate to different strategies, and your plan for scaling up or down as your account grows or shrinks. It answers the question, “How can I protect and grow my entire account over time?”

In short, risk management protects you from being knocked out by one bad trade. Money management ensures your entire trading operation can survive and thrive over the long haul. You absolutely need both.

A disciplined approach to risk is what separates consistently profitable traders from everyone else. The best way to build that discipline is to track your performance and understand your own emotional patterns.

TradeReview gives you the tools to do just that, from a visual trade calendar to deep performance analytics that help you turn your data into smarter decisions. Start journaling your trades for free and build the habits you need to stay in the game for the long run.