Ever had a trading idea that felt like a sure thing, only to watch it fall flat in the live market? It’s a gut-wrenching experience, and a painfully common one for traders. Backtesting is the disciplined process that separates hopeful guesses from data-driven strategies.

Simply put, backtesting is the practice of testing a trading idea on historical data to see how it would have performed. It’s your chance to simulate your strategy — without risking a single dollar — to see if that brilliant idea actually had an edge.

Why Backtesting Matters for Every Trader

Think of it like a pro sports team reviewing hours of game tape. They don’t just watch the epic wins; they dissect every single play to understand what works, what doesn’t, and why. They’re looking for patterns, weaknesses, and opportunities to sharpen their execution for the next game.

For a trader, backtesting is that game tape review. Instead of deploying real capital on an unproven concept, you get to simulate its performance across months, or even years, of market history. The result is pure, objective feedback on your strategy’s potential. It helps answer the critical question: “Does this idea have a real, statistical edge, or was I just lucky?”

From a Vague Idea to a Testable System

We’ve all been there. You’re staring at a chart, a pattern clicks, and you have that “lightbulb moment” — “If I just buy every time the RSI is oversold and the price is above the 200-day moving average, I’ll clean up!”

Backtesting forces you to move beyond that hunch. It demands that you define concrete, non-negotiable rules for every action you take. This process turns a subjective idea into a testable, mechanical system by forcing you to specify:

- Entry Signals: What exact conditions must be met to open a trade? For example, “The 20-period EMA must cross above the 50-period EMA on the 1-hour chart.”

- Exit Signals: When do you take profit or, just as importantly, cut a loss? For example, “Place a stop-loss at 2% below the entry price and a take-profit target at a 3:1 risk/reward ratio.”

- Risk Management: How much are you risking per trade? What’s your position size? For example, “Risk no more than 1% of the total account balance on any single trade.”

By simulating these rules, you start uncovering the real story. Does the strategy actually have a positive expectancy? How does it hold up in a brutal bear market versus a raging bull market? And what’s the longest, most painful losing streak you might have to survive? Answering these questions is key to long-term thinking.

A backtest is so much more than a final profit and loss number. It’s a detailed report card on your strategy’s personality. It reveals not just the potential rewards but also the psychological gauntlet — like deep drawdowns and losing streaks — that you must be ready to endure to reap those rewards.

Building Confidence with Data

Ultimately, the goal of backtesting is to build unshakable confidence in your approach before your money is on the line. A big part of that is ensuring your results are actually meaningful.

Many traders agree that a backtest should include at least 100-200 trades to be considered statistically significant, though more is always better. However, it’s just as crucial to test across different market conditions (bull, bear, and sideways markets) to prove your strategy isn’t just a one-trick pony. You can find more great insights on sample size over at Financial Modeling Prep.

Answering these tough questions with historical data is what builds the discipline needed for long-term success. It’s about replacing hope with evidence.

Key Components of a Backtest at a Glance

This table breaks down the essential elements required to run a meaningful backtest, giving you a quick reference guide.

| Component | Description | Why It’s Important |

|---|---|---|

| Trading Strategy | The set of objective rules defining entry, exit, and risk management. | This is the “what” you are testing. Without clear rules, the test is meaningless. |

| Historical Data | Past price and volume data for the asset(s) you’re trading. | The “game tape” for your simulation. The quality and timeframe of data are critical. |

| Backtesting Engine | The software or platform that runs your strategy against the historical data. | This is the simulator that executes your rules and crunches the numbers for you. |

| Performance Metrics | The statistics used to evaluate the results (e.g., net profit, drawdown). | These metrics tell you if the strategy is viable and suited to your risk tolerance. |

With these components in place, you have a framework for turning an idea into an evidence-backed trading system.

The Two Pillars of a Reliable Backtest

A backtest is only as good as its ingredients. No amount of fancy analysis can save a test that’s built on a shaky foundation. To get results you can actually trust, you need to nail two fundamental pillars: your historical data and your trading hypothesis.

Think of it like building a house. Your data is the concrete foundation, and your hypothesis is the architectural blueprint. If either one is flawed, the whole structure is compromised, no matter how good the rest of it looks.

Pillar 1: High-Quality Historical Data

The first and most critical pillar is the data itself. Using incomplete or bad data is like trying to navigate with a faulty map — it’s guaranteed to lead you to the wrong conclusions. Your data has to be clean, accurate, and free from common errors.

This means you need to be on the lookout for nasty issues like:

- Survivor Bias: A classic trap. It happens when your dataset only includes assets that “survived” over the test period. For example, a stock index dataset that leaves out all the companies that went bankrupt will paint an overly rosy picture of market returns.

- Data Gaps: Missing price data for certain periods can throw everything off. Your backtesting engine might skip trades entirely or miscalculate performance, completely skewing your results.

- Inaccurate Prices: Even small errors in the open, high, low, or close prices can invalidate your strategy’s signals and render the whole test useless.

The granularity of your data also matters immensely. End-of-day data only gives you the closing price, which is rarely enough for strategies that trade during the day. Intraday data (like 1-minute or 5-minute bars) offers more detail, but tick data — which records every single transaction — is the gold standard for high-fidelity testing.

The precision of your data is non-negotiable. Research from the London Stock Exchange Group highlights that high-frequency data is beneficial even for daily strategies, as it allows for more realistic simulations of trade execution. You can explore more about the impact of data quality on backtesting at LSEG.

Pillar 2: A Rock-Solid, Testable Hypothesis

The second pillar is about transforming a vague trading idea into a precise, testable set of rules. An idea like “buy the dip” isn’t a strategy; it’s a starting point. A backtest demands absolute clarity.

Let’s turn “buy the dip” into a specific, mechanical hypothesis for an S&P 500 ETF using a simple moving average (SMA) crossover system. A testable hypothesis would look like this:

- Asset: SPDR S&P 500 ETF (SPY)

- Timeframe: Daily chart

- Data Range: January 1, 2010, to December 31, 2020

- Entry Rule: Buy one unit when the 50-day SMA crosses above the 200-day SMA.

- Exit Rule: Sell the position when the 50-day SMA crosses back below the 200-day SMA.

- Risk Management: This initial test will not account for commissions or taxes.

This level of detail removes all ambiguity. The rules are so clear that a computer could execute them flawlessly without any human discretion. This discipline is essential for producing objective, repeatable results and helps you understand critical factors like what slippage in trading is and how it might impact your live performance.

Without this rigor, you’re not really backtesting. You’re just curve-fitting and setting yourself up for disappointment down the road.

Choosing Your Backtesting Methodology

Just like there are different ways to train for a marathon, there are several ways to run a backtest. Some methods are quick sprints to see if an idea has legs, while others are grueling endurance tests designed for maximum rigor. Picking the right approach is everything when it comes to understanding how your strategy might actually hold up when real money is on the line.

The most common starting point is a basic in-sample backtest. This is where you test your strategy’s rules on one continuous chunk of historical data. For instance, you might test a moving average crossover system on S&P 500 data from 2015 to 2020. It’s a fantastic way to do a quick sanity check and see if an idea has any potential at all.

But this simple approach has a massive blind spot. A strategy can look amazing on a specific dataset purely by chance, a trap we call overfitting. Think of it like a student who crams for a test by memorizing the answers on a practice exam — they ace the practice test but completely fail when faced with new questions. The strategy knows the past perfectly but is totally unprepared for the future.

Moving to a More Robust Method

To build strategies that can actually weather changing markets, professionals use a much more advanced technique: walk-forward analysis. This method does a far better job of mimicking how trading works in the real world.

Instead of one long, simple test, walk-forward analysis breaks the historical data into smaller segments. It’s a rinse-and-repeat process:

- Optimization Period: First, the strategy’s parameters are tuned on an initial data set (let’s say, two years of data).

- Testing Period: The optimized strategy is then tested on the next block of “out-of-sample” data it has never seen before (for example, the following six months).

- Repeat: The window then “walks forward,” sliding along the timeline to repeat the process over and over again.

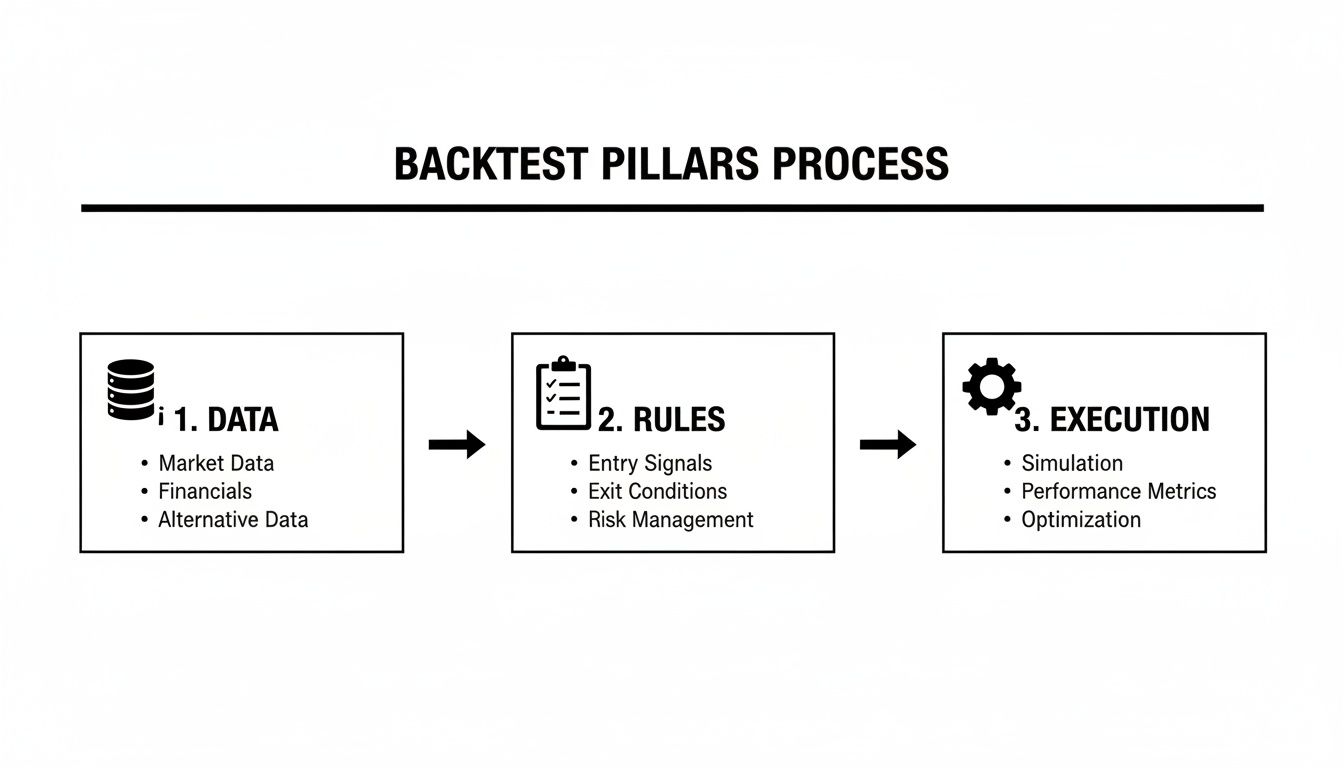

This infographic breaks down the core pillars that every backtest, no matter the method, needs to stand on.

It all starts with solid data and clear rules before you even think about putting a strategy through its paces.

By constantly testing on unseen data, walk-forward analysis gives you a much more honest assessment of a strategy’s robustness. It helps you avoid the false confidence that comes from overfitting.

Walk-forward backtesting is widely considered the gold standard in serious financial analysis today. It simulates how a portfolio would be managed in live conditions, with strategies adapting as new market data rolls in.

This disciplined approach is absolutely essential, and having the right backtesting software can make implementing these advanced methods much, much easier.

Reading the Story Behind Your Backtest Results

Once your backtesting engine crunches the numbers, it spits out a report. It’s tempting to just scan for the total profit and call it a day, but that single figure is just the headline. The real story — the juicy details — is buried in the performance metrics.

Learning to interpret these numbers is what separates disciplined traders from gamblers just chasing a lucky streak. They don’t just tell you if a strategy made money; they reveal its personality. Is it a steady, reliable performer, or a wild, stomach-churning rollercoaster?

Answering that is critical because a profitable strategy you can’t emotionally handle is a useless one.

Going Beyond Net Profit

Net profit is the obvious starting point, but it tells you nothing about the journey. A $10,000 profit looks fantastic until you realize you had to stomach a $15,000 drop along the way. That’s why we need to dig into the metrics that paint the complete picture of risk and reward.

Here’s a quick look at the essential numbers that truly define a strategy’s character and help you compare different approaches on a level playing field.

Essential Backtesting Performance Metrics Explained

This table breaks down the key metrics you’ll find in any good backtesting report. Think of it as the spec sheet for your trading strategy.

| Metric | What It Measures | A Good Sign Is… |

|---|---|---|

| Profit Factor | The gross profit from winning trades divided by the gross loss from losing trades. | Anything above 1.0 is profitable. A score of 2.0 or higher is excellent. |

| Win Rate | The percentage of all trades that were profitable. | A high number feels good, but it’s only meaningful when paired with risk/reward. |

| Sharpe Ratio | How much return you get for each unit of risk (volatility) you took on. | Higher is better. A value over 1.0 is generally considered good. |

| Max Drawdown | The largest peak-to-trough drop in your account’s equity during the test period. | A smaller percentage. This should align with your personal risk tolerance. |

Looking at these metrics together gives you a much clearer, more honest view of how a strategy actually behaves in the wild.

The One Metric That Matters Most for Survival

Of all the numbers, Maximum Drawdown is arguably the most important one for real-world trading. This figure represents the single most painful losing streak your strategy endured, measured from its highest point to its lowest.

Why is this so critical? Because your ability to stick with a strategy is directly tied to your ability to survive its worst drawdown. A 50% drawdown means you have to make a 100% return just to get back to where you started.

Imagine logging into your account and seeing half your capital gone. Could you honestly place the next trade with confidence, or would you panic and abandon the system right at its lowest point? Be brutally honest with yourself here.

This metric is your psychological stress test. No matter how profitable a system looks on paper, if its maximum drawdown exceeds your personal pain threshold, you will not be able to trade it successfully in the long run.

Avoiding Common Backtesting Traps and Pitfalls

When a backtest spits out incredible results, it’s easy to get excited. But this is the exact moment when you need to be the most disciplined. So many promising strategies that look perfect on paper completely fall apart in live markets because of hidden flaws in the testing process.

These errors create a false sense of confidence that can lead to real, painful losses.

Truly understanding backtesting means knowing its weaknesses just as well as its strengths. By learning to spot these common traps, you can protect your capital and make sure your results are grounded in reality — not just wishful thinking. Let’s shine a light on the three most dangerous pitfalls you’ll encounter.

The Overfitting Trap

Overfitting is probably the number one dream killer for new traders. This is what happens when you tweak a strategy’s parameters so much that it perfectly matches the historical data you tested it on. Your strategy essentially becomes a “one-trick pony” — it’s flawlessly tuned to the past but completely unprepared for the future.

Imagine you build a strategy with a dozen different indicators and rules. After running hundreds of tests, you finally find that magic combination that would have captured every single major market move over the past five years. The problem? You’ve just curve-fitted the noise; you haven’t actually discovered a true, repeatable edge.

To sidestep this trap, keep your strategies as simple as possible. A great gut check is to test your idea on an “out-of-sample” data period, which is just a chunk of market history the strategy has never seen before. If the performance holds up, you might be onto something.

The Lookahead Bias Flaw

Lookahead bias is a subtle but seriously destructive error. It happens when your backtest accidentally uses information that wouldn’t have been available at the actual time of the trade. It’s like peeking at the answers before taking a test — of course you’re going to get a perfect score.

A classic example is using a day’s closing price to generate a signal to enter a trade on that same day. In the real world, you wouldn’t know the closing price until after the market is shut, making it impossible to act on that information in time.

This bias is painfully easy to introduce but can be incredibly hard to spot. Always ask yourself: “At the exact moment this signal was generated, did I have every single piece of data used to make this decision?” If the answer is no, your backtest is flawed.

To prevent this, you have to be meticulous. Make sure your backtesting platform only uses data that was historically available up to the point of each decision. Double-check that all your signals are calculated using the previous candle’s close or the current candle’s open, never future data.

The Survivorship Bias Illusion

Survivorship bias paints an unrealistically rosy picture by only including the “winners” in your historical data set. For instance, if you run a backtest for a stock strategy on the current components of the S&P 500, you’re completely ignoring all the companies that got delisted over the years due to bankruptcy or poor performance.

Your strategy will naturally look amazing because it was only tested on the companies that were strong enough to survive. This creates a dangerously skewed perspective on how your strategy might actually perform.

The only real way to combat this is by using high-quality, point-in-time historical data. This kind of data includes delisted stocks, ensuring your test reflects the true market landscape — the good, the bad, and the bankrupt.

Connecting Your Backtest to a Live Trading Journal

A successful backtest isn’t the finish line — it’s the starting gun. Your historical data just told you a story about what could have worked in a perfect, simulated world. But the live market? That’s where your strategy has to prove its mettle. This is where a trading journal becomes the essential bridge between your backtest and reality.

Once you’ve found a promising strategy, the real work begins. Your journal is where you meticulously track every trade you take with that strategy, whether you’re paper trading or dipping your toes in with small, live positions. This isn’t just about logging wins and losses; it’s about building a brand new, real-world dataset.

Comparing Theory to Reality

Think of your journal as the ultimate feedback loop. It lets you stack up your live performance right against your backtested results. Is the real-world equity curve as smooth as you expected? Does that 80% win rate still hold up? What about the profit factor?

The goal is to see if your historical edge actually survives in the wild. The live market is full of nuances like slippage, commissions, and your own trading psychology — factors a simple backtest might have completely missed.

This dashboard view from a trading journal is a perfect example of how you can track real-time performance analytics.

Here, you can instantly see your win rate, average return, and profit factor, which you can then compare directly to what your backtest predicted.

Don’t expect a perfect match — discrepancies are totally normal. Instead, treat it like an investigation. If your live results are falling short, use your journal entries to figure out why. Are you hesitating on entries? Cutting your winners too soon? For a deeper dive into this critical tool, check out our guide on why every trader needs a trading journal.

This disciplined cycle of testing, tracking, and comparing is what allows you to refine your approach with confidence. It’s how you turn a promising backtest into a durable, real-world trading strategy.

Answering Your Backtesting Questions

Once you get the hang of the basics, a few practical questions almost always pop up. Let’s tackle some of the most common ones so you can get started with confidence.

How Much Historical Data Do I Really Need?

The short answer is: it depends entirely on your trading style.

If you’re a day trader taking multiple trades a day, a couple of years of intraday data might be enough to generate hundreds of trades and see how your strategy weathers different short-term market conditions.

But if you’re a swing trader or a long-term investor working off weekly charts, a few years won’t cut it. You’ll need decades of data to see how your strategy handles full-blown economic cycles, including major recessions and bull runs. A good rule of thumb is to aim for a data set large enough to generate at least 100-200 trades and make sure it covers bull markets, bear markets, and those frustrating sideways grinds.

What’s the Difference Between Backtesting and Forward Testing?

They’re two sides of the same coin, each used at a different stage of strategy validation.

- Backtesting is your time machine. You take your strategy and run it on historical data to see how it would have performed in the past. This is your first filter for weeding out bad ideas.

- Forward testing (also called paper trading) is the dress rehearsal. You apply your strategy to the live market, in real-time, but without risking a single dollar. This tells you if your backtested edge actually holds up right now.

The best workflow uses both. First, you backtest to find a strategy that looks promising on paper. Then, you forward test it to make sure it’s not just a fluke of the past before you put real capital on the line.

Can I Backtest a Strategy if I Can’t Code?

Absolutely. You don’t have to be a programming wizard to test your ideas. While coding gives you ultimate flexibility, tons of platforms have user-friendly, built-in backtesting tools.

Platforms like TradingView (which uses a relatively simple language called Pine Script), MetaTrader, and other specialized tools let you build and test strategies with a few clicks. Once you’ve found something that works, a trading journal is the perfect place to track its performance as you start forward testing or trading it live.

Ready to bridge the gap between your backtest and your live P&L? TradeReview gives you the tools to track, analyze, and refine your strategies with real-world data. Start your free trading journal today and see how your backtested edge holds up in the live market. Get started at https://tradereview.app.