It’s a classic question: what’s the best day trading software? But here’s the honest answer — there isn’t one. The “best” platform is the one that fits your specific trading style, strategy, and risk management approach. The journey to finding it is a personal one, and it’s a critical step toward building a sustainable trading career.

For a scalper, the perfect fit might be a platform with razor-sharp Level 2 data (a detailed view of buy and sell orders) and millisecond execution. A momentum trader, on the other hand, would probably prioritize advanced market scanners and real-time news feeds. The right choice is deeply personal and hinges entirely on your needs.

Why Finding the Right Software Matters

The search for the best day trading software can feel like navigating a maze of over-the-top promises. We’ve all seen the flashy ads promising guaranteed profits and effortless gains. But as a trader, you know the reality: success isn’t about a magic bullet — it’s about finding a reliable tool that supports your disciplined strategy. We know it’s a tough road, and the pressure is immense.

Choosing your software is one of the most critical decisions you’ll make, second only to defining your trading plan.

Your platform is your command center, your direct line to the market. A slow, clunky, or overly complex system creates friction, adds hesitation, and can lead to costly mistakes. But the right platform? It feels like a natural extension of your own mind, empowering you to act decisively and manage risk with confidence, even when the market is chaotic.

Beyond a Simple Feature List

This guide is designed to cut through the marketing hype. We’ll give you a clear framework for making a smart choice, moving past surface-level feature comparisons to focus on the criteria that actually impact your bottom line. Our goal is to help you pick a tool that genuinely supports your trading journey, not just the one with the longest feature list.

The market for these platforms is exploding — valued at $9.57 billion in 2023 and projected to hit $15.62 billion by 2030, according to Grandview Research. That means more choices, but also more noise to filter through.

The software you choose should reduce complexity, not add to it. A great platform allows you to focus on market analysis and execution, confident that your tool will perform reliably under pressure.

To get there, you need an honest assessment of what you truly need. We’ll break down the key differences that matter for different trading styles, so you can confidently choose the platform that gives you an edge. For a closer look at our favorite tools, check out our guide on the best tools for day traders.

Before you can even begin comparing platforms, you need a solid framework for what to look for. Think of it as a mental checklist of non-negotiable features. These are the pillars that support high-performance trading, and a weakness in any one of them can create friction, hesitation, and costly mistakes.

These aren’t just marketing bullet points on a pricing page. They’re the core components that separate a professional-grade tool from a frustrating liability.

To help you get started, here’s a quick rundown of what matters most, what it means for your trading, and the red flags you should never ignore.

Key Features of Day Trading Software Explained

| Essential Feature | Impact on Trading Performance | Warning Signs to Watch For |

|---|---|---|

| Execution Speed & Reliability | Millisecond delays (latency) can turn a winning scalp into a loss. Platform stability during market volatility is crucial for trust and consistency. | Frequent crashes, lag during market opens, or noticeable delays between clicking and order confirmation. |

| Advanced Charting | Provides the visual data needed for technical analysis. Customizable charts with a full suite of indicators and drawing tools are essential for identifying patterns. | Limited indicators, clunky chart navigation, or an inability to save custom chart layouts and templates. |

| Advanced Order Types | Enables precise risk management and trade automation. Bracket orders, trailing stops, and OCOs help remove emotion from trade execution. | Only basic market and limit orders are available. Lack of automated stop-loss or take-profit functionality. |

| Broker Integration | A seamless, low-latency connection prevents data delays and order routing errors. Direct-access integration is the gold standard for speed. | Discrepancies between platform data and broker statements, slow order status updates, or frequent connection drops. |

| Automation & APIs | An API (Application Programming Interface) allows systematic traders to run custom algorithms, backtest strategies, and automate trade execution. | No public API documentation, or a “closed” system that doesn’t allow for external connections or third-party tools. |

Understanding these features is the first step. Now, let’s dig a little deeper into why each one is so critical for day-to-day performance.

Execution Speed and Reliability

In day trading, speed isn’t just a feature — it’s everything. The tiny gap between when you click “buy” and your order actually gets filled is called latency. For scalpers trying to capture tiny price movements, a few milliseconds can be the difference between profit and loss. For example, if you’re trying to scalp a stock for a $0.02 gain, a $0.01 slip in your fill price cuts your potential profit in half instantly.

But speed is worthless without reliability. A platform that’s lightning-fast one minute and crashes during a market-moving news event is a ticking time bomb. You need software that performs consistently under pressure, especially during chaotic market opens when volume skyrockets.

Your trust in your software has to be absolute. If you’re constantly worried about platform freezes or slow fills, your focus shifts from analyzing the market to fighting your tools. The best software just works, becoming an invisible extension of your strategy.

Advanced Charting and Order Types

Charting is the language of technical analysis. Your software needs to go way beyond simple line graphs. Look for fully customizable candlestick charts, a massive library of technical indicators (think Moving Averages, RSI, and MACD), and versatile drawing tools to mark up trends and patterns.

Just as important is a full suite of order types. Every platform offers basic market and limit orders, but professionals need tools for precise risk management.

- Stop-Loss Orders: The most basic and essential tool for automatically capping your downside on a trade. This is your primary defense.

- Trailing Stops: A dynamic stop-loss that follows a winning trade, letting you lock in profits while giving a position room to run.

- Bracket Orders (OCO): This is a game-changer. It lets you place a take-profit limit order and a protective stop-loss order at the same time. Once one gets triggered, the other is automatically cancelled.

Imagine you jump into a volatile stock. A bracket order lets you define your entire exit plan from the start, taking emotion and guesswork completely out of the equation. This kind of mechanical execution is a cornerstone of disciplined, long-term trading.

Broker Integration and Automation

The handshake between your software and your broker needs to be flawless. A clunky integration can cause data discrepancies, delayed order updates, and infuriating technical glitches. Direct-access brokers often provide their own software or tight integrations with third-party platforms to ensure the lowest possible latency.

For traders who lean toward systematic or algorithmic approaches, an Application Programming Interface (API) is non-negotiable. An API lets you plug in custom-coded strategies or other tools, opening the door to fully automated trading. While not every trader needs this, its presence is a strong signal that the platform is built for serious, professional use. It gives you the power to execute strategies based on predefined rules, removing the human element entirely.

Aligning Software Features with Your Trading Style

Picking the right day trading software isn’t about finding a single “best” platform — it’s about finding the right tool for your specific strategy. A platform that a high-frequency scalper loves might feel clunky and slow for a momentum trader. The goal is to match the software’s strengths with what your trading style demands.

This is a critical distinction. Different strategies operate on wildly different timeframes and need unique tools to find an edge. A scalper’s entire world exists in seconds and fractions of a cent, while an intraday swing trader thinks in minutes and broader chart patterns. Your software has to be a natural extension of how you see the market.

For the High-Frequency Scalper: Speed Is Everything

Scalpers live and die by their execution speed. They jump in and out of trades to capture tiny, fleeting price moves, sometimes placing dozens or even hundreds of orders in a day. For them, a platform’s main job is to execute trades instantly. A delay isn’t just an annoyance; it’s a guaranteed loss.

Here are the non-negotiables for a scalper:

- Direct Market Access (DMA): This is your private highway to the exchange, letting your orders bypass your broker’s trading desk entirely. The result is lower latency and faster fills, which you absolutely need to catch micro-movements in price.

- Level 2 Data: A standard chart shows you the last price, but Level 2 data shows you the entire order book — the bids and asks from everyone in the market. This depth is how scalpers anticipate tiny shifts in supply and demand before they happen.

- Programmable Hotkeys: When every millisecond is precious, clicking through menus is out of the question. Hotkeys let you fire off complex orders — like buying at the ask while setting a stop-loss and take-profit — with a single keystroke.

A scalper’s platform should feel like a high-performance race car — stripped down, responsive, and built for one purpose: speed. Anything that adds a millisecond of friction between your decision and your order is a liability.

For the Momentum Trader: Spotting Breakouts Is Key

Momentum traders are hunters. They’re looking for stocks making big moves on high volume, usually sparked by news or a technical breakout. Their success hinges on spotting these opportunities early and riding the wave. For that, their software needs to be a powerful reconnaissance tool.

This is what a momentum trader should be looking for:

- Advanced Market Scanners: This is the lifeblood of momentum trading. A great scanner lets you filter the entire market in real-time using custom criteria like unusual volume, percent change, or proximity to 52-week highs. For example, a trader could set a scan for “stocks hitting new day highs with 3x normal volume” to find potential breakouts.

- Real-Time News Feeds: Breaking news is what fuels momentum. An integrated, low-latency news feed is essential for understanding why a stock is moving and getting in before the rest of the market catches on.

- Customizable Alerts: You can’t watch every stock at once. Smart alerts that trigger on technical conditions (like crossing a moving average) or specific price levels let you monitor dozens of potential setups without being glued to every single chart.

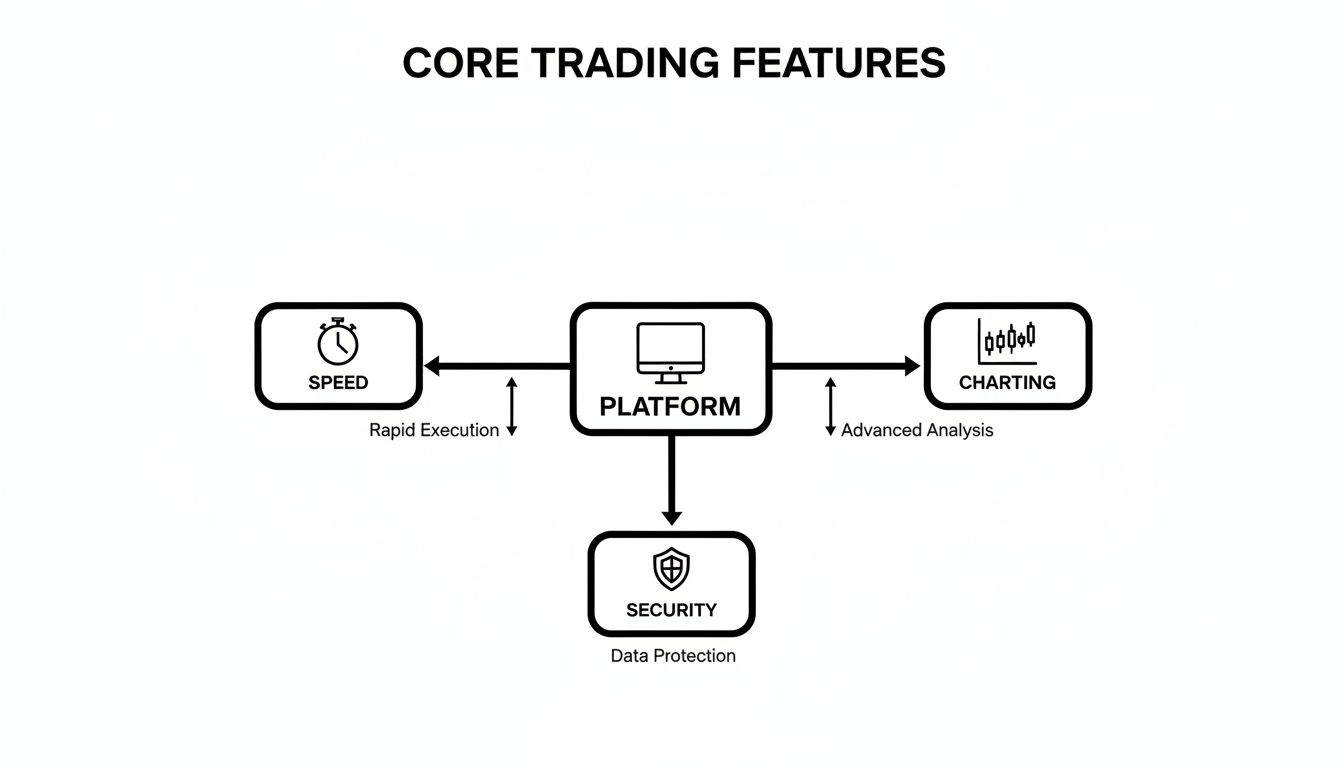

While different traders prioritize specific features, this image shows how every professional-grade platform must be built on a solid foundation of speed, analytics, and security.

For the Intraday Swing Trader: Analysis Is Paramount

Intraday swing traders hold positions longer than scalpers — from a few minutes to several hours — trying to capture one major price “swing” during the day. Their approach is more analytical and less frantic, relying on deep technical analysis to build a strong case for each trade.

Their software needs to be a top-tier analytical suite.

- Sophisticated Charting Tools: This is the big one. They need platforms with a massive library of technical indicators, advanced drawing tools, and the flexibility to view multiple timeframes on one screen.

- Backtesting Capabilities: A swing trader’s strategy is often based on a specific set of rules. The ability to test that strategy against historical data is invaluable for validating its edge and building the confidence to trade it with real money.

The demand for these specialized tools is exploding. According to one report, the global day trading software market was valued at $1.2 billion in 2023 and is projected to hit $2.5 billion by 2030, all because traders are demanding more powerful and specialized features. You can dive deeper into this trend in the full market analysis from HTF Market Intelligence.

A Practical Framework for Evaluating Trading Platforms

Choosing your trading software is a serious commitment. It’s not something you do on a whim based on a flashy ad or a random forum post. That’s a fast track to frustration and expensive mistakes. The goal is to find a tool that feels like a natural extension of your trading mind — intuitive, reliable, and perfectly suited to your strategy.

This framework breaks the whole process down into a few manageable steps. We’ll go from figuring out what you actually need to putting platforms through their paces. It’s about replacing guesswork with a clear, logical method so you can be confident you’ve found the best day trading software for you.

Step 1: Start With Self-Assessment

Before you even glance at a single platform, you need to look inward. Without a crystal-clear picture of your own needs, every platform will look shiny for different reasons, making a real choice impossible. This first step is all about defining your personal trading blueprint.

Start by getting brutally honest with yourself about these questions:

- What’s my real budget? Figure out what you can comfortably spend each month. Don’t forget to factor in the software fees, essential data subscriptions, and any paid add-ons. Overspending on tools is a classic trap that just adds unnecessary pressure.

- What’s my primary trading style? Are you a scalper who lives and dies by millisecond execution and full Level 2 data? Or maybe you’re a momentum trader who needs top-tier scanners and integrated news feeds. Be specific about how you actually trade day-to-day.

- What are my non-negotiable tech needs? Do you need software that runs on a Mac? Is a solid mobile app a must-have for managing trades when you’re away from your desk? Make a list of your absolute deal-breakers.

Answering these questions acts as a powerful filter. It instantly shrinks the overwhelming number of options down to a handful of platforms that are genuinely a good fit.

Step 2: Research and Shortlist Your Candidates

Now that you have your personal criteria, you can start the research. The objective here isn’t to find “the one” right away, but to build a shortlist of 2-3 strong contenders. Use the core pillars we’ve already discussed — execution speed, charting, order types, and broker integration — as your guide.

Hunt down independent reviews, but read them with a critical eye. Zero in on feedback that talks about performance during major volatility, because that’s when a platform’s true colors show. Ignore reviews that just gush about features without mentioning how the software holds up under real market pressure.

As you find promising candidates, pop them into a simple comparison table and note how they stack up against your must-haves. If you want to see how different platforms measure up, check out our detailed trading platform comparison guide.

The most crucial part of this process is the trial period. A feature list can tell you what a platform can do, but only a hands-on demo can show you how well it actually does it during live market hours.

Step 3: The Critical Trial Period

This is where the rubber meets the road. Nearly every reputable platform offers a free trial or a demo account. Your job is to use this period to simulate your real trading day as closely as possible. Don’t just click around aimlessly — be methodical.

Here’s a simple checklist to guide you:

- Test During Live Market Hours: The only way to gauge true performance is under fire. Use the demo during the market open (9:30 AM ET) and at the close to see how the platform handles high volume and wild price swings.

- Evaluate Order Execution: Even in a sim account, you can get a feel for the order entry system. Is it easy to set up hotkeys? Can you fire off complex bracket orders quickly and without thinking?

- Assess Charting Responsiveness: Load up your favorite indicators and drawing tools on a few different charts. Does the software lag, stutter, or freeze? Can you flip between timeframes smoothly?

- Check Customer Support: Send a test question to their support team. How fast do they reply? Is the answer actually helpful? You’ll be thankful for good support when you have a real problem with real money on the line.

This structured trial replaces hope with hard evidence. By the end, you’ll have a clear, data-driven understanding of which platform truly clicks with your workflow, letting you make that final decision with total confidence.

Why Your Software Needs a Trading Journal

Picking the right day trading software is a big deal, but the platform is only half the battle. Your software is your execution tool — it’s how you get your buys and sells to the market. What it can’t tell you is why a trade worked out beautifully or what caused a frustrating loss. That’s a hard truth many traders learn after months of inconsistent results.

Real success in trading isn’t about just having the fastest platform; it’s about disciplined, continuous improvement. This is where a dedicated trading journal becomes an essential partner to your software, bridging the gap between simply placing orders and truly understanding your performance on a deep, analytical level.

Beyond Basic Profit and Loss

Your broker statement gives you a simple P&L summary. It tells you what happened. A trading journal, on the other hand, is built to uncover the why. It’s a tool for systematic review, helping you answer the questions that actually shape your long-term success.

A journal helps you objectively analyze the critical parts of your trading:

- Strategy Effectiveness: Which of your setups are consistently profitable, and which ones are just draining your account?

- Rule Adherence: Are you actually following your trading plan, or are emotions like fear and greed sneaking into your execution?

- Pattern Recognition: Do you tend to give back profits on Fridays? Do you trade poorly right after a big win?

By tagging each trade with details like the setup, your emotional state, and any mistakes you made, you turn raw P&L data into actionable insights. This separation of execution (in your software) from analysis (in your journal) is fundamental to building a sustainable trading career.

The Power of Automated Analysis

Manually logging every single trade in a spreadsheet is a tedious grind, and it’s easy to make mistakes. It creates friction, making you less likely to do the consistent review that improvement demands. Modern trading journals solve this by connecting directly to your broker.

By automatically syncing your trades, a journal eliminates the manual data entry and lets you focus your energy on what actually matters — analyzing your performance and refining your strategy. It turns review from a chore into a powerful feedback loop.

This automation is more than just a convenience. It ensures your data is 100% accurate, giving you a completely objective look at your equity curve, win rate, and other key metrics. Without this impartial data, it’s far too easy to let biases and emotions color your perception of how well you’re actually trading.

The market for these tools is growing fast as more traders see the need. According to data from The Business Research Company, the stock trading and investing applications market is projected to see significant year-over-year growth, reflecting a strong demand for smarter analytical tools.

From Good Tools to a Great System

Even the best day trading software can’t make you a profitable trader on its own. It’s an instrument, and its effectiveness depends entirely on the skill of the person using it. A trading journal is the tool you use to sharpen that skill.

By integrating a journal into your routine, you create a complete trading system:

- Your Strategy: The set of rules that define your edge.

- Your Trading Software: The tool for executing that strategy in the market.

- Your Trading Journal: The feedback mechanism for measuring performance and improving your strategy.

Without that third piece, you’re essentially flying blind, repeating the same hidden mistakes and never truly understanding what’s driving your results. If you’re serious about your trading performance, exploring a purpose-built solution is a logical next step. You can learn more about how to get started with our guide on choosing the right trading journal software.

Answering Your Top Questions About Day Trading Software

Picking the right trading platform can feel like a high-stakes decision, because it is. When every choice seems to impact your bottom line, it’s easy to get overwhelmed. Let’s cut through the noise and answer some of the most common questions traders have when they’re on the hunt for the right software.

My goal here is to give you straight answers, not a sales pitch. Trading already has enough uncertainty built-in — your tools shouldn’t add to it.

What’s the Single Most Important Feature to Look For?

While every trader’s “must-have” list is a bit different, two things are non-negotiable for everyone: execution speed and rock-solid reliability. Think about it — as a day trader, a tiny delay, what we call latency, can flip a winning trade into a loser before you can even react. Your platform has to be stable and execute your orders instantly, especially during the chaos of the market open.

Once you’ve got that covered, the next things on your list should be advanced charting and a complete set of order types. You absolutely need tools like bracket orders and trailing stops to execute your strategies with precision and manage risk without letting your emotions call the shots.

Do I Really Need to Pay for Day Trading Software?

Not always, but it’s important to know that “free” usually comes with a catch. Plenty of brokers offer their own free platforms, and honestly, they’re a great place for new traders to start. You get the basic tools you need to trade without paying a monthly fee.

But there’s a trade-off. These free platforms often have slower data feeds, less powerful charting tools, or clunkier order routing compared to professional-grade, paid software. Most serious day traders eventually decide that a monthly subscription for a direct-access platform is a smart investment. The speed and advanced features can lead to better fills and help you spot more opportunities, which may offset the software’s cost over time.

A broker’s P&L statement tells you what happened. A trading journal helps you understand why it happened. This distinction is the foundation of long-term improvement.

Can I Use More Than One Platform?

Yes, and many experienced traders do exactly this. It’s actually pretty common to use one platform that has amazing charting and scanning tools, but then place your trades through a separate, direct-access broker known for its lightning-fast execution. The trick is to build a workflow that feels natural and doesn’t trip you up when the market is moving.

This is also where a good trading journal with broker sync becomes a game-changer. It can pull all your trades from different platforms into one place. This gives you a clean, unified view of your performance without having to manually stitch everything together in a spreadsheet.

Finding the best day trading software is your first step, but analyzing your performance is how you build a lasting edge. TradeReview complements any platform by providing the deep analytics you need to understand your habits, refine your strategy, and trade smarter. Stop guessing why you win or lose — start your free trading journal today and get the data-driven insights you need to improve. Get started at https://tradereview.app.