A daily trading journal is far more than just a list of your wins and losses. Think of it as your personal performance playbook — it’s where you turn raw trading data into real, actionable insights that build discipline and sharpen your edge over the long term.

Why a Journal Is Your Most Important Trading Tool

Let’s be honest for a moment — most traders struggle with inconsistent results and emotionally-driven decisions. We’ve all been there. You might end a trading day feeling like you did pretty well, but feelings aren’t data. A daily trading journal is the tool that bridges the gap between a vague hunch and the hard evidence of your performance. It’s arguably the most critical tool for anyone serious about building a sustainable trading career.

Without a journal, you’re essentially flying blind. It’s human nature to remember the big wins and conveniently forget the small, repetitive mistakes that are quietly bleeding your account dry. Your journal acts as an unbiased business partner, holding you accountable to the one thing that truly matters: your trading plan.

From Guesswork to Data-Driven Decisions

The core purpose of a journal is to transform your trading activity into a structured dataset you can actually work with. This process forces you to stop thinking in subjective terms and start looking at objective facts.

- Instead of: “I feel like I’m pretty good at trading opening range breakouts.”

- You get: “My win rate on opening range breakouts over the last 60 trades was 65% with an average risk-to-reward ratio of 1.8R.”

The difference is night and day. The first statement is a feeling; the second is a statistical edge you can actually lean on. It helps you identify exactly what’s working and, just as importantly, what isn’t.

A trading journal isn’t about adding another chore to your day; it’s about building the discipline needed to identify your unique edge, pinpoint costly mistakes, and finally trade with data-driven confidence.

The Uncomfortable Truth About Retail Trading

Keeping a journal isn’t just a “nice-to-have” habit; it’s a core behavior that separates consistently profitable traders from the rest. The markets can be unforgiving. We know that a significant majority of retail traders struggle to find consistent profitability. While exact numbers vary, many analyses from regulatory bodies and brokers suggest that a large percentage of active short-term traders lose money over a 12-month period.

A journal is one of the few tools you have to improve those odds by turning your trade history into actionable intelligence. For more perspectives on trader performance, you can explore resources like tradebench.com.

By systematically reviewing your entries, you start to see the behavioral patterns that are completely invisible in the heat of the moment. Maybe you realize you consistently cut your winners short on Fridays out of anxiety. Or perhaps you tend to take impulsive “revenge trades” right after a loss. These are the expensive habits a journal drags into the light, giving you the chance to create specific rules to fix them. It’s not just about the numbers — it’s about understanding the psychology behind the numbers.

Crafting Your Perfect Journal Entry

A journal is only as good as the information you put into it. It’s tempting to just jot down your Profit & Loss (P&L), but the real value is in capturing the full story behind each trade. This isn’t just about recording your entry and exit points; it’s about understanding the “why” that drove your decisions in the heat of the moment.

This is the shift from being a simple scorekeeper to becoming a performance analyst of your own trading. A detailed entry in your daily trading journal is the raw material for every single insight you’ll gain later. If you put garbage in, you’ll get garbage out.

The Foundation: Essential Data Points

Every single trade, whether it’s a tiny scalp or a multi-day swing, needs a baseline of objective information. Think of these as the non-negotiable facts of the case — what happened, when it happened, and for how much.

- Date and Time: When did you enter and exit? This helps spot patterns, like whether you consistently lose money on Monday mornings.

- Ticker/Symbol: What did you trade? (e.g., AAPL, EUR/USD).

- Direction: Were you long (buying) or short (selling)?

- Entry and Exit Prices: The exact price points where you got in and out.

- Position Size: How many shares, lots, or contracts did you put on the line?

- Stop-Loss and Take-Profit Levels: Where were your initial risk and profit targets? This is critical for measuring your discipline.

- Final P&L: The net profit or loss from the trade.

These data points are the absolute minimum. Without them, it’s nearly impossible to calculate performance metrics or conduct any kind of meaningful review.

The Story: Psychological and Contextual Data

This is where dedicated traders separate themselves from the pack. The numbers tell you what happened, but this qualitative data tells you why it happened. It’s your chance to connect your actions to your mindset, the market environment, and your strategy. Skipping this step is like reading a box score without ever watching the game — you completely miss the nuance.

The most expensive trading mistakes rarely show up on a chart. They show up in your thoughts, emotions, and deviations from your plan. Capturing this context is what turns a simple log into a powerful tool for growth.

Adding these layers provides the context you need for true self-improvement. It forces you to be brutally honest about your execution and emotional state, which is often the weakest link in any trader’s process. For a deeper dive into structuring these entries, check out our complete guide on how to create a trading journal entry.

Essential vs. Elite Data Points for Your Journal Entry

To really level up your analysis, you have to go beyond the basics. The table below shows the difference between a standard journal entry and one designed for a deep, honest performance review.

| Data Category | Essential (Bare Minimum) | Elite (For Deeper Analysis) |

|---|---|---|

| Trade Rationale | Basic setup name (e.g., “Breakout”). | A detailed sentence explaining why this specific setup met your criteria, including market context. Example: “Bull flag forming above the 21 EMA on the 5-min chart, with SPY showing strength.” |

| Emotional State | Vague notes like “Felt good.” | A score from 1-5 for Fear, Greed, and Discipline. Notes on specific feelings (e.g., “Felt FOMO and chased the entry after missing the initial move.”). |

| Execution Quality | Just the P&L. | A grade (A, B, C, F) on how well you followed your plan, regardless of the outcome. Note any deviations. |

| Market Condition | None. | Tags for the broader market environment (e.g., “Trending Up,” “Choppy/Ranging,” “High Volatility”). |

| Screenshot | No visual record. | An annotated chart screenshot showing your entry, stop, and target levels at the time of the trade. |

Building the habit of recording these “elite” data points is what transforms your journal from a simple logbook into a dynamic feedback loop. You start to see connections you’d otherwise miss — like realizing your worst trades happen when your discipline score is low, or that your A+ setups perform exceptionally well in trending markets. This is how you find your real edge.

Turning Raw Data Into Actionable Insights

Just collecting data in your daily trading journal is the easy part. The real growth — the kind that builds a career — happens when you actually step back and review what you’ve logged. This is the moment you turn a simple list of trades into a powerful feedback loop.

It’s all too easy to get lost in the day-to-day noise of the market. Your review process is your chance to zoom out. It’s how you finally connect the dots between what you did and the results you got, moving from just reacting to the market to trading with real intention.

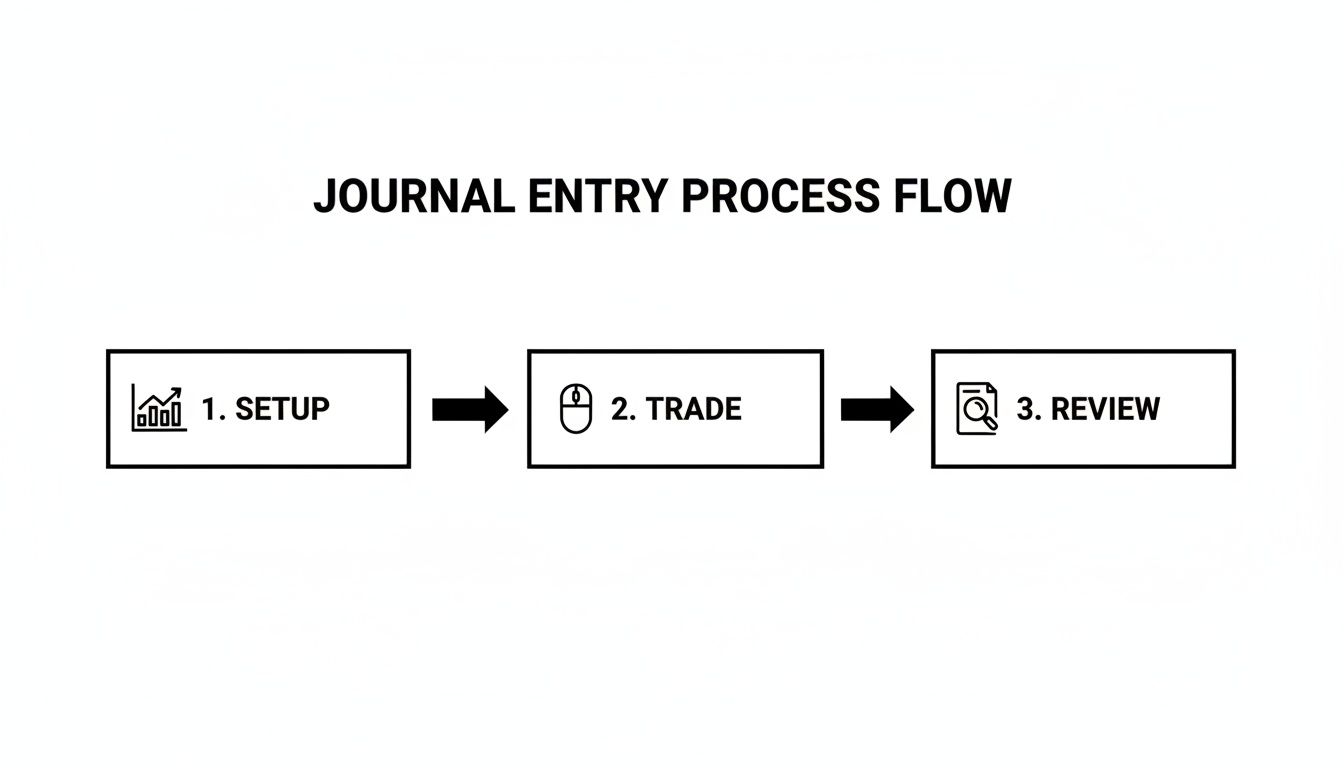

Think of it as a simple, repeatable cycle.

This workflow shows that reviewing your trades isn’t just something you do if you have extra time. It’s a core part of the trading process itself.

The Post-Trade Review Workflow

Your review can’t just be a quick glance at your P&L. It needs to be a structured, systematic process. Put on your detective hat. You’re looking for clues, patterns, and hard evidence that lead to a solid conclusion about your performance.

A great place to start is by asking the same set of questions after every trade, especially the losing ones. We all want to forget our losses and move on, but they hold the most valuable lessons if we’re willing to look.

Let’s walk through a real-world scenario. Imagine you just took a frustrating loss on a stock you were sure was breaking out.

- Initial Emotion: Anger. “This market is rigged. I did everything right.”

- Objective Review: You pull up your journal and look at the screenshot you took right before you entered. You notice two things: the breakout happened on pretty weak volume, and the broader market index was starting to roll over at the exact same time.

- The Insight: The lightbulb goes on. Your entry criteria weren’t actually fully met. You got so focused on the potential profit that you completely ignored two massive red flags.

- The Actionable Rule: You write a new rule for your trading plan: “I will not take a long breakout trade if the S&P 500 is trading below its 20-period moving average on the 5-minute chart.”

See what happened there? You turned a painful loss into a concrete rule that can save you money in the future. It’s all about extracting a lesson, not blaming the market.

Demystifying Key Performance Metrics

Once you start logging trades consistently, your journal will begin to reveal key performance indicators (KPIs) that tell the real story of your trading — the one that goes way beyond a simple P&L number.

Metrics are the language of performance. They strip out emotion and subjectivity, telling you in stark, objective terms what’s working and what’s costing you money. Understanding them isn’t optional.

Here are a few of the most important metrics you need to be tracking:

- Win Rate: This one’s simple: the percentage of your trades that are profitable. A 50% win rate means you win on half your trades. But it’s almost meaningless without its partner, the risk-to-reward ratio.

- Average Risk-to-Reward (R:R) Ratio: This compares the size of your average winning trade to your average losing trade. An R:R of 2:1 means your winners are typically twice as big as your losers. This is a crucial piece of the puzzle.

- Profit Factor: This is your gross profit divided by your gross loss. Any profit factor above 1.0 means you’re profitable. A value of 2.0, for instance, means you’ve made twice as much as you’ve lost. It’s a fantastic, all-in-one health check for your strategy.

These numbers work as a team. You can be profitable with a “low” 35% win rate if your R:R ratio is consistently high, like 4:1. On the flip side, you can have a “great” 70% win rate and still lose money if your few losses are massive compared to your small wins.

Spotting Your Hidden Patterns

Over weeks and months, your journal becomes a goldmine of your own behavioral data. The real magic happens when you organize and filter this data to spot the hidden patterns that are completely invisible day-to-day. This is why using tags and categories for your trades is so powerful.

Suddenly, you might start seeing things like:

- You have an 80% win rate on trades taken in the first hour of the market open, but only a 40% win rate in the afternoon.

- Your biggest losses almost always happen on days you skipped your pre-market preparation.

- You consistently make money on your “Flag Pattern” setup but give it all back trading “Reversals.”

Finding these patterns is the entire point of keeping a journal. For traders who want to go even deeper, exporting your data to a spreadsheet is the next level. If you’re ready for that, check out our guide on how to build a pivot table for trade analysis. It lets you slice and dice your performance in countless ways, uncovering insights that will truly sharpen your edge.

Building a Sustainable Journaling Habit

Let’s be real — the initial excitement of starting a daily trading journal can wear off quickly. Manually logging every entry, exit, position size, and P&L feels like a chore, especially after a tough day. This friction is the number one reason traders give up on their journals, missing out on all the powerful insights that could have changed their game.

Discipline isn’t an infinite resource. If you drain your mental energy on tedious data entry, you’ll have less left for the important stuff: analysis and self-reflection. The goal isn’t just to start a journal; it’s to build a frictionless habit that becomes a core part of your trading routine for the long haul.

The Manual vs. Automated Showdown

For decades, the humble spreadsheet was the go-to for serious traders. There’s something to be said for manually typing in each trade — it forces you to confront your results head-on. But that method has some serious drawbacks that often lead straight to burnout.

- It’s incredibly time-consuming. Logging dozens of trades by hand eats up time you could be spending studying charts or backtesting a new setup.

- It’s prone to human error. One tiny typo in an entry price or share count can throw off your entire performance analysis, leading you to draw the wrong conclusions.

- The analytics are limited. Sure, you can build an equity curve in Excel, but creating advanced filters and reports requires significant spreadsheet wizardry and a lot of upfront work.

Modern journaling platforms were built to solve these exact problems. Many active traders now leverage technology to streamline this process, as highlighted in discussions within the trading community and industry reports. For an overview of modern tools, you can review the full industry guide on stockbrokers.com.

Embrace Automation to Free Your Mind

This is where technology really changes things. Automated broker synchronization is the single biggest step forward for building a journaling habit that actually sticks. Instead of wrestling with spreadsheets, you just connect your brokerage account once, and the platform does all the heavy lifting.

Automation eliminates the friction of data entry. It frees up your mental capital to focus on what actually matters — analyzing your behavior, spotting your patterns, and improving your process.

With every trade captured accurately and without any effort on your part, the barrier to consistency vanishes. You can no longer use a bad day as an excuse to skip logging your trades. The data is already there, waiting for you. This simple shift moves your focus from data collection to data analysis, and that’s where real growth happens.

How Automation Creates a Sustainable System

Automated journaling isn’t about being lazy; it’s about being smart with your time and energy. By removing the most tedious part of the process, you build a system that works for you, not against you.

- Guaranteed Accuracy: Every trade, commission, and fee gets imported exactly as it happened. No more second-guessing your numbers. Your metrics reflect reality.

- Effortless Consistency: Forget to check in for a few days? No problem. A quick sync brings your journal completely up to date, killing that “I’ve fallen too far behind” feeling that makes so many traders quit.

- More Time for What Matters: With the numbers handled automatically, you can jump straight into adding the good stuff — your thoughts, emotions, and a grade on your execution. This is the high-leverage work that actually sharpens your edge.

The best approach is often a hybrid one. Let automation handle the quantitative data (the ‘what’), and you handle the qualitative story behind each trade (the ‘why’). This combination ensures your daily trading journal is not only complete and accurate but also packed with the personal context you need for true improvement. If you’re exploring your options, our guide to finding a free trading journal app can help you get started with these modern features.

Common Journaling Mistakes and How to Fix Them

Getting started with a daily trading journal is the easy part. The real challenge — and where the growth happens — is sticking with it in a way that actually makes you a better trader. It’s a common story: traders put in the time but don’t see the results they’re hoping for. Usually, it’s because a few small, sneaky habits have crept in and are derailing the whole effort.

Spotting these pitfalls is the first step. Let’s break down the most frequent mistakes traders make and, more importantly, cover the practical fixes to turn your journal from a chore into your most powerful trading tool.

Focusing Only on Profit and Loss

This is, without a doubt, the number one mistake. It’s so easy to get fixated on the P&L column, but judging a trade solely by its outcome is a classic trap called outcome bias.

Think about it: a poorly planned trade that lucked into a profit teaches you a dangerous lesson. On the flip side, a perfectly executed trade that ended in a small, managed loss is packed with valuable insights about your strategy and the market’s nature. When your journal just becomes a scoreboard of wins and losses, you miss the entire point: separating your process from the outcome. Even the best setups can fail; that’s just a reality of the market. Your goal isn’t to be right all the time — it’s to execute your plan flawlessly every time.

The Fix: Start grading your execution, not the result. After you close a position, give yourself a simple letter grade (A, B, C, F) based on one question: “Did I follow my trading plan to the letter?”

- A-Grade Trade: You followed every rule for your entry, stop-loss, and take-profit, no matter if you won or lost money.

- F-Grade Trade: You chased an entry, revenge-traded, or moved your stop because you “felt” something. Even if it made money, it was a terrible trade because it reinforces bad habits.

Being Inconsistent with Your Entries

Life happens. After a long, draining day at the screens — especially a losing one — the last thing anyone wants to do is sit down and relive their mistakes. This is where inconsistency creeps in. You might journal for a few days, then skip a week, leaving huge holes in your data.

An incomplete journal is an unreliable one. You simply can’t spot meaningful patterns from a spotty record. And ironically, those tough losing days are the ones that hold the most powerful lessons. Skipping them is like throwing away the answer key to your final exam.

Your trading journal is like a muscle. It only gets stronger with consistent, daily exercise. Skipping days, especially the hard ones, only weakens it.

The Fix: Build a non-negotiable end-of-day routine. Block out just 15 minutes after the market closes to wrap up your journal. The trick is to “stack” this new habit onto an existing one, like when you pour your evening coffee or shut down your computer for the day. Make it as automatic as brushing your teeth. If you’re really crunched for time, a tool with broker sync can be a game-changer by automating the raw data entry, so all you have to do is add your thoughts.

Writing Vague and Useless Notes

“Bought the dip.” “Felt good about this one.” “Bad trade.” These are the kinds of notes that feel productive in the moment but are completely useless when you look back a week later. They have zero analytical value.

Your future self needs context to deconstruct what happened. Why did you think that was a dip worth buying? What technical or fundamental signals were you seeing? What exactly were you feeling — was it confidence, greed, or a bad case of FOMO?

The Fix: Use a structured template for your notes to force clarity. Instead of just writing whatever comes to mind, answer a few pointed questions for every single trade:

- What was my primary reason for entry? (e.g., “Price broke above the 50-day moving average on high volume, confirming a bullish trend.”)

- What was my emotional state on a scale of 1-5? (1 = Calm, 5 = Anxious/Greedy)

- Did I deviate from my plan in any way? (e.g., “Yes, I entered before the candle closed, which violates my entry rule.”)

This simple shift turns vague feelings into structured, searchable data, making your review sessions infinitely more powerful.

Still Have Questions About Trading Journals?

Even with a clear roadmap, jumping into a daily trading journal can bring up a few questions. Building this habit is a big commitment, and getting these details right can be the difference between sticking with it long enough to see real progress and dropping it after a few weeks.

Let’s clear up some of the most common things traders wonder about.

How Soon Should I Expect Results From My Journal?

This is a big one, and it’s all about setting the right expectations. Journaling isn’t a magic wand that promises instant profits. It’s a tool for deliberate, long-term skill development, and its real value comes from stacking up data and insights over time.

You’ll probably start having small “aha!” moments within the first few weeks — maybe you’ll finally spot a repetitive emotional mistake or realize that a setup you thought was a winner actually isn’t. But for the big, meaningful improvements in your consistency and discipline? That usually takes several months of dedicated logging and review.

The point of a trading journal is to sharpen your process day by day. Profits are a byproduct of a solid, repeatable process, and building that takes time and patience. Focus on making one good trade, then the next.

Should I Log Paper Trades or Only Real Money Trades?

Absolutely log your paper trades. And do it with the same seriousness and detail as if real money were on the line. This is your training ground, your simulator. It’s where you build the muscle memory for journaling without the emotional baggage or financial risk.

Think of it like a pilot in a flight simulator. They aren’t just messing around; they run through checklists and procedures exactly as they would in a real cockpit. When you treat paper trading with that same respect, the jump to live trading is so much smoother because the journaling habit is already baked in.

What If I Have a Bad Day and Don’t Want to Journal?

We’ve all been there. The last thing anyone wants to do after a sea of red is relive every painful moment. But those are the single most important days to journal. Wanting to just shut the laptop and forget it all is a natural human reaction, but avoiding the pain means you miss the lesson.

Forcing yourself to sit down and document what went wrong — especially when you least feel like it — is an incredible discipline-building exercise. Become a scientist studying a failed experiment.

- Did you break a rule?

- Was it a revenge trade after a frustrating loss?

- Did you completely ignore the broader market context?

Get the facts down, pinpoint the error in your process, and write down one specific, actionable thing you’ll do to prevent it next time. Your losing days hold the most valuable data you will ever collect.

Your daily trading journal is the ultimate tool for turning raw experience into refined expertise. TradeReview makes this entire process feel effortless with powerful features like auto broker sync, deep performance analytics, and a visual trade calendar to help you find your edge. It’s time to stop guessing and start analyzing.