The loss ratio formula is a deceptively simple calculation that packs a serious punch. At its heart, it compares the money you lose against the money you make. Think of it as a critical health monitor for anyone managing risk — whether you’re a global insurance giant or a solo trader grinding it out every day.

We’ve all been there: staring at a string of red trades and wondering if our strategy is broken. It’s easy to get caught in the emotional rollercoaster of wins and losses. This formula helps you cut through that noise and see the unvarnished truth about your performance.

What Is the Loss Ratio and Why Should You Care?

The loss ratio isn’t just another piece of financial jargon to memorize. It’s a fundamental measure of how efficient — and viable — your strategy really is.

Let’s bring it home with a practical example. Imagine managing your personal budget. You have income coming in (your salary) and expenses going out (bills, groceries, etc.). The loss ratio is like asking, “For every dollar I bring in, how many cents am I spending on things I absolutely have to pay for?”

That one question tells you almost everything you need to know about the health of your budget. In the same way, the loss ratio reveals the health of any risk-based operation by answering a crucial question: is my core strategy actually profitable before I even think about other business expenses?

A Universal Tool for Managing Risk

It doesn’t matter if you’re an insurance underwriter or a day trader; the principle is exactly the same. The loss ratio gives you a clear, objective number that cuts straight through emotional bias and gut feelings. It’s a tool that forces you to be disciplined and think long-term by confronting the raw performance of your system.

For instance, an insurance company uses this metric to:

- Gauge profitability: Are the premiums they collect enough to cover all the claims they have to pay out?

- Set prices: A sky-high loss ratio is a massive red flag that their policies are probably priced too low for the risk involved.

- Stay compliant: Regulators like the National Association of Insurance Commissioners (NAIC) often require insurers to maintain certain loss ratios to make sure customers are getting fair value.

For traders, tracking your loss ratio is an act of self-awareness. It moves you from hopeful guessing to data-driven analysis, helping you refine your strategy with cold, hard facts instead of emotion.

Ultimately, getting a handle on the loss ratio formula is the first step toward making smarter, more sustainable decisions. It gives you the foundational insight you need to figure out if your current approach is built to last or just destined to blow up.

Breaking Down the Insurance Loss Ratio Formula

If you want to know how healthy an insurance company really is, you need to look under the hood. The insurance loss ratio is the diagnostic tool that tells you how efficiently its core business is running. It’s a simple calculation, but every part of it tells a story.

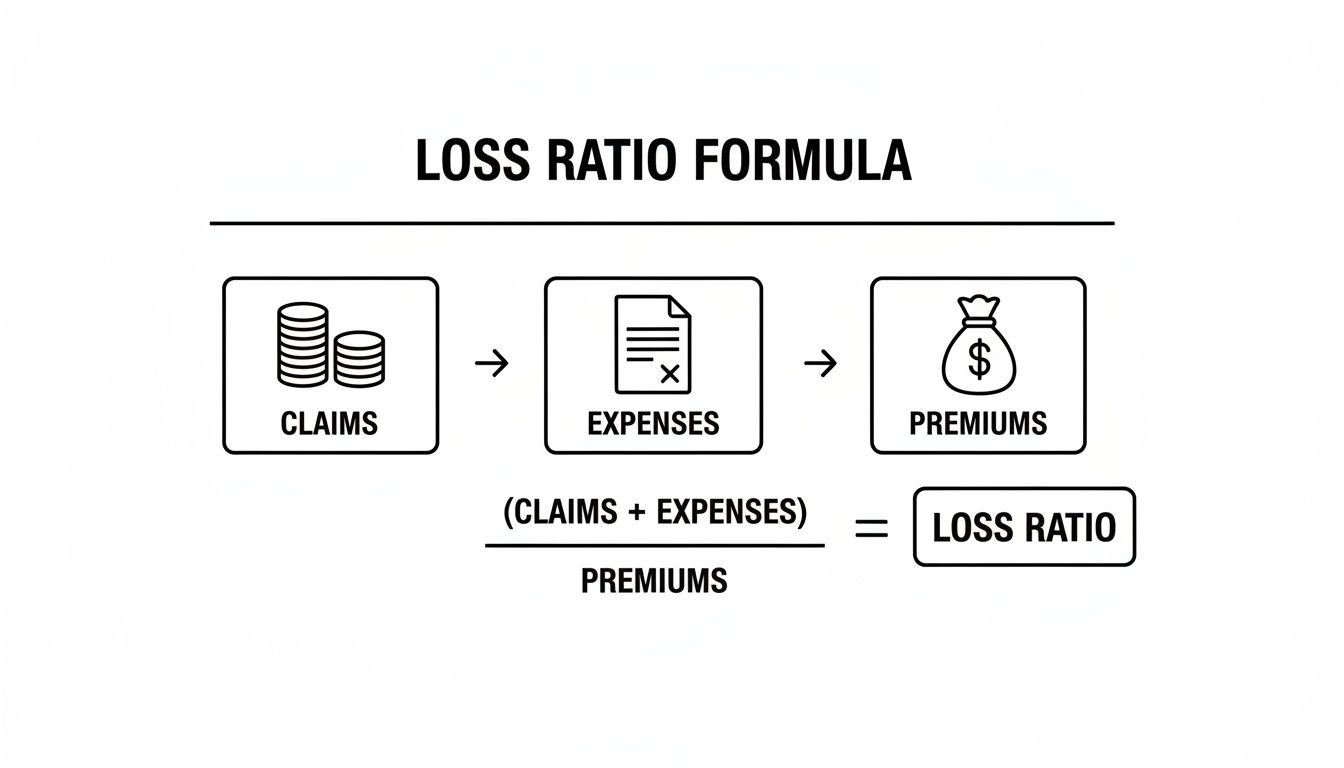

At its heart, the formula is straightforward:

Loss Ratio = (Incurred Losses + Loss Adjustment Expenses) / Earned Premiums

This little equation reveals exactly how much of an insurer’s premium income is being spent on paying out claims and covering the costs to handle them. Let’s break down what these terms actually mean, without the overly technical jargon.

The Key Components

To get the formula, you need to understand its three main ingredients. Each one represents a critical flow of money in the insurance world.

- Incurred Losses: This is the big one. It’s the total amount of money paid out to policyholders for the claims they’ve filed. Think of it as the primary “cost of goods sold” for an insurer.

- Loss Adjustment Expenses (LAE): Claims don’t settle themselves. These are the costs tied to investigating and settling a claim — everything from an investigator’s salary to legal fees.

- Earned Premiums: This isn’t just the total cash an insurer collects. It’s only the portion of the premium that applies to the coverage period that has already passed. For example, if you pay for a full year of car insurance, after six months, the insurer has only “earned” half of that premium.

A Practical Example

Let’s put this into action with a fictional company, “Secure Home Insurance.” This makes the concept much clearer than just looking at the formula.

Imagine Secure Home collected $500,000 in earned premiums over the last year. During that same time, they paid out $275,000 in claims for things like storm damage and burst pipes. On top of that, it cost them $25,000 in adjustment expenses to manage those claims.

Here’s how we’d calculate their loss ratio:

- Add up total claim costs: $275,000 (Losses) + $25,000 (LAE) = $300,000

- Divide by earned premiums: $300,000 / $500,000 = 0.60

- Turn it into a percentage: 0.60 x 100 = 60%

Secure Home’s loss ratio is 60%. This tells us that for every single dollar they earned in premiums, they spent 60 cents paying for claims and the costs to settle them. It’s a powerful snapshot of their underwriting performance, which we’ll dive into more later.

Adapting the Loss Ratio Formula for Trading

The loss ratio isn’t just a stuffy metric for big insurance companies — it’s an incredibly powerful tool for any trader looking to get a real edge. While the insurance world talks about premiums and claims, we can borrow the core idea to measure the raw financial efficiency of our trading strategies.

It helps answer one of the most important questions a trader can ask: for every single dollar I make, how much am I losing to get it? Many traders feel the pain of losses but don’t quantify them, which prevents long-term improvement. This formula helps you face the numbers head-on.

This is how the insurance folks visualize it, weighing the money they pay out (claims and expenses) against the money they bring in (premiums).

For our purposes as traders, we can strip this down to what really matters: our wins versus our losses.

The Trader’s Loss Ratio Formula

We can tweak the formula to give us a direct, no-nonsense measure of our performance. The math is straightforward, but the insight it offers is game-changing.

Trading Loss Ratio = Total Losses from Losing Trades / Total Gains from Winning Trades

If the result is below 1.0 (or 100%), it means your winning trades are bringing in more cash than your losing trades are costing you. That’s a good sign you’re on the right track. But if it creeps above 1.0, your losses are starting to outmuscle your gains — a clear warning sign that something needs to change.

This simple number cuts right through the emotional highs and lows of individual trades, giving you a brutally honest look at your bottom line.

A Practical Walkthrough

Let’s get our hands dirty with a real-world example. Looking at your losses isn’t always fun, but confronting this data is your best path toward long-term improvement.

Below is a sample log from a trader’s last 10 positions. We’ll use this to calculate their loss ratio.

Sample Trading Log for Calculating Your Loss Ratio

| Trade ID | Outcome (Profit/Loss in $) | Categorization |

|---|---|---|

| 1 | +$150 | Win |

| 2 | -$75 | Loss |

| 3 | +$200 | Win |

| 4 | -$100 | Loss |

| 5 | -$50 | Loss |

| 6 | +$90 | Win |

| 7 | -$120 | Loss |

| 8 | +$250 | Win |

| 9 | -$60 | Loss |

| 10 | -$80 | Loss |

First, we need to separate the wins from the losses to get our totals.

- Total Gains: Let’s add up all the winning trades: $150 + $200 + $90 + $250 = $690

- Total Losses: Now, we’ll do the same for the losing trades: $75 + $100 + $50 + $120 + $60 + $80 = $485

With our two totals, we can plug them straight into the formula:

$485 (Total Losses) / $690 (Total Gains) = 0.70

The trading loss ratio here is 0.70, or 70%. So, what does this actually mean? For every single dollar this strategy generated in profit, it gave back 70 cents in losses.

This metric is just one piece of the puzzle, of course. But truly understanding your personal profit or loss formula is a huge step toward building the discipline and clarity needed for long-term success.

How to Interpret Your Loss Ratio for Smarter Decisions

Figuring out your loss ratio is the easy part. The real skill is turning that number into smart, actionable intelligence that actually sharpens your strategy. A single percentage can tell you a powerful story about how well you’re managing risk and whether you’re on the path to profitability.

In the insurance world, the loss ratio is a constant balancing act. If it’s too high, it’s a red flag that underwriting is too risky or premiums are set too low. But if it’s too low, it could mean premiums are so expensive that customers are heading straight to competitors.

Insurers typically aim for a loss ratio between 40% and 60%. This is the sweet spot that suggests a healthy balance between paying out claims and staying financially stable, as explained in more detail in these insurance finance insights from the Corporate Finance Institute.

The Trader’s Perspective

For traders, the story is a bit different but just as important. A loss ratio of 70% isn’t automatically “good” or “bad.” Its real meaning only comes to light when you pair it with another crucial metric: your win rate. Think of them as two sides of the same coin; together, they give you a complete picture of your strategy’s health.

A high loss ratio can be totally fine if you have a high win rate to match. A scalper, for instance, might rack up dozens of small wins that more than cover the occasional larger loss. The real danger zone is a high loss ratio combined with a low win rate — that’s a clear signal your losses are both frequent and painful.

Ultimately, your goal is to see how these two numbers dance together. Looking at them side-by-side helps you step back from the emotional rollercoaster of individual trades and focus on what the data is truly telling you. Trading is a marathon, not a sprint, and these metrics provide the map you need for the long journey.

Thinking Beyond a Single Metric

While the loss ratio is a fantastic diagnostic tool, it only ever tells part of the story. If you rely on it in isolation, you risk getting a dangerously incomplete picture of your performance. Real, long-term success comes from a more balanced and multi-faceted approach.

Think about an insurance company. The loss ratio formula only looks at claims and the costs tied directly to them. It completely ignores all the other crucial expenses needed to keep the lights on — things like marketing, employee salaries, agent commissions, and technology.

This is exactly why insurers lean so heavily on another key metric: the combined ratio. This figure simply adds the loss ratio and the expense ratio together, giving a much more holistic view of whether the company is actually making money.

Broadening Your Trading Dashboard

Traders have to think the same way. Your loss ratio is absolutely critical, but it doesn’t capture everything. A truly successful trading system depends on a whole dashboard of metrics working together in harmony. Success isn’t about finding a secret formula; it’s about building a disciplined, data-driven process.

You also need to keep a close eye on other vital signs:

- Trade Frequency: How often does your strategy actually give you a signal? A great loss ratio doesn’t mean much if you only get one trade a year.

- Position Sizing: Are you risking too much on any single trade? Sloppy risk management can blow up an account, even with a strategy that has a solid loss ratio on paper.

- Maximum Drawdown: What’s the biggest hit your account has taken from a peak? This number measures the psychological pain and the real risk of ruin.

A disciplined trader understands that no single metric defines success. The goal is to build a complete and honest assessment of your performance by analyzing multiple data points together.

The loss ratio also has serious implications in the wider financial world. Regulators watch these numbers closely to make sure insurers can actually pay out claims. A ratio that consistently creeps over 100% is a huge red flag that a business is unsustainable.

Instead of getting fixated on one number, treat your loss ratio as a starting point for deeper questions. It’s most powerful when you pair it with other performance indicators, like the ones we cover in our guide to understanding the profit factor in trading.

Answering Your Top Questions About Loss Ratio

Once you start using the loss ratio formula, a few practical questions almost always pop up. Let’s tackle the common sticking points so you can use this metric with complete confidence.

Can a Loss Ratio Go Over 100 Percent?

Absolutely. While a loss ratio over 100% is a massive red flag, it’s more common than you might think. For an insurance company, it means they paid out more in claims and expenses than they collected in premiums during that period — an underwriting loss.

For a trader, it’s a clear sign that your total losses were greater than your total profits. The strategy was unprofitable for the period you measured. This isn’t a final judgment on your skills, but it’s a critical signal telling you it’s time to review your strategy, risk management, or position sizing. This is not a moment to panic, but a moment to pause, analyze, and adjust.

How Often Should I Calculate My Trading Loss Ratio?

The best answer really depends on your trading style. There’s no one-size-fits-all rule, but whatever you choose, consistency is key.

- Active day traders might run the numbers weekly to get fast feedback on their performance.

- Swing traders often find a monthly review works best, as it aligns better with the duration of their trades.

- Long-term investors may only need to check in quarterly or even annually to see the bigger picture.

Calculating it regularly helps you spot when things are starting to slip. It creates a feedback loop that lets you make smart adjustments before a small issue snowballs into a major problem.

Is a Super Low Loss Ratio Always Good?

Not always. Context is everything here. In the insurance world, an extremely low loss ratio might mean premiums are way too high, scaring away customers. It could also suggest the company is being too strict with claims, which can destroy its reputation over time.

For a trader, a very low loss ratio is usually a good thing, but you have to look at it alongside your win rate and how often you trade. A strategy with tiny losses is great, but if it only produces a handful of tiny wins, it might not be profitable enough to be worth your time. This is a perfect example of why you need to analyze your metrics together to get the full story.

Ready to stop guessing and start analyzing? TradeReview provides the performance analytics you need — including your win rate, profit factor, and equity curve — all in one clear dashboard. Track your trades with precision and make data-driven decisions. Get started for free at https://tradereview.app.