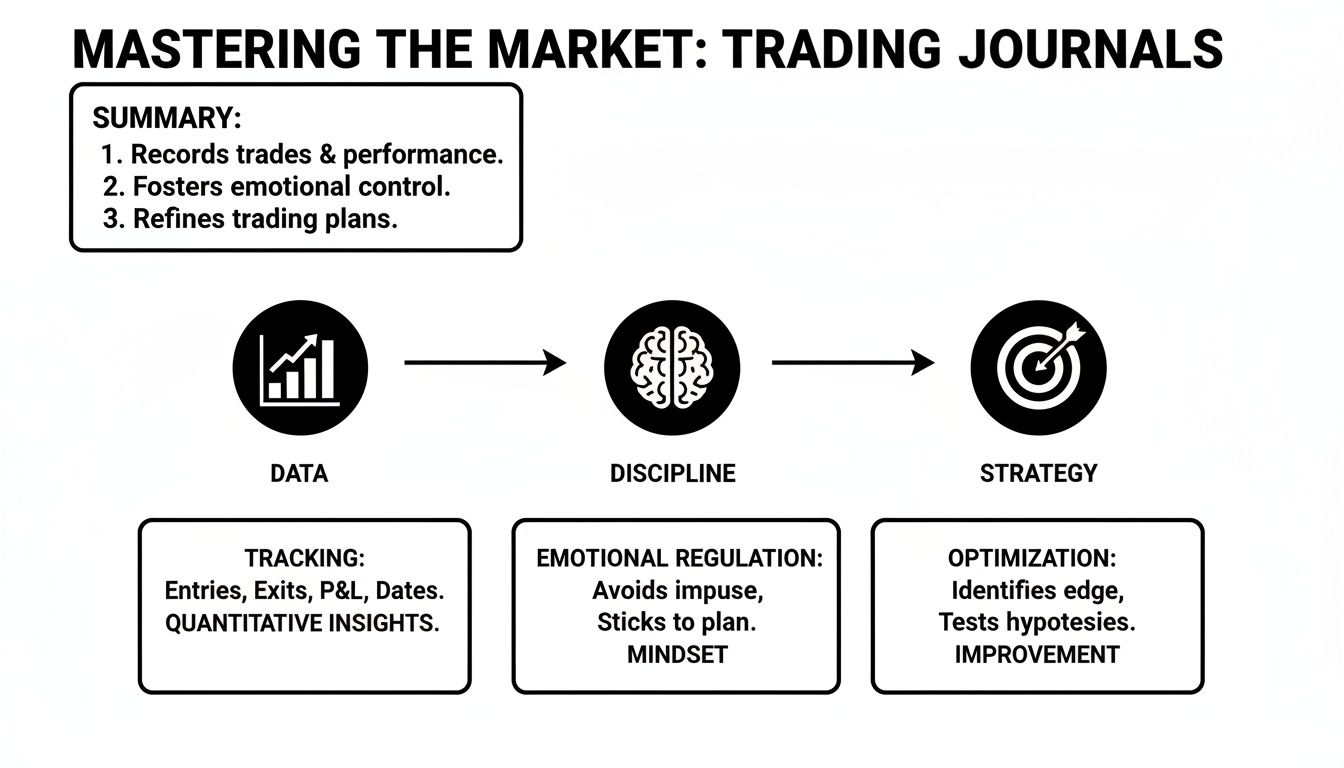

If you want to create a journal that actually moves the needle on your performance, you first need to understand what it’s for. It’s not just a diary of wins and losses; it’s a tool for turning gut feelings into cold, hard data.

Think of it as your personal performance database. It’s designed to expose the hidden patterns in your wins and losses, which is the key to building a more disciplined, data-driven approach to your trading. This isn’t about finding a magic formula for guaranteed profits — it’s about building a system for long-term improvement.

Why a Trading Journal Is Your Most Powerful Tool

Let’s be honest — trading can feel like a constant battle against market chaos and your own emotions. It’s incredibly frustrating to feel like you’re taking one step forward and two steps back. When you don’t have a system for tracking your performance, you’re essentially flying blind. You end up repeating the same costly mistakes without even knowing it.

A journal forces you to look at the reality of your decisions. It’s what moves you from reactive gambling to proactive, strategic analysis.

This whole process is about building unshakable discipline. Every time you log a trade, you’re creating a feedback loop that directly connects your actions to their outcomes. It helps you find your unique strengths, pinpoint critical weaknesses, and start turning inconsistent results into a reliable edge. This is how you start making smarter, more confident decisions over the long haul.

You can dive deeper into the psychological edge a journal provides by exploring why every trader needs a trading journal.

From Guesswork to Data-Driven Insights

The real magic of a journal is how it converts subjective experiences into objective data you can actually analyze. A dashboard like the one below, for example, shows how raw trade data gets turned into actionable intelligence.

A visual summary like this immediately flags performance trends, letting you see what’s working and what isn’t at a glance.

The impact of this disciplined habit is significant. While credible, large-scale studies on retail trader journaling are difficult to find, anecdotal evidence and smaller surveys consistently point to a strong correlation between detailed journaling and improved performance. For instance, some platform-specific data has suggested that traders who regularly review their trades may see a reduction in impulsive decision-making. The point isn’t about a specific number guaranteeing profits; it’s about systematically improving your odds by learning from your own history.

By meticulously documenting your trades, you stop being a passenger in your trading journey and start being the pilot. Each entry is a lesson, and each review is a step toward mastering your craft.

Building Your Journal: What Data Truly Matters

A powerful journal starts with tracking the right stuff, but it’s easy to get lost in the weeds. I’ve seen traders try to track everything and burn out, while others track too little and learn nothing. The sweet spot isn’t just logging trades — it’s gathering data that shines a light on your own habits and patterns.

When you create your own journal, your primary goal should be to answer one question: why did this trade work or fail?

Your P&L (Profit and Loss) is important, obviously, but it’s just the outcome. It’s the final score. Real, lasting improvement comes from connecting that score to your strategy, your mindset, and the specific actions you took.

The Core Quantitative Data

Let’s start with the basics. Every single trader, no matter their strategy or experience level, needs to lock down a few non-negotiable data points for every trade. This is the foundation of your entire analysis.

- Entry and Exit Prices: The exact prices you got in and out.

- Position Size: How many shares, contracts, or units you were holding.

- Date and Time: Pinpointing when you opened and closed the position.

- Strategy Used: What was the setup? Be specific. “Breakout,” “Mean Reversion,” or “Earnings Play” are good starts.

Without these, you’re just guessing. They provide the raw “what” and “when” of your trade. Once you have this down, you can start adding layers of context to figure out the “why.”

A journal entry without the ‘why’ is just a receipt. An entry that explains your reasoning, emotions, and the specific strategy is a lesson. This is the difference between simple record-keeping and active performance improvement.

Capturing the Qualitative Edge

This is where the real learning happens, and it’s what most struggling traders completely ignore. Your mental and emotional state has a massive impact on your decision-making, but you won’t find it on a P&L chart. Tracking this “soft” data is what separates consistently profitable traders from everyone else.

Think about adding a few fields for this:

- Pre-Trade Mindset: How were you feeling before you clicked the button? Were you focused, antsy, rushed, or confident? A simple 1-5 scale works wonders.

- Post-Trade Emotions: What did you feel after closing out? Regret over a loss? Euphoria after a big win? Relief that it was over?

- Confidence Rating: On a scale of 1-10, how much did you believe in this setup before you entered?

This is all about building a feedback loop. You’re connecting your internal state to your external results, which is the key to mastering your own performance.

This process shows that real success isn’t just about finding a good strategy. It’s about the interplay between objective data, your own discipline, and how you execute that strategy under pressure.

Here’s a practical example. An options trader sells a covered call. They log the strike price, expiration, and premium — all the standard stuff. But they also add a note: “Feeling anxious due to market chop,” and give the trade a confidence score of 3/10. The trade eventually closes for a small loss.

A few weeks later, they’re reviewing their journal and a pattern jumps out. Nearly every trade taken with a confidence score below 5 and an “anxious” mindset has underperformed, no matter the setup. That’s a game-changing insight that pure P&L data would never reveal. It’s a concrete, actionable piece of feedback that will directly improve their next trading decision. That’s the kind of power you unlock when you create your own journal with the right data.

Essential vs. Advanced Journal Fields

As you get more comfortable with journaling, you can start tracking more nuanced data. Here’s a quick breakdown of where to start and what you can add later for a deeper dive.

| Field Category | Essential Fields (Start Here) | Advanced Fields (For Deeper Insight) |

|---|---|---|

| Trade Execution | Entry/Exit Price, Date/Time, Position Size | Order Type (Market, Limit), Slippage, Commissions & Fees |

| Strategy | Strategy Name (e.g., “Breakout”) | Market Condition (Trending, Ranging), Timeframe, Catalyst (News, Technical) |

| Performance | Profit/Loss ($), Win/Loss | Profit/Loss (%), R-Multiple, Max Favorable Excursion (MFE) |

| Psychology | Pre-Trade Mindset (1-5), Confidence (1-10) | Post-Trade Emotions, Reason for Early Exit, Discipline Score |

| Review | Notes/Comments on the trade | Screenshots of Charts (Entry/Exit), Link to Trade Plan |

Start with the essentials. Once you have a consistent habit of logging those, you can begin layering in the advanced fields to uncover even more subtle patterns in your trading.

Adding Context with Charts and Commentary

The raw numbers in your journal — profit, loss, position size — are only half the story. They tell you what happened, but they don’t explain why. To really get to the bottom of your trading performance, you need to add the narrative behind the numbers. This is where visual evidence and some honest commentary can turn a simple logbook into your most powerful tool for improvement.

Think of yourself as a detective investigating each trade. Your charts are the crime scene photos, and your notes are the witness statements. When you create your own journal, your job is to piece it all together. This process builds the kind of deep, analytical discipline that separates consistently profitable traders from everyone else.

Capturing the Visual Story

A picture is worth a thousand pips. Seriously, attaching screenshots to your trade entries provides the objective evidence of what you were seeing — or what you completely missed. It cuts through the emotional fog and hindsight bias that can easily cloud your memory of a trade.

Get into the habit of capturing these three key moments for every single trade:

- The Pre-Entry Chart: This is your “before” picture. It needs to show the setup exactly as you saw it, complete with your trendlines, support/resistance levels, and key indicators. This screenshot holds you accountable. Did the setup actually meet all the criteria in your trading plan?

- The Execution Confirmation: It might seem minor, but a quick snap of your order fill confirmation is incredibly useful. It captures the exact entry price, timestamp, and commissions, giving you a clean record without having to rely on memory or broker reports.

- The Post-Exit Chart: Here’s your “after” shot. It shows what the price did after you closed the position. Did it rip higher without you, or did you nail the exit right before it reversed? This visual feedback is absolutely critical for fine-tuning your exit strategy.

To take it a step further, start annotating your charts. Use simple drawing tools to circle the specific candlestick pattern that triggered your entry or draw an arrow to the volume spike that confirmed your thesis. Understanding these visual cues is fundamental. If you feel like you need a refresher, learning how to read stock charts properly will sharpen this skill.

Writing Commentary That Matters

Your notes are where you connect the dots between the chart, your plan, and what you actually did. This isn’t the place for a novel; it’s about being brutally honest and specific. Go beyond just logging your P&L and really dig into the “why” behind your actions.

A trader who only logs P&L learns very little. A trader who logs their rationale, execution quality, and emotional state for every trade is building a personalized roadmap to consistent improvement.

To keep your analysis focused and effective, structure your commentary around a few key questions:

- What was my original trade thesis? In one or two sentences, why did you take this trade? Was it a clean technical breakout? A reaction to a news catalyst? Spell it out.

- How well did I execute my plan? Be honest and grade your execution on a simple scale, maybe 1-10. Did you get the entry and exit you wanted? Or did you hesitate, chase the price, or move your stop?

- What was the key lesson learned? Every single trade, win or lose, has a lesson. Maybe you learned to be more patient with your entries, to always respect your stop-loss, or that a certain setup just doesn’t work well for you in the afternoon.

When you combine this kind of visual evidence with honest reflection, you create a rich, multi-dimensional record of your trading journey. This is what allows you to spot those recurring mistakes, reinforce what you’re doing right, and ultimately build the long-term discipline needed to succeed in the markets.

Analyzing Your Performance to Find Your Edge

Collecting data is one thing, but making sense of it is where the real work begins. This is the step where your journal transforms from a simple logbook into your own personal intelligence agency, revealing the hidden patterns that define your trading edge.

Just logging trades isn’t enough. The real growth comes from connecting the dots — interpreting what the numbers are telling you about your own behavior. This is how you link your actions directly to your P&L and turn raw data into a clear roadmap for getting better.

Key Metrics to Uncover Your Edge

You don’t need to track dozens of complicated metrics to get started. In fact, a handful of core performance indicators can give you profound insights into your trading habits. Focus on these first.

- Win Rate: This is the most basic one — the percentage of your trades that are profitable. While it’s a good starting point, it can be dangerously misleading on its own. A high win rate means nothing if your small wins are wiped out by a few massive losses.

- Profit Factor: This is your total profit divided by your total loss. A profit factor above 1.0 means you’re in the green. A value of 2.0, for example, tells you that you’re making $2 for every $1 you lose. It’s a much more honest look at profitability.

- Average Win vs. Average Loss: This ratio is crucial. It compares the size of your typical winning trade to your typical losing trade. A healthy ratio (ideally above 1.5:1) ensures your winners are big enough to pay for your losers, with plenty left over.

Modern tools can automate all these calculations, saving you from getting bogged down in spreadsheet formulas. This frees you up to focus your energy on what actually matters — making better decisions. If you’re curious about how this works behind the scenes, you can check out this guide on how to build a pivot table.

Putting Analysis into Action

Let’s walk through a practical scenario. A trader diligently logs every single trade for a month. At the end of it, their profit factor is a disappointing 1.1 — they’re barely breaking even and feel completely stuck.

Instead of giving up, they dive into their journal’s analytics. The data reveals something surprising:

- Trades taken between 9:30 AM and 11:00 AM have a profit factor of 2.8.

- Trades taken after 1:00 PM have a profit factor of 0.6.

Here’s a glimpse of what that kind of performance dashboard might look like.

This visual breakdown instantly shows where their true edge is. The disparity in performance based on the time of day is crystal clear.

This isn’t a strategy problem; it’s a behavioral one. The journal proves they are highly effective during the volatile market open but give back most of their profits trading in the slower afternoon session. That single insight is invaluable. Armed with this data, they can make a simple rule: stop trading after lunch. This one change could dramatically boost their profitability without altering their core strategy at all.

Your journal’s job is to expose the truth about your trading, even when it’s uncomfortable. It holds up a mirror to your habits, forcing you to confront the behaviors that are costing you money.

The impact of this kind of pattern recognition is powerful. While specific statistics can vary, the principle remains: traders who consistently analyze their performance data are better equipped to identify and eliminate their unprofitable habits. When you create your own journal, you are building a system designed to uncover these profitable — and unprofitable — habits.

Creating a Journaling Habit That Sticks

Let’s be real. The most advanced trading journal on the planet is useless if it’s sitting there gathering dust. We’ve all done it — kicked off a new routine with a ton of motivation, only to watch it fizzle out after a few tough days. But in trading, discipline is everything, and building a solid journaling habit isn’t just a “nice-to-have,” it’s a core part of the job.

The goal isn’t to write a novel for every trade. The real win is consistency. You want to build a simple, repeatable process that becomes as second nature as checking the opening bell. Forget spending hours on overly detailed entries; a few focused minutes every single day will do more for your trading than a marathon session once a month.

Building Your Daily Routine

The trick is to weave journaling directly into your trading day so it feels like part of the workflow, not some extra chore you have to do later. Start small and build from there.

Here’s a simple framework you can put into action right away:

- The 5-Minute Pre-Market Check-In: Before the action starts, quickly jot down your take on the market, any key levels on your radar, and a quick mental check. Are you dialed in and ready to go, or is your head somewhere else? This small step sets the tone for the entire day.

- The 15-Minute End-of-Day Review: This is where the magic happens. Log your trades, drag and drop your chart screenshots, and add your commentary. Don’t just focus on the P&L; think about your execution, your discipline, and whether you stuck to your plan.

This bookend approach gives your trading day structure, providing a clear moment for preparation and a dedicated time for reflection.

Cutting Out the Friction with Modern Tools

Manual data entry is a momentum killer. I’ve seen more traders give up on journaling because of tedious data entry than for any other reason. The easier you can make it to log your trades, the higher the odds you’ll actually do it. This is where technology becomes your best friend.

The secret to any lasting habit is making the right thing the easy thing. Automate the grunt work so you can spend your mental energy on what actually matters: analysis and self-improvement.

This is exactly why tools like TradeReview were built. With features like Auto Broker Sync, your trades are pulled in automatically, which means no more manually typing in every single entry and exit. It’s a game-changer that removes the single biggest obstacle to consistency and guarantees your data is always spot-on.

The global market for digital journal apps is projected to grow significantly in the coming years, according to market analysis from firms like Straits Research’s market analysis. For traders, this trend means access to increasingly powerful and user-friendly tools designed to streamline performance tracking and analysis, helping them stay disciplined and focused.

The Power of the Weekly Review

Daily entries are great for capturing the nitty-gritty of each trade, but the weekly review is where you start connecting the dots. Block out 30-45 minutes every weekend to zoom out and look at the bigger picture.

Ask yourself some hard questions:

- What setup made me the most money this week? Why?

- What was my single biggest unforced error?

- Did I let my emotions get the best of me on any trades?

- What’s the one thing I need to focus on improving next week?

This is the habit that truly separates the amateurs from the pros. It’s the engine that drives real, continuous improvement, turning your raw trade data into an actionable game plan for the week ahead.

A Few Common Trading Journal Questions

Diving into journaling can feel like a big commitment, and it’s totally normal to have a few questions before you start. Let’s tackle some of the most common ones that pop up when traders decide to create their own journal.

Think of journaling less like searching for a secret formula and more like building a system for self-awareness and discipline. It’s about you, your habits, and your decisions.

How Long Does It Take to See Results?

This is the big one, right? The honest answer is: it really depends on how consistent you are. While there are never any guarantees in trading, a lot of traders start feeling real improvements in their discipline and pattern recognition within the first 30 to 90 days.

The first benefits you’ll notice are usually psychological. You’ll probably find yourself taking fewer impulsive trades and feeling a greater sense of control almost right away. As for the numbers — like a better win rate or profit factor — those tend to show up after you’ve logged enough data. Typically, after about 50-100 trades, you’ll have a solid sample size to start spotting and fixing your recurring mistakes.

What’s the Biggest Journaling Mistake?

By far, the most common mistake is focusing only on the numbers and, just as importantly, being inconsistent. It’s human nature to want to skip journaling after a rough day or a string of losses. But that’s precisely when the journal is most valuable. If you hide from your bad days, you never learn from them.

Another major pitfall is just jotting down your P&L without capturing the why behind the trade. What was your strategy? What was the market doing? How were you feeling? The real power of a journal comes from analyzing both your wins and your losses to understand the patterns in your own behavior.

A journal that only tracks profits and losses is just a scoreboard. A journal that tracks decisions, emotions, and lessons learned is your playbook for success.

Spreadsheet or Dedicated Journaling App?

Look, spreadsheets are a decent place to start. They’re free, and you can customize them endlessly, which is a big draw for a lot of traders at first. But they come with some serious downsides that can sabotage your consistency in the long run.

Manually typing in every trade is not only a huge time sink, but it’s also easy to make costly mistakes. Even more importantly, spreadsheets don’t come with built-in analytics. You’ll find yourself wrestling with complex formulas just to calculate crucial metrics like profit factor, drawdowns, or performance by setup.

A dedicated app, on the other hand, is built from the ground up for one thing: helping traders. It can:

- Automate data entry by syncing with your broker, which saves a ton of time and keeps things accurate.

- Give you instant performance analytics on a clean, visual dashboard.

- Let you tag and filter trades with ease, so you can find insights in seconds.

- Sync across all your devices, making it easy to journal no matter where you are.

Ultimately, a dedicated app makes the whole process smoother and more sustainable. It helps you build the habit and stick with it for good.

Ready to build a journaling habit that actually sticks? TradeReview automates the tedious work with features like Auto Broker Sync and instant performance analytics, so you can focus on what matters: making smarter decisions. Create your free journal on TradeReview today.