When you place a stop loss, you’re setting a pre-determined order to sell a security if it hits a certain price. This is your number one tool for limiting potential losses on a trade. This isn’t just some technical box-ticking exercise; it’s a strategic decision you make with a clear head, saving you from making emotional calls when the market gets choppy. There are no guaranteed profits in trading, but a well-placed stop loss is the closest thing you have to guaranteed risk control.

Why Stop Losses Are Your Most Important Trading Tool

Let’s be real — nothing stings quite like watching a winning trade reverse and turn into a painful loss. We’ve all been there, clinging to hope as our profits vanish and our capital dwindles. It’s an emotional rollercoaster that can lead to bad decisions. This is exactly why mastering the stop loss is non-negotiable for anyone serious about long-term success in the markets.

A stop loss isn’t a sign of pessimism or an admission that you might be wrong. Think of it as your professional safety net. It’s the business plan for your trade, defining the absolute maximum risk you’ll accept before you even click “buy.” This simple action is what separates hopeful gambling from strategic, disciplined trading.

Preserving Capital for the Long Game

Your trading capital is the lifeblood of your career. Without it, you’re on the sidelines. A stop loss is your primary defense for protecting that capital, ensuring you can trade tomorrow, next week, and next year.

By cutting your losses short and sticking to the plan, you ensure that one or two bad trades don’t blow up your account. This lets you survive the inevitable drawdowns and stay in the game, ready for the next opportunity. It’s a cornerstone of any solid set of risk management techniques.

Here’s what it really comes down to:

- Emotional Detachment: It takes the anxiety and greed out of the equation. Your exit plan is locked in, so you don’t have to second-guess yourself under pressure.

- Capital Preservation: It turns a potentially catastrophic event into a small, manageable setback. You live to trade another day.

- Improved Discipline: Using stop losses consistently builds the disciplined habits that are essential for long-term, sustainable trading.

A stop loss is your pre-commitment to discipline. It’s the decision you make when you’re rational and logical, which protects you from the emotional person you become when real money is on the line.

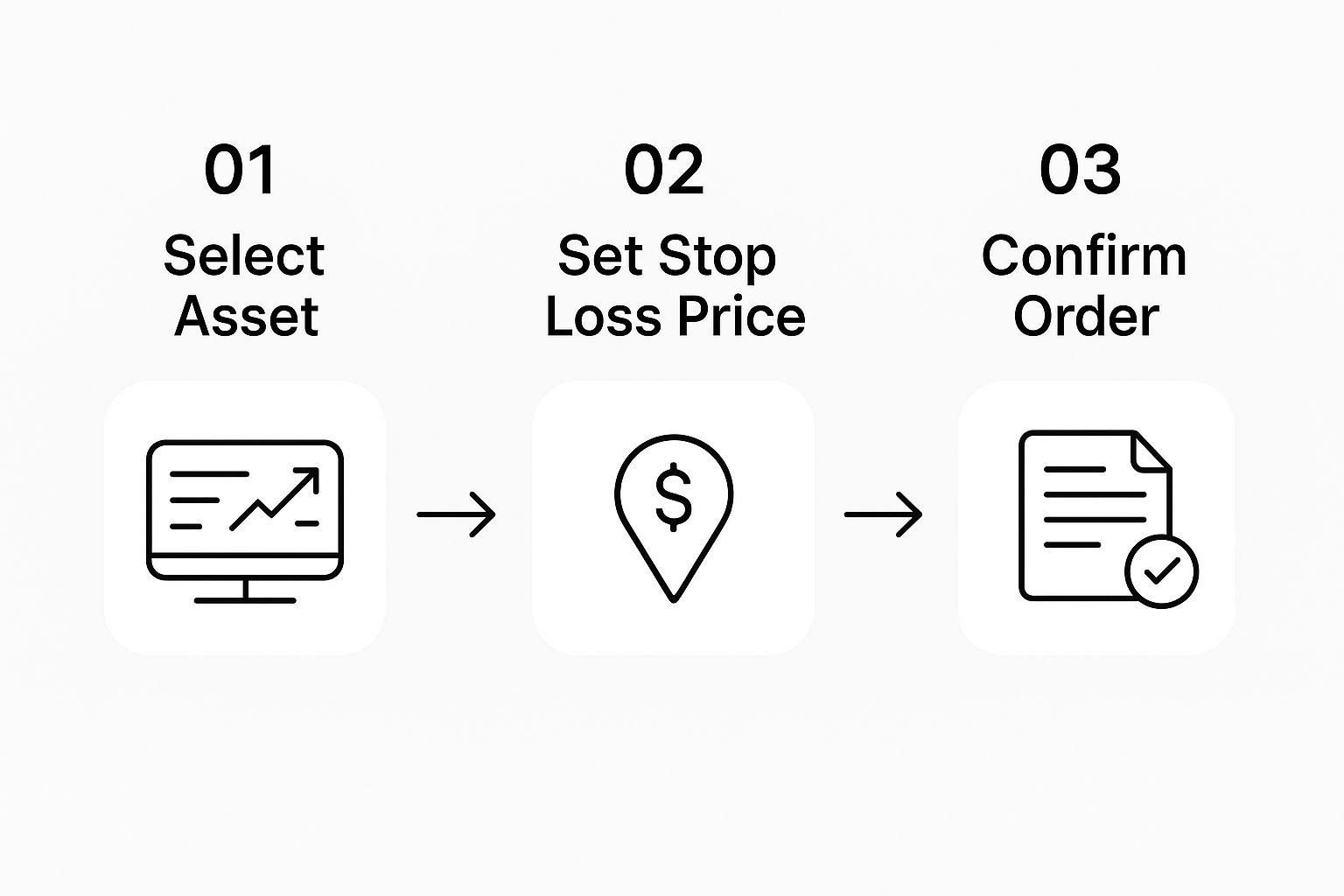

The image below gives a great visual of how a basic stop-loss order works in practice.

As you can see, the order is designed to automatically trigger a sale if the price drops to your pre-set level. This effectively puts a cap on your downside. Getting this right is the first major step toward building a resilient and long-lasting trading career.

Finding the Right Place for Your Stop Loss

Figuring out where to set your stop loss is more of an art than a science, but it should never be a random guess. A smart stop loss is tied directly to the asset’s behavior and your trading plan — not your gut feeling or wishful thinking. Forget about arbitrary percentages. Let’s dig into a few practical, chart-based methods that experienced traders rely on to define their risk.

The whole point is to place your stop at a logical level where the original reason for taking the trade is proven wrong. It’s the price that screams, “My analysis was off, and it’s time to get out.”

Placing Stops Below Key Support Levels

One of the most reliable approaches is to find a clear support level on the chart and set your stop just underneath it. Support is simply a price zone where buyers have historically shown up, keeping the price from dropping further. By placing your stop below this area, you give your trade a buffer against minor wiggles while ensuring you exit if that established buying pressure evaporates.

Let’s walk through a practical example. Say you want to buy NVIDIA (NVDA) because you see it’s in a strong uptrend. You notice on the daily chart that the stock has consistently found buyers around the $125 mark, bouncing off that level multiple times over the past few weeks.

- Your Entry: You decide to buy NVDA at $130.

- Logical Stop Placement: Instead of setting your stop right at $125, where a quick dip could easily knock you out, you place it slightly below — maybe at $124.40.

This gives the support level a little room to breathe. If NVDA breaks decisively below $124.40, it’s a strong signal that the buyers have left the building and your bullish outlook is probably incorrect.

Using Moving Averages as a Dynamic Guide

Moving averages are fantastic because they act like moving support or resistance levels that adapt to the latest price action. They are especially handy in trending markets. For many traders, the 50-day and 200-day simple moving averages (SMA) are go-to indicators for an asset’s health. They aren’t complex formulas; they simply show the average price over a specific period, helping you see the underlying trend.

If you’re in a long trade, a great spot for a stop loss is just beneath a key moving average.

For instance, imagine you’re bullish on Microsoft (MSFT) and it’s trading comfortably above its 50-day SMA. You enter a trade at $450, and the 50-day SMA is currently sitting at $441. A strategic stop could be set just under it, at $440.50. As long as the stock holds above this moving average, your uptrend thesis is still in play. But if it breaks below, that’s a clear sign that momentum has shifted against you.

Your stop loss placement is a direct reflection of your trading thesis. It is the specific price action that will prove your initial analysis wrong and signal it’s time to protect your capital.

Accounting for Volatility with the ATR

Sometimes, support levels and moving averages just aren’t enough, especially in choppy markets. An asset might swing wildly and stop you out, only to immediately reverse and head in your intended direction. It’s incredibly frustrating, and every trader has felt this pain.

This is where the Average True Range (ATR) indicator is a lifesaver. The ATR measures an asset’s volatility over a set period (usually 14 days). Think of it as a ruler for price swings. Using it helps you set a stop that respects the asset’s normal price movements, giving your trade the “breathing room” it needs.

Here’s a practical example of how to apply it:

- Find the Current ATR Value: Check the 14-day ATR for the stock you’re trading. Let’s say for Apple (AAPL), the ATR is $3.50.

- Choose a Multiple: Traders often use a multiple of the ATR, like 1.5x or 2x, to set their stop. A 2x multiple is quite common.

- Calculate the Stop Distance: Multiply the ATR by your chosen multiple: $3.50 (ATR) * 2 = $7.00.

- Set the Stop Loss: If you buy AAPL at $195, you’d subtract this value to find your stop loss price: $195 – $7.00 = $188.

This method ensures your stop loss is tailored to the specific volatility of that asset right now, helping you avoid getting shaken out by normal market noise.

Connecting Your Stop Loss to Position Size

A perfectly placed stop loss is a powerful tool, but it’s only half the story when it comes to long-term survival in the markets. The other, equally critical part is making sure no single trade can land a knockout blow to your account. This is where disciplined position sizing turns risk management from an abstract idea into concrete action.

At its core, position sizing just answers the question, “How many shares should I buy?” The answer, though, has to be rooted in a strict risk framework. Without one, you might be tempted to buy 100 shares when you should only buy 20, turning what should have been a small, manageable loss into a major setback.

This brings us to the “1% Rule” — a simple but profound guideline used by traders all over the world. The rule is straightforward: never risk more than 1% of your total trading capital on any single trade. This isn’t about capping your profits; it’s about making your losses so small that they become statistically insignificant over the long haul.

Calculating Your Position Size

Let’s walk through a practical example. Imagine you’re working with a $20,000 trading account.

- Define Your Max Risk: First, apply the 1% Rule. Your maximum acceptable loss on this trade is 1% of $20,000, which comes out to $200. This number is your line in the sand. No matter what, you won’t lose more than this.

- Determine Your Per-Share Risk: Your chart analysis tells you to buy a stock at $100 and place your stop loss at $96. The distance between your entry and your stop is your per-share risk: $100 – $96 = $4 per share.

-

Calculate Your Ideal Position Size: Now, just connect the two. Divide your maximum risk ($200) by your per-share risk ($4).

$200 (Max Risk) / $4 (Risk Per Share) = 50 Shares

Your perfect position size is 50 shares. By buying this exact amount, you’ve guaranteed that if the trade hits your stop, you will lose precisely $200 (plus commissions), keeping you firmly within your 1% risk limit.

This process is a core part of placing an order, as this infographic shows.

As you can see, setting the stop loss price is a fundamental step in the trade execution workflow, directly tying your risk definition to the live order you place.

By basing your position size on your stop loss, you make risk the one constant in a sea of market variables. Your dollar loss will be the same whether you’re trading a volatile tech stock or a stable blue-chip company.

This mechanical approach pulls emotion and guesswork out of the equation. It forces you to think about what you could lose before you get attached to what you might gain. Many experienced traders automate this process, and you can learn more about how this works by exploring what is algorithmic trading in our detailed guide.

Adopting this structured method is a massive step toward building a resilient and sustainable trading career.

Choosing Between Fixed and Trailing Stop Losses

Once you get the hang of setting stop losses, you’ll quickly realize they aren’t a one-size-fits-all tool. The two main flavors you’ll run into are the fixed (or static) stop loss and the trailing stop loss. Knowing the difference is a game-changer for matching your exit strategy to what you’re trying to accomplish with a trade.

A fixed stop loss is the most straightforward of the two. You place an order to sell at one specific price, and it stays right there unless you physically move it. It’s the classic “set it and forget it” approach, perfect for trades where you have a crystal-clear price that tells you your entire trade idea was wrong.

Think about it this way: you buy a stock at $100 because it just bounced beautifully off a strong support level at $97. You might pop a fixed stop loss in at $96.50. That order is going to sit at $96.50 whether the stock shoots up to $110 or drifts down to $98. It only gets triggered if the market proves you wrong and smashes through your line in the sand.

Letting Your Winners Run with Trailing Stops

On the flip side, a trailing stop loss is dynamic. It’s built to protect your profits while giving a winning trade room to breathe and keep running. Instead of locking in a fixed price, you set a trailing amount — either a percentage or a specific dollar value — that follows the price up as it moves in your favor.

Let’s walk through a practical example. Say you buy a stock at $50 and decide on a 15% trailing stop.

- Initial Stop: Right away, your stop loss is placed at $42.50 (15% below your $50 entry).

- Price Rises: The stock has a great run and hits $60. Your stop automatically adjusts itself upward to $51 (15% below the new high of $60), locking in a small profit.

- Price Peaks and Dips: If the stock continues its tear and peaks at $70, your stop now sits at $59.50. It will only trigger if the price pulls back 15% from that $70 high.

A trailing stop loss is your mechanical tool for practicing the age-old trading wisdom of “cut your losses short and let your winners run.” It removes the emotional temptation to take profits too early.

This dynamic approach is fantastic for capturing big moves in strong trending markets. It helps you maximize your upside without giving all your hard-earned gains back.

Which Type Should You Use?

So, which one is better? It completely depends on the market environment and your reason for entering the trade in the first place.

| Stop Loss Type | Best For | Key Advantage |

|---|---|---|

| Fixed Stop Loss | Range-bound markets or trades based on specific support/resistance levels. | Provides a clear, unchanging invalidation point for your trade idea. |

| Trailing Stop Loss | Strong trending markets where you want to capture a large move. | Protects profits automatically and lets you ride a trend without exiting too soon. |

In the world of commodities, both strategies have been shown to improve returns and manage risk effectively. A 2023 analysis of commodity factor trading revealed that while fixed stop-loss strategies performed well, trailing stops significantly boosted risk-adjusted returns. They achieved a Sharpe ratio of 1.28 compared to 0.92 for fixed stops.

You can read the full research on stop loss impacts in commodities to dig into the data yourself. The main takeaway is simple: it’s all about picking the right tool for the job.

Common Stop Loss Mistakes Traders Make

Knowing where to set a stop loss is a technical skill. But knowing when to leave it alone is where discipline and psychology are truly tested. Even the sharpest entry can be completely undone by a few common, costly mistakes. We’ve all felt the sting of these errors, so let’s tackle them head-on.

The “Too Tight” Stop Loss

One of the most frequent traps is setting your stop loss way too tight. It usually comes from a fear of losing money, so you place your stop just a few cents below your entry. This almost always results in getting “whipsawed” — stopped out by normal market noise or a minor dip, only to watch the price immediately reverse and rocket in your original direction.

This is especially true for different trading styles. Someone scalping for tiny price movements might need a tighter stop than a swing trader holding for days or weeks. To get a feel for how different time horizons impact your strategy, check out our guide comparing swing trading vs day trading.

The Most Dangerous Mistake

By far, the most destructive habit you can have is moving your stop loss further away once a trade starts going against you. This single action turns a calculated, managed risk into a desperate prayer. It’s a purely emotional decision that completely violates your trading plan.

Instead of taking a small, planned loss, you’re now inviting a much larger one. This is exactly how small drawdowns snowball into account-crippling events.

Avoiding Obvious Levels

Another major pitfall is placing stops at obvious, psychological round numbers. Think $50.00, $100.00, or $200.00. Big institutional players and their algorithms know that retail traders love to cluster their orders at these clean levels. This creates pockets of liquidity that can actually attract price, making it more likely your stop gets hit.

It’s a well-documented phenomenon. An analysis from the Federal Reserve Bank of New York found that waves of stop-loss triggers in the currency markets were responsible for creating sudden, sharp price cascades. Your stop isn’t just a personal safety net; it’s part of a larger market dynamic.

To sidestep these traps, try building these habits into your routine:

- Let Volatility Be Your Guide: Instead of guessing, use the Average True Range (ATR) indicator. Setting your stop at a multiple of the ATR (like 1.5x or 2x) gives your trade room to breathe based on the asset’s actual, current volatility.

- Place Stops Logically: Don’t put your stop right on a key support or resistance level. Tuck it just below support or just above resistance. If support is at $95.00, consider placing your stop at $94.87 to avoid the crowd.

- Commit to Your Plan: Once your stop is set based on sound analysis, do not touch it. The only exception is moving it in your favor to lock in profits, like with a trailing stop.

Your initial stop loss placement is the most objective decision you’ll make in a trade. Honor it. Moving it further from your entry is a direct path to emotional trading and significant losses.

Answering Your Top Stop Loss Questions

As you start putting stop losses into practice, you’ll inevitably run into some common “what if” scenarios. Let’s tackle a few of the biggest questions that pop up for traders in the real world.

Do I Really Need a Stop Loss on Every Single Trade?

For most of us who are trading on a short-to-medium-term basis, the answer is a hard yes. Think of your stop loss as the business plan for your trade. It’s what keeps you disciplined and saves your account from those nasty, unexpected market spikes.

The only real exception is for long-term, buy-and-hold investing. If you’re parking your money in a fundamentally solid company for years, you probably aren’t going to let short-term price noise shake you out of your position.

What’s This “Stop Loss Hunting” I Keep Hearing About?

Stop loss hunting is the idea that big market players can see where everyone has placed their stop orders and will push the price just far enough to trigger a wave of selling.

Whether it’s a deliberate strategy or just a natural market function, you can protect yourself from it. Here’s how:

- Ditch the Obvious Numbers: Don’t set your stop right at a clean, round number like $50.00 or $100.00. Those are predictable. Try something more specific, like $49.87, to stay off the radar.

- Use Real Technical Levels: Base your stop on solid analysis. Place it just below a proven support level or use a multiple of the ATR. Don’t just pick a number out of thin air.

Can a Stop Loss Guarantee I Won’t Lose More Than I Planned?

Not always, and this is a big one to remember. Under normal conditions, your stop loss order will get filled right around your target price. But when the market gets wild or liquidity dries up, slippage can happen.

Slippage is when your order executes at a worse price than you intended because the market moved too fast between the time your stop was triggered and when your order was filled. This is a very real risk, especially around major news events.

Even with that risk, the data is clear. Research into momentum strategies shows that using stop losses drastically improves outcomes. In one strategy, a 10% stop-loss cut the maximum monthly loss from a painful -49.79% down to a much more survivable -11.34%. You can discover more insights about momentum strategies and see the data for yourself.

A stop loss isn’t about a perfect, guaranteed exit. It’s about having a pre-defined, non-emotional plan to protect your capital when a trade goes against you.

Getting better at placing stop losses means you have to track what’s working. With TradeReview, you can log every trade, analyze where you placed your stops, and see exactly how your risk management is impacting your P&L. Track your win rate, profit factor, and equity curve to turn your trading data into smarter decisions. Start your free trading journal at https://tradereview.app.