The bearish hammer candlestick is a one-candle pattern that acts as a warning flare after a solid uptrend. It’s got a small body, a long wick sticking out the top, and almost no wick at the bottom.

Think of it this way: buyers gave it their all and pushed the price way up, but then sellers crashed the party and slammed it right back down. It’s a sign of a struggle, and for traders, understanding that struggle is key.

Decoding the Bearish Hammer Candlestick

Candlestick patterns can feel like a foreign language at first, but they’re not as complicated as they look. Each one tells a simple story about the ongoing fight between buyers and sellers. The bearish hammer is one of the easiest stories to read, and getting its message is a huge step toward mastering price action.

This single candle captures a dramatic tug-of-war. For a moment, the buyers were winning, driving the price higher and higher. But their victory was short-lived. Sellers stormed in with overwhelming force, erasing all those gains and forcing the price to close right back where it started. It’s this sudden reversal of fortune that gives the pattern its punch.

The Psychology Behind the Pattern

The message of a bearish hammer is simple: buying exhaustion. The momentum that fueled the uptrend is starting to sputter out. We’ve all been there — that painful feeling when a stock you’re holding has been on a tear, and then one day, what looked like another big gain completely evaporates by the closing bell.

Now, this pattern doesn’t scream “sell everything!” and it certainly isn’t a guarantee of profits. Instead, it signals a critical shift in market sentiment. The buyers, who were confidently in charge, just got shoved back hard. That crack in their armor is often the first sign that sellers are gearing up to take control. Recognizing this psychological shift is far more powerful than just memorizing a candle’s shape.

A single candlestick tells a story of the session’s battle. The bearish hammer candlestick tells a story of a failed rally, where sellers landed the final, decisive blow, signaling that the balance of power may be shifting.

Let’s break down the key parts of this pattern.

Anatomy of a Bearish Hammer

| Component | Description | What It Signifies |

|---|---|---|

| Small Real Body | The distance between the open and close is small. Color can be green or red. | Indecision. Neither buyers nor sellers could secure a meaningful close far from the open. |

| Long Upper Wick | At least 2x the length of the real body. | Buyers initially pushed the price up significantly, but failed to hold those highs. |

| Little/No Lower Wick | The low of the session is very close to the open or close price. | Sellers were in control from the moment the highs were rejected. |

| Location | Appears after a clear uptrend. | Its significance comes from its context as a potential end to bullish momentum. |

This anatomy tells a clear story: a failed auction at higher prices.

Common Naming Confusion

One of the first things that trips up new traders is the name. The bearish hammer looks identical to a Shooting Star and an Inverted Hammer. It’s all about context.

Here’s how to tell them apart:

- Bearish Hammer / Shooting Star: Same exact candle, same meaning. It appears after an uptrend and signals a potential bearish reversal. “Shooting Star” is just the more classic, old-school name for it.

- Inverted Hammer: Same exact shape, but it shows up after a downtrend. This one is actually a potential bullish signal, suggesting sellers are losing steam.

For our purposes here, we’re focused on what this candle means when it pops up at the top of a nice run-up.

While the pattern itself gives us a clue, its reliability isn’t set in stone. Market conditions matter — a lot. For instance, renowned technical analyst Thomas Bulkowski found that the classic hammer (the bullish version) works as a reversal about 60% of the time after a downtrend. But in a bear market, its failure rate climbs. This just goes to show that context is king and no pattern is foolproof.

Ultimately, mastering patterns like the bearish hammer is a core part of learning how to read stock charts effectively. When you can see beyond the shape and understand the psychology behind it, you build a much stronger, more intuitive feel for the market.

How to Reliably Identify the Bearish Hammer

It’s one thing to spot a candle with a long upper wick. That’s the easy part. The real skill — and where so many traders get tripped up — is learning to tell which ones actually signal a reversal and which ones are just market noise.

This isn’t about making a guess; it’s about building a solid, rules-based case for every trade you consider. Think of it like a detective. You wouldn’t act on a single piece of flimsy evidence, right? The more clues you line up, the stronger your trade becomes. A high-quality bearish hammer doesn’t just show up out of the blue; it forms under very specific conditions.

The Three Pillars of Identification

To confidently identify a bearish hammer that’s worth your attention, you need to check off three boxes. If even one is missing, the pattern’s reliability plummets, and you’re probably better off staying on the sidelines.

Let’s walk through this essential checklist.

- It Must Follow a Clear Uptrend: Context is king. A bearish hammer is a reversal pattern, which means it needs something to reverse in the first place. You should see a clear series of higher highs and higher lows leading into the candle. If a similar-looking candle pops up in the middle of choppy, sideways action, it’s not a valid signal.

- The Anatomy Must Be Correct: The visual rules are strict for a good reason. The upper shadow (the wick) absolutely must be at least twice the length of the real body. This isn’t an arbitrary number. That ratio is what visually screams “failed rally.” It shows buyers tried to push prices way up, but sellers came in with overwhelming force and slammed them back down. A candle with a wick that’s only a little longer than its body just shows a bit of indecision, not a powerful rejection.

- Location, Location, Location: This is the big one. A bearish hammer carries the most weight when it forms right at a known resistance level. This could be a previous swing high, a key moving average, or a major Fibonacci retracement. When sellers step in and reject prices at a level that has historically acted as a ceiling, it adds a massive layer of confirmation to the pattern.

The goal is to train your eye to spot textbook setups, not to chase every half-baked signal. A disciplined trader waits for the market to present a clear opportunity that meets all their criteria, rather than trying to force a trade on a mediocre pattern. This long-term mindset is crucial for survival.

This is what separates traders who get consistently caught in false moves from those who wait for the A+ setups.

Does the Candle Color Matter?

This is a common question. Can a bearish hammer be green (bullish)? The short answer is yes, but the color definitely adds a layer of nuance.

- A Red (Bearish) Body: This is the stronger version. It means sellers not only fought back against the highs but were strong enough to push the price all the way down to close below where it opened. It’s a clear sign of aggressive selling.

- A Green (Bullish) Body: This is still a valid pattern because the long upper wick is the star of the show. It tells us sellers rejected the highs, but buyers still had just enough gas left in the tank to eke out a close above the open. It signals exhaustion, but with a little less immediate bearish conviction.

Ultimately, both are valid, but a red-bodied hammer at a key resistance level is the kind of premium setup you should be looking for.

This pattern is just one of many useful signals you can add to your arsenal. To build a more well-rounded view of the market, check out our guide on the most important day trading chart patterns. By sticking to a checklist and focusing only on top-tier setups, you turn pattern recognition from a guessing game into a repeatable, strategic process.

We’ve all been there. You spot what looks like a picture-perfect bearish hammer, jump into a short trade feeling like a genius, and then watch the market rip right back up and stop you out. It’s that painful sting of being right about the pattern but wrong about the timing.

This usually happens when we act on an incomplete signal.

A single candle, no matter how clean it looks, isn’t a direct order to sell. Think of the bearish hammer as a warning shot fired by sellers — a sign that the uptrend might be losing steam. It’s your job to wait for more evidence before you put real capital on the line. This is where the discipline of seeking confirmation separates the pros from the crowd.

Waiting for confirmation turns trading from a game of spotting patterns into a methodical, risk-managed process. By demanding that the market prove your idea is correct, you automatically filter out a ton of false signals and massively upgrade the quality of your trades.

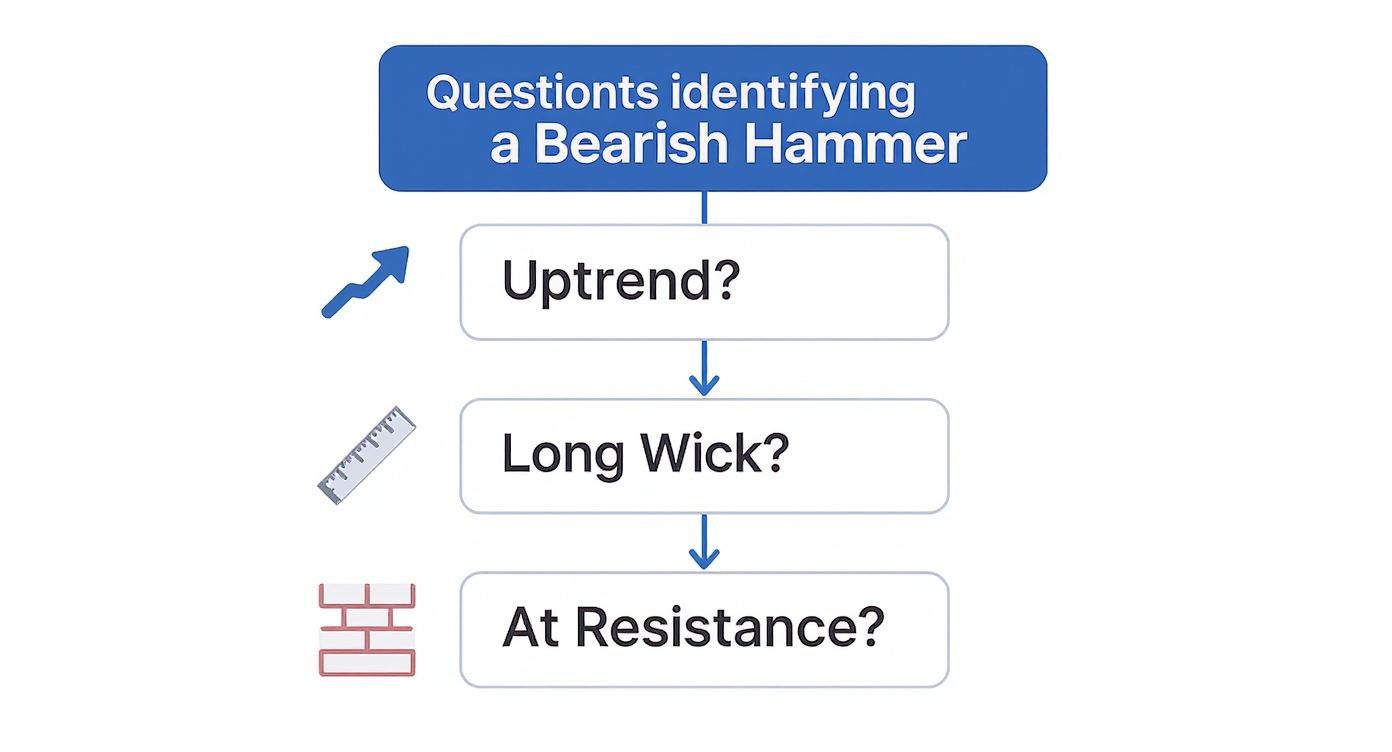

This decision-making flowchart helps visualize the key checkpoints for identifying a high-probability bearish hammer.

As you can see, a truly valid signal needs three things: a prior uptrend, the right candle anatomy, and a strategic location like a resistance level.

What Does Strong Confirmation Look Like?

Confirmation isn’t just a gut feeling; it’s a set of concrete events you can see on the chart that validate the story the bearish hammer is telling. Waiting for one or more of these signals is an act of professional patience. It’s the difference between reacting emotionally and executing a well-thought-out plan.

Here are the primary forms of confirmation to look for:

- Bearish Price Action: The most classic and reliable confirmation is a follow-up candle that closes below the low of the bearish hammer. This proves that sellers not only rejected the highs but now have enough muscle to push prices to new lows. The momentum has officially shifted.

- A Spike in Volume: If the bearish hammer candle itself forms on higher-than-average volume, it shows there was real conviction behind that rejection of higher prices. It’s even better when the bearish confirmation candle also has high volume, signaling that more traders are jumping on the selling side.

- Indicator Agreement: Technical indicators can provide an excellent second opinion. A bearish hammer appearing while the RSI is overbought (above 70) or followed by a bearish MACD crossover adds significant weight to the reversal signal.

This need for confirmation isn’t some new-age trading fad. The hammer pattern, which has its roots in 18th-century Japanese rice trading, has always been a tool whose reliability depends on its context. Its adoption into modern stock, forex, and commodities markets hasn’t changed that one bit. Experienced traders know that signals on higher timeframes like the daily or weekly charts are generally more trustworthy because they filter out a lot of market noise.

A bearish hammer tells you what might happen. Confirmation from the next candle tells you what is happening. Acting on the latter is how you protect your capital and trade with a genuine edge.

Adopting a Risk Manager Mindset

It’s so easy to get swept up in the excitement of spotting a pattern. The fear of missing out (FOMO) is a powerful force that pushes traders to jump the gun.

But here’s the thing: consistently profitable traders aren’t just pattern hunters; they are elite risk managers.

Their number one goal isn’t to catch every single move. It’s to protect their capital and only put it to work when the odds are stacked firmly in their favor. Waiting for confirmation is a core part of this mindset. It’s a deliberate choice to trade less but trade better.

By patiently waiting for the market to validate your analysis of a bearish hammer, you shift from being a reactive gambler to a proactive strategist. This discipline will not only save you from countless frustrating losses but will also build the long-term thinking required for a sustainable trading career.

Building Actionable Bearish Hammer Trading Plans

Spotting a confirmed bearish hammer candlestick is a fantastic start, but it’s just that — a start. A reliable pattern isn’t a complete strategy. The real work begins when you turn that observation into a clear, disciplined plan. This is where we shift from just watching the charts to taking calculated action.

It’s a classic mistake: you see the perfect setup, feel a rush of adrenaline, and dive in headfirst without a second thought. That emotional impulse is where most big losses come from. By building a complete trading plan before you risk a single dollar, you move from being a reactive gambler to a proactive strategist. You trade with a cool head and a clear edge.

This isn’t about trying to predict the future. It’s about setting your own rules of engagement so that when the pattern appears, you know exactly what to do.

The Three Core Components of a Trade Plan

Every solid trading plan, no matter the setup, boils down to three simple but critical questions:

- Where do I get in?

- Where do I get out if I’m wrong?

- Where do I take profits if I’m right?

Answering these questions beforehand is your best defense against making emotional decisions in the heat of the moment. Let’s build a framework for trading the bearish hammer, step by step.

1. Defining Your Entry Point

Your entry is your line in the sand. A disciplined and common approach is to place a sell-stop order just a few ticks below the low of the confirmation candle.

Why not the hammer itself? Because waiting for that next candle to close proves that sellers are actually following through. Entering below its low ensures there’s real downside momentum building before you jump in.

2. Setting Your Stop-Loss

This is your most important decision because it defines your risk. A logical spot for your stop-loss is just above the high of the bearish hammer’s wick.

That wick high represents the peak of buying exhaustion — the exact point where sellers took definitive control. If the price breaks back above that level, the whole bearish idea is invalidated, and you should be out of the trade with a small, managed loss.

3. Outlining Your Profit Targets

Your exit strategy needs to be just as clear as your entry. A simple and effective method is to aim for a risk-to-reward ratio of at least 1:2. For instance, if your stop-loss is 50 cents from your entry, your first target should be at least $1.00 away.

Another great technique is to target the nearest significant support level, like a previous swing low or a major moving average.

The professional trader thinks about how much they can lose before they ever think about how much they can win. This risk-first mindset is the bedrock of long-term consistency. Your stop-loss is not a sign of failure; it is a tool of capital preservation.

By nailing down these three elements, you’ve created a complete, actionable trading plan.

A Practical Bearish Hammer Example

Let’s walk through a trade on a hypothetical stock to see this plan in action.

Imagine XYZ stock has been in a strong uptrend and hits a known resistance level at $150. Right at that level, a clear bearish hammer forms. You don’t jump in yet. You wait patiently for the next candle, which turns out to be a strong red candle closing at $147 — well below the hammer’s low. Now you’ve got confirmation.

Here’s the trading plan you’d build:

- Asset: XYZ Stock

- Entry Signal: Place a sell-stop order at $146.90 (just below the confirmation candle’s low).

- Stop-Loss: Place a stop-loss order at $150.60 (just above the hammer’s high).

- Risk per Share: Your total risk is the difference: $150.60 – $146.90 = $3.70.

- Profit Target: To hit a 1:2 risk/reward, your target is $7.40 below your entry ($3.70 x 2). This puts your profit target at $139.50.

Now, the trade becomes mechanical. If the price drops to $146.90, your order gets filled. Your stop-loss is already set, protecting your capital. If the trade moves your way, you have a clear target to take profits. There’s no guesswork once you’re in because you made all the hard decisions when you were calm and objective.

Bearish Hammer Trade Plan Template

A structured template is an excellent way to ensure you cover all your bases before entering a trade. It removes emotion and forces you to think through every step logically.

| Component | Rule / Guideline | Rationale |

|---|---|---|

| Setup | Confirmed Bearish Hammer at a key resistance level or after a strong uptrend. | Ensures the pattern has context and isn’t just random noise. |

| Entry | Sell-stop order placed a few ticks below the low of the confirmation candle. | Confirms downside momentum is present before committing capital. |

| Stop-Loss | Placed a few ticks above the high of the Bearish Hammer’s wick. | Invalidates the bearish thesis if breached; defines maximum risk. |

| Profit Target 1 | Set at a 1:2 Risk/Reward ratio from the entry price. | A simple, effective way to ensure potential rewards justify the risk. |

| Profit Target 2 | Set at the next major support level (e.g., a prior swing low). | Targets a logical area where buyers might step back in. |

| Position Size | Calculated based on the stop-loss distance and a pre-defined risk % (e.g., 1% of account). | Keeps losses consistent and manageable across all trades. |

| Trade Management | Consider moving the stop-loss to break-even after hitting Profit Target 1. | Protects profits and allows for a risk-free ride to the second target. |

This structured approach applies universally, whether you’re trading stocks, forex, or crypto. The principles of entry, risk management, and profit-taking are timeless. The real key is having the discipline to execute your plan, every single time.

Refining Your Strategy with Backtesting and Journaling

Knowing how to spot a bearish hammer candlestick is a great start. Building a trading plan around it is even better. But the real work — the stuff that separates consistently profitable traders from the rest — comes down to proving that your strategy actually works.

That’s where backtesting and journaling come in. These aren’t just tedious chores; they are the bedrock of a professional trading career.

It’s tempting to skip this step and dive straight into the live market. We’ve all felt that urge. But that’s a classic rookie mistake. Think of backtesting as your simulator and journaling as your post-flight debrief. Together, they turn hopeful guesses into a data-driven operation.

Building Confidence Through Backtesting

Backtesting is simply the process of going back in time on your charts to see how a specific setup, like the bearish hammer, has performed. It’s not about predicting the future with 100% certainty. It’s about collecting your own data to build unshakable confidence in your edge.

The process is straightforward but incredibly powerful:

- Pick Your Playground: Stick to one asset and one timeframe you plan to trade, like the 4-hour chart for TSLA or the daily for BTC/USD.

- Turn Back the Clock: Scroll back at least six months or even a year on your chart.

- Hunt and Document: Move forward one candle at a time. Every time you spot a bearish hammer that fits your rules, log it. Based on your entry, stop, and target rules, would it have been a win or a loss?

This manual process does something automated backtesters can’t: it burns the pattern into your brain. You’ll start to develop a real, intuitive feel for how the market behaves around these signals. For a deeper dive, check out our guide on how to backtest trading strategies.

The Power of Data in Trading

Here’s a reality check: no single pattern is a magic bullet. For example, some market studies show candlestick patterns having just over a 50% win rate when traded in isolation. This highlights that simply trading the pattern without additional context or confirmation is not a viable long-term strategy.

However, other analyses have shown the same pattern hitting a 60-63% success rate in markets like Indian equities or crypto when combined with other factors. The performance varies wildly between asset classes. And that’s exactly why your own backtesting is so critical — it tells you what actually works in the market you trade.

A trading journal is the ultimate feedback loop. It’s the brutally honest business partner that shows you what you’re doing right, what you’re doing wrong, and exactly where you need to improve to grow your account.

Your Trading Journal: The Ultimate Feedback Loop

If backtesting builds your confidence in a strategy, journaling perfects your execution of it. A journal is so much more than a simple log of wins and losses. It’s where you capture the why behind every trade.

For every bearish hammer trade you take, your journal entry should have:

- A screenshot of the setup with your entry, stop loss, and take profit levels clearly marked.

- The context: Was price at a major resistance level? What was the higher timeframe trend doing?

- The confirmation: What gave you the green light? A follow-up bearish candle? A spike in volume?

- Your mindset: Were you patient and calm? Or did you feel anxious and jump the gun? Did you follow your plan to the letter?

Over time, this log becomes your personal performance playbook. With a modern journaling tool like TradeReview, you can tag each trade with “Bearish Hammer” and instantly see the stats for that specific setup. You’ll see your win rate, average risk-to-reward, and common mistakes, turning raw data into actionable steps for getting better.

Common Questions About the Bearish Hammer Pattern

Even with a solid trading plan, questions always pop up when you’re trying to apply a new pattern in a live market. It’s a totally normal part of the learning curve. Let’s tackle some of the most common points of confusion to help you get a better handle on the bearish hammer candlestick.

Getting these details straight is what separates traders who just see a shape on a chart from those who truly understand the story the market is telling.

What Is the Difference Between a Bearish Hammer and a Shooting Star?

This is easily the most frequent question, and the answer is refreshingly simple. When you get right down to it, a Bearish Hammer and a Shooting Star are the exact same pattern.

Both have a small body near the lows, a long wick sticking out the top, and almost no lower wick. Both of them hint at a potential bearish reversal after the market has been climbing. The only real difference is what people decide to call it.

- Shooting Star: This is the classic, textbook name for this pattern when it shows up after an uptrend.

- Bearish Hammer: This is a more modern, descriptive name that a lot of traders now use. It gets the point across a bit more directly.

Ultimately, it doesn’t matter what you call it. What matters is that you recognize the story it’s telling — buyers tried to push prices higher, failed, and sellers took control — and that you see it in the right location.

How Reliable Is This Pattern on Its Own?

Let’s be direct: the bearish hammer pattern is not reliable enough to be traded in isolation. We’ve all felt that sting of jumping into a trade based on a single promising candle, only to watch the market immediately turn around and stop us out. This pattern is a classic trap for that kind of mistake.

Its real power is found in confluence, which is just a trader’s way of saying “multiple signals lining up at once.” A bearish hammer only becomes a high-probability setup when:

- It forms at a key resistance level, like a previous swing high or a major moving average.

- It appears with a noticeable spike in trading volume.

- It’s followed by a strong bearish candle that closes below the hammer’s low, confirming the selling pressure.

Think of the bearish hammer as a single, compelling piece of evidence. It’s a flashing yellow light telling you to pay close attention, not a green light to slam the sell button.

Relying on it alone is a recipe for frustration and a string of unnecessary losses. The professional approach is to wait for the market to prove the signal is valid before you put your capital on the line.

Does the Bearish Hammer Work in All Markets and Timeframes?

Yes, the core psychology behind the pattern — a failed rally and sellers stepping in — is universal. You’ll spot the bearish hammer on charts for stocks, forex, crypto, and commodities. The story it tells about human behavior and market dynamics is the same everywhere.

However, its reliability changes a lot depending on the timeframe you’re looking at. The pattern is generally much more trustworthy on longer timeframes like the daily, weekly, or 4-hour charts. These higher timeframes filter out a lot of the random, intraday “noise” and represent more significant shifts in market sentiment. A rejection on a weekly chart carries far more weight than one on a 5-minute chart.

While you’ll definitely see bearish hammers on shorter timeframes, they’re often less reliable and require much faster confirmation and more hands-on trade management to be profitable. If you’re still mastering this pattern, sticking to the higher timeframes is a smart way to stack the odds in your favor.

The best way to truly get comfortable with this pattern is through practice and meticulous record-keeping. By journaling every trade, you build a personal database of what works for your strategy and the markets you trade. A powerful tool like TradeReview helps you tag, analyze, and review your bearish hammer setups, transforming your trading from a series of random events into a data-driven business. Track your performance, spot your weaknesses, and refine your edge with a professional-grade journal.

Start building your data-driven edge today at https://tradereview.app.