At its core, the difference is simple: a credit spread means you get paid a premium upfront, hoping the options expire worthless. A debit spread means you pay a premium to bet on a specific directional move.

Think of it this way. With a credit spread, you’re the insurance seller. You collect a small, upfront payment and your goal is for nothing to happen. Time and stability are your best friends. With a debit spread, you’re the insurance buyer. You pay a premium for the chance at a much bigger payout if a specific event — in this case, a price swing — occurs.

Foundational Strategies: Credit Spread vs Debit Spread

Jumping into options trading can feel like learning a new language. Strategies often sound alike but work on completely different principles. We get it. Many traders get stuck deciding between a credit spread and a debit spread because the choice goes deeper than just picking a market direction. It’s about how you want to interact with volatility, time decay, and your own tolerance for risk. This struggle is a normal part of the learning curve, and mastering this choice is a major step forward.

This guide is built to cut through that noise. We’ll move past basic definitions and give you a practical framework for picking the right spread for the right market scenario. The idea is to help you build a repeatable, disciplined thought process every time you analyze a trade, turning uncertainty into a structured plan.

Before we get into the weeds, let’s lay out the key differences.

Credit Spread vs Debit Spread At a Glance

Here’s a quick summary table that breaks down the fundamental differences between these two workhorse strategies. It’s a great reference to come back to as you get more comfortable.

| Attribute | Credit Spread (Net Credit) | Debit Spread (Net Debit) |

|---|---|---|

| Primary Objective | Profit from time decay and the options expiring worthless. | Profit from a directional move in the underlying asset. |

| Initial Transaction | You receive money (a net credit) when opening the trade. | You pay money (a net debit) when opening the trade. |

| Ideal Market View | Neutral, mildly bullish, or mildly bearish. | Directional (bullish or bearish). |

| Max Profit | Capped at the initial net credit received. | Capped at the difference between the strikes, minus the debit paid. |

| Max Loss | Capped at the difference between the strikes, minus the credit received. | Capped at the initial net debit paid. |

This table makes it clear: one strategy is about collecting income and managing probability, while the other is about capturing a specific price move.

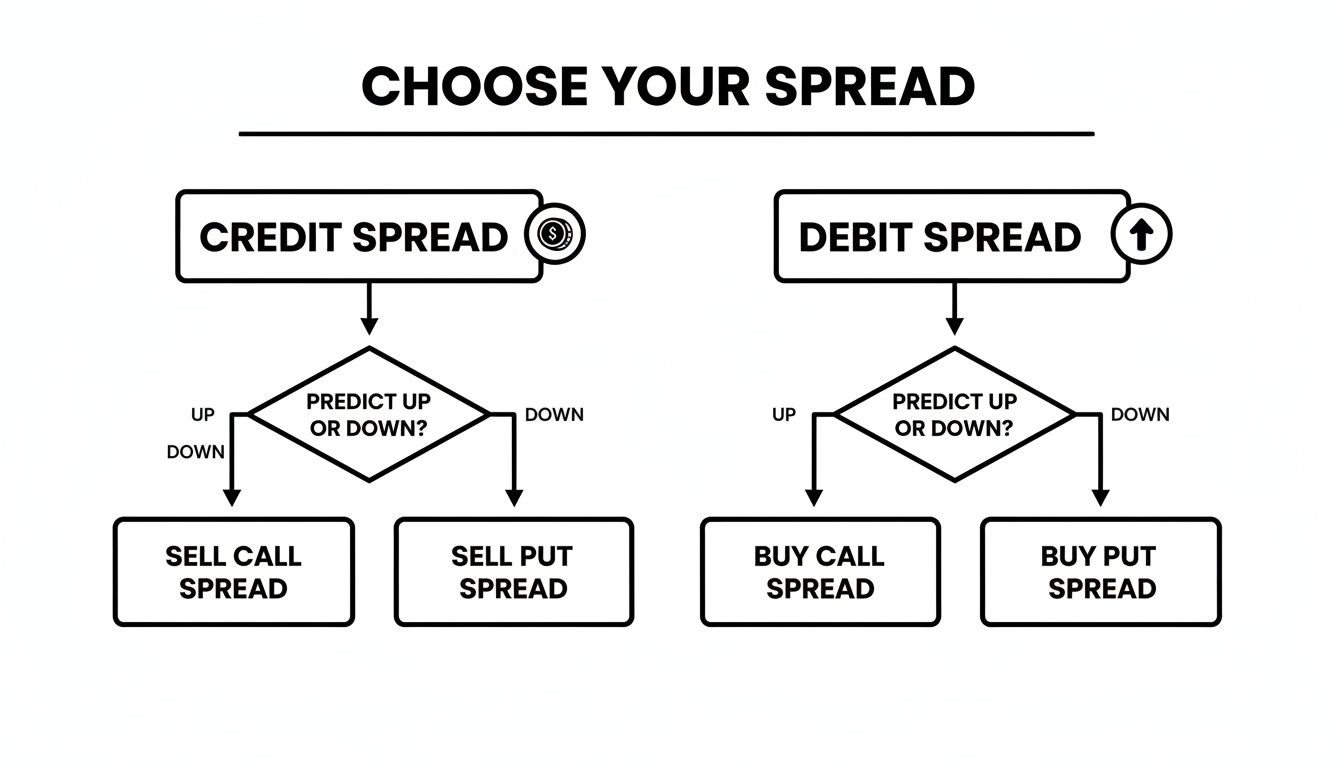

This decision tree gives you a visual for the core choice: are you selling premium for income (credit spreads) or buying it for a directional gain (debit spreads)?

As the flowchart shows, your market outlook and what you expect from volatility should be the first things you consider when picking your strategy.

The Mindset Behind Each Spread

Choosing between these two strategies also says a lot about your trading psychology. A credit spread trader is usually playing a game of probabilities. They look for high-probability setups that can generate consistent, smaller returns over the long term. It’s a game of patience where your biggest ally is the clock.

A credit spread positions you to profit if the stock stays flat, moves in your favor, or even moves slightly against you. A debit spread requires you to be correct about the direction of the move to be profitable.

On the other hand, a debit spread trader is looking to capitalize on a predicted price move. This approach often gives you a better risk-to-reward ratio, meaning your potential profit can be much larger than your initial risk. But, it also demands you be more accurate in your market forecast.

Getting this core distinction down is the first real step toward mastering both strategies and knowing exactly when to pull each one out of your toolbox.

Understanding the Core Mechanics and Payoff Structures

To really get the difference between a credit spread vs debit spread, you have to look past the initial transaction and see how they’re actually built. Each one is a two-legged strategy — you’re buying one option and selling another — designed to give you a predictable, risk-defined outcome. Let’s pull back the curtain on how they work.

Credit Spreads: Receiving Premium for Stability

A credit spread is all about selling a more expensive option while buying a cheaper, further out-of-the-money option as protection. The moment you place the trade, a net credit hits your account. The game plan here is simple: you want the underlying stock to stay away from your short strike, letting both options expire worthless so you can pocket the entire premium.

There are two flavors of credit spreads:

- Bullish Put Credit Spread: This is for when you’re mildly bullish or even just neutral on a stock. You sell a put and buy another put with a lower strike. The goal is for the stock to stay above the put you sold. For a full breakdown, check out our guide with detailed bull put spread examples.

- Bearish Call Credit Spread: You use this when you’re mildly bearish or neutral. You sell a call and buy another call with a higher strike. Your goal is for the stock price to stay below the call you sold.

Practical Example: A Bull Put Credit Spread

Let’s say stock XYZ is trading at $105. You believe it will likely hold above $100 for the next month. You could set up a trade like this:

- Sell the $100 put option and collect a $2.00 premium.

- Buy the $95 put option for protection, which costs you $0.75.

This trade immediately gives you a net credit of $1.25 ($2.00 – $0.75) per share, or $125 per contract. That $125 is your maximum profit. Your maximum risk is the width of the strikes ($5) minus your credit ($1.25), which works out to $3.75, or $375 per contract. This is a defined-risk trade, so you know your worst-case scenario before you even enter. As long as XYZ closes above $100 at expiration, you keep the full $125 credit.

Debit Spreads: Paying for a Directional Move

A debit spread is the mirror image. You buy a more expensive, closer-to-the-money option and sell a cheaper, further out-of-the-money option. This means you have a net debit — a cost to get into the trade. With a debit spread, you need the underlying stock to make a move in your favor, which increases the value of your spread so you can sell it for a profit.

The two main types of debit spreads also reflect a directional bias:

- Bullish Call Debit Spread: You expect a stock to go up. You buy a call and sell another call at a higher strike price.

- Bearish Put Debit Spread: You expect a stock to go down. You buy a put and sell another put at a lower strike price.

With a credit spread, your primary goal is for both options to expire worthless. With a debit spread, your goal is for both to expire in-the-money.

Practical Example: A Bull Call Debit Spread

Using the same stock, XYZ, trading at $105, let’s say you’re bullish and think it could run up toward $110. You could:

- Buy the $105 call option, paying a $3.00 premium.

- Sell the $110 call option to help finance the trade, collecting $1.00.

This trade costs you a net debit of $2.00 ($3.00 – $1.00), or $200 per contract. That $200 is the most you can possibly lose. Your maximum profit is the width of the strikes ($5) minus your debit ($2.00), which comes to $3.00, or $300 per contract. For this trade to be profitable, XYZ needs to move above your breakeven point of $107 ($105 strike + $2.00 debit) by expiration.

How Implied Volatility Shapes Your Trading Decision

Beyond just picking a market direction, the single most critical factor in the credit spread vs debit spread debate is often implied volatility (IV). Think of IV as the market’s forecast for future price swings. When IV is high, option prices get more expensive; when it’s low, they become cheaper. Understanding this relationship is key to putting the odds in your favor.

A powerful rule of thumb emerges from this:

- High IV environments favor credit spreads. When fear is high and options are expensive, you want to be a seller of premium.

- Low IV environments favor debit spreads. When the market is calm and options are cheap, you want to be a buyer of premium.

This simple guideline helps shift your thinking from just guessing direction to making a much more strategic decision based on what the market is actually telling you.

Selling Premium When Volatility Is High

Think about scenarios that cause market anxiety — an upcoming earnings announcement, a Federal Reserve meeting, or a sudden market downturn. During these times, implied volatility spikes. This inflates option premiums across the board, creating a rich opportunity for sellers.

This is the perfect setup for a credit spread. By selling a now-expensive option and buying a cheaper one for protection, you collect a significant credit. Your goal is for the event to pass, causing IV to drop back to normal levels.

This phenomenon, known as a volatility crush, can be a powerful tailwind for your trade. Even if the underlying stock moves slightly against you, the sharp drop in IV can make your spread profitable. You’re essentially betting that the market’s fear is overpriced.

High implied volatility means you get paid more to take on the same amount of risk. This is the core advantage of selling credit spreads when the market is fearful.

Buying Premium When Volatility Is Low

So what about quiet, trending markets? When IV is low, options are relatively cheap. This is where debit spreads really shine. Paying a small premium for a directional bet becomes much more attractive when the cost of entry is low.

A debit spread lets you gain directional exposure at a discount. And because you are a net buyer of options, an increase in implied volatility can actually help your position. This positive relationship to volatility is measured by the option greek Vega, which is simply a term for how much an option’s price changes for every 1% change in implied volatility. A rising IV can increase the value of your spread, adding another potential profit driver on top of your directional view.

Research from Charles Schwab suggests a practical approach, advising traders to consider buying debit spreads when IV is in the lower half of its yearly range. You can discover more insights on aligning your spread with volatility on ETF Trends.

By paying attention to IV, you move beyond simple bullish or bearish thinking. You start trading volatility itself, using credit spreads to capitalize on fear and debit spreads to position for movement when the market is complacent. It’s a disciplined approach that can make a huge difference in your long-term results.

A Realistic Look at Risk, Reward, and Probabilities

When it comes to credit spreads vs. debit spreads, the entire conversation boils down to one simple trade-off: do you want to win more often, or do you want to win big? There’s no magic strategy that gives you a high win rate and a massive payout. Anyone who tells you otherwise is not being honest about the realities of trading.

Getting a handle on this balance is the key to managing your expectations and, just as importantly, your trading psychology. The core difference is baked right into their statistical DNA. Credit spreads are built for a high probability of profit (POP) but come with a lopsided risk-to-reward ratio. On the flip side, debit spreads have a lower POP but offer a much sweeter risk-to-reward profile.

The Credit Spread Probability Game

Credit spreads are the bread and butter of income-focused traders. You collect a premium upfront for taking on a specific amount of risk, and you walk away a winner if the stock stays flat, moves in your favor, or even drifts a little bit against you. That wide profit window is what gives them such a naturally high win rate.

For instance, a pretty standard out-of-the-money (OTM) put credit spread might have a 70% probability of profit. The catch? For that high win rate, you might be risking $70 just to make a maximum of $30. This inverted risk-reward structure can be a tough pill for new traders to swallow, since one single loss can easily wipe out the profits from two or more winners.

This is exactly why discipline and position sizing are absolutely non-negotiable. Without them, the math will eventually catch up with you. You can learn more about how to evaluate these trade-offs by understanding the risk-reward ratio in our detailed guide.

The Debit Spread Payout Advantage

Debit spreads work on the complete opposite principle. They are pure directional bets that cost you money to get into, and you need the underlying stock to move in the direction you predicted to make a profit. That need for directional accuracy is what naturally lowers their win rate.

A similar debit spread might only have a 40% probability of profit. While that number might look a bit discouraging at first, the payoff makes up for it. In this scenario, you could be risking $50 for the chance to make a maximum profit of $150. Here, a single winning trade can more than cover the losses from two or three losers, which can feel pretty great psychologically.

The choice isn’t about which spread is “better.” It’s about aligning the strategy’s statistical profile with your personal goals and risk tolerance. One trader’s reliable income stream is another’s slow grind; one’s home run potential is another’s frustrating string of losses.

What the Data Tells Us

This trade-off isn’t just a theory; it’s backed by years of market data. The research team at tastylive, a financial network, has analyzed years of trade data comparing these strategies. One of their studies on SPY put credit spreads revealed a 73% win rate but with an average return of just 12% per trade.

Meanwhile, simulated debit spreads averaged a lower 52% win rate but cranked out a much higher 28% average return. This data perfectly frames the classic dilemma: would you rather have more frequent, smaller wins (credit spreads) or less frequent but larger wins (debit spreads)? Answering that question for yourself is the first step to building a trading plan you can actually stick with for the long haul.

Practical Trade Management and Exit Plans

Putting on a trade is just the first step. Knowing how to manage it — and when to get out — is what separates traders who consistently pull money from the market from those who just get lucky once in a while.

The emotional tug-of-war between greed and fear is very real, and the only way to win is with a non-negotiable, rules-based exit plan. You need to have this figured out before you even click the buy or sell button. This isn’t about being perfect; it’s about being disciplined. For both credit and debit spreads, your rules should be simple, clear, and written down so you can execute without hesitation when you’re under pressure.

Managing Credit Spreads for Consistent Income

When you’re trading credit spreads, your edge comes from probability and time decay. The goal isn’t to hit a home run by squeezing every last penny out of the trade. It’s about methodically taking profits and cutting losses before they have a chance to spiral.

A common and highly effective approach boils down to two simple rules:

- Take Profit at 50%: A widely accepted guideline is to close your credit spread once you’ve captured 50% of the maximum potential profit. If you sold a spread for a $40 credit, your goal is to buy it back for $20. That locks in a $20 profit. Waiting around to capture 100% of the credit just exposes you to unnecessary risk for diminishing returns as expiration gets closer.

- Define a Stop-Loss at 2x the Credit: Your max loss is defined, but you should never let a trade get there. A solid rule is to exit if the spread’s value doubles, meaning your loss is equal to the credit you initially received. So, if you collected $40, you’d get out if the cost to close hits $80, taking a managed $40 loss. This simple rule prevents one bad trade from wiping out a handful of winners.

The hardest part of trading credit spreads isn’t finding good setups. It’s having the discipline to take a loss at your predetermined exit point. Hesitation is what turns a small, managed loss into a max loss.

Now, what if a trade is challenged but you still believe in your original thesis? You might consider “rolling” the position. This means closing your current spread and opening a new one with the same strikes but a further-out expiration date, ideally for another credit. This maneuver buys you more time to be right, but it should be used selectively — not as a way to avoid taking a loss you know you should take.

Debit Spread Management: Timely Exits are Key

Managing a debit spread is all about capturing that directional move you predicted and getting out before the market snatches your profits back. Since you paid a premium to get into the trade, time decay (Theta) is your enemy, constantly eating away at your position’s value. Holding on for too long is one of the most common mistakes traders make.

Here are a few clear exit triggers for your debit spreads:

- Price Target Hit: This is the most straightforward exit. If your analysis suggested the stock would run to $150 and it gets there, close the trade. Don’t get greedy and hope for more.

- Profit Target Reached: Instead of holding until the bitter end, aim to cash out when you’ve captured 70-80% of the maximum potential profit. This strategy gets you out while the trade is a clear winner, sidestepping the risk of a late-stage reversal.

- Thesis Invalidation: If the reason you entered the trade is no longer valid — for example, a key support level breaks on your bull call spread — it’s time to get out. Sticking with a broken trade is just hoping, and hope is not a strategy.

Ultimately, whether you’re managing a credit spread or a debit spread, the principle is identical: trade your plan. That discipline is what transforms trading from a gamble into a structured, repeatable business.

Applying These Strategies With Real-World Examples

Let’s move from theory to practice. Seeing how a credit spread vs. debit spread decision actually plays out in different market conditions is the best way to make these concepts stick. We’ll walk through two hypothetical but very realistic scenarios using the S&P 500 ETF (SPY).

The key thing to remember is that this choice is rarely just about being bullish or bearish. It’s really about matching your strategy to the market’s volatility profile. We’ve all been there — you get the direction right but still lose money because you picked the wrong tool for the job. These examples are designed to help you build a more disciplined thought process to avoid that exact frustration.

Scenario 1: The Bull Put Credit Spread in Higher Volatility

Imagine SPY has just pulled back, and as a result, implied volatility (IV) has ticked up. You believe the selling is probably overdone and that SPY will likely hold above a key support level, but you aren’t expecting some massive, V-shaped rally. This is a classic setup for a bull put credit spread.

Your goal here is to collect a premium, essentially betting that SPY will stay above your short strike price. You’re not trying to time a breakout; you’re simply selling insurance to other traders who are feeling fearful.

- Your Action: Sell a put option below the current price and simultaneously buy a cheaper put even further down for protection.

- The Rationale: That elevated IV means option premiums are richer, so you get paid more to take on the risk. Time decay becomes your best friend, eroding the value of the options you sold with each passing day.

Scenario 2: The Bull Call Debit Spread in Lower Volatility

Now, let’s flip the script. The market has been calm for a while, and IV on SPY is low. You’ve done your analysis and have a strong conviction that SPY is poised for a breakout to the upside over the next few weeks. In this environment, a bull call debit spread makes a lot more sense.

Here, you’re buying a directional opportunity at a discount. Because options are relatively cheap due to low IV, you can purchase a call spread for a small debit. This gives you a defined-risk way to profit from the move you’re anticipating.

The core decision is simple: When fear is high and options are expensive, sell premium with a credit spread. When the market is calm and options are cheap, buy premium with a debit spread to position for a move.

For example, a typical put credit spread on SPY might involve selling a 0.30 delta put and buying a 0.10 delta put for protection. This could net you a credit of around $0.33 per share ($33 per contract). In contrast, a bullish call debit spread might require a net debit of $0.51 ($51 per contract), but its max reward could be $149 on a $2 wide spread, offering a much better risk-reward profile.

Getting a feel for these numbers is vital for mastering different options trading strategies.

Frequently Asked Questions

Once you start digging into options, a few questions about the credit spread vs debit spread choice always seem to pop up. It’s totally normal. Every trader who’s found success has wrestled with these exact same points, so let’s clear them up.

Which Spread Is Better For Beginners?

Honestly, both are solid starting points because they come with defined risk — a critical safety net when you’re just getting your feet wet. That said, many new traders find credit spreads to be a bit more forgiving.

The high probability of profit and the way time decay works in your favor means you can still make money even if the stock just chops around sideways. That can be a real confidence booster early on. Debit spreads are fantastic, too, but they definitely demand a bit more accuracy on your directional call.

The single most important thing for a beginner using either strategy is to start small. I’m talking really small position sizes. This lets you learn the mechanics and handle the emotional swings of trading without putting serious capital at risk.

How Does Assignment Risk Work With Spreads?

Assignment risk is a common worry, and it’s all about the option you sold — your short leg.

With a credit spread, your short option is closer to the money, so it has a higher chance of being assigned if the stock moves against you, especially as expiration gets close. Your long option is your insurance policy. If you get assigned shares, you can simply exercise your long leg to flatten the position, which locks in your trade’s predefined maximum loss.

For debit spreads, assignment risk is much, much lower since your short leg is further out-of-the-money. The easiest way to sidestep any assignment headaches? Just make it a habit to close your spreads before the expiration day.

Should I Use Both Credit and Debit Spreads?

Absolutely. A good options trader doesn’t just stick to one playbook; they adapt to what the market is giving them.

Think of it like this:

- Credit Spreads: These are your go-to in high-volatility environments. You get to collect bigger premiums, essentially acting like an insurance seller when fear is pumping up option prices.

- Debit Spreads: Pull these out in low-volatility, trending markets. They let you make a directional bet with limited risk and a lower cost to get in the game.

Using both strategies based on the market conditions is what separates the pros from the amateurs. It gives you the flexibility to find opportunities and express your view no matter what the market climate looks like.

No matter which strategy you favor, tracking your performance is the only path to long-term success. TradeReview gives you the tools to break down every trade, spot your patterns, and sharpen your approach. Stop guessing and start making data-driven decisions. Sign up for your free trading journal at https://tradereview.app and see the difference it makes.