Planning your exit strategy is about one simple, critical thing: deciding how and when you’ll close a trade before you even think about opening it. It means setting concrete profit targets and non-negotiable stop-loss levels ahead of time. This single practice is what turns trading from an emotional gamble into a disciplined, systematic business.

Why Your Exit Plan Is More Important Than Your Entry

Every trader obsesses over finding the perfect entry. We hunt through charts, stare at indicators, and wait for that textbook setup to appear. But here’s a hard truth every seasoned pro learns, often the hard way: profits are made or lost on the exit. A brilliant entry is worthless if you let a winning trade reverse into a loser or let one bad trade blow up your account.

This is why your exit strategy is the absolute foundation of every trade you take. It’s not just another step in the process; it’s the entire blueprint that dictates your actions the second your capital is on the line. Without it, you’re just navigating the markets on pure emotion and hope.

The Emotional Battleground of Trading

Let’s be real—trading is an emotional rollercoaster. We’ve all been there. When a position moves in your favor, that little voice of greed starts whispering, “Just a little more…” It’s an intoxicating feeling, but it’s also how you end up watching all your unrealized gains evaporate when the market inevitably turns.

On the flip side, when a trade goes against you, fear kicks in. You might freeze up, hoping for a miracle comeback, or even worse, you start dragging your stop-loss further down, breaking the most important rule you set for yourself. A well-defined exit plan is your logical defense against these gut reactions that wreck accounts.

A trader’s greatest enemy is not the market, but the emotional reactions within themselves. A pre-defined exit strategy acts as a circuit breaker, forcing disciplined action when emotions are running high.

When you set clear profit and loss limits before you click “buy,” you completely shift your mindset. You’re no longer chasing jackpots or gambling on a hunch. You’re now running a business, and this trade is just one transaction with a clear operational plan. This discipline means you’re committed to:

- Protecting Capital First: Your number one job is to live to trade another day. A non-negotiable stop-loss ensures no single trade can cause catastrophic damage.

- Systematically Locking in Gains: A profit target forces you to pay yourself. It’s the difference between consistently growing your account and constantly kicking yourself for “what could have been.”

- Removing In-the-Moment Decisions: Your most expensive decisions are almost always made under pressure. An exit plan takes the decision-making out of the heat of the moment and places it back when you were calm and analytical.

A Mindset for Long-Term Success

This structured approach isn’t just a trading tactic; it’s a core business principle. Think about it: nearly half of business owners around the world plan to exit their ventures within five years. This statistic shows just how vital exit planning is for creating long-term value. As primior.com explains, companies that build their daily operations with an end goal in mind are far more likely to succeed.

For a trader, every single position is a mini-business. Your “exit” is the final act that determines if the venture was profitable. By focusing on methodical, pre-planned exits, you build the resilience to survive market swings and stay in the game long enough to achieve real consistency. It’s this long-term thinking that truly separates the pros from the hobbyists.

How to Set Realistic Profit Targets

Alright, let’s get practical and move from planning on paper to setting real-world profit goals. A solid exit strategy isn’t built on wishful thinking or swinging for the fences. It’s grounded in data and a repeatable process for taking money off the table.

One of the fastest ways to see a great trade sour is by chasing unrealistic gains. The real skill is setting targets the market is likely to hit based on its current behavior. This means you have to ditch the guesswork and use technical analysis to find logical price levels where the momentum could stall or reverse. It’s about syncing your exit with the market’s natural rhythm.

Using Technical Analysis to Define Your Target

Technical analysis is your roadmap for finding those high-probability profit zones. Instead of just picking a number out of thin air, you can lean on actual chart data to make an educated call. This is the bedrock of any good exit strategy.

Here are a few time-tested methods for pinpointing realistic targets:

- Support and Resistance Levels: This is trading 101 for a reason. If you’re long, a major resistance level overhead—a price zone where the stock has struggled to break through before—is the most logical place to cash out. Practical Example: If you buy a stock at $50 and see it has repeatedly failed to break above $55 in the last month, setting your profit target at $54.75 is a high-probability plan.

- Chart Patterns: Patterns like a head and shoulders, double top, or triangle often give you measurable price objectives. For instance, you can project the height of a head and shoulders pattern downward from where it breaks down to get a solid estimate for a target.

- Fibonacci Extensions: These are fantastic for projecting where a price might be headed after a pullback. A common target for many traders is the 1.618 extension level, which can act like a magnet for price, especially in strong trends.

The point isn’t to perfectly predict the absolute top or bottom. It’s to consistently capture the “meat” of the move by getting out at high-probability levels. Leave the crystal ball stuff to others.

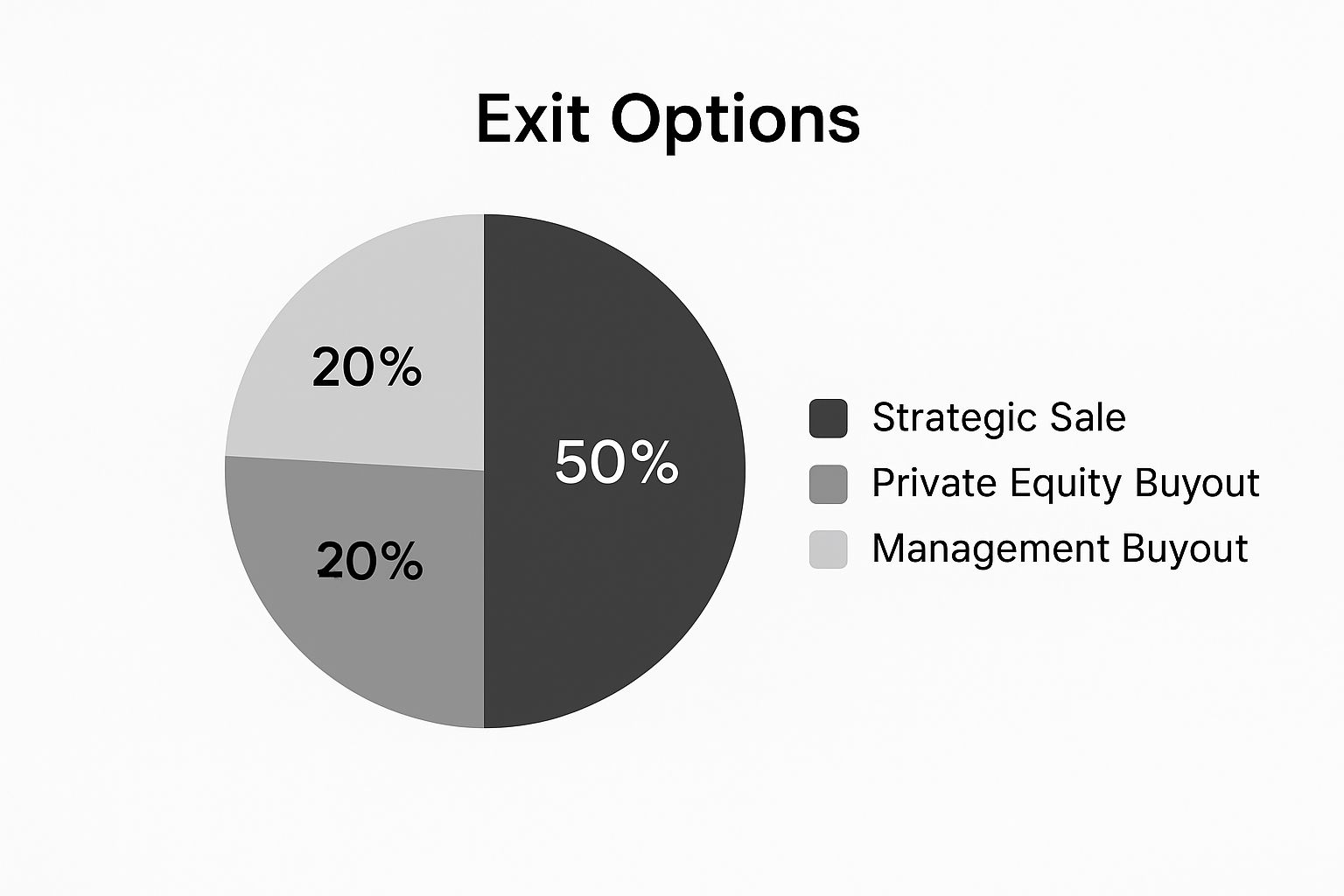

The image below shows how business owners think about their exits, highlighting that a planned, strategic sale is far and away the most common approach.

This just reinforces what we already know: having a clear plan pays off, whether you’re selling a multi-million dollar company or just closing out a day trade.

Comparing Profit Target Methodologies

Choosing the right method often depends on the market’s personality at the moment. Some techniques work better in trending markets, while others shine in choppy, range-bound conditions. Here’s a quick breakdown to help you decide which tool to pull out of your toolbox.

| Methodology | Description | Best For | Potential Drawback |

|---|---|---|---|

| Support & Resistance | Setting targets at historical price ceilings (resistance) or floors (support). | Ranging or consolidating markets with clear horizontal levels. | Can be subjective; levels may not hold in strong trends. |

| Chart Patterns | Using the measured move objective from classic patterns (e.g., triangles, flags). | Breakout scenarios after a period of consolidation. | Patterns can fail, leading to false signals and missed targets. |

| Fibonacci Extensions | Projecting potential price targets based on the size of a previous price swing. | Strong, trending markets where price is making new highs or lows. | Can provide too many potential levels, causing confusion. |

| Fixed Risk-Reward | Exiting at a predetermined multiple of your initial risk (e.g., 2R, 3R). | Systematic trading where consistency is the primary goal. | Ignores market structure; may exit before a logical target. |

Ultimately, the best approach is often a combination of these methods. For example, you might look for a key resistance level that also happens to line up with a 1.618 Fibonacci extension. When multiple signals point to the same area, your confidence in that target should go way up.

The Power of Scaling Out

One of the biggest mental hurdles in trading is that nagging fear of exiting too early and leaving a pile of money on the table. A simple yet incredibly effective way to deal with this is by scaling out—taking partial profits as the trade moves in your favor.

Instead of having just one all-or-nothing profit target, you can set several. For instance, you could:

- Sell 50% of your position at your first target (let’s say a 1:2 risk-reward ratio).

- Move your stop-loss on the remaining 50% to your entry price. Now, the rest of the trade is completely risk-free.

- Let that last piece run toward a more ambitious secondary target.

This approach is a game-changer psychologically. You’ve already locked in a win, which immediately reduces the anxiety of giving back your gains. It frees you up to manage the rest of the trade with a clear head, giving you a shot at catching a much bigger move without all the emotional baggage. You can dive deeper into these techniques in our complete guide to profit-taking strategies.

When you create a repeatable system for taking profits, you’re building the discipline that long-term consistency is made of. You’re no longer just hoping for a home run; you’re methodically running your trading like a business, one trade at a time. This is how you pay yourself and make sure you’re still in the game for the next opportunity.

Mastering the Stop-Loss to Protect Your Capital

If your profit target is the offense, then your stop-loss is the non-negotiable defense. It’s probably the single most important tool you have, because its only job is to protect your hard-earned capital.

So many traders see hitting a stop-loss as an admission of being wrong or a sign they’ve failed. It’s time to completely reframe that mindset.

Think of a stop-loss as your business’s insurance policy. You set it with a clear, logical mind before the trade’s outcome can stir up any emotions. When it gets triggered, it’s not a failure; it’s your pre-defined plan working exactly as intended. It’s what stops a small, manageable loss from turning into a catastrophic one. That discipline is the very core of effective exit strategy planning.

Setting Stops Based on Logic, Not Fear

One of the biggest mistakes is traders placing stops based on an arbitrary dollar amount they’re willing to lose. This completely ignores the personality of the asset you’re trading. A volatile tech stock simply needs more breathing room than a slow-moving utility stock.

Placing your stop too close in a volatile market is a surefire way to get shaken out of a perfectly good trade on normal price fluctuations. Your stop placement must be based on technical analysis and respect the asset’s natural volatility.

A powerful tool for this is the Average True Range (ATR) indicator. The ATR measures an asset’s average price movement over a specific period. By setting your stop-loss at a multiple of the ATR (like 2x ATR) below your entry, you’re giving the trade room to move based on its recent, actual behavior—not just a random guess.

You can dive deeper into this in our guide on how to set stop losses.

A stop-loss is simply the price at which you admit your trade idea was wrong. By pre-defining that point, you remove your ego from the equation and let your system protect your account.

Static vs. Trailing Stops

Not all stop-losses are created equal. The two most common types serve different purposes, and knowing when to use each can make a huge difference in your results.

- Static Stop: This is a fixed price that doesn’t move. You set it at the start of the trade based on a key support level or an ATR calculation, and it stays put. It’s simple, effective, and fantastic for building discipline.

- Trailing Stop: This stop is dynamic. It moves up as the trade moves in your favor, locking in profits along the way. Practical Example: You could set a trailing stop that always stays 15% below the highest price the stock has reached since you entered. This lets you capture a huge chunk of a strong trend without giving all your gains back.

Which one is better? It all comes down to your strategy. Static stops are great for shorter-term trades with clear price targets. Trailing stops, on the other hand, are ideal for trend-following strategies where you want to let your winners run as long as possible.

Ultimately, mastering the stop-loss is about long-term survival in the markets. It’s the tool that ensures you can come back and trade tomorrow, even after a string of losses. It takes real discipline to honor your stops without question, but it’s a non-negotiable skill for anyone serious about treating trading as a business.

Finding the Right Risk to Reward Ratio

You’ve got your profit target and your stop-loss locked in. Now, it’s time to connect those two points and see if the trade is actually worth taking. This is where the risk-to-reward ratio (R:R) comes in—it’s the simple math that sits at the core of any solid exit strategy.

At its heart, the R:R ratio just asks one question: How much am I trying to make for every dollar I’m risking? The calculation is dead simple. You just divide your potential profit (the distance from entry to your target) by your potential loss (the distance from entry to your stop-loss).

Practical Example: You want to buy a stock at $100. You place your stop-loss at $98 (risking $2 per share) and your profit target at $106 (potential gain of $6 per share). Your risk-to-reward ratio is $6 / $2 = 3, or 1:3. This one little number is what turns trading from a random guess into a game where you can actually stack the odds in your favor over time.

Why a Favorable Ratio Is Your Edge

Here’s where the real magic happens. When you consistently take trades with a good risk-to-reward ratio, you don’t actually have to be right all the time to make money. In fact, you can be wrong more often than you’re right and still grow your account. This is a tough pill for many new traders to swallow, but the math doesn’t lie.

Let’s run through a quick example. Imagine you make a rule to only take trades with at least a 1:2 risk-to-reward ratio.

- You risk $100 on every trade.

- Your stop-loss is set to take you out for a $100 loss.

- Your profit target is waiting to cash you out with a $200 gain.

Now, let’s say you take 10 trades, and only four of them are winners. That’s just a 40% win rate.

- Your 4 winning trades make: 4 x $200 = $800

- Your 6 losing trades lose: 6 x $100 = -$600

- Your net profit is: $800 – $600 = $200

Even though you were wrong more than half the time, you still came out ahead. That’s the power of positive asymmetry. Your winners did all the heavy lifting, easily covering your losers and leaving you with a profit. This is one of the most fundamental principles for surviving and thriving in the markets long-term.

Being Selective Is a Superpower

This mathematical advantage only works if you have the discipline to actually stick to your rules. You have to start treating your trading capital like the finite, precious resource it is. Not every chart pattern is a gift, and not every news event is an opportunity. Your real job is to be the gatekeeper, only putting your money to work when the potential reward clearly outweighs the risk.

Your discipline in passing on low-quality, low-reward setups is just as important as your skill in finding high-quality ones. Saying “no” is a profitable trading action.

This kind of discipline is crucial, especially when you look at the wider market. Even the big institutional players are being cautious. For instance, private equity exit activity recently slowed to a two-year low, with firms only closing 473 exits in Q1 for a total of $80.81 billion. You can dig into these PE exit trends at enventure.io to learn more. If institutional funds are being this selective about when they exit, retail traders should be even more careful about when they enter.

Learning to confidently skip trades that don’t meet your minimum R:R criteria is a huge sign of growth. It shows you’ve moved from a mindset of “I need to be in a trade” to “I will only get involved when the odds are stacked in my favor.” This selectivity is the final piece of the puzzle, tying your profit targets and stop-losses together into an exit strategy that actually works.

Using Trading Tools to Enforce Discipline

Let’s be honest, the biggest enemy in your trading career is often staring back at you in the mirror. Even the most well-researched exit strategy planning can completely fall apart under the pressure of live market action. This is where technology becomes your greatest ally, helping you build an emotional moat around your decisions.

Instead of just white-knuckling it and relying on willpower, you can use your trading platform’s built-in tools to enforce discipline automatically. Doing this takes the critical decisions out of your hands right when emotions like fear and greed are screaming the loudest. By setting up the trade correctly from the start, you let your system do the hard work for you.

Automating Your Exits with Advanced Order Types

Most modern trading platforms offer advanced order types specifically designed to manage your risk and lock in profits. Think of these as pre-programmed instructions that execute your exit plan without any more clicks from you. For maintaining discipline, this is an absolute game-changer.

Two of the most powerful order types you’ll find are:

- Bracket Orders: When you place your entry order, a bracket order automatically attaches both a stop-loss and a profit target. The moment one of these orders gets filled, the other is automatically canceled. It’s a complete, self-contained trade plan from entry to exit.

- OCO (One-Cancels-the-Other) Orders: An OCO order links two separate orders together. For example, you can set a profit target above the current price and a stop-loss below it. As soon as one gets triggered, the other is immediately canceled, preventing any unwanted orders from lingering in the market.

Using these tools means your entire exit plan is locked in the second you enter a trade. There’s no room for second-guessing, hesitating, or hoping a loser will magically turn around. You made your decision with a clear head, and the machine simply executes it.

Turning Subjective Feelings into Objective Data

While automating exits enforces discipline in the moment, your long-term improvement comes from analyzing your performance with cold, hard data. This is where a robust trading journal becomes completely indispensable. It’s the key to moving beyond gut feelings and identifying the real, recurring patterns in your trading behavior.

A quality journal helps you ask the tough questions about your exit strategy planning:

- Are you consistently cutting your winners short out of fear?

- Are your stop-losses placed too tight, causing you to get shaken out of otherwise good trades?

- Do you tend to widen your stops on losing trades, breaking your own rules?

The kind of visual data a good journal provides can immediately highlight where your strategy is strong and where it’s leaking profits, allowing for precise, effective adjustments.

Your trading journal is your personal performance review. It doesn’t have an ego and it doesn’t care about your feelings—it just shows you the numbers. Listen to what they’re telling you.

Tools like TradeReview provide the analytics needed to see exactly how your exits are performing over hundreds of trades. By tagging your trades and reviewing the data, you can spot subtle mistakes that might be costing you thousands over the year. You can learn more about this process in our guide explaining why every trader needs a trading journal. This data-driven feedback loop is exactly how you systematically refine your exit strategies and build the discipline required for long-term success.

Common Questions About Trading Exit Strategies

Even the best-laid plans get tested the second you enter a live trade. This is where all that discipline you’ve been building really gets put to the test. Let’s break down some of the most common dilemmas traders run into when it’s time to pull the trigger on an exit.

Should I Adjust My Stop-Loss or Profit Target Mid-Trade?

This is the classic internal tug-of-war every trader knows. You set your plan with a clear head, but then the price action starts messing with your emotions. The disciplined—and almost always correct—answer is to let your plan play out.

But there is one big exception. You can, and often should, move your stop-loss in the direction of your trade. For example, if you’re in a long position that’s moving in your favor, you can trail your stop up to your entry price (break-even) or even higher to lock in some profit.

What you should never do is move your stop-loss further away to give a losing trade more “room to breathe.” That’s a fast track to blowing up your account because it completely trashes your initial risk assessment.

Fiddling with your profit target should be an extremely rare event. It should only happen if some major, unexpected market news completely changes the game—not just because you suddenly feel more bullish. For the vast majority of your trades, sticking to your original plan is how you build the long-term discipline that separates the pros from the rest.

What Is the Best Risk-to-Reward Ratio for Me?

There’s no magic number that fits everyone. The right risk-to-reward ratio is tied directly to your strategy’s historical win rate. The two metrics are two sides of the same coin and determine whether you’ll be profitable.

Think of it like this:

- High Win-Rate Strategies: A scalper who wins 65% or 70% of their trades can be profitable even with a 1:1 risk-to-reward. Their edge is being right more often than not, even if the wins aren’t huge.

- Low Win-Rate Strategies: A trend-follower who’s trying to catch massive, infrequent moves might only have a 40% win rate. For their strategy to work, the wins have to be way bigger than the losses, demanding a risk-to-reward of 1:3, 1:4, or even higher.

A great starting point for many traders is to simply refuse any trade setup that doesn’t offer at least a 1:2 risk-to-reward ratio. This forces you into a disciplined mindset from day one. From there, your trading journal is your best friend for analyzing your results and figuring out what ratio actually works for your specific approach.

The real goal isn’t finding a perfect ratio; it’s making sure your average winning trade is significantly larger than your average losing trade over a big sample of trades.

This kind of strategic thinking is vital. In the wider financial world, exit planning is serious business. When structuring exits for something like a physician’s practice, financial advisors plan meticulously for years so owners can maximize value. They might even sell off a portion of the business to bank some gains while letting the rest grow. It’s that same long-term, strategic mindset you need to bring to your own trading.

How Can I Stop Exiting Winning Trades Too Early?

The fear of watching your unrealized profits evaporate is real and powerful. It’s why so many traders snatch tiny profits, only to watch in frustration as the trade continues on a massive run without them. A battle-tested technique to fight this is to scale out of your positions.

Instead of one all-or-nothing profit target, you set up multiple exit points along the way.

Here’s a simple example: Imagine you buy 100 shares of a stock.

- First Target: You sell 50 shares at your first profit target. This locks in a small, guaranteed win.

- Adjust Your Stop: You immediately move the stop-loss on your remaining 50 shares up to your original entry price.

- Second Target: Now you can let the rest of your position run toward a more ambitious second target.

This little trick is a psychological game-changer. Once you’ve locked in a profit, you’ve paid yourself, and the pressure is off. The rest of the trade is now completely risk-free, which calms your nerves and lets you participate in a bigger move with a clear head. It’s a fantastic way to manage both the trade and your own emotions.

Ready to stop guessing and start analyzing? A trading journal is the single most powerful tool for dialing in your exit strategies. With TradeReview, you can track every exit, analyze your performance with clear data, and see exactly where you can improve.