Let’s be blunt: managing your trading risk is the single most important skill you will ever learn. It’s the one thing that keeps you in the game long enough to find consistent success. We’re not talking about being timid or avoiding risk altogether — trading is inherently risky. This is about having a smart, repeatable plan to control it, so you can trade tomorrow, next week, and next year.

Why Your Defense Wins Championships

Most new traders are obsessed with offense. They spend all their time hunting for the perfect entry, convinced that one huge win will make them a star. But the pros know the truth: consistency isn’t built on home runs. It’s forged with a rock-solid defense. We’ve all felt the rush of a winning trade, but true longevity comes from surviving the inevitable losses.

Your ability to protect your capital when things go wrong — and they absolutely will go wrong — is what separates a professional from a gambler. This requires a complete shift in your thinking. Forget chasing profits. Your number one job is capital preservation.

From Gambler to Business Owner

Start treating your trading like a business. For a business, risk is just a managed expense, like rent or inventory. A gambler just hopes a trade will work out, crossing their fingers for a win. A business owner has a plan for when it doesn’t. That plan is your edge.

It’s incredibly easy to feel like a genius after a couple of winners, but that overconfidence is a silent account killer. We’ve all been there. A single large, unplanned loss can trigger a devastating spiral of revenge trading and emotional mistakes. Good risk management is your circuit breaker, stopping one bad call from burning down your entire account.

“The essence of trading isn’t about being right all the time. It’s about ensuring that when you’re wrong, the damage is small enough to let you play another day.”

The Unseen Cost of Poor Risk Management

Failing to manage risk properly costs you more than just the money on one bad trade. It leads to a nasty portfolio drawdown, which is the drop from your account’s peak value to its lowest point. The math for climbing out of that hole is brutal and often demoralizing.

Look at how quickly it gets out of hand:

- A 10% loss needs an 11% gain to get back to even.

- A 25% loss needs a 33% gain to recover.

- A 50% loss requires a massive 100% gain just to break even.

Understanding what is maximum drawdown is non-negotiable. It shows you exactly why large losses are so devastating to your long-term growth. By getting a handle on risk from day one, you build a foundation that can actually support a long and successful trading career.

How to Define Your Personal Risk Profile

Before you even think about placing a trade, the most important analysis you’ll ever do is on yourself. Seriously. Forget the charts for a minute. Real risk management isn’t some universal formula you pull from a textbook; it’s a deeply personal framework built on your unique financial situation and, just as importantly, your emotional toughness.

This self-assessment is the bedrock of your entire trading career. Without it, you’re just gambling, hoping for the best.

It all starts with an honest, hard look at your finances. This means figuring out your disposable income and carving out a specific pot of capital just for trading. This has to be money you can truly afford to lose — without it affecting your rent, your family, or your retirement plans. It’s not just about the numbers; it’s about creating a psychological safety net so you can make clear-headed decisions when the pressure is on.

Finding Your Sleep-at-Night Number

Every trader has a pain threshold. The trick is to find yours before the market finds it for you in the form of a painful loss. This is what many of us call the “sleep-at-night” number — the absolute maximum dollar amount you could lose on a single trade without it stressing you out or keeping you up at night.

Is it $50? $500? $1,000? Be brutally honest with yourself. If the thought of a potential loss makes your stomach churn, it’s too big. This number isn’t about ego; it’s a practical tool for protecting your mental capital, which is just as valuable as the money in your account.

Your personal risk profile is your trading constitution. It lays out the rules of engagement for every decision you make and stops you from letting fear or greed take the wheel during a volatile market.

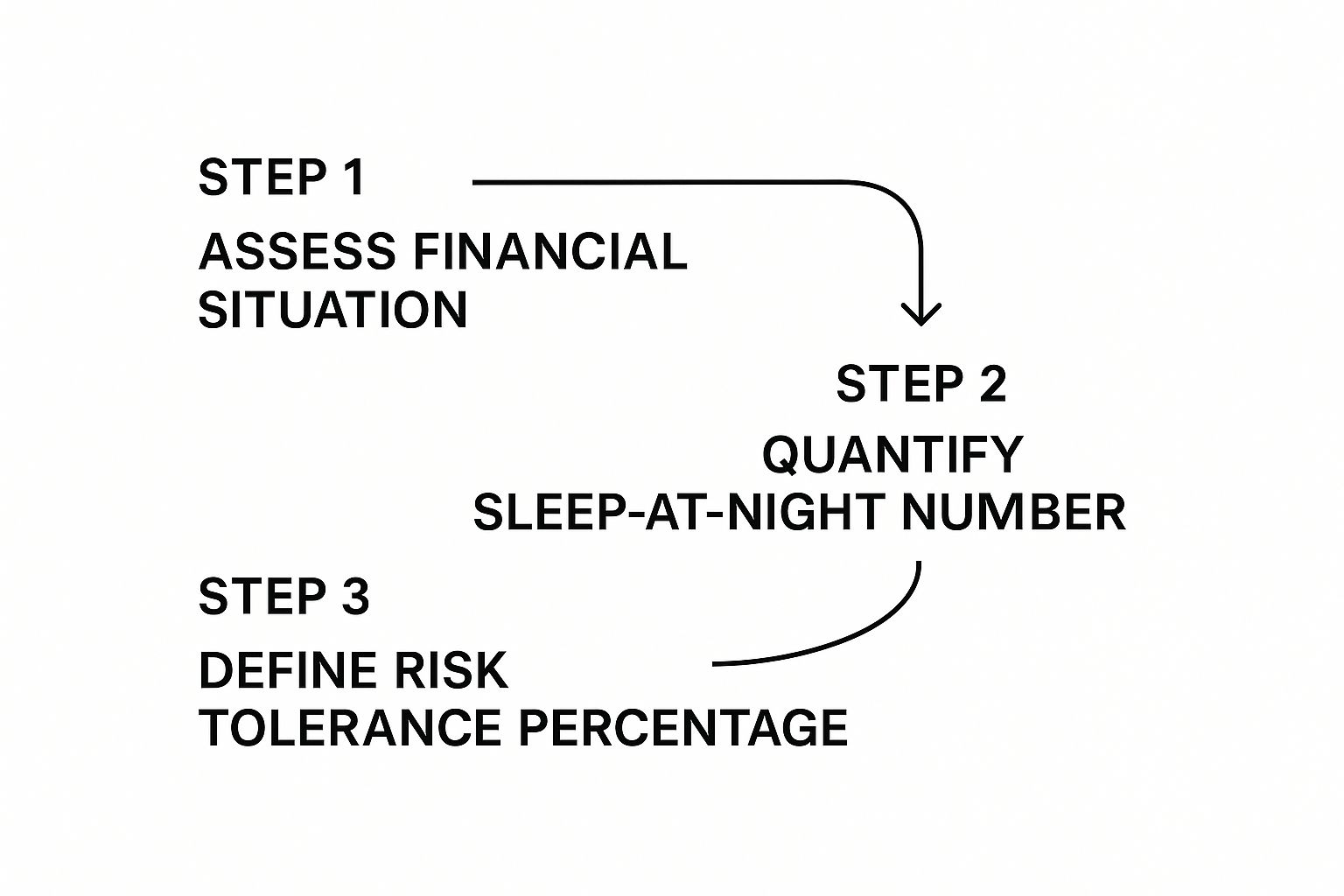

This process boils down to assessing your finances, figuring out your emotional limit, and then defining a strict risk percentage you’ll stick to for every single trade.

This infographic breaks down the three essential steps to building your personal risk profile.

As you can see, it’s a clear path: your financial health directly informs your emotional tolerance, which gives you what you need to set a concrete risk percentage for your trades.

From Personal Feelings to Practical Rules

Once you’ve got that number, you turn it into a hard-and-fast rule. For example, if your sleep-at-night number is $200, you can decide that’s your maximum acceptable loss per trade. Period.

This one rule then becomes the guide for everything else — from how you size your positions to where you place your stop-loss. Suddenly, managing trading risk becomes a systematic process, not an emotional reaction.

Understanding a bit of market history really drives this point home. Research analyzing stock market indexes from 1900 to 2016 found that lower perceived risk often aligns with higher asset prices. This just reinforces why having a pre-defined risk profile is so critical; it anchors you when market sentiment inevitably shifts, preventing you from getting swept up in the crowd’s euphoria or panic. You can read more about the interplay between risk management and market performance to see the data for yourself.

Practical Risk Tools: Position Sizing And Stop-Losses

This is where the rubber meets the road—where your abstract risk profile turns into a concrete, repeatable action plan for every trade you take.

Managing risk sounds complicated, but it really just boils down to answering two simple questions before you ever hit the “buy” button:

- How much of this should I actually buy? (Position Size)

- Where do I get out if I’m wrong? (Stop-Loss)

The answers lie in two of the most powerful tools in a trader’s arsenal: position sizing and stop-losses. Mastering these is what separates the gamblers from the pros, giving you precise control over your potential downside on every single trade.

Calculating Your Position Size

Forget about buying 100 shares of a stock just because it’s a round number or “feels right.” Professional traders use a simple formula to determine their exact position size, ensuring that a potential loss never exceeds their predetermined risk limit — like that 1% rule we talked about earlier.

The calculation is straightforward and connects three key variables:

- Your total trading account size.

- Your maximum risk per trade (e.g., 1%).

- Your stop-loss distance (the dollar amount per share between your entry and your exit).

Let’s say you have a $10,000 account and you’re disciplined about the 1% rule. Your maximum allowable risk on any single trade is $100. This number is non-negotiable. It’s your north star.

No matter how perfect a trade setup looks, your potential loss should never exceed your predefined risk limit. This discipline is what separates long-term traders from those who blow up their accounts.

Now, let’s see how this works in a real-world scenario. Imagine you want to buy a stock trading at $50. After analyzing the chart, you identify a key support level and decide your stop-loss should be at $48. That’s a $2 risk per share.

To find your position size, you just divide your max risk ($100) by your per-share risk ($2). The result is 50 shares. Simple. If the trade turns against you and hits your stop, you lose exactly $100, which is your planned 1%. No surprises, no panic.

Setting Intelligent Stop-Losses

A stop-loss isn’t just a random percentage you pluck out of thin air. The best, most effective stop-loss placements are based on the market’s structure — the natural price levels that other traders are watching. This skill is absolutely critical, and you can dive deeper into it in our detailed guide on how to set stop-losses.

Truly effective stops are placed in logical areas, such as:

- Just below a strong support level.

- Right under a key moving average that has been holding as a floor.

- Based on a stock’s typical volatility, often measured with the Average True Range (ATR).

Let’s bring this to life by comparing two different stocks, both using our $10,000 account and $100 risk limit.

Example Position Sizing with the 1% Rule ($10,000 Account)

This table shows how the same $100 risk limit results in very different position sizes depending on the stock’s volatility and where you place your stop-loss.

| Metric | Stock A (Lower Volatility) | Stock B (Higher Volatility) |

|---|---|---|

| Account Size | $10,000 | $10,000 |

| Max Risk per Trade (1%) | $100 | $100 |

| Entry Price | $50.00 | $50.00 |

| Stop-Loss Price | $48.00 (Based on support) | $45.00 (Based on ATR) |

| Risk per Share | $2.00 | $5.00 |

| Calculated Position Size | 50 Shares ($100 / $2) | 20 Shares ($100 / $5) |

Notice how your position size automatically adjusted? For the more volatile stock, you have to buy fewer shares to keep your total risk capped at $100.

This is the very essence of effective risk management. You let the market’s behavior — not your emotions or a gut feeling — dictate your exposure.

Building a Resilient Portfolio with Diversification

Putting all your capital behind a single stock or sector is a recipe for disaster. It’s the trading equivalent of putting all your eggs in one basket — a mistake that can be incredibly painful. Real, long-term success in this game relies on building a portfolio that can take a punch without collapsing.

This is where smart diversification comes in.

It’s a common rookie mistake to think diversification just means buying a bunch of different stocks. The real art lies in understanding how those assets behave in relation to one another. The key concept here is correlation, which is just a way of measuring how two assets move together.

If you own five different high-growth tech stocks, you might feel diversified. But when a nasty industry report hits or interest rates jump, they’re all likely to sink together. That’s not true diversification. It’s just concentrated risk wearing a disguise.

Understanding Asset Correlation

To build genuine resilience, you need to mix in assets that are uncorrelated (move independently) or, even better, negatively correlated (move in opposite directions). What does that mean in practice? It means when one part of your portfolio is getting hammered, another part might be holding steady or even climbing. This smooths out your returns and keeps you in the game during tough times.

Here’s a practical example of how this plays out during market-wide stress:

- Stocks: In a panic, your equity positions could take a serious beating.

- Gold: Often seen as a “safe-haven” asset, gold prices can rise as investors flee from riskier assets like stocks.

- Bonds: High-quality government bonds often act as a buffer, with their value increasing as investors flock to safety.

By holding a mix of these, a nasty downturn in your tech holdings doesn’t have to crater your entire account. The gains in your gold or bond positions can help offset those losses, protecting your capital.

Preparing for Inevitable Downturns

Thinking this way forces you to prepare for what you know is coming. History is a powerful teacher here. Since 1946, the U.S. stock market has gone through 34 major drawdowns of over 10%.

Let that sink in. These events aren’t rare; they’re a regular part of the market cycle. Knowing this helps you shift from a reactive mindset (“Oh no, the market is crashing!”) to a proactive one (“I have a plan for this.”). Many of these downturns were sparked by macroeconomic shifts, which often lead to longer, deeper corrections. You can discover more insights about historical market downturns on msci.com to see how the pros prepare.

“Diversification is the only free lunch in finance. It’s about accepting that you don’t know the future and building a portfolio that doesn’t require you to.”

This principle isn’t just for long-term buy-and-hold investors, either. Short-term traders benefit from diversifying their strategies and the markets they trade. If your momentum strategy for tech stocks is dead in the water, maybe a range-trading setup on a commodity is firing on all cylinders.

This strategic diversification prevents you from being overly dependent on one specific set of market conditions, making your entire trading operation far more durable.

Using a Trading Journal to Refine Your Edge

The single most valuable source of trading data isn’t a news feed or some guru’s hot pick. It’s you. It’s your wins, your losses, and the thought process behind every single click. A trading journal is the tool that captures this priceless data, turning your raw experience into real, performance-boosting insights.

It’s easy to dismiss journaling as just tedious record-keeping, but that’s a rookie mistake. A well-kept journal is like an objective mirror reflecting your actual trading behavior, completely free from ego or wishful thinking. Think of it as the ultimate feedback loop for managing trading risk — it exposes the subtle, often unconscious patterns that are secretly bleeding your account dry.

Beyond Just Entries and Exits

A truly great journal goes way beyond just logging your entry and exit prices. To get any real value, you have to track the why behind every trade. This means capturing your state of mind, the market context, and the rationale for your decision.

For every trade, you should be tracking:

- The Trade Setup: What was the specific technical or fundamental trigger? Get in the habit of taking a screenshot of the chart right at the moment you entered.

- Your Emotional State: Were you feeling confident? Anxious? Greedy? Maybe just impatient? Be brutally honest with yourself here; this is often where the biggest mistakes are hiding.

- The Post-Trade Review: Once the trade is closed, review it. Did you follow your plan to the letter? If not, why? What could you have done better?

This commitment to self-analysis is what separates amateurs from professionals. It transforms you from a passive market participant into an active student of your own behavior. If you’re still not sure where to start, our guide explores why every trader needs a trading journal in much more detail.

Uncovering Your Hidden Patterns

Over time, this data becomes an absolute goldmine. After just a few dozen trades, you can start running a self-audit to identify your unique trading “demons.” Are you constantly moving your stop-loss right before a trade goes bad? Do you snatch tiny profits on winning trades out of fear, only to watch them run for another 100 pips?

Your trading journal is your personal risk manager. It holds you accountable to the rules you set for yourself and forces you to confront the habits that are costing you money.

For example, you might look at your data and discover that 80% of your biggest losses happen when you trade out of boredom on slow market days. That single insight is incredibly powerful. The fix is simple: create a new rule to stay flat when your primary setup isn’t there.

This need for disciplined risk analysis isn’t just for personal trading; it’s a massive global trend. The risk management market was valued at around USD 13.5 billion in 2024 and is projected to hit USD 38.9 billion by 2033. This explosion highlights a huge shift toward using data to manage financial challenges. You can discover more insights about the risk management market on imarcgroup.com. By journaling, you’re applying the exact same professional principles to your own trading business.

Common Questions About Trading Risk

It’s one thing to read about risk management, but it’s a whole different ball game when you’re live in the market and your money is on the line. Questions and doubts will inevitably pop up.

We’ve all been there — staring at a chart, fighting the urge to make a bad decision. Having clear, pre-defined answers to these common questions is what separates disciplined traders from the rest. It helps you act on your plan, not your emotions.

How Much Should I Risk Per Trade?

This is probably the first and most important question every trader needs to answer. Your risk per trade is the guardrail that keeps your account safe.

A solid, time-tested rule of thumb is the 1% rule. This is a guideline, not a law, but it’s an excellent starting point for most traders. Simply put, you should never risk more than 1% of your trading capital on a single idea.

So, if you have a $10,000 account, your maximum loss on any given trade should be capped at $100. If your account grows to $12,000, that number adjusts to $120. This simple rule is incredibly powerful because it ensures that a string of losses — which will happen — won’t knock you out of the game. It gives you the breathing room to learn and adapt without blowing up your account.

Is It Ever Okay to Move My Stop-Loss?

The short answer is a firm “yes and no,” and knowing the difference is absolutely critical.

You should never, ever move your stop-loss further away to give a losing trade “more room to breathe.” This is a classic, painful mistake. It’s no longer trading; it’s just hoping. This is how small, manageable losses turn into account-crippling disasters.

The only time you should move your stop-loss is to protect a profit. As a trade moves in your favor, you can trail your stop up behind it. For example, once the trade is profitable, you might move your stop to your original entry point, creating what’s essentially a “risk-free” trade (you can’t lose money, only give back some paper profit).

“A stop-loss is your pre-commitment to discipline. Honoring it protects you from your worst emotional impulses during a trade. Moving it further away is a sign that hope has replaced your strategy.”

What’s the Difference Between Risk Management and a Trading Strategy?

Great question. It’s a common point of confusion, but the distinction is simple and crucial.

- A trading strategy is your playbook for when to get in and out of the market. It answers the question, “What conditions must be met for me to enter a trade?” For example, “I buy when a stock breaks above its 50-day moving average and shows high volume.” It identifies a potential opportunity.

- Risk management is the set of rules that protects your capital no matter what your strategy is. It answers the questions, “How much do I risk on this setup?” and “Where is my non-negotiable exit if I’m wrong?”

You could have the best strategy in the world, but without solid risk management, a few bad trades can wipe out weeks of profits. Your strategy finds the trades, but your risk management plan is what keeps you in business long enough for that strategy to pay off.

Ready to turn these principles into practice? The best way to master managing trading risk is by tracking your performance with objective data. TradeReview provides the tools you need to analyze your trades, identify your patterns, and refine your edge with discipline. Start journaling for free and take control of your trading journey. https://tradereview.app