Let’s be honest, staring at a stock chart for the first time can feel like trying to decipher a secret code. All those colorful bars, squiggly lines, and fluctuating numbers can seem chaotic. It’s a feeling every trader has experienced. But inside that chaos is a powerful story about a company’s financial journey and the collective emotions of every investor involved.

Beyond the Squiggly Lines: Why Charts Matter

This guide isn’t about some magic formula that guarantees profits that doesn’t exist. Instead, it’s about learning to read the story the market is telling. We’re here to help you move from feeling overwhelmed by the data to feeling empowered by it. This is a skill built with patience and discipline, not a get-rich-quick scheme.

Think of a chart as a visual record of market psychology. It shows you the tug-of-war between buyers and sellers in real-time, helping you make informed decisions based on evidence, not just gut feelings or market hype.

The Foundation of Technical Analysis

The skill of reading charts is the bedrock of technical analysis, a discipline that uses historical price data to get a sense of where things might be headed next. This isn’t some new fad; its roots go way back, with early forms showing up in 17th-century Amsterdam and later refined in 18th-century Japan with the invention of candlestick charts.

Pioneers like Charles Dow helped build this field on a simple idea: all known information is already baked into a stock’s price. If you want to dive deeper, the evolution of technical analysis is well-documented on Wikipedia.

By learning to interpret charts, you’re essentially getting a roadmap of a stock’s past behavior. This visual evidence helps you build discipline and make choices based on patterns and data, not just emotional reactions.

The goal is to replace fear and greed with a structured, repeatable process. A chart provides the framework for that process, showing you where the market has been, which offers clues about where it might go next.

Why Visual Data Matters

At the end of the day, a stock chart takes incredibly complex market dynamics and simplifies them into a picture. It’s a tool that helps traders of all styles from short-term day traders to long-term investors – spot opportunities and manage risk.

Whether you’re comparing fast-paced approaches like swing trading vs. day trading or just checking in on your retirement portfolio, understanding charts is a massive advantage.

This skill helps you answer crucial questions quickly:

- Is the stock trending up, down, or just chopping sideways?

- Where are the key price levels where buyers or sellers have historically shown up?

- Does the current price move have real strength behind it, or is it losing steam?

Learning to answer these questions is the first real step toward building a solid, long-term foundation for analyzing the markets on your own.

Getting to Know Your Stock Chart

Before you can make sense of the market’s story, you have to learn the language it’s written in. Every stock chart you’ll ever look at is built on a handful of core components. Don’t worry if it looks like a wall of confusing data at first; learning these basics is your first real step toward reading charts with confidence.

Think of it as learning the alphabet before you try to read a book. Once you get a feel for these fundamentals, the bigger picture starts snapping into focus.

The Lay of the Land: Axes and Timeframes

Every chart is built on two simple axes that give it structure and meaning. These are the absolute fundamentals that provide the context for every single price movement you see.

- The Y-Axis (Price): This runs vertically up the right side of your chart, showing the stock’s price. When the chart moves up, the price is rising. When it moves down, it’s falling.

- The X-Axis (Time): This runs horizontally along the bottom, representing time. This can be anything from minutes, to hours, days, weeks, or even years, all depending on the timeframe you select.

The timeframe you choose is absolutely critical. For example, a day trader looking for quick profits might use a five-minute chart, where each candle represents five minutes of trading. A long-term investor, however, is more likely to use a weekly chart to analyze the big-picture trend over several years, filtering out the distracting day-to-day noise.

The Story Inside a Candlestick

While some charts use simple lines, most traders rely on Japanese candlesticks because they pack a ton of information into a single shape. Each candle tells a rich story about the battle between buyers (bulls) and sellers (bears) over a specific time period.

Let’s say you’re looking at a daily chart for Apple (AAPL). Each candle represents one full trading day. A green candle tells you the stock closed higher than it opened – a clear win for the bulls. A red candle means it closed lower, a victory for the bears.

But the story goes much deeper than just the color.

- The Body: This is the thick, rectangular part. It shows you the range between the open and close price. A long green body suggests strong buying pressure, while a long red body signals that sellers were firmly in control.

- The Wicks (or Shadows): These are the thin lines sticking out from the top and bottom of the body. They show you the absolute highest and lowest prices the stock hit during that period. Long wicks can hint at volatility and indecision in the market.

Before we move on, let’s break down exactly what you’re seeing in a single candle.

How to Read a Candlestick

| Candlestick Part | What It Represents | Bullish (Green) Candle | Bearish (Red) Candle |

|---|---|---|---|

| Body | The range between the open and close price. | The bottom is the open; the top is the close. | The top is the open; the bottom is the close. |

| Upper Wick | The highest price reached during the period. | Shows how high buyers pushed the price. | Shows the peak price before sellers took over. |

| Lower Wick | The lowest price reached during the period. | Shows the lowest point before buyers stepped in. | Shows how low sellers pushed the price. |

Understanding these four points for every candle is the foundation of technical analysis. It tells you not just what the price did, but how it did it.

Trader’s Insight: A candle with a long upper wick and a tiny body is a classic red flag. It tells you that buyers tried to rally the price higher, but sellers stormed in and slammed it back down before the session closed. This can be an early warning that the buying momentum is fading.

Volume: The Clue Everyone Misses

At the bottom of most stock charts, you’ll see a series of vertical bars. That’s the volume indicator. Ignoring it is one of the biggest mistakes new traders make. Volume simply tells you how many shares were traded during a specific period.

Think of it like this: price shows you what happened, but volume shows you the conviction behind it.

A big price move up on massive volume is far more compelling than the same move on weak volume. High volume acts as confirmation, showing that many traders and institutions agree with the move.

For example, if a stock finally breaks out to a new all-time high, you want to see a huge spike in volume. That tells you there’s real institutional buying power fueling the breakout, making it more likely to succeed. On the flip side, a price that’s drifting up on low, dwindling volume might be a sign that the trend is exhausted and running on fumes.

Learning how to read stock charts is all about piecing these clues together. You’re analyzing how price got there, who was in control, and how much force was behind the move. It’s a skill that takes practice, but it all starts with understanding each piece of the puzzle.

Finding the Flow: Identifying Trends and Key Levels

Once you get comfortable reading individual candlesticks, the real analysis begins: seeing how they string together to tell a larger story. Markets rarely move in a straight line. Instead, they flow in patterns we call trends. Learning to spot these is one of the most important skills you can develop.

It’s a tough lesson to learn, but fighting the market’s dominant direction is often a losing battle. The very first question to ask when looking at a chart is, “What’s the overall trend?” This one question frames your entire analysis and helps keep you on the right side of the market’s momentum.

Spotting the Market’s Direction

A trend is simply the general direction a stock is heading over time. There are three main types, defined by a series of peaks (highs) and troughs (lows).

- Uptrend: A series of higher highs and higher lows. This is a classic sign that buyers are in control, pushing the price up and eagerly buying any dips along the way.

- Downtrend: The exact opposite, marked by lower highs and lower lows. In this scenario, sellers have the upper hand, driving prices down and selling into any small rallies.

- Sideways Trend (Consolidation): The price bounces around in a relatively tight range, making similar highs and lows. It’s a sign of indecision – a stalemate between buyers and sellers.

Spotting these can be as simple as connecting the dots. Drawing lines to connect the major peaks and valleys on your chart – a practice known as drawing trendlines – gives you a clean visual boundary of what’s happening.

Support and Resistance: The Invisible Battle Lines

Look closer at any chart, and you’ll notice prices seem to hit invisible walls. They stall, reverse, or just struggle to push through certain levels. These are called support and resistance levels, and they are a cornerstone of technical analysis. They show you where the forces of supply and demand are clashing.

Here’s a simple way to think about them:

- Support: This is like an invisible “floor.” It’s a price level where buying pressure has historically been strong enough to stop a decline and push the price back up. It’s where demand is concentrated.

- Resistance: Think of this as an invisible “ceiling.” It’s an area where selling pressure has consistently overpowered buyers, causing the price to turn back down. It’s where supply is concentrated.

These levels exist because of market psychology. For example, if a stock consistently finds buyers at $100, traders start viewing that price as a bargain, creating a psychological floor. On the flip side, if it repeatedly fails to break above $120, traders begin to see it as overvalued, creating a ceiling.

Key Takeaway: Support and resistance aren’t laser-precise lines; they are zones. A price might poke through a level for a bit before reversing. It’s more art than science, so think of them as general areas of interest, not impenetrable fortresses.

Learning to draw these horizontal lines at significant peaks and valleys is a game-changer. It gives you a logical framework for your decisions. Instead of buying a stock on a whim, you can wait for it to pull back to a known support level, giving you a much more structured entry with a clearer idea of your risk. This simple skill is what separates strategic trading from pure guesswork.

The Role Reversal Principle

One of the most powerful concepts in charting is what happens when one of these levels finally breaks. When a strong resistance level is decisively broken, it often flips its role and becomes the new support level. We call this a role reversal.

Why does this happen? The psychology is straightforward. All the traders who sold at the old resistance level are now regretting it as the price soars without them. Many will look for a chance to buy back in if the price dips to their original exit point, creating a fresh wave of demand right at that old ceiling. This dynamic is a critical part of understanding momentum, a topic we dive into in our detailed guide on what momentum trading is.

Trends in the Real World: A Century of Data

The power of identifying trends and key levels isn’t just for short-term trades; it gives you an invaluable long-term perspective. The Dow Jones Industrial Average (DJIA) chart is a perfect example. Zoom out over decades, and you can clearly see the massive market cycles that have defined economic history.

During the Great Depression, for instance, historical DJIA charts vividly show the catastrophic fall of roughly 85%. In contrast, from the 1980s onward, the chart paints a picture of a powerful, prolonged uptrend as it climbed from just a few thousand to over 30,000 points, reflecting decades of sustained economic growth. You can see these fascinating historical market trends on Macrotrends.net.

Using Indicators for Deeper Insight

If trends, support, and resistance are the main plot of a stock’s story, then technical indicators are like a second opinion. They are mathematical calculations based on price and volume data that provide additional visual cues on your chart.

Let’s be clear: indicators are not crystal balls. They do not predict the future with certainty, and relying on a single indicator signal is a recipe for disaster.

The real value comes from using them to confirm what you’re already seeing in the price action. They help you gauge the health of a trend, measure its momentum, and spot moments where the balance of power might be shifting. It’s easy to get overwhelmed by the hundreds of indicators out there, so we’ll stick to two of the most trusted tools in any trader’s kit.

Smoothing Out the Noise with Moving Averages

One of the most common and powerful tools is the moving average (MA). Its job is to cut through the daily price chatter and give you a clean, clear view of the underlying trend. It does this by calculating the average closing price of a stock over a specific period.

The result is a single, flowing line that’s far easier to interpret than jagged individual candlesticks. The timeframe you choose for your MA depends entirely on your trading style.

- Short-term MAs (like the 20-day): These hug the price closely and react quickly. They are often used by swing traders trying to catch shorter moves.

- Long-term MAs (like the 200-day): These are slow, steady lines that define the big picture. The 200-day MA is watched closely by institutions and is often seen as the ultimate bull vs. bear dividing line for a stock.

A practical use case is watching how the price interacts with a key MA. In a healthy uptrend, a moving average like the 50-day often acts as dynamic support – the price will pull back to it and bounce. For a disciplined trader, that bounce offers a logical spot to consider entering a trade, as it aligns with the broader trend.

Gauging Momentum with the Relative Strength Index (RSI)

While moving averages show you the trend’s direction, the Relative Strength Index (RSI) tells you about its speed and strength. The RSI is an oscillator, which means it moves between 0 and 100 in a separate window below your main chart.

Its main purpose is to flag potentially overbought or oversold conditions.

- Overbought: A reading above 70 suggests buying has been very strong, and the stock might be due for a pause or pullback.

- Oversold: A reading below 30 suggests selling has been intense, and the stock might be due for a relief bounce.

Now for a critical lesson about RSI that many new traders miss: “overbought” does not mean “sell,” and “oversold” does not mean “buy.”

A Word of Caution: A stock can stay “overbought” for weeks or even months in a strong uptrend. Selling simply because the RSI crossed 70 could mean missing out on significant further gains. Discipline is key.

Think of the RSI as a confirmation tool. For instance, if a stock you like is in a solid uptrend and pulls back to a key support level, seeing the RSI dip near 30 can add confidence that the selling is exhausted and buyers may be about to step back in. This layered approach is absolutely fundamental when you learn how to read stock charts effectively.

In the end, it all comes down to building a disciplined process. Indicators are just one piece of the puzzle. They offer valuable context but should never be your sole reason for a trade. Real chart analysis comes from weaving these insights together with your understanding of trends, support, and resistance to build a complete story of what the market is truly telling you.

A Real-World Chart Analysis Walkthrough

Theory is great, but the real learning starts when you apply it to a live chart. It’s easy to feel intimidated when you’re staring at a blank screen, trying to build a coherent analysis from scratch. Many traders feel that pressure, worried they’ll miss something obvious or draw the wrong conclusion. Remember, this is a normal part of the learning curve.

This walkthrough is designed to show you a repeatable process – not for finding guaranteed winners, but for building a solid, evidence-based market thesis with discipline.

Let’s imagine we’ve just opened a daily chart for a fictional tech company, “Innovate Corp” (ticker: INVT). We’re coming in with an open mind, ready to let the price action guide us.

Start with the Big Picture: The Primary Trend

The very first thing to do is zoom out. Before you draw a single line, you need to understand the dominant market direction. Looking at the last year of price data for INVT, we can see a clear pattern of higher highs and higher lows.

Right away, that tells us the stock is in a primary uptrend.

This single observation is our foundation. It frames every other decision we make, reminding us that, for now, the path of least resistance is up. Trying to short this stock would be fighting the trend, a low-probability move. Our analysis will instead focus on finding potential opportunities to join it.

Drawing the Key Battlegrounds

Next up, we identify the most obvious support and resistance zones. We’re looking for clear areas where the price has reacted multiple times. We spot a significant horizontal zone right around $150, where the price stalled for several weeks before finally breaking higher. That old ceiling is now a potential floor – a classic role reversal.

We also see a more recent support area around $175, where the stock has bounced twice in the past month. These two levels – $150 and $175 – are now our key areas of interest. They are the logical places where we’d expect buyers to show up again.

Adding Layers of Confirmation

With our trend and key levels established, we can start adding indicators to see if they confirm our view. We’ll add two common tools to our chart:

- The 50-Day Moving Average (MA): We notice this line is sloping upwards, which backs up our uptrend observation. More importantly, the price has respected it consistently, dipping down to touch it before bouncing higher. The 50-day MA is acting as strong dynamic support.

- The Relative Strength Index (RSI): Looking at the RSI below the price chart, we see that during the recent pullbacks to the $175 support level, the RSI dipped into the low 40s before turning up. It didn’t become deeply “oversold” (below 30), but it did show selling pressure was easing right at a logical spot.

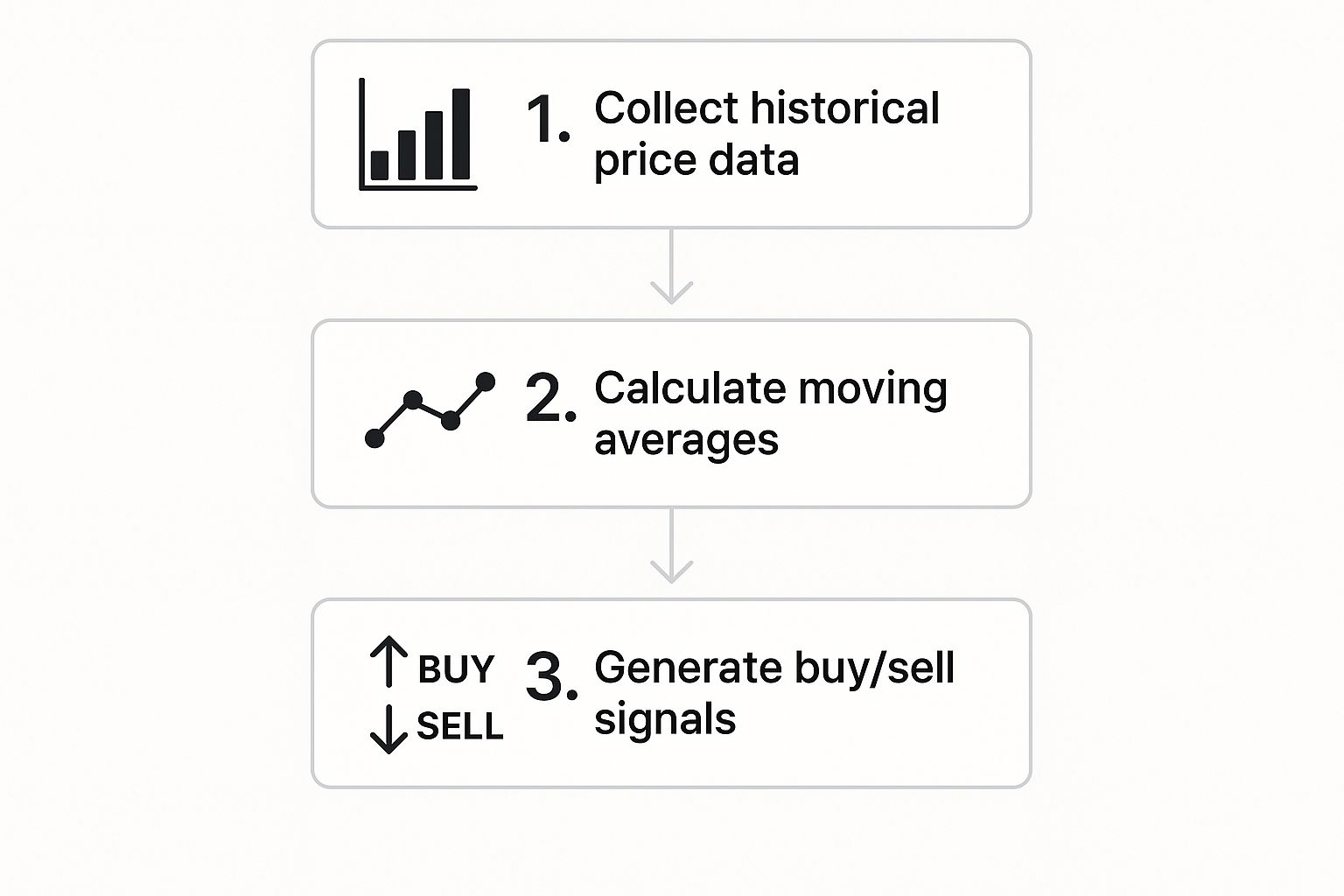

This process of collecting data, calculating trends, and generating potential signals is the very heart of technical analysis.

Building the Final Thesis

Now we can put all the pieces together into a simple, coherent story. We’re not trying to predict the future; we’re creating a strategic plan based on the evidence we’ve gathered.

Our Market Thesis for INVT: The stock is in a clear primary uptrend. It has established support at $175, which also lines up with the 50-day moving average. If the price were to pull back to this $175 zone again, it would represent a confluence of support, offering a potentially lower-risk entry point to join the existing trend.

See how that works? It’s not just a random guess. It’s a conclusion built by layering multiple, non-correlated pieces of evidence. This structured approach helps remove emotion from the equation and builds the discipline you need for long-term consistency. It transforms the chaotic squiggles on a screen into a clear map of potential opportunities.

This disciplined approach is crucial for navigating real-time markets. For instance, the US stock market index (US500) recently climbed by 2.71% over a month and showed a 20.5% gain compared to the previous year. Traders use charts to interpret these kinds of daily price changes and volume spikes, helping them make informed decisions based on momentum. You can dig into more of these recent market statistics on TradingEconomics.com.

By practicing this walkthrough on different charts, you will slowly build the confidence to analyze any stock, transforming abstract concepts into a practical, repeatable skill.

Common Chart Reading Questions Answered

As you start putting these chart reading skills into practice, it’s completely normal for questions and a little bit of uncertainty to pop up. Every single trader has been there. This last section tackles some of the most common hurdles beginners face, offering clear answers to help you build confidence.

Feeling a bit lost at times is just part of the process. The real key is to stay disciplined, never stop learning, and refuse to let the early struggles knock you out of the game.

Can I Use Just One Indicator to Make Decisions?

This is easily one of the most tempting shortcuts for new traders, but it’s a dangerous one. There’s no such thing as a “magic bullet” indicator. An RSI reading over 70 doesn’t automatically mean “sell,” just as a moving average crossover isn’t a guaranteed signal to buy.

Indicators are at their best when used as confirmation tools, not as standalone decision-makers. They should support what you’re already seeing in the price action, the overall trend, and the key support or resistance levels. Relying on just one indicator is like trying to navigate a new city with only a compass – you’re missing the map.

How Do I Know Which Timeframe to Use?

The right timeframe boils down entirely to your trading style and your goals.

- Day Traders: Live on very short timeframes, often using the 1-minute or 5-minute charts to catch small, quick price moves throughout the day.

- Swing Traders: Usually operate on the hourly, 4-hour, or daily charts. Their goal is to capture market swings that play out over several days or weeks.

- Long-Term Investors: Prefer to zoom way out, using weekly or even monthly charts. This helps them analyze the big-picture trend over months or years, effectively tuning out short-term market noise.

Trader’s Tip: Many experienced traders use a multi-timeframe analysis. They might glance at the weekly chart to nail down the primary trend and then zoom into the daily chart to pinpoint a precise entry that aligns with that bigger move.

What if I Keep Making Mistakes?

Here’s a hard truth about trading: mistakes aren’t just common; they are guaranteed. The real difference between traders who succeed long-term and those who don’t is how they learn from those errors. The single most effective way to do that is by meticulously tracking your performance.

Keeping a detailed log of your trades – what you did, why you did it, how you felt, and what happened – is non-negotiable. This simple practice turns every trade, win or lose, into a powerful lesson. If you want to build this crucial habit, learning why every trader needs a trading journal can give you a solid framework to start from.

At the end of the day, learning to read stock charts is a journey, not a destination. It takes patience, discipline, and a commitment to continuous improvement. Don’t chase perfection or expect to master everything overnight. Focus on making small, steady progress, celebrate the small wins, and remember that even the pros were once beginners staring at a confusing chart. The goal is steady improvement, not instant profits.

Ready to turn your analysis into action and learn from every trade? TradeReview provides the tools you need to track your performance, identify patterns in your trading, and make data-driven decisions. Log your trades, analyze your wins and losses, and start building the discipline required for long-term success. Get started for free today at https://tradereview.app.