At its core, the simple loss profit formula is your trade’s selling price minus its buying price, multiplied by the quantity you traded. But this isn’t just a math equation; it’s the bedrock of discipline that separates hopeful amateurs from consistent traders. It is your ultimate source of truth in a market filled with uncertainty.

The Real Foundation of Successful Trading

Let’s be honest — starting out in trading can feel like trying to navigate a storm without a compass. Many new traders get lost chasing complex strategies and “secret” indicators, hoping to find a shortcut to easy profits. We understand the struggle; the pressure to perform can be immense. In the process, many overlook the most powerful and fundamental tool they have.

The loss profit formula is that compass. No, it’s not a secret code that unlocks guaranteed wins — nothing can do that. Instead, it’s the simple, unshakable foundation of discipline that every successful trader builds their long-term career upon. This basic calculation cuts through the market chaos, helping you shift from emotional, gut-based reactions to clear, data-driven decisions.

Why This Simple Math Matters

When you truly understand your numbers, you’re speaking the language of the market. It lets you objectively measure what’s working and what isn’t, turning every single trade — win or lose — into a valuable lesson. Without this clarity, you’re just guessing, and guessing is a quick way to drain an account.

The idea of measuring performance isn’t new; it’s a concept that has evolved alongside economic theory for centuries. Early industrial capitalism relied on basic profit ratios to figure out if a venture was successful. Over time, as economists debated profitability trends, the formulas grew more detailed to account for complex market factors. If you’re curious about the deep history, there’s a good overview of profit calculation on Wikipedia.

A trader’s P&L statement is their report card. It doesn’t lie, it doesn’t have biases, and it shows exactly where you need to improve. Treating it as your primary source of feedback is the first step toward genuine, long-term growth.

This guide reframes the loss profit formula, not as a boring chore, but as the single most crucial step toward building a sustainable trading career. By mastering it, you gain:

- Objective Clarity: Replace the emotional highs and lows with cold, hard data about your actual performance.

- Informed Decision-Making: Use past results to refine your strategy, manage risk more effectively, and spot your highest-probability setups.

- Long-Term Discipline: Build the habit of meticulous record-keeping, a non-negotiable hallmark of professional traders.

Ultimately, this formula is your source of truth. It’s what empowers you to trade with confidence and a clear, actionable plan.

How to Calculate Your Basic Profit and Loss

Let’s be clear, the math behind your trading results is refreshingly simple. You don’t need an advanced degree to figure it out — just basic arithmetic. Once you nail down two core formulas, you’ll have everything you need to measure a trade’s outcome. This is the bedrock of building the discipline required for consistent self-analysis.

Every trader starts their journey by learning how to calculate profit and loss on a standard trade where you buy first and sell later. We call this going long, or taking a long position, and it’s the most intuitive way to think about trading.

The formula for a long position is straightforward:

(Sell Price – Buy Price) x Quantity = Profit or Loss

If the number is positive, you’ve made a profit. If it’s negative, you’ve taken a loss. It’s that simple.

A Practical Example of a Long Position

Let’s say you’re optimistic about a stock, which we’ll call ABC Corp, and you think its price is about to climb.

- You buy 100 shares of ABC at $50 per share.

- The stock moves as you expected, and you sell all 100 shares at $55 per share.

Plugging those numbers into our formula:

($55 Sell Price – $50 Buy Price) x 100 Shares = $500 Profit

But what if the trade went against you and the price dropped? If you followed your plan and decided to cut your losses by selling at $48:

($48 Sell Price – $50 Buy Price) x 100 Shares = -$200 Loss

This is a perfect example of disciplined trading — taking a small, planned loss to prevent a much larger one.

What About When You Bet on a Price Drop?

Sometimes, you might believe an asset is overvalued and due for a fall. This is called taking a short position, or “shorting” the stock. The logic is just the reverse of a long trade, and the formula is just as easy. You borrow shares to sell them immediately, hoping to buy them back later at a lower price.

The profit and loss formula for a short position is:

(Entry Price – Exit Price) x Quantity = Profit or Loss

In this case, your “Entry Price” is the price at which you sold the borrowed shares, and your “Exit Price” is what you paid to buy them back to return to the lender.

Key P&L Formulas at a Glance

To make it even clearer, here’s a quick summary of the fundamental formulas you’ll use every day to calculate your profit or loss.

| Calculation Type | Formula for Long Positions | Formula for Short Positions |

|---|---|---|

| Absolute P&L ($) | (Sell Price – Buy Price) x Quantity |

(Entry Price – Exit Price) x Quantity |

| Percentage P&L (%) | (Absolute P&L / Total Cost) x 100 |

(Absolute P&L / Total Cost) x 100 |

These two formulas are the foundation for tracking your performance, whether you’re trading stocks, options, or futures.

Why Percentages Matter More Than Dollars

Knowing your dollar profit or loss is essential, but it doesn’t paint the complete picture. Think about it: a $500 profit on a $1,000 investment is an incredible 50% return. But a $500 profit on a $50,000 investment is a much more modest 1% return.

This is exactly why calculating your return as a percentage is so critical. It helps you compare the performance of different trades on an apples-to-apples basis, regardless of their size. This concept is a cornerstone of what financial pros call Return on Investment, or ROI. If you want to go deeper on this topic, you can learn more about how to calculate return on investment in our detailed guide.

To calculate your P&L as a percentage, you use this formula:

- Percentage Gain/Loss = (Absolute P&L / Total Cost of Trade) x 100

Let’s revisit our winning long trade. The total cost to enter the position was 100 shares x $50 = $5,000.

($500 Profit / $5,000 Cost) x 100 = 10% Gain

Looking at your results in percentages gives you a standardized metric, allowing you to objectively evaluate every single decision you make. It’s a game-changer for understanding what’s truly working in your strategy over the long run.

Adapting the P&L Formula for Different Markets

The basic profit and loss calculation is a great starting point, but thinking it’s a one-size-fits-all formula is a common mistake. To trade with discipline and accuracy, you have to adapt the loss profit formula for the specific instrument you’re trading.

Each market has its own units and conventions. Stocks trade in shares, forex in pips and lots, and options and futures have their own unique terms. Understanding these nuances ensures your P&L calculations reflect what’s actually happening in your account, leaving no room for guesswork.

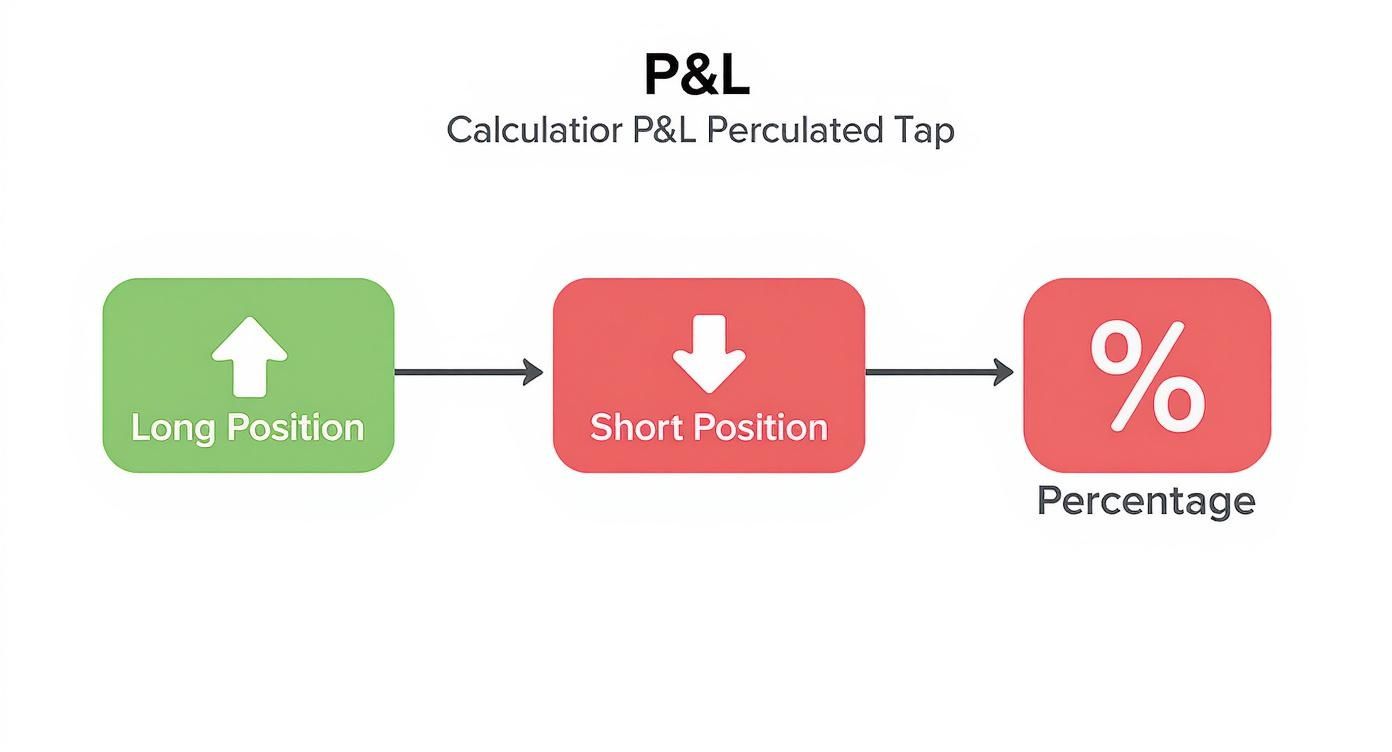

This map breaks down the fundamental flow for both long and short positions, all leading to that final, all-important percentage.

It’s a good visual reminder that no matter the market, the goal is always to translate your trade’s outcome into an objective number you can compare and learn from.

P&L Calculations in Forex Trading

In the world of forex, we don’t typically talk about dollars per share. We talk about pips — the smallest price move an exchange rate can make. The dollar value of a single pip isn’t fixed; it changes based on the currency pair and your trade size, which is measured in lots (standard, mini, or micro).

The formula essentially comes down to the difference between your entry and exit price, multiplied by your trade volume. For instance, if a trader buys one standard lot (100,000 units) of EUR/USD at 1.1050 and sells at 1.1065, they’ve captured a 15 pip profit. If each pip is worth $10 for that lot size, the total profit is $150. For more examples, check out this guide on forex profit calculations on EBC.com.

P&L Calculations in Options Trading

Options trading adds a couple more variables to the mix. Your P&L here is a function of the premium you paid (or received), the contract multiplier (typically 100 shares per contract), and the strike price.

For a basic long call option, where you’re betting the price will rise, the formula looks like this:

P&L = [(Stock Price at Expiration – Strike Price) – Premium Paid] x 100

(Remember, a standard options contract controls 100 shares.)

Let’s walk through a practical example. Say you buy one call option for XYZ stock with a $50 strike price, and you pay a $2 premium per share. The stock moves higher to $55 by the time the option expires.

- P&L = [($55 – $50) – $2] x 100 = $300 Profit

But what if the stock only nudged up to $51? Your P&L would be negative.

- P&L = [($51 – $50) – $2] x 100 = -$100 Loss

P&L Calculations in Futures Trading

Futures work a lot like forex, where gains and losses are measured in standardized price moves called ticks. Every futures contract — from oil to corn to the S&P 500 — has its own tick value and contract size set by the exchange.

The formula is:

P&L = (Exit Price – Entry Price) / Tick Size x Tick Value x Number of Contracts

Here’s how that plays out. Imagine you go long one E-mini S&P 500 (ES) futures contract at 4500.00. For the ES, the tick size is 0.25 and the tick value is $12.50. You ride a move up and sell the contract at 4505.00.

- First, find the number of ticks: (4505.00 – 4500.00) / 0.25 = 20 ticks.

- Then, calculate the profit: 20 ticks x $12.50/tick x 1 contract = $250 Profit.

Getting these market-specific calculations right isn’t just for show — it’s a core discipline for serious performance tracking. It’s how you make sure the data you’re logging is a true reflection of reality.

Uncovering the Hidden Costs That Affect Your P&L

It’s an exhilarating feeling to close a trade for what looks like a solid win. But the number your broker flashes on the screen isn’t always what you actually get to keep. Many developing traders make this mistake — they forget about the small, almost invisible costs that quietly chip away at their returns.

Think of it like running a shop. The price you sell an item for is just revenue. Your real profit is what’s left after you pay for the product, the shipping, and all the other little expenses. Trading works the exact same way. Your gross P&L is only the beginning; to find your true net profit, you have to account for the cost of doing business in the markets.

Getting a handle on these costs isn’t just about good bookkeeping. It’s a core part of risk management that separates disciplined traders from everyone else. If you ignore them, you’re flying blind with a completely warped view of your performance.

The Most Common Trading Costs

Your basic loss profit formula needs a few tweaks to show you the real picture. The exact fees will vary depending on your broker and what you trade, but nearly everyone runs into these.

- Brokerage Commissions: This is the most obvious one. Most brokers charge a fee for every trade or every share you transact. And even if you’re with a “commission-free” broker, they’re often making their money on a wider bid-ask spread — an indirect cost that still comes out of your pocket.

- Exchange and Regulatory Fees: These are tiny fees charged by the exchanges (like the NYSE) and regulators (like the SEC) to execute your trades. They might only be fractions of a penny per share, but they add up fast over hundreds or thousands of trades.

- Taxes: This is the big one that many forget until it’s too late. Depending on where you live and how long you hold a position, your trading profits are usually subject to capital gains taxes. This needs to be part of your long-term financial planning.

Dealing With Dynamic Variables Like Slippage

Beyond the fixed fees, you’ll also face dynamic costs that are much harder to pin down. The most notorious of these is slippage — that frustrating gap between the price you thought you’d get and the price where your order actually filled.

Slippage usually bites you in fast-moving, volatile markets or when you’re trading something with low liquidity. For instance, you might place a market order to buy a stock at $10.50, but by the time your order goes through, the best available price is $10.52. That $0.02 difference is slippage, and it’s a direct hit to your potential profit.

If you want to dive deeper, our guide on what slippage is in trading breaks down exactly how to manage this unavoidable part of the market.

Acknowledging and tracking every single cost, no matter how small, is a non-negotiable habit. A trader who ignores a $2 commission is the same one who will eventually ignore a $200 risk management rule. Discipline starts with the details.

When you meticulously factor these expenses into your math, your loss profit formula transforms into a tool for genuine clarity. It ensures the numbers in your trading journal reflect reality, giving you an honest, unfiltered look at how well your strategy is really performing.

Realized vs. Unrealized P&L: A Critical Distinction

Here’s a simple truth every trader learns, sometimes the hard way: a profit isn’t really yours until the trade is closed. This is the core difference between unrealized P&L (often called ‘paper’ profit) and realized P&L. Getting this concept straight isn’t just about accounting; it’s fundamental to building the emotional discipline you need to survive and thrive in the markets.

Unrealized P&L is that floating number you see on an open position. It’s the profit or loss you would have if you hit the close button right this second. It’s incredibly easy to get emotionally attached to this figure, but it’s just potential — it’s not yet reality.

Fixating on a big unrealized gain is a classic psychological trap. We’ve all been there. Greed kicks in, and suddenly, a carefully crafted trading plan goes out the window as you start dreaming of an even bigger win. This often leads to watching a perfectly good trade reverse, bleeding profits away, all because we were mesmerized by a paper gain we never bothered to lock in.

The Psychology of Paper Profits

Think of it like the estimated value of your house. It feels great to see that number climb online, but you can’t actually spend that money until you sell the property. Until the deal is done and the cash is in your bank, that value is just a number on a screen, completely at the mercy of the market.

Realized P&L is the only number that actually hits your account balance. It’s the final score of a completed trade and the ultimate source of truth for your performance.

This distinction is more than just a technicality. It’s a mental barrier that reinforces the need for a solid trading plan with pre-defined exits. When you know exactly where you’re taking profits or cutting losses before you even enter a trade, you insulate yourself from the emotional rollercoaster driven by those fluctuating unrealized numbers.

- Realized P&L: This is the concrete result after you’ve closed a position. It’s the number you log in your journal and the one that truly measures your performance.

- Unrealized P&L: This is a temporary, shifting metric for an open trade. Treat it as a guide, not a final result, and maintain your emotional distance.

By focusing your loss profit formula calculations on realized gains and losses, you’re building a foundation of discipline. You learn to follow your plan, turning those fleeting paper profits into real, tangible growth in your account.

Turning P&L Data into Actionable Trading Insights

So, you’ve nailed down how to calculate your profit and loss. That’s a great first step, but it’s just that — a first step. The real growth, the kind that separates consistently profitable traders from the rest, comes from what you do next. It’s about turning those raw numbers into a clear story about your trading habits and strategy.

This is where a good trading journal becomes your most valuable asset. Seriously. Just knowing you won or lost on a trade is surface-level information. The magic happens when you understand the why behind the outcome. A powerful journal goes way beyond the basic loss profit formula; it captures the context and the thinking behind every single click of the mouse.

Going Beyond the Basic Numbers

To really learn from your trades, you need to paint a complete picture. Your journal needs to be more than just a scoreboard — it should be an analytical tool.

Consider adding these fields to your log for every trade:

- Trade Setup: What specific pattern or signal got your attention? Was it a technical breakout, a fundamental catalyst, or something else?

- Rationale for Entry: Write down exactly why you thought this setup was a winner. What gave you conviction?

- Rationale for Exit: Did you exit at your pre-planned target or stop-loss? Or did you panic and close the trade based on emotion? Be honest.

- Emotional State: How were you feeling? Confident? Anxious? Greedy? This self-awareness is crucial.

This process of digging into the “why” isn’t just a trading concept. It’s a core principle in financial analysis. For instance, in business litigation, experts sometimes use a “before and after” approach to calculate lost profits and determine what a company would have earned if not for a specific negative event. You can learn more about these economic methodologies on Rule703.com. For traders, our “negative events” are losing trades, and our journal is how we analyze them to prevent future losses.

Finding Your Edge in the Data

Once you start logging this deeper info consistently, you can ask some game-changing questions. Do you notice that one particular setup is a consistent money-maker? Do you tend to make impulsive mistakes when trading a certain asset? Are your biggest losers the ones where you ignored your own rules?

You can absolutely start with a simple spreadsheet. In fact, our guide on creating an Excel trading journal is a great place to begin building this habit.

But as you grow, modern tools can do the heavy lifting for you, transforming your trade history into visual, easy-to-digest insights.

A dashboard like this can instantly show you patterns you might otherwise miss, like your win rate on Tuesdays versus Fridays, or how your average profit changes with your position size. By analyzing these real metrics, you get an objective, unfiltered look at your own strengths and weaknesses. That clarity is what builds the discipline you need to improve, one trade at a time.

Common P&L Questions Answered

Even after you nail down the basics, a few practical questions always pop up when traders start applying the loss profit formula to their own P&L. Let’s walk through some of the most common ones to clear up any confusion and make sure your calculations are always spot-on.

What Is a Good Profit and Loss Ratio?

This is a very common question, but the honest answer is: it completely depends on your strategy’s win rate. There’s no single magic number that works for everyone.

A scalper, for instance, might do incredibly well with a risk/reward ratio under 1:1 if they are winning 70% of their trades. On the flip side, a trend follower could be very profitable with a 3:1 ratio or higher, even if they only win 40% of the time.

The real goal isn’t a specific ratio but achieving a positive expectancy over the long term. You just need to be sure that your average winning trade is big enough to outweigh your average losing trade, considering how often you win.

How Often Should I Calculate My P&L?

Immediately. For every single trade. As soon as it’s closed.

This isn’t just about bookkeeping; it’s about getting instant feedback on your decisions. Of course, daily, weekly, and monthly reviews are also vital for seeing the bigger picture and tweaking your overall strategy for long-term improvement.

Waiting until the end of the month to review your trades is like trying to navigate using a map you only look at once a day. You need real-time data to make real-time course corrections.

Does the Loss Profit Formula Change for Different Timeframes?

Nope. The core formula stays exactly the same.

It doesn’t matter if you’re a day trader holding a position for five minutes or a swing trader holding for five weeks. The math — your entry price versus your exit price, minus all costs — is universal. The only thing that changes is how long it takes for that profit or loss to be realized.

Stop guessing and start analyzing. With TradeReview, you can automatically sync your trades, track every cost, and turn your P&L data into actionable insights that sharpen your edge. Get your free, powerful trading journal today at https://tradereview.app.