Welcome to the world of options trading, a landscape often painted with promises of instant wealth and complex charts. We get it. The journey can be tough, filled with confusing jargon and the frustration that comes from a trade not going your way. The reality is that successful trading isn’t about finding a magic “guaranteed profits” button; it’s about building discipline, committing to continuous learning, and mastering specific tools for different market conditions.

This guide is built to cut through that noise. We’re here to demystify nine powerful options trading strategies, offering practical, real-world examples without the hype. You won’t just learn the theory; you will see how these strategies are applied in realistic scenarios. We will break down each strategy, discussing its ideal market outlook, risk profile, and profit potential in simple terms.

Our goal is to help you move beyond random trades and build a robust framework for long-term, sustainable trading. By exploring these varied approaches, from the income-generating Covered Call to the risk-defined Iron Condor, you’ll gain the knowledge needed to select the right strategy for your market thesis. This is about transforming your trading journey from a high-stakes gamble into a structured, repeatable process. Let’s begin building that sustainable edge.

1. The Covered Call: Generating Income from Stocks You Own

The covered call is one of the most foundational and widely used options trading strategies, favored by long-term investors and income seekers alike. The strategy involves holding a long position in at least 100 shares of a stock and selling, or “writing,” a call option against those shares. In essence, you are selling someone the right to purchase your stock at a specific price (the strike price) before a certain date (the expiration date). In return for selling this right, you receive an immediate cash payment known as a premium.

This approach is ideal for investors with a neutral to slightly bullish outlook on a stock they already own. You don’t expect the stock to skyrocket, but you’re happy to hold it and collect income. The trade-off is clear: you cap your potential profit on the stock at the strike price, but you lower your cost basis and generate consistent cash flow. It’s a disciplined way to make your existing portfolio work harder for you.

Example Trade Setup

Imagine you own 100 shares of Microsoft (MSFT), currently trading at $425. You believe the stock will likely trade sideways or creep up slightly over the next month. You decide to implement a covered call strategy:

- Your Position: Own 100 shares of MSFT.

- Action: Sell one MSFT call option with a strike price of $440 that expires in 35 days.

- Premium Collected: You receive a premium of $5.00 per share, totaling $500 ($5.00 x 100 shares).

Possible Outcomes at Expiration:

- MSFT closes below $440: The option expires worthless. You keep the full $500 premium and your 100 shares. Your effective profit is the premium collected. You can then repeat the process for the next month.

- MSFT closes above $440: The option buyer will likely exercise their right. Your 100 shares are automatically sold at $440 each. You keep the sale proceeds ($44,000) and the initial $500 premium. Your gain is capped, but it’s a profitable outcome based on a price you were willing to sell at.

Actionable Tips for Implementation

- Timeframe: Sell options with 30-45 days to expiration (DTE) to maximize the benefits of time decay (theta), which is the primary source of profit in this strategy.

- Strike Selection: Choose a strike price you would be comfortable selling your shares at. A strike 5-10% above the current stock price is a common starting point for balancing income and potential upside.

- Discipline: Avoid chasing the highest premiums on volatile stocks unless you are truly prepared for the associated risks. Consistency is more important than hitting a home run.

Performance Tracking in TradeReview:

Consistently tag every covered call trade with a ‘Covered Call’ tag. Over time, filter your reports by this tag to analyze your strategy’s true performance. This helps you answer a crucial question: does the income generated from premiums outweigh the gains you missed from having your upside capped? This data-driven insight is essential for refining your approach.

2. The Cash-Secured Put: Getting Paid to Buy Stocks You Want

The cash-secured put is a powerful income-generating strategy favored by investors who want to acquire a particular stock but at a lower price than where it currently trades. The strategy involves selling, or “writing,” a put option while simultaneously setting aside enough cash to buy the underlying stock at the agreed-upon strike price if the option is exercised. In essence, you get paid a premium for your willingness to buy a stock you already like at a discount.

This approach is ideal for investors with a neutral to bullish long-term outlook on a stock. You are happy to either collect the premium if the stock stays above your chosen price or to be “put” the shares at a lower effective cost basis. It’s often described as a patient investor’s tool for systematically entering positions, turning your waiting time into income.

Example Trade Setup

Imagine you want to own shares of Tesla (TSLA) but feel its current price of $185 is a bit high. You would be happy to buy it if it dropped to $175. You decide to implement a cash-secured put strategy:

- Your Position: Set aside $17,500 in cash ($175 strike x 100 shares). This is a critical step – the “secured” part means the cash is ready.

- Action: Sell one TSLA put option with a strike price of $175 that expires in 40 days.

- Premium Collected: You receive a premium of $6.50 per share, totaling $650 ($6.50 x 100 shares).

Possible Outcomes at Expiration:

- TSLA closes above $175: The option expires worthless. You keep the full $650 premium and your cash is freed up. Your profit is the premium collected, and you can repeat the process.

- TSLA closes below $175: You are assigned and obligated to buy 100 shares of TSLA at $175 each. The $17,500 you set aside is used for the purchase. Your effective cost basis is $168.50 per share ($175 strike – $6.50 premium), which is lower than your original target price. You now own the stock you wanted, but at a better price.

Actionable Tips for Implementation

- Stock Selection: This is the most important rule: Only use this strategy on high-quality stocks you genuinely want to own for the long term. Never sell a put on a stock you wouldn’t be happy to have in your portfolio.

- Strike Selection: Target strike prices near significant technical support levels or at a valuation you find attractive. This increases the probability the stock will find a floor at or above your strike.

- Patience and Discipline: The goal is to get paid to buy a great company at a great price. Don’t get greedy by selling puts on low-quality stocks just because the premium is high.

Performance Tracking in TradeReview:

Tag every cash-secured put as ‘CSP’ or a similar unique identifier. Periodically filter your trades by this tag to analyze your results. Key metrics to watch are your win rate (options expiring worthless) and your effective cost basis on assigned stocks. This helps you determine if the strategy is successfully lowering your entry points or simply generating consistent income.

3. The Iron Condor: Profiting from Low Volatility

The iron condor is a popular market-neutral strategy for traders who believe a stock or index will trade within a specific price range. It’s one of the quintessential options trading strategies for generating income from low volatility. The trade is constructed by simultaneously selling a bear call spread and a bull put spread on the same underlying asset with the same expiration date. This creates a defined-risk position where you collect a net premium upfront, which represents your maximum potential profit.

This strategy is ideal for traders with a neutral outlook who expect the underlying asset to remain stable. Your goal is for the stock price to stay between the short strike prices of your two spreads, allowing all four options to expire worthless. The trade-off is that your profit is capped at the initial premium received, but your maximum loss is also strictly defined from the outset, which is a key benefit for risk management.

Example Trade Setup

Imagine the SPDR S&P 500 ETF (SPY) is trading at $445. You anticipate little movement over the next month and decide to set up an iron condor:

- Your Position: A neutral outlook on SPY, believing it will stay within a certain range.

-

Action:

- Sell one SPY put option with a strike price of $435 (short put).

- Buy one SPY put option with a strike price of $430 (long put).

- Sell one SPY call option with a strike price of $455 (short call).

- Buy one SPY call option with a strike price of $460 (long call).

- Premium Collected: You receive a net premium of $1.50 per share, totaling $150.

Possible Outcomes at Expiration:

- SPY closes between $435 and $455: All four options expire worthless. You keep the full $150 premium as your profit. This is the ideal outcome.

- SPY closes above $460 or below $430: The price has moved beyond your profitable range. The position results in the maximum possible loss, which is the difference in the strikes minus the premium received ($500 – $150 = $350). Knowing your max loss upfront is a cornerstone of disciplined trading.

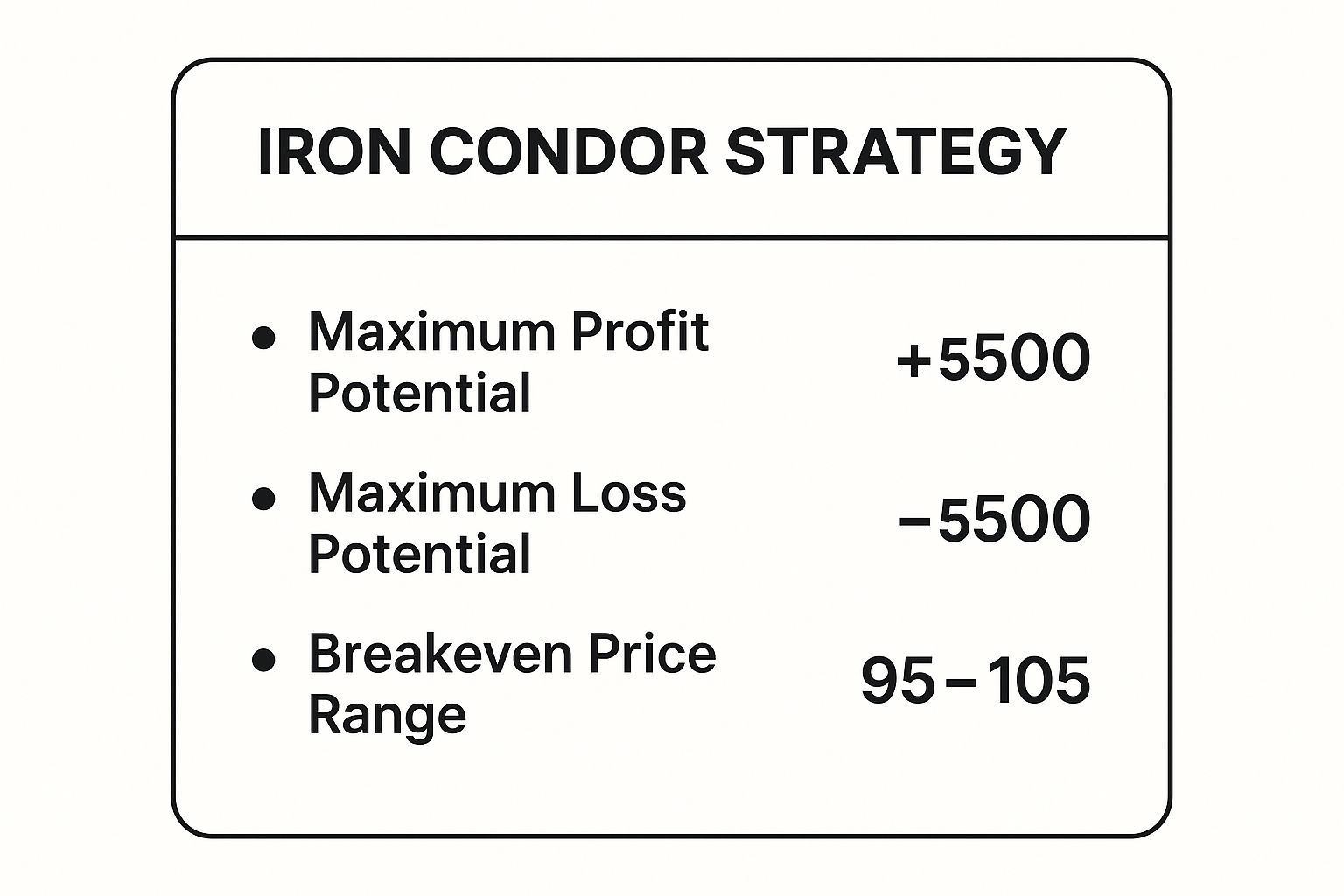

This infographic provides a quick reference for the iron condor’s key risk and reward metrics.

Understanding these metrics before entering the trade is crucial, as it allows you to clearly define your risk-to-reward ratio and manage the position effectively.

Actionable Tips for Implementation

- Volatility: Look to enter iron condors when implied volatility (IV) is high. This increases the premium you collect and widens your breakeven points, giving you a larger margin for error.

- Profit Target: Discipline is key. Don’t hold out for maximum profit. A common practice is to close the trade when you’ve captured 25-50% of the initial premium collected. Waiting until expiration increases risk.

- Management: Have a plan for what to do if the underlying price approaches one of your short strikes. Will you adjust the position or take a small loss? Decide this before you enter the trade.

Performance Tracking in TradeReview:

Use the ‘Iron Condor’ tag for every trade. This allows you to filter your trading journal and analyze critical metrics over time. You can determine your average profit, win rate, and the best underlying assets for this strategy. This data-driven feedback is invaluable for refining your strike selection and management rules.

4. The Protective Put: Insuring Your Stock Gains

The protective put is one of the most essential options trading strategies for risk management, often described as portfolio insurance. We all feel the anxiety of holding a winning stock through a volatile period. This strategy helps manage that feeling. It involves holding a long position in at least 100 shares of a stock and simultaneously buying a put option on those same shares. In essence, you are buying the right to sell your stock at a predetermined price (the strike price), protecting you from any significant drops in value below that price before the option expires.

This approach is ideal for investors who are bullish long-term but want to hedge against short-term uncertainty, such as an upcoming earnings report or macroeconomic announcement. The trade-off is the cost of the option premium, which eats into your potential profits but provides valuable peace of mind. It allows you to maintain all the upside potential of your stock while defining your maximum possible loss.

Example Trade Setup

Imagine you own 100 shares of NVIDIA (NVDA), currently trading at $130, and you’re concerned about potential volatility around an upcoming industry conference. You want to protect your unrealized gains without selling.

- Your Position: Own 100 shares of NVDA.

- Action: Buy one NVDA put option with a strike price of $120 that expires in 45 days.

- Premium Paid: You pay a premium of $4.00 per share, totaling $400 ($4.00 x 100 shares).

Possible Outcomes at Expiration:

- NVDA closes above $120: The put option expires worthless. You lose the $400 premium you paid for the insurance, but your stock shares have retained their value or appreciated. This is a small price to pay for peace of mind.

- NVDA closes below $120 (e.g., at $100): You can exercise your put option, forcing the sale of your 100 shares at the guaranteed price of $120 each. While the stock dropped significantly, your maximum loss on the shares from the strike price is locked in, minus the premium paid. Your insurance policy paid off.

Actionable Tips for Implementation

- Strike Selection: Choose a strike price that represents the maximum loss you are willing to accept. Puts that are 5-10% below the current stock price often offer a good balance between protection and cost.

- Timing: Purchase puts before an anticipated event when implied volatility (IV) might still be reasonable. Waiting until everyone is panicking can make the “insurance” prohibitively expensive.

- Cost vs. Protection: Think of the premium as an insurance cost. The goal isn’t for every put to be a winner, but for the strategy to protect you from catastrophic losses over the long term.

Performance Tracking in TradeReview:

Tagging every protective put as ‘Hedging’ or ‘Insurance’ is a powerful practice. This allows you to analyze the costs of your risk management over time. By filtering for this tag, you can determine if the premiums paid were a worthwhile expense compared to the losses they prevented, helping you refine your approach to protecting your portfolio. For more insights, explore these essential risk management techniques.

5. The Straddle: Betting on Big Moves or Calm Markets

The straddle is a pure volatility strategy, allowing traders to profit from a stock’s movement, or lack thereof, without needing to predict the direction. This options trading strategy involves simultaneously buying or selling both a call option and a put option with the same strike price and expiration date. A long straddle (buying both) profits from a significant price swing in either direction, while a short straddle (selling both) profits when the stock remains stable.

This approach is ideal for traders anticipating a major event, such as an earnings report, FDA announcement, or other catalyst that could cause a sharp price reaction. The long straddle is a bet on high volatility, while the short straddle is a bet on low volatility. The trade-off for the long straddle is the high initial cost (premium paid for both options), which creates a wide break-even range. It’s a tough strategy to win with consistently, as the market often prices in the expected move.

Example Trade Setup

Imagine a tech company, XYZ, is set to announce its quarterly earnings next week. The stock is currently trading at $150. You expect the news to cause a major price move but are unsure of the direction. You decide to implement a long straddle:

- Your Position: Neutral on direction, but bullish on volatility.

- Action: Buy one XYZ call option with a $150 strike and buy one XYZ put option with a $150 strike, both expiring in 10 days.

- Premium Paid: The call costs $7.00 and the put costs $6.50, for a total debit of $13.50 per share, or $1,350.

Possible Outcomes at Expiration:

- XYZ has a large move (e.g., to $175 or $125): If XYZ rallies to $175, your call is worth $25 ($2,500), resulting in a net profit of $1,150 ($2,500 value – $1,350 cost). If it drops to $125, your put is worth $25, yielding the same profit. The move must be larger than the premium you paid.

- XYZ closes near $150: If the stock barely moves, both options expire with little to no value. You could lose your entire initial investment of $1,350. This is the maximum risk.

Actionable Tips for Implementation

- Volatility Analysis: Be wary of buying straddles when implied volatility (IV) is already very high, as is often the case before earnings. The subsequent “IV crush” can cause you to lose money even if the stock moves.

- Event-Driven: Target major catalysts like earnings or product launches, as these are the most likely drivers of the large price swings needed for a long straddle to profit.

- Profit Taking: For short straddles, discipline is paramount. Consider taking profits when you’ve captured 25-50% of the maximum premium. Holding until expiration exposes you to unlimited risk if the stock suddenly makes a huge move.

Performance Tracking in TradeReview:

Use tags like ‘Long Straddle’ and ‘Earnings Play’ for these trades. This allows you to filter and analyze your performance around specific events. You can answer critical questions like: Do I consistently overestimate post-earnings moves? Is the premium I collect on short straddles enough to compensate for the occasional large loss? This data is vital for refining your volatility trading approach.

6. The Bull Call Spread: Defined-Risk Bullish Bets

The bull call spread is a popular debit spread strategy used by traders who are moderately bullish on a stock or ETF. It allows you to express a directional view with a clearly defined risk and reward, making it one of the more capital-efficient options trading strategies. The strategy involves buying a call option at a lower strike price and simultaneously selling a call option at a higher strike price, both with the same expiration date. The premium paid for the long call is partially offset by the premium received from the short call, reducing the total cost and risk of the position.

This strategy is ideal for traders who anticipate a moderate rise in a stock’s price up to a specific level. Instead of paying the full price for a single long call, you create a spread that caps both your potential profit and your maximum loss. This trade-off makes it a powerful tool for managing risk and expressing a specific price target, reflecting a disciplined and structured market view.

Example Trade Setup

Let’s say the QQQ ETF is trading at $445, and you expect it to rise toward $460 over the next month but not significantly beyond that. You decide to set up a bull call spread:

- Your Position: Moderately bullish on QQQ.

- Action: Buy one QQQ call with a $450 strike and sell one QQQ call with a $460 strike, both expiring in 45 days.

- Net Cost (Debit): The $450 call costs $8.00, and you sell the $460 call for $4.50. Your net debit is $3.50 per share, or $350 total. This is your maximum possible loss.

Possible Outcomes at Expiration:

- QQQ closes below $450: Both options expire worthless. Your loss is limited to the $350 net debit you paid to enter the trade.

- QQQ closes above $460: Both options are in-the-money. The spread reaches its maximum value, and your profit is the difference between the strikes minus your initial cost: ($10 – $3.50) x 100 = $650.

- QQQ closes between $450 and $460: The long call is in-the-money, and the short call is not. Your profit is the stock price minus the long strike, less your initial debit.

Actionable Tips for Implementation

- Strike Selection: Choose strikes that align with your price target. The long strike is typically at or slightly out-of-the-money, while the short strike is placed at your expected resistance level.

- Reward-to-Risk Ratio: Aim for spreads offering a favorable reward-to-risk ratio, such as 2:1 or 3:1, to make the trade worthwhile.

- Discipline: Define your profit target and stop-loss before entering. It’s often prudent to close the position when you’ve captured 50-75% of the maximum potential profit to avoid late-stage risks like price reversals.

Performance Tracking in TradeReview:

Use a specific tag like ‘Bull Call Spread’ for every trade. This allows you to isolate and analyze the performance of this strategy over time. By reviewing your win rate, average profit, and loss, you can determine which market conditions or underlying assets work best for your bull call spreads. This disciplined approach is fundamental to refining your edge.

7. The Bear Put Spread: Profiting from a Controlled Decline

The bear put spread is a defined-risk, moderately bearish strategy for traders who anticipate a stock’s price will fall, but not necessarily plummet. This is one of the essential options trading strategies for limiting capital exposure. The trade involves buying a put option at a higher strike price and simultaneously selling another put option at a lower strike price, both with the same expiration date. The premium paid for the long put is partially offset by the premium collected from the short put, reducing the overall cost and risk of the trade.

This strategy is ideal when you have a bearish outlook but want to protect yourself from an unexpected price reversal or a sharp increase in implied volatility. Your maximum profit is capped at the difference between the two strike prices minus the net debit paid, and your maximum loss is limited to the initial cost of setting up the spread. This defined-risk nature promotes disciplined trading.

Example Trade Setup

Imagine you believe the SPDR S&P 500 ETF (SPY), currently trading at $520, is due for a minor correction over the next month. You decide to set up a bear put spread:

- Your Position: Moderately bearish on SPY.

- Action: Buy one SPY put with a $515 strike and sell one SPY put with a $505 strike, both expiring in 40 days.

- Net Debit Paid: The $515 put costs $8.00, and you sell the $505 put for $4.50. Your net cost is $3.50 per share, or $350 for the spread. This is the most you can lose.

Possible Outcomes at Expiration:

- SPY closes above $515: Both options expire worthless. Your loss is limited to the $350 net debit you paid.

- SPY closes below $505: Both options are in-the-money. You realize the maximum profit, which is the difference in strikes ($10) minus your initial cost ($3.50), totaling $6.50 per share, or $650.

- SPY closes between $515 and $505: The long put is in-the-money. The profit is the difference between SPY’s price and the $515 strike, minus your initial $350 cost.

Actionable Tips for Implementation

- Entry Point: Time your entries around overbought technical conditions or fundamental catalysts you believe will drive the price down. Avoid emotional, reactive entries.

- Timeframe: Focus on spreads with 30-45 days to expiration (DTE) to give the trade time to work while managing time decay.

- Spread Width: The distance between your strike prices (the spread’s width) determines your max profit and loss. Wider spreads offer higher potential rewards but cost more and increase your break-even point. Choose a width that reflects your confidence in the trade.

Performance Tracking in TradeReview:

Use a ‘Bear Put Spread’ tag for every trade. This allows you to analyze how often these setups reach max profit versus a partial gain or max loss. Tracking this data helps refine your strike selection and understanding when to close a position early. Having clear profit-taking strategies for these defined-risk trades is crucial for long-term success.

8. The Butterfly Spread: A Low-Cost Bet on Stability

The butterfly spread is a neutral options trading strategy that offers a high reward-to-risk ratio by betting on a stock’s price remaining within a specific, narrow range. It combines both bull and bear spreads, constructed using three different strike prices with the same expiration date. The classic long call butterfly involves buying one in-the-money call, selling two at-the-money calls, and buying one out-of-the-money call.

This strategy is ideal for traders who anticipate minimal price movement in the underlying asset, such as during periods of consolidation before an earnings report or after a major market move. The trade-off is that the stock must be very close to the middle strike price at expiration to achieve maximum profit, making it a precise but potentially very rewarding strategy. It requires patience and a strong thesis that the stock will “do nothing.”

Example Trade Setup

Imagine Apple (AAPL) is trading at $150, and you expect it to hover around this price for the next month. You decide to set up a butterfly spread to profit from this expected lack of volatility:

- Your Position: A long call butterfly spread.

-

Action:

- Buy 1 AAPL call at a $145 strike.

- Sell 2 AAPL calls at a $150 strike.

- Buy 1 AAPL call at a $155 strike.

- Net Debit: The cost to enter this trade might be around $0.50 per share, or $50 total, representing your maximum risk.

Possible Outcomes at Expiration:

- AAPL closes at exactly $150: Maximum profit is achieved. The profit would be the difference between the middle and lower strike prices minus the initial debit ($5.00 – $0.50 = $4.50), totaling $450.

- AAPL closes below $145 or above $155: The spread expires worthless. Your loss is limited to the initial $50 debit paid to enter the position.

Actionable Tips for Implementation

- Timeframe: Target expirations of 30-45 days to allow the position to develop, but be aware that maximum profit occurs near expiration, which also brings maximum risk.

- Strike Selection: Center the middle strike price on a strong technical level, like a key support or resistance area where you expect the stock to stall.

- Profit Target: This strategy requires discipline. Consider closing the position early if it reaches 25-50% of its maximum potential profit to avoid the risks associated with holding through the final days of expiration week.

Performance Tracking in TradeReview:

Tag every butterfly trade with ‘Butterfly Spread’. Use the reporting tools to analyze your win rate and average profit versus loss. This helps determine your effectiveness in predicting price ranges and can highlight if you are better off closing trades early for consistent gains rather than holding out for the maximum, less probable, profit.

9. The Collar Strategy: Protecting Your Stock Holdings

The collar is a powerful risk management options trading strategy used to protect an existing long stock position from significant downside risk. It involves holding at least 100 shares of a stock, buying a protective put option, and simultaneously selling a covered call option. The premium received from selling the call helps finance the cost of buying the put, often resulting in a low or even zero-cost “collar” around your stock’s value.

This strategy is perfect for investors who want to retain their stock but are concerned about a potential near-term decline. It’s a disciplined way to remove emotion and set a clear floor and ceiling on a position’s value, especially through a volatile event like an earnings announcement. The trade-off is that you define a price range for your stock, limiting your potential losses but also capping your potential gains.

Example Trade Setup

Suppose you own 100 shares of a volatile tech stock, currently trading at $150. You want to protect it through its upcoming earnings report without selling the shares.

- Your Position: Own 100 shares of the stock.

- Action (Protective Put): Buy one put option with a strike price of $140 for a premium of $4.00 per share ($400 total cost).

- Action (Covered Call): Sell one call option with a strike price of $160 for a premium of $4.00 per share ($400 total credit).

- Net Cost: $0 (This is a “zero-cost collar”).

Possible Outcomes at Expiration:

- Stock closes between $140 and $160: Both options expire worthless. You keep your shares, and the strategy had no net cost. Your protection was free.

- Stock closes below $140: Your put option is in-the-money. You can exercise it to sell your shares for $140, limiting your maximum loss.

- Stock closes above $160: Your call option is in-the-money. Your shares will be called away at $160, capping your maximum profit.

Actionable Tips for Implementation

- Strike Balancing: Adjust the strike prices of the put and call to achieve your desired cost structure. Wider collars offer more room for movement but are harder to establish for zero cost.

- Timing: Implement collars around specific events you are concerned about, such as earnings reports or major economic announcements, when you want to reduce uncertainty.

- Long-Term View: A collar is a short-term hedge on a long-term position. The goal is not to maximize profit on the options but to protect the underlying stock holding.

Performance Tracking in TradeReview:

Tag your collar trades with a ‘Collar’ or ‘Risk Management’ tag. This allows you to isolate these positions and analyze their effectiveness. By filtering your reports, you can evaluate if the protection provided by collars justifies the capped upside over the long term, helping you refine when and how you deploy this defensive strategy.

Options Trading Strategies Comparison Matrix

| Strategy | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| Covered Call Strategy | Relatively simple, requires owning 100 shares | Requires owning shares; moderate margin | Generates premium income, limited upside | Sideways or slightly bullish markets | Consistent income, lowers cost basis, beginner-friendly |

| Cash-Secured Put Strategy | Moderate; requires cash collateral equal to shares | Significant cash needed as collateral | Premium income; potential to buy stock at discount | Entry into stocks at desired prices | Income while waiting, conservative risk |

| Iron Condor Strategy | Complex four-leg strategy with multiple options | Requires margin and pays multiple commissions | Limited profit & loss, profits in range-bound markets | Neutral, low volatility markets | Defined risk, high success probability |

| Protective Put Strategy | Moderate; combines stock ownership and puts | Requires premium payment for puts | Downside protection while retaining upside | Risk management in volatile or uncertain markets | Limits downside risk, unlimited upside |

| Straddle Strategy | High complexity; simultaneous call & put options | High premium cost (long) or high risk (short) | Profits from large moves (long) or stable markets (short) | Volatile market events or earnings announcements | Direction-neutral, profits from volatility |

| Bull Call Spread Strategy | Moderate; two-leg call options | Moderate premium payment and commissions | Limited risk/reward, profits from moderate up moves | Moderately bullish outlook | Reduced cost, defined risk |

| Bear Put Spread Strategy | Moderate; two-leg put options | Moderate premium and commissions | Limited risk/reward, profits from moderate down moves | Moderately bearish outlook | Lower cost, defined risk |

| Butterfly Spread Strategy | Moderate to complex; three-leg 1-2-1 structure | Moderate capital and commissions | Profits from stable prices near center strike | Neutral, range-bound markets | High probability of small profit, well-defined risk |

| Collar Strategy | Complex; combines stock, calls, and puts | Requires owning stock, plus option premiums | Limited upside and downside, portfolio protection | Concentrated stock positions needing protection | Downside protection with income generation |

Your Next Move: From Knowledge to Actionable Strategy

We’ve journeyed through a comprehensive playbook of nine distinct options trading strategies, each offering a unique way to navigate the markets. From the income-focused Covered Call and Cash-Secured Put to the risk-defined Iron Condor and Butterfly Spread, you now have a foundational understanding of how to structure trades for various market outlooks- bullish, bearish, neutral, or volatile. Strategies like the Protective Put offer portfolio insurance, while the Straddle provides a way to capitalize on significant price swings, regardless of direction.

The key takeaway is that theory alone doesn’t create a successful trader. We’ve all been there—excited by a new strategy only to see it fail in the real world. The real differentiator is the disciplined application of this knowledge. Simply knowing how a Bull Call Spread works is different from knowing when to deploy it, how to select the right strike prices, and how to manage the position if the underlying asset moves against you. The most successful traders don’t hunt for a single “magic bullet” strategy; they build a versatile toolkit and master the art of selecting the right tool for the job at hand.

Turning Theory into a Trading Edge

Your path forward isn’t about memorizing every strategy but about integrating them into a cohesive trading process. This transition from passive learning to active implementation is where true growth occurs.

Here are your actionable next steps:

- Identify Your Core Strategies: Start by selecting two or three strategies that align with your risk tolerance and typical market analysis. For instance, if you’re a long-term investor looking for supplemental income, mastering the Covered Call and Cash-Secured Put is a logical starting point. If you prefer non-directional plays, focus on the Iron Condor.

- Paper Trade with Purpose: Before risking real capital, open a paper trading account and execute your chosen strategies. Your goal isn’t just to “win,” but to experience the mechanics. Watch how the P&L changes with movements in the underlying price and volatility. This is your low-risk environment for making mistakes and learning from them.

- Define Your Rules of Engagement: For each strategy, create a checklist. What are your entry criteria (e.g., specific implied volatility rank, technical indicators)? What are your exit rules for both profit-taking and loss-cutting? Writing these down removes emotion from your in-the-moment decisions.

- Analyze Every Single Trade: This is the most crucial step and the one most often ignored. Every trade, win or lose, is a data point. What went right? What went wrong? Was your initial thesis correct? Did you follow your plan? This rigorous review process is what separates amateurs from professionals.

Ultimately, mastering options trading strategies is a marathon, not a sprint. It’s about building a systematic approach grounded in continuous learning and ruthless self-assessment. The goal isn’t just to place a trade but to understand why you’re placing it and to learn from every outcome. This commitment to process is what transforms theoretical knowledge into a tangible, repeatable edge in the markets.

Ready to move from theory to disciplined execution? A trading journal is your single most powerful tool for analyzing performance and refining your approach. Start tracking your trades with TradeReview to get automated analytics, identify your patterns, and transform every trade into a valuable lesson. Sign up for free at TradeReview and begin building your professional trading process today.