Welcome to the world of trading. It’s an exciting, sometimes intimidating space filled with charts, numbers, and endless opportunities. But before you can execute your first trade, you need the right tools — starting with a trading platform. Choosing from the dozens of options can feel overwhelming. Many promise low fees and easy-to-use apps, but what does that actually mean for a beginner who is just trying to learn without making costly mistakes?

This guide cuts through the noise. We’re not just listing the best trading platforms for beginners; we’re breaking them down from a new trader’s perspective to help you find the right fit for your specific needs and goals. For each platform, you will find direct links, screenshots of the interface, and a clear breakdown of pros and cons.

We will look at the features that genuinely matter when you’re starting out, like:

- Paper Trading: Practice your strategies risk-free with virtual money. A practical example would be testing how a simple strategy — like buying a stock when it crosses its 50-day moving average — performs over a few weeks without any financial risk.

- Clear Fee Structures: Understand exactly what you’ll pay so there are no surprises. Trading isn’t about “guaranteed profits,” and unexpected fees can be a frustrating setback.

- Educational Resources: Access tools and content to build your knowledge base.

We’ll also touch on a crucial habit for growth: trade journaling. Understanding how a platform integrates with tools like TradeReview for logging and analysis is a key step in developing disciplined trading habits. Remember, the goal isn’t to find a platform that promises instant success, because none can. The objective is to find one that supports your learning, encourages discipline, and helps you build a solid, long-term foundation for your trading journey.

1. Fidelity Investments

Fidelity stands out as one of the best trading platforms for beginners due to its all-encompassing approach to investing. It pairs a powerful, yet manageable, trading experience with an extensive library of educational resources, making it an ideal starting point for new traders. With no account minimums and a wide range of account types like Roth IRAs, traditional IRAs, and standard brokerage accounts, Fidelity removes common barriers to entry.

New investors can confidently navigate the market with Fidelity’s robust research tools, stock screeners, and in-depth market analysis. The platform’s commitment to education helps users build a solid foundation, moving from basic concepts to more complex strategies at their own pace.

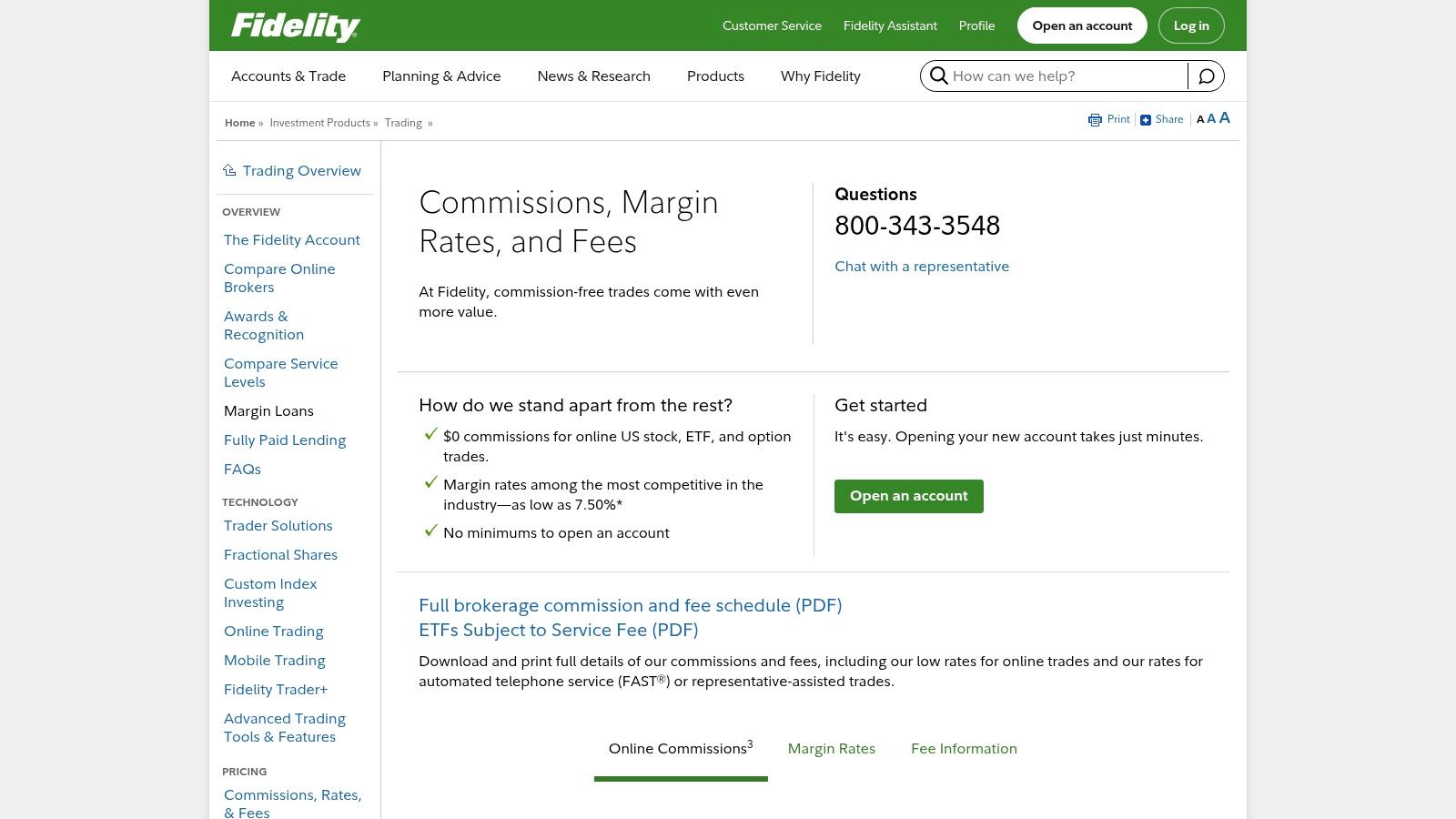

Key Features and Pricing

Fidelity’s pricing structure is exceptionally beginner-friendly. They offer $0 commissions on online U.S. stock and ETF trades, which is a significant advantage for those starting with smaller capital. This transparent model ensures that costs do not eat into potential returns on basic trades. For those venturing into options, the fee is a competitive $0.65 per contract with no base commission. This simple fee schedule allows new traders to focus more on developing their skills and less on navigating complex costs. For those interested in developing their approach, exploring some of the best trading strategies for beginners can be a great next step.

Pros and Cons

-

Pros:

- Transparent Pricing: Zero-commission stock and ETF trades are perfect for new investors.

- Strong Educational Hub: Extensive articles, videos, and webinars to guide beginners.

- Reliable Platform: Known for excellent customer support and platform stability.

-

Cons:

- Higher Options Fees: While competitive, the $0.65 per-contract fee isn’t the absolute lowest available.

- Limited Advanced Products: Access to futures or advanced derivatives is more restricted compared to specialized brokers.

Website: https://www.fidelity.com/commissions

2. Charles Schwab (including thinkorswim)

Charles Schwab offers a powerful combination of beginner-friendly features and professional-grade tools, making it an excellent long-term choice for new investors. Its acquisition of TD Ameritrade brought the acclaimed thinkorswim platform into its ecosystem, giving users access to an industry-leading suite for analysis and trading. With a strong reputation, extensive educational content, and no account minimums, Schwab effectively supports traders from their first investment to more advanced strategies.

The platform is particularly noteworthy for its paperMoney® simulated trading feature within thinkorswim. This allows beginners to practice trading with virtual funds in a real-time market environment without risking any capital. It’s an invaluable tool for building confidence and testing strategies — for example, you could practice placing stop-loss and take-profit orders on a volatile tech stock to see how they execute in live conditions. This makes it one of the best trading platforms for beginners who want to learn by doing.

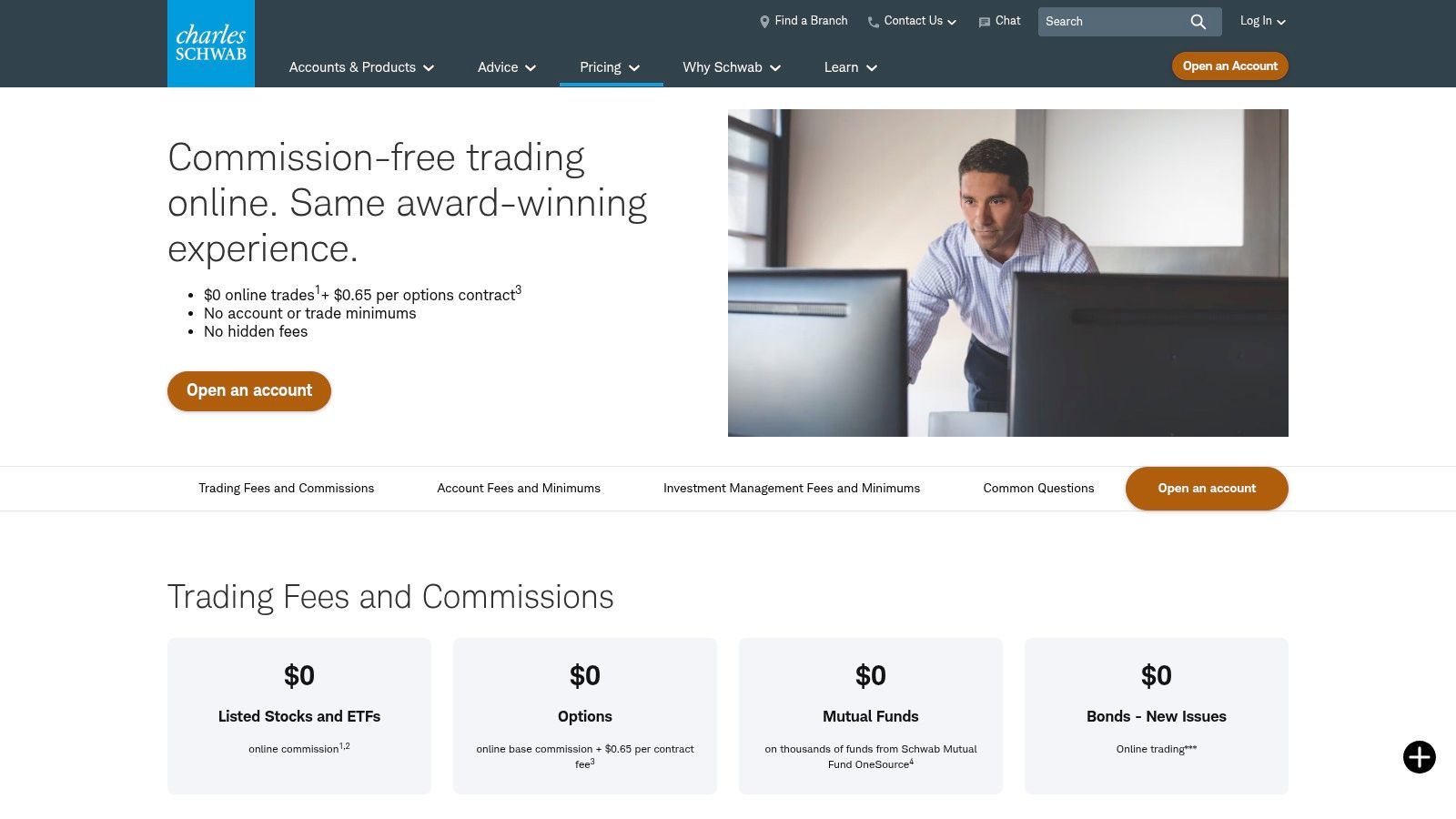

Key Features and Pricing

Schwab’s pricing is straightforward and highly competitive for beginners. The platform charges $0 commission for online U.S. stock and ETF trades, removing a major cost barrier for new investors. This allows you to focus on learning the market instead of worrying about fees on every stock trade. For those looking to explore options, the cost is a standard $0.65 per contract. The real value comes from the free access to the powerful thinkorswim suite (desktop, web, and mobile), which includes elite charting, scanners, and the paperMoney simulator. This blend of low-cost trading and premium tools is a significant advantage.

Pros and Cons

-

Pros:

- Powerful Trading Platform: Free access to the thinkorswim suite and its paperMoney simulator is ideal for practice.

- Extensive Education: Robust library of articles, webcasts, and even in-person branch coaching.

- Zero-Commission Trading: No fees on stock and ETF trades makes it accessible for any budget.

-

Cons:

- Potentially Overwhelming Interface: The depth of thinkorswim can present a steep learning curve for absolute beginners.

- Standard Options Fees: The $0.65 per-contract fee is competitive but not the lowest available.

Website: https://www.schwab.com/pricing?utm_source=openai

3. E*TRADE (from Morgan Stanley)

ETRADE provides a well-rounded experience that makes it one of the best trading platforms for beginners who are curious about growing into more complex strategies, particularly with options. The platform strikes an excellent balance, offering an intuitive interface for newcomers alongside the powerful Power ETRADE platform for those ready to advance. This dual-platform approach ensures that as your skills develop, the tools you need are readily available without feeling overwhelming at the start.

With a strong educational library and a wide selection of account types, E*TRADE supports investors at every stage of their financial journey. The platform’s robust planning tools also help beginners think about long-term goals, encouraging a disciplined approach to building wealth beyond just initial trades.

Key Features and Pricing

ETRADE maintains a competitive and beginner-friendly pricing model with $0 commissions on U.S.-listed stock and ETF trades. This is a critical feature for new traders who want to start investing without worrying about fees eroding their capital. For those interested in options, the standard fee is $0.65 per contract, but this can be reduced to $0.50 for active traders (30+ trades per quarter). This activity-based discount offers a clear path for cost reduction as trading frequency increases. The Power ETRADE platform provides specialized tools that help visualize potential outcomes, making complex options strategies more approachable for those learning the ropes.

Pros and Cons

-

Pros:

- Strong All-Around Platform: Great balance of user-friendly design and advanced analytical tools.

- Active Trader Discounts: Options fees can drop to a competitive $0.50 per contract.

- Excellent for Options: Power E*TRADE is a top-tier tool for new and intermediate options traders.

-

Cons:

- Standard Options Fee: The $0.65 per-contract fee isn’t the lowest available without meeting activity requirements.

- Learning Curve: The advanced features on Power E*TRADE can take some time for a complete beginner to master.

Website: https://us.etrade.com/what-we-offer/investment-choices/options?utm_source=openai

4. Robinhood

Robinhood has become synonymous with accessible trading, making it one of the best trading platforms for beginners thanks to its simplified, mobile-first design. The platform’s core mission is to democratize finance, which it achieves through an exceptionally intuitive interface and a streamlined onboarding process that allows users to start trading within minutes. It is designed specifically for those who may feel intimidated by traditional brokerage platforms.

This app-centric approach is perfect for new investors who prefer managing their portfolio on the go. Robinhood offers stocks, ETFs, options, and even some futures, providing a solid range of products for beginners to explore as they build their market knowledge. The in-app educational resources are a key benefit, helping users grasp fundamental concepts directly within the trading environment.

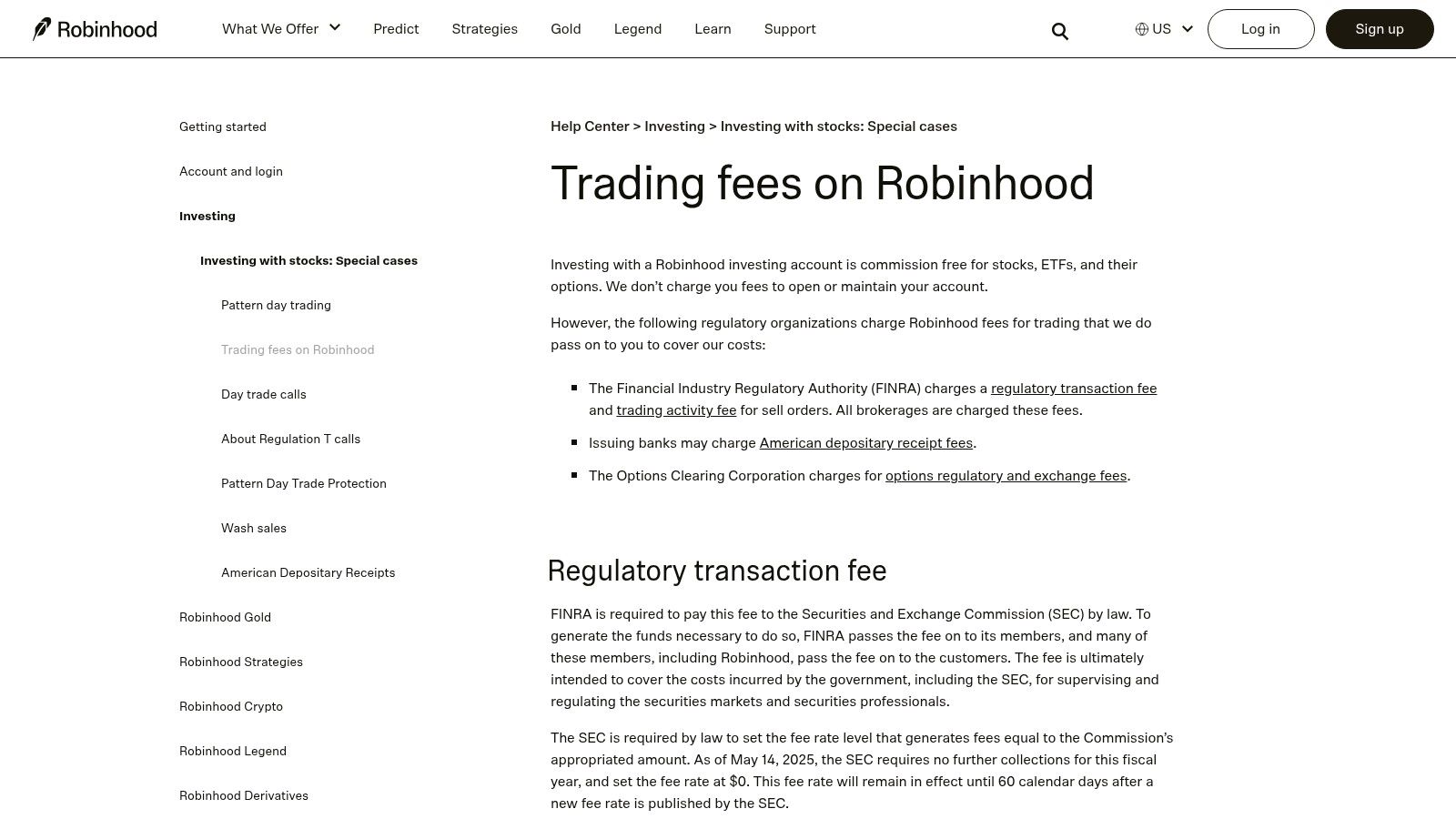

Key Features and Pricing

Robinhood is famous for its $0 commission on stock and ETF trades, which removes a major cost barrier for new traders. Its options trading policy is also appealing, as there is no per-contract fee on most stock and ETF options. However, it’s important for users to note that regulatory and exchange fees are passed through, a standard industry practice. The optional Robinhood Gold subscription provides access to more in-depth market data and margin trading for those ready to take the next step.

Pros and Cons

-

Pros:

- Extremely Simple Onboarding: Account setup is incredibly fast and user-friendly.

- No Per-Contract Options Fee: A significant cost-saver on most options trades (pass-through fees still apply).

- Strong In-App Education: Learning resources are integrated directly into the platform.

-

Cons:

- Mixed Order Quality Reputation: Some advanced traders have raised concerns about trade execution quality.

- Some Fees Apply: Certain index options carry a contract fee, and regulatory fees are always applicable.

Website: https://robinhood.com/support/articles/trading-fees-on-robinhood/?utm_source=openai

5. Webull

Webull carves out its space as one of the best trading platforms for beginners who are eager to engage more actively with the market. It offers a feature-rich mobile-first experience that appeals to those who want to learn technical analysis and practice their strategies without initial risk. With its powerful charting tools and a built-in paper trading simulator, Webull provides a hands-on environment for new traders to build confidence before committing real capital.

The platform is designed for a more trade-centric user, offering detailed market data, advanced order types, and an active community feed. This focus on active trading, combined with zero account minimums, makes it an accessible and dynamic starting point for anyone looking to move beyond simple buy-and-hold investing and into more nuanced trading techniques.

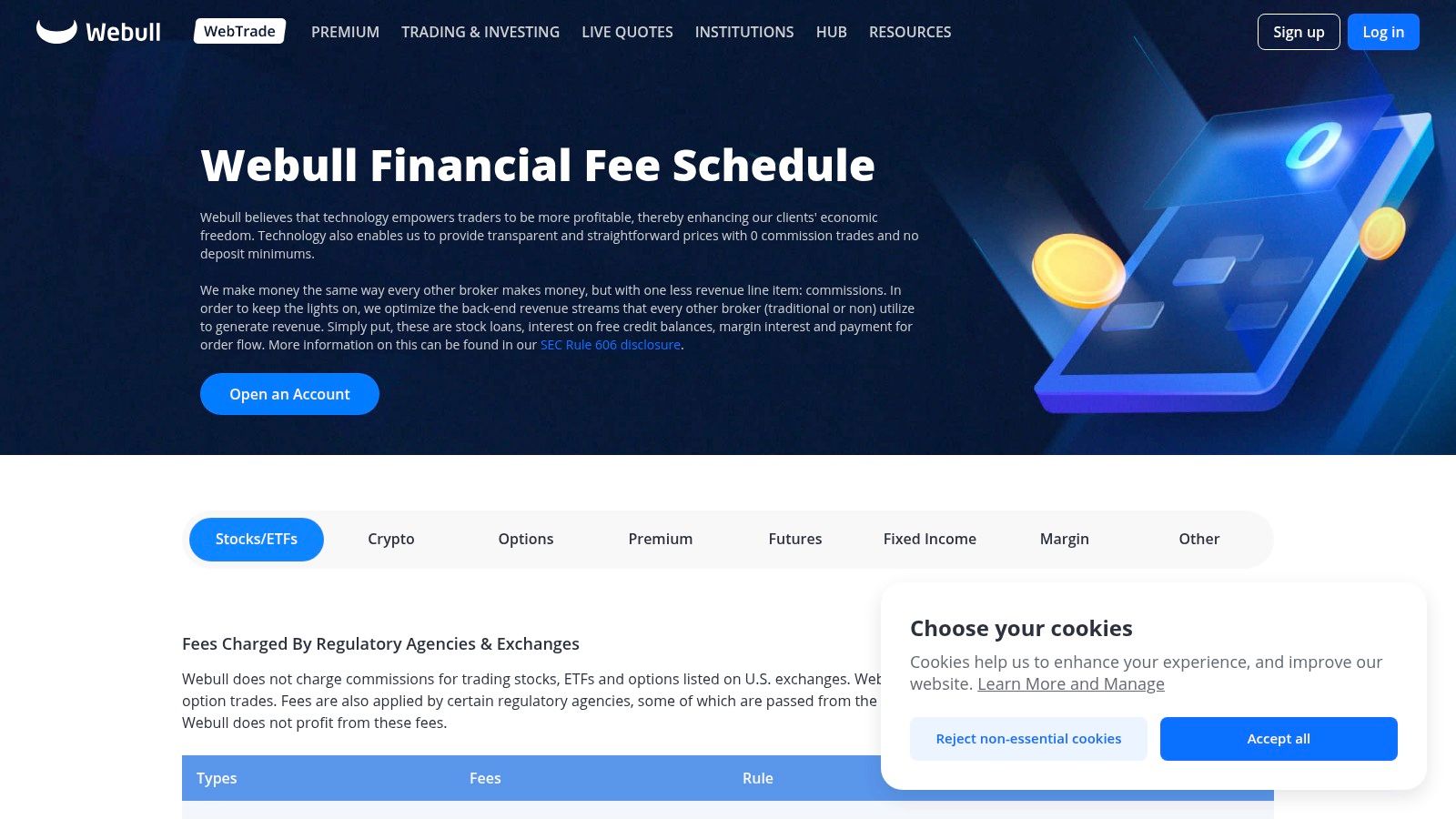

Key Features and Pricing

Webull’s pricing model is a major draw for new traders. It offers $0 commissions on U.S. stock, ETF, and options trades, allowing beginners to experiment with different assets without fees impacting their learning process. While most options trades are free of per-contract fees, certain proprietary and index options do carry small charges, which are clearly outlined on their pricing page. This structure encourages exploration, particularly for those interested in options, while maintaining cost-effectiveness for basic stock trading.

Pros and Cons

-

Pros:

- Advanced Tools for Free: Provides capable charting software and a paper trading account at no cost.

- Commission-Free Options: Most stock and ETF options trades have no per-contract fees.

- Intuitive Mobile Experience: A strong, feature-packed app for trading on the go.

-

Cons:

- Less Focus on Long-Term Investing: The platform is geared more toward active trading than retirement planning.

- Can Be Overwhelming: The sheer number of features may feel complex for absolute beginners.

Website: https://www.webull.com/pricing?utm_source=openai

6. SoFi Invest (Active and Automated)

SoFi Invest presents a unique hybrid model that makes it one of the best trading platforms for beginners who are unsure whether to manage their own investments or use a robo-advisor. It elegantly combines both active (DIY) and automated investing within a single, user-friendly app, allowing new investors to start with a managed portfolio and transition to self-directed trading as their confidence grows. This flexibility removes the pressure of choosing one path from the very beginning.

The platform is designed to be approachable, integrating educational resources and financial calculators directly into the app. This helps users learn foundational concepts and make more informed decisions. With no account minimums and a simplified interface, SoFi lowers the barrier to entry for anyone looking to start their investment journey.

Key Features and Pricing

SoFi Invest stands out with its exceptionally beginner-friendly fee structure. It offers $0 commissions on stock and ETF trades, making it cost-effective for new investors to build a portfolio. A major differentiator is its approach to options: SoFi charges no commissions and no per-contract fees for eligible Level 1 (covered calls, cash-secured puts) and Level 2 strategies. This is a significant advantage for those wanting to explore basic options without incurring typical trading costs, allowing them to focus purely on the strategy itself.

Pros and Cons

-

Pros:

- Hybrid Model: Offers both automated robo-portfolios and self-directed active investing.

- No Options Fees: Zero commissions and contract fees for supported options strategies is a huge plus for beginners.

- User-Friendly App: The platform is designed for simplicity and ease of use.

-

Cons:

- Potential Inactivity Fee: An inactivity fee may apply if you do not log in for six months.

- Simpler Feature Set: Lacks the advanced charting and research tools found on more professional platforms.

- Mutual Fund Fees: Some mutual funds may carry small transaction fees.

Website: https://www.sofi.com/invest

7. Public

Public introduces a unique social dimension to investing, making it one of the best trading platforms for beginners who value community and shared learning. It blends a user-friendly trading interface with a social feed where users can follow experienced investors, share insights, and discuss market trends. This approach helps demystify the stock market by making it a collaborative, rather than solitary, journey for new traders.

The platform is designed to be approachable, removing intimidating jargon and presenting information clearly. Beginners can start with fractional shares, allowing them to invest in well-known companies with a small amount of capital. For instance, instead of needing thousands of dollars to buy one share of a high-priced stock, you could invest just $20. This focus on accessibility and community-driven education creates a supportive environment for building investment confidence.

Key Features and Pricing

Public offers $0 commission trading on stocks and ETFs, making it cost-effective for beginners. A standout feature is its options trading model, where it shares a portion of its payment for order flow revenue directly with the user. This results in a small rebate paid back to you on every options contract traded, a novel concept that slightly reduces trading costs. While a premium subscription is available for advanced analytics and research, the core platform remains free and fully functional for new investors.

Pros and Cons

-

Pros:

- Social Investing: The integrated community feed provides valuable peer insights and learning opportunities.

- Unique Options Rebate: The order-flow sharing model is a transparent approach that can lower net costs for options traders.

- Beginner-Friendly Interface: The platform is clean, intuitive, and easy to navigate.

-

Cons:

- Paid Premium Analytics: Access to in-depth research and data requires a paid subscription.

- Limited Advanced Tooling: Lacks the sophisticated charting tools and order types found on more advanced, pro-level platforms.

Website: https://public.com/premium?utm_source=openai

8. Interactive Brokers (IBKR Lite/Pro and GlobalTrader)

Interactive Brokers offers a uniquely scalable experience, making it one of the best trading platforms for beginners who plan to grow into more sophisticated traders. While historically known for its professional-grade tools, IBKR has successfully catered to new investors with its IBKR Lite plan and the user-friendly GlobalTrader mobile app. This allows beginners to start in a simplified environment without sacrificing access to powerful features later on.

The platform provides an excellent pathway for growth. A new trader can start with commission-free stock and ETF trades on the intuitive Client Portal or GlobalTrader app, then transition to the powerful Trader Workstation (TWS) as their skills and needs evolve. This scalability ensures you won’t need to switch brokers as you become more experienced.

Key Features and Pricing

The IBKR Lite plan is designed for beginners, offering $0 commissions on U.S. stock and ETF trades. This straightforward pricing removes a major cost barrier for new investors. Options trading is also highly competitive, with low, transparent per-contract fees that follow a tiered schedule, often benefiting active traders. For those wanting to practice before committing capital, you can set up a free Interactive Brokers paper trading account to get familiar with the platform’s functionality. This combination of low costs and extensive market access is a compelling reason for its place on this list.

Pros and Cons

-

Pros:

- Scalable Platforms: Seamlessly grow from the simple GlobalTrader app to the advanced Trader Workstation.

- Extremely Low Costs: IBKR Lite’s $0 commissions and competitive options pricing are hard to beat.

- Unmatched Market Access: Provides access to a vast range of global stocks, options, and other securities.

-

Cons:

- Potential Complexity: The flagship TWS platform has a steep learning curve for absolute beginners.

- Confusing Plan Tiers: Distinguishing between the Lite and Pro plans can be initially confusing for new users.

Website: https://www.interactivebrokers.com/lite?utm_source=openai

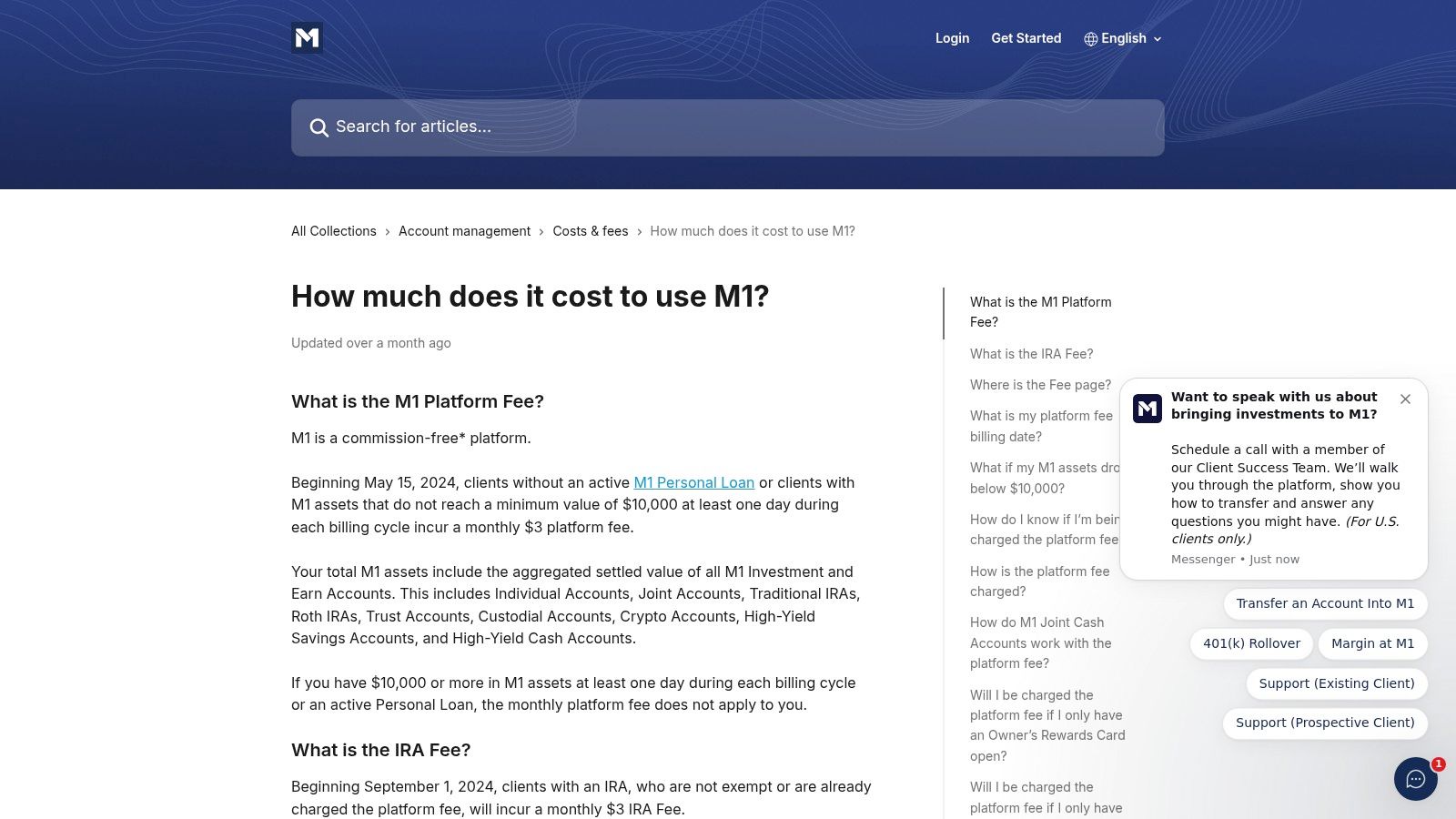

9. M1 Finance

M1 Finance offers a unique, hybrid approach that blends automated investing with individual stock selection, making it one of the best trading platforms for beginners focused on long-term wealth building. The platform’s core concept revolves around creating customizable “Pies,” which are visual portfolios of stocks and ETFs. This method encourages a disciplined, set-it-and-forget-it strategy, ideal for new investors who want to build a diversified portfolio without the pressure of daily market timing.

The platform excels at simplifying portfolio management through automatic rebalancing and fractional shares, allowing you to invest with as little as one dollar. This accessibility, combined with its focus on long-term, rules-based investing, helps beginners develop sound financial habits from the start.

Key Features and Pricing

M1 Finance is built around its innovative “Pie” investing system, allowing users to easily construct and automate their portfolios. While investing is commission-free, there is a $3/month platform fee. However, this fee is waived for users who maintain a total account value of $10,000 or more across their M1 Invest and Save accounts. This structure incentivizes long-term growth and consolidation of assets on the platform, providing a clear path to fee-free investing for committed users.

Pros and Cons

-

Pros:

- Simple Portfolio Building: The “Pie” system is an intuitive way to create diversified portfolios.

- Hands-Off Investing: Automatic rebalancing and deposits promote a disciplined, long-term approach.

- Fractional Shares: Enables investing in high-priced stocks with small amounts of capital.

-

Cons:

- Platform Fee: The $3/month fee applies if you don’t meet the waiver criteria.

- Not for Active Traders: Lacks tools for day trading, technical analysis, and has limited trade windows.

- No Options Trading: The platform is focused solely on stocks and ETFs.

Website: https://help.m1.com/en/articles/9331969-how-much-does-it-cost-to-use-m1?utm_source=openai

10. tastytrade

tastytrade carves out a unique space as one of the best trading platforms for beginners who are specifically interested in learning and trading options. Its platform is built from the ground up to support options strategies, complemented by an enormous library of accessible, bite-sized educational content. This focus makes it less intimidating for newcomers wanting to move beyond simple stock and ETF investing into the world of derivatives.

While it’s options-centric, tastytrade still offers the essentials for general investing, like commission-free stock and ETF trades. The platform is designed to make complex information — such as probability of profit and implied volatility — easy to understand, which is a significant advantage for those building their strategic foundation.

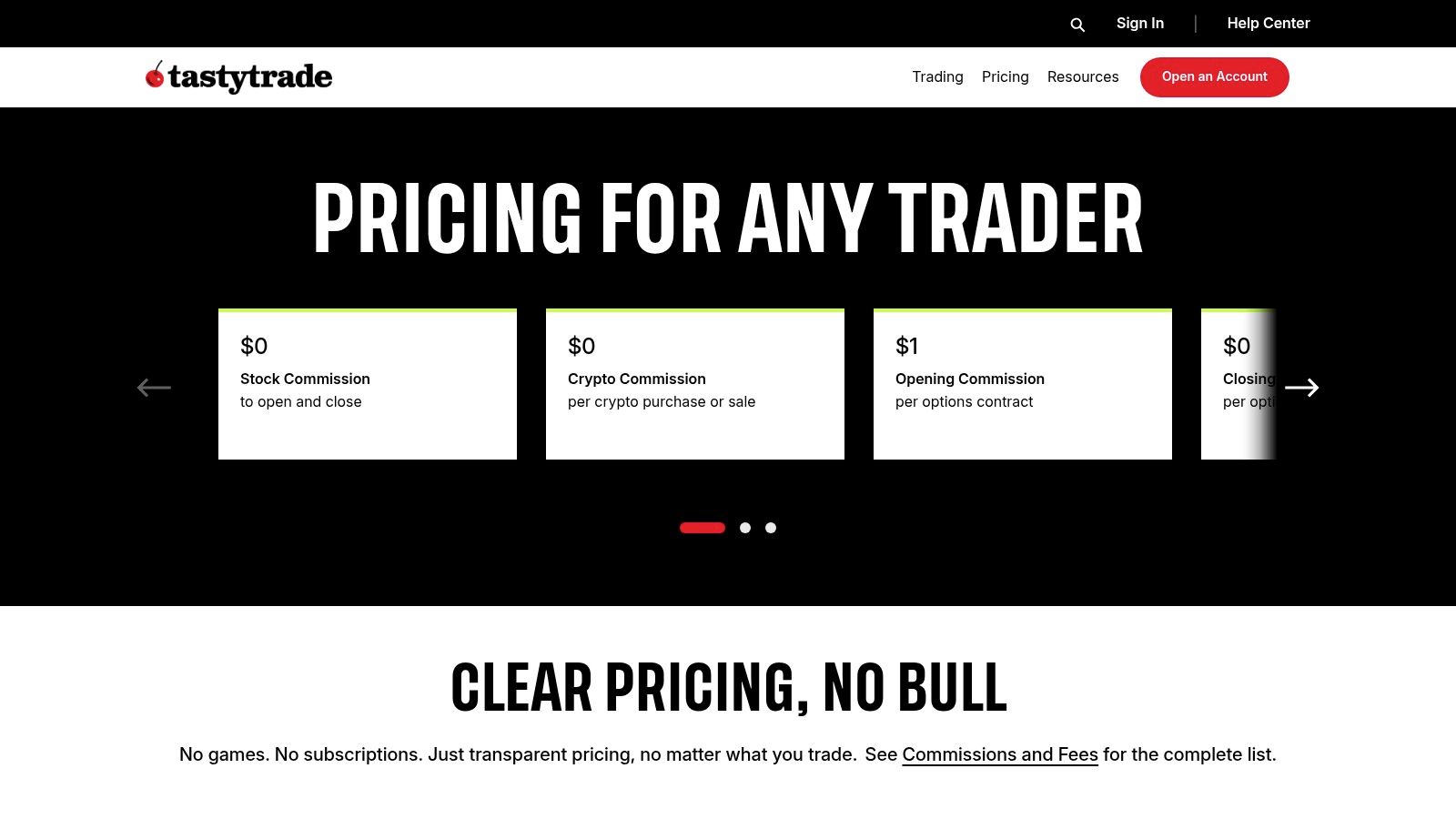

Key Features and Pricing

tastytrade’s pricing is straightforward and particularly appealing for options traders. The platform offers $0 commissions on stock and ETF trades. For options, there is a $1 fee to open a contract, capped at $10 per leg, and $0 to close any position. This structure encourages active management and makes exiting trades cost-effective, which is a critical aspect for new traders learning to manage risk and take profits. The platform also supports futures and futures options, providing a path for growth as a trader’s skills advance.

Pros and Cons

-

Pros:

- Strong Options Education: Unmatched library of videos and courses tailored for options beginners.

- Simple, Capped Pricing: The $10 cap on opening commissions per leg is great for larger trades, and $0 to close is a major benefit.

- Powerful Platform: Tools are designed to simplify complex options analysis.

-

Cons:

- Options-First Interface: The platform may feel less intuitive for investors who only plan to buy and hold stocks.

- Opening Commission: Unlike some competitors, there is a fee to open options trades.

Website: https://tastytrade.com/pricing/?utm_source=openai

11. NerdWallet (broker comparison resource)

Instead of being a trading platform itself, NerdWallet is an indispensable research tool for finding the best trading platforms for beginners. It offers curated, regularly updated rankings and in-depth comparisons of U.S. brokers, making it an excellent first stop for anyone feeling overwhelmed by the sheer number of available options. By providing clear fee snapshots, promotion highlights, and quick pros and cons, NerdWallet simplifies the decision-making process.

The platform’s strength lies in its transparent methodology, which explains the criteria used to rate each broker. New investors can use their “Best for beginners” lists to quickly shortlist platforms that align with their specific needs, whether it’s access to paper trading, low fees, or strong educational content. This resource empowers you to make an informed choice before committing any capital.

Key Features and Pricing

NerdWallet is a completely free-to-use editorial resource. Its primary features are its detailed broker reviews, comparison tables, and curated “best of” lists. The site clearly breaks down pricing structures, such as $0 commission summaries, and links directly to current broker promotions and sign-up pages. This saves beginners significant time and effort in gathering crucial information. You can find more details in this comprehensive trading platform comparison guide.

Pros and Cons

-

Pros:

- Transparent Methodology: Clearly explains how brokers are scored and ranked.

- Needs-Based Shortlisting: Easily find platforms tailored to specific needs like paper trading or advisor access.

- Free Resource: No cost to access all reviews, comparisons, and promotional links.

-

Cons:

- Not a Trading Platform: It is a research tool, so you cannot execute trades on the site.

- Affiliate-Driven: The site earns revenue from affiliate relationships, and promotions can change frequently.

Website: https://www.nerdwallet.com/best/investing/online-brokers-for-beginners?utm_source=openai

12. Investopedia (broker reviews and roundups)

While not a trading platform itself, Investopedia is an indispensable research tool for anyone searching for the best trading platforms for beginners. Its annual ‘Best Online Brokers’ awards provide a thorough, data-driven analysis of the industry’s top players. This editorial resource offers deep-dive reviews and publishes its scoring criteria, giving new traders a transparent framework to compare platforms based on their individual needs.

For beginners, the value lies in understanding the key differences between brokers beyond just cost. Investopedia’s methodical approach helps you evaluate platforms on factors like ease of use, educational resources, research tools, and mobile app quality, ensuring you make an informed decision before committing your capital.

Key Features and Pricing

Investopedia is a completely free informational resource. Its primary features for beginners include its annual broker awards, in-depth individual broker reviews, and clear rating methodology with weighted criteria. Each review breaks down a platform’s offerings, from investment selection and fees to customer service and platform usability.

The site also provides timely news coverage on broker feature changes and industry trends relevant to beginners. By using this resource, you can confidently compare commission structures, account minimums, and the specific tools that will support your learning journey without spending a dime.

Pros and Cons

-

Pros:

- Independent and Methodical: The scoring system and detailed explanations offer an unbiased view.

- Comprehensive Comparisons: Helps users understand critical differences beyond pricing.

- Free to Use: Provides high-quality research and education at no cost.

-

Cons:

- Not a Trading Venue: It is a research tool only; you cannot open an account or trade.

- Potential Lag: Reviews and award pages may not reflect the most recent, rapidly changing promotions.

Website: https://www.investopedia.com/2023-best-online-brokers-awards-7152001?utm_source=openai

Comparison of 12 Beginner Trading Platforms

| Platform | Key Features ✨ | UX / Quality ★ | Pricing / Value 💰 | Target 👥 | Standout 🏆 |

|---|---|---|---|---|---|

| Fidelity Investments | Research & screeners; $0 US stocks/ETFs; options tools | ★★★★☆ Reliable desktop & mobile | 💰 $0 stocks/ETFs; options $0.65/contract | 👥 Beginners → long-term investors | 🏆 Deep research & education |

| Charles Schwab (thinkorswim) | thinkorswim + paperMoney; broad products | ★★★★☆ Powerful, steeper learning curve | 💰 $0 stocks/ETFs; options ~$0.65/contract | 👥 Learners & active traders | 🏆 Industry-leading simulated trading |

| ETRADE (Power ETRADE) | Power E*TRADE options tools; account planning | ★★★★☆ Intuitive mobile + advanced tools | 💰 $0 stocks/ETFs; options discounts (to ~$0.50) | 👥 Options beginners & active traders | 🏆 Balanced ease-of-use & options tools |

| Robinhood | Mobile-first onboarding; stocks/options/futures | ★★★☆☆ Very simple UX; mixed advanced trade quality | 💰 $0 stocks/ETFs; pass-through option fees | 👥 Newcomers wanting fast setup | 🏆 Fast, frictionless onboarding |

| Webull | Paper trading; charts & options chains | ★★★★☆ Trade-centric with good charting | 💰 $0 stocks/ETFs; most options no per-contract fee | 👥 Learning traders & practitioners | 🏆 Paper trading + technical tools |

| SoFi Invest | Hybrid robo + DIY; Level 1/2 options access | ★★★☆☆ Beginner-friendly, simple app | 💰 $0 stocks/ETFs; inactivity fee if idle 6mo | 👥 First-time investors & hybrids | 🏆 Robo + commission-free eligible options |

| Public | Social feeds; investor education & optional premium | ★★★☆☆ Community-led, accessible UX | 💰 $0 stocks/ETFs; small options rebates | 👥 Social investors & beginners | 🏆 Unique options rebate program |

| Interactive Brokers (IBKR) | Multiple platforms; global markets; tiered pricing | ★★★★☆ Institutional-grade, complex at first | 💰 IBKR Lite $0 US stocks; low tiered options | 👥 Traders scaling from beginner→pro | 🏆 Low costs + global access |

| M1 Finance | Rules-based ‘pies’; fractional shares; auto-rebal. | ★★★☆☆ Extremely simple, long-term focus | 💰 $0 trades; $3/mo fee unless $10k+ held | 👥 Hands-off, buy-and-hold investors | 🏆 Automated, rules-based portfolios |

| tastytrade | Options-first education; capped opening fees | ★★★★☆ Education-focused, options-centric UI | 💰 $0 stocks/ETFs; options open $1 (cap $10/leg) | 👥 Options learners & active traders | 🏆 Bite-sized options education & clear pricing |

| NerdWallet (resource) | Curated broker lists; methodology & promos | ★★★★☆ Clear, beginner-friendly comparisons | 💰 Free editorial resource | 👥 Beginners researching brokers | 🏆 Easy shortlists + transparent scoring |

| Investopedia (resource) | In-depth reviews; annual broker awards | ★★★★☆ Methodical editorial analysis | 💰 Free editorial resource | 👥 Researchers & comparison shoppers | 🏆 Detailed reviews & weighted criteria |

Beyond the Platform: Your Next Steps to Smarter Trading

Navigating the landscape of trading platforms can feel overwhelming, but making an informed choice is a foundational step in your trading journey. We’ve explored a range of options, from the comprehensive, research-rich environments of Fidelity and Charles Schwab to the streamlined, mobile-first experiences offered by Robinhood and Webull. Each platform presents a unique combination of tools, fee structures, and educational resources tailored to different types of new investors.

Your ideal platform hinges entirely on your personal goals. An aspiring day trader might gravitate toward the powerful charting tools of thinkorswim or the speed of tastytrade, while a long-term, passive investor may find the automated portfolios of SoFi or the “Pie” system at M1 Finance to be a perfect fit. Remember, the “best trading platforms for beginners” are not a one-size-fits-all solution; the best platform is the one that aligns with your specific trading style, risk tolerance, and learning preferences.

From Access to Insight: The Real Work Begins Now

Selecting your broker is like buying a high-performance vehicle; it gives you the potential to reach your destination, but it doesn’t guarantee a safe or successful trip. The platform is merely the tool for execution. The real driver of your long-term success will be your discipline, your strategy, and your commitment to continuous improvement. This is where many new traders falter, getting caught up in the excitement of market movements without developing a system for self-analysis.

Success in the markets is not built on finding a “perfect” platform that makes winning easy. It’s built on a rigorous process of planning, executing, and, most importantly, reviewing your decisions. Every trade, whether it results in a profit or a loss, is a valuable data point. It contains a lesson about your strategy, your market timing, and your psychological state at the moment of execution. Without a system to capture and analyze this data, you are simply guessing.

The Critical Role of a Trading Journal

This is why pairing your chosen platform with a dedicated trading journal is not just a recommendation; it’s a necessity for serious growth. A journal transforms your trading from a series of isolated events into a coherent, data-driven feedback loop. It’s the bridge between having market access and gaining market insight.

By meticulously logging your trades, you can begin to answer critical questions:

- What are my most profitable setups?

- Do I tend to cut my winners too short or let my losers run too long?

- Am I making impulsive decisions based on fear or greed?

- Does my strategy perform better under specific market conditions?

Answering these requires more than just looking at your broker’s activity log. It requires context, notes on your thesis, and performance analytics. Many of the platforms we’ve discussed, such as Interactive Brokers, Fidelity, and E*TRADE, can be connected to journaling software for automatic trade syncing. This integration removes the friction of manual entry and ensures your data is always accurate, allowing you to focus purely on analysis and improvement.

Your chosen platform provides the arena, but your journal is your coach, your playbook, and your post-game analyst all in one. It’s the tool that fosters the discipline and self-awareness needed to navigate the inevitable challenges of trading. Embrace this process, stay patient, and commit to learning from every single trade. This disciplined approach is what truly separates a novice from a consistently improving trader, setting you on a more sustainable path toward achieving your financial goals.

Ready to turn your trading activity into actionable insights? TradeReview connects seamlessly with many of the brokers listed here, automatically importing your trades so you can focus on analysis, not data entry. Start your free trial today and discover the patterns in your trading that will define your future success at TradeReview.