When you automate a trading strategy, you’re building a piece of software that executes trades on your behalf. It follows a strict set of rules you define beforehand, completely removing manual clicks and — more importantly — emotional second-guessing. This whole approach is about swapping gut feelings for discipline, speed, and data-driven execution. You’re creating a system to trade your plan perfectly, even when you’re not there.

Why Traders Ditch Manual Trading for Automation

We’ve all been there — glued to the charts, feeling the pressure mount. The constant what-ifs and the fear of missing a move can push anyone into making impulsive decisions that wreck an otherwise solid strategy. It’s that emotional rollercoaster, the anxiety of watching a position move against you or the sting of a missed opportunity, that often becomes the catalyst for exploring automation.

This shift isn’t about chasing some “holy grail” that promises guaranteed profits. It’s a conscious move toward consistency and long-term thinking. A well-built automated system follows your trading plan with robotic precision, 24/7, without ever falling victim to fear or greed. It’s the ultimate tool for enforcing the rules you already know work.

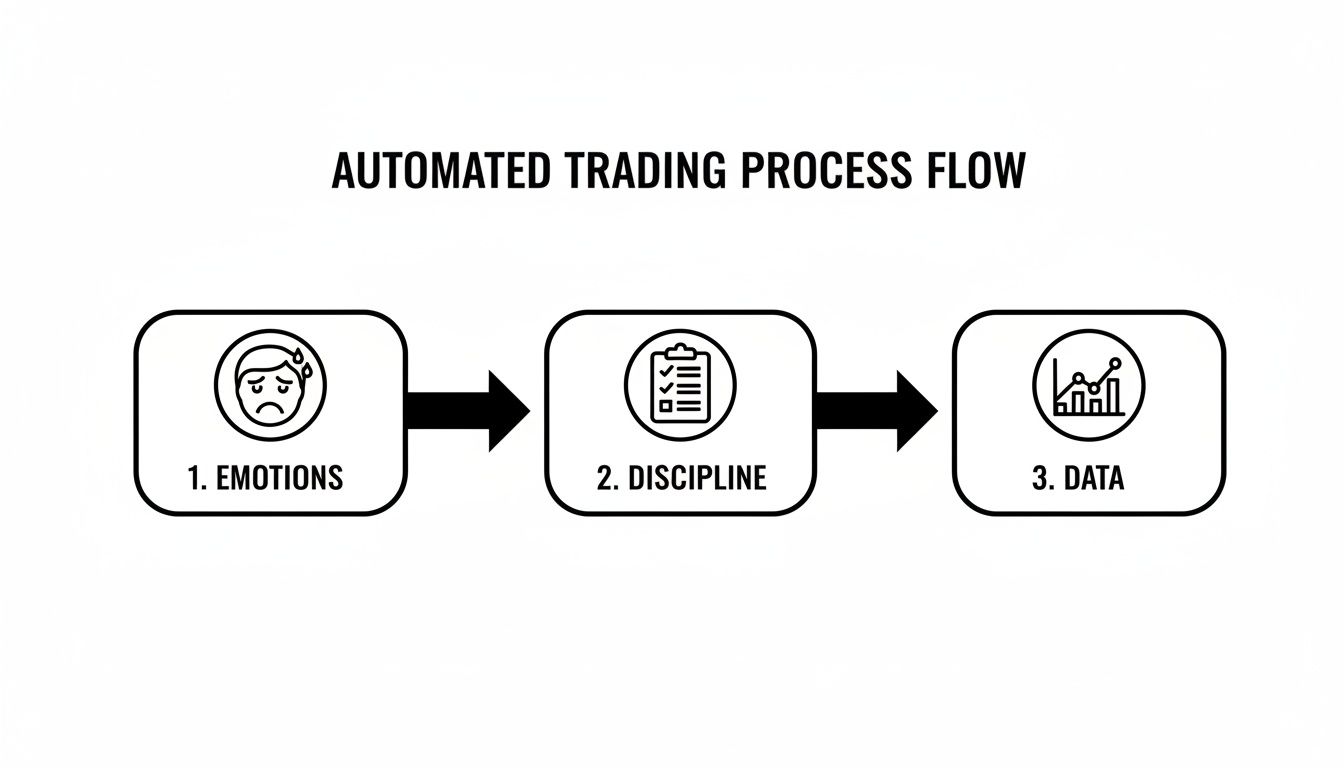

From Emotional Guesses to Data-Backed Execution

Automation completely changes your relationship with the market. It forces you to stop trading based on subjective feelings and start defining objective, testable rules. This process transforms trading from a high-stress, reactive grind into a strategic, analytical endeavor. If you want to go deeper on this, it’s worth understanding what algorithmic trading is and how it works.

This chart really captures the evolution every trader goes through when they embrace automation.

Think of automation as the bridge that gets you from an emotional, undisciplined state to a calm, data-focused mindset.

The benefits of making this leap are tangible and powerful:

- Flawless Execution: Your system enters and exits based on your exact criteria. No hesitation, no fat-finger errors, no costly mistakes.

- Increased Speed: In fast-moving markets, milliseconds can make all the difference. A bot can spot a setup and place an order faster than any human ever could, giving you a potential edge.

- Broader Market Scanning: You can only watch so many charts at once. An automated system can scan hundreds of instruments simultaneously, making sure you never miss a valid signal from your strategy.

The true power of an automated strategy is its ability to execute your plan without emotion. It’s your best self — the disciplined, patient, analytical trader — calling the shots on every trade, even when you’re asleep.

Ultimately, the goal is to build a powerful feedback loop. By automating your strategy, you generate clean, unbiased performance data. That data, when captured in a trading journal like TradeReview, lets you analyze what’s working, what isn’t, and why. This is how you adapt to changing market conditions and continuously sharpen your edge over the long term.

Defining Your Strategy’s Mechanical Rules

Before you even think about writing a single line of code, your entire trading strategy needs to be on paper. I’m talking about excruciating detail. This document is the absolute blueprint for your trading bot, and any fuzzy logic or ambiguity here will become expensive, painful errors when real money is on the line.

The whole point is to create a set of rules so mechanical and objective that you and I — or a piece of software — would execute them identically every single time. No exceptions. It’s this disciplined, upfront work that really separates the consistently profitable automated traders from everyone else. Your bot won’t “know what you mean”; it only knows what you tell it, exactly.

And this isn’t some niche hobby anymore. Algorithmic trading is booming, with the market growing from USD 17.2 billion in 2024 to a projected USD 42.5 billion by 2033. This massive shift is all about the demand for speed and discipline that only automation can deliver. You can read the full research about the automated trading market’s growth to see just how deep this trend runs.

From Vague Idea to Concrete Blueprint

A “good feeling” about a stock or a general sense that the market is bullish is completely useless to a computer. To successfully automate a trading strategy, you have to break down every single idea into quantifiable, binary rules. Think yes or no, true or false.

You need to define the entire lifecycle of a trade, not just the entry.

- Market and Timeframe: What exactly are you trading? Be specific (e.g., SPY, AAPL, EUR/USD). And on what chart timeframe will your signals be based (15-minute, 4-hour, daily)?

- Setup Conditions: What has to happen in the broader market before you even look for a trade? For instance, maybe the S&P 500 must be trading above its 200-day moving average.

- Entry Signals: What is the precise, measurable event that triggers a buy or sell order? This can’t be a pattern your eye recognizes; it has to be a mathematical condition.

- Position Sizing: How much capital will you risk on any given trade? This needs to be a hard rule, like a fixed 1% of your account or based on volatility (e.g., sizing based on the Average True Range, or ATR). The ATR is a technical analysis indicator that measures market volatility by decomposing the entire range of an asset price for that period.

- Exit Rules (Profit): How are you taking profits? Is it a fixed percentage gain like +3%, an indicator crossing a level (RSI over 70), or a trailing stop that follows the price up?

- Exit Rules (Loss): Where is your stop-loss? A hard -1.5%? Below a recent swing low? Define it.

Your written plan is the single source of truth for your automated system. If a rule is not explicitly written down, it does not exist. This clarity prevents you from tweaking the system on the fly and ensures every action your bot takes is deliberate and planned.

Real-World Example: A Trend-Following Strategy

Let’s make this real. Here’s how you’d map out a simple trend-following strategy for the QQQ ETF on a daily chart.

| Strategy Component | Mechanical Rule |

|---|---|

| Market Filter | The QQQ must be trading above its 200-day simple moving average (SMA). If it is below, no new long positions are initiated. |

| Entry Signal | Buy when the 50-day SMA crosses above the 100-day SMA. The entry order is placed on the opening of the next trading day’s candle. |

| Position Sizing | Risk 1% of the total account equity on each trade. |

| Stop-Loss | Place an initial stop-loss at 1.5 times the 14-day Average True Range (ATR) below the entry price. This becomes a trailing stop, moving up as the price moves in your favor but never moving down. |

| Profit Target | There is no fixed profit target. The position is exited only when the trailing stop is hit or when the exit signal occurs. |

| Exit Signal | Sell the position when the 50-day SMA crosses back below the 100-day SMA. The exit order is placed on the opening of the next trading day’s candle. |

See? No ambiguity. Every condition is nailed down with a specific number or indicator value. This creates the perfect blueprint for the next stage: backtesting. This is the foundation, and without it, everything else you build will eventually crumble.

How to Properly Backtest Your Trading Idea

This is the moment of truth. Backtesting is where your carefully crafted rules get thrown into the ring with historical market data. It’s a simulation, yes, but it’s the most critical one you’ll run. This is how you find out if your brilliant idea has a fighting chance or if it just looked good on paper.

A lot of traders stumble here. They see a positive result, get excited, and dive in headfirst, only to get wiped out in the live markets. Remember, the point of backtesting isn’t just to find a winner. It’s to honestly — and brutally — assess your strategy’s character before you risk a single cent.

Gathering Your Data and Avoiding Common Traps

Your backtest is only as good as the data you use. Period. Using incomplete or dirty data is like trying to build a skyscraper on a swamp. It’s destined to fail. You absolutely need clean, professional-grade data for the specific market and timeframe you intend to trade.

Once you have the data, you have to be vigilant about the biases that can trick you into thinking you’ve found a holy grail.

- Lookahead Bias: This is a classic rookie mistake. It happens when your simulation uses information that wasn’t actually available at the time of the trade. For example, using a candle’s closing price to decide on a trade at the open of that same candle. You’re basically cheating by looking into the future.

- Survivorship Bias: This one is sneaky. It happens when your data only includes assets that “survived” the test period, conveniently ignoring all the stocks that went bankrupt or were delisted. This paints a wildly optimistic picture of performance that just isn’t real.

A backtest is a controlled experiment. Your goal should be to try and break your idea, not confirm your own bias. Think like a scientist, hunting for every flaw. This mindset is your single best defense against expensive surprises down the road.

Accounting for Real-World Trading Frictions

A backtest that ignores trading costs isn’t a backtest; it’s a fantasy. In the real world, every single trade costs you money, and these costs add up fast. If you’re serious about your goal to automate a trading strategy, your simulation needs to reflect this reality.

Your test must include realistic numbers for:

- Commissions: What your broker charges you to place a trade.

- Slippage: The difference between the price you thought you’d get and the price where your order actually filled. This is a huge factor in fast-moving markets or when trading with larger size.

Neglecting these costs is one of the quickest ways to turn a seemingly profitable system into a money pit. They might look small on a single trade, but over hundreds or thousands of trades, they can completely destroy your edge.

Understanding Key Performance Metrics

When the test is done, you’ll get a report packed with numbers. It’s easy to get fixated on the total profit, but the real story is in the details. You need to understand the metrics that reveal the true risk and reward profile of your system. For a more comprehensive look, check out our full guide on how to backtest trading strategies effectively.

Digging into the right metrics helps you understand not just if a strategy makes money, but how it makes money — and what kind of ride you’re in for.

Key Backtesting Performance Metrics Explained

| Metric | What It Measures | Why It Matters for an Automated Strategy |

|---|---|---|

| Profit Factor | Gross profits divided by gross losses. A value over 1.0 shows profitability. | This is your quick-and-dirty health check. A higher number (think 1.75+) suggests a more resilient system that can handle some bumps. |

| Sharpe Ratio | The strategy’s risk-adjusted return, comparing profit to volatility. | It tells you how much bang you’re getting for your buck, risk-wise. A higher Sharpe Ratio means better performance for the amount of risk taken. |

| Max Drawdown | The largest peak-to-trough drop in your account value during the test. | This is the number that keeps traders up at night. It represents the worst losing streak you would have had to sit through. Can you stomach it? |

| Win Rate | The percentage of trades that were profitable. | Don’t be fooled by this one. A strategy can be very profitable with a low win rate (30-40%) as long as the winners are massive compared to the losers. |

Looking at these metrics together gives you the complete picture. A system with a huge total profit but a gut-wrenching 50% maximum drawdown might be profitable on paper, but could you actually stick with it in real-time? Backtesting lets you answer that question before your real money is on the line.

Choosing Your Platform and Building the Bot

Alright, you’ve defined your strategy and the backtest looks promising. Now comes the exciting part: actually building the thing. This is where your abstract rules become a real, functional trading bot that can interact with the market.

The good news? You’ve got more options than ever, regardless of whether you’re a coding veteran or have never written a single line of code in your life.

The path you take really boils down to your technical skill, how much customization you need, and what you’re trying to accomplish long-term. Let’s dig into the two main routes traders take.

The No-Code and Low-Code Path

You absolutely do not need a computer science degree to start automating. Platforms like TradingView have completely opened up the world of algorithmic trading, letting you build surprisingly sophisticated systems with simple scripting languages (like Pine Script) or even visual, drag-and-drop tools.

These platforms are a fantastic starting point because they handle all the heavy lifting for you. Forget about sourcing market data, managing servers, or wrestling with broker connections. You get to focus purely on your strategy’s logic.

- TradingView: Lets you code strategies in Pine Script that can trigger alerts. These alerts can then be picked up by a third-party service to execute trades automatically in your brokerage account.

- Other Bot Services: Plenty of services let you build bots by simply choosing indicators and logic from dropdown menus, no coding required.

The trade-off here is flexibility. You’re living within the platform’s ecosystem, limited to the indicators, data, and brokers they support. For a lot of traders, especially those just getting their feet wet, this is a more than fair compromise.

The Custom Coding Path with Python

For traders who want total control and zero limitations, building a custom bot using Python is the gold standard. There’s a reason Python dominates this space — its ecosystem of libraries built specifically for financial analysis and trading is massive.

This route is definitely a bigger commitment. It requires real discipline and a hunger to learn. You become responsible for everything: grabbing data, executing orders, logging errors, you name it.

Building your own bot is like building a custom car. It’s more work, but every single part is exactly what you want. You have the power to connect to any data source, any broker, and implement any strategy you can imagine, no matter how complex.

A basic bot architecture usually has a few core pieces:

- Data Handler: This component connects to a market data API (like Polygon.io or directly from your broker) to pull in the price data your strategy needs.

- Strategy Engine: The brains of the operation. It takes the data, applies your rules (e.g., “is the 50-day moving average above the 200-day?”), and decides when to fire off a buy or sell signal.

- Execution Handler: This part receives the signal and talks to your broker’s API (like Interactive Brokers or Alpaca) to place, manage, and cancel orders.

- Logging & Monitoring: This is non-negotiable. It records every single thing your bot does — every piece of data fetched, every order sent, every confirmation received. It’s your lifeline for debugging and figuring out what went wrong (and right).

The move towards automation is an industry-wide trend. A report from The Trade suggests automation will continue to grow in importance, with speed and efficiency becoming paramount in modern market structures. You can discover more insights about the future of automation in trading to see why this is a skill worth learning.

Building a bot from the ground up is a journey. The trick is to start small. Nail one component at a time, test it obsessively, and then add the next layer of complexity. Your first goal isn’t to create a Wall Street killer; it’s to build a simple, reliable bot that places one trade based on one condition. Once you do that, you can build anything.

From Paper Trading to Your First Live Order

After weeks of planning, coding, and backtesting, the urge to flip the switch and go live is overwhelming. Every trader gets that itch — the need to see their creation finally work in the real world. But jumping straight in with real money would be a massive, costly mistake.

Before you risk a single dollar, your bot needs to graduate from the perfect, sterile environment of historical data to the messy, unpredictable world of live markets. This is where paper trading comes in.

The Final Dress Rehearsal

Think of paper trading as the ultimate stress test. It’s where your bot connects to a live data feed and places trades in a simulated brokerage account. You aren’t trying to make money here. You’re trying to break things.

The goal is to expose your system to all the real-world frictions that backtests simply can’t account for. This is where you’ll find all the little gremlins hiding in your logic. Our guide on what paper trading is and why it’s essential dives deeper into why you can’t skip this step.

During this phase, forget about profitability. Your entire focus should be on operational stability. You need to watch your bot like a hawk.

Your forward-testing checklist should look something like this:

- Order Fills & Slippage: Are you getting filled at the prices you expect? Or is slippage eating away at profits far more than your backtest predicted?

- System Uptime: Can your code run for days on end without crashing or needing a restart? What happens if your internet connection blips for a second?

- API Gremlins: Are you hitting broker rate limits? Does the API occasionally send back garbage data that your bot doesn’t know how to handle?

- Performance Drift: How closely do the paper trading results follow your backtest’s equity curve? If there’s a huge difference, that’s a major red flag.

This is your final chance to find and fix every potential point of failure before there are real financial consequences. If your bot can’t run flawlessly for weeks in a simulated environment, it has no business touching your real money.

Making the Cautious Leap to Live Capital

Once your bot has proven itself in the paper trading arena, it’s time to go live. But this isn’t a sprint; it’s a slow, methodical crawl. You have to shift your mindset: your first live deployment is still just the final stage of testing. It’s not the finish line.

The number one mistake traders make is going live with their full, intended position size. Don’t do it. Instead, start with the absolute smallest size your broker will allow — sometimes called “trading with dust.” Your goal isn’t to make a profit. It’s to confirm that every piece of your system, from signal to execution, works perfectly with real money on the line.

Before deploying, make sure you have these non-negotiable safeguards in place:

- Rock-Solid Hosting: Running a bot from your home computer is asking for trouble. A power outage or Windows update could be disastrous. Get a cloud server (VPS) for 24/7 uptime.

- The Big Red Button: You absolutely need a manual override. Have a simple, one-click way to flatten all positions and shut the bot down immediately.

- Automated Kill Switches: Code safety nets directly into your bot’s logic. For example, if it hits three consecutive losses or the daily drawdown exceeds 2%, it should automatically shut down and send you an alert.

This slow, careful process is what separates the pros from the gamblers. By starting small and layering in safety measures, you give yourself the best possible chance to automate a trading strategy that lasts, building confidence in your system one tiny trade at a time.

Monitoring and Improving Your Live Performance

So, your bot is live. The temptation is to sit back and watch the profits roll in, right? Not so fast. Launching your automated strategy isn’t the finish line — it’s just the starting gun for a continuous cycle of monitoring, analysis, and refinement.

The biggest myth in this game is that you can automate a trading strategy and walk away. In reality, markets are always shifting. A killer strategy from last year could easily start bleeding money today if left unchecked.

Your live performance is the only truth that matters. To stay ahead, you have to think like a scientist running an experiment. That means meticulously logging every single detail of every trade: the entry signal, the exact execution price, commissions, slippage, and why the bot exited. This isn’t optional; it’s fundamental to long-term survival.

Creating Your Data-Driven Feedback Loop

Here’s where the real work begins. You need to constantly compare your live results to what your backtest promised. Is your equity curve still tracking expectations, or is it starting to drift? A big divergence is a red flag. It’s a sign that something has changed, either in the market or in your bot’s execution.

This is where a trading journal becomes your most critical tool. Forget manual spreadsheets. Tools like TradeReview can automatically sync with your broker, pulling in every trade your bot makes without you lifting a finger. It creates an instant, unbiased record of what’s actually happening.

This kind of dashboard lets you visualize performance data and spot trends in seconds.

When all your metrics are in one place, you can immediately see if your win rate, profit factor, or average profit per trade is holding up against your historical tests.

This constant review cycle is what allows you to make smart, unemotional decisions. Is it time to tweak a parameter? Or is it time to pull the plug on the strategy altogether? Without clean data, you’re just flying blind.

The entire financial industry is moving this way. The AI in finance market is projected to continue its rapid growth, a trend driven by systems that process enormous amounts of data in real-time. You need to apply that same principle to your own trading. You can get more insights on the AI-powered systems transforming finance to see where things are headed.

Your live trading data is the most valuable asset you have. It tells you the unfiltered story of your strategy’s health. Neglecting it is like flying a plane without instruments — you’re operating blind and heading for a crash.

Ultimately, the goal is to build a professional, systematic process. By logging every trade, comparing live results to your backtest, and digging into the data, you create a powerful feedback loop. This disciplined approach is what separates the traders who adapt and thrive from those who get left behind.

Got Questions? Let’s Talk Strategy

Diving into automated trading is exciting, but it’s completely normal to have a few questions before you start. It’s a whole new world of technology, discipline, and a fresh way to look at the markets. Let’s tackle some of the most common things traders wonder about when they’re just getting started.

My goal here is to give you some straight-up advice to help you clear those first few hurdles with confidence.

How Much Capital Do I Need To Start?

There’s no magic number here. The most important rule is to start with an amount you are 100% prepared to lose. Think of this initial capital as your “tuition” for learning how your system behaves in a live environment, but with minimal financial risk.

Once your bot has a solid track record over a good number of live trades, then you can start methodically scaling up your position size. Starting small isn’t just about protecting your capital; it’s about building confidence as you iron out any of those inevitable, unexpected bugs.

Can I Automate Trading Without Knowing How To Code?

Absolutely. You don’t have to be a software developer to get in the game.

Platforms like TradingView (with its user-friendly Pine Script) and a bunch of other bot-building services offer low-code or even no-code solutions. These tools let you build out your strategies using visual interfaces or much simpler scripting languages.

Sure, learning a language like Python gives you the ultimate flexibility for a truly custom-built machine. But for most traders, these platforms are a fantastic and totally accessible place to start.

The biggest mistake I see new algo traders make is ‘curve fitting’ — they build a strategy that looks perfect on paper because it’s over-optimized for past data, but it completely falls apart in live markets. The other critical error is blowing off risk management. Always, always prioritize building a robust, safe system over chasing a flawless backtest.

Ready to stop guessing and start analyzing? TradeReview automatically syncs your trades, giving you the hard data you need to refine your automated strategy and trade smarter. Sign up for free and build your feedback loop.