Ever spotted a tiny hammer-shaped candle at the bottom of a downtrend and wondered what it meant? That’s the inverted hammer candle pattern, a classic single-candle formation that often signals a potential bullish reversal is on the horizon. It’s one of many signals traders use, but understanding its story can offer a valuable clue about market sentiment.

It’s recognized by its small body at the low end of the session, a long upper shadow, and barely any lower shadow. Think of it as a sign that buyers are starting to wake up and challenge the sellers’ dominance. However, like any technical pattern, it’s not a crystal ball — it’s a tool that requires context and discipline.

Understanding the Inverted Hammer Pattern

Let’s paint a picture. Imagine a stock has been in a downtrend for days. Sellers are in complete control, confidently pushing prices lower and lower.

Then, a new session opens, and buyers attempt to launch a surprise attack. They drive the price significantly higher, catching the sellers off guard. This fierce buying pressure creates that long upper shadow (or wick) of the inverted hammer. For a moment, it seems like a major reversal is happening right then and there.

But the sellers aren’t ready to give up just yet. They fight back, and by the end of the session, they manage to push the price back down, forcing it to close near its opening level. This tug-of-war is what forms the small “body” of the candle.

Even though the sellers clawed back some ground, the psychological damage is done. The inverted hammer candle pattern is a clear warning shot — it shows that buyers have found a price they’re willing to defend, and they’ve got some fight in them.

Key Characteristics to Identify

To properly spot an inverted hammer, you have to know what to look for. The color of the candle’s body (green or red) doesn’t matter nearly as much as its shape and where it appears in the trend. If you’re just getting started with technical analysis, taking some time to learn how to read stock charts is a great first step to building a solid foundation.

Here are the non-negotiables for this pattern:

- Location: It must show up after a clear downtrend. Its position is everything; it’s what gives the pattern its bullish meaning.

- Upper Shadow: The upper shadow has to be long — at least twice the size of the real body. This is the pattern’s defining feature and shows that initial burst of buying pressure.

- Real Body: The body of the candle should be small and sit at the lower end of the day’s trading range.

- Lower Shadow: There should be little to no lower shadow. A tiny stub is okay, but a noticeable wick at the bottom invalidates the pattern.

This specific structure tells a story of a potential shift in momentum from sellers to buyers.

Key Takeaway: The inverted hammer isn’t a guaranteed sign that the trend is over. Instead, it’s a heads-up. It’s the market whispering, “Hey, this downtrend might be running out of gas.”

Inverted Hammer Pattern Quick Reference

To make identification a breeze, here’s a quick checklist to keep handy. When you spot a candle that ticks all these boxes at the bottom of a downtrend, you’ve likely found an inverted hammer.

| Characteristic | Description |

|---|---|

| Trend Context | Must appear at the bottom of a sustained downtrend. |

| Body Size | The body is small and positioned at the low end of the session’s range. |

| Upper Shadow | Must be long — at least two times the length of the real body. |

| Lower Shadow | Should be non-existent or extremely small. |

| Indication | Signals potential bullish reversal and buying pressure. |

Recognizing the pattern is just step one. The real skill comes from understanding the psychology behind it and knowing how to confirm the signal before you even think about placing a trade.

The Market Psychology Behind the Inverted Hammer

To really trust a pattern like the inverted hammer, you have to get inside its head. Think of it less like a shape on a chart and more like the footprint of a fierce battle between buyers (bulls) and sellers (bears). Once you see it that way, it stops being an abstract signal and becomes a tangible story unfolding in the market.

Let’s set the scene. A stock has been in a downtrend for days, maybe even weeks. Sellers are feeling invincible. Every day, they push the price lower with almost no fight, and anyone shorting the asset is profiting. This is the world our inverted hammer is about to step into.

The day of the inverted hammer starts just like all the others. Bears are in complete control, shoving the price down right from the opening bell. From their point of view, it’s business as usual — another easy, profitable day in a solid downtrend.

The Bulls Launch a Surprise Attack

Then, out of nowhere, the buyers show up. They see the beaten-down price as a potential bargain and start buying with surprising force. This wave of demand completely catches the sellers off guard, sending the price rocketing higher and creating that long upper shadow.

This is the heart of the pattern’s psychology. For the first time in a long time, the bears’ dominance has been challenged. They’re no longer running the show unopposed; someone just landed a solid punch.

That moment of defiance is a huge piece of intel. It tells you that a group of traders believes the downtrend may have gone too far and is willing to put their money where their mouth is.

Sellers Fight Back But Fail to Dominate

But the fight isn’t over yet. Seeing the price surge, sellers scramble to regain control. They manage to stop the rally and push the price all the way back down, forcing it to close near where it opened.

This counter-attack is what forms the small body of the inverted hammer candle pattern. At first glance, you might think the sellers won the round since the price closed so far off its high. But something fundamental has shifted.

The bears did manage to fend off the rally, but they couldn’t push the price to a new low. The bulls, even though they were pushed back, proved they have the firepower to move the market. A warning shot has been fired.

The result is a candle that screams market indecision, but with a distinctly bullish flavor. The downtrend’s momentum has officially been broken.

- Sellers’ Position: They’re still in the game, but their absolute control is gone. Their failure to make a new low starts to plant seeds of doubt.

- Buyers’ Position: They’ve revealed their hand. They’ve found a price level they’re ready to defend and have shown they can create serious buying pressure.

Understanding this tug-of-war is what separates a mechanical trader from someone who can truly read the market. You no longer see a random shape, but a pivotal moment where power is potentially shifting from exhausted sellers to newly energized buyers. This psychological context is exactly why the next candle — the confirmation candle — is so incredibly important.

Why Confirmation Is Crucial for This Pattern

Spotting an inverted hammer candle pattern after a long downtrend feels like a breakthrough. It’s a flicker of hope — a sign that the relentless selling might finally be running out of steam. But here’s the critical part that separates disciplined traders from the rest: the pattern itself isn’t a buy signal. It’s just a question mark.

Acting on an unconfirmed inverted hammer is one of the quickest ways to get burned. We’ve all been there — seeing a promising setup, jumping in with excitement, and watching the market immediately reverse. Think of it like a scout reporting from the front lines. The scout (our inverted hammer) saw the buyers put up a fight, but the battle is far from over. An unconfirmed signal is nothing more than potential. It’s a reason to pay very close attention, not a reason to risk your capital.

Without that validation, you’re just gambling. You’re betting that the buyers’ first push has enough power to reverse the entire trend. This often leads to a false start, where the price just hiccups before plummeting again, stopping you out for a frustrating loss.

The Power of the Next Candle

The most reliable way to confirm an inverted hammer is simply to wait and see what happens next. The very next candle reveals whether the buyers’ show of strength was a one-off fluke or the start of a real momentum shift.

Your best proof is a strong, bullish candle immediately following the inverted hammer. Ideally, this confirmation candle should close decisively above the high of the inverted hammer. When that happens, it’s a clear message: the sellers who had been in control are now being overpowered. The buyers didn’t just show up; they seized control.

This simple act of waiting one more session can drastically stack the odds in your favor. It turns the inverted hammer from a hopeful guess into a validated setup backed by real market conviction.

Adding Volume as a Credibility Filter

Another layer of confirmation comes from volume. Volume is your conviction meter — it shows how many participants are behind a market move. A signal that forms on high volume carries a lot more weight than one that appears during quiet, low-volume trading.

When you see an inverted hammer candle pattern, zoom in on the volume for both the pattern candle and its confirmation.

- The Inverted Hammer Candle: Ideally, you want to see volume on the inverted hammer candle that is higher than the candles just before it. This shows the battle between buyers and sellers was intense.

- The Confirmation Candle: For the strongest signal, the bullish confirmation candle should also print on increasing volume. This tells you that more traders are jumping in, supporting the new bullish move.

A bullish candle closing above the inverted hammer’s high on a surge of volume is one of the highest-quality confirmations you can get. It signals that both price and participation are supporting the reversal.

The data backs this up. Thomas Bulkowski’s extensive analysis suggests the pattern performs as a bullish reversal under certain conditions. You can explore more data on the inverted hammer candlestick pattern to see how these numbers compare across different market environments.

Stacking the Odds with Confluence

Finally, seasoned traders almost never take a trade based on a single pattern. They look for “confluence” — a term for multiple signals all pointing in the same direction. When you find an inverted hammer at a location where other technical factors also suggest a bounce, you stack the odds heavily in your favor.

Keep an eye out for these powerful confluence factors:

- Key Support Levels: Does the inverted hammer form right on a known horizontal support zone, a major trendline, or a key Fibonacci level? A pattern at a predefined support area is far more powerful.

- Moving Averages: The appearance of an inverted hammer near a significant moving average, like the 50-day or 200-day, often acts as a catalyst for a strong reversal.

- Indicator Divergence: Check momentum indicators like the Relative Strength Index (RSI). If the price is hitting a new low but the RSI is making a higher low (bullish divergence), it means selling momentum is fading. An inverted hammer at that exact moment is a top-tier setup.

By demanding confirmation, you build discipline and patience. You learn to filter out the market noise and focus only on the setups with a higher probability of success, turning a simple candle pattern into a cornerstone of a robust trading strategy.

How to Build a Trading Strategy Around the Inverted Hammer

Knowing what an inverted hammer candle pattern looks like is one thing. Actually turning that knowledge into a repeatable, rule-based trading strategy? That’s where the real work begins.

It’s easy to get caught up in finding the perfect signal, but long-term success comes from having a disciplined plan for execution — a clear map detailing your entry, exit, and how you’ll manage your risk.

Without a strategy, you’re just guessing. With one, you transform a simple candle into a structured opportunity. Let’s break down a few practical ways you can trade this pattern, ranging from conservative to aggressive, so you can build a plan that fits your own style.

The Conservative Confirmation Strategy

This approach is all about safety over speed. It’s built for traders who want to see solid proof that the bulls are actually in control before they risk a single dollar. The core rule is simple: you wait for the next candle (the confirmation candle) to fully close before you even think about entering.

This forces you to be patient and avoid jumping the gun on what might be a false alarm. The flash of an inverted hammer can be exciting, but a disciplined trader knows that confirmation is everything.

Here’s how it works, step-by-step:

- Spot the Setup: Find a clean inverted hammer at the bottom of a downtrend.

- Wait for Proof: Don’t enter yet. Sit on your hands and wait for the next candle to form and close. The best confirmation is a strong bullish candle that closes above the high of the inverted hammer.

- Place Your Entry: Once that confirmation candle closes, place a buy order at the open of the next candle.

- Set Your Stop-Loss: Your stop-loss goes just below the low of the inverted hammer candle. This clearly defines your risk right from the start.

- Set Your Profit Target: A good initial target is the next major resistance level. You could also use a simple risk-to-reward ratio, like aiming for a profit that’s at least twice your risk (a 2:1 R:R).

By waiting for that candle to close, you’re trading based on proven strength, not just potential. You might get in at a slightly higher price, but your trade has a much higher probability of working out because the market itself has validated the signal.

The Aggressive Entry Strategy

If you have a higher appetite for risk, the aggressive strategy is about getting a better entry price by acting faster. Instead of waiting for the confirmation candle to close, you jump in during its formation, as soon as the price breaks above the high of the inverted hammer.

This can lead to bigger profits if the reversal takes off like a rocket, but it also comes with a much higher risk of a “fakeout” — where the price pops up for a moment, only to reverse and smash your stop-loss.

- The Entry Trigger: You’d place a buy-stop order just a few ticks above the high of the inverted hammer. This order triggers automatically if the price moves in your favor.

- The Stop-Loss: The stop-loss is placed in the exact same spot — just below the low of the inverted hammer.

- The Profit Target: The rules for taking profit are the same. Look for the next resistance level or use a fixed risk-to-reward ratio.

This approach is a trade-off. You’re swapping a higher probability of success for a better potential entry price. It demands quick thinking and the acceptance that some trades just won’t follow through.

The High-Probability Confluence Strategy

This is the most robust approach of them all because it doesn’t rely on the inverted hammer candle pattern alone. Instead, it combines the pattern with other technical signals. A single signal can be unreliable, but when several independent indicators all point to the same conclusion, the probability of a successful trade increases. This is called trading with confluence.

Your goal here is to find an inverted hammer that forms at a spot on the chart that already has technical significance.

Here’s what to look for:

- A Major Support Zone: The pattern pops up right on a price level where the market has bounced before.

- A Key Moving Average: It forms right at a widely-watched moving average, like the 50-day or 200-day Simple Moving Average (SMA).

- Bullish Divergence: You spot an inverted hammer at the same time a momentum indicator like the RSI is showing bullish divergence (price hits a new low, but the RSI makes a higher low).

When you start layering these elements, your trade setups become incredibly powerful. For example, an inverted hammer that forms at the 200-day SMA with RSI divergence is a classic A+ setup that professional traders are always looking for.

These multi-layered strategies require more patience, but the quality of the signals is often far superior. Before putting real money on the line, it’s wise to backtest these strategies on historical data. This data-driven approach is what builds real, long-term confidence in your plan.

Common Mistakes Traders Make with This Pattern

Knowing what to do when you see an inverted hammer candle pattern is important, but knowing what not to do can be the difference between a disciplined trade and a costly mistake. Even the most promising-looking pattern can fall flat if it’s misinterpreted or traded in the wrong environment.

Let’s be honest — we’ve all been there. You spot a textbook-perfect pattern, feel that jolt of excitement, and jump into a trade, only to watch it immediately turn against you. That frustration is usually a sign of a few common, but totally avoidable, errors. Once you understand these pitfalls, you’ll develop the critical eye needed to filter out the low-quality setups and focus only on the real opportunities.

Mistake 1: Ignoring the Market Context

The single biggest mistake traders make is taking the inverted hammer at face value, completely ignoring its surroundings. The pattern’s bullish power is entirely dependent on where it shows up.

An inverted hammer in the middle of a choppy, sideways market is not a signal — it’s just noise.

The psychology of the pattern relies on it appearing after a solid downtrend. It’s meant to be the first real sign of buyers fighting back after a period of heavy selling. Without that preceding drop, the pattern loses all its meaning and becomes just another random candle on a messy chart. Before you even think about a trade, always ask yourself: “Is this asset clearly trending down, or is it just bouncing around without any real direction?”

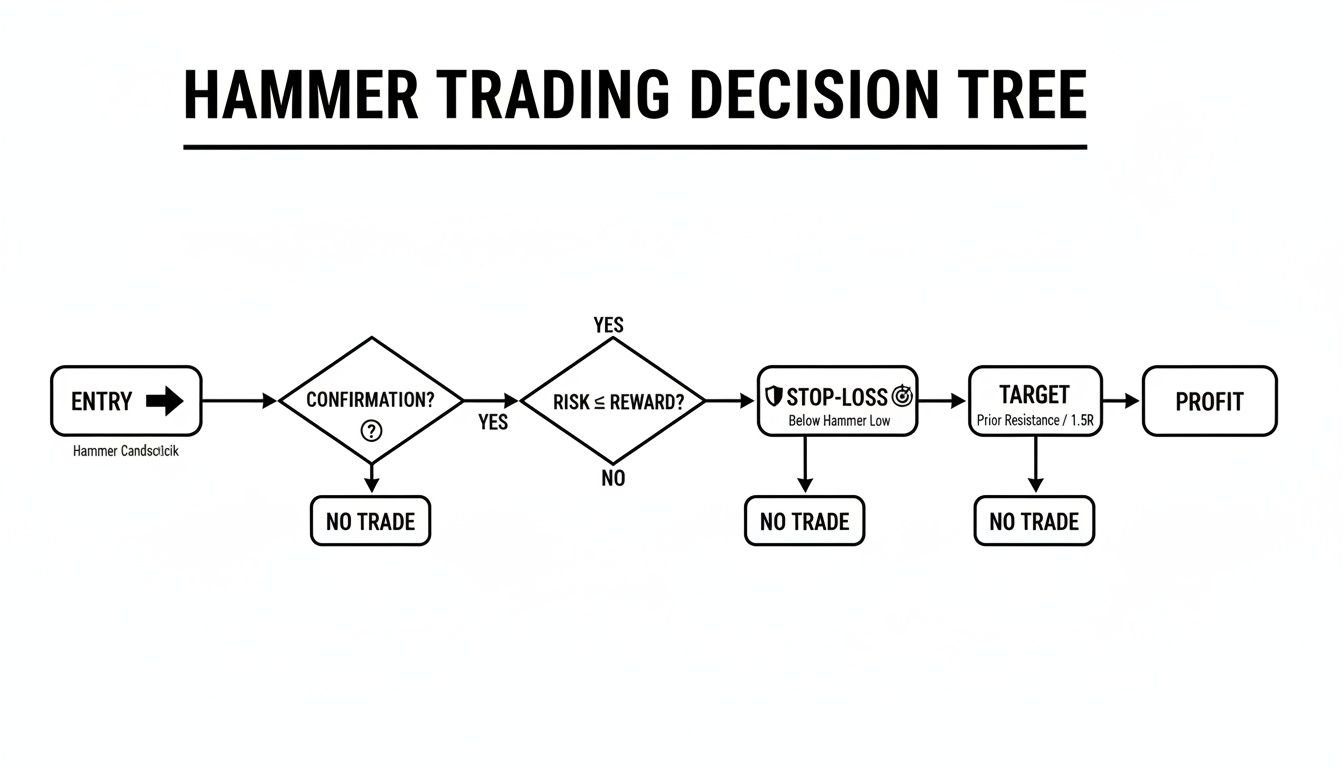

This simple decision tree can help guide your trading process, making sure you have a plan for your entry, stop-loss, and profit targets.

The flowchart lays out a structured approach, ensuring you have a clear plan from the moment you enter to the moment you exit.

Mistake 2: Disregarding the Timeframe

Not all timeframes are created equal. A pattern that looks promising on a daily chart might be completely unreliable on a 5-minute chart. The dependability of the inverted hammer candle pattern can shift dramatically depending on the timeframe you’re trading.

Lower timeframes are naturally noisier. You’ll see more patterns, but a huge chunk of them will be false signals. Higher timeframes, like the 4-hour or daily charts, tend to produce more reliable signals because they represent a much bigger, more significant battle between buyers and sellers.

Forex-specific research really drives this point home. One study on major currency pairs found that on a 30-minute chart, an inverted hammer led to a bullish reversal about 52.9% of the time. But on the 4-hour chart, the same pattern was surprisingly linked to a bearish continuation 52.9% of the time, completely flipping its traditional meaning. You can read more about these forex candlestick findings to see just how much timeframe can alter a pattern’s behavior.

Mistake 3: Confusing It with a Shooting Star

This is a classic case of mistaken identity. An inverted hammer looks identical to a shooting star candle — they both have a small body at the bottom and a long upper wick. So, what’s the difference?

It all comes down to one thing: location.

- Inverted Hammer: A bullish reversal signal that appears at the bottom of a downtrend.

- Shooting Star: A bearish reversal signal that appears at the top of an uptrend.

Mixing these two up is a catastrophic error. If you act on what you think is an inverted hammer during an uptrend, you’re trying to buy right at a potential market top, just as sellers are gearing up to take control. This mistake highlights why context is everything. Always, always confirm the preceding trend before you decide what a candle is telling you.

Using a Journal to Refine Your Strategy

Here’s a hard truth: no single pattern will make you a profitable trader overnight. Real, lasting progress comes from systematically tracking and analyzing your own performance. To truly master the inverted hammer candle pattern, you need to build a strategy based on data from your own trades — and a trading journal is your number one tool for the job.

Without one, you’re just trading based on memory and gut feelings, which is a perfect recipe for inconsistent results. Meticulously logging every trade helps you shift from guessing to building a genuine, data-driven edge. It’s not optional; understanding why every trader needs a trading journal is the first real step toward treating your trading like a business.

How to Systematically Log Your Trades

An effective journal is more than just a list of entry and exit prices. The real magic happens when you capture the context surrounding each trade. For every inverted hammer setup you take, you need to log specific, searchable details.

Using a platform like TradeReview, you can use flexible tags to turn your trade history into a powerful, personal database. This lets you slice and dice your performance with incredible precision.

- Pattern Tag: At a minimum, always tag the trade with “Inverted Hammer.”

- Context Tags: This is where you add the color. Use tags like “At Support,” “High Volume Confirmation,” or “RSI Divergence” to describe the setup.

- Asset Tags: Note the specific stock, crypto, or forex pair you traded, like “AAPL” or “EUR/USD.”

This simple habit transforms your journal from a dusty old notebook into a personal analytics engine.

Turning Your Data into Actionable Insights

Once you’ve logged around 50-100 trades, you’ll have a solid dataset to work with. Now you can start asking the tough questions that your memory and emotions could never answer objectively.

This data-driven feedback loop is what separates guesswork from building a personalized, sustainable edge in the market. It allows you to discover what truly works for you.

With this data, you can finally get clear answers to crucial strategy questions:

- What’s my actual win rate when I trade the inverted hammer?

- Does my performance get better when the pattern forms at a key support level?

- Which specific assets seem to respond best to this signal for me?

Studies from trusted sources provide benchmarks for pattern performance. For example, some analyses suggest that when an inverted hammer is combined with other confirming factors like volume and support, its performance improves. You can even learn more about candlestick pattern rankings to see how it stacks up. By tagging and analyzing your trades, you can discover which specific combinations get your results closer to that benchmark, letting you fine-tune your strategy with cold, hard data.

Got Questions? Let’s Clear Things Up

Even with a clear strategy in hand, questions always pop up when you’re staring at a live chart. Let’s tackle some of the most common ones traders ask about the inverted hammer candle pattern so you can act with confidence when you see it.

What’s the Difference Between an Inverted Hammer and a Shooting Star?

This is easily the most frequent point of confusion, and the answer is simple: it’s all about location.

Visually, these two patterns are identical. Both have a small body at the bottom and a long wick sticking straight up. But their meaning is the complete opposite, and it’s the trend that tells you which one you’re looking at.

- An Inverted Hammer shows up at the bottom of a downtrend and hints at a potential bullish reversal.

- A Shooting Star forms at the top of an uptrend and signals a potential bearish reversal.

That’s it. The trend leading into the candle is the only thing that separates them.

How Reliable Is the Inverted Hammer, Really?

On its own, the inverted hammer is moderately reliable at best. Thinking it’s a guaranteed winner is a classic rookie mistake.

Its true power comes from confirmation and confluence. The pattern becomes much more meaningful when it appears at a major support level, is followed by a strong bullish candle on high volume, or gets a thumbs-up from a bullish divergence on an indicator like the RSI.

Never trade this pattern in isolation. A lonely inverted hammer is just market noise. But a confirmed one at a key level? That’s a high-quality signal worth paying attention to.

Can I Use This Pattern in Any Market or Timeframe?

Absolutely. The pattern shows up everywhere — stocks, forex, crypto — and on every timeframe, from the 1-minute chart to the weekly.

However, its effectiveness isn’t always the same across the board. Some data suggests its behavior can change between lower and higher timeframes, especially in certain markets. This is why you have to backtest it or journal your trades. You need to verify that it actually works for the specific markets and timeframes you trade.

Ready to turn these insights into a data-driven edge? TradeReview provides the tools you need to log, tag, and analyze every inverted hammer trade you take. Stop guessing and start refining your strategy with powerful analytics. Sign up for free today at tradereview.app and discover what your trading data is trying to tell you.