Failing to learn from your wins and losses is one of the costliest mistakes a trader can make. We’ve all been there — staring at a loss that erases a week’s worth of gains and wondering, “How did I let that happen?” Consistent profitability isn’t about finding a single magic strategy; it’s about disciplined analysis, identifying your personal patterns, and making data-driven adjustments. This is where a trading journal becomes your most critical tool, transforming raw trading activity into actionable intelligence. Simply put, if you aren’t journaling, you’re just guessing.

The core problem is that manual tracking in a spreadsheet is cumbersome, error-prone, and fails to provide the deep analytics needed to uncover your strategic blind spots. Are you consistently closing profitable trades too early out of fear? Do you tend to over-leverage on Tuesdays? Which setups — like a “break-and-retest” or an “opening range breakout” — really work for you, and which ones are draining your account? A dedicated trading journal answers these questions with precision, helping you refine your edge and build the discipline required for long-term success.

Finding the best free trading journal can be a challenge, as “free” often comes with hidden limitations. That’s why we’ve done the heavy lifting. This guide provides an in-depth, feature-by-feature comparison of the top free platforms available today. We’ll explore everything from automated broker synchronization and advanced performance analytics to asset class support and user interface design.

Inside, you’ll find:

- A detailed review of 12 leading free trading journal platforms.

- Direct comparisons of key features like win-rate tracking, R-multiple analysis, and reporting tools.

- Honest pros and cons for each option, complete with screenshots and direct links.

- Clear guidance on which journal is best suited for different trader types, including day traders, options traders, and long-term investors.

Our goal is to help you move beyond guesswork and start analyzing your performance like a professional. Let’s find the right tool to help you sharpen your strategy and build lasting consistency in the markets.

1. TradeReview

Best For: All-in-one performance analysis and cross-platform access.

Pricing: Completely free.

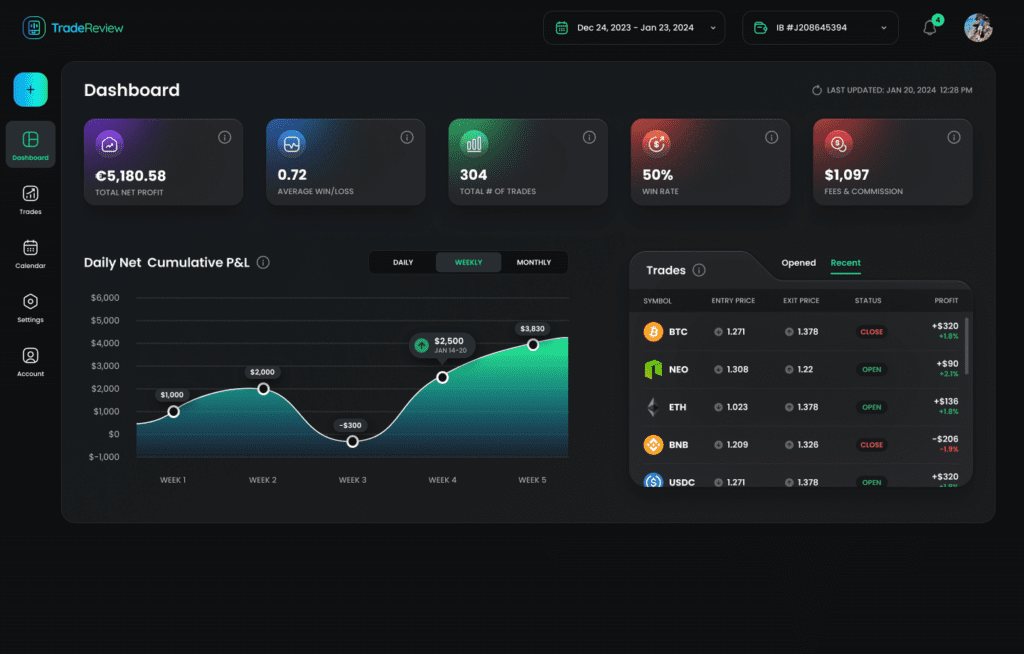

TradeReview solidifies its position as a top-tier choice by delivering a comprehensive, multi-platform journaling experience without any cost. It masterfully balances a clean, beginner-friendly interface with the powerful analytics required by experienced traders, making it the best free trading journal for a wide audience. The platform’s core strength lies in its ability to turn raw trading data into actionable insights, helping users identify profitable patterns and eliminate costly emotional mistakes that we all struggle with.

Why It Stands Out

What truly distinguishes TradeReview is its seamless ecosystem. With native applications for web, iOS, and Android, your journal is always synchronized and accessible, whether you are at your desk or on the go. This accessibility encourages consistent logging, a cornerstone of disciplined trading. The platform supports a broad range of assets, including stocks, options, crypto, futures, and forex, ensuring it can grow with you as your strategies evolve.

Key Features and Practical Application

TradeReview is built for efficiency and deep analysis. Its features are designed not just to log trades, but to understand the “why” behind your wins and losses.

- Effortless Data Entry: Drastically reduce logging time with automatic broker synchronization. For unsupported brokers, the CSV import tool is a reliable alternative to manual entry. You can check for supported brokerages on their website.

- Actionable Analytics: Move beyond simple P&L. The dashboard visualizes critical metrics like your equity curve, win rate, average return, and profit factor, providing an immediate health check on your trading performance.

-

Deep-Dive Tagging System: The flexible tagging feature is a standout. For a practical example, you can create custom tags for setups (

#break-and-retest), emotions (#overconfident,#revenge-trade), or any other variable. Over time, you can filter your analytics by these tags to see exactly which strategies and mindsets are most profitable.

Pros and Cons

| Pros | Cons |

|---|---|

| Completely Free: No hidden fees or premium tiers. | Broker Sync Limitations: Auto-sync is not yet universal. |

| True Multi-Platform: Native Web, iOS, & Android apps. | Lacks Institutional Features: May not satisfy hedge fund-level analytics needs. |

| Powerful Visualizations: Interactive equity curve and calendar. | |

| Flexible Tagging & Notes: Identify and analyze patterns easily. | |

| Security-Focused: Uses encrypted storage for user data. |

The Bottom Line

TradeReview offers a powerful, secure, and genuinely free solution that removes the friction from journaling. Its focus on accessible data and cross-platform utility makes it an exceptional tool for traders committed to consistent, data-driven improvement.

Visit Website: https://tradereview.app

2. TradesViz

TradesViz positions itself as a powerhouse of analytics, offering one of the most feature-rich free trading journal plans available. It’s an excellent starting point for traders who crave deep, data-driven insights into their performance without an initial financial commitment. The platform supports a wide array of asset classes, including stocks, options, futures, forex, and crypto, making it a versatile choice for multi-asset traders. Its free tier is notably generous, allowing up to 3,000 executions per month, which is more than sufficient for most developing and moderately active traders.

The platform stands out by providing over 50 performance visualizations right out of the box, even on the free plan. This allows you to immediately start dissecting your trading habits, analyzing win-loss ratios by setup, and identifying patterns that you might otherwise miss. While the interface can feel a bit dense at first due to the sheer volume of data presented, it rewards the time invested with unparalleled analytical depth. For a closer look at the data-rich interface, you can explore a TradesViz dashboard example.

Key Features & User Experience

- Best For: Data-focused day traders and quantitative analysts who want deep visualizations.

- Pros: Extremely generous free plan; broad asset class support; powerful, pre-built analytics and charts.

- Cons: The interface has a steeper learning curve than simpler journals; advanced AI analysis and multi-account syncing are reserved for paid tiers.

TradesViz offers a clear upgrade path, but its free version is a robust, standalone tool that provides immense value for traders committed to improving through detailed performance review.

Website: www.tradesviz.com

3. Trademetria

Trademetria offers a clean, user-friendly interface combined with a true free-forever plan, making it an excellent choice for new or less active traders looking to establish a journaling habit. This web-based platform provides a solid foundation for performance analysis without requiring a credit card to sign up. It supports a diverse range of assets, including equities, options, futures, forex, and crypto, and integrates with over 140 brokers, which simplifies the process of getting your trade data into the journal.

The platform’s strength lies in its simplicity and accessibility. Its free tier allows for 30 imported orders per month, which is perfect for swing traders, investors, or those just starting their trading journey. While this limit may be restrictive for active day traders, it provides enough capacity to track key trades and begin analyzing performance metrics. The WYSIWYG (What You See Is What You Get) journal editor is intuitive, allowing for detailed notes on a daily or per-trade basis, helping you connect your mindset and strategy to your results.

Key Features & User Experience

- Best For: Swing traders, investors, and new traders seeking a straightforward, genuinely free trading journal.

- Pros: True free plan with no credit card required; supports a wide array of assets and brokers; clean, easy-to-navigate interface.

- Cons: The 30-order monthly limit on the free plan is too low for active day traders; auto-sync and advanced analytics are paywalled.

Trademetria serves as a fantastic entry point into disciplined trade tracking, providing essential tools that encourage a methodical approach to performance review without overwhelming the user.

Website: https://trademetria.com/pricing

4. Tradervue

Tradervue is a well-established name in the trading journal space, known for its robust import capabilities and clean, analytical interface. It has built a strong reputation over the years, especially among U.S.-based traders, by providing a reliable platform for performance review. While its free tier is more of a starting point than a long-term solution for active traders, it serves as an excellent introduction to disciplined journaling. The platform supports stocks, options, and futures, making it a solid choice for traders focused on these core asset classes.

The free plan’s primary limitation is its cap of 30 trades per calendar month, which suits low-frequency swing traders or those just beginning to track their performance. Where Tradervue shines is its massive library of over 80 broker and platform integrations, simplifying the import process. The user interface is straightforward and less overwhelming than some data-heavy competitors, focusing on core metrics that matter. For a better sense of how it visualizes data, you can review an example of the Tradervue dashboard.

Key Features & User Experience

- Best For: Low-volume traders, beginners wanting a simple start, and those who prioritize easy broker integration.

- Pros: Highly respected platform with a long history; extensive list of broker importers; clear and simple upgrade path as trading activity increases.

- Cons: The 30-trade monthly limit on the free plan is very restrictive for active traders; many advanced analytics and coaching features are locked behind the paid Gold plan.

Tradervue provides a reliable, no-frills entry into journaling, with a proven system that encourages traders to upgrade as their needs and volume grow.

Website: www.tradervue.com/site/pricing/

5. StonkJournal

StonkJournal offers a refreshingly minimalist and entirely free approach to trade journaling, positioning itself as a fast, no-frills tool for manual entry. It is designed for traders who prioritize speed and simplicity over complex automated analytics. The platform supports a broad range of assets, including stocks, options, futures, crypto, and forex, making it a flexible choice. As a completely free and ad-free service, it stands out for its commitment to providing core journaling functions without a price tag or future upsell.

The platform shines with its clean user interface, which makes logging trades and adding reflective notes a quick and painless process. Key features like a profit and loss calendar, tagging for trade setups, and support for multiple accounts are all included. A unique aspect of StonkJournal is its community-driven roadmap, where users can vote on upcoming features, giving them a direct say in the tool’s evolution. This makes it one of the most user-centric options on our list of the best free trading journal platforms. While it lacks direct broker integration, its manual-first philosophy encourages a more deliberate and reflective journaling practice.

Key Features & User Experience

- Best For: Manual-entry purists and new traders who want a simple, 100% free tool without overwhelming analytics.

- Pros: Entirely free with no ads; clean, fast user interface optimized for quick manual logging; community-driven feature development.

- Cons: No direct broker auto-sync means all trades must be entered manually; the interface can be confusing for some users initially.

StonkJournal is an excellent choice for traders dedicated to the discipline of manual journaling and who appreciate a product that grows with its community’s input.

Website: https://stonkjournal.com/

6. Kinfo

Kinfo is a mobile-first trading journal designed for the modern trader who wants to track performance on the go. It stands out by combining automated trade syncing via secure, read-only broker connections with a social component, allowing traders to learn from a community. Its free app tier is powerful, providing a streamlined way to analyze key metrics without manual data entry, making it an excellent choice for those who primarily trade US equities, futures, or crypto and prefer managing their journal from their phone.

The platform focuses on simplicity and accessibility, presenting your performance through clean, easy-to-digest visualizations. By connecting your broker, Kinfo automatically imports your trades and calculates crucial stats like win rate, average return, and performance breakdowns. While it keeps your portfolio private by default, it offers optional leaderboards and social features, providing a unique blend of personal analysis and community insight that distinguishes it from other, more isolated journaling tools.

Key Features & User Experience

- Best For: Mobile traders and those who value automated syncing and optional social features.

- Pros: Excellent mobile-first design; secure, read-only broker auto-sync; performance is private by default but can be shared.

- Cons: Advanced analytics and custom alerts are behind the Pro subscription; broker coverage is dependent on its third-party aggregator.

Kinfo’s free version delivers a seamless and automated journaling experience, perfect for traders who need a reliable, set-it-and-forget-it tool to track their progress from anywhere.

Website: https://kinfo.com/

7. CoinMarketMan (CMM)

For traders focused exclusively on the cryptocurrency market, CoinMarketMan (CMM) offers a specialized and automated journaling experience. It’s designed to provide crypto-specific insights by connecting directly to popular exchanges, creating a seamless workflow for tracking digital asset performance. Its free “Basic” plan serves as an excellent entry point for new crypto traders who want to move beyond manual spreadsheets and into automated analytics without an upfront cost.

The platform shines with its hands-off approach to trade logging. While the free tier requires manual imports unless your account is “unlocked” through specific activities, it still provides a powerful portfolio overview and analytics on metrics like time-of-day performance. This helps crypto traders identify crucial patterns, such as which trading hours are most profitable for their strategy. The user interface is clean and centered around the unique data points relevant to crypto, making it a highly accessible and effective free trading journal for this niche.

Key Features & User Experience

- Best For: Dedicated cryptocurrency traders using a single exchange who need automated analytics.

- Pros: Tailored specifically for crypto markets; clear, easy-to-understand analytics; offers automated imports on unlocked or paid plans.

- Cons: Free plan is limited to one exchange connection and often manual imports; not suitable for multi-asset traders (stocks, forex, etc.).

CMM provides a focused solution that removes much of the manual data entry burden for crypto traders, allowing them to concentrate on analyzing performance and refining their edge in a volatile market.

Website: https://coinmarketman.com/pricing/

8. TradeBench

TradeBench presents a unique, 100% free trading journal model, funded entirely by sponsor clicks rather than user subscriptions. It integrates pre-trade planning — including position sizing and risk management — directly with post-trade journaling, creating a holistic tool for disciplined traders. The platform supports a versatile range of assets like stocks, forex, crypto, CFDs, and futures, making it a functional choice for traders across different markets.

The core philosophy of TradeBench is to provide essential journaling tools without a price tag. Its integrated TradingView-powered charts allow for seamless technical analysis alongside your trade logs. While it may not have the advanced AI-driven analytics of paid competitors, it covers the fundamentals exceptionally well. The platform’s unique funding model simply requires users to click a sponsor link roughly once a month to maintain access, making it a truly free solution for those who don’t mind this minor inconvenience.

Key Features & User Experience

- Best For: Traders on a strict budget who prioritize trade planning and fundamental journaling.

- Pros: Genuinely free with no paid tiers; excellent integration of planning and review tools; supports Excel import/export for data portability.

- Cons: The sponsor-click funding model can be a minor interruption; lacks the premium analytical features and sleek interface of subscription-based platforms.

TradeBench stands out as a practical and accessible option, offering a robust framework for building and maintaining disciplined trading habits without any financial cost.

Website: https://tradebench.com/

9. TradeNote

TradeNote caters to a specific niche of traders who prioritize data ownership and customizability above all else. As an open-source platform, it offers a truly free trading journal experience for those willing to self-host it, giving you complete control over your data and the software’s functionality. This approach is ideal for privacy-conscious traders or developers who want the freedom to tweak and extend their journaling tool to fit their exact needs. The platform supports key features like broker imports, trade charting with entry and exit points, tagging, and performance metrics like Maximum Favorable Excursion (MFE) — which shows the highest price a trade reached in your favor.

While the self-hosted version is entirely free, it does require some technical knowledge to set up using Docker and MongoDB. For those who prefer a hands-off approach, TradeNote also provides an inexpensive, hosted cloud version, though this option is not free. The interface is clean, mobile-responsive, and focuses on core journaling essentials without the overwhelming complexity of some other platforms. This makes it a great choice for traders who know what they want from a journal and have the technical skills to build it themselves or prefer a minimalist, focused tool.

Key Features & User Experience

- Best For: Tech-savvy traders, developers, and anyone who wants 100% data privacy and control.

- Pros: Completely free and open-source for self-hosting; high degree of customizability; active development on GitHub with good documentation.

- Cons: Self-hosting requires technical expertise and ongoing maintenance; the convenient cloud-hosted version is a paid service.

TradeNote stands out by empowering traders to own their journaling environment, offering an unparalleled level of privacy and flexibility for those who don’t mind a bit of initial setup.

Website: https://tradenote.co/

10. Notion — Trading Journal Template

For traders who value complete control and a do-it-yourself approach, Notion offers a unique and highly flexible alternative to dedicated journaling platforms. Instead of a pre-built tool, you start with a free, community-published Trading Journal template that you can duplicate and endlessly customize. This makes it an ideal choice for traders focused on the qualitative aspects of their performance — such as emotional state, pre-trade analysis, and post-trade reflections — rather than just raw quantitative data.

This template-based method turns your journal into a personal productivity hub. You can link your trade logs directly to research notes, strategy documents, and habit trackers all within the same ecosystem. While it lacks the automated features of specialized software, its strength lies in forcing a deliberate, manual logging process, which can be invaluable for building discipline and deepening your understanding of your own trading psychology. It’s the ultimate blank canvas for a methodical trader looking for a free trading journal.

Key Features & User Experience

- Best For: Discipline-focused traders and anyone who wants a fully customizable, manual journaling system.

- Pros: Completely free and infinitely adaptable; no vendor lock-in; excellent for building habits and detailed qualitative analysis.

- Cons: Requires manual data entry as there is no broker auto-sync; analytical depth is entirely dependent on your ability to build out the template’s features.

Notion empowers you to build the exact journal you need from the ground up, making it a powerful tool for those who prioritize reflection and process over automated analytics.

Website: www.notion.so/templates/trading-journal-149

11. WealthBee — Google Sheets Trading Journal

For traders who prefer ultimate control and transparency over a dedicated application, the WealthBee Google Sheets Trading Journal offers an excellent, no-cost solution. It’s a pre-built template that leverages the power and familiarity of Google Sheets, making it a perfect starting point for spreadsheet-savvy individuals. By connecting to the native GoogleFinance function, it can pull basic real-time and historical data for US-listed tickers, automating some of the more tedious aspects of P&L tracking. This approach is ideal for traders who want to build and customize their own analytical system without starting from scratch.

The primary advantage of this template is its complete customizability. Since you own the copy of the sheet, you can modify any formula, add new columns for specific data points like emotional state or trade setup, and build out charts that are meaningful to your specific strategy. While it demands a more hands-on approach compared to automated platforms, it provides a level of ownership and flexibility that many dedicated software solutions lack. It’s a fantastic free trading journal for those who believe in building their tools from the ground up to perfectly fit their workflow.

Key Features & User Experience

- Best For: DIY traders and spreadsheet enthusiasts who want full control over their journal’s data and analytics.

- Pros: 100% free and transparent with no hidden costs; fully editable and customizable to your needs; operates within the familiar Google Sheets environment.

- Cons: Requires manual data entry for most trades; analytical capabilities are limited by your spreadsheet skills and GoogleFinance API constraints; lacks advanced features like broker sync or charting.

WealthBee provides a solid foundation, but the true power of this journal is unlocked by the user’s willingness to invest time in customizing it.

Website: wealthbee.io/tradingjournal/

12. TerraTrade

TerraTrade enters the field as a modern, all-in-one platform aiming to consolidate key trading workflows into a single, cohesive experience. It combines a trading journal with backtesting and trade replay features, offering a free tier that allows new users to explore its core functionality without a financial commitment. This makes it an intriguing option for traders who want to not only log their trades but also analyze and re-evaluate their strategies within the same environment. The free plan supports one connected account and unlimited trade imports, though it does come with a storage cap.

What sets TerraTrade apart is its integration of journaling with practical strategy development tools like backtesting and replay, even on its free plan. While some advanced features are reserved for paid tiers, the ability to test a hypothesis based on your journaled trades without switching platforms is a significant advantage. The modern, clean user interface also contributes to a more streamlined and less intimidating user experience, which can be beneficial for traders who find more data-heavy platforms overwhelming. This makes it a solid contender for one of the best free trading journal solutions available.

Key Features & User Experience

- Best For: Traders who want an integrated journaling, backtesting, and trade replay tool in one place.

- Pros: A genuinely useful free plan that includes analysis tools; clean, modern UI; combines multiple trading workflows effectively.

- Cons: As a newer platform, its ecosystem is still growing; the free plan has storage and strategy limits that may be restrictive for very active traders.

TerraTrade is a promising platform for traders seeking efficiency. Its free offering provides a substantial taste of how integrated tools can enhance a trader’s review process, encouraging a holistic approach to performance improvement.

Website: https://terratrade.app/pricing

Best Free Trading Journals — 12-Tool Feature Comparison

| Product | Key features ✨ | Usability & Analytics ★ | Price & Value 💰 | Target 👥 |

|---|---|---|---|---|

| 🏆 TradeReview | ✨ Auto broker‑sync, interactive calendar, equity curve, tags, encrypted multi‑platform | ★★★★★ Beginner‑friendly, fast UI, real‑time analytics (win rate, P&L) | 💰 Free — high value for multi‑asset journaling | 👥 Beginners → experienced traders |

| TradesViz | ✨ 50+ visualizations, many import guides, TradingView workflow | ★★★★ Deep analytics; steeper learning curve | 💰 Generous free (3k execs/mo); paid for unlimited/AI | 👥 Data‑driven traders & analysts |

| Trademetria | ✨ Portfolio tracking, 140+ brokers, WYSIWYG journal | ★★★ Good for light users; simple reports | 💰 Free (30 orders/mo) + paid tiers | 👥 Light traders / portfolio trackers |

| Tradervue | ✨ 80+ integrations, advanced reporting & mentoring paths | ★★★★ Established importers; robust reporting | 💰 Free (30 trades/mo) → Silver/Gold paid | 👥 US traders scaling volume & coaching |

| StonkJournal | ✨ Speed‑focused UI, tags, P&L calendar, community roadmap | ★★★ Very fast manual journaling; simple UX | 💰 Free, ad‑free | 👥 Manual entry traders who want speed |

| Kinfo | ✨ Mobile‑first, read‑only broker sync, verified performance | ★★★★ Smooth mobile UX; private by default | 💰 Free tier; Pro for alerts/advanced analytics | 👥 Mobile traders & privacy‑minded users |

| CoinMarketMan (CMM) | ✨ Crypto‑centric imports, time‑of‑day & size analytics | ★★★ Strong crypto insights; exchange‑focused | 💰 Free Basic (1 exchange); paid for more | 👥 Crypto traders needing automation |

| TradeBench | ✨ Pre‑trade planning, TradingView charts, checklists | ★★★ Integrates planning + review; straightforward | 💰 100% free (sponsor clicks) | 👥 Traders who want planning + journaling free |

| TradeNote | ✨ Open‑source, self‑hostable, MFE tracking, customizable | ★★★ Highly flexible but requires tech setup | 💰 Free to self‑host; low‑cost hosted option | 👥 Tech‑savvy & privacy‑first traders |

| Notion — Trading Journal Template | ✨ Custom databases, templates, formulas & dashboards | ★★ Manual; capability depends on template complexity | 💰 Free template (Notion account req) | 👥 Traders wanting fully customizable manual journal |

| WealthBee — Google Sheets | ✨ Editable sheets, GoogleFinance pulls, transparent formulas | ★★ Spreadsheet‑driven; manual entry expected | 💰 Free | 👥 Spreadsheet‑comfortable DIY traders |

| TerraTrade | ✨ Journal + replay + basic backtesting, modern UI | ★★★ Modern interface; growing feature set | 💰 Free tier (limits); paid for more storage/strategies | 👥 Traders wanting integrated replay & testing |

Choosing Your Tool and Building the Journaling Habit

We’ve navigated the landscape of the best free trading journal options available, from powerful, dedicated platforms like TradeReview and TradesViz to flexible DIY solutions like Notion and Google Sheets. The journey from simply placing trades to meticulously analyzing them is the single most significant step you can take to elevate your performance. It’s the bridge between trading on gut feelings and trading with a data-driven edge.

The core takeaway is this: the perfect tool doesn’t exist, but the perfect tool for you certainly does. Your ideal journal depends entirely on your unique trading style, technical needs, and long-term goals. What works for a high-frequency crypto day trader using CoinMarketMan will be vastly different from what a long-term options investor needs from a custom-built Notion template.

From Selection to Habitual Practice

Choosing your platform is just the first step. The real challenge — and where true growth occurs — is in building the discipline to use it consistently. Remember, a trading journal is not a magic wand for profitability; it’s a diagnostic tool. Its value is directly proportional to the effort and honesty you invest in it.

To make the habit stick, consider these practical strategies:

- Start Small: Don’t try to track 20 different data points on day one. Begin by logging the basics: entry price, exit price, setup, and a brief note on your emotional state. You can always add more complexity later.

- Integrate It Into Your Routine: Just as you perform pre-market analysis, make post-market journaling a non-negotiable part of your trading day. Set aside 15-20 minutes after the market closes to import trades and add your notes.

- Focus on the “Why”: The most critical data isn’t just what trade you took, but why you took it. Did you follow your plan? Did you revenge trade? Were you feeling overconfident after a winning streak? This psychological data is where you’ll find your most valuable patterns.

- Schedule a Weekly Review: Designate time every weekend to review your journal’s analytics. Look for patterns in your wins and, more importantly, your losses. Are you consistently losing money on Friday afternoons? Are you cutting your winners too short on a specific setup? The data will reveal the truth.

Key Factors to Guide Your Decision

As you make your final choice, revisit these crucial questions. Answering them honestly will point you directly to the tool that best fits your workflow.

- What is your primary trading instrument? If you’re a crypto trader, a tool with strong exchange API support like CoinMarketMan is essential. For stock and options traders, platforms like TradeReview or Tradervue, with their robust broker integrations, are more suitable.

- How much automation do you need? If you despise manual entry, automatic broker synchronization is a must-have feature. This immediately prioritizes tools like TradeReview, TradesViz, and Trademetria over manual solutions like TradeNote or spreadsheets.

- What level of analysis do you require? Are you looking for basic win-rate and P&L tracking, or do you need advanced analytics like MFE/MAE (Maximum Favorable Excursion / Maximum Adverse Excursion) and detailed setup performance breakdowns? Your answer will determine if a simple tool like StonkJournal is sufficient or if a more powerful platform is necessary.

- How important is community and sharing? If you value sharing your journey and learning from others, a platform with integrated social features like Kinfo or TradeReview could be a deciding factor.

Ultimately, the best free trading journal is the one you will consistently use. It’s the tool that removes friction from your process and empowers you with the insights needed to identify your weaknesses and double down on your strengths. The journey of a trader is one of continuous learning, and a well-maintained journal is your most reliable map and compass.

Ready to turn analysis into action? If you’re looking for a powerful, free, and community-driven platform that excels in automatic broker synchronization and insightful analytics, TradeReview is an excellent place to start. Discover your trading edge by signing up for a free account at TradeReview today.