We’ve all been there — that gut-wrenching moment when you check your account and see a sea of red. It’s a feeling every investor knows, and it often leads to panicked, reactive decisions that do more harm than good. We get it; managing your hard-earned money is stressful, and seeing it decline is tough.

The key to navigating this emotional rollercoaster is diversification. Put simply, it’s the practice of spreading your investments across different asset classes, industries, and even countries to help manage risk. This isn’t a magic formula for guaranteed profits; it’s about building a resilient portfolio that combines growth-focused assets like stocks with more stable ones like bonds to smooth out the market’s inevitable bumps. It’s about playing the long game with discipline.

Why Diversification Is Your Best Defense in Volatile Markets

At its core, diversification is the age-old wisdom of not putting all your eggs in one basket. It’s a foundational strategy designed to protect you from the market’s wild swings and create a more durable financial future. We know it’s hard to stay calm when the news is screaming about a market crash, but a well-diversified portfolio is your best tool for staying the course.

The idea is straightforward: different investments react differently to the same economic events. When one corner of your portfolio is taking a hit, another part might be thriving, helping to balance your overall returns. This doesn’t mean you can eliminate risk completely — no investment is ever truly risk-free. Instead, it’s about managing it smartly so that a downturn in a single stock or sector doesn’t derail your long-term goals.

Before we dive deeper, here’s a quick look at the core strategies we’ll be breaking down.

Key Diversification Strategies at a Glance

This table gives you a snapshot of the key concepts we’ll explore. Think of it as your roadmap to building a more balanced and resilient investment portfolio.

| Strategy | What It Means | Why It’s Important |

|---|---|---|

| Asset Allocation | Dividing your portfolio among different asset categories, like stocks, bonds, and alternatives. | Different assets perform differently under various market conditions, smoothing out your overall returns. |

| Geographic Diversification | Investing in companies and markets outside of your home country. | Reduces risk tied to a single country’s economy, politics, or currency fluctuations. |

| Sector & Industry Spreading | Spreading investments across various economic sectors (e.g., tech, healthcare, energy). | Prevents overexposure to a single industry, protecting you if that sector faces a downturn. |

| Rebalancing | Periodically buying or selling assets to maintain your original target allocation. | Ensures your portfolio stays aligned with your risk tolerance and long-term goals. |

Understanding these pillars is the first step toward building a portfolio that can weather any storm.

The Power of Balance

Think of your portfolio like a well-rounded team. You wouldn’t build a basketball team with only star shooters; you also need great defenders and strategic playmakers. In the same way, a strong portfolio needs a mix of assets playing different roles.

- Stocks (Equities) are your offense, driving long-term growth and offering the highest potential for returns.

- Bonds (Fixed Income) are your defense, providing stability and predictable income, especially when stocks get shaky.

- Alternatives, like real estate or commodities, can act as specialized players, offering a hedge against inflation or moving independently of traditional markets.

This balance is what saves you from making emotional decisions. When the market plunges, the stability from your bond holdings can give you the confidence to stay put instead of selling everything at the worst possible moment — a common and costly mistake for many investors.

Diversification isn’t just a protective measure; it’s a proactive strategy for reducing volatility’s impact over the long run. It’s an admission that we can’t predict the future, so we prepare for multiple outcomes instead.

A Look at the Historical Proof

When you look at the historical data, the value of this approach becomes crystal clear. Over the past 30 years, stocks have delivered impressive average annual returns, often topping 9% per year. But that growth came with some major volatility and painful single-year losses.

On the flip side, bonds and Treasury bills offered more modest returns, usually in the 3-5% range annually, but with far less drama. This trade-off is precisely why blending high-growth, high-volatility assets with more stable ones is the cornerstone of building a portfolio that can truly last.

For more on this, Britannica offers some great insights into the benefits of portfolio diversification.

Define Your Personal Investment Strategy

Before you invest a single dollar, the most important thing to understand is yourself. Learning how to diversify an investment portfolio isn’t about grabbing a generic template; it’s about crafting a framework that fits your unique financial life. It’s easy to get caught up chasing the “best” stock or the “hot” fund, but the real foundation is a strategy that actually aligns with your personal situation.

This process starts with an honest look in the mirror. Are you a recent grad with decades to go before retirement? Or are you hoping to leave the 9-to-5 behind in the next five years? The answers to questions like these will completely change your approach. A good portfolio should be a direct reflection of your goals, your timeline, and what you can stomach when it comes to risk — not someone else’s.

Assess Your Time Horizon

Your time horizon is just a way of saying how long you have until you need to start using your invested money. This one factor, more than any other, dictates how much risk you can reasonably afford to take. A longer timeline gives you more runway to recover from market downturns, which are an inevitable part of the investing journey.

Let’s look at a couple of practical examples:

- The Early Career Professional: A 28-year-old saving for retirement has a time horizon stretching over 30 years. A big market drop might feel scary, but on that long of a journey, it’s really just a temporary dip. This investor can afford to put a larger chunk of their portfolio into growth-focused assets like stocks, knowing they have plenty of time to ride out the inevitable waves.

- The Pre-Retiree: Now, consider a 62-year-old who wants to retire at 67. Their time horizon is only five years. A major market crash could be catastrophic, leaving little time to recover before they need to start living off that money. For this person, the priority shifts from all-out growth to capital preservation, which means leaning more heavily on stable assets like bonds and cash.

Getting this difference is the first real step in building a strategy that fits your life stage. It’s about matching your portfolio to your personal calendar, not chasing the highest possible returns this quarter.

Determine Your True Risk Tolerance

Risk tolerance isn’t just a number on a questionnaire; it’s about how you feel when the market gets choppy. It’s one thing to call yourself an “aggressive” investor when everything is going up, but your true tolerance comes out when your portfolio suddenly drops 20%. How would you react then? Would you sell in a panic, or would you trust your long-term plan?

The goal is to build a portfolio that lets you sleep soundly at night. If market swings are giving you constant anxiety and making you want to ditch your strategy, your asset mix is probably too aggressive for you.

There are generally three investor profiles. Being brutally honest about where you fit is the key to sticking with your plan for the long haul.

- Conservative: Protecting your money is your top priority. You’re okay with lower returns if it means avoiding big swings.

- Moderate: You’re looking for a healthy balance between growth and stability. You can handle some market ups and downs to achieve solid long-term returns.

- Aggressive: Your main focus is on maximizing long-term growth. You’re willing to stomach significant volatility for the chance at higher potential returns.

One of the best ways to get a real feel for market volatility without risking your own money is to practice. You can get a much better sense of your own emotional reactions by testing out different investment scenarios completely risk-free. If you want to learn more, check out our guide on what is paper trading. This kind of hands-on experience is invaluable for helping you create a strategy you can actually stick with when your emotions are running high.

Build Your Foundation With Strategic Asset Allocation

Once you’ve locked in your personal strategy, it’s time to start laying the foundation. Strategic asset allocation isn’t about chasing hot stocks or trying to time the market — it’s about methodically combining the fundamental building blocks of investing to create a portfolio that’s both balanced and resilient.

We’ll focus on three core components: stocks for growth, bonds for stability, and cash for safety. Each one plays a unique and critical role. Understanding how they work together is the secret to building a portfolio that can weather any storm. Getting this foundation right is how you truly learn to diversify your investments.

The Three Core Building Blocks

Think of your portfolio like a three-legged stool. If one leg is too short or too long, the whole thing gets wobbly. The same is true for your investments.

- Stocks (Equities): These are your primary growth engine. When you buy a stock, you’re buying a small piece of a company, giving you a claim on its future profits. They offer the highest potential for long-term returns but also come with the most volatility.

- Bonds (Fixed Income): Think of these as loans you make to a government or a corporation. In return, you get regular interest payments and your original investment back when the bond matures. Bonds provide stability and income, often holding their ground when stocks are having a tough time.

- Cash and Equivalents: This is the money in your high-yield savings accounts, money market funds, or short-term T-bills. Its job is to provide safety and liquidity, acting as a secure buffer during market downturns and giving you firepower for emergencies or new opportunities.

A smart blend of these three is what creates a portfolio that can chase growth while protecting you from devastating losses.

Keep It Simple With Low-Cost ETFs

It’s easy to get overwhelmed by the thousands of investment options out there. The good news? You don’t need to be a Wall Street analyst to build a powerful, diversified portfolio. Broad-market Exchange-Traded Funds (ETFs) offer a simple and incredibly effective solution.

An ETF is a fund that holds a basket of assets — like stocks or bonds — but trades on an exchange just like a single stock. With one purchase, you can own hundreds or even thousands of different securities.

Here are some practical examples:

- Vanguard Total Stock Market ETF (VTI): This single fund gives you a piece of nearly every publicly traded company in the United States, from giants like Apple to the smallest startups.

- iShares Core U.S. Aggregate Bond ETF (AGG): This fund instantly diversifies your holdings across thousands of U.S. investment-grade bonds, including both government and corporate debt.

Using just two or three of these low-cost ETFs, you can build a core portfolio that is more diversified than what most people could ever achieve picking individual stocks and bonds. It simplifies everything and helps you avoid the common trap of over-complicating your strategy.

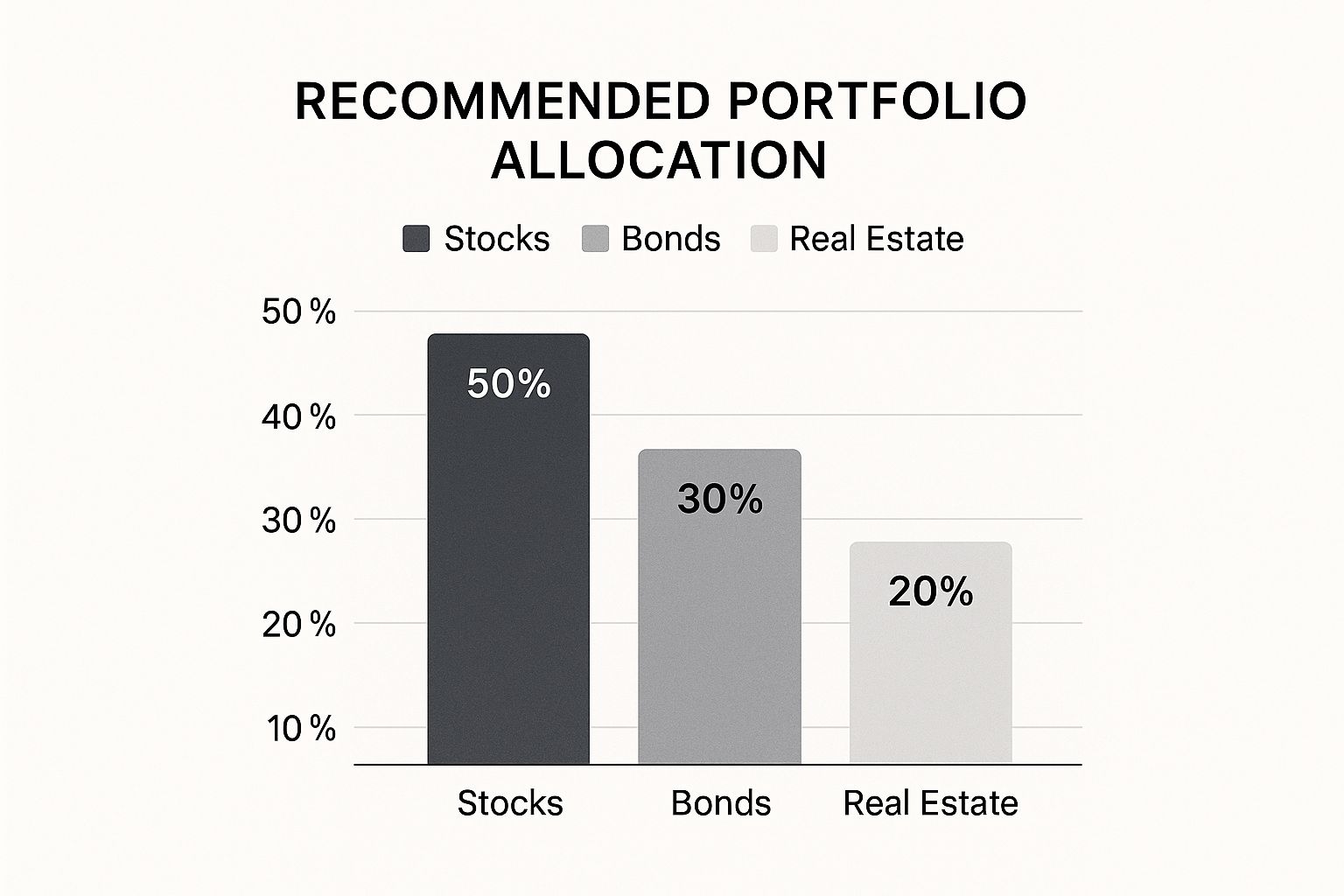

The chart below shows how different asset classes can be combined to form a balanced portfolio.

This visual gives you a great look at a moderate approach, blending growth-focused stocks with the stability of bonds and real estate to create a solid foundation.

Sample Asset Allocation Models by Risk Profile

To give you a clearer picture, here are a few tangible starting points. These models show how you can adjust your stock and bond allocations based on how much risk you’re comfortable with.

| Risk Profile | Stocks (%) | Bonds (%) | Alternatives/Cash (%) |

|---|---|---|---|

| Conservative | 40 | 50 | 10 |

| Moderate | 60 | 35 | 5 |

| Aggressive | 80 | 15 | 5 |

Remember, these are just templates. The “right” mix for you depends entirely on your personal goals, timeline, and comfort with market swings. Use these as a guide to start crafting your own ideal allocation.

The Time-Tested 60/40 Portfolio

One of the most classic and durable models is the 60/40 portfolio. It’s simple: 60% of your money goes into stocks and 40% into bonds. The idea is to capture a healthy chunk of the stock market’s growth while using bonds as a cushion during downturns.

While some have questioned its relevance lately, its historical performance speaks for itself.

The 60/40 split is a powerful starting point because it forces discipline. It’s a simple, rules-based approach that helps you balance the hunger for growth with the need for stability, keeping you from getting too greedy or too fearful.

Looking back, the data shows this strategy works. From 1901 to 2022, this simple allocation delivered real annual returns ranging from about 2.95% in Japan to nearly 5% in Australia. Even when both asset classes fell at the same time, like in 2022, the balanced portfolio still cushioned the blow and outperformed less diversified strategies over the long run.

This strategy is often a great fit for moderate-risk investors with a long time horizon. But it’s not a one-size-fits-all solution. A younger, more aggressive investor might tilt toward an 80/20 split, while someone nearing retirement might prefer a conservative 40/60 allocation. The key is to use this classic model as a benchmark and tweak it to fit your life.

A disciplined allocation pairs perfectly with consistent investing habits. Our guide on what is dollar-cost averaging explains how you can systematically invest over time to smooth out market bumps — a technique that makes a well-allocated portfolio even more powerful.

Add Layers of Protection with Advanced Diversification

So, you’ve got your foundation — a solid mix of stocks, bonds, and cash. Think of that as the sturdy frame of your investment house. Now, it’s time to add the specialized layers that protect it from all kinds of financial weather. This is where we go deeper into diversification, looking within each asset class to build real resilience.

Just holding a “stock” fund is a great start, but we need to get more granular. We’re going to spread your investments across different geographies, company sizes, and entire economic sectors. This is how you make sure a storm hitting one corner of the market doesn’t flood your entire portfolio.

Look Beyond Your Home Country

It’s completely natural for investors to have a “home bias.” We stick to what we know, concentrating our investments in our own country’s market. But while it feels safe, it creates a massive blind spot.

If all your stocks are tied to a single country’s economy, you’re exposing yourself to concentrated political risks, a local recession, or sudden currency swings. Adding international stocks is a game-changer. It gives you a stake in global growth and can insulate your portfolio when your home market is having a tough time.

The easiest way in? An international stock ETF like the Vanguard Total International Stock ETF (VXUS). One purchase gives you exposure to thousands of companies in both developed and emerging markets outside the U.S., instantly broadening your financial horizons.

Even though global markets are more connected than ever, research covering 1986 to 2016 confirms that the benefits of global diversification are still very much alive for long-term investors. Because stocks in different countries react to unique local conditions, spreading your investments internationally remains a powerful way to reduce risk. You can read the full research about these diversification benefits to dig into the data yourself.

Diversify Across Company Sizes

Not all stocks are created equal. The market is made up of businesses of all sizes, and they often perform very differently depending on the economic climate. Spreading your investments across them adds another critical layer of protection.

- Large-Cap Stocks: These are the established giants (think Apple, Microsoft). They tend to be stable and often pay dividends, but their explosive growth days may be behind them.

- Small-Cap Stocks: These are smaller, younger companies with huge growth potential. They come with more volatility and risk, but they can deliver incredible returns during economic booms.

A well-rounded portfolio needs both. Large-caps provide the stability, while small-caps offer the growth engine. You can achieve this balance with separate large-cap and small-cap funds, or simply by using a total stock market fund that already includes companies of all sizes.

Spread Your Bets Across Economic Sectors

Just like you wouldn’t put all your money in one country, you shouldn’t bet it all on one industry. Piling into a single sector — like tech or energy — can feel amazing when it’s booming, but it can be devastating when sentiment shifts.

A much smarter approach is to spread your stock investments across various economic sectors.

| Sector | Role in a Portfolio | Example Companies |

|---|---|---|

| Technology | Drives innovation and offers high growth potential, but can be volatile. | NVIDIA, Adobe |

| Healthcare | Considered “defensive” as demand is constant, regardless of the economy. | Johnson & Johnson, Pfizer |

| Consumer Staples | Another defensive sector — people always need food and household products. | Procter & Gamble, Coca-Cola |

| Financials | Tends to perform well when interest rates are rising and the economy is strong. | JPMorgan Chase, Visa |

The good news is that by owning a broad-market fund, you automatically get exposure to all of these sectors. This ensures that if one industry tanks — like airlines did in 2020 — your portfolio can absorb the shock because of its strength elsewhere. This is a core part of effective risk management, which you can learn more about in our guide on risk management techniques.

Introduce Alternative Assets

Finally, let’s talk about adding assets that move independently of the traditional stock and bond markets. These are often called alternatives, and they can be a fantastic tool for smoothing out your returns over time.

Alternatives act like a different set of tools in your financial workshop. When your primary tools (stocks and bonds) aren’t working well, alternatives can often get the job done, providing stability when you need it most.

Here are two of the most accessible examples for individual investors:

- Real Estate Investment Trusts (REITs): These companies own or finance income-producing real estate. Investing in a REIT is like being a landlord without the headaches, giving you exposure to the property market and a steady stream of dividend income.

- Commodities: These are raw materials like gold, oil, and agricultural products. Gold, in particular, is often seen as a “safe-haven” asset that tends to hold its value during economic uncertainty or high inflation.

Adding a small allocation (say, 5-10%) to alternatives like these can provide a valuable buffer during market crises, making your portfolio that much more robust.

Master the Discipline of Portfolio Rebalancing

Building a diversified portfolio is a huge step, but it’s not something you can just set and forget. Over time, your carefully constructed asset mix will naturally start to drift. This happens because different investments grow at different rates, subtly shifting your portfolio’s risk profile without you even realizing it.

This is where the discipline of portfolio rebalancing comes into play.

It’s the simple act of periodically buying or selling assets to get back to your original, intended allocation. It can feel a little counterintuitive — selling your winners and buying more of what’s lagging — but it’s a critical maintenance habit for long-term success. This is how you make sure your portfolio stays aligned with your financial goals and risk tolerance, preventing you from becoming unintentionally overexposed to a single soaring asset.

Why Your Portfolio Drifts Out of Balance

Imagine you started the year with a classic 60/40 portfolio — that’s 60% in stocks and 40% in bonds. Let’s say the stock market has a fantastic run, and your stock holdings surge in value while your bonds stay relatively flat. By the end of the year, your portfolio might have drifted to a 70/30 split.

Without any action on your part, you’re now taking on more risk than you originally planned for.

Rebalancing is the corrective action that brings you back to your target 60/40 mix. It forces a disciplined approach: buy low and sell high. You systematically trim the profits from your outperforming assets and reinvest those funds into the underperforming ones, restoring your intended balance. This isn’t about timing the market; it’s all about managing your risk.

Simple Strategies for Rebalancing

You don’t need a complicated system to rebalance effectively. Most investors stick to one of two straightforward methods. The real key is to just pick one and stay consistent with it, turning it into a regular, unemotional habit.

- Calendar-Based Rebalancing: This is the simplest method. You pick a specific schedule — like once a year on your birthday, or every six months — to sit down, review your portfolio, and make the necessary adjustments.

- Percentage-Based Rebalancing: With this approach, you set a tolerance band for each asset class, say 5%. If any single asset class drifts more than 5% away from its target (for instance, your 60% stock allocation grows to 65.1%), that drift triggers a rebalance.

A lot of investors actually combine these two. They might check their portfolio on a set schedule (annually) but only rebalance if an asset class has drifted significantly beyond its target percentage.

Rebalancing is an act of discipline, not prediction. It’s the essential maintenance that keeps your diversified portfolio on track, preventing emotion and market hype from steering you off course.

Overcoming the Psychological Hurdle

Let’s be honest: selling an investment that’s been performing brilliantly just feels wrong. Our instincts scream at us to let our winners run, and it’s a genuine struggle every investor faces. You have to fight that urge to hang on, believing it will just keep climbing forever.

This is where having a rules-based system truly shines. By committing to a rebalancing strategy before your emotions get involved, you create a logical framework for your decisions. It takes the guesswork, and the anxiety, right out of the equation.

Think of it this way:

- You are locking in gains from your top performers.

- You are reinvesting in other quality assets that are currently “on sale.”

- You are maintaining the exact risk level you consciously chose from the start.

This disciplined, systematic process is one of the most powerful tools you have. It ensures that a single high-flying asset doesn’t grow so large that its eventual correction can sink your entire portfolio. By mastering this habit, you transform diversification from a one-time setup into a dynamic, resilient, and lifelong strategy.

Common Questions About Portfolio Diversification

It’s one thing to grasp the theory of diversification, but putting it into practice is where the real questions pop up. Let’s tackle some of the most common uncertainties investors face when building a diversified portfolio.

How Many Stocks Do I Need for Proper Diversification?

You’ll often hear that you need 20-30 individual stocks from different industries to be properly diversified. While that’s technically true, it’s also a ton of work. It requires a significant amount of research and constant monitoring.

Honestly, there’s a much simpler way.

A single broad-market index fund or ETF can give you incredible diversification in one shot. A fund that tracks the S&P 500 or the total stock market gives you instant ownership in hundreds — or even thousands — of companies. This saves you the immense effort of building and managing a stock portfolio from scratch.

Is It Possible to Be Too Diversified?

Absolutely. It’s a common trap sometimes called “diworsification.” When you own too many funds, especially ones with a lot of overlap, you can actually water down your potential returns and create a portfolio that’s a nightmare to manage.

The goal isn’t to own a tiny piece of everything. It’s to hold a smart mix of assets that behave differently from one another. A well-designed portfolio with just 5 to 10 thoughtfully chosen funds is often far more effective than one with dozens of overlapping investments.

The point of diversification is to reduce risk, not to own every asset under the sun. Simplicity often leads to better results and less stress.

Does Diversification Guarantee I Won’t Lose Money?

No, and this is a crucial point to understand. Diversification is a strategy to manage risk, not eliminate it. During a major market downturn, it’s possible for nearly every asset class to lose value at the same time.

But a well-diversified portfolio is built to fall less than a concentrated one and, hopefully, recover faster. Think of it like the shocks on a car—it smooths out the bumps on your financial journey but doesn’t make the road perfectly flat. It’s about building resilience, not invincibility.

How Often Should I Review My Portfolio?

For most long-term investors, checking in on your portfolio once or twice a year is plenty. This gives you a chance to see if your asset allocation has drifted from your targets and if it’s time to rebalance.

Constantly watching your investments is usually counterproductive. It tends to trigger emotional, knee-jerk decisions, like panic-selling when the market takes a temporary dip.

Here’s a simple checklist for your annual review:

- Check Allocation Drift: Has your stock allocation crept up from 60% to 70%?

- Assess Life Changes: Have your financial goals or risk tolerance shifted?

- Rebalance if Needed: Sell a little of what’s done well and buy more of what’s lagging to get back to your target weights.

Trust the plan you put in place. Make adjustments based on your strategy, not on daily market noise. A disciplined, patient approach is what wins in the long run.

A well-diversified portfolio requires consistent tracking and analysis to stay on course. With TradeReview, you can monitor all your assets in one place, analyze your performance with detailed analytics, and use our visual trade calendar to see your strategy in action. Take control of your financial journey and build a more resilient portfolio today by signing up at https://tradereview.app.