A trading plan template is your personal rulebook for navigating the market. It’s a structured document you create that outlines your goals, specific strategies, and — most importantly — your risk management rules. Think of it as a business plan for your trading career, designed to keep you on track, eliminate emotional decisions, and enforce the discipline required for long-term consistency.

Why a Trading Plan Is Your Most Important Tool

Let’s be clear: most traders don’t fail because their strategy is flawed. They fail because they lack structure and discipline. You could have the most profitable system in the world, but if you abandon it at the first sign of a losing streak, it’s completely useless. We’ve all been there — the frustration of a loss pushes us to break our rules, only to regret it later.

This is where a trading plan becomes the single most important tool in your arsenal.

It’s much more than just a document. It’s your operational guide, your emotional guardrail, and your map through the chaos of the markets. A solid plan isn’t about predicting the future with certainty. Its real power comes from controlling your own actions when the market is doing everything it can to make you act impulsively.

The Business Plan for Your Trading Career

If you want to succeed long-term, you must treat trading as a serious business, not a hobby or a get-rich-quick scheme. A startup founder wouldn’t dream of operating without a detailed business plan, so why would you risk your own hard-earned capital without one? This document forces you to think critically about every single part of your operation.

Let’s frame it in business terms:

- Your “Products”: These are your specific, tested trading setups. For example, a bull flag breakout on the daily chart or a mean reversion play on the 5-minute chart.

- Your “Market”: This defines what you trade (e.g., large-cap US stocks, major forex pairs) and the market conditions where your setups perform best (like a trending or a range-bound market).

- Your “Financials”: Here’s where you define your risk management — your position sizing rules, profit targets, and non-negotiable stop-losses.

When you start treating trading like a business, your mindset shifts from gambling to executing a well-defined process. You become the CEO of your trading account, making objective decisions based on a pre-approved plan instead of gut feelings.

A trading plan forces you to define every action before the market opens. When faced with a losing trade or a sudden spike in volatility, you won’t have to think — you’ll just have to execute the rules you created when you were calm and objective.

Your Ultimate Emotional Guardrail

The market is a psychological minefield. Fear of missing out (FOMO) and the fear of loss are powerful forces that can hijack your brain and lead to destructive mistakes like revenge trading or chasing a stock that has already run up. Your trading plan is the barrier that stands between you and those emotional impulses.

Picture two traders watching the same stock move erratically. Trader A has no plan. Their heart is pounding as the position moves against them. Panic sets in. They slam the sell button for a massive loss, only to watch the stock reverse and rally moments later. We’ve all felt that sting.

Trader B has a plan. They calmly consult their rules: “If the price closes below the 50-day moving average, I exit. No questions asked.” The rule is crystal clear. There’s no room for debate or emotion — they just follow the plan.

The second trader survives not because they’re smarter, but because they came prepared. While there are no guarantees of profit, historical analysis of trader behavior suggests that those who adhere to a plan tend to manage risk more effectively and avoid catastrophic losses. This structure is your psychological anchor in a stormy sea.

The Core Components of a Winning Trading Plan

A trading plan doesn’t need to be a complex, 50-page document. Think of it more like a straightforward business plan for your trading, broken down into clear, actionable rules. Every single piece is designed to keep you objective and disciplined, especially when market chaos tries to get the best of you. Each component has a specific job.

We’re going to build this section by section. The goal is to make each rule so crystal clear that there’s zero room for second-guessing when you’re in a live trade.

Your trading plan is your personal rulebook. To help you build one that’s both comprehensive and practical, here’s a rundown of the essential elements every plan needs.

| Component | Purpose | Practical Example |

|---|---|---|

| Trading Identity & Goals | Defines your style and what you aim to achieve, ensuring your plan fits your personality and schedule. | “I am a part-time swing trader aiming for a 1.5 profit factor this quarter by focusing only on my two primary setups.” |

| Pre-Market Routine | A checklist to prepare you mentally and strategically before the market opens. | “8:30 AM: Review overnight economic news. 8:45 AM: Identify key support/resistance levels. 9:00 AM: Finalize watchlist.” |

| Entry Rules | Specific, non-negotiable criteria that must be met to enter a trade. | “Enter long only if the 9 EMA crosses above the 21 EMA on the 15m chart with 150% of average 20-period volume.” |

| Exit Rules (Stop-Loss) | Your automatic exit for a losing trade to protect capital. | “Exit immediately if the price closes below the entry candle’s low.” |

| Exit Rules (Profit Target) | Your pre-defined exit for a winning trade to lock in gains. | “Sell half the position at a 2:1 risk/reward ratio; trail the stop on the remainder.” |

| Risk Management | Rules governing how much capital you’ll risk per trade and per day. | “Risk no more than 1% of my account on any single trade. Stop trading for the day after 3 consecutive losses.” |

Think of this table as your foundational checklist. If any of these pieces are missing from your plan, you’re leaving a critical part of your trading business up to chance.

Define Your Trading Identity and Goals

Before you write a single rule, you have to know who you are as a trader. Does the idea of holding a position overnight cause you anxiety, or are you comfortable waiting days for a setup to play out? This self-assessment is the bedrock of your entire plan.

Your personality will naturally guide you to a specific style:

- Scalper: You thrive on speed and high frequency, aiming for small profits on many trades throughout the day. This demands intense focus and quick decision-making.

- Day Trader: You open and close all positions within the same day, avoiding overnight risk. Your focus is on intraday price movements.

- Swing Trader: You prefer a slower pace, holding positions for several days or weeks to capture larger market “swings.” This requires significant patience.

Once you know your style, set measurable goals. Vague ambitions like “make more money” aren’t actionable. Instead, focus on process-oriented metrics you can control.

A much better goal would be: “Achieve a profit factor of 1.5 or higher this quarter by only taking trades that meet my A+ setup criteria.” It’s specific, has a deadline, and focuses on the quality of your trading, not just a dollar amount.

Establish a Pre-Market Routine

Professional traders don’t just roll out of bed and start clicking buttons. They have a disciplined pre-market routine that prepares them mentally and strategically for the day. This ritual clears away the noise and helps you operate from a state of readiness, not reaction.

Your pre-market checklist needs to become a non-negotiable habit. It’s a key separator between professional execution and amateur gambling.

A solid routine might include:

- Checking Economic Calendars: Note any major economic reports or earnings announcements that could cause volatility in your target markets.

- Mapping Key Levels: Identify major support and resistance on higher timeframes (like the daily or weekly charts) for the assets on your watchlist.

- Building Your Watchlist: Scan for setups that perfectly match your strategy’s criteria. If nothing fits, you don’t trade. It’s that simple and that difficult.

- Mental Preparation: Take a few quiet moments. Review your core rules, visualize yourself executing trades flawlessly, and commit to staying disciplined, whether you win or lose.

This process primes you to act decisively, not react emotionally. You’ll start the day with a clear plan of attack.

A trader’s morning routine is their first line of defense against emotional decision-making. By starting the day with structure and analysis, you build a psychological buffer that protects you from the market’s chaos.

Create Crystal-Clear Entry and Exit Rules

This is the absolute heart of your trading plan template. Your rules for entering and exiting trades must be 100% objective and mechanical. If there’s any room for interpretation, you’ll hesitate — and hesitation is costly in trading.

The best way to write them is as simple “if-then” statements.

Bad Rule (Vague): “Buy when the stock looks strong.”

Good Rule (Specific): “If the 9 EMA crosses above the 21 EMA on the 15-minute chart, and the trading volume is at least 150% of its 20-period average, then enter a long position.”

See the difference? The second example is a mechanical signal. It can be executed consistently, helping to remove your emotions from the decision-making process.

You need equally specific rules for your three exit scenarios:

- Stop-Loss (The Protective Exit): Your non-negotiable escape plan on a losing trade. For example: “If the price closes below the low of the entry candle, exit the position immediately.”

- Profit Target (The Goal Exit): Where you lock in gains on a winner. For example: “Set a profit target at a 2:1 risk/reward ratio based on the stop-loss distance.”

- Time-Based Exit (The Invalidation Exit): For when a trade stagnates and goes nowhere. For example: “If the trade is not profitable within five 15-minute candles, exit the position at market.”

By defining every possible action ahead of time, you eliminate the need to make high-stakes decisions when you’re most vulnerable to fear or greed. You’re no longer guessing; you’re simply following your own well-researched instructions.

Mastering Risk: The Bedrock of Your Plan

If there’s one part of your trading plan template that must be non-negotiable, it’s this one. A great entry strategy feels exciting, but without rock-solid risk management, you’re building on an unstable foundation.

Your real job as a trader isn’t finding winning trades. It’s protecting your capital so you can stay in the game long enough for your winning setups to appear and play out.

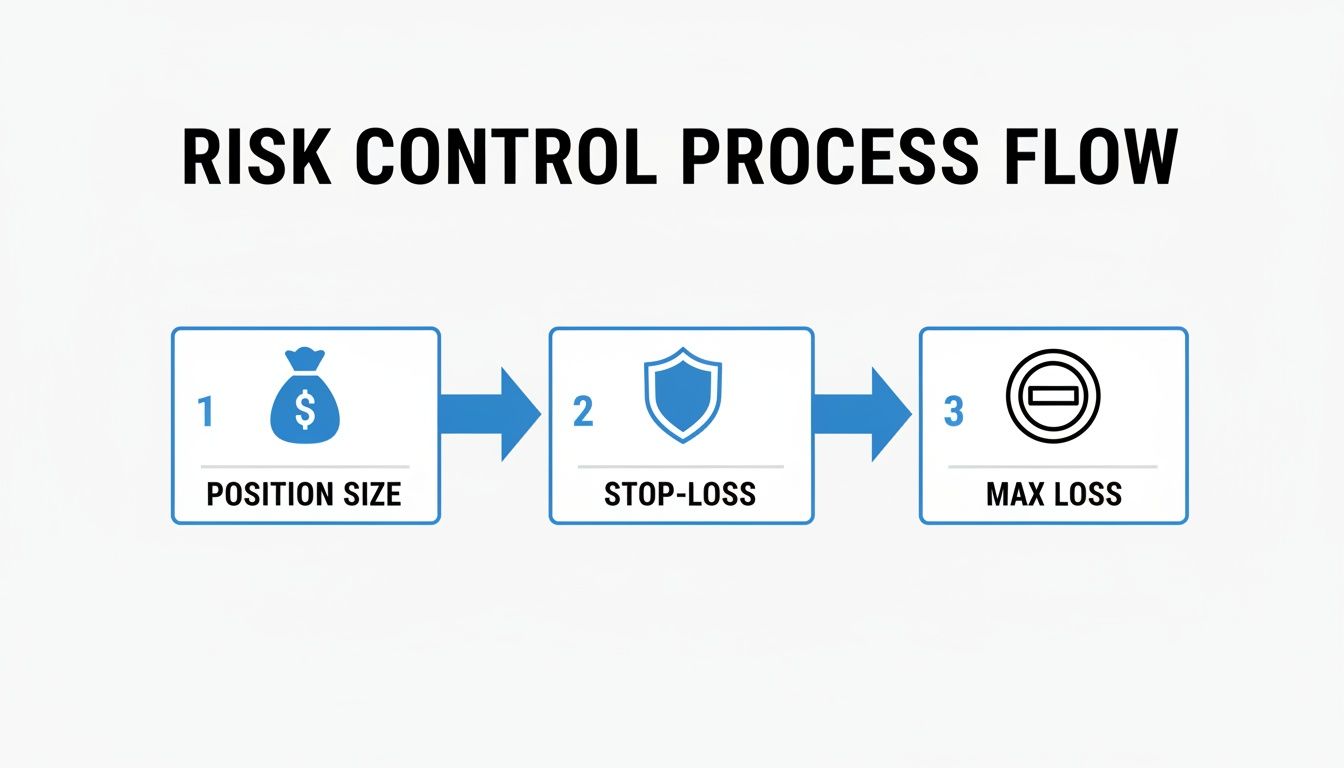

Many traders hear the generic “1% rule,” check the box, and move on. But that’s just the starting line. Real risk control is a dynamic process. It tells you if you should trade, how big you should trade, and when it’s time to stop for the day. This is what separates a small, expected loss from a catastrophic account blowout.

Position Sizing the Right Way

Let’s get practical. How do you turn a risk percentage into an actual trade? It all comes down to position sizing — calculating how many shares or contracts to take based on your stop-loss, not just a random number that feels right.

Let’s say you’re working with a $10,000 account, and your plan caps your risk at 1% per trade. That means your maximum acceptable loss on any single idea is $100.

Now, imagine you want to buy stock ABC at $50. Your strategy indicates the trade is invalidated if it drops to $48, so that’s your stop-loss. This means you’re risking $2 per share.

To calculate your position size, divide your max risk by your per-share risk:

$100 (Max Risk) / $2 (Risk Per Share) = 50 shares

That’s it. You can buy exactly 50 shares of ABC. If you get stopped out, you lose your planned $100, not a penny more. This simple calculation takes emotion and guesswork out of the equation.

Setting Intelligent Stop-Losses

A stop-loss shouldn’t be a random price you pull out of thin air. It needs to be a strategic level where your original trade idea is officially proven wrong.

One useful tool for this is the Average True Range (ATR) indicator. The ATR measures an asset’s recent volatility, giving you a data-driven way to place your stop. For example, if the 14-day ATR for a stock is $1.50, placing your stop 2x ATR ($3.00) below your entry gives the trade enough breathing room to withstand normal market fluctuations without getting stopped out prematurely.

This makes your risk adaptable. You’re not using the same tight stop on a volatile tech stock that you would on a slow-moving utility stock.

The goal of a stop-loss isn’t to avoid losses — losses are a cost of doing business in trading. The goal is to ensure that when you’re wrong, you lose a small, pre-defined, and completely manageable amount.

Defining Your Breaking Point

Even with perfect per-trade risk, a string of losses can damage your account and your psychology. That’s why your plan must have circuit breakers — hard-and-fast rules for daily and weekly loss limits.

- Daily Loss Limit: This is your “tools down” rule for the day. For example: “If my account is down 3% in one day ($300 on a $10,000 account), I shut down my platform and walk away. No exceptions.”

- Weekly Loss Limit: This is your bigger-picture protection. “If my account is down 5% for the week, I stop trading until the following Monday.”

These rules are your best defense against revenge trading — that destructive urge to “make it all back” immediately after a loss. By setting your breaking point when you’re calm and rational, you prevent your emotional self from taking over and wrecking your account. The path to long-term trading involves surviving drawdowns, and these rules are your survival kit.

Building Your Custom Trading Plan Template

Alright, this is where the theory ends and the work begins. We’ve talked about the importance of having a plan, but a plan in your head is just a wish. It’s time to write it down and create a tangible document that will act as your guide in the markets.

Let’s be clear: there’s no “one-size-fits-all” trading plan. Your personality, your schedule, and your risk tolerance are all unique to you. That means your trading plan template must be, too. A day trader glued to the 5-minute chart needs a completely different rulebook than a swing trader who checks in once a day.

The goal here is to give you a solid foundation you can build on. We’ll look at templates for different trading styles and then walk through a completely filled-out example. Seeing the thought process behind each rule will help you build a plan that truly works for you.

Choosing the Right Template for Your Style

First, you need a framework that matches your trading identity. A day trader’s plan is all about speed and intraday precision. A swing trader’s plan, on the other hand, is built for patience and looking at the bigger picture.

Here’s a quick breakdown of what makes each style’s template different:

- Day Trading Template: This is focused on the here and now. You’ll want sections detailing your prime trading hours (e.g., the first two hours after the open), strict daily loss limits, and rules for handling midday market chop.

- Swing Trading Template: This one takes a wider view. It needs rules for holding positions overnight, setting stops based on daily chart patterns, and managing trades that might unfold over several days or weeks.

- Options Trading Template: This template adds another layer of complexity. It must cover rules for selecting strike prices and expiration dates, how you’ll manage assignment risk, and strategies for using data like implied volatility (IV) to your advantage.

Starting with the right structure saves you a ton of headaches. Your plan instantly becomes more relevant and easier to follow when the pressure is on.

Anatomy of a Filled-Out Trading Plan

Let’s make this real. Meet Alex, a fictional part-time swing trader with a $25,000 account. Alex has a very specific setup they’ve tested and trust: the “Bull Flag Breakout.”

Here’s a look at what Alex’s filled-out trading plan template looks like for this one strategy.

Trader Profile & Goals

- Trader Identity: Part-time swing trader.

- Time Commitment: 1-2 hours per night for scanning and review.

- Quarterly Goal: Achieve a profit factor of 1.6 or higher on the Bull Flag strategy.

Pre-Trade Routine

- After the market closes, run a scan for stocks that are up 20% or more in the last 10 days.

- Manually review each chart, looking for a clean, sharp “flagpole” move up.

- Identify stocks that are consolidating sideways in a tight “flag” pattern on low volume.

- Map out the breakout level (top of the flag) and the stop-loss level (bottom of the flag).

- Narrow it down to the top 3 candidates and add them to a watchlist for the next day.

This routine is non-negotiable. It ensures Alex only trades A+ setups that meet their strict, pre-vetted criteria. There’s no room to chase a stock that just “looks good.”

Your trading plan is the ultimate filter. Its only job is to screen out low-probability setups and emotional whims, leaving you with only the best opportunities that align with your proven edge.

Entry, Exit, and Risk Rules

This is the heart of the plan — no grey areas allowed.

- Entry Signal: Enter a long position with a buy-stop order placed a few cents above the high of the flag’s consolidation.

- Confirmation: The breakout must occur on at least 150% of the 20-day average volume. If the volume isn’t there, the trade is invalid.

- Position Size: Never risk more than 1% of the account per trade ($250). The position size is calculated as $250 divided by the distance (in dollars) between the entry price and the stop-loss.

- Stop-Loss: A hard stop-loss order is placed immediately, just below the low of the flag. No exceptions.

- Profit Target: Sell half the position when the price hits a 2:1 risk/reward ratio. For the remaining half, move the stop-loss to breakeven and trail it under each new daily low.

This entire risk control process is the most critical piece of the puzzle. Alex’s capital is protected because every single trade must pass through this structured risk check.

This flow is simple but powerful. It forces discipline and ensures that no single bad trade can derail the entire account.

The Importance of Backtesting Your Rules

How does Alex know these rules have a chance of working? They weren’t just pulled out of thin air. Every single parameter, from the volume requirement to the profit-taking strategy, was developed and refined through rigorous backtesting on historical charts.

Backtesting is how you build confidence in your plan. It allows you to see how your rules would have performed in the past, giving you data that suggests your strategy has a positive expectancy or “edge.” If this is a new concept for you, our guide can help you master backtesting trading strategies so your plan is built on a solid statistical foundation.

Without that data, you’re just guessing. You have no objective reason to believe your rules will work, which makes it nearly impossible to stick with the plan when you hit an inevitable losing streak. But with data on your side? You can execute with conviction, knowing that you’re playing a long-term game based on probabilities.

How to Review and Refine Your Strategy

Your trading plan isn’t a static document you write once and follow forever. Think of it as a living document that must evolve with your skills and with changing market conditions. Without a structured review process, you’re flying blind, letting gut feelings guide you instead of hard data.

This is where a feedback loop becomes your most valuable asset. By systematically reviewing your performance, you can pinpoint what’s working, eliminate what isn’t, and make intelligent adjustments based on evidence, not emotion. This process turns your trading plan template from a static checklist into a dynamic tool for continuous improvement.

The Power of the Weekly Review

A consistent review routine is the engine of your growth as a trader. This is your dedicated time to step away from the live market and look at your performance with the cool, objective eye of an analyst. You’re not just glancing at profits and losses; you’re digging into the why behind every outcome.

Your main goal here is to answer some tough but critical questions:

- Did I follow my plan with 100% discipline on every single trade? If not, why?

- Which of my setups are performing well, and which are underperforming?

- Are there specific market conditions where I consistently struggle?

- Is my risk management working as intended, or am I letting losers run too far?

This honest self-assessment is challenging, but it’s how you spot bad habits before they become account-killers.

Let Your Data Tell the Story

Your trading journal is your source of truth. By tagging each trade to a specific strategy within your journal, you can unlock powerful analytics that reveal exactly where your strengths and weaknesses lie. Instead of guessing, you get undeniable proof.

For example, after a month of disciplined journaling, your data might reveal, “My opening range breakout strategy has a negative profit factor on Fridays.” That isn’t a feeling; it’s a cold, hard fact. An insight like that is invaluable. It empowers you to make a precise, data-driven tweak, like deciding to avoid that specific setup on Fridays.

A trading plan without a review process is just a collection of good intentions. The review is what turns your plan into a powerful, self-correcting system that gets smarter with every trade you take.

A detailed trading journal highlights the performance gap between disciplined and unplanned traders. The data doesn’t lie: analysis of trader performance often shows that consistent traders focus on maintaining a positive profit factor (the ratio of gross profits to gross losses) over a high win rate. By using a journal to review your setups, you can focus on improving the metrics that matter.

Making Smart, Incremental Adjustments

Once you’ve identified a weak spot, the secret is to make small, controlled changes. A complete overhaul of your entire plan after a few bad trades is a recipe for disaster. Instead, focus on tweaking just one variable at a time.

Here’s a practical approach:

- Isolate the Problem: Use your journal data to pinpoint the exact issue. Is it a specific setup? A certain time of day? Perhaps your stop-loss placement is consistently too tight.

- Form a Hypothesis: Create a new rule to address what you found. For example, “I will not trade the opening range breakout on Fridays for the next month.”

- Test and Measure: Trade with this new rule in place for a set period (or for a specific number of trades, like the next 20) and track the results meticulously.

- Analyze the Outcome: Did the change improve your performance metrics? If it did, that new rule becomes a permanent part of your trading plan template. If not, no problem — you simply revert to the old rule and test a new hypothesis.

This methodical process removes emotion from the equation and ensures your plan evolves based on statistical evidence. If you’re looking for a simple way to get started, check out our guide on using a trading journal template in Excel. It’s a fantastic first step toward building this crucial, data-driven feedback loop.

Got Questions About Your Trading Plan?

Even with a great template, it’s normal for questions to come up as you put your plan into action. Let’s address some of the most common ones.

How Often Should I Review My Trading Plan?

Think of your plan as a living document. A deep, data-driven review should happen at least once a month. This is when you analyze your journal metrics, look for patterns in your performance, and identify areas for improvement.

On a daily basis, a quick check-in is essential. Before the market opens, spend five minutes reviewing your core rules. This simple ritual reinforces discipline and keeps your strategy top-of-mind, helping you avoid impulsive mistakes in the heat of the moment.

Resist the urge to change your plan mid-day just because you took a loss. Real, strategic changes should only be made after you have enough data — at least 20-30 trades for a specific setup — to support your decision.

What Is the Most Important Part of a Plan?

Every component is important, but if you had to prioritize one, it would be risk management rules. They are the absolute foundation of your trading survival. You can have a mediocre entry strategy but still survive and even thrive with excellent risk management.

The reverse is also true: the world’s best entry signal will eventually blow up your account if you don’t manage your risk properly. Your rules for position sizing, stop-loss placement, and daily loss limits are what keep you in the game long enough to succeed.

My Trading Plan Isn’t Working. What Should I Do?

First, ask yourself with complete honesty: are you really following the plan to the letter, 100% of the time? Your trading journal will provide the answer. Often, the plan isn’t broken — the execution is.

If you can genuinely say you’re following it perfectly and the results are still poor, then it’s time to examine the strategy itself. Use your journal data to play detective. Is your win rate too low for your average risk-to-reward ratio? Are you consistently struggling in certain market conditions? Analyze the data from at least 30-50 trades to find the weak spot, make one small, informed adjustment, and then continue testing and tracking.

Ready to stop guessing and start making decisions based on cold, hard data? The TradeReview trading journal is built to help you track your performance against your plan, tag your setups, and use powerful analytics to find and sharpen your edge.