The best tools for day traders aren’t just one thing. They typically fall into four essential categories: a powerful charting platform for your analysis, a low-latency brokerage for getting your orders filled, a real-time market scanner to pinpoint opportunities, and a disciplined trading journal to keep score. Real success doesn’t come from finding one magic tool, but from building a cohesive tech stack where every piece works together seamlessly.

Your Essential Toolkit for Navigating the Markets

Stepping into the world of day trading without the right setup is like a pilot trying to fly through a storm without a cockpit — it’s chaotic, stressful, and incredibly risky. Success isn’t about luck; it’s about making disciplined, data-driven decisions under pressure. The right tools don’t guarantee profits, but they provide the clarity and structure needed to follow your trading plan consistently.

Many new traders get hung up on finding a single “holy grail” indicator or platform, hoping it will solve all their problems. But if you talk to experienced professionals, you’ll find they all rely on an integrated system — a complete toolkit where each piece has a specific, critical job to do. This system, often called a trading tech stack, is what turns trading from a reactive, emotional gamble into a proactive, methodical business.

Core Day Trading Tool Categories at a Glance

To give you a quick overview, here are the non-negotiable tool categories every day trader needs. Think of these as the four pillars of your trading operation.

| Tool Category | Primary Function | Why It’s Essential |

|---|---|---|

| Charting Platforms | Visualizing price action and performing analysis | Lets you “read” the market, spot patterns, and identify potential entry/exit points. |

| Brokers & Execution | Placing and managing trades in the live market | Fast, reliable execution is critical. A bad fill can turn a winning trade into a loser. |

| Scanners & Screeners | Finding stocks that meet your specific trade criteria | Sifts through thousands of tickers in real-time to find actionable opportunities. |

| Trade Journals | Recording and analyzing trade performance over time | The only way to find your edge, fix mistakes, and measure what’s actually working. |

Each of these components plays a vital role in your daily workflow, from finding a setup in the morning to reviewing your performance after the close.

Why Your Tech Stack Matters

Your trading workflow depends on these tools working together without a hitch. Each one tackles a different part of the process, and when they’re integrated, they create a powerful feedback loop for continuous improvement.

The demand for these kinds of tools has exploded. The global day trading software market was valued at USD 1.2 billion in 2023 and is projected to hit USD 2.4 billion by 2032. This isn’t just noise; it shows how much traders are leaning on real-time data and solid analytics to find an edge. You can read the full research on the day trading software market to see the trends for yourself.

A professional trader’s toolkit is not a random collection of software; it’s a carefully curated ecosystem. Each tool must communicate with the others to create a smooth workflow from idea generation to post-trade analysis.

Ultimately, the goal is to build a system that supports your unique trading style and helps enforce discipline when the pressure is on. This guide will walk you through each of these tool categories, giving you the insights you need to build a professional-grade trading toolkit that actually works for you.

Charting Platforms: Your Window into Market Behavior

Think of a charting platform as your map and compass in the wilderness of the market. It takes the overwhelming flood of raw price data and translates it into a visual story — a story of greed, fear, supply, and demand. This is where you’ll spend most of your time as a day trader, performing technical analysis (the study of price patterns and market data) to spot patterns, build a trading thesis, and decide exactly when and where to act.

We’ve all been there. You enter a trade too early or get scared out too late, only to watch the price move exactly as you first predicted. More often than not, this isn’t a failure of strategy but a failure of clarity. A great charting platform provides that clarity, turning gut feelings into decisions backed by visual evidence.

But what really separates a basic chart from a professional-grade analysis tool?

What to Look for in a Charting Platform

Not all charting software is built the same. While almost any platform can show you a simple line chart, the best tools for active traders offer a much deeper, more functional experience. Your job is to find one that feels intuitive and, most importantly, supports your unique trading style.

Here are the non-negotiables:

- Vast Indicator Library: You need access to a wide range of technical indicators. This includes the classics like the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and Bollinger Bands that help you measure momentum, trend strength, and volatility.

- Sophisticated Drawing Tools: You’re going to need more than just straight lines. Look for tools that let you easily draw Fibonacci retracements, pitchforks, trend channels, and custom price ranges to precisely map out key support and resistance levels.

- Customizable Layouts: Day trading isn’t a one-stock-at-a-time game. A good platform lets you save and quickly switch between different chart layouts — maybe a 9-chart grid for your morning scan and a focused 3-chart view for managing an active trade.

- Multi-Timeframe Analysis: Seeing the same stock on different timeframes at once (like the daily, 15-minute, and 1-minute charts) is critical. This gives your trade context, helping you see if a short-term pattern is moving with or against the bigger trend.

Popular Platforms Compared

Two names you’ll hear over and over again are TradingView and Thinkorswim. Both are absolute powerhouses, but they cater to slightly different traders.

| Platform | Key Strength | Best For |

|---|---|---|

| TradingView | Cloud-based charts and a massive social community | Traders who want to access charts from any device and learn from a global network. |

| Thinkorswim (TD Ameritrade) | Powerful analytics and broker integration | Traders who want an all-in-one solution for deep analysis and seamless execution. |

TradingView really shines with its clean, browser-based interface and the world’s largest library of community-built indicators. Thinkorswim, on the other hand, is an analytical beast known for its advanced options tools and sophisticated scripting language, thinkScript.

A chart doesn’t predict the future, but it can give you a probabilistic edge. It shows you where the big battles between buyers and sellers have been fought, offering clues as to where they might be fought again.

Practical Application: Analyzing a Breakout

Let’s walk through a real-world scenario. You’re watching stock XYZ, which has been stuck in a tight range between $100 and $102 for the last hour. You think it’s coiled up for a potential breakout.

Here’s how you’d use your tools:

- Draw the Range: First, you use your platform’s drawing tool to place a horizontal line right at the $102 resistance level. This is your line in the sand.

- Set an Alert: Next, you set an alert that will ping you the second the price crosses above $102. No more staring at the screen.

- Check Indicators: On your 5-minute chart, you pull up the Volume indicator. You notice that as the price creeps toward $102, the buying volume is picking up — a great sign of conviction.

- Confirm with RSI: You glance at the RSI, which is climbing but not yet “overbought” (above 70). This tells you the stock likely has more room to run before it gets exhausted.

When your alert finally goes off and XYZ punches through $102 with a surge in volume, your charting tools have just given you multiple points of confirmation. You can now enter the trade with a plan, not just a hope.

This systematic process, made possible by a quality platform, is what separates disciplined trading from gambling. Choosing the right one is your first step.

Brokerage Platforms: Your Gateway to the Market

If charting platforms are your map, then your brokerage platform is the engine that gets you there. It’s so much more than just a place to click “buy” and “sell” — it’s your direct connection to the market. In a game of milliseconds, the quality of that connection is everything.

A slow or unreliable broker can turn a perfectly planned trade into a frustrating loss before you even have a chance to react. We’ve all heard the horror stories: platform freezes during peak volatility, orders that get filled at a much worse price than expected, or worse, not at all. These aren’t just minor inconveniences; they are direct hits to your bottom line.

Choosing the right broker isn’t about finding the cheapest option. It’s about selecting a reliable partner for execution.

Beyond Zero Commissions: What Really Matters

The rise of zero-commission trading has made the market more accessible than ever, which has been a net positive for many. This trend fueled a massive surge in retail participation, with U.S. stock trader involvement jumping from 15% in 2019 to 25% in 2021. North America now dominates the trading software landscape, driven by this retail enthusiasm and the algorithmic power of exchanges like the NYSE and NASDAQ. You can discover more insights on the global trading software market to see just how big this has become.

But for active day traders, the real cost of a broker goes far beyond commissions. Here’s what you should actually be looking at:

- Execution Speed and Reliability: How quickly are your orders routed and filled? A direct-access broker offers the fastest pathways, minimizing delays that lead to slippage — the gut-wrenching difference between your expected fill price and the actual price.

- Data Feed Quality: Is your price data truly real-time? Professional-grade platforms provide unfiltered Level 2 data and Time and Sales information, which are absolutely essential for understanding supply and demand.

- Platform Stability: Can the platform handle the intense volume and volatility of the market open or a major news event without crashing? A single platform failure can wipe out a week’s worth of profits in an instant.

Decoding Essential Brokerage Tools

To truly understand what the market is doing, you need to see beyond the basic chart. This is where professional data feeds become one of the best tools for day traders, period.

Level 2 Data: Think of this as the market’s order book. It shows you the bid and ask prices from different market makers, giving you a transparent view of supply and demand at various price levels. It’s how you see where the big players are lining up.

Time and Sales (The Tape): This is a live, running feed of every single executed trade, showing the exact price, time, and number of shares. Watching the tape helps you gauge the speed and conviction of buying and selling pressure in real time.

Without these, you’re trading with a blindfold on. You can see the price on your chart, but you can’t see the underlying order flow that’s actually moving it. For a deeper dive, check out our guide on how to choose the right trading platform for your needs.

Comparing Brokers for Active Traders

For serious day traders, brokers like Lightspeed and Interactive Brokers are often preferred over the mainstream zero-commission apps. While they have different fee structures, they are built from the ground up for one thing: performance.

| Broker | Key Strength | Ideal For |

|---|---|---|

| Interactive Brokers | Low-cost execution and global market access | Traders who need a robust, all-in-one platform for stocks, options, and futures. |

| Lightspeed | Extremely fast direct-access order routing | High-volume equity traders who prioritize execution speed above all else. |

Choosing between them often comes down to your specific trading style and volume. The key takeaway is to prioritize reliability and speed. The sting of a missed opportunity or a bad fill due to a subpar platform will always cost more than a few dollars in commissions. Your broker is your gateway to the market — make sure it’s a fast and stable one.

Market Scanners for Finding Opportunities in the Noise

With thousands of stocks moving every second, finding a solid trade can feel like searching for a needle in a global haystack. A market scanner is your powerful magnet, pulling those needles right to you. It cuts through the overwhelming noise and shines a spotlight on stocks that meet your exact trading criteria.

Many traders burn out chasing random “hot” stocks they see on social media. This leads to impulsive decisions and a great deal of frustration. A scanner flips that script entirely, replacing the chaos with a systematic process. It shifts your approach from being reactive to proactive. The goal isn’t just finding more trades; it’s about finding the right ones.

Scanners vs. Screeners: Understanding the Difference

People often use these terms interchangeably, but they serve very different roles in a trader’s daily routine. Nailing down the distinction is key to using them effectively.

- Real-Time Scanners: This is the workhorse for active day traders. Scanners watch the market tick-by-tick, sending you live alerts the second a stock meets your rules — like blowing past a key price level or seeing a sudden volume spike. This is all about finding opportunities right now.

- End-of-Day Screeners: Think of these as your homework tools. You’ll use a screener after the market closes or before it opens to build a watchlist for the next trading day. You can filter for stocks that closed strong, formed a specific pattern on the daily chart, or have a major news catalyst.

A professional workflow really uses both. You might use a screener like Finviz in the morning to find stocks gapping up in the pre-market, then use a real-time scanner like Trade Ideas to alert you the moment one of those stocks breaks above its opening range high.

A scanner doesn’t tell you what to trade. It tells you what to look at. Your analysis and execution are still the most important parts of the equation, but the scanner ensures your attention is focused on the highest-probability setups.

How to Configure a Practical Scan

The real power of a scanner is in its customizability. Instead of using generic, pre-built scans, the best tools let you build filters that align perfectly with your strategy. For a more detailed guide, you can learn more about the fundamentals of scanning stocks for day trading in our dedicated article.

Let’s walk through setting up two common, powerful scans.

Example 1: The “Gap and Go” Morning Scan

This scan is built to find stocks that have gapped up on heavy pre-market volume, signaling intense interest right from the opening bell.

- Price: Greater than $5 and less than $100.

- Pre-Market Volume: At least 200,000 shares.

- Pre-Market Gap: Up at least +3% from yesterday’s close.

- Float: Under 100 million shares (optional, but helps find more volatile names).

Running this scan five minutes before the market opens gives you a tight, focused list of stocks to watch for a potential breakout right at the open.

Example 2: The “High of Day Breakout” Scan

This is a classic momentum scan used to find stocks showing exceptional strength during the trading day.

- Current Price: Within 1% of the day’s high price.

- Volume: At least 1.5x the average volume for that specific time of day.

- Relative Volume (RVOL): Greater than 2 (meaning it’s trading at twice its normal volume).

This scan will pop an alert when a stock is on the verge of making a new leg up, giving you a chance to catch momentum moves just as they’re happening.

By turning the firehose of market data into a focused stream of actionable alerts, a well-configured scanner becomes one of your most valuable allies. It frees you from the emotional trap of chasing random tickers and instills the discipline of waiting for your specific edge to appear.

Trading Journals for Mastering Your Performance

Every elite performer, from professional athletes to top surgeons, has a process for reviewing their work to find and fix weaknesses. For a day trader, this process is powered by a trading journal — arguably the single most critical tool for building long-term, sustainable profitability. It’s the one piece of the toolkit traders often neglect, yet it’s the only bridge between inconsistent results and disciplined execution.

We get it. You hit a frustrating losing streak, only to realize you’ve been making the same impulsive mistake over and over again. Or maybe you nail a massive winning trade but can’t quite put your finger on the exact conditions that made it work. Without a journal, you’re just guessing, relying on a flawed memory that’s easily clouded by emotion.

Why Your Memory Is Your Worst Enemy

The raw statistics of day trading show exactly why disciplined self-review isn’t optional. While exact figures vary, numerous studies and reports highlight the challenges. For example, a often-cited FINRA study serves as a reminder of the risks involved and why data-driven improvement is so crucial for long-term viability.

These numbers aren’t meant to discourage you; they’re a reality check. “Winging it” is a recipe for struggle. A trading journal strips away the guesswork and emotion, replacing them with cold, hard data about your actual performance.

A trading journal is your personal data scientist. It uncovers the hidden patterns in your behavior, revealing the difference between what you think you’re doing and what you’re actually doing in the live market.

From Manual Spreadsheets to Automated Insights

Not long ago, journaling meant tedious manual entry into a spreadsheet at the end of a long, stressful day. This is where a modern, automated journal like TradeReview changes the game entirely. The goal is to spend less time on data entry and more time on analysis that actually makes you better.

Modern journaling tools bring a suite of features designed to make performance review seamless:

- Automated Broker Sync: This feature eliminates the soul-crushing task of manual trade logging. By connecting directly to your broker, every trade is imported automatically and accurately, saving you hours and preventing data entry errors.

- Performance Analytics: Instantly see your most important metrics. A good journal calculates your win rate, profit factor, average gain, and average loss, presenting it all on a clear, visual dashboard.

- Advanced Tagging: This is where the magic happens. Tag each trade with the specific setup you used (e.g., “Opening Range Breakout,” “Bull Flag”) and any mistakes you made (“Chased Entry,” “Held Too Long”). Over time, this data reveals which patterns make you money and which emotional triggers cost you.

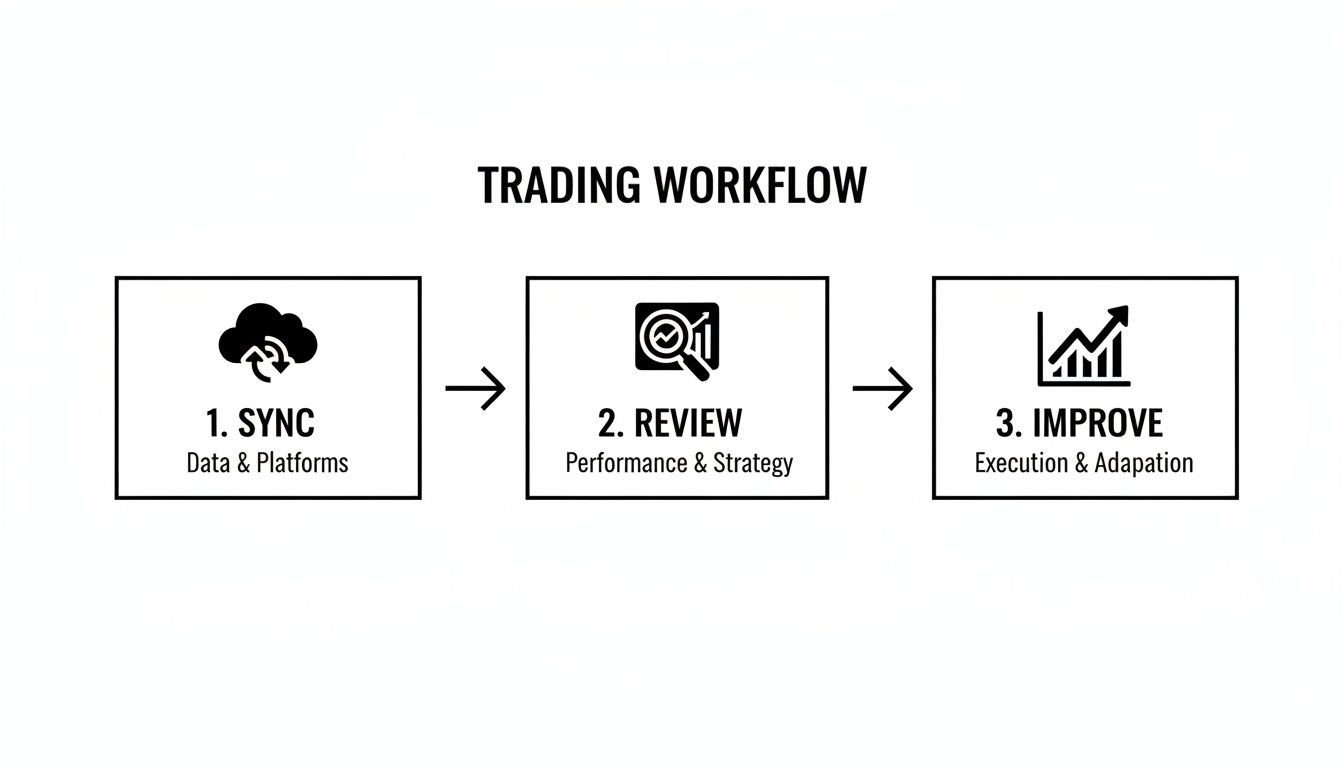

This simple workflow is what turns raw trade data into a cycle of continuous improvement.

The process is straightforward: your trades are automatically synced, you review the objective performance data, and you use those insights to make specific, targeted improvements to your strategy and execution.

Putting Your Journal to Work

Imagine it’s the end of the trading week. Instead of just glancing at your P&L, you open your journal and filter your trades. You discover that your “Opening Range Breakout” strategy has a 70% win rate and a 2.5 profit factor. Awesome. But you also see that trades you tagged with the “Chased Entry” mistake are losing 80% of the time.

The data gives you a clear roadmap. Your action plan for next week is simple: focus exclusively on taking A+ “Opening Range Breakout” setups and immediately stop trading if you feel the urge to chase. This is how you use data to build real discipline. If you want to dive deeper, check out our guide on the best trading journal apps and how to use them.

Here’s a practical look at how you can weave a journal into your daily and weekly routine to start seeing immediate benefits.

Integrating TradeReview into Your Daily Workflow

| Step | Action | Benefit |

|---|---|---|

| 1. After Trading Session | Open your journal. Add tags (e.g., “ORB,” “Impulsive Exit”) and notes to the day’s trades while your memory is fresh. | Captures crucial context and emotional state for each trade, which numbers alone can’t provide. |

| 2. End of Day | Do a quick 10-minute review of the day’s dashboard. Look at your biggest win and biggest loss. What did you do right? What went wrong? | Identifies immediate patterns and prevents the same mistake from carrying over into the next day. |

| 3. End of Week | Dedicate 30-60 minutes to a deeper dive. Filter trades by setup, mistake tags, and other metrics to find your strengths and weaknesses. | Uncovers larger trends in your performance, helping you refine your strategy and set clear goals for the upcoming week. |

This structured approach transforms your trading history from a series of random wins and losses into an invaluable dataset for mastering your own performance. It’s the fastest way to shorten your learning curve and build lasting consistency.

Building Your Integrated Trading Workflow

Having the right tools is a great start, but it’s only half the battle. The real pros don’t just collect software; they build a seamless, integrated system where every piece works in perfect harmony. This section is a practical guide to connecting your toolset into a disciplined daily routine, turning chaotic actions into a repeatable, professional process.

Think of it like a finely tuned assembly line. Each station has a specific job, and the product moves smoothly from one to the next. Your trading day should feel the same — structured, efficient, and completely methodical.

The Pre-Market Routine: Building Your Watchlist

Your trading day kicks off long before the opening bell rings. The mission here is to cut through the overwhelming market noise and build a small, manageable watchlist of stocks with the highest potential for clean moves. This is where your screener becomes the star of the show.

- Action (7:30 AM EST): Fire up your screener, like Finviz, and run your pre-market gap scan. You’re hunting for stocks gapping up or down on significant volume — think over 100,000 shares already traded.

- Result: You’ll quickly narrow the field down to 5-10 stocks that have real, catalyst-driven interest behind them.

- Next Step: Take those tickers and plug them into your charting platform. Pull up their daily charts and start marking the key support and resistance levels that could come into play once the market opens.

By 9:00 AM, you’re not scrambling; you have a focused list and a clear game plan for each stock.

The Opening Bell: Spotting Live Setups

Once the market opens, the game changes from preparation to pure execution. Your real-time scanner now takes center stage, ready to alert you the moment a stock on your watchlist meets your specific entry criteria. This is where you put all that pre-market homework into action.

A common trap for traders is feeling completely overwhelmed by the flood of information at the open. An integrated workflow solves this. You’re no longer watching everything; you’re watching only the stocks you’ve already vetted, waiting patiently for the patterns you planned to trade.

Let’s say one of your watchlist stocks, ticker XYZ, is a prime candidate for an “Opening Range Breakout.” Your scanner will ping you the second XYZ breaks above its first 5-minute high with a noticeable surge in relative volume.

Trade Execution and Management

That scanner alert is your signal to move. Your workflow immediately shifts to your brokerage and charting platforms. The alert is the trigger, but your charts provide the final confirmation.

- Confirm the Setup: You flip to your multi-chart layout for XYZ. You see the breakout on the 1-minute chart, strong volume is pouring in, and a quick glance at the daily chart shows no major resistance overhead. It’s a go.

- Execute the Trade: Over on your brokerage platform, you place your buy order. Your stop-loss is immediately set just below the breakout level. Your risk is defined and managed from the very start.

- Manage the Position: Now you monitor the price action on your charts, using key levels and indicators to decide where to lock in profits or trail your stop.

Closing the Loop with Your Trading Journal

The final — and arguably most crucial — step happens the moment you close the trade. That position is automatically logged in your TradeReview journal, closing the feedback loop on your entire process. This is what separates amateurs from professionals.

Instead of just remembering the P&L, you can now tag the trade (“Opening Range Breakout,” “Good Entry”) and add quick notes about your mindset or what you saw. At the end of the day, you have hard data showing exactly what worked, what didn’t, and why. This workflow transforms every single trade, win or lose, into a priceless lesson.

Your Questions About Trading Tools, Answered

Jumping into the world of trading software can feel like trying to drink from a firehose. There are a lot of options, and it’s easy to get sidetracked. Let’s clear up a few of the most common questions traders have when building out their toolkit.

Do I Really Need to Pay for Day Trading Tools?

While you can find some free tools out there, many traders who are serious about this business eventually invest in professional-grade software. It really comes down to a few key advantages: real-time data feeds, lightning-fast execution speeds, and the kind of deep analytics that free versions just can’t offer.

Think of it as a necessary business expense. The cost of a single missed trade or a terrible fill because of delayed data can easily cost you more than a year’s worth of subscription fees for the right tools.

What Is the Most Important Tool for a Beginner?

You obviously need a charting platform and a solid broker just to place a trade. But the single most important tool for a beginner’s long-term survival and success is a trading journal.

Why? Because a journal gives you objective, cold, hard data on what you’re doing right and — more importantly — what you’re doing wrong. It’s the only way to spot and fix expensive emotional mistakes, helping you build the discipline you need to make it past that brutal learning curve. The fastest way to get better is to master the data on your own performance.

How Do I Avoid Getting Overwhelmed by Data?

Information overload is a real and frustrating part of trading. The secret is to keep things simple and ruthlessly focused.

The goal isn’t to see everything the market is doing. It’s to filter out the noise and find the specific information that matches your proven trading edge. Real discipline is ignoring everything that doesn’t matter to your system.

Start by mastering just one or two trading setups. From there, you can configure your scanner to show you only the patterns that fit your game plan. The best tools aren’t the ones that show you the most information; they’re the ones that help you filter it down to what actually counts.

Ready to turn your trading history into a clear roadmap for what to do next? TradeReview gives you automated broker sync, powerful analytics, and a simple visual calendar to help you master your performance. Start journaling for free today and see what a difference data-driven insights can make.