Picking the right options trading software can feel like choosing a co-pilot for your trading journey. You’re not just buying a tool; you’re investing in a system that needs to help you make sense of the market’s complexities. This guide is designed to cut through the noise and focus on what actually matters — strategy, not hype.

Why Your Trading Software Matters

Trying to navigate the options market without solid software is like trying to sail across the ocean with just a compass. Sure, it’s possible, but it’s unnecessarily difficult and incredibly risky. The market moves fast, and great opportunities can disappear in a flash. The right software is your advanced navigation system, giving you the data, analysis, and execution speed you need to make smart decisions when it counts.

We get it. The journey of a trader can be a lonely one, filled with moments of doubt and frustration. It’s easy to feel overwhelmed by flashy dashboards and countless features that don’t add any real value to your trading. This guide will help you look past the marketing and zero in on the things that will actually make a difference.

The real goal is to find a platform that supports disciplined, long-term thinking — not one that promises easy profits or encourages you to take reckless chances. Success in options is a marathon, not a sprint, and your software should be built for the long haul.

We’ll walk through the essential building blocks of powerful options trading software, breaking down concepts like reading an options chain with confidence or interpreting a risk graph at a glance. Think of this as your roadmap to making a much more informed choice.

We’ll cover:

- Core Features: The non-negotiable tools every serious trader needs in their arsenal.

- Evaluation Criteria: How to match a platform’s capabilities to your unique trading style.

- Workflow Integration: Building a repeatable process, from coming up with an idea to reviewing the trade later.

This honest look will give you the knowledge you need to find a tool that genuinely supports your growth as a trader.

What to Look For: The Key Features That Actually Matter

When you’re shopping for software for options trading, it’s easy to get distracted by flashy marketing and promises of “revolutionary” tools. But experienced traders know to look under the hood. The best platforms are built on a solid foundation of practical, powerful features that support disciplined trading, not just shiny buttons.

The demand for these robust tools is exploding. The global market for options trading platforms hit around USD 1.5 billion in 2023 and is on track to double to USD 3.0 billion by 2032. This isn’t just a random number; it shows that traders everywhere are actively searching for better software to gain an edge. You can read more about this market growth on dataintelo.com.

So, what separates the truly great platforms from the mediocre ones? Let’s dive into the core features you can’t live without.

Core Features Checklist for Options Trading Platforms

Before we get into the details, here’s a quick rundown of what every serious options trader should be looking for in their software. Think of this as your essential checklist.

| Feature | Why It Matters | What to Look For |

|---|---|---|

| Real-Time Options Chains | A delayed options chain is useless. You need live data to make timely decisions. | Customizable columns, real-time quotes, and easy filtering by strike and expiration. |

| The Greeks | These are your core risk metrics. Ignoring them is like flying blind. | Visual displays of Delta, Gamma, Theta, and Vega that are easy to understand. |

| Strategy Builders | Lets you model complex trades before risking a single dollar. | Interactive tools for multi-leg strategies with visual profit/loss graphs. |

| Risk Graphs | Visually shows your trade’s potential outcomes, including max profit, loss, and breakeven. | Clear, interactive graphs that update as you adjust strikes and expirations. |

| Trade Execution | The link between analysis and action. It needs to be fast and reliable. | Low-latency order routing, complex order types, and minimal slippage. |

| Broker Integration | A seamless connection to your broker simplifies everything. | Direct API integration, position syncing, and the ability to trade from the platform. |

| Trade Journaling | This is how you learn and grow. Without it, you’re just guessing. | Built-in or integrated journaling to track performance, notes, and strategy effectiveness. |

This table covers the fundamentals. A platform that skimps on any of these core areas will hold you back, no matter how good it looks.

Real-Time Options Chains and The Greeks

First things first: the options chain. This is your command center, listing every available call and put for an underlying stock. If this data is delayed or static, you’re already behind. You need a live, highly customizable chain that lets you instantly filter by strike price, expiration, and volume.

But just seeing the prices is only half the battle. The best software makes the Greeks — the essential risk metrics for options — come alive. It’s not about just displaying numbers; it’s about understanding what they mean for your trade.

- Delta: Think of Delta as the option’s speedometer. It tells you how much the option’s price should move for every $1 change in the underlying stock. A call option with a 0.40 Delta is expected to gain about $0.40 if the stock price rises by $1.

- Gamma: This is the acceleration of your Delta. It shows how quickly your directional risk can ramp up or down, which is critical for managing your position as expiration nears.

- Theta: Often called “time decay,” Theta is like a melting ice cube. It represents the value an option loses every single day as it gets closer to expiration. Good software helps you visualize this decay, so you feel the urgency of time. For example, seeing a Theta of -0.05 means your option loses five cents in value each day, all else being equal.

- Vega: This metric measures an option’s sensitivity to implied volatility. It helps you understand how a sudden shift in market fear or greed could impact your bottom line.

A great platform doesn’t just spit out the Greeks; it makes them intuitive. It helps you see the invisible forces of time, volatility, and price movement acting on your trade before you ever place it.

Interactive Strategy Builders and Risk Graphs

This is where modern software really flexes its muscle. An interactive strategy builder is a must-have, allowing you to build complex multi-leg strategies — like Iron Condors, Straddles, or Butterfly Spreads — and see the potential outcomes visually.

This feature takes you from abstract theory to hands-on practice. You can drag strike prices around, switch expiration dates, and instantly see how those tweaks impact your profit and loss on a risk graph. This graph is your trade’s blueprint, clearly showing your max profit, max loss, and breakeven points at expiration.

For example, before placing an Iron Condor, you could model it to see exactly how a 5% move in the underlying stock would affect your position’s value. This process builds discipline and confidence, forcing you to define your risk upfront and preventing you from making emotional, in-the-moment mistakes. It’s a lot like using backtesting software for trading strategies to see how an idea would have performed in the past.

How to Choose the Right Software for Your Trading Style

Picking the best software for options trading isn’t about finding a one-size-fits-all solution — it’s a deeply personal decision. A platform built for a high-frequency day trader who’s in and out of dozens of trades before lunch is going to feel clunky and overpriced for a long-term investor just selling covered calls once a month.

The real goal isn’t to find the software with the longest list of features. It’s to find the one that clicks with your strategy, your personality, and your goals. We’ve seen countless traders get bogged down simply because they chose a tool that fights their natural workflow. An overly complex interface can trigger analysis paralysis, while a tool that’s too basic might not have the risk management features you desperately need when things go sideways.

That’s why a little thoughtful evaluation upfront can save you a ton of headaches down the road.

Match the Platform to Your Trading Personality

First things first, you need to get honest about who you are as a trader. Are you glued to your desk all day, or do you need to check in on positions from your phone while you’re out and about? The answer completely changes what you should be looking for.

- The Swing Trader: This trader holds positions for days or weeks at a time. They live and die by best-in-class mobile alerts, clean charting tools to spot entries and exits, and a simple interface for firing off orders from a phone or tablet.

- The Portfolio Hedger: This person is less concerned with the daily noise and more focused on protecting a larger stock portfolio. They need sophisticated risk modeling tools and portfolio-level Greek analysis to see exactly how a new options position will affect their overall risk.

- The Income Seller: A trader focused on selling premium (think covered calls or cash-secured puts) needs an efficient options scanner to find high-probability setups. For example, they might scan for stocks with high implied volatility rank and filter for options with a specific Delta range. They also need clear visuals that show potential return on capital at a glance.

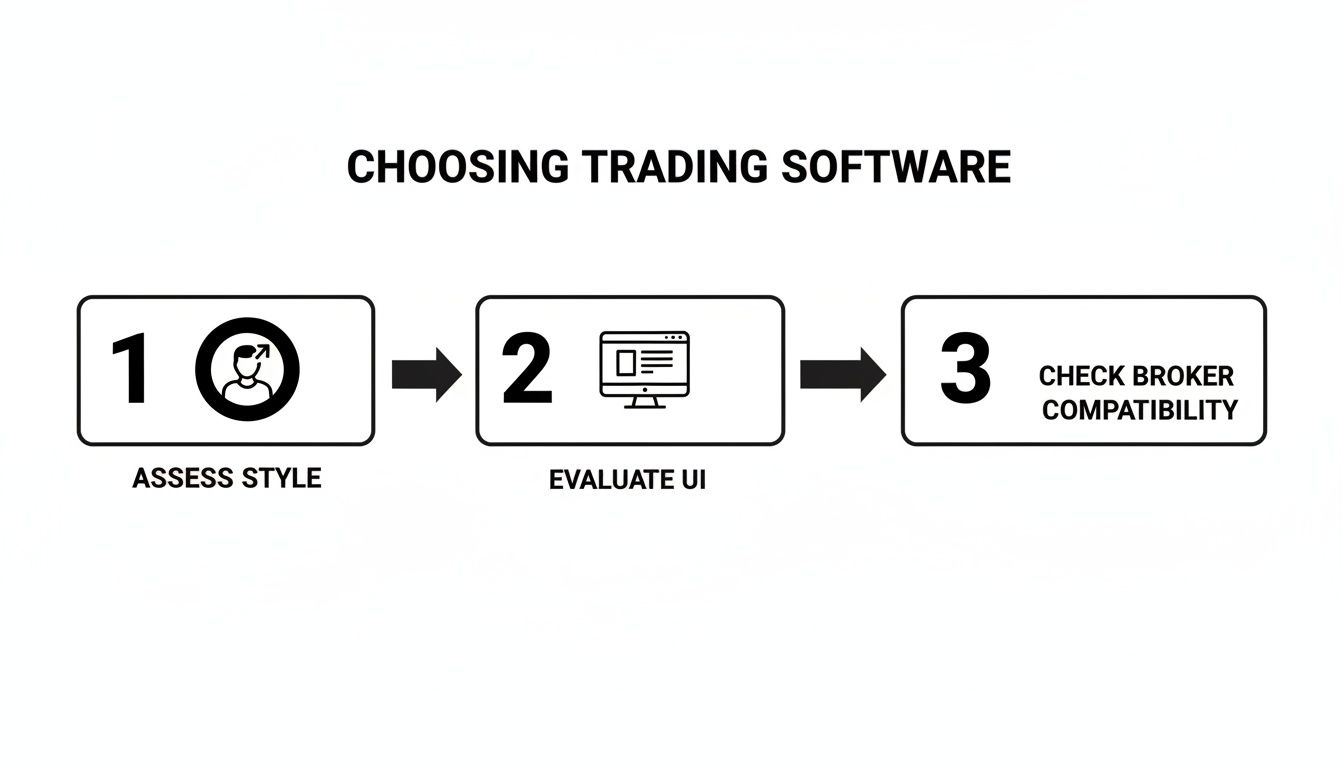

Evaluate User Interface and Broker Integration

Once you’ve nailed down your trading style, the user interface (UI) is the next big hurdle. A cluttered, confusing dashboard is a recipe for expensive mistakes. Look for a clean layout where you can find what you need — your positions, risk graphs, and order entry — without digging through a maze of menus. Most top-tier platforms offer free trials, so definitely take them for a spin.

Just as important is seamless broker integration. The software needs to connect directly and reliably to the brokerage where you hold your money. This gets rid of manual data entry, cuts down on errors, and makes trade execution faster and more accurate. Finding the right fit is a common challenge, especially with millions of new traders jumping into the market. In fact, the options trading platform market in North America and Europe was valued at USD 1.52 billion in 2024, thanks to a huge surge in retail trading in the U.S. You can discover more insights about this growing market on databridgemarketresearch.com.

The right software feels like an extension of your own thinking. It should reduce friction and mental clutter, allowing you to focus on making smart decisions instead of fighting with the tool itself.

At the end of the day, the software is just one piece of your trading toolkit. To help you weigh your options, our trading platform comparison gives you a deeper look at what different providers bring to the table. The best platform is simply the one that supports your unique approach and reinforces good, disciplined habits over emotional, impulsive clicks.

Building a Disciplined Workflow From Idea to Execution

Great options trading software does more than just throw data at you — it becomes part of a repeatable, disciplined process. A structured workflow transforms trading from a series of gut reactions into a methodical practice, which is the real foundation for long-term success. It’s all about building a system that guides you from a promising idea all the way to a thoughtful review.

This process ensures every action has a purpose, helping you sidestep the emotional pitfalls that can derail even the sharpest traders. Think of a consistent workflow as your best defense against market chaos.

From Idea Generation to Strategy Building

Every single trade starts with an idea. This first stage is where you’ll lean on your software’s scanners and screeners to hunt for opportunities that fit your specific criteria. For instance, you might scan for stocks with high implied volatility to sell premium or look for specific chart patterns that suggest a breakout is on the horizon.

Once you’ve found a candidate, it’s time for analysis and strategy building. This is where you model the trade using the software’s risk graphs and P/L simulators. You can actually see how a multi-leg strategy like an Iron Condor might perform under different market conditions, clearly defining your max profit, max loss, and breakeven points before you ever risk a single dollar.

The Critical Path: Execution and Review

With a solid plan in place, execution becomes a simple, mechanical step. Your software should make it easy to enter orders accurately and efficiently, especially for complex multi-leg spreads. The goal here is to minimize slippage and make sure you get the fills your strategy depends on. A quick, reliable execution engine isn’t a “nice-to-have” — it’s a must.

This three-step process — assessing your style, evaluating the user interface, and checking broker compatibility — is a simple but powerful framework for choosing the right software.

As this guide shows, finding the right tool starts with understanding your own needs first, before you get lost in a sea of features.

But the workflow doesn’t stop once the trade is placed. The most crucial — and most often skipped — stage is the review. This is where a dedicated trade journal becomes your most powerful tool for growth.

Many traders spend 90% of their energy finding new trades and only 10% reviewing past performance. Elite traders often flip that ratio. They know the real growth comes from analyzing what went right and, more importantly, what went wrong.

Unlocking Growth Through Trade Journaling

A quality trade journal, like the analytics dashboard offered by TradeReview, helps you see beyond simple profit and loss. It lets you analyze your performance and spot destructive behavioral patterns — like closing winners too early or holding losers for far too long — and systematically sharpen your strategy over time.

By tracking metrics like your win rate and profit factor, you get an honest, data-driven look at what’s working and what isn’t. When you build journaling into your workflow, you create a feedback loop that turns every trade, win or lose, into a valuable lesson. This disciplined approach is what separates the consistently profitable traders from everyone else.

Why Security and Trade Journaling Are Non-Negotiable

When you’re chasing the next big trade, it’s all too easy to ignore two pillars of long-term success: security and trade journaling. We get so laser-focused on finding the perfect setup that we forget to protect our capital and, just as crucially, our own mindset. Any options trading software worth its salt has to nail both of these.

Think about it: your trading platform is the digital vault holding your hard-earned capital. Treating its security like an afterthought is a risk no trader can afford. In a game where a single click can make or break you, a security breach could wipe out months of progress in an instant.

But protecting your money is only half the battle. You also have to protect yourself from your own worst instincts. This is where a trade journal goes from a tedious chore to the single most powerful tool you have for growth and discipline.

Fortifying Your Digital Trading Floor

Your first line of defense is rock-solid platform security. These aren’t just “nice-to-have” features; they’re absolute musts designed to keep bad actors out and your financial data locked down.

At a minimum, look for these essentials:

- Two-Factor Authentication (2FA): This adds a critical second step to your login, usually a code sent to your phone. It makes it exponentially harder for anyone but you to access your account.

- Data Encryption: Your personal info and trade data should be scrambled with strong encryption, both when it’s sent over the internet and when it’s sitting on their servers.

Without these, you’re essentially leaving the door to your vault wide open.

The Unbreakable Feedback Loop of Journaling

While security protects your capital from outside threats, journaling protects it from the enemy within — your own psychological biases. We all have them. Maybe you hold onto losers for too long, praying for a comeback, or you cut your winners short out of fear. A journal makes these destructive patterns impossible to ignore.

Consistent journaling is the bridge between trading as a hobby and trading as a business. It forces you to move from emotional gut reactions to data-driven decisions, turning every single trade into a lesson.

With options trading volumes growing, the need for this kind of discipline has never been more critical. While projections vary, sources like Cboe have noted significant growth in options contracts traded annually. For example, a Cboe options industry report highlights trends in the market, including the rise of short-dated options that require even greater discipline from traders.

In an environment that moves this fast, your journal is your anchor. It’s where you document your thesis, track your results, and dissect your mistakes. This feedback loop is what builds the mental toughness needed to navigate the chaos.

To get started, you can explore our guide on building an effective options trading journal template. When you pair strong security with diligent journaling, you create a complete ecosystem for sustainable, long-term growth as a trader.

Answering Your Questions About Options Trading Software

Diving into the world of software for options trading always kicks up a lot of questions. It’s a big decision — one that shapes your entire workflow, puts your capital on the line, and can either help or hinder your growth. We’ve heard just about every question in the book from traders just like you.

Our goal here is to give you some clear, no-nonsense answers. We want to help you cut through the noise, avoid the common traps, and pick the tools that actually work for you. Let’s get right into it.

Do I Need Expensive Software to Start Trading Options?

Nope, absolutely not. This is probably one of the biggest myths out there.

Plenty of traders get their start — and become consistently profitable — using the free, high-powered platforms their brokers provide. Tools like TD Ameritrade’s thinkorswim or Interactive Brokers’ TWS give you all the essentials you need to find, analyze, and execute trades without costing you a dime.

So, why would anyone pay for software? Usually, it’s for very specific, advanced features, like:

- Sophisticated backtesting engines for running strategies against years of historical data.

- Niche options screeners designed to hunt for very particular setups.

- In-depth portfolio analytics that dig much deeper than a standard broker report.

The smart move is to start free, focus on building good habits, and only upgrade when you hit a wall. Don’t pay for fancy features until you know exactly what problem you’re trying to solve.

Can Software Guarantee Profits in Options Trading?

Let’s be crystal clear: no software on earth can guarantee profits. If you see a platform making that kind of promise, run the other way.

An options trading platform is just a tool. It’s not a crystal ball. Its job is to give you good data, help you visualize risk, and make your trade execution smooth and efficient. It’s there to help you make better decisions, but it can’t make them for you.

Success in trading comes from a well-defined strategy, disciplined risk management, and a commitment to continuous learning. The software is there to support that process, not replace it.

Think of it like a pro chef’s kitchen. The best knives and ovens don’t guarantee a Michelin star; they just give a talented chef the ability to perform at their absolute best. Your software does the same thing for your trading.

How Does a Trade Journal Work With My Trading Platform?

This is where things get interesting. Your trading platform and your trade journal are two sides of the same coin — they work together to create a powerful feedback loop for improvement.

Your platform is for doing — placing and managing trades. Your journal is for learning — figuring out what you did right, what you did wrong, and why.

Most modern journals, like TradeReview, can sync directly with your broker to automatically import your trading history. This is a game-changer. It saves you hours of tedious data entry and makes sure everything is 100% accurate. Once the trades are in, the journal gets to work, organizing the data to reveal insights you’d never find in a simple broker statement.

For instance, a journal helps you:

- Tag trades by strategy (like “Iron Condor” or “Covered Call”) to see which ones actually make you money.

- Track your win rate, average profit/loss, and other key metrics over time.

- Pinpoint bad habits, like cutting winners short or revenge trading after a loss.

By connecting your broker to a journal, you create a clean separation between the act of trading and the act of analysis. This lets you step back and review your performance objectively, turning every single trade — win or lose — into a lesson that makes you better.

Ready to build the discipline that separates successful traders from the rest? TradeReview offers a powerful, free trade journal that syncs with your broker to provide the data-driven insights you need to grow. Start making smarter decisions today by visiting https://tradereview.app.