The path to consistent trading isn’t about finding a single ‘holy grail’ indicator; it’s about building a robust, multi-faceted analytical framework. We’ve all been there: staring at a chart, caught between the fear of missing out and the fear of losing, letting emotions drive our decisions. This reactive approach, often leading to frustrating whipsaws and inconsistent results, stems from a one-dimensional view of the market. This article moves beyond simple chart patterns to explore nine powerful market analysis techniques that professionals use to gain a comprehensive, data-driven view of market dynamics.

This isn’t a get-rich-quick guide promising guaranteed profits. Instead, it’s a practical roadmap for each method, showing you not just what they are, but how to apply them with actionable steps and real-world examples. Adopting these diverse analytical tools requires discipline and a commitment to long-term thinking, but doing so is fundamental to building a true edge. By learning to implement these strategies, you can develop the confidence to navigate market uncertainty and make decisions driven by evidence, not by fear or greed. This guide is designed to help you construct a more complete picture of the market, empowering you to identify opportunities and manage risk with greater clarity and precision.

1. SWOT Analysis: A Trader’s Internal and External Scorecard

While often associated with corporate boardrooms, SWOT Analysis is one of the most powerful and accessible market analysis techniques for individual traders. It provides a structured framework for evaluating the internal and external factors that can make or break a trade or investment. By separating your analysis into four distinct quadrants, you move from reactive trading to proactive strategic planning.

This method forces an honest self-assessment of your personal Strengths (e.g., deep knowledge of the tech sector) and Weaknesses (e.g., a tendency to exit winning trades too early out of fear). Simultaneously, it prompts you to scan the market for external Opportunities (e.g., a new government subsidy for renewable energy companies) and Threats (e.g., potential interest rate hikes that could hurt growth stocks).

How to Apply SWOT to Your Trading

Applying this framework isn’t a one-time event; it’s a dynamic tool for maintaining strategic alignment with the market. For instance, a day trader might identify a strength in their disciplined risk management but a weakness in overtrading during slow market hours. The opportunity could be a high-volatility earnings season, while a threat might be new regulations on short-selling.

Practical Example: You’re considering a trade in a solar energy company.

- Strength: You have a deep understanding of renewable energy policies.

- Weakness: You tend to hold losing positions too long (hope).

- Opportunity: The government just announced a new tax credit for solar installations.

- Threat: The company’s main competitor is launching a more efficient panel next quarter.

This simple analysis immediately gives you a more balanced view than just looking at the stock chart.

Actionable Tips for an Effective SWOT Analysis:

- Be Brutally Honest: The analysis is only as good as your objectivity. Acknowledge weaknesses without judgment to build a plan to mitigate them. It’s not failure, it’s data.

- Stay Specific: Instead of “good at research” (Strength), write “proficient in analyzing quarterly earnings reports for tech stocks.”

- Update Regularly: Conduct a full SWOT analysis quarterly and a quick review monthly. Market conditions and personal skills evolve.

- Connect the Quadrants: Find ways to use your strengths to seize opportunities. Identify how threats could exploit your weaknesses and plan accordingly.

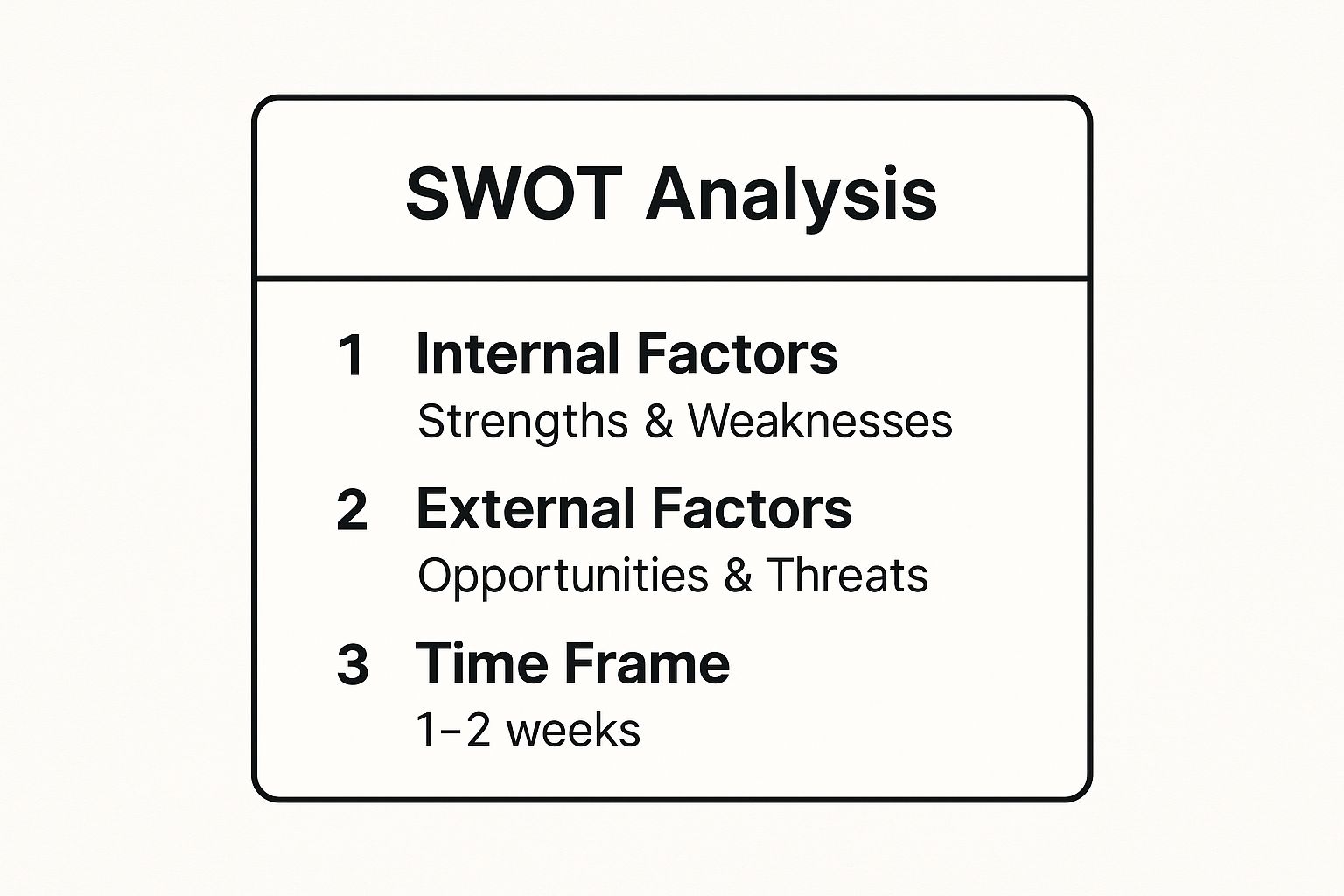

This infographic provides a quick reference for organizing the core components of your analysis.

As the visualization highlights, this process requires dedicating time to both internal self-reflection and external market scanning, making it a comprehensive strategic exercise.

2. Porter’s Five Forces: Deconstructing Industry Competition

Developed by Michael E. Porter, this framework moves beyond a single company’s performance to analyze the entire competitive landscape of an industry. Porter’s Five Forces is a crucial market analysis technique for traders and investors seeking to understand an industry’s long-term profitability and attractiveness. It provides a model for evaluating the power dynamics that dictate competition and profit potential.

This method dissects an industry’s structure into five core forces: the Threat of New Entrants, the Bargaining Power of Buyers, the Bargaining Power of Suppliers, the Threat of Substitute Products or Services, and the Intensity of Rivalry among existing competitors. A weak force represents an opportunity, while a strong one can be a significant threat to profitability.

How to Apply Porter’s Five Forces to Your Investments

This framework is not just for corporate strategists; it’s a powerful lens for long-term investors. For instance, an investor analyzing the airline industry would find intense rivalry, high supplier power (from Boeing and Airbus), and significant buyer power, explaining the sector’s notoriously thin profit margins. In contrast, analyzing Apple’s position in the smartphone market reveals high barriers to entry and strong brand loyalty, which weakens buyer power and sustains profitability.

Practical Example: Considering an investment in a new electric vehicle (EV) startup?

- Threat of New Entrants: High (Tesla, Ford, GM are established; other startups emerging).

- Bargaining Power of Buyers: Medium (many choices, but switching brands has costs).

- Bargaining Power of Suppliers: High (key components like batteries are controlled by a few large suppliers).

- Threat of Substitutes: High (gasoline cars, hybrids, public transport).

- Intensity of Rivalry: Very High.

This analysis reveals the tough competitive environment the startup faces, tempering excitement about the technology alone.

Actionable Tips for an Effective Five Forces Analysis:

- Define the Industry Clearly: Be precise about the market you are analyzing. “The automotive industry” is too broad; “the luxury electric vehicle market” is more effective.

- Gather Diverse Data: Don’t rely on a single report. Use industry publications, company filings, and news analysis to assess the strength of each force.

- Think Dynamically: Consider how forces might change in the future due to technology, regulation, or shifts in consumer behavior.

- Weight the Forces: In some industries, one force (like the threat of substitutes) may be far more influential than others. Assign importance accordingly.

3. PESTLE Analysis: Mapping the Macro-Environmental Landscape

While many market analysis techniques focus inward on a company or a trader’s personal strategy, PESTLE Analysis broadens the scope to the entire macro-environment. It is an essential framework for understanding the “big picture” forces that shape industries and create long-term trends. By systematically evaluating Political, Economic, Social, Technological, Legal, and Environmental factors, traders can anticipate market shifts rather than just reacting to them.

This strategic tool helps you identify large-scale opportunities and threats that might not be visible on a price chart. It moves your analysis beyond company fundamentals to consider how government policy, economic cycles, societal trends, innovation, regulations, and sustainability concerns will impact your investments over months or years, making it one of the most comprehensive market analysis techniques available.

How to Apply PESTLE to Your Trading

Applying PESTLE is about connecting global events to specific market outcomes. For an investor in electric vehicle (EV) stocks, a Political factor might be new government subsidies for green energy. An Economic factor could be rising inflation affecting consumer purchasing power. Socially, a growing awareness of climate change could boost demand, while Technologically, a breakthrough in battery storage could create a new market leader.

Practical Example: Analyzing a social media company.

- Political: Potential for government regulation on data privacy in the US and Europe.

- Economic: A recession could decrease advertising spending from businesses.

- Social: A shift in user preference towards short-form video content.

- Technological: The rise of AI could either enhance its platform or empower a new competitor.

- Legal: Ongoing antitrust lawsuits could lead to forced changes in its business model.

- Environmental: Pressure to power its massive data centers with renewable energy.

Actionable Tips for an Effective PESTLE Analysis:

- Focus on Relevance: Don’t analyze every global event. Concentrate on the factors with the most direct and significant impact on your specific sector or asset class.

- Use Credible Sources: Base your analysis on reputable news outlets, government reports, industry journals, and economic data to avoid acting on speculation.

- Connect the Factors: Acknowledge how these forces interact. For example, a new environmental (E) regulation is also a legal (L) and political (P) event that has economic (E) consequences.

- Update Periodically: The macro-environment is constantly changing. Revisit your PESTLE analysis quarterly or when significant global events occur to ensure your strategy remains relevant.

4. Competitive Analysis: Understanding Your Market Rivals

Trading isn’t just about reading charts; it’s about understanding the entire business ecosystem of the companies you invest in. Competitive Analysis is a crucial market analysis technique that involves systematically evaluating the rivals of a company to uncover its true market position. By dissecting competitors’ strategies, products, and market share, you can better predict a company’s potential for growth or its vulnerability to disruption.

This method moves beyond a company’s balance sheet to assess its strategic footing in the industry. You identify its direct competitors (e.g., Ford vs. GM), indirect competitors (e.g., a movie theater vs. Netflix), and potential future threats. This gives you a panoramic view of the competitive pressures that can influence stock performance, helping you identify sustainable competitive advantages, often called “moats.”

How to Apply Competitive Analysis to Your Trading

For an investor, this means looking at a company like Zoom not in isolation, but in the context of rivals like Microsoft Teams and Google Meet. You would analyze their feature sets, pricing models, and enterprise adoption rates. A trader might use this information to anticipate market share shifts after a key product launch or to gauge the impact of a competitor’s negative earnings report on the entire sector.

Practical Example: You’re looking to invest in Coca-Cola (KO). A competitive analysis would involve comparing it directly to PepsiCo (PEP). You’d look at revenue growth, brand portfolio (PepsiCo’s snack business vs. Coke’s pure beverage focus), marketing spend, and expansion into new markets like health drinks. This helps you understand if KO’s current stock price is justified relative to its primary competitor’s performance and strategy.

Actionable Tips for an Effective Competitive Analysis:

- Define Competitor Tiers: Clearly categorize rivals as direct, indirect, and potential. This prevents you from underestimating a disruptive newcomer.

- Go Beyond Financials: Analyze customer reviews, marketing strategies, and technological innovation. These qualitative factors are often leading indicators of performance.

- Monitor Continuously: The competitive landscape is dynamic. Set up alerts for competitor news and review their strategic shifts at least quarterly.

- Learn from Failures: Analyzing a competitor’s failed strategy can be just as insightful as studying their successes. It reveals market pitfalls to watch out for.

By understanding the competitive dynamics, you can make more informed decisions. You can even test trading strategies based on this analysis risk-free; find out more about how to do this with paper trading. This process transforms you from a passive stock picker into a strategic market analyst.

5. Market Segmentation Analysis: Targeting Your Ideal Customer

While traders often focus on market-wide movements, Market Segmentation Analysis offers a powerful lens for understanding the “who” behind the demand. This technique involves dividing a broad market into smaller, more defined groups of consumers with shared characteristics, needs, or behaviors. For businesses, this means tailoring products and marketing to specific audiences, but for traders, it provides deep insights into a company’s strategic positioning and growth potential.

By analyzing how a company like Nike segments its audience by sport, performance level, and lifestyle, a trader can better assess its resilience and ability to capture different market shares. This granular view helps you understand a firm’s addressable market, predict demand for new products, and evaluate the effectiveness of its marketing spend, all of which are crucial data points for long-term investment decisions.

How to Apply Segmentation to Your Analysis

Applying this framework means looking beyond a company’s total revenue and asking where that revenue comes from. For instance, a fintech company’s success might depend on its ability to capture different user segments: young professionals seeking robo-advisors, retirees looking for wealth management, or small businesses needing payment solutions. A change in regulations affecting one segment could present a threat or opportunity that a high-level analysis would miss.

Practical Example: Analyze a luxury automaker like Ferrari. They don’t just sell to “rich people.” Their segments include high-net-worth individuals, car collectors, and racing enthusiasts. Each segment has different motivations and price sensitivities. If you see them launching a new model aimed at a younger, “new money” segment, you can analyze whether that strategy will dilute the brand’s exclusivity (a risk) or open up a major new revenue stream (an opportunity).

Actionable Tips for an Effective Segmentation Analysis:

- Identify Key Variables: Look for how companies segment their markets based on demographics (age, income), geography (region, country), psychographics (lifestyle, values), and behavior (purchase history, brand loyalty).

- Analyze Segment Profitability: Read investor reports and listen to earnings calls to determine which segments are the most profitable. A company shifting focus toward a high-margin segment can be a strong bullish signal.

- Assess Accessibility: A company may identify a perfect segment, but if it lacks the distribution channels or marketing capability to reach it, the strategy is flawed.

- Evaluate Competitor Segments: Analyze how a company’s direct competitors are targeting different customer groups. A firm carving out a unique and underserved niche often has a significant growth runway.

6. Customer Journey Mapping: Understanding the Market Through the Customer’s Eyes

While many market analysis techniques focus on financial data or competitor actions, Customer Journey Mapping provides a unique, qualitative lens by visualizing every interaction a customer has with a company. This narrative approach helps a business understand the market from the perspective of its most important asset: the customer. By mapping touchpoints from initial awareness to post-purchase loyalty, companies can uncover pain points and moments of delight that traditional analysis often misses.

For an analyst or investor, understanding a company’s customer journey provides deep insights into its operational efficiency, brand strength, and potential for sustainable growth. A seamless journey, like Amazon’s one-click ordering or Starbucks’ integrated mobile app experience, often correlates with strong customer loyalty and a durable competitive advantage. This technique shifts the focus from “what” the market is doing to “why” customers are behaving in certain ways.

How to Apply Customer Journey Mapping to Market Analysis

As an investor, you don’t need to be a customer experience expert to use this concept. You can reverse-engineer a company’s customer journey by becoming a customer yourself or by analyzing customer reviews, social media feedback, and app store ratings. For example, by mapping the journey of a new Tesla buyer from online configuration to delivery, an investor can assess the company’s direct-to-consumer model and identify potential friction points that could impact future sales.

Practical Example: Look at a telecom company like Comcast. Map their customer journey: seeing an ad, visiting the website, comparing plans, scheduling installation, experiencing the service, calling customer support with an issue, and paying the monthly bill. If you find through online reviews that the “calling customer support” step is consistently a major point of frustration, you’ve identified a key vulnerability that a competitor could exploit.

Actionable Tips for an Effective Customer Journey Analysis:

- Focus on ‘Moments of Truth’: Identify critical touchpoints where a customer’s perception of the brand is formed, such as the initial purchase, a customer service call, or the unboxing experience.

- Include Emotional Highs and Lows: A successful journey isn’t just functional; it’s emotional. Note points of frustration (e.g., a confusing website) and delight (e.g., personalized recommendations).

- Involve Multiple Perspectives: Look at reviews from different customer segments. A power user’s journey will differ significantly from a first-time buyer’s.

- Translate Insights into Actionable KPIs: Connect journey insights to business metrics. A difficult checkout process (pain point) can be linked to cart abandonment rates (KPI).

This video provides a more detailed breakdown of how to construct and analyze a customer journey map.

As the video explains, this qualitative tool is one of the most powerful market analysis techniques for gauging a company’s long-term viability and customer-centric focus.

7. Trend Analysis: Riding the Wave of Market Momentum

Trend Analysis is a cornerstone of market analysis techniques that involves examining historical data to identify patterns, predict future market direction, and understand cyclical behaviors. Instead of focusing on a single point in time, it charts the course of market sentiment and asset prices over days, months, or even years. This allows traders to align their strategies with the prevailing momentum, whether it’s bullish, bearish, or sideways.

This method involves more than just looking at charts; it combines statistical analysis with broader market intelligence. For a trader, this means identifying whether an upward price movement is a temporary blip or the beginning of a sustained uptrend. It helps differentiate between market noise and genuine shifts in supply and demand, providing a foundation for making informed entry and exit decisions.

How to Apply Trend Analysis to Your Trading

Applying Trend Analysis is about becoming a market historian to predict its future. For example, a real estate investor might analyze long-term demographic and price trends to forecast which neighborhoods are poised for growth. Similarly, a stock trader can use tools like moving averages and trendlines to confirm the strength of a stock’s upward movement before committing capital. You can learn more about how to read stock charts to master this skill.

Practical Example: You notice the price of NVIDIA (NVDA) has been rising for months. Using a 50-day and 200-day moving average, you see the shorter-term average is consistently above the longer-term one—a classic sign of a strong uptrend. You decide to look for buying opportunities on minor pullbacks to these moving averages, rather than trying to short the stock and fight the powerful momentum. This is a disciplined, trend-following approach.

Actionable Tips for an Effective Trend Analysis:

- Use Multiple Timeframes: A trend on a 15-minute chart might be just a minor pullback on a daily chart. Always analyze trends across several timeframes for a complete picture.

- Combine with Other Indicators: Use indicators like the Relative Strength Index (RSI) or Moving Average Convergence Divergence (MACD) to confirm the strength and momentum of a trend. A rising price with falling momentum can be a warning sign.

- Distinguish Trend Types: Clearly identify if you are looking at a primary (long-term), secondary (intermediate-term), or minor (short-term) trend to align your trading strategy accordingly.

- Define Your Exit Strategy: Know in advance what market signal will tell you the trend has reversed. This prevents you from holding on to a losing position based on hope.

8. Value Chain Analysis: Deconstructing a Company’s Competitive Edge

Value Chain Analysis, a concept pioneered by Michael Porter, is one of the most granular market analysis techniques for understanding a company’s true source of competitive advantage. It moves beyond surface-level financials to dissect a company into its distinct activities, from inbound logistics to customer service, to see where it creates the most value and where it can improve.

This method separates a firm’s processes into Primary Activities (creating and delivering a product, like operations and marketing) and Support Activities (the infrastructure enabling the primary ones, like technology and HR). By analyzing this chain, traders can identify durable competitive moats that are not immediately obvious from a balance sheet, such as Apple’s superior design integration or Walmart’s hyper-efficient supply chain.

How to Apply Value Chain Analysis to Your Trading

Applying this framework helps you pinpoint why a company is or isn’t a market leader. For an investor analyzing an airline, this means comparing Southwest’s focus on operational efficiency (fast turnarounds, single aircraft type) against a legacy carrier’s hub-and-spoke model. This reveals which business model is more resilient to fuel price shocks or economic downturns.

Practical Example: Compare Amazon and a traditional retailer. Amazon’s value chain is optimized for logistics and technology (Primary Activities) and data infrastructure (Support Activities). This allows them to offer faster delivery and better recommendations than a competitor whose value chain is optimized for in-store experience. This insight explains Amazon’s durable competitive advantage.

Actionable Tips for an Effective Value Chain Analysis:

- Focus on Customer Value: Identify which activities in the chain have the biggest impact on the end customer’s experience and willingness to pay a premium.

- Benchmark Against Competitors: Compare each activity in your target company’s value chain to its closest rivals. Is its logistics faster? Is its R&D more innovative?

- Evaluate Cost vs. Differentiation: Determine if the company wins by performing activities at a lower cost or by performing them in a unique way that justifies a higher price.

- Link to Overall Strategy: A strong value chain is fully aligned with the company’s strategic goals. A discount retailer’s value chain should be optimized for cost reduction at every step.

9. Conjoint Analysis: Decoding Customer Preferences

While many market analysis techniques focus on what consumers have done (historical sales data), Conjoint Analysis is a sophisticated statistical method that reveals what they will do. It uncovers how people value the different attributes that make up a product or service, effectively deconstructing their decision-making process. This technique presents consumers with a series of trade-offs and measures their preferences to determine the relative importance of individual features.

Instead of asking a direct question like “Is price important?” (to which the answer is almost always yes), it forces a more realistic choice, such as “Would you prefer a laptop with a longer battery life for $1,200 or one with a sharper screen for $1,100?”. By analyzing thousands of these choices across a sample audience, companies can precisely model customer priorities, predict market share for new product configurations, and identify optimal pricing strategies.

How to Apply Conjoint Analysis to Product Strategy

Applying this framework is crucial before a major product launch or redesign. For instance, a technology company can use it to decide whether to invest in a superior camera or a larger storage capacity for its next smartphone. By understanding the perceived value of each feature, they can allocate R&D resources more effectively. Similarly, airlines use it to optimize route and service configurations, balancing factors like ticket price, layover times, and in-flight amenities.

Practical Example: An automaker is designing a new EV. They use conjoint analysis and discover customers value 300 miles of range far more than a 0-60 time under 4 seconds. They also find that consumers are willing to pay a $5,000 premium for the extra range but only $1,000 for the faster acceleration. As an investor, if you hear that the company is focusing its R&D budget on range extension, you know they are making a data-driven decision aligned with customer preference, which is a positive sign for future sales.

Actionable Tips for an Effective Conjoint Analysis:

- Select Relevant Attributes: Focus only on the most critical features that influence a purchase decision. Including too many can overwhelm participants and dilute the results.

- Ensure Realistic Levels: The variations for each attribute (e.g., price points, feature levels) must be credible and reflect plausible market offerings.

- Use Appropriate Design: Ensure your experimental design is statistically sound for your sample size to generate reliable data and meaningful insights.

- Validate When Possible: If feasible, follow up the analysis with A/B testing or a limited market launch to validate the model’s predictions in a real-world environment.

Market Analysis Techniques Comparison Matrix

| Framework | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| SWOT Analysis | Low – simple, intuitive framework | Low – cost-effective, time-efficient | Holistic view of internal & external factors | Strategic planning, market entry, competitive positioning | Easy to use, encourages collaboration, quick insights |

| Porter’s Five Forces | Medium – industry-wide analysis | Medium – data collection & evaluation | Industry attractiveness & competitive forces | Industry analysis, market entry, competitive strategy | Comprehensive industry structure insights, widely accepted |

| PESTLE Analysis | Medium-High – six macro factors | Medium-High – extensive data needed | External environment risks and opportunities | Strategic planning, risk assessment, international markets | Broad external environment coverage, future-oriented |

| Competitive Analysis | High – ongoing, detailed research | High – continuous data and tools | Deep competitor insights & market positioning | Product development, pricing, market positioning | Identifies market gaps, anticipates competitor moves |

| Market Segmentation Analysis | High – complex segmentation models | High – significant data & analysis | Defined customer segments, tailored strategies | Marketing strategy, product development, customer acquisition | Enables targeted marketing, improves ROI |

| Customer Journey Mapping | Medium-High – multi-touchpoint design | Medium – cross-functional coordination | Enhanced customer experience and satisfaction | CX optimization, service design, digital transformation | Aligns teams, identifies pain points, improves retention |

| Trend Analysis | Medium – continuous data analysis | Medium – quality data & tools | Early identification of market trends | Strategic planning, product development, investments | Enables proactive planning, reduces uncertainty |

| Value Chain Analysis | High – detailed activity breakdown | High – internal cost & activity data | Identifies cost drivers and competitive advantage | Operational improvement, cost reduction, positioning | Highlights cost reduction & efficiency opportunities |

| Conjoint Analysis | High – statistical design & execution | High – large samples & expert analysis | Quantitative consumer preference insights | Product development, pricing strategy, feature prioritization | Optimizes product design, predicts market share |

From Analysis to Action: Your Path to Disciplined Trading

Navigating the markets can feel like an overwhelming flood of information, where emotional impulses often threaten to derail even the most well-intentioned strategies. This is where the true power of disciplined analysis lies. We’ve explored a comprehensive suite of market analysis techniques, from the broad, environmental scans of PESTLE and Porter’s Five Forces to the customer-centric insights of Journey Mapping and Conjoint Analysis. Each framework serves as a vital tool in your arsenal, designed not to eliminate risk but to manage it with intelligence and foresight.

The journey from a novice trader reacting to market noise to a seasoned professional making calculated decisions is paved with consistent process. Mastering these techniques is not an academic exercise; it’s the foundation of a sustainable trading career. It’s about shifting your mindset from chasing fleeting “hot tips” to building a deep, structural understanding of the market forces at play. Remember, a single analysis rarely tells the whole story. The real edge comes from synthesis: combining a SWOT analysis of a company with a broader Trend Analysis of its industry, for instance, provides a multi-layered perspective that uncovers both hidden risks and overlooked opportunities.

The Power of a Process-Driven Approach

The most common pitfall for traders is inconsistency. You might use a detailed Competitive Analysis for one trade, then abandon the process for the next three because of a gut feeling or market hype. We’ve all done it. This is a recipe for erratic results and frustration. The goal is to transform these powerful analytical methods into ingrained habits.

A disciplined approach provides three critical advantages:

- Emotional Detachment: When you have a clear, repeatable process for evaluating an opportunity, you are less likely to be swayed by fear or greed. Your decisions become rooted in data and logic, not momentary panic or euphoria.

- Systematic Improvement: By consistently applying specific market analysis techniques and documenting your reasoning, you create a feedback loop. You can go back and review why a trade worked or failed, connecting the outcome directly to your analytical process. This is impossible when your decisions are random.

- Adaptability: Markets evolve. A solid understanding of frameworks like PESTLE or Market Segmentation allows you to identify and adapt to macro shifts, rather than being caught off guard. You learn to see the bigger picture beyond daily price fluctuations.

Your Actionable Path Forward

Knowledge without application is useless. The next step is to bridge the gap between reading about these techniques and integrating them into your daily routine. Don’t try to master all nine at once. Instead, choose one or two that resonate most with your trading style and commit to using them for the next month. For example, before entering your next position, perform a quick SWOT analysis on the company. Log your findings. Then, track the trade’s performance.

This practice of deliberate application and review is the cornerstone of professional development. It’s about building a robust, evidence-based system that you can trust, especially when the market is volatile and your convictions are tested. This is how you move from gambling to strategic investing. Your long-term success will not be defined by a single winning trade, but by the quality and consistency of your decision-making process over hundreds of trades.

Ready to turn theory into a powerful, data-driven trading system? TradeReview is the ultimate tool for logging your analysis, tagging trades with the specific techniques you used, and visualizing how a disciplined process impacts your bottom line. Start building your analytical edge and track your progress with a free account at TradeReview.