If you’re serious about trading, you know it’s a marathon, not a sprint. The market is a relentless teacher, and its lessons are often expensive. The difference between traders who thrive long-term and those who burn out often comes down to one thing: a systematic process for review and improvement. This is where finding the best trading journal for your specific needs becomes indispensable.

It’s not just a log of wins and losses; it’s a mirror reflecting your habits, biases, and the subtle patterns that define your P&L. We’ve all been there — taking a “revenge trade” after a frustrating loss or getting greedy during a win streak. These emotional decisions can feel impossible to control. A dedicated journal helps you trade with intention, turning gut feelings into data-driven strategies. It’s the tool that helps you diagnose why you won or lost, moving you beyond just the outcome.

This guide is designed to cut through the noise and help you find the perfect platform. We will dive deep into the top digital apps like TradeReview and TraderSync, explore customizable templates, and even consider physical logbooks for those who prefer pen and paper.

For each option, you will find:

- A detailed breakdown of key features and analytics.

- Honest pros and cons based on real-world use cases.

- Clear pricing information and who the tool is best suited for.

- Screenshots and direct links to help you evaluate your choices.

Our goal is to provide a comprehensive, people-first resource that helps you select the right tool to build discipline, identify your unique edge, and finally start trading your plan, not your emotions. Let’s get started.

1. TradeReview

TradeReview establishes itself as an exceptional choice for the best trading journal by delivering a powerful, data-centric platform that remains impressively accessible and completely free. It’s designed for the modern trader who needs to move beyond simple win/loss tracking and uncover the behavioral patterns and strategic habits that truly define their performance. The platform excels at transforming raw trade data into an actionable feedback loop, helping you replace emotional decision-making with objective, data-driven insights. Its seamless synchronization across web, iOS, and Android ensures your journal is always within reach, whether you’re at your desk or on the move.

What truly sets TradeReview apart is its focus on efficiency without sacrificing depth. The broker auto-sync feature is a game-changer, dramatically reducing manual entry time. This automation allows you to spend less time on administrative tasks and more time analyzing the rich, real-time analytics presented on your dashboard, including win rate, profit factor, and your personal equity curve. This focus on efficiency and analysis is a core tenet of effective journaling, and for those wanting a deeper understanding, TradeReview provides excellent resources on why a trading journal is an essential tool for success.

Key Features & Analysis

- Automated and Manual Imports: Supports auto-sync with a growing list of popular brokerages. For unsupported brokers, a straightforward CSV import function ensures no trade is left behind.

- Comprehensive Analytics Dashboard: Visualizes critical metrics like your equity curve, profit factor, average win/loss, and more. This consolidated view is perfect for identifying performance trends at a glance.

- Flexible Tagging System: The ability to add custom tags is a standout feature. For example, a trader can tag setups (“Break and Retest,” “Earnings Play”), psychological states (“FOMO,” “Confident”), or market conditions (“High Volatility”) to filter and analyze performance under specific circumstances.

- Multi-Asset Support: Tracks a wide range of instruments, including Stocks, Options, Futures, Forex, and Crypto, making it a versatile tool for diversified traders.

- Cross-Platform Availability: Full functionality on web, iOS, and Android with encrypted cloud storage ensures secure and convenient access to your journal anytime, anywhere.

Pros and Cons

| Pros | Cons |

|---|---|

| Completely Free: No paid tiers or hidden costs for core features. | Broker-Dependent Auto-Sync: Requires CSV for unsupported brokers. |

| Time-Saving Automation: Broker sync drastically cuts down manual logging. | Lacks Enterprise-Level Features: No formal certifications for institutional use. |

| Powerful, Flexible Analytics: Custom tags and a clean dashboard provide deep insights. | |

| Active Development: Constantly updated with a public feedback channel and Discord community. |

Pricing

TradeReview is 100% free to use. There are no premium tiers or subscription fees for the core product, making it an incredible value for traders at all levels.

- Website: https://tradereview.app

2. TraderSync

TraderSync is a powerhouse in the trading journal space, offering one of the most comprehensive analytics and automation platforms available. It caters to active traders across various asset classes — including stocks, options, futures, and crypto — making it a versatile choice for those who don’t stick to just one market. The platform’s core strength lies in its ability to automatically import trades from hundreds of brokers, saving you the tedious task of manual entry.

This tool shines for traders who want to dive deep into their performance metrics. Beyond simple win/loss rates, TraderSync provides AI-powered feedback, market replay simulations, and advanced reporting on everything from your holding times to your performance by specific market conditions. For options traders, its ability to recognize complex spreads and model fees is a significant advantage. This level of detail helps you move beyond just recording trades and start understanding the “why” behind your results, a crucial step in refining your strategy.

Who is TraderSync For?

- Best for: Active day traders and options traders who need deep analytics and broad broker compatibility.

- Pricing: Offers a free (but limited) plan. Paid tiers are Premium ($29.95/mo), Elite ($49.95/mo), and Pro ($79.95/mo), with discounts for annual billing. The most valuable features, like market replay and advanced options reporting, are on the Elite and Pro plans.

| Pros | Cons |

|---|---|

| Extensive automated syncs with many brokers | Core analytics are locked behind higher-priced tiers |

| Advanced features for options spread analysis | Mobile app UX can feel less refined than the web app |

| AI-powered coaching and market replay tools | Can be overwhelming for complete beginners |

| Mobile and web apps for access on the go |

Website: TraderSync.com

3. Tradervue

Tradervue is one of the original and most respected names in the trading journal world, known for its mature and powerful analytics engine. It appeals to serious traders who prioritize function over form, offering robust tools for analyzing performance across stocks, options, and futures. The platform excels at importing trades from a wide array of brokers, allowing you to quickly get into the core task of reviewing your decisions rather than getting stuck on manual data entry.

Where this tool truly distinguishes itself is in its analytical depth and sharing capabilities. Tradervue allows you to tag, filter, and run reports on virtually any aspect of your trading strategy, helping you answer complex questions like, “How do I perform on Tuesdays with high-volume tech stocks?” It also features unique mentor-mentee sharing functions, making it a top choice for trading communities and coaching programs. The platform’s exit analysis — which shows your potential P&L if you had held longer or sold sooner — is an invaluable feature for refining your exit timing.

Who is Tradervue For?

- Best for: Data-driven discretionary traders and those in coaching or mentorship groups who need robust analytical and sharing tools.

- Pricing: A free plan is available with basic journaling. Paid plans are Silver ($29/mo) and Gold ($49/mo), with discounts for annual prepayment. Advanced features like risk analysis and exit analysis require the Gold plan.

| Pros | Cons |

|---|---|

| Mature and trusted analytics engine | The user interface can feel dated or utilitarian |

| Excellent filtering and reporting capabilities | Some users have reported mixed billing experiences |

| Unique features for sharing with mentors | Lacks some of the modern AI features of newer tools |

| Detailed exit and risk analysis reports |

Website: Tradervue.com

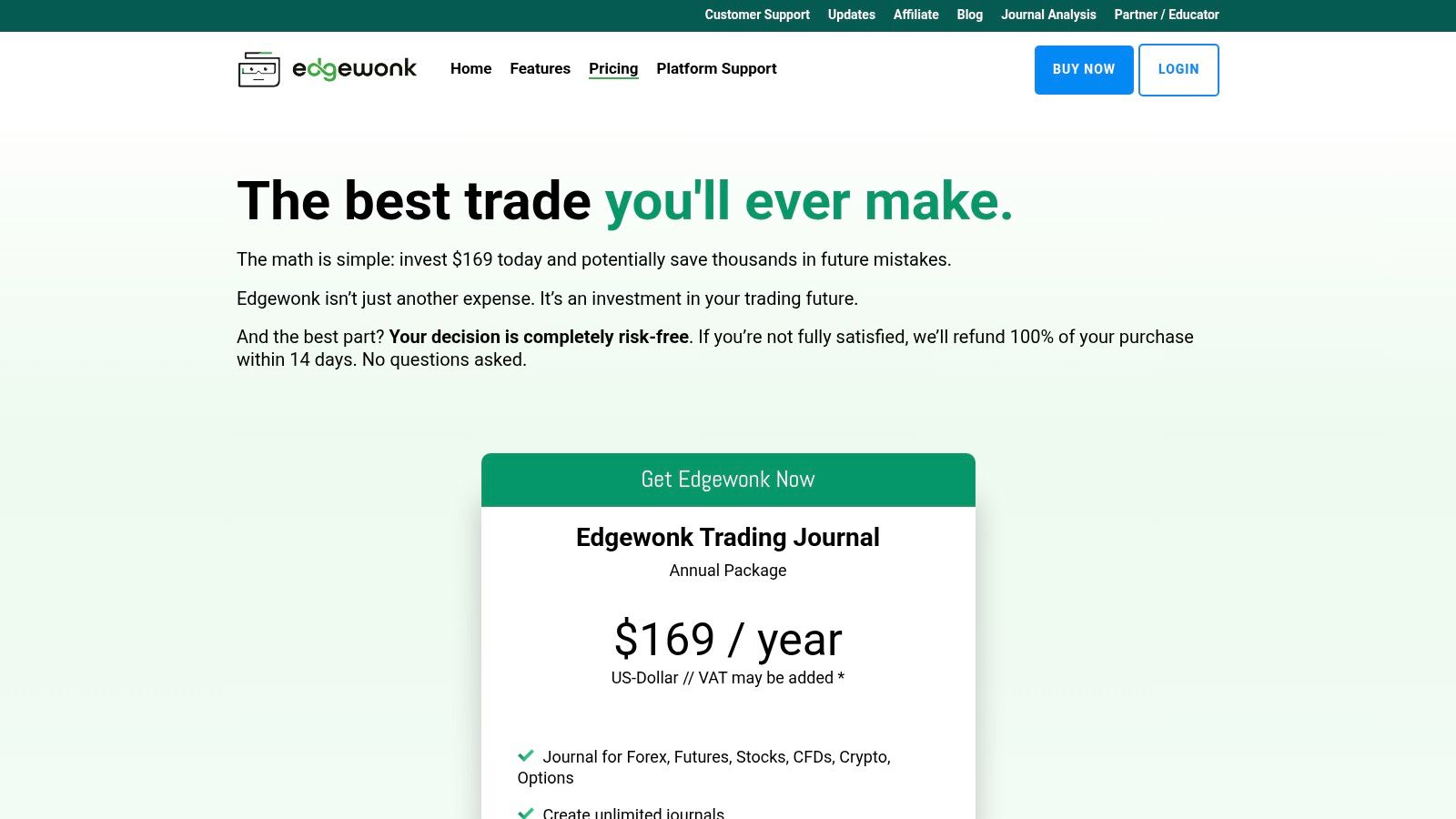

4. Edgewonk

Edgewonk positions itself as more than just a data tracker; it’s a dedicated trading coach designed to refine your process and mental discipline. This platform is built for traders who understand that long-term success comes from behavioral improvement, not just finding a winning setup. It supports a wide range of assets — including stocks, futures, forex, and crypto — and offers automated imports to streamline the journaling process.

The platform’s strength lies in its structured approach to analysis. Features like the ‘Edge Finder’ use AI-augmented analytics to pinpoint patterns in your winning and losing trades, helping you discover your unique statistical edge. It moves beyond basic win rates to analyze trade quality, drawdown behavior, and emotional patterns. This focus on psychology and process makes it one of the best trading journal options for serious traders looking to eliminate costly mistakes and build consistent habits.

Who is Edgewonk For?

- Best for: Process-driven traders who want to focus on psychology, discipline, and behavioral analysis.

- Pricing: Edgewonk simplifies pricing with a single annual plan for $169. This plan includes all features, updates, and unlimited trades and journals, making it a straightforward value proposition without complex tiers.

| Pros | Cons |

|---|---|

| Strong focus on process and trader psychology | Desktop-style workflow with fewer social/sharing tools |

| Single annual plan that includes all features | No native mobile apps for on-the-go journaling |

| AI-augmented ‘Edge Finder’ for strategy insights | |

| Detailed analytics and drawdown tracking |

Website: Edgewonk.com

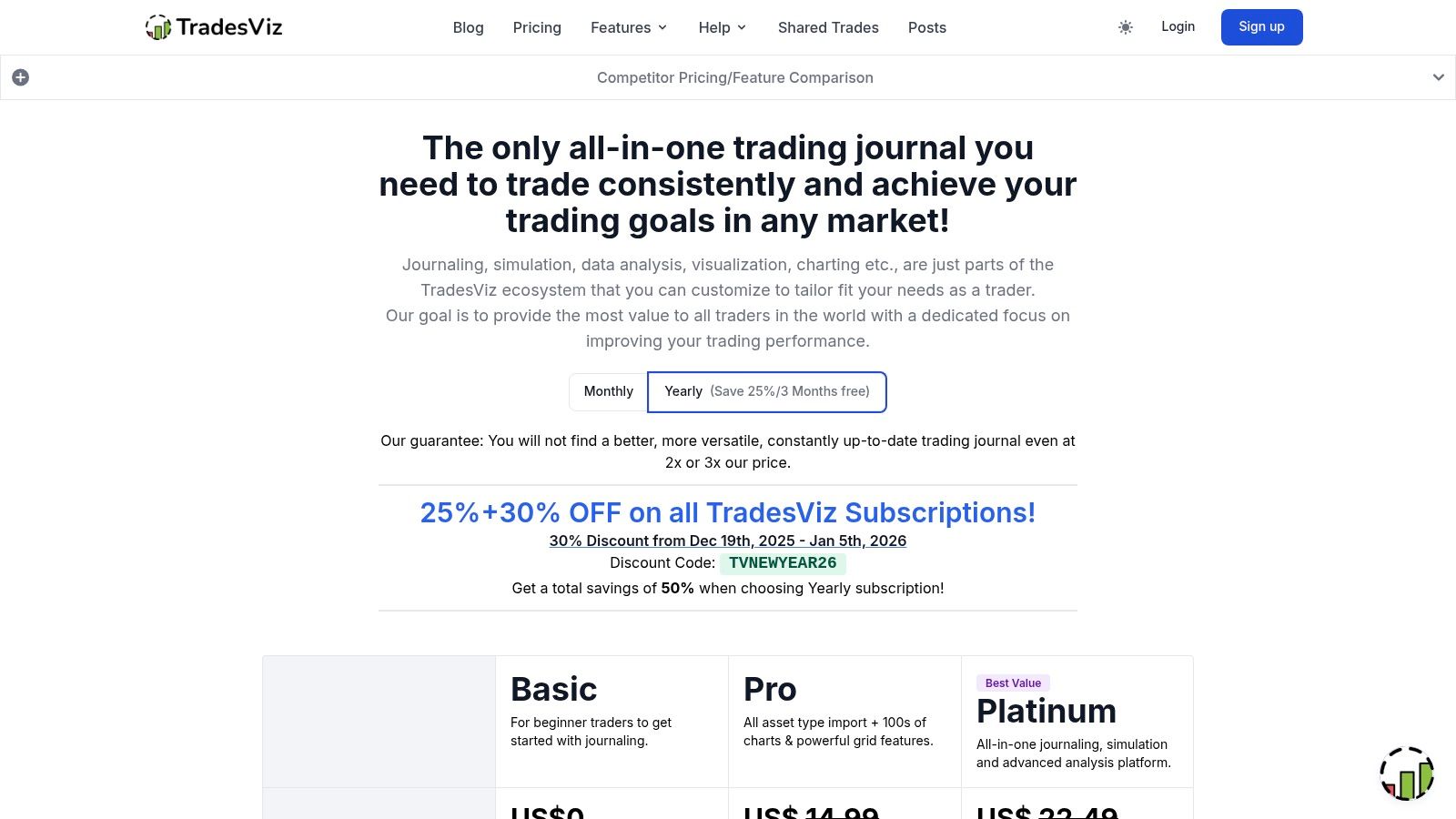

5. TradesViz

TradesViz positions itself as the ultimate data-driven trading journal, designed for traders who crave granular detail and deep analytical power. Supporting stocks, options, futures, forex, and crypto, it stands out for its sheer volume of metrics and customization options. It automates trade imports from over 200 brokers, allowing you to quickly move past data entry and focus on analysis.

This journal is built for traders who treat their performance analysis like a science. With an extensive number of unique statistics, pivot grids for custom data slicing, and AI-powered Q&A features, TradesViz lets you explore your habits from every conceivable angle. For instance, you could analyze your win rate specifically for morning trades on high-volume tech stocks, then compare that to your performance with options spreads in the afternoon. This level of detail is invaluable for identifying subtle patterns — both good and bad — that shape your P&L over time. The native iOS and Android apps also ensure your analysis is never far away.

Who is TradesViz For?

- Best for: Data-focused traders and quants who want maximum customization and a vast array of performance metrics.

- Pricing: Offers a free plan with basic journaling. Paid plans are Pro ($15.00/mo) and Platinum ($30.00/mo), with significant discounts for annual billing. Advanced features like AI tools and simulators are exclusive to the Platinum tier.

| Pros | Cons |

|---|---|

| Extremely deep analytics with many stats | The sheer volume of features can be overwhelming for beginners |

| Powerful data visualization and pivot grids | Most advanced AI and simulator tools are on the top tier |

| Excellent broker compatibility and asset support | |

| Native mobile apps for iOS and Android |

Website: TradesViz.com

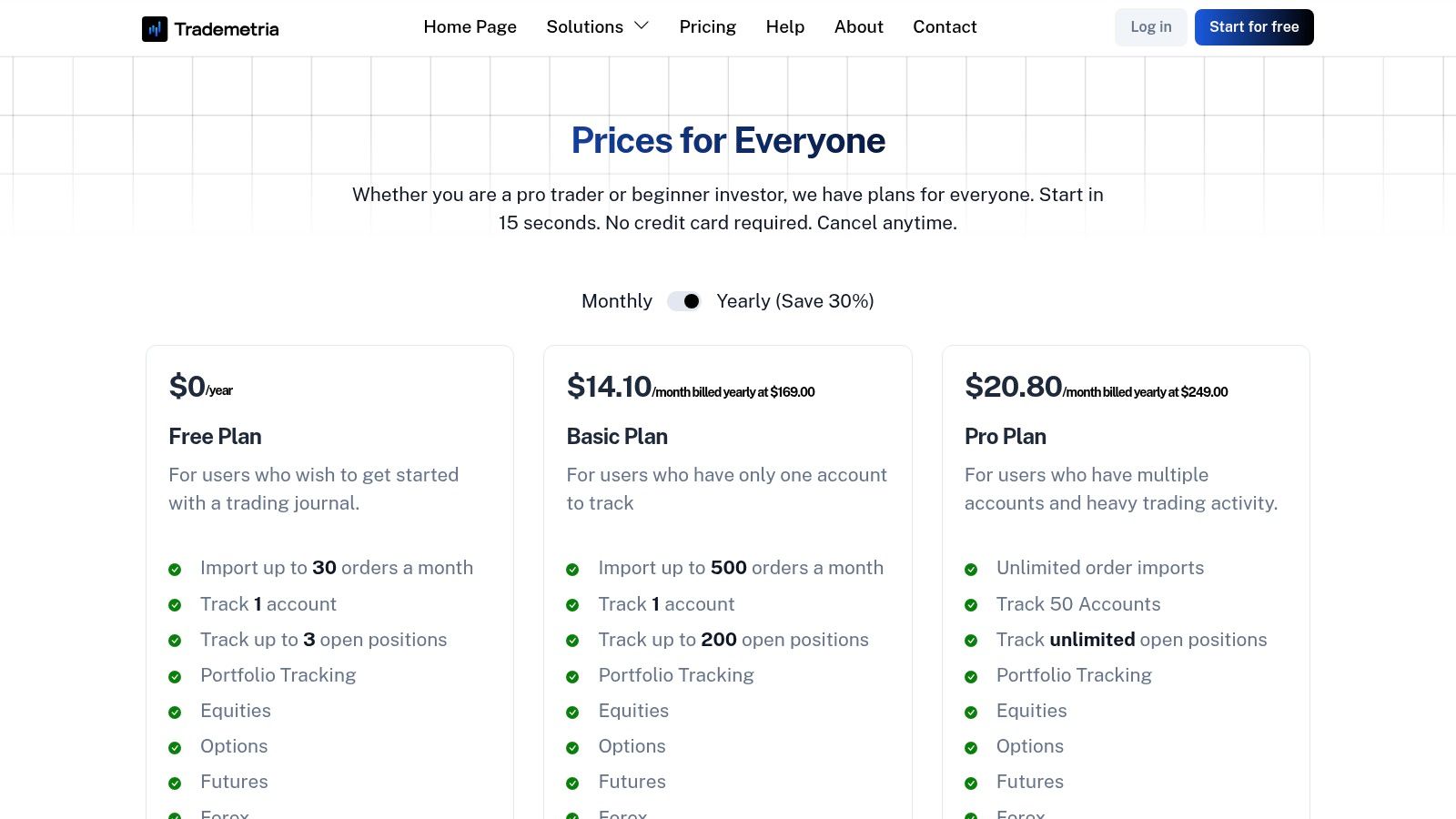

6. Trademetria

Trademetria offers a well-rounded and accessible trading journal that strikes a balance between powerful features and ease of use, making it a strong contender for traders at any level. It supports a wide array of asset classes — including stocks, ETFs, crypto, futures, and options — and connects with over 200 brokers for automated trade importing. The platform is designed to provide clear, conventional analytics without a steep learning curve, helping traders identify profitable patterns and costly mistakes.

This tool is particularly notable for its generous free plan, which offers enough functionality for new traders to genuinely track and analyze their performance without an initial investment. For those who need more, Trademetria scales effectively with features like multi-account tracking, advanced strategy reporting, and AI-driven insights to evaluate your decision-making process. While its interface is more functional than flashy, it provides a solid, no-nonsense approach to journaling that focuses purely on the data that matters for improving your trading discipline.

Who is Trademetria For?

- Best for: Beginners seeking a robust free option and experienced traders wanting a scalable, multi-asset journal without excessive complexity.

- Pricing: Offers a comprehensive Free plan. Paid tiers are Basic ($29.95/mo) and Pro ($39.95/mo), with discounts for annual billing. The Pro plan is necessary for managing multiple accounts and accessing the full suite of analytical tools.

| Pros | Cons |

|---|---|

| One of the most generous free plans available | Interface is practical but less modern than some rivals |

| Supports a wide range of asset classes | Advanced options analytics are not as deep as specialized tools |

| Scales well from beginner to professional tiers | AI insights are useful but less extensive than some competitors |

| Clean, straightforward analytics and reports |

Website: Trademetria.com

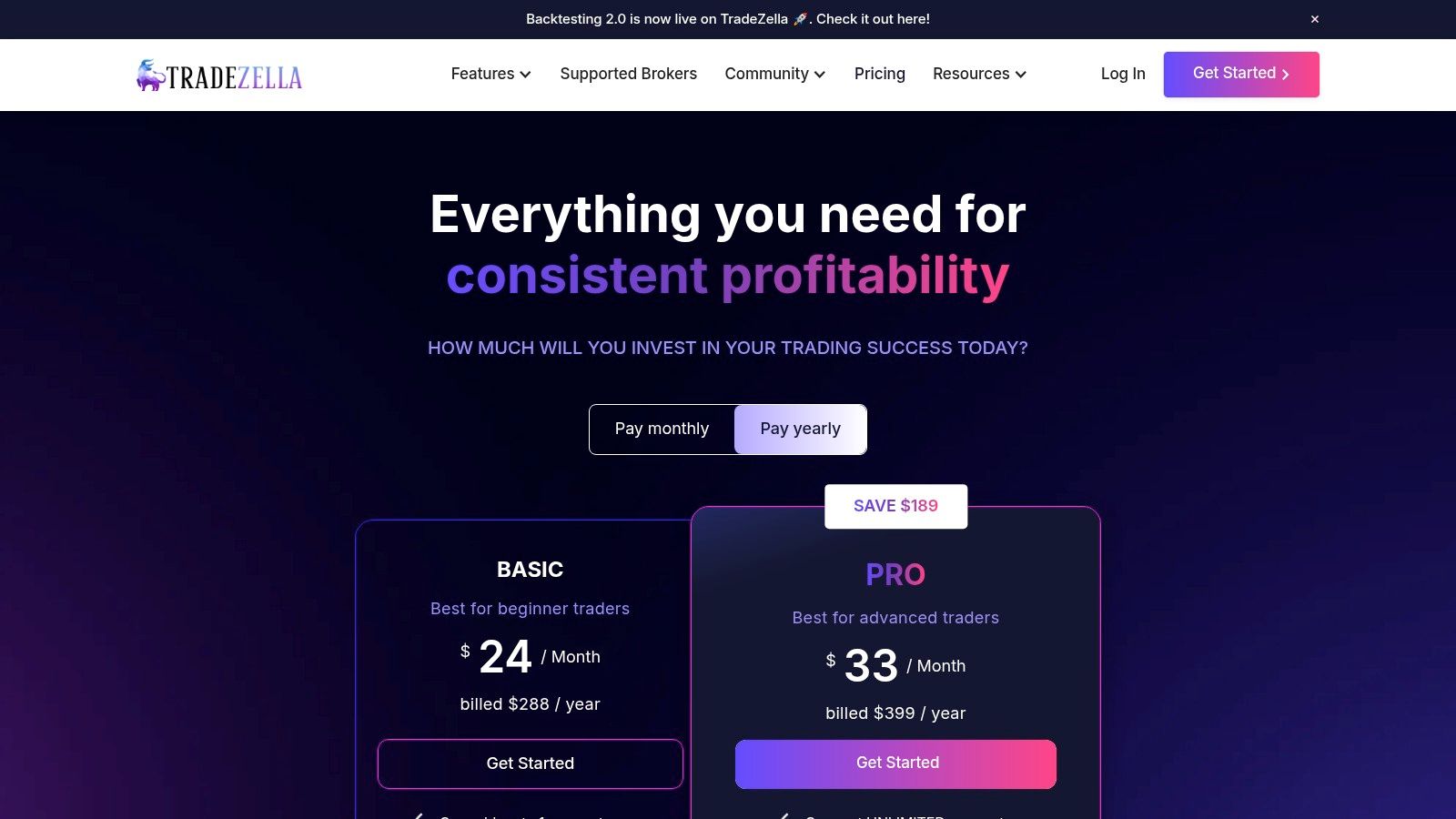

7. TradeZella

TradeZella is a modern, visually appealing trading journal designed with the discretionary trader in mind. It places a strong emphasis on education and strategy refinement through its unique “Playbook” feature, which allows you to tag trades to specific setups and analyze their performance individually. By focusing on the conditions and rules that define your best trades, it helps you build a repeatable process, a critical step for achieving long-term consistency in the markets.

This platform excels for those who want to review their trading decisions in detail. TradeZella offers powerful trade and session replay features, allowing you to re-watch your trading day to identify emotional mistakes or execution errors. The clean, intuitive user interface makes it easy to navigate complex data without feeling overwhelmed. Furthermore, its collaborative features, like inviting a mentor to review your journal, provide a valuable feedback loop that is often missing for retail traders. If your goal is to systematically improve your playbook, this is an excellent choice for a trading journal.

Who is TradeZella For?

- Best for: Discretionary day traders and options traders focused on building and refining specific trading playbooks.

- Pricing: Offers a Basic plan ($29/mo), Pro ($49/mo), and Advanced ($99/mo). Key features like trade replay, backtesting, and unlimited playbook analytics are reserved for the Pro and Advanced tiers. Discounts are available for annual subscriptions.

| Pros | Cons |

|---|---|

| Clean user interface with an education-first feel | Storage caps on lower-priced tiers can be limiting |

| Excellent for playbook-driven trading styles | Replay and backtesting features vary significantly by plan |

| Mentor invite feature for collaborative review | Broker support is more limited than some competitors |

| Integrated trade and session replay tools |

Website: TradeZella.com

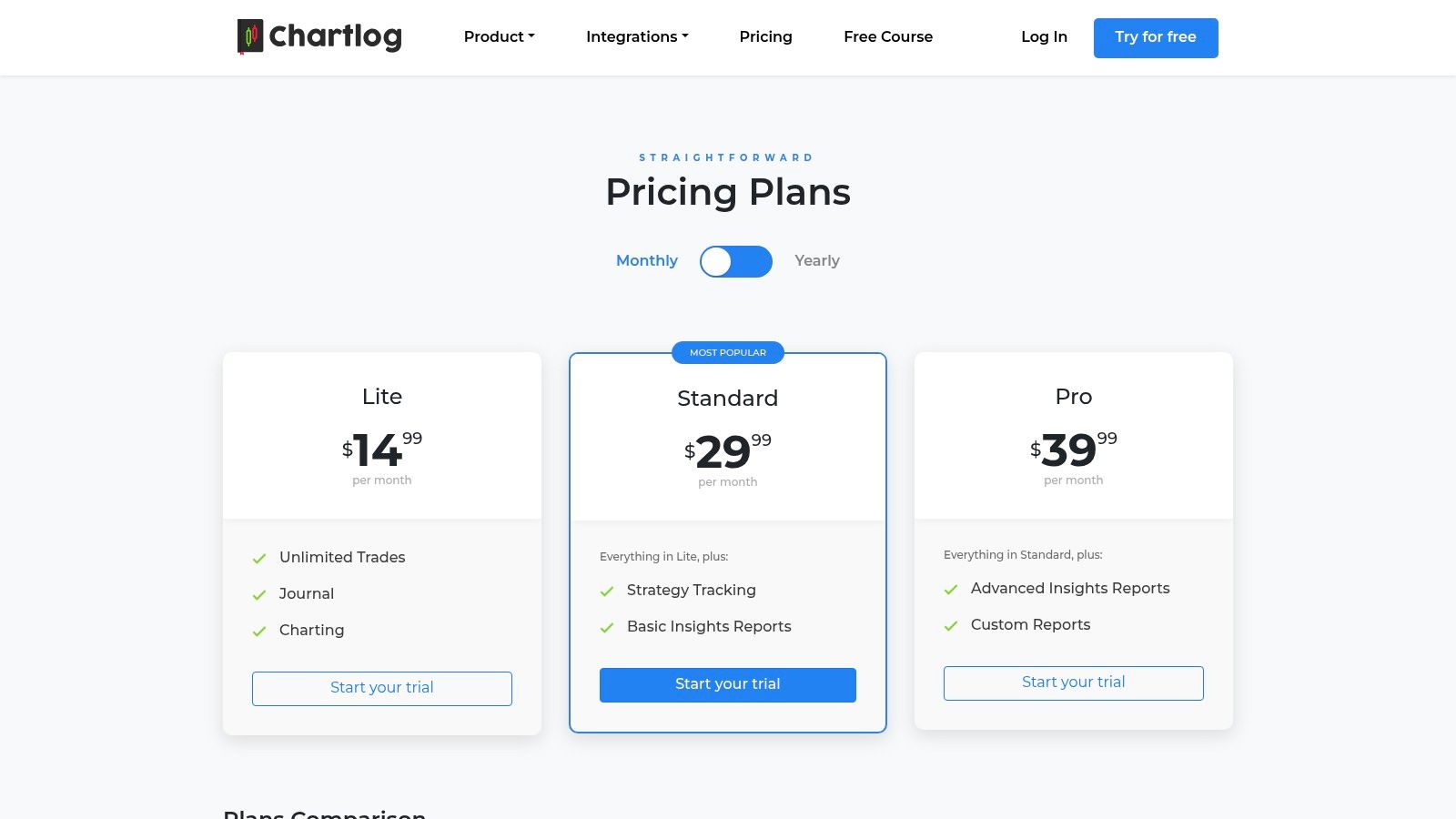

8. Chartlog

Chartlog stands out as a clean, powerful, and cloud-based trading journal designed for traders who value clarity and unlimited data. Its core philosophy is straightforward: provide essential journaling and analytics tools without overwhelming users. Chartlog supports stocks, options, and futures, and its biggest draw is offering unlimited trade imports and accounts across all its pricing tiers, a feature many competitors gate behind more expensive plans.

This platform excels at helping you track the performance of specific strategies and trading rules. With detailed MFE/MAE (Maximum Favorable Excursion / Maximum Adverse Excursion) reporting, you can precisely measure how well you execute your entries and exits. MFE shows how much a trade moved in your favor, while MAE shows how much it moved against you. Analyzing this can reveal if you’re exiting winners too early or holding losers too long. The interface is intuitive, allowing you to quickly filter trades and generate reports on your performance by time of day, sector, or specific setups. For traders who want a no-nonsense tool that focuses purely on performance analytics without extra social or community features, Chartlog is an excellent choice.

Who is Chartlog For?

- Best for: Traders who want unlimited trade imports on an affordable plan and a clean, analytics-focused interface.

- Pricing: Offers three simple tiers: Lite ($14.99/mo), Standard ($29.99/mo), and Pro ($39.99/mo). Annual plans provide a discount. The main difference is the depth of reporting, with custom dashboards and reports reserved for the Pro plan.

| Pros | Cons |

|---|---|

| Unlimited trade imports/accounts on all tiers | Fewer social or mentoring features than some rivals |

| Straightforward plans and transparent features | Broker import list is smaller than the largest players |

| Clean, intuitive user interface | No mobile application available at this time |

| Powerful strategy and rule tracking |

Website: Chartlog.com

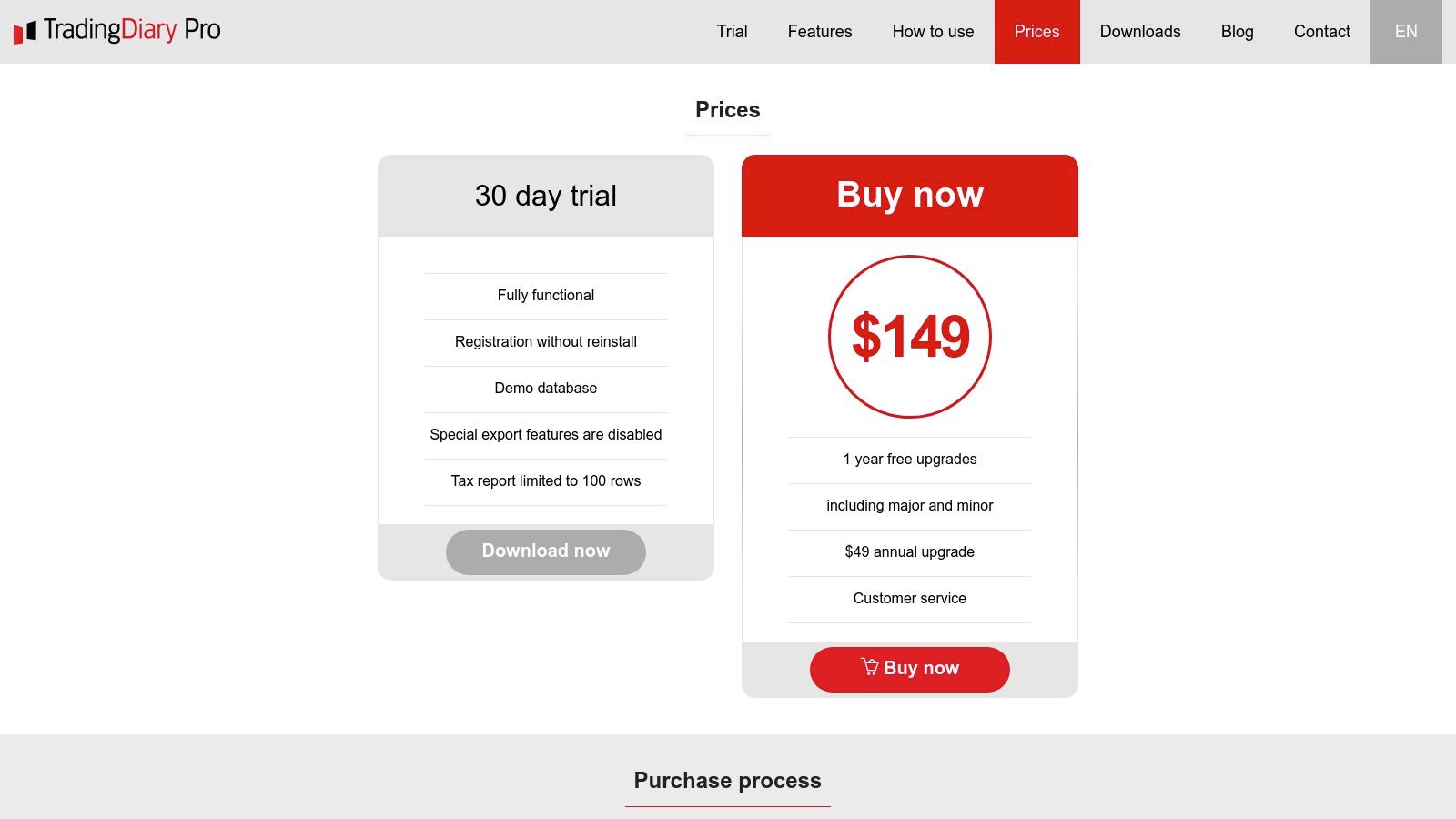

9. TradingDiary Pro

TradingDiary Pro stands out from the cloud-based crowd by offering a robust, downloadable trading journal for Windows. It operates on a one-time purchase model, appealing to traders who prioritize data privacy, offline access, and a sense of software ownership over recurring subscriptions. This makes it a unique choice for those who prefer to keep their sensitive trading data stored locally on their own hardware rather than on a third-party server.

The platform is built for function over form, providing extensive import capabilities from numerous brokers and detailed reporting features, including those useful for tax purposes. While its interface may feel more utilitarian than its modern web-based competitors, its strength lies in its performance and reliability. For the disciplined trader who values a one-and-done purchase and doesn’t require mobile access or fancy UI elements, TradingDiary Pro is an excellent, secure solution for deep performance analysis.

Who is TradingDiary Pro For?

- Best for: Traders who prefer a one-time purchase, offline access, and keeping their data stored locally. It’s ideal for Windows users who value function over aesthetics.

- Pricing: A one-time license costs $129, which includes one year of support and updates. Optional yearly renewals for continued updates are available at a discounted rate.

| Pros | Cons |

|---|---|

| One-time purchase model avoids subscriptions | Windows-only; no Mac, mobile, or web app |

| Data is stored locally for maximum privacy | User interface is dated compared to web-based tools |

| Extensive reporting, including for tax purposes | No cloud-syncing capabilities across devices |

| Operates fully offline without internet |

Website: https://www.tradingdiarypro.com/prices/?utm_source=openai

10. Journalytix (by Jigsaw Trading)

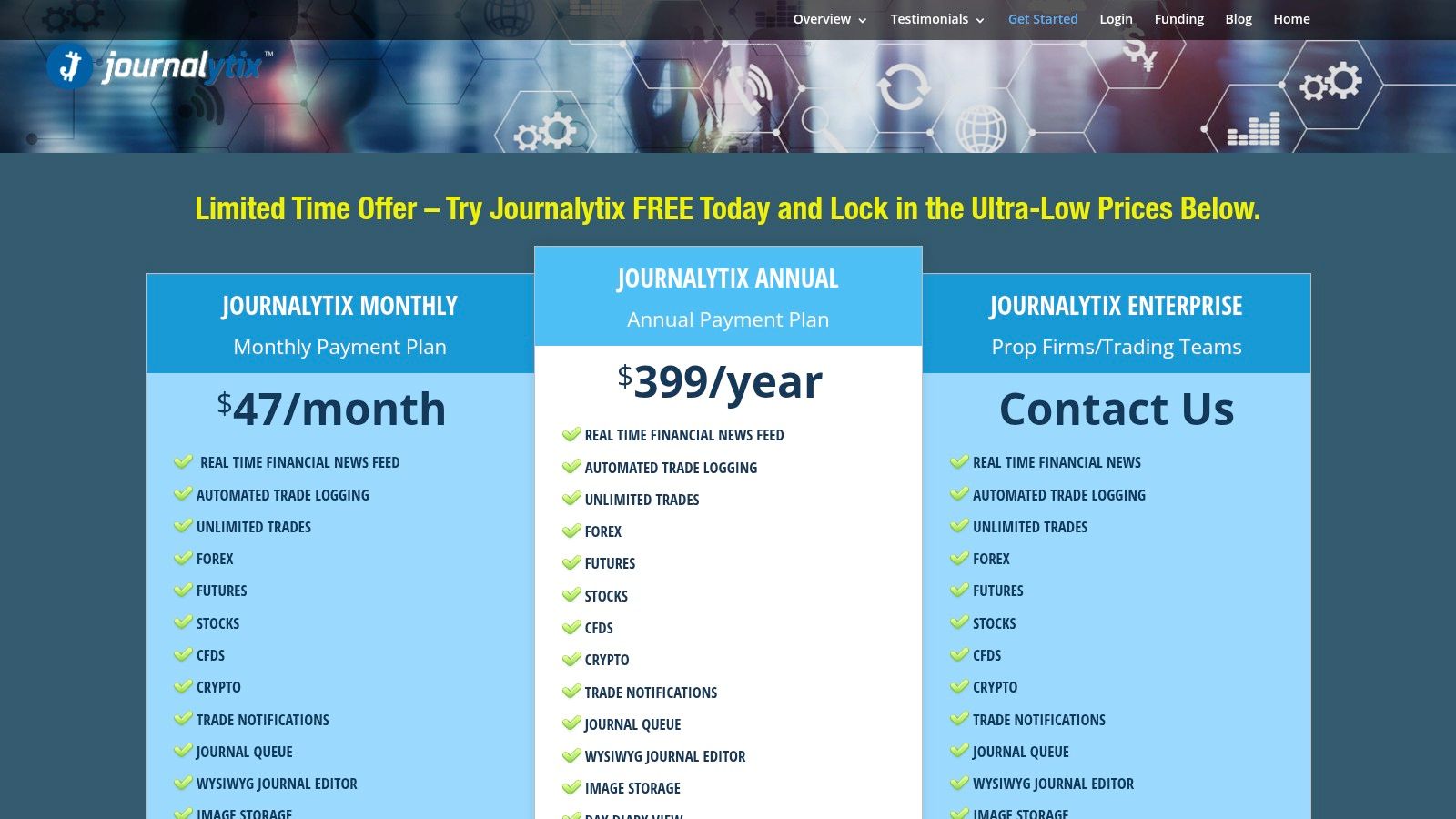

Journalytix is a professional-grade trading journal and workflow platform designed for serious, active traders, particularly those in the futures and proprietary trading space. Developed by Jigsaw Trading, a name known for its order flow tools, Journalytix goes beyond simple trade logging. It integrates real-time news, an economic calendar, and automated risk analysis directly into the trader’s workflow, creating a comprehensive command center rather than just a retrospective tool.

This platform stands out for its deep integration with professional data feeds like Rithmic and CQG, which is a key requirement for many futures traders. Its standout feature is the analytics suite, which is built not just for individuals but for trading firms and groups. Managers can access firm-level dashboards and leaderboards to oversee team performance. For the individual trader, this means access to the kind of robust, data-driven performance analysis that prop desks use to gain an edge, making it one of the best trading journal options for those on a professional track.

Who is Journalytix For?

- Best for: Professional futures traders, proprietary trading firms, and serious retail traders who need an all-in-one workflow and analytics solution.

- Pricing: Journalytix is a premium product with two main tiers. The Independent plan is $49/mo, and the Professional plan is $99/mo. It also offers a 14-day free trial to test the platform.

| Pros | Cons |

|---|---|

| Built for serious active traders and trading teams | Higher price point than many retail journals |

| Deep integration with futures trading workflows | Setup can be more involved due to data feed configs |

| Includes real-time news and economic calendars | Focus on futures may limit appeal for stock traders |

| Powerful group/firm level analytics & dashboards |

Website: https://journalytix.me/get-started/?utm_source=openai

Top 10 Trading Journals — Feature & Pricing Comparison

| Product | Core features ✨ | UX / Quality ★ | Price / Value 💰 | Target audience 👥 | Unique selling points |

|---|---|---|---|---|---|

| 🏆 TradeReview | Log every trade, interactive calendar, real-time analytics, broker auto-sync, encrypted cloud | ★★★★☆ | 💰 Free — full core features | 👥 Beginners → experienced day/options/crypto traders | ✨ Broker auto-sync, interactive calendar, encrypted storage, active community |

| TraderSync | Automated imports, options spread recognition, market replay, AI coaching | ★★★★ | 💰 Tiered — advanced features on higher plans | 👥 Traders needing broad broker coverage & options analytics | ✨ Extensive broker coverage, market replay, options depth |

| Tradervue | Broker sync, exit analysis, liquidity & fee reports, advanced filtering | ★★★★ | 💰 Paid plans (mature analytics) | 👥 Active traders & coaching workflows | ✨ Mature performance/risk analytics, mentor sharing |

| Edgewonk | Multi-asset support, drawdown analytics, AI “Edge Finder” | ★★★★ | 💰 Annual one-time plan (all features included) | 👥 Process/psychology-focused traders | ✨ Behavior-driven tools, milestones, Edge Finder |

| TradesViz | 600+ stats, broker imports, AI Q&A/summaries, simulators, mobile apps | ★★★★☆ | 💰 Tiered — deep analytics; some features on Platinum | 👥 Data-driven & advanced traders | ✨ Massive stats set, AI tools, strong visualization |

| Trademetria | Daily/trade journals, P&L simulator, watchlists, broker auto-sync, AI insights | ★★★★ | 💰 Free tier + Pro paid tiers | 👥 Beginners scaling to multi-account pros | ✨ Generous free plan, conventional analytics, auto-sync |

| TradeZella | Auto-sync, playbooks, backtesting, trade/session replay | ★★★★ | 💰 Tiered (storage limits on lower plans) | 👥 Discretionary & playbook-driven traders | ✨ Playbooks, replay & backtesting focus |

| Chartlog | Strategy/rules tracking, MFE/MAE reports, time-of-day & sector reports, custom dashboards | ★★★★ | 💰 Lite→Pro tiers (unlimited imports on all tiers) | 👥 Traders wanting simple, transparent plans | ✨ Unlimited imports/accounts even on Lite tier |

| TradingDiary Pro | One-time license, offline operation, extensive imports, tax reports | ★★★★ | 💰 One-time purchase + optional yearly updates | 👥 Traders preferring local/offline tools | ✨ Own-the-software model; offline & private |

| Journalytix (Jigsaw) | Automated logging, real-time news/economic calendar, firm dashboards, datafeed support | ★★★★ | 💰 Higher, firm/prop pricing | 👥 Prop desks, serious active traders & teams | ✨ Firm-level analytics, CQG/Rithmic integrations |

From Data to Discipline: Making Your Trading Journal Work for You

We’ve explored a comprehensive landscape of tools, from advanced analytics platforms like TraderSync and TradesViz to the disciplined, methodology-focused approach of Edgewonk and the sleek, user-friendly interface of TradeZella. We’ve seen how specialized tools like Chartlog cater to visual learners and how desktop-based software like TradingDiary Pro offers robust, offline capabilities. The sheer variety underscores a fundamental truth: there is no single “best trading journal” for everyone. The best tool is the one that you will actually use, consistently and thoughtfully.

Choosing your journal is just the first step on a much longer journey. The real work — and the real reward — begins with implementation. The goal is not merely to log data; it is to create a powerful feedback loop that transforms raw information into actionable wisdom. A trading journal is your personal performance coach, your psychological mirror, and your strategic playbook all rolled into one. It’s the bridge between the trader you are today and the disciplined, more consistent trader you aspire to be.

Turning Your Journal into Your Greatest Trading Asset

The initial excitement of starting a new journal can fade quickly if you don’t establish a sustainable routine. The key is to integrate journaling into your trading process until it becomes an unbreakable habit, as essential as your pre-market analysis.

Here’s how to make your chosen journal work for you:

- Commit to a Daily Ritual: Set aside a non-negotiable block of time each day, even if it’s just 15 minutes, to review and document your trades. This consistency is far more impactful than a marathon review session once a week. The details of your emotional state and market observations are freshest right after the closing bell.

- Go Beyond the Numbers: Don’t just record your entry, exit, and P/L. This is the most common mistake traders make. Ask the hard questions: Why did I take this trade? Did it align perfectly with my trading plan? What was my emotional state before, during, and after? Was I patient or did I chase the market? Answering these questions turns a simple log into a profound tool for self-discovery.

- Identify Your “A+” Setups: Use your journal’s tagging and filtering features to find the patterns that lead to your biggest wins. Isolate the specific market conditions, time of day, and technical signals that consistently work for you. For example, you might discover that your “Opening Range Breakout” strategy on tech stocks has a 70% win rate in the first hour of trading but a 35% win rate after lunch. The goal is to trade more of what works and less of everything else.

- Confront Your Mistakes: Your journal is a safe space to be brutally honest about your losses. Instead of seeing red on your screen as a failure, view it as tuition paid to the market. Analyze every losing trade to find the root cause. Was it a revenge trade? A FOMO entry? A failure to honor your stop-loss? Identifying these recurring behavioral errors is the first step to eliminating them.

Final Thoughts: Your Path to Consistent Improvement

The market is an unforgiving environment that relentlessly exploits emotional and disciplinary weaknesses. It doesn’t care about your gut feelings, your hopes, or your predictions. It only responds to your actions. A trading journal is your most powerful tool for ensuring those actions are deliberate, strategic, and aligned with a proven edge.

The journey to trading mastery is not a sprint; it’s a marathon of continuous improvement. There will be frustrating days and costly mistakes. Your journal is your constant companion through it all, providing the objective data needed to learn, adapt, and grow stronger. By committing to this process, you are investing in the single most important asset in your entire trading career: yourself. The insights you gain will build not just a better strategy, but a better, more resilient trader.

Ready to turn your trading data into a clear, actionable edge? TradeReview offers a modern, intuitive platform designed to simplify your journaling process with powerful analytics, automated imports, and a clean interface. Start for free and see how a dedicated journaling tool can help you identify your strengths and eliminate costly mistakes. Discover your edge with TradeReview.