A trader’s daily p l, or daily profit and loss, is simply the net change in your account’s value from the trades you closed out that day. But it’s so much more than just a score. It’s a critical piece of data that gives you a raw, unfiltered look at your strategy and risk management.

Your Daily P&L Is More Than Just a Number

Let’s be honest — the first thing most of us check is our daily P&L. That flash of green or red feels like the final grade on a test, instantly telling you whether you’re a genius or an idiot. We’ve all been there, riding the emotional high of a big win or feeling the gut punch of a nasty drawdown. It’s a natural reaction, but it’s one we must learn to manage.

But treating your daily profit and loss as just a final score is a huge rookie mistake. A professional trader learns to see it completely differently.

Instead of a judgment, your daily P&L is a vital diagnostic tool. It’s an objective mirror reflecting the truth about your trading habits, your discipline, and how well your strategy actually holds up under live-fire conditions.

Shifting from Scorekeeping to Analysis

The real gold isn’t in the P&L number itself, but in the story it tells. When you start consistently tracking it, you arm yourself with the data needed to ask the right questions:

- Emotional Patterns: Do your biggest losses tend to happen right after a big winning day? That’s probably overconfidence creeping in. Do you find yourself taking unplanned “revenge” trades after a losing streak? It’s a common struggle, but recognizing the pattern is the first step to fixing it.

- Strategy Performance: Is your P&L consistently positive during the market open but always gives it back in the afternoon? Your strategy might be best suited for specific times of the day.

- Risk Management Leaks: Are small, manageable losses frequently snowballing into account-denting disasters? Your stop-loss discipline might need a serious overhaul.

Thinking this way reframes the entire exercise. You stop being reactive and emotional, and you start being proactive and analytical. The focus shifts from the outcome (the money) to the process (the decisions you made that led to that outcome).

A single day’s P&L is just noise. The trend of your daily P&L over weeks and months? That’s the signal. It’s this signal that tells you whether you have a sustainable edge or if you’re just gambling.

This mindset shift is absolutely crucial for long-term survival in the markets. It’s about detaching your self-worth from any single day’s results and using that data as a foundation for real improvement. By viewing each daily P&L as a feedback loop, you gain the clarity to spot bad habits, refine your edge, and build the disciplined mindset of a pro.

How to Accurately Calculate Your Daily P&L

Before you can analyze anything, you have to trust your numbers. An inaccurate daily P&L calculation is worse than useless — it gives you a false sense of security or, even worse, unnecessary panic. Getting a true picture of your results is the bedrock of building long-term consistency.

The whole process starts with understanding the two core components of your P&L: realized and unrealized. Most traders know these terms, but the distinction is absolutely critical for keeping a clear head during the trading day.

Realized vs. Unrealized P&L: A Quick Comparison

Think of realized P&L as money in the bank. It’s the concrete profit or loss from trades you have officially closed out.

Unrealized P&L, on the other hand, is the potential profit or loss on your open positions. It’s a floating number that changes with every single tick of the market. Here’s a simple way to think about it:

| Attribute | Realized P&L | Unrealized P&L |

|---|---|---|

| Trade Status | Locked in from closed trades. | Fluctuates with open trades. |

| Impact on Account | Directly affects your cash balance. | Reflects potential but isn’t final yet. |

| Emotional Focus | Should be used for historical analysis. | Can cause anxiety if watched too closely. |

It’s incredibly tempting to get emotionally attached to those big, green unrealized gains, but they aren’t yours until you close the trade. Real discipline means focusing on your trade management plan, not getting mesmerized by the flickering P&L of an open position.

Going Beyond Gross Profit

Here’s where so many new traders make a critical mistake. They see a trade close for a $100 gain and immediately log “+$100” in their journal. But that’s just the gross profit. Your net P&L — the number that actually matters — has to account for the costs of doing business.

These often-ignored costs can silently eat away at your returns over time. They include:

- Commissions: The fee your broker charges for executing a trade.

- Exchange Fees: Tiny charges from the exchanges for routing your order.

- Overnight Financing (Swaps): Costs for holding leveraged positions overnight.

These small deductions really add up. A strategy that looks profitable on paper can quickly become a losing one once you factor in all the associated costs. Neglecting them is like trying to run a business without tracking expenses; you’re just operating blind.

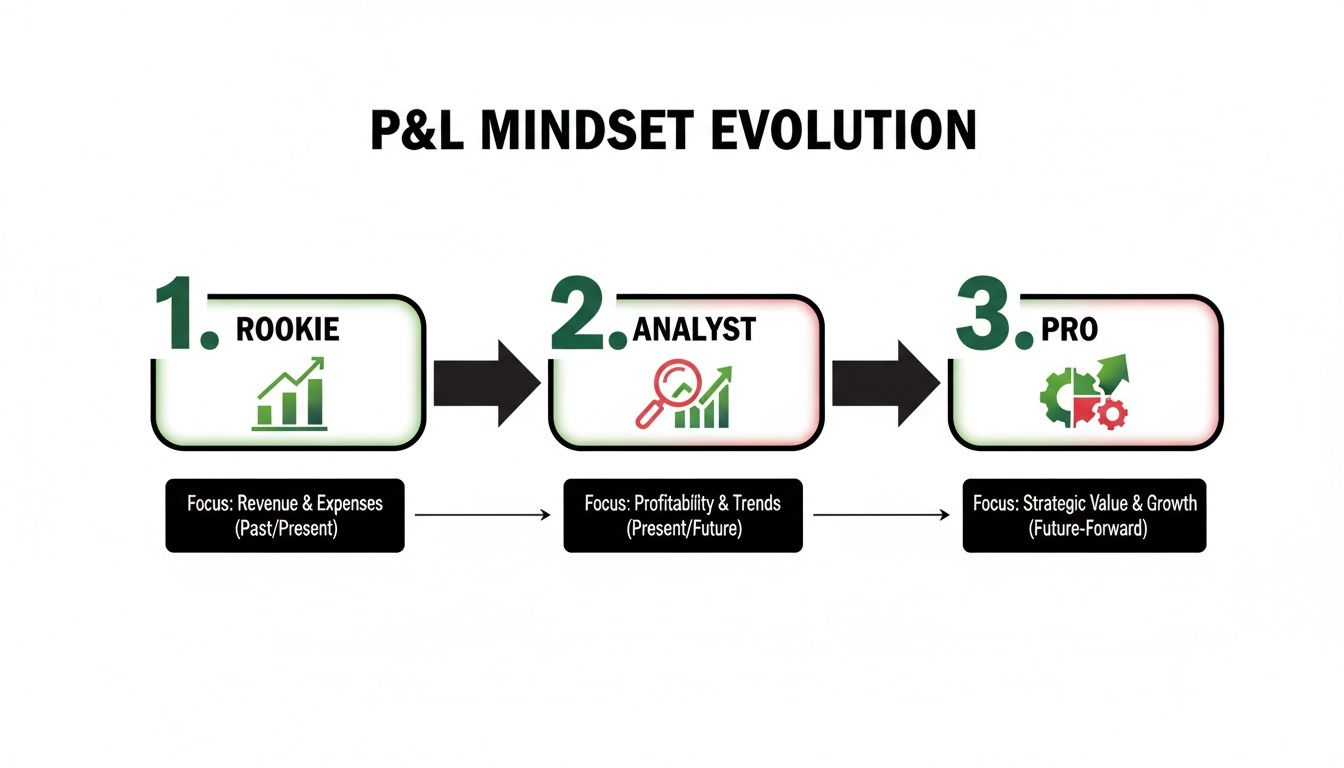

The infographic below perfectly illustrates the mindset shift from just looking at P&L to truly analyzing it.

This visual shows the evolution from a “Rookie” who only sees wins and losses to a “Pro” who uses P&L as a diagnostic tool for much deeper analysis.

A Practical Example of Net Daily P&L Calculation

Let’s walk through a realistic day trading scenario to see how this plays out. Imagine you’re trading shares of Company XYZ.

Trade 1:

You buy 100 shares of XYZ at $50.00 per share.

You later sell all 100 shares at $50.75.

- Gross Profit: ($50.75 – $50.00) x 100 shares = +$75.00

Trade 2:

You buy 50 shares of XYZ at $51.00.

The trade moves against you, and you sell all 50 shares at $50.60.

- Gross Loss: ($50.60 – $51.00) x 50 shares = -$20.00

Your total gross P&L for the day is $75.00 – $20.00 = $55.00. Great, but we’re not done yet. Let’s add the costs. We’ll assume your broker charges a commission of $1 per trade (the entry and exit each count as one trade).

- Total Commissions: 4 trades (buy/sell for Trade 1, buy/sell for Trade 2) x $1.00 = $4.00

Now we can finally calculate the true net daily P&L.

Net Daily P&L = Gross P&L – Total Costs

Net Daily P&L = $55.00 – $4.00 = $51.00

This might seem like a small difference, but for active traders firing off dozens of trades a day, these costs can easily be the difference between a profitable month and a losing one. For a deeper dive, our complete guide on calculating trading profit breaks down even more complex scenarios involving various fees and asset classes.

Mastering this calculation is a non-negotiable first step. It ensures the data you log is accurate, which is the foundation for all the powerful analysis you’ll do later to refine your strategy and improve your discipline. Without this foundational accuracy, any insights you draw from your journal will be built on shaky ground.

Understanding How Market Volume Impacts Your P&L

Your daily P&L doesn’t happen in a vacuum. It’s a direct reaction to the massive, relentless flood of orders that defines today’s markets. For any active trader, grasping the link between your personal performance and the wider market structure isn’t just a “nice-to-know” — it’s a core survival skill.

Too many traders fall into the trap of seeing their results as a pure reflection of their own genius or, worse, their own failures. While your strategy and discipline are absolutely critical, the environment you’re trading in plays a massive role. It’s like being a surfer: you can have perfect technique, but if the ocean is flat, you’re not going anywhere. On the flip side, a monster wave can toss even the best surfer around.

The sheer volume of trading in modern markets creates the volatility — the waves — that drives every single P&L swing you experience.

The Era of Hyper-Volume and Intraday Swings

Nowhere is this more obvious than in super-liquid products like index options. The volume of contracts changing hands every second is so immense that a position can whip from green to red and back again in minutes. This isn’t just random noise; it’s the collective footprint of millions of market participants expressing their views all at once.

This hyper-active environment is fueled by an explosion in short-term trading products. More and more, your daily P&L is being shaped by colossal intraday order flow. Just look at the numbers: according to a 2023 report from Cboe Global Markets, their options exchanges processed an average daily volume (ADV) of 18.4 million contracts. A huge chunk of that came from the rise of 0DTE (zero-days-to-expiry) S&P 500 options, which saw about 2.6 million SPX 0DTE contracts traded daily. For active traders, this extreme volume means P&L can swing wildly multiple times in a single session. You can dig into the specifics in Cboe’s full 2023 volume report.

Understanding this context is vital. It helps explain why your P&L can feel so chaotic and why tracking every detail is the only way to separate a genuine edge from just getting lucky.

Why Context Is Your Most Powerful Tool

Acknowledging the market’s power isn’t an excuse for a bad trade. It’s a call to become a smarter, more aware trader. When you start connecting your P&L to specific market conditions, you unlock a whole new level of analysis.

Your trading journal should do more than just record entries and exits. It should be a log of the market environment itself. Was volume high or low? Was volatility expanding or contracting? Was there a major news event?

Without this context, your data is incomplete. You might ditch a solid strategy after a few losses, when the real problem was that it just doesn’t work in low-volume, choppy markets. Or, you might think you’ve struck gold after a winning streak, failing to see it only performs during strong, high-volume trends.

Here’s how you can start connecting the dots:

- Tag Your Trades: As you log trades, add tags for the market environment. Think “High Volume Open,” “Low Volume Lunch,” or “Post-Fed Announcement.”

- Note Volatility: Get in the habit of checking the VIX or other volatility gauges. Was the market calm or panicky when you took your best trades?

- Track by Product: If you trade different things, analyze them separately. Your daily P&L from 0DTE options will have a totally different volatility profile than P&L from your longer-term stock positions.

This approach turns your journal from a simple receipt book into a powerful analytical tool. It helps you see which market conditions favor your style and — just as important — which ones you should probably sit out. That discipline, knowing when not to trade, is often what separates consistently profitable traders from those stuck on a P&L rollercoaster. Building this awareness is a crucial step toward long-term, sustainable performance.

Moving From Manual Spreadsheets to Automated Journals

Manually calculating your daily P&L is a fantastic place to start. It forces you to get your hands dirty and truly understand the mechanics of your performance, from gross profits right down to those pesky commissions that seem to multiply out of nowhere. Many disciplined traders I know began their careers with a simple spreadsheet — it’s a rite of passage that builds a solid foundation.

But as you start trading more actively, you’ll quickly run into the limits of doing everything by hand. What begins as a simple end-of-day task can balloon into a time-consuming chore, especially if you’re ripping off multiple trades a day. This is where a lot of traders hit a wall, and the discipline of logging every single trade starts to feel like a massive burden.

The Honest Truth About Spreadsheets

We’ve all been there. You promise yourself you’ll update the spreadsheet right after the market closes, but then life happens. A few days slip by, and suddenly you’re staring at a mountain of trade data that needs to be entered.

The reality is, for an active trader, manual spreadsheets have some serious drawbacks:

- They are incredibly time-consuming. Every single entry, exit, commission, and fee has to be typed in by hand. That’s time you could be spending reviewing charts, refining your strategy, or just stepping away to recharge.

- They are prone to human error. A simple typo — an extra zero here, a misplaced decimal there — can completely throw off your P&L data. These small mistakes can lead you to draw dangerously wrong conclusions about your performance.

- They are a nightmare to scale. Managing a spreadsheet with a few dozen trades is one thing. Trying to keep one with hundreds or thousands of trades is a recipe for frustration and, eventually, giving up altogether.

The goal of a trading journal isn’t just to record numbers; it’s to free up your mental energy so you can focus on analysis and improvement. If the logging process itself is causing stress, it’s defeating the whole purpose.

This frustration is a common experience, but it’s also a good sign. It means your trading is evolving. You’re ready to move past basic data entry and into genuine performance analysis, which calls for more powerful and efficient tools.

The Power of Automation with Broker Sync

This is where dedicated trading journals completely change the game. Modern platforms are built to solve the very problems that make spreadsheets so clunky. The single most impactful feature they bring to the table is automatic broker synchronization.

Instead of typing everything in, you just connect your brokerage account to the journal through a secure link. The platform then automatically imports all your trading activity — every buy, every sell, and every associated cost — with 100% accuracy.

This isn’t just a convenience; it’s a fundamental shift in how you run your trading business. For instance, a journal like TradeReview can connect with a huge range of brokers to pull in your data automatically, saving you from the headache of manual entry.

Freeing Your Mind to Focus on What Matters

The real benefit of automation is the time it gives back to you. When you’re no longer bogged down by the tedious task of data entry, you can invest that time and mental bandwidth where it truly counts:

- Objective Analysis: With a complete and accurate dataset at your fingertips, you can start asking the important questions. Which of my setups are actually making money? What time of day do I consistently take my biggest losses?

- Pattern Recognition: Automated journals can instantly create charts and reports that would take hours to build in a spreadsheet. This makes it far easier to spot recurring patterns in your trading behavior, both the good and the bad.

- Reduced Friction: By removing the biggest roadblock to consistent journaling — the manual labor — you are far more likely to stick with the habit for the long haul.

Ultimately, making the switch to an automated journal is about efficiency. It allows you to spend less time working in your trading business (doing admin tasks) and more time working on your trading business (refining your strategy, psychology, and risk management).

If you want to see how this works, you can explore the benefits of a free trading journal app to see how automation can fit into your workflow without any upfront cost. This one move can be one of the most significant upgrades you make to your entire trading process.

Turning Raw P&L Data Into Actionable Insights

Having your data synced up and accurate is a great first step, but the numbers alone won’t make you a better trader. The real magic happens when you turn that raw data into a clear picture of your actual trading behavior. This is where visualization steps in, transforming your daily P&L from just a number into a powerful roadmap for improvement.

The whole process starts with the single most important chart for any trader: the equity curve. It’s a simple line graph that plots your account balance over time, but its shape tells a profound story about your trading. Is it choppy and volatile with scary drawdowns? That suggests inconsistent risk-taking. Or is it a smooth, steadily rising curve? That’s the hallmark of a disciplined trader with a real edge.

We’ve all felt the sting of a deep drawdown. Looking at your equity curve forces you to face that reality objectively, which helps you maintain a long-term perspective instead of getting lost in the emotional rollercoaster of a single day. It makes you ask tough questions about your risk management and position sizing.

Uncovering Hidden Patterns in Your P&L Data

Beyond the equity curve, other visual tools can help you dig deeper to find the subtle patterns that are secretly driving your profitability. Your trading history is a goldmine of information, but you need the right tools to pull out the good stuff.

Two really powerful methods are performance calendars and P&L heatmaps. These tools lay out your trading results in a way that makes it dead simple to spot recurring trends tied to specific times.

- Performance Calendars: Picture a calendar where every day is colored green for a profit or red for a loss, with the shade getting darker based on the size of the move. At a glance, you can see if you tend to have “red weeks” or if Tuesdays are consistently your best days.

- P&L Heatmaps: These take it a step further, breaking down your performance by the day of the week and the time of day. This can reveal shockingly specific patterns you’d never notice otherwise.

The goal is to move beyond asking “Did I make money today?” to asking “Why did I make or lose money today?” Visualization provides the clues to answer that crucial second question.

This deeper level of analysis can lead to some game-changing realizations about your trading habits.

Turning Visuals Into Actionable Steps

Let’s walk through a practical scenario. A trader pulls up their P&L heatmap and sees a glaring block of red squares every Friday afternoon. The data is crystal clear: they consistently give back their weekly profits in the final few hours of the trading week.

So, what could be happening here?

- Fatigue: After a long week of staring at charts, their decision-making is probably shot.

- FOMO: They might be trying to squeeze out one last trade before the weekend, leading to impulsive, low-quality setups.

- Market Dynamics: The market often behaves differently on Friday afternoons as big players close out positions, which might not suit their strategy at all.

Armed with this visual evidence, the trader can now take specific, actionable steps. They might decide to just stop trading after 12 PM on Fridays or cut their position size way down during that period. This is how raw daily P&L data becomes a tool for real improvement. Building custom reports to find these insights is incredibly powerful; for those who know their way around a spreadsheet, learning how to build a pivot table can be a great way to start slicing your data in new ways.

Ultimately, by visualizing your trading history, you’re transforming it from a simple record of wins and losses into your greatest learning asset. You’re no longer guessing about your weaknesses — you’re seeing them in black and white (or red and green), giving you the clarity needed to finally fix them.

Avoiding Common Pitfalls for Long-Term Success

Analyzing your daily P&L is a technical skill. Surviving the daily P&L rollercoaster? That’s a psychological one.

We’ve all been there — feeling invincible after a string of green days or desperately trying to “make it all back” after one bad trade blows a hole in our account. These emotional reactions are totally normal, but acting on them is what separates the amateurs from the pros.

This isn’t about some magic formula that promises easy profits. It’s about building the emotional resilience and disciplined mindset you need to navigate the inevitable ups and downs of trading. Success isn’t measured by a single winning day; it’s measured by your ability to stay in the game long enough for your edge to actually play out.

From Emotional Reactions to Disciplined Responses

The two most dangerous traps in trading are greed after a win and fear after a loss. It’s a classic setup. Overconfidence from a big win can lead you to take on way too much risk and toss your rules out the window. On the flip side, “revenge trading” is that frantic attempt to erase a loss, which almost always ends up making it much, much worse.

Both are driven purely by emotion, not strategy.

To counter these destructive impulses, you have to build a system of rules that protects you from your worst self. Think of these rules as non-negotiable guardrails for your trading day.

Here are a few practical strategies to help you stay grounded:

- Set a Hard Daily Max Loss: This is your line in the sand. Decide on a maximum dollar amount or percentage of your account you’re willing to lose in a single day. Once you hit it, you are done. No exceptions. This one rule can literally save your entire trading career.

- Celebrate the Process, Not the P&L: Did you follow your plan perfectly? Manage risk correctly? Execute without hesitation? That’s a successful day, even if the P&L is red. Shift your focus from the monetary outcome to the quality of your execution.

- Conduct Objective Weekly Reviews: Step away from the daily noise. Once a week, review your P&L, but more importantly, review your decisions. This distance helps you analyze your behavior without the emotional charge of the live market.

Trading is a business of probabilities, not certainties. Your job is not to be right on every trade but to manage risk and execute your plan flawlessly over and over again. Your P&L is the byproduct of that discipline.

Treating Trading Like a Business

Ultimately, long-term success comes from treating trading as a serious business, not a get-rich-quick scheme.

A business owner doesn’t panic after one bad day of sales; they analyze the data, review their processes, and stick to their business plan. You need to do the same.

Your daily P&L is just one data point in a long career. By setting hard rules, focusing on disciplined execution, and maintaining a long-term perspective, you build the foundation needed to weather any market storm and achieve lasting success.

Your Top P&L Questions, Answered

Let’s tackle some of the most common questions traders have about their daily performance.

How Often Should I Be Checking My P&L During the Day?

This is a big one. Staring at your P&L tick-by-tick is a recipe for emotional decision-making. It tempts you to snatch profits too early from a good trade or stubbornly hold a loser hoping it turns around.

The best approach? Focus on executing your plan, not the floating dollar amount. Many disciplined traders I know only do a full review of their daily p l after the market closes. This gives them a chance to analyze their performance objectively, away from the heat of the moment.

What’s a Realistic Daily P&L Target?

It’s tempting to aim for a specific dollar amount each day, but that often leads to forcing trades that aren’t there. A much healthier and more sustainable goal is to focus on your process.

Aim for flawless execution of your strategy. Stick to your risk rules, like risking no more than 1% of your account on any single trade. True, lasting profitability is a byproduct of rock-solid discipline, not the primary daily target itself.

Your P&L is an outcome of good decisions. Focus on making good decisions, and the P&L will eventually follow. It’s a subtle but powerful shift in mindset that promotes long-term thinking over short-term gratification.

My Daily P&L Is All Over the Place. What Should I Do?

A rollercoaster P&L is almost always a symptom of inconsistent risk management or erratic position sizing. Your trading journal is your best friend here.

Pull up your biggest winning and losing days. Ask yourself honestly: were you following your rules on both? Smoothing out your equity curve starts with standardizing your risk on every trade and cutting out those “home run” swings that usually end up causing major drawdowns.

Stop guessing and start analyzing. TradeReview automatically syncs your trades, visualizes your performance, and gives you the data-driven insights needed to build discipline and refine your edge. Sign up for free at https://tradereview.app.