A stop-loss on an option is supposed to be simple: you set a price, and if your contract hits it, you sell to cap your losses. But here’s the catch — options aren’t like stocks. Their value is a cocktail of different factors, not just the underlying’s price, which makes a simple stop-loss a surprisingly unreliable and often frustrating tool. We’ve all been there, and it’s a tough lesson to learn.

Why a Stop Loss on Options Is So Complicated

We’ve all felt that knot in our stomach — watching a trade slowly bleed out, torn between hoping for a comeback and fearing a total wipeout. The stop-loss is meant to be our safety net, our unemotional exit plan. But with options, that net has some serious holes. Too many traders, myself included when I started, learn this the hard way by applying stock market rules to an entirely different beast.

Unlike a share of stock, an option’s price is a moving target, constantly being pushed and pulled by powerful forces. A standard stop-loss strategy can easily backfire, kicking you out of a position at the worst possible moment because of market “noise” instead of a genuine breakdown of your trade idea. This isn’t about finding a secret that guarantees profits; it’s about building discipline for the long haul.

The Many Faces of an Option’s Price

An option’s value isn’t a single number; it’s more like an equation the market is constantly solving in real-time. This is precisely why a simple percentage drop doesn’t tell you the whole story. To use them effectively, you need to understand what’s moving the price.

Several key factors, often called “the Greeks,” are always in the mix:

- Underlying Stock Price (Delta): This is the big one, of course. You buy a call, the stock tanks, and your option’s value follows suit. No surprise there. Delta measures how much the option’s price changes for every $1 move in the stock.

- Time Decay (Theta): This is the silent killer. Every single day that passes, your option loses a tiny bit of value, even if the stock price doesn’t budge. This steady drip, drip, drip can easily trigger a stop-loss on a trade that’s just consolidating.

- Implied Volatility (Vega): This is the market’s best guess about future price swings. A sudden “volatility crush” — a sharp drop in expected volatility — can hammer an option’s premium, forcing an exit even if the stock is actually moving in your favor.

These elements are all interconnected. Your stop-loss might get hit because of a shift in volatility or simply because time is running out — not because the underlying stock made a big move against you.

Building a More Disciplined Mindset

Dealing with these challenges means ditching the simplistic “set it and forget it” mentality. It requires a disciplined approach and a healthy respect for the unique risks baked into options. This isn’t about finding some magical formula to guarantee wins; it’s about learning to protect your capital with a much smarter, more nuanced strategy that focuses on long-term thinking.

A well-placed stop-loss in options trading isn’t about picking an arbitrary price or percentage. It’s about defining the exact point where your original trading thesis is proven wrong.

That shift in perspective is everything. Instead of reacting to the wild swings in the option’s price itself, a stronger strategy links your exit decision to what the underlying asset is doing. This guide is all about helping you build that smarter approach — moving from gut reactions to a systematic plan built for the real world of options trading.

How Options Differ from Stocks for Stop Losses

Before we dive into setting a stop loss on an option, we have to get one thing straight: options and stocks are fundamentally different animals. Trying to apply the same risk management rules from your stock portfolio to your options trades is one of the most common and expensive mistakes a trader can make. It feels right, but it ignores what really makes an option’s price tick.

A stock’s price is simple. It’s one number that goes up or down. Think of it like a basic thermometer. An option’s price, on the other hand, is more like a sophisticated weather station — it’s driven by price, but also by time, volatility, and a few other moving parts all at once.

The Multi-Dimensional Nature of an Option’s Price

When you set a stop loss on a stock, you’re reacting to a single variable: price. If you buy a stock at $100 and set a 10% stop, you’re out if the price hits $90. Simple. But an option’s price is a puzzle with multiple pieces, and any one of them can shift and trigger your stop, often without the stock itself making a big move.

These are the main culprits that can sink your option’s value:

- Time Decay (Theta): This is the silent portfolio drain. Every day that passes, your option loses a tiny bit of its value, and this decay speeds up dramatically as you get closer to expiration. A long option is a melting ice cube.

- Implied Volatility (Vega): This is the market’s best guess about how much the stock will swing in the future. If that expectation drops — what traders call a “volatility crush” — the value of your option can get hammered, even if the stock is moving in the direction you wanted.

Practical Example: Imagine you’re right about the stock. It’s slowly grinding higher, just like you predicted. Your call option should be making money, but if time decay is eating away at it or volatility suddenly collapses after an earnings report, the option’s price could still drop and hit your stop. You get kicked out of a winning trade for all the wrong reasons. It’s a frustrating experience that almost every options trader goes through.

Why a 20% Loss Is Not the Same

This brings us to a huge, and often painful, misconception. A 20% stop loss on a stock means something very different than a 20% stop loss on an option. Options have built-in leverage, which means a tiny, insignificant wiggle in the underlying stock can cause a massive percentage swing in your option’s premium.

This gets even more extreme with the short-dated options that have exploded in popularity. According to the New York Stock Exchange, the volume of options contracts with less than one week to expiration has grown significantly, making up a large portion of daily trading. These options are incredibly sensitive to time and price changes, meaning a simple percentage-based stop is just asking to get triggered by normal market noise, turning small bumps into big losses.

A stop loss on a stock protects you when your core idea about the company is proven wrong. A stop loss on an option can get triggered by background noise, costing you money even when your thesis is perfectly right.

To really nail this down, here’s a look at the core differences side-by-side.

Stock vs. Option Stop Loss Key Distinctions

This table breaks down why you can’t treat these two instruments the same when it comes to managing risk.

| Factor | Stock Stop Loss | Option Stop Loss |

|---|---|---|

| Primary Driver | Driven solely by the stock’s price movement. | Influenced by stock price, time decay, and implied volatility. |

| Price Behavior | Moves in cents and dollars, relatively linear. | Experiences rapid, non-linear percentage swings due to leverage. |

| Predictability | A 5% drop in stock price equals a 5% loss. | A 5% drop in stock price can cause a 20%, 50%, or even 80% loss in premium. |

| Risk of False Trigger | Lower. Triggered only by a defined price drop. | Higher. Can be triggered by time decay or volatility crush, even if the stock is stable. |

Getting a handle on these distinctions is the first real step toward building a smarter risk management plan for your options trades. It’s all about moving past simple price-based stops and learning to base your exits on the factors that truly prove your original trade idea was wrong.

Practical Methods for Setting Your Option Stop Loss

Alright, let’s move from theory to the trading floor. It’s time to build your toolkit for managing risk. Setting a stop loss on options isn’t a one-size-fits-all game. The best method really depends on your strategy, how much risk you’re comfortable with, and the specific option you’re trading.

We’ll walk through a few practical approaches, starting with the most common and moving toward the techniques that actually work in the long run.

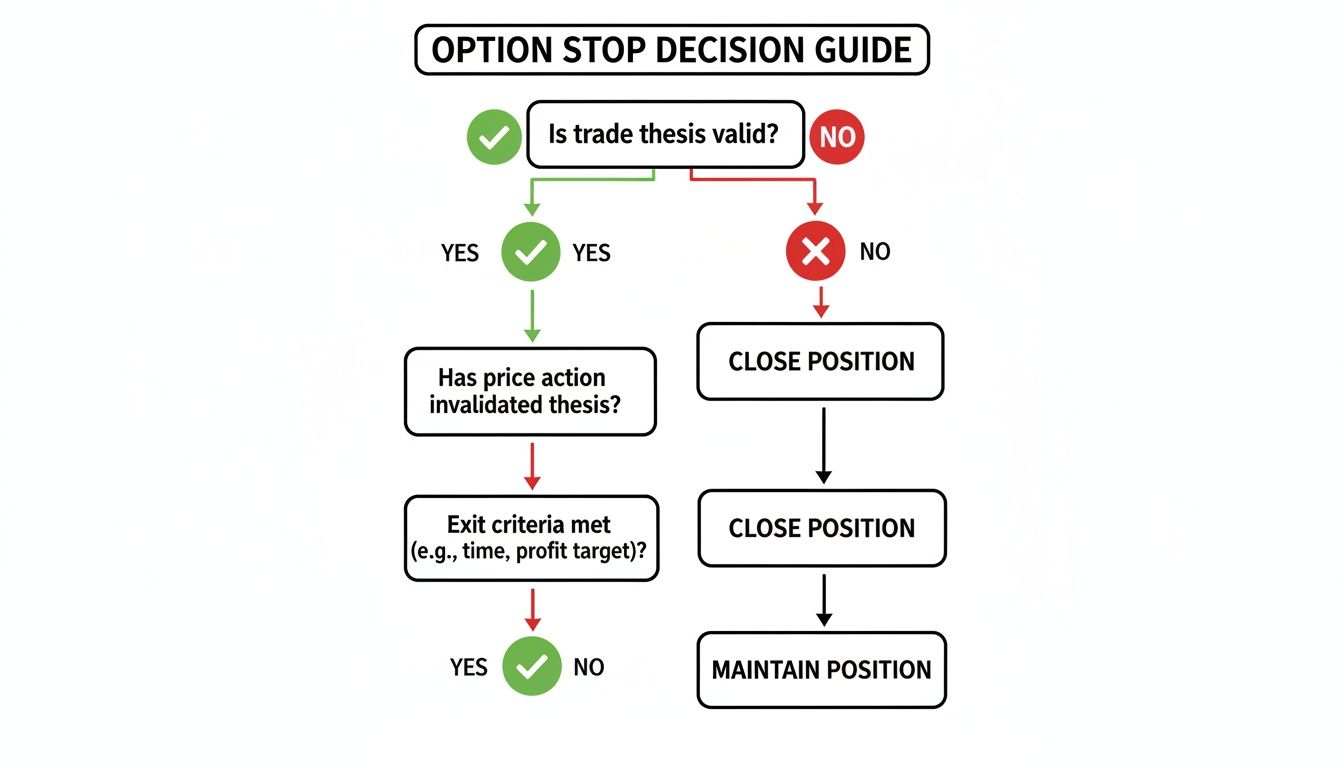

This decision tree is a great way to visualize a disciplined approach for managing a trade based on your core thesis.

The main takeaway here is simple but powerful: your exit signal should be the moment your original reason for the trade is proven wrong, not just some random price swing.

The Pitfall of the Percentage of Premium Method

The most intuitive way people try to set an option stop loss is with a fixed percentage of the premium. For example, you buy an option for $2.00 and set a 50% stop, planning to sell if it drops to $1.00. It feels simple and disciplined on the surface.

But this method is a trap, and it’s deeply flawed for options.

Because of their built-in leverage, a 50% drop in an option’s premium can happen with just a tiny, insignificant wiggle in the underlying stock. This is especially true for volatile stocks or options getting close to expiration, where time decay just eats away at the value. You’ll constantly find yourself getting shaken out of perfectly good trades by nothing more than market noise.

A More Robust Approach: Tying Stops to the Underlying Price

A far better way to do this is to base your stop loss on the price of the underlying stock. This approach directly connects your exit trigger to your actual trading thesis. Instead of reacting to the chaotic swings of the option’s premium, you’re making a decision based on whether your core idea about the stock is still valid.

Here’s how that looks in practice:

- Your Thesis: You buy a call option on XYZ stock when it’s at $100, because you believe it’s heading to $110. You’ve identified a key technical support level at $95.

- Your Stop Condition: Your entire trade idea is invalidated if XYZ breaks below that $95 support.

- Your Action: You set an alert for when XYZ hits $95. If that alert goes off, you manually log in and sell your call option, no matter what its premium is at that moment.

This method requires more discipline since it’s usually a “mental stop” you have to execute yourself, but it keeps you in the game as long as your thesis is intact and gets you out the moment it’s broken. This is a core concept we cover in our broader guide on how to set stop losses effectively.

Using the Greeks for Advanced Stop Loss Management

For traders who are comfortable with the Greeks, these metrics offer a much more sophisticated way to manage risk. The Greeks measure an option’s sensitivity to different market factors, letting you create smarter, more dynamic exit rules.

The goal isn’t to exit when a price hits an arbitrary number. It’s to exit when the risk profile of the trade changes in a way you no longer find acceptable.

Here are a couple of ways you can put this into action:

- Delta-Based Stops: Delta tells you how much an option’s price should change for every $1 move in the underlying stock. A common tactic for a long call is to decide you’ll exit if the delta drops below a certain point (e.g., from .50 down to .25). A falling delta means the probability of your trade working out has tanked.

- Vega-Based Stops: Vega is all about sensitivity to implied volatility. If your strategy depends on high or rising volatility, you might set a mental stop to get out if implied volatility collapses (what traders call a “vega crush”), since this will absolutely destroy your option’s premium. This is a classic risk right after big events like earnings announcements.

By anchoring your exit rules to the underlying stock or the trade’s changing Greek profile, you stop reacting to the noise of premium fluctuations. Instead, you start managing risk with a systematic, thesis-driven approach. That shift is fundamental to building long-term discipline and, most importantly, preserving your trading capital.

Understanding Order Types and Execution Risks

Figuring out your stop level is only half the battle. You still have to make sure it actually executes, and that’s a whole different challenge. Once you’ve decided when to get out, you need to decide how. The mechanics of your exit order can be the difference between a small, disciplined loss and a truly catastrophic one, especially in the blink-and-you’ll-miss-it world of options.

This is where a lot of traders get tripped up. They obsess over the perfect trigger price but completely ignore the real-world risks of getting that order filled. To protect your capital when a trade goes south, you absolutely have to understand the two main order types and the hidden dangers that come with them.

Stop-Market Orders: The Double-Edged Sword

A Stop-Market order is the most direct way to set up a stop loss on options. You pick a trigger price. If the option’s bid price falls to that level, your order instantly becomes a market order to sell at whatever the best available price is at that moment.

- The Pro: Guaranteed execution. Once your stop is hit, you’re out. Period. This is huge for enforcing discipline and stopping you from hesitating while a small loss snowballs into a massive one.

- The Con: Slippage. This is the big one. “Best available price” can be a terrifying phrase during a market panic. If bad news sends a stock into a nosedive, your option’s value can evaporate in seconds. Your stop-market order will trigger and sell, but it might fill way below your intended price, making your loss much worse than you planned.

This execution risk is what makes stop-market orders so risky. You’re guaranteed an exit, but the price you get might be devastating. You can dive deeper into how this works in our guide on what slippage is in trading.

Stop-Limit Orders: Price Protection with a Catch

A Stop-Limit order is designed to solve the slippage problem. It uses two prices: a stop (or trigger) price and a limit price. When the option hits your stop price, your order turns into a limit order to sell, which means it will only execute at your limit price or better.

- The Pro: Price control. This gives you a safety net against getting a horrible fill. You won’t sell your option for less than the limit price you set, which protects you from extreme slippage in a crash.

- The Con: Non-execution risk. And here’s the trade-off. If the market gaps down violently and blows right past your limit price without a single trade happening at or above it, your order won’t get filled. You’ll be stuck holding a losing position that’s now in freefall, completely unprotected.

Choosing between a Stop-Market and Stop-Limit order is a classic risk management dilemma: Do you want to risk a bad price (slippage) or risk no price at all (non-execution)? There is no perfect answer, only a trade-off.

The Hidden Risks of Illiquid Options

These execution risks get amplified tenfold when you’re trading illiquid options — those contracts that don’t trade much and have a wide bid-ask spread. A wide spread means there’s a huge gap between what buyers are willing to pay and what sellers are asking.

With these options, a stop-market order can trigger way too early if the bid price temporarily dips, only to fill you at a terrible price somewhere in the middle of that wide spread. This can happen even if the underlying stock barely moved.

What’s more, things can get intense during volatile events. When a bunch of stop-loss orders on options trigger all at once, market-makers hedging their positions can be forced to sell or buy the underlying stock, which can add to the downward spiral and make slippage worse for everyone. If you want to see how the pros monitor this, check out the data at OptionCharts.io. This is why a simple stop loss can sometimes do more harm than good in a chaotic market.

Integrating Stop Losses into Your Trading Plan

A stop loss isn’t just some order you place with your broker; it’s a foundational piece of your trading discipline. To really work, it needs to be woven into your risk management plan before you even think about hitting the “buy” button. This is about moving away from reacting to market noise and building a systematic, repeatable process to protect your capital.

The first step is figuring out your maximum acceptable loss for any single trade. This isn’t a random number you pull out of thin air. It should be tied directly to your portfolio size and personal risk tolerance. A solid rule of thumb is to risk no more than 1-2% of your total account value on one position.

When you set this limit ahead of time, your stop loss placement becomes a direct reflection of your long-term financial health. It forces you to think systematically: if a trade setup requires a stop that goes beyond your predefined risk limit, the answer is simple — you pass on the trade.

Removing Emotion from the Equation

One of the biggest wins of having a pre-defined exit plan is psychological. When a trade sours and the market gets chaotic, fear and hope are powerful forces that completely cloud your judgment. A clear, pre-determined exit point takes the emotional wrestling match out of the equation.

Think of your plan as a co-pilot, reminding you of the rules you set when you were calm, cool, and collected.

The goal of a stop loss is not just to limit financial loss, but to preserve your mental capital. It’s an automated decision that protects you from your own worst impulses during high-stress moments.

This disciplined approach is what builds the consistency you need to survive in the markets long-term. It turns the stop loss from a simple panic button into an essential part of a professional trading strategy.

The Power of Review and Refinement

Your job isn’t over when a stop loss gets hit. In fact, some of the most important work is just beginning. Every triggered stop is a valuable piece of data — a lesson the market is teaching you for the price of your loss.

The key is to meticulously log and analyze these trades. By reviewing why your stops were hit, you can start to uncover critical patterns in your trading.

- Was the stop too tight? If you’re constantly getting stopped out by minor blips in volatility, only to watch the trade roar back in your favor, your stops might not be giving the position enough room to breathe.

- Was the entry flawed? A triggered stop can also shine a spotlight on a weak entry. Maybe you jumped in too early or misread a key technical signal.

- Was it just a bad trade idea? Let’s be honest, sometimes the thesis was just wrong from the get-go. Recognizing this is crucial for not making the same mistake twice.

This feedback loop of constant review and adjustment is what separates amateurs from professionals. Keeping a detailed journal is non-negotiable for this analysis. Using a dedicated tool can make this process way more efficient. You can get started with a solid foundation by checking out an options trading journal template that helps you track all the metrics that matter.

Ultimately, integrating stop losses into your plan transforms them into a powerful tool for learning and continuous improvement. It’s about building the discipline to not only cut your losses but to learn from them, every single time.

Common Questions About Using a Stop Loss on Options

Even with a solid game plan, theory and practice can be two different things. Let’s tackle some of the most common questions that pop up when traders try to apply stop-loss concepts in the real world. This should help clear up any lingering confusion and get you trading with more confidence.

Is It Always a Good Idea to Use a Hard Stop Loss on Options?

Not necessarily. While a “hard” stop loss — an actual order sitting with your broker — is fantastic for enforcing discipline, it can be a real headache with options. The two biggest culprits are getting stopped out too early and suffering from brutal slippage.

Illiquid options with wide bid-ask spreads are the worst offenders. A temporary, meaningless dip in the bid price can easily trigger your stop, kicking you out of a perfectly good trade. On the flip side, a sudden, violent price move can cause a stop-market order to fill at a disastrous price you never saw coming.

Many seasoned options traders prefer using “mental stops” or price alerts instead. They base their exit decision on the underlying stock’s price, not the option’s premium. For example, they’ll set an alert if the stock breaks a critical support level. When that alert goes off, they pull up the chart, take a look, and then decide if it’s time to close the position manually.

This approach demands a ton of discipline, but it stops you from getting shaken out of a trade by random market noise. You stay in control and only exit when your actual trading idea has been proven wrong.

How Does a Trailing Stop Work with Options?

A trailing stop is a clever way to lock in profits on a winning trade. Instead of a fixed price, it “trails” the market price by a specific amount or percentage. As the trade moves in your favor, the stop moves up with it. It only triggers a sale if the price falls from its peak by the amount you set.

Imagine you set a 20% trailing stop on a call option you bought. If the premium runs from $2.00 all the way up to $5.00, your stop automatically adjusts itself to $4.00 (20% below that $5.00 peak). This lets you ride a winner and capture a big chunk of the move while protecting your gains from a sudden reversal.

But be warned, trailing stops suffer from the same issues as regular stops when it comes to options:

- Volatility Spikes: A quick, nasty drop can trigger your stop, knocking you out of a great trade that might have bounced right back.

- Time Decay (Theta): As you get closer to expiration, theta can chew away at the premium fast enough to hit your trailing stop, even if the stock is still doing exactly what you want it to.

They can be great for taking profits, but you have to manage them carefully to avoid getting kicked out too soon.

Can I Use a Stop Loss on Multi-Leg Option Spreads?

This is a big one. Trying to use a single, automated stop-loss order on a complex spread like an iron condor or a vertical is often impossible — most brokers don’t even support it. And trying to place individual stops on each leg is incredibly dangerous.

Here’s the risk: what if the stop on one leg of your spread gets triggered, but the other doesn’t? You’ve just turned your carefully built, risk-defined position into a trade with potentially unlimited risk — like being left with a naked short option. That’s a nightmare scenario for any trader.

The right way to manage risk on spreads is to base your exit on the spread’s total value or, even better, on the price of the underlying stock.

- Practical Example: You might decide your exit for a bull put spread is when the stock price drops below the strike of your short put.

- Execution: Once that price is hit, you manually go in and execute a single order to close the entire spread at once. This ensures both legs are closed together, just as they were opened.

This means you need to be watching the underlying stock closely or setting price alerts on it — not on the options themselves.

What Are Some Alternatives to a Traditional Stop Loss for Options?

Beyond just a simple stop on the premium, experienced traders have a few other tools in their risk-management toolbox that are much better suited for options. These are less about bailing on a trade and more about actively managing it.

- Rolling the Position: If a trade goes against you but you still believe in the idea, you can “roll” it. This means you close your current option and open a new one with a further-out expiration date or a different strike. It’s like buying your trade more time or giving it more room to be right.

- Hedging the Position: Instead of closing a loser, you can hedge it. Let’s say you’re long a call and the market turns south. You could sell a different call against it, turning your position into a spread. This puts a cap on your maximum loss while still giving the original trade a chance to recover.

- Using ‘Catastrophe Insurance’: This is a popular one for option sellers. Instead of a tight stop loss, they might buy a very cheap, far out-of-the-money option. It acts like an insurance policy against a black swan event, capping their maximum loss without getting them stopped out by the normal day-to-day market chop.

At the end of the day, the best alternative is a rock-solid trading plan. Your plan should spell out the exact conditions — based on the underlying asset’s behavior — that will tell you it’s time to get out. That’s far more reliable than relying on the often-erratic price of an option premium.

A disciplined approach to risk management requires constant analysis and refinement. The most effective way to improve is by meticulously tracking your trades to understand what works and what doesn’t. TradeReview provides the tools you need to log every detail, from entry and exit points to the reasons your stops were triggered. By analyzing your performance data, you can move beyond guesswork and build a data-driven strategy. Start journaling your trades for free and gain the insights needed for long-term success at https://tradereview.app.