Let’s get one thing straight: solid risk management for traders has nothing to do with complicated formulas or trying to predict the future. It’s the art of survival. It is the single most important skill that separates a sustainable trading career from becoming another market statistic.

Why Risk Management Is Your Most Important Skill

Trading is a constant tug-of-war between greed and fear. It’s only natural. Many traders get hung up on finding the perfect entry or that one “holy grail” indicator that will call every market turn. The real key to longevity, though, is something far less glamorous but infinitely more powerful: protecting your capital.

There’s this myth that legendary traders are defined by their incredible, home-run wins. The truth? They’re defined by their relentless discipline over losses. Sure, big wins feel great, but a single, runaway loss can erase weeks or even months of hard work. It’s a painful lesson every single trader learns, and admitting that struggle is the first step toward building a better process.

The Pilot, Not the Daredevil

Think of a professional trader less like a high-stakes gambler and more like an airline pilot. A pilot’s #1 job isn’t to pull off risky, heart-stopping maneuvers; it’s to get everyone on board to their destination safely. They do this by meticulously following checklists and managing every potential risk. Safety checks, flight plans, and emergency procedures always come first.

Trading is a game of probabilities. You don’t have to be right all the time. You just need to make sure your winners are bigger than your losers over the long haul. Risk management is the mathematical engine that makes this possible.

This is the exact mindset you need in trading. Your trading capital is your “aircraft,” and your job is to protect it at all costs. An effective risk management for traders strategy is your pre-flight checklist. It’s what keeps you in the air long enough to reach your goals, even when you fly into a bit of turbulence.

Shifting Your Focus for Long-Term Success

To build a career that lasts, you have to shift your focus from chasing massive profits to diligently managing your downside. This is about creating a financial and psychological safety net for yourself. True success isn’t measured by one huge win but by your ability to stay in the game—day after day, week after week.

This guide will give you a practical blueprint for building that safety net. We’ll reframe risk management not as a restrictive set of rules, but as the foundational skill that empowers sustainable growth.

The Evolution of Modern Trading Risk

To really get a handle on the risk strategies that work today, it helps to look back at how we got here. The rules of risk management for traders weren’t invented in a boardroom; they were forged in the fire of market history, evolving from gut-feel decisions into the sophisticated, data-driven frameworks we rely on now.

Think back to the trading floor before the 1990s. It was a completely different world. Risk management was more of an art than a science, leaning heavily on a trader’s personal experience, intuition, and basic tools like simple stop-loss orders. Traders protected their capital based on what felt right, not necessarily what the numbers proved.

For a while, that worked. But as markets got faster and more connected, the cracks in that approach started to show. A single unexpected event could kick off a domino effect that no amount of intuition could predict or contain. It became painfully clear that we needed a more structured, systematic way to handle risk.

The Data Revolution Begins

The 1990s changed everything. With powerful personal computers and the internet hitting the scene, traders suddenly had access to mountains of data and the tools to make sense of it all. This was a massive shift away from purely intuitive trading toward quantitative, evidence-based strategies.

Risk management evolved from gut feel to complex analysis. Before the ‘90s, traders relied on simple position sizing and experience. The tech boom of the ‘90s introduced quantitative tools like Value at Risk (VaR) and early risk software. Since the 2000s, risk management has become a proactive discipline, now powered by AI, stress testing, and integrated platforms. For a deep dive into this history, check out this great article on QuantInsti’s blog.

But this wasn’t just about new technology—it was a fundamental change in mindset.

The most successful traders understand that they are not in the business of predicting the future. They are in the business of managing probabilities and protecting their capital from catastrophic loss.

This new way of thinking was all about preparing for a range of possible outcomes instead of just betting big on a single one.

Hard-Won Lessons from Market Shocks

Nothing teaches a lesson quite like a market crisis. Major events like the 2008 financial crisis were brutal but powerful catalysts for change. They showed just how interconnected global markets were and how terrifyingly fast risk could spread through the entire system.

These shocks laid bare the weaknesses of only managing risk one trade at a time. The industry learned the hard way that a portfolio could get wiped out even if every single trade seemed to follow the rules. This led to the development of much sharper tools and concepts, such as:

- Stress Testing: Simulating how your portfolio would hold up under extreme, worst-case scenarios. Think of it as a fire drill for your capital. For instance, you could model what happens to your tech stocks if an event like the dot-com bubble burst happened tomorrow.

- Correlation Analysis: Understanding how different assets in your portfolio move in relation to each other. Do they all sink together, or does one rise when another falls? This knowledge is crucial for true diversification.

- Portfolio-Level Monitoring: Looking at the total risk exposure across all your open positions, not just individual trades. This prevents a scenario where ten “safe” 1% risk trades all get stopped out at once during a market shock, resulting in a 10% portfolio loss.

Today’s best practices are the direct result of these hard-won lessons. They aren’t just arbitrary rules; they are survival strategies hammered out over decades of market chaos. Understanding this history gives you a much deeper appreciation for why disciplined risk management for traders is your most critical shield in today’s complex markets.

Building Your Personal Risk Framework

Theory is one thing; putting it into practice is what really counts. This is where you turn abstract risk management ideas into a concrete, personal action plan. A solid framework isn’t some complex algorithm—it’s just a simple set of rules you create to protect your capital and match your trading style. Think of it as the blueprint that guides your decisions when the market gets chaotic and emotions are running high.

We’re going to build this framework on three essential pillars. First, defining what you can truly afford to lose. Second, mastering position sizing so no single trade can wreck your account. And third, setting non-negotiable exit rules to take the guesswork out of cutting losses or taking profits. Let’s build something you can actually use.

The Three Pillars of Your Risk Framework

Before diving into each pillar, it’s helpful to see how they all fit together. This table breaks down the core components of a healthy risk framework, giving you a clear, at-a-glance guide to what matters most.

| Pillar | What It Means | Practical Rule of Thumb | Example ($25,000 Account) |

|---|---|---|---|

| Personal Risk Tolerance | The maximum amount you can lose without it hurting your financial or mental well-being. | Never trade with money you can’t afford to lose completely. | Knowing a $1,250 loss (5% of the account) would be painful but not catastrophic. |

| Position Sizing | Deciding how much capital to put into a single trade based on a fixed risk percentage. | The 1-2% Rule: Risk no more than 1-2% of your total account on any one trade. | Risking a maximum of $250 (1%) or $500 (2%) on a single trade idea. |

| Exit Rules | Pre-defined price levels where you will automatically exit a trade (stop-loss and take-profit). | Set your stop-loss before entering a trade, at a level that invalidates your original idea. | Placing a stop-loss order that guarantees your maximum loss on the trade is $250. |

These three pillars work in tandem. Your overall tolerance dictates your per-trade risk, which in turn determines your position size and where you must place your stop-loss.

Pillar 1: Define Your Personal Risk Tolerance

Before you even think about your next trade, you have to ask yourself a brutally honest question: how much can I truly afford to lose? This isn’t about how much you want to lose (which is zero), but the amount of money that, if it vanished tomorrow, wouldn’t sink you financially or mentally.

This number is your risk tolerance, and it’s different for everyone. A 25-year-old with no dependents will have a different tolerance than someone nearing retirement. There’s no right answer, but ignoring the question is definitely the wrong approach. Trading with money you can’t afford to lose is a recipe for disaster, paving the way for emotional decisions like revenge trading or clinging to a losing position out of pure desperation.

Your risk framework is your business plan. It’s not about restricting your opportunities; it’s about ensuring your business stays solvent long enough to capitalize on them.

Let’s make this real. For a trader with a $25,000 account, it’s about understanding what a 1%, 2%, or 5% loss actually feels like in hard dollars. Getting comfortable with that reality is the first step toward trading with a clear head.

Pillar 2: Master Your Position Sizing

Once you know your overall tolerance, the next step is managing risk on a trade-by-trade basis. This is where position sizing comes in. Honestly, it’s the most powerful tool you have for risk management because it mathematically stops any single trade from blowing up your account.

The most common and effective guideline is the 1-2% rule. This simply means you should risk no more than 1-2% of your total trading capital on any single trade. It’s a simple guardrail that keeps you in the game. For our trader with the $25,000 account, this looks like:

- 1% Risk: $25,000 x 0.01 = $250 maximum risk per trade.

- 2% Risk: $25,000 x 0.02 = $500 maximum risk per trade.

This dollar amount becomes your line in the sand. It’s the absolute most you will let yourself lose if a trade idea goes south. This one calculation forces you to shift your focus from “How much can I make?” to the far more important question, “How much can I lose?”

This simple hierarchy shows that your entire strategy rests on having disciplined rules for exiting both your winners and your losers.

Pillar 3: Set Non-Negotiable Exit Rules

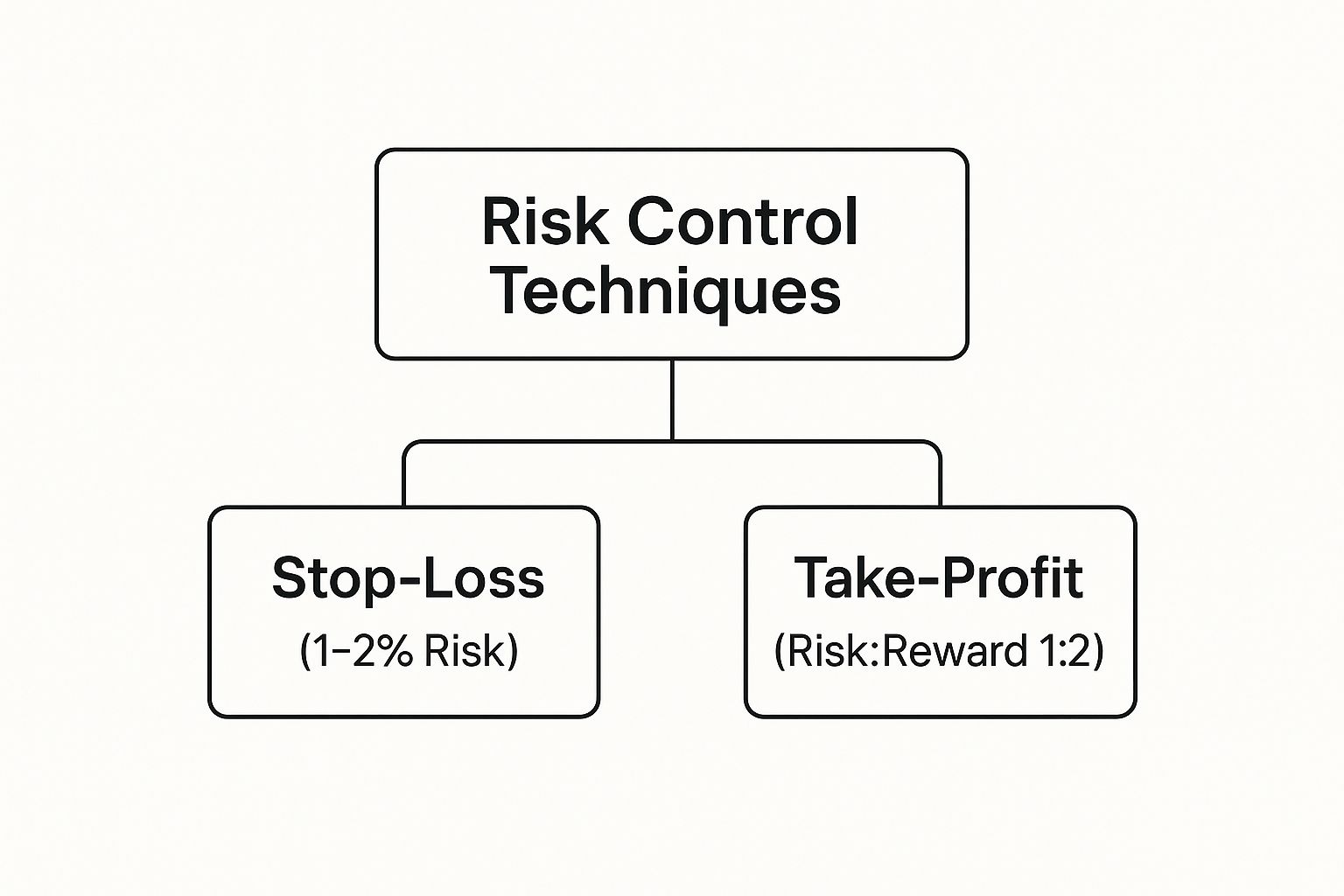

You’ve set your max risk per trade. Great. Now, how do you actually enforce it in the heat of the moment? The answer is simple: create clear, non-negotiable exit rules before you ever enter the trade. These are your stop-loss and take-profit targets.

A stop-loss is a pre-set order that automatically closes your position if the price hits a specific level, locking in a manageable loss. It’s your mechanical safety net, built to execute your plan without emotional interference. Your stop-loss shouldn’t be based on a random dollar amount; it should be placed at a technical level that proves your original trade idea was wrong. Our guide on how to set stop losses effectively dives much deeper into the strategies behind this.

A take-profit order is the flip side, automatically closing your position at a predetermined price to lock in your gains. This helps you stick to the plan and fight the greed that makes you hold on too long, only to watch a winner turn into a loser.

Let’s bring it all together with a quick scenario.

Trader Profile:

- Account Size: $25,000

- Risk Rule: 1% per trade

- Maximum Dollar Risk: $250

Trade Scenario:

You want to buy stock XYZ, which is currently trading at $50 per share. Your analysis tells you there’s strong support at $48, so you decide to place your stop-loss just below it at $47.50.

-

Calculate Your Risk Per Share:

- Entry Price: $50.00

- Stop-Loss Price: $47.50

- Risk Per Share: $50.00 – $47.50 = $2.50

-

Calculate Your Position Size (Number of Shares):

- Maximum Dollar Risk ($250) / Risk Per Share ($2.50) = 100 shares

By following this process, you know you can buy 100 shares of XYZ. If the trade moves against you and hits your stop at $47.50, you will lose exactly $250 (100 shares x $2.50 loss per share), which is precisely 1% of your account. You’ve perfectly controlled your risk. You survived to trade another day—and that’s the entire point.

Essential Risk Management Tools And Techniques

Okay, you’ve got your risk framework mapped out. Now it’s time to put it into practice. This is where we move from theory to action, turning your risk management rules from a vague idea into a daily, disciplined habit.

We’ll cover the tools and techniques that professional traders rely on to stay in the game. Think of these as your toolbox for survival—the repeatable actions that protect you from emotional decisions and keep you grounded in the market’s chaos. We’re going to make sure your potential wins are actually worth the risk, pick the right stop-loss for the job, and look at your entire portfolio’s exposure in a much smarter way.

Calculating Your Risk-To-Reward Ratio

One of the first things any seasoned trader learns is the power of the Risk-to-Reward Ratio. It’s a surprisingly simple concept that gets ignored way too often by those chasing a quick buck.

All it does is compare how much money you’re willing to lose on a trade versus how much you stand to gain. That’s it. But consistently taking trades with a favorable ratio is what separates sustainable trading from gambling.

Most pros won’t even look at a trade unless it has a ratio of 1:2 or better. This means for every dollar they risk, they’re aiming to make at least two.

A favorable Risk-to-Reward Ratio doesn’t guarantee a win. What it does guarantee is that your winners will be big enough to cover your losers and still leave you with a profit over time.

Imagine risking $100 on every trade with a 1:2 ratio. Your target profit is $200. With this simple rule, you could be wrong on more than half of your trades and still come out ahead. This is how you build a real statistical edge.

Here’s how it looks in action:

- You decide to buy a stock at $50.

- You set your stop-loss at $48, meaning your risk is $2 per share.

- To get that 1:2 ratio, your profit target needs to be at least $54 (a $4 gain).

Choosing The Right Stop-Loss Strategy

A stop-loss is your non-negotiable exit plan—your “eject” button when a trade goes south. But not all stops are created equal. The type you use should fit your trading style and the personality of the asset you’re trading. Getting this right is a huge part of effective risk management for traders.

Let’s break down the most common types.

Picking the right stop-loss isn’t just a technical detail; it’s about giving your trade the space it needs to work while still protecting your capital. Below is a quick comparison to help you decide which tool to pull out of the box for any given situation.

| Stop-Loss Type | How It Works | Best For | Potential Drawback |

|---|---|---|---|

| Static Stop | A fixed price level that doesn’t change once the trade is open. | Short-term strategies or trades with a very clear invalidation point. | Can get hit by normal market “noise” if you set it too close to your entry. |

| Trailing Stop | Moves up with a long position (or down with a short) by a set percentage or dollar amount, locking in profits as you go. | Trend-following strategies where you want to let your winners run without giving back all the gains. | A sudden, sharp pullback can stop you out prematurely, even if the overall trend is still intact. |

| Volatility-Based (ATR) Stop | Placed at a distance from your entry based on the asset’s recent volatility, often using the Average True Range (ATR). | Volatile markets or assets without obvious support/resistance. It adapts to the market’s behavior. | The stop will be wider in choppy markets, forcing you to use a smaller position size to stick to your risk rules. |

This choice is crucial. It dictates how you’ll manage the trade from start to finish. For a deeper dive, check out our guide on advanced risk management techniques for traders.

Strategic Diversification Beyond Just More Stocks

A lot of traders think diversification is just owning a bunch of different stocks. But if all those stocks are in the tech sector and tech suddenly crashes, you’re not diversified at all. You’re just exposed to the same risk in a dozen different ways.

Real diversification is about holding uncorrelated assets—things that don’t always move in the same direction at the same time. The goal is to have one part of your portfolio zigging while another part is zagging. This helps smooth out the bumps in your equity curve.

- Example: A portfolio might hold stocks, but it could also include assets like gold, bonds, or different currencies. When the stock market is in a freefall, investors might rush into a “safe haven” like gold, helping to balance out some of those equity losses.

This isn’t about hitting home runs. It’s a defensive strategy that puts capital preservation first.

Understanding Your Portfolio’s Total Risk

Finally, let’s zoom out. While the 1% rule is great for managing risk on a single trade, what happens if you have ten trades open at once and a surprise market event triggers all your stops? That’s a huge hit to your account.

This is where you need to think about your portfolio’s total exposure. A concept from the institutional world called Value at Risk (VaR) helps with this.

VaR is a statistical model used to estimate the potential loss of a portfolio over a specific time frame. For example, a 1-day 95% VaR of $1,000 means there’s a 95% chance you won’t lose more than $1,000 on any given day, based on historical data.

This metric became a big deal for banks back in the 1990s as a way to standardize risk measurement. Of course, it famously failed to predict the extremes of the 2008 financial crisis, which shows that no single tool is perfect. If you’re curious about its history, you can read more about the origins and evolution of VaR.

You don’t need to be a math whiz to apply the basic idea. The key takeaway is to always be aware of your total exposure. Ask yourself: “What’s my worst-case scenario right now?” This forces you to stay disciplined and avoid getting so over-leveraged that one bad day can wipe you out.

The Psychology of Sticking to Your Plan

Let’s be honest. A perfect risk management plan is totally useless if you can’t actually follow it. This is probably the hardest truth in trading: the biggest obstacle you’ll ever face isn’t a bad market; it’s the person staring back at you in the mirror.

Your own emotions—fear, greed, hope, and regret—are far more dangerous to your account than any volatile price swing.

Every single trader, from the greenest rookie to the seasoned pro, fights the same psychological demons. We’ve all felt that pit in our stomach from the fear of missing out (FOMO) as a stock takes off without us. We’ve all been tempted by revenge trading, trying to force a win back after a loss with a reckless, oversized position.

And who hasn’t been guilty of nudging a stop-loss just a little bit further down, hoping the trade will magically turn around?

These aren’t personal failings. They are completely normal human reactions to uncertainty and money on the line. The first step is just admitting that. The goal of solid risk management for traders isn’t to pretend these emotions don’t exist—that’s impossible. It’s about building systems that stop them from driving your decisions.

From Emotional Reactions to Disciplined Actions

Building that mental toughness is a skill, and like any skill, it takes the right tools and a lot of practice. You need to create a buffer between an emotional impulse and the “click” of your mouse. This is where objective, rule-based systems become your best friend.

Here are three practical strategies to build that buffer and enforce discipline:

- Use a Pre-Trade Checklist: Before you even think about entering a position, you have to run through a checklist. This isn’t just about the technical setup; it’s a final sanity check. Your checklist forces you to slow down and ask objective questions. Does this trade fit my strategy? Is the Risk/Reward Ratio at least 1:2? Is my stop-loss placed at a logical level? This simple habit is a powerful way to short-circuit impulsive decisions.

- Set a Hard Daily Loss Limit: Some days, the market just isn’t on your side. On those days, you are your own worst enemy. A hard daily loss limit—say, 3% of your total account value—is your circuit breaker. Once you hit that number, you’re done for the day. No exceptions. This rule isn’t about one bad day; it’s about preventing one bad day from snowballing into a week that wipes out your account and your confidence.

- Keep a Trading Journal to Spot Emotional Triggers: A plan is just a theory until you start tracking your results. This is where a trading journal becomes non-negotiable for mastering your psychology. It’s for more than just logging wins and losses; it’s for documenting your state of mind. Were you anxious when you entered? Did you exit out of fear instead of letting the trade hit its target? By writing this stuff down, you start to see destructive patterns emerge. You’ll see, in black and white, that every time you feel FOMO and break your rules, you lose money. To learn more, check out our guide on why every trader needs a trading journal.

Your trading journal is the ultimate accountability partner. It holds up a mirror to your decisions, separating what you thought you should do from what you actually did. The data doesn’t lie.

At the end of the day, psychological mastery is about building a system so solid that it protects you from yourself. It’s the conscious effort to go from being a trader who just knows the rules to one who executes them consistently, especially when it’s hardest. That’s the real bridge between being an amateur and a pro.

Your Blueprint for Trading Longevity

Let’s get one thing straight. This journey isn’t about finding some magical indicator or a “holy grail” system that guarantees endless profits. The truth is much simpler, and frankly, more powerful: lasting success boils down to how seriously you take the one thing you can actually control—your risk.

We’ve walked through the essential pillars of risk management for traders, from building your own personal framework to mastering the tools and mindset needed to actually follow through. The point was never to hold you back, but to give you a blueprint for a long and sustainable trading career. This is what separates the pros from the gamblers.

The Foundation You Control

Think of your trading account as a business. A good business owner doesn’t just celebrate the big sales days; they are obsessed with managing costs, controlling inventory, and making sure the lights can stay on during a slow month. Your risk management plan is your business plan. It sets your “costs” (your acceptable losses) so your “business” can survive and thrive.

Sure, profits are the goal, but they are never a guarantee. The market is going to do what it’s going to do. But surviving to trade another day? That is a direct result of the decisions you make before you even think about clicking the “buy” or “sell” button.

Disciplined risk management is the bedrock of a sustainable trading career. It is the conscious decision to prioritize capital preservation above all else, ensuring you stay in the game long enough for your edge to play out.

This blueprint gives you the structure to make those decisions wisely. It’s all about swapping out hope and fear for a repeatable, logical process. By committing to this discipline, you’re not just managing individual trades; you’re building your future in the markets, one well-managed position at a time. Your future self will thank you for it.

Common Questions on Trading Risk

Knowing the theory is one thing, but applying it when your money is on the line is a completely different ballgame. Let’s tackle some of the most common questions traders have when they’re trying to put solid risk management into practice.

How Should My Risk Management Change For Day Trading Vs. Swing Trading?

Your trading timeframe is everything when it comes to risk. The faster you trade, the tighter your risk needs to be.

- For day trading: You’re in and out of the market quickly and often. This means your risk per trade should be smaller, maybe 0.5% to 1% of your capital, because you’re taking more shots. A hard daily loss limit is non-negotiable here; it stops a series of small paper cuts from turning into a major wound.

- For swing trading: You might stick to the classic 1-2% risk per trade, but you have a new enemy: overnight and weekend gap risk. You can’t just set a tight stop. You’ll often need wider stops, perhaps based on a volatility indicator like the Average True Range (ATR), to avoid getting shaken out by normal market noise while you’re holding a position for days or weeks.

Where Is The “Right” Place To Put A Stop Loss?

This is a big one. The right place for your stop loss is a technical level that proves your trade idea was wrong. It should never, ever be based on an arbitrary dollar amount you’re comfortable losing.

Your stop should be placed at a point of structural importance. Think just below a major support level if you’re long, or just above a key resistance level if you’re short. Using a multiple of the ATR is another great objective method. The point is to let the market—not your emotions—tell you when you’re wrong.

What Should I Do If My Risk Plan Isn’t Working?

First, take a deep breath. You need to figure out if you have a good process that’s just hitting a rough patch (which is totally normal) or if your process is actually broken. Your trading journal is your best friend here.

A losing streak doesn’t automatically mean your plan is broken. The worst thing you can do is panic and start changing your rules mid-game. That’s a surefire way to lose. Make adjustments only after a calm, clear-headed review when the market is closed.

Go back and look at your trades. Were you actually following your rules? If the answer is yes, then maybe your strategy needs a slight tweak for the current market conditions. If the answer is no, then the problem isn’t the plan—it’s your discipline.

Is Risking 1% Per Trade Too Small To Make Real Money?

Not at all. In fact, it’s the secret to staying in the game long enough to make real money. Small, consistent risk is what protects you from those account-blowing losses that sideline traders for good.

Think about the math: if you lose 50% of your account, you need to make a 100% return just to get back to where you started. That’s a massive hill to climb. The goal isn’t to hit a home run on a single trade; it’s to grow your capital steadily over time through compounding. Good risk management for traders is what ensures you survive long enough for that compounding magic to kick in.

Ready to put these ideas into action with a tool that helps you stay disciplined? TradeReview is a free and powerful trading journal built to help you analyze your performance, track your key metrics, and build a data-driven approach to risk. Stop guessing and start improving.

Sign up for free at TradeReview and take control of your trading.