Let’s be real — most new traders are on a quest for the holy grail. They hunt for that one perfect indicator or chart pattern that promises to unlock flawless entries, thinking that’s the secret sauce to making money in the markets. We’ve all felt that pull. But the hard truth? It’s not about finding a magic signal. The single most important factor that separates consistent traders from the crowd is something far less glamorous: risk management.

It’s the practice of identifying, analyzing, and ultimately controlling the financial risks you take on every single trade. This isn’t about trying to dodge losses altogether — that’s a fantasy. Losses are a normal part of this business. Instead, it’s about managing your potential downside so you can survive the inevitable losing streaks and stay in the game long enough to let your strategy work.

Why Managing Risk Is Your Most Important Trade

Let’s be honest — trading is an emotional rollercoaster. The adrenaline rush of a big win is intoxicating, but the gut punch from a major loss can sideline you for good. This is the central battle every trader fights, and it’s where countless promising careers flame out before they even get started. We’ve all felt the sting of a trade going wrong; the key is not letting it define your journey.

So, what’s the real difference between those who build lasting success and those who are just a flash in the pan? It isn’t some secret indicator or a “can’t-miss” setup. The true differentiator is mastering the art and science of trading and risk management.

Shifting from Gambling to Business

This guide is your roadmap to treating trading like a business, not a trip to the casino. When you jump into the market without a solid plan for handling losses, you’re not really trading; you’re gambling. You’re just rolling the dice and hoping for the best.

A smart business owner would never operate that way. They know that costs and potential losses are just part of doing business. They don’t bet the entire company on a single deal; they manage their inventory, control their expenses, and, most importantly, protect their capital.

Effective risk management brings that same professional mindset to your trading account. Forget chasing lottery-ticket wins. It’s time to focus on the one thing you actually have control over: how much you stand to lose.

Think of risk management as the foundation of your trading house. Without it, even the most brilliant strategy will eventually collapse under the weight of an unexpected storm or a string of inevitable losses.

The Long-Term Perspective

The goal isn’t a perfect, loss-free track record. The real goal is longevity. By putting solid risk principles in place, you make sure that no single trade — or even a nasty string of them — can knock you out of the market. This is about playing the long game.

This allows you to survive those tough periods, often called drawdowns, and keep your capital intact so you’re ready to seize the next opportunity. You can get a better handle on these periods by understanding what is maximum drawdown and why it’s a non-negotiable metric for any serious trader.

Ultimately, a strong risk management framework gives you three massive advantages:

- Capital Preservation: First and foremost, it protects your trading account from a catastrophic wipeout. Your capital is your business’s inventory; you must protect it.

- Emotional Stability: It helps neutralize the fear and greed that fuel impulsive, costly decisions. With a plan, you can trade with a clearer head.

- Consistent Growth: It builds a sustainable structure for achieving long-term, repeatable results, not just one-off lucky wins.

Understanding the Risks You Face in the Market

What exactly is ‘risk’ when we talk about trading? It’s more than just a scary word; it’s a fundamental part of the market itself.

Imagine you’re the captain of a ship sailing across a vast ocean. You can’t control the weather — the sudden storms, the strange currents, or the rogue waves. Those things just happen.

But you absolutely can control how well your ship is built, how you navigate, and where you place your life rafts. This is the heart of trading and risk management. You learn to respect the ocean’s power while taking deliberate steps to protect your vessel and your crew.

In the market, these “weather patterns” come in a few distinct forms. The first step toward managing risk like a pro is seeing it not as a single, vague threat, but as a set of forces you can actually prepare for.

The Different Faces of Market Risk

Most traders know that gut-wrenching feeling of a position moving against them. That experience is usually a direct hit from one of three primary types of risk. Knowing which one you’re up against helps you prepare for the right kind of storm.

- Market Risk: This is the most common one you’ll face. It’s the danger that your investment will lose value because of big-picture factors affecting the entire market, like economic news, interest rate changes, or geopolitical events. For instance, a surprise inflation report could send the whole stock market tumbling, dragging your perfectly good stock down with it, no matter how solid your analysis was.

- Liquidity Risk: Ever tried to sell a position but couldn’t find a buyer at a fair price? That’s liquidity risk. It pops up when there aren’t enough buyers or sellers for a certain asset, forcing you to either sell at a steep discount or not sell at all. This is more common in less-traded assets like penny stocks or obscure options contracts, where a large order can drastically move the price.

- Systemic Risk: This is the big one — the risk of a collapse in the entire financial system, not just a single stock or sector. The 2008 financial crisis is the textbook example. When major banks failed, it set off a domino effect that crushed nearly every corner of the global economy, no matter how solid individual companies were.

A Growing Ocean of Opportunity — and Risk

The scale of these risks has grown right alongside the markets. As more people around the world have started trading, the potential for both volatility and widespread impact has shot up.

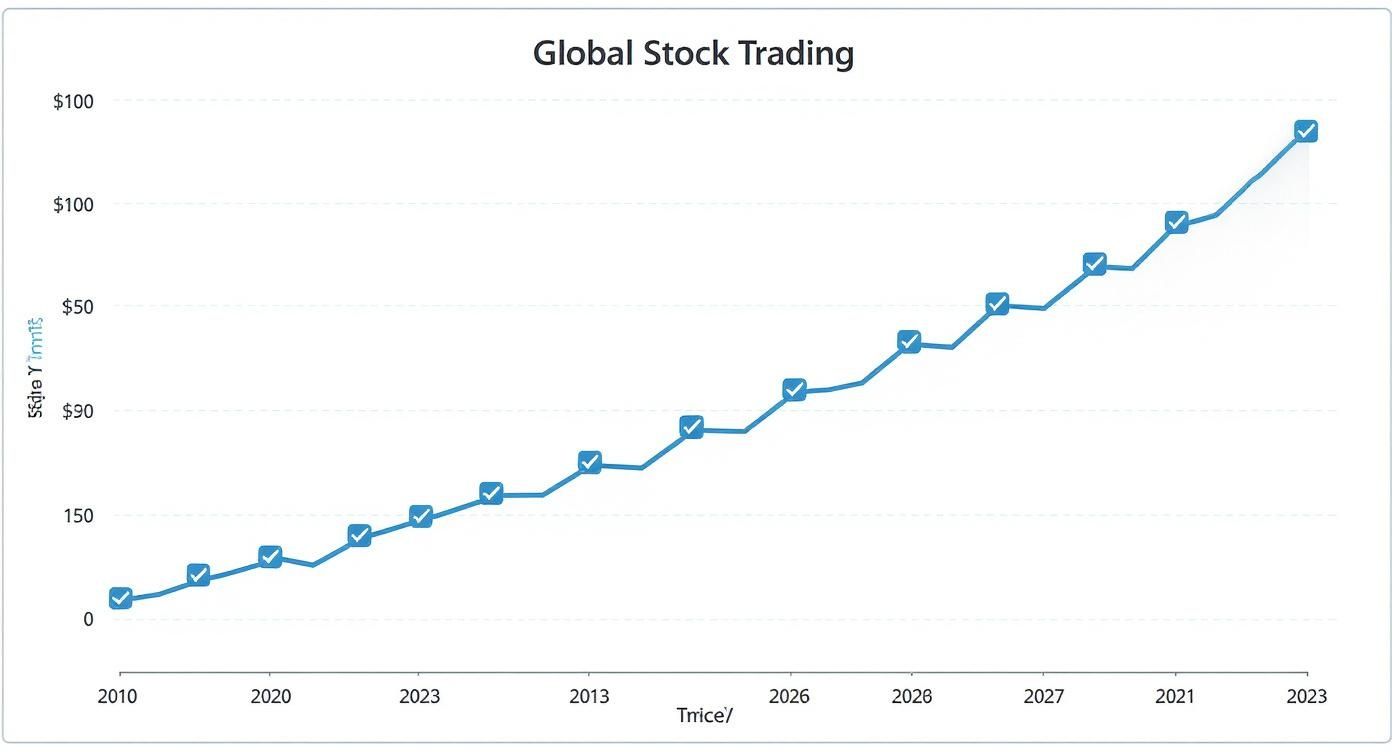

The total value of stocks traded globally soared past $100 trillion in 2023, a massive leap from around $50 trillion in 2010. This explosion in activity creates more opportunities, but it also dials up the danger of flash crashes and systemic shocks. That makes disciplined risk management more critical than ever. You can dig into more historical market volume stats on cboe.com.

This growth highlights a vital point for every single trader: you can’t control these huge market dynamics, but you have complete authority over your personal exposure to them.

You don’t get paid for taking risks; you get paid for managing them well. The market doesn’t reward bravery without discipline. It rewards calculated decisions where the potential upside justifies the carefully controlled downside.

By figuring out which type of risk is most relevant to your strategy, you can start building a defense system tailored to the specific challenges you’re likely to face. This is how you shift from being a passive passenger, tossed around by the waves, to becoming an active captain, navigating with a clear plan.

Your Essential Risk Management Toolkit

Alright, let’s move from theory to action. This is where a trading career is truly built — not on flashy wins, but on solid defense. We’re going to assemble your core risk management toolkit, the essential system every disciplined trader relies on to protect their capital and keep emotions in check.

These aren’t complicated, abstract ideas. They are practical, non-negotiable tools for managing risk in the markets.

As global stock trading volumes have surged, so has the market’s volatility. Just look at the growth in total value traded from 2010 to 2023.

This explosion in activity is precisely why a robust personal risk management plan is no longer optional. It’s essential for survival. Let’s break down the three pillars you need.

Master Your Position Sizing

Hands down, the single biggest mistake new traders make is risking way too much on one trade. It’s a fatal error, and position sizing is your primary defense against it.

Position sizing is just a formal way of saying you decide how many shares or contracts to trade based on a pre-defined risk level — not on a gut feeling about how much you could win.

The simplest and most effective guideline is the 1% Rule. It’s exactly what it sounds like: you should never risk more than 1% of your total trading capital on a single trade.

Let’s make this real. Imagine you have a $10,000 trading account.

- Your Maximum Risk: 1% of $10,000 is $100.

- Your Mission: On any given trade, you are not allowed to lose more than $100. Period.

This simple rule is incredibly powerful. Even if you hit a brutal losing streak of ten straight bad trades, you’d only be down about $1,000 (or 10% of your account). It makes blowing up your account mathematically difficult and gives you the staying power to weather the inevitable drawdowns.

To see the impact of this rule, let’s compare different risk levels during a losing streak.

Position Sizing Scenarios for a $10,000 Account

| Risk per Trade | Dollar Amount at Risk | Account Value after 5 Losses | Total Drawdown |

|---|---|---|---|

| 1% | $100 | $9,509.90 | -4.9% |

| 2% | $200 | $9,039.21 | -9.6% |

| 5% | $500 | $7,737.81 | -22.6% |

Notice how the drawdown grows exponentially. A 5% risk per trade doesn’t just put 5x more capital at risk; it creates a hole that’s nearly impossible to dig out of. Stick to a small, manageable risk percentage.

Set a Hard Stop-Loss Order

If position sizing tells you how much you can risk, the stop-loss order is the mechanism that enforces that limit. Think of it as your pre-planned emergency exit. It’s an order you place with your broker to automatically sell your position if the price hits a specific level, cutting your loss before it spirals.

We’ve all been there. A trade moves against us, and we start hoping it will turn around. A stop-loss removes hope from the equation. It is your commitment to your plan, made when you were calm and objective — not in the heat of a losing trade.

A stop-loss isn’t just a technical order; it’s a promise you make to yourself to protect your capital. Honoring it is one of the greatest acts of trading discipline you can practice.

Setting the right stop-loss is both an art and a science, mixing technical analysis with an understanding of volatility. For a deeper look, our complete guide on how to set stop losses breaks down several effective methods you can start using today.

Define Your Risk/Reward Ratio

The final piece of your toolkit is the risk/reward ratio. This simple calculation makes sure the potential profit of a trade is actually worth the capital you’re putting on the line. It compares what you stand to lose (your risk, from entry to stop-loss) with what you stand to gain (your reward, from entry to profit target).

A common professional standard is to only take trades with a minimum risk/reward ratio of 1:2 or, even better, 1:3. This means for every $1 you risk, you aim to make at least $2 or $3 in profit.

Here’s why this is a complete game-changer:

- Practical Example: You risk $100 per trade (your 1%) and aim for a 1:3 risk/reward ratio.

- Potential Loss: $100

- Potential Gain: $300

With this kind of ratio, you can be wrong more often than you are right and still be profitable.

Think about it. Out of ten trades, you could lose seven of them (7 x -$100 = -$700) and win only three (3 x +$300 = +$900). You’d still walk away with a net profit of $200. This completely changes the psychological pressure of needing to be right all the time, allowing you to focus on executing your strategy over the long term.

How Two Traders Handle the Same Losing Trade

Theory is one thing, but seeing risk management in action is where the lesson truly sticks. Let’s walk through a tale of two traders. They both face the exact same losing trade in the same market, but their approaches — and outcomes — couldn’t be more different.

This isn’t just a hypothetical story. It’s a perfect snapshot of the two paths every trader must choose between. One leads to burnout and a blown-up account. The other leads to discipline, longevity, and a real shot at long-term success.

Trader A: The Emotional Gambler

First, meet Trader A. He’s pretty new to this and just landed a huge win on a tech stock. The feeling is electric. He’s on top of the world, convinced he’s finally cracked the code.

Riding that high, he spots what he thinks is another “sure thing.” Fueled by adrenaline and a nasty case of FOMO, he decides to go all-in. He throws all the rules out the window, dumping 25% of his $10,000 account — a massive $2,500 — into one highly speculative trade.

For a moment, it looks like he’s a genius. The trade moves in his favor, and he’s already spending the profits in his head. Then, the market turns. An unexpected news event sends the stock plummeting. Panic. He’s glued to the screen, watching the red numbers bleed, his heart pounding with every tick down.

“It has to come back,” he tells himself, hoping for a miracle. But the stock freefalls past any logical exit point. Finally, unable to take the pain anymore, he caves and sells for a devastating loss.

In a single trade, Trader A torched $2,500 of his capital, wiping out a quarter of his entire account. The emotional damage is just as bad. He’s drowning in regret, anger, and fear. His confidence is shattered, and his head is no longer clear enough to make sound decisions. This is what happens when you trade without a net.

Trader B: The Disciplined Professional

Now, let’s meet Trader B. She sees the exact same setup as Trader A and likes the potential. But her process is worlds apart. She runs her trading like a business, not a casino trip. Her approach is methodical and completely unemotional.

Here’s her step-by-step game plan:

- Analyze the Setup: First, she confirms the trade meets all the specific criteria laid out in her trading plan. No exceptions.

- Calculate Position Size: She applies the 1% Rule to her $10,000 account. The absolute most she is willing to lose on this trade is $100.

- Set a Stop-Loss: She identifies a logical price level where her trade idea would be proven wrong and places a hard stop-loss order right there.

- Define a Profit Target: She sets a clear take-profit level that gives her a favorable 1:3 risk/reward ratio. She is risking $100 to potentially make $300.

With her plan locked in, she pulls the trigger. Just like with Trader A, she watches the market turn against her on the same piece of news. But here’s the game-changing difference: Trader B feels zero panic.

Her stop-loss order is her pre-commitment to discipline. It’s the circuit breaker that protects her capital and her emotional state from the chaos of the market. She accepted the risk before she even entered the trade.

The stock hits her stop-loss, and the system automatically closes her position. The result? A small, pre-defined, and emotionally painless loss of $100. It’s just 1% of her account — simply the cost of doing business. She makes a few notes in her trading journal and immediately starts scanning for the next quality setup, with her capital and her mindset fully intact.

This idea of proactively managing risk isn’t just for individual traders. In global business, companies face massive risks like currency swings. A 10% drop in a currency’s value can gut profits on exports. To guard against this, they use financial instruments like derivatives to hedge their exposure. You can discover more insights about international trade risks on unctad.org. The core principle is identical: control what you can control.

The difference in outcomes between Trader A and Trader B is night and day. One is emotionally wrecked after losing a quarter of his account. The other lost 1% and is already on to the next opportunity. This story drives home a critical point: your long-term success isn’t defined by your winners, but by how well you manage your losers.

Avoiding Common Psychological Trading Traps

You can have the best technical system in the world, with perfect position sizing and textbook risk/reward ratios, and still lose money. How is that possible? Because the toughest opponent you’ll ever face in the market isn’t a surprise headline or a sudden reversal — it’s the person staring back at you in the mirror.

Even a flawless strategy can fall apart when psychological traps get in the way. This is the human side of trading and risk management, and getting your own mind right is just as crucial as reading the charts.

We’ve all been there. The sting of a loss, the anxiety of watching a big move from the sidelines, or the temptation to bend your rules “just this once.” The first step to becoming a pro is learning to spot these emotional triggers before they take control.

The Revenge Trade

Ever taken a loss, felt that rush of frustration, and immediately jumped back into the market to try and win it back? That impulsive, angry move is a classic revenge trade. It’s not driven by strategy or logic; it’s fueled entirely by emotion.

These trades almost never end well. They tend to be oversized, poorly timed, and completely ignore the rules you painstakingly set for yourself. The market doesn’t know you just lost money, and it certainly has no obligation to give it back.

A single revenge trade can wipe out a week’s worth of disciplined gains. The best defense is an emotional circuit breaker. If you take a hard loss, walk away from the screen for at least an hour. Let your head clear.

The Fear of Missing Out (FOMO)

Another killer is the Fear of Missing Out, or FOMO. This is that gut-wrenching anxiety you feel watching a stock rocket higher without you. The green candles keep stacking up, and an overwhelming urge to jump in right now takes over before all the profit is gone.

This feeling pushes you to abandon your plan and chase a trade that has already left the station. More often than not, you end up buying at the top, right as the disciplined traders who got in early are starting to sell.

To beat FOMO, you need one non-negotiable rule: If a trade doesn’t meet your pre-defined entry criteria, you do not take it. Period. There will always be another opportunity. Your job isn’t to catch every single move, but to catch the ones that fit your strategy.

Bending the Rules on Your Stop-Loss

This is arguably the most destructive habit in trading. You place a stop-loss based on sound analysis, but as the price gets close, you start to rationalize. “I’ll just move it down a little bit,” you tell yourself, “I’m sure it’s about to turn around.”

That isn’t risk management; it’s just hope disguised as a strategy. By moving your stop-loss, you completely invalidate your entire risk calculation. A small, acceptable loss is now allowed to mushroom into a catastrophic one, violating the number one rule of capital preservation.

Here are a few practical rules to build mental discipline and sidestep these traps:

- Create a “Cool-Down” Rule: After three straight losses or hitting your max daily loss, you’re done for the day. No exceptions. This prevents a bad day from snowballing into a disaster.

- Use a Pre-Trade Checklist: Before you enter any trade, you have to tick every box on your list (e.g., Is the setup valid? Is the position sized correctly? Is the stop-loss defined?). This forces a moment of logic before you click the button.

- Never Move a Stop-Loss Further Away: You can move a stop to lock in profits, but you can never move it to increase your initial risk. Once it’s set, it’s sacred.

Building this kind of discipline isn’t easy and it takes conscious effort. It’s all about creating a structured process that keeps your logical, strategic mind in the driver’s seat, not your emotional, reactive one.

Using Your Trading Data to Get Smarter

The best traders are always learning, and their most powerful teacher is their own performance. To really get a handle on trading and risk management, you have to move beyond gut feelings and hunches. The only way forward is with objective, data-driven analysis.

This is where the simple act of keeping a trading journal becomes your greatest strategic advantage.

Think of your journal as more than just a log of wins and losses. It’s a detailed record of your decisions, your mindset, and the market conditions for every single trade. By tracking this, you build a feedback loop that turns trading from a guessing game into a process of constant improvement.

Moving Beyond Profit and Loss

To get real value from your journal, you need to track metrics that show the quality of your process, not just the final score. Your journal should become a rich dataset for analysis.

Here are a few key metrics to get started with:

- Average Risk/Reward Ratio: Are you consistently taking trades where the potential upside actually justifies the risk? This number tells the true story of your trade selection.

- Win Rate vs. Profit Factor: A high win rate feels great, but it’s totally meaningless if your few losses are big enough to wipe out dozens of wins. The profit factor (total profits divided by total losses) tells you exactly how much you make for every dollar you risk.

- Maximum Drawdown: This shows the largest peak-to-trough drop your account has ever taken. It’s a raw measure of how much pain your strategy can dish out and is absolutely crucial for your mental game.

Analyzing your own data is like getting an undeniable, objective report card. The numbers don’t lie, and they will point directly to your biggest weaknesses and most consistent strengths.

Uncovering Your Hidden Trading Patterns

Once you have this data, the real work begins. Your journal is now a tool for finding the hidden patterns that are quietly shaping your results. The insights can be startlingly specific and incredibly valuable.

For example, you might discover that:

- You consistently lose money on Friday afternoons. Maybe it’s weekend anxiety, or maybe it’s the thinning market liquidity.

- Your largest losses almost always happen right after a big winning streak, revealing a tendency to get overconfident and take on way too much risk.

- A specific setup that you feel is a winner actually has a negative expectancy over your last 50 trades.

This is the process of turning raw data into actionable intelligence. It allows you to systematically patch the leaks in your strategy and double down on what’s actually working. For traders looking to test these patterns on historical data, learning how to backtest trading strategies is an essential next step in validating your findings before risking real capital.

Platforms like TradeReview automate this entire process, syncing with your broker to provide dashboards and performance analytics. This saves you from tedious manual entry and gives you instant access to the insights needed to refine your edge. Ultimately, using your data wisely is the final step in treating trading like a professional business — one where every decision is measured, reviewed, and improved upon.

Your Top Risk Management Questions Answered

We’ve dug deep into the principles of risk management, but it’s totally normal for questions to pop up as you start putting these ideas into practice. Let’s tackle some of the most common ones we hear from traders just like you.

Is Risk Management Only for Beginners?

Not at all. In fact, it’s the other way around. Professional traders are often way more obsessed with managing risk than beginners are. Newcomers tend to chase the thrill of a big win, but the pros? They’re laser-focused on protecting their capital and controlling the downside.

Risk management isn’t a training wheel you take off. It’s the engine that drives a long-term trading career. The market is always shifting, and even the best traders on the planet know that one sloppy, oversized loss can wipe out months of hard work. Pros don’t outgrow risk management; they build their entire careers on top of it.

How Much Should I Risk Per Trade?

This is one of the most important questions you can ask. While there’s no single magic number that fits everyone, the professional standard is to risk somewhere between 0.5% and 2% of your total account balance on any given trade. For most traders, especially when you’re starting out, sticking to 1% is the smartest and safest bet.

Risking a small, fixed percentage like 1% makes it almost mathematically impossible to blow up your account. It takes a potentially career-ending losing streak and turns it into a manageable drawdown — one you can recover from, both emotionally and financially.

Can I Still Make Money If I Lose More Trades Than I Win?

Yes, absolutely. This is where the simple math behind a solid risk/reward framework really shines. If you discipline yourself to only take trades with a minimum risk/reward ratio of 1:2 or 1:3, you don’t actually need a high win rate to be profitable.

Think about it: with a 1:3 ratio, you could lose on 70% of your trades and still come out ahead. This completely changes the game. Your goal shifts from trying to be right all the time to simply finding quality setups where the potential upside is significantly greater than the potential loss.

Ready to stop guessing and start analyzing? TradeReview syncs with your broker to give you the data-driven insights you need to master your risk, find your edge, and trade smarter. Start journaling for free and transform your performance.