Think of a daily log book as the black box for your trading career. It’s a systematic record of everything you do in the markets, designed to capture not just the profits and losses, but the why behind every single click. It’s how you turn hunches and gut feelings into cold, hard data you can actually use to improve.

Why a Daily Log Book Is Your Most Critical Trading Tool

Let’s be real — trading is a mental battlefield. We’ve all been there: a few bad trades in a row trigger that knot of frustration in your stomach, tempting you to take a reckless “revenge trade” to win it all back. Fear, greed, and FOMO aren’t just buzzwords; they are powerful emotional impulses that derail even the best-laid plans, leading to inconsistent results and painful mistakes.

This is exactly where a daily log book steps in. It’s more than just a notebook; it becomes your objective coach, your strategist, and your accountability partner all rolled into one. It won’t guarantee profits, but it will give you a fighting chance at consistency.

So many struggling traders get stuck focusing only on the outcome. Did I make money? Did I lose money? This completely misses the most important part of the puzzle — the process. A detailed log forces you to look at the reasons behind your actions, transforming you from a reactive gambler into a proactive business owner who learns from every move.

Moving Beyond Gut Feelings

Relying on memory to improve your trading is a losing game. Our minds are wired with biases; we celebrate the one big win and conveniently forget the five small, undisciplined losses that wiped out those gains. A log book cuts through the noise with an objective, factual history of your performance.

This unbiased record is a goldmine for spotting patterns you’d otherwise never see. After just a few weeks of consistent logging, you might discover some uncomfortable truths:

- Emotional Triggers: Example: You realize you almost always lose money on “revenge trades” right after a losing streak. The log shows you held onto losers for twice as long on those days.

- Time-Based Patterns: Example: Your win rate tanks on Friday afternoons. Maybe it’s fatigue, maybe it’s a lack of focus, but the data doesn’t lie.

- Strategy Flaws: Example: That one chart setup you love? Turns out, it has a terrible risk-to-reward ratio when you look at the last 50 times you traded it.

A trading log is a psychological mirror. It reflects who you actually are as a trader, not who you think you are. That honest feedback is the only real foundation for building discipline.

Cultivating a Professional Mindset

Think about any other high-stakes profession. Pilots use checklists and debriefs. Surgeons review procedures. Professional athletes analyze game footage. Trading is no different. It demands a similar level of rigorous, data-driven self-assessment to succeed in the long run.

Keeping a daily log is the single biggest step you can take to treat your trading like a serious business. It demands discipline, but it’s this daily habit that separates the amateurs who burn out from the pros who build lasting careers.

Your focus starts to shift. Instead of trying to be “right” on every trade, you start concentrating on flawless execution of your strategy — a process you can actually control. Over the long haul, that commitment to process is what carves out a sustainable edge in the markets.

Learning From History’s Master Navigators

To really get why a daily log book is so powerful, let’s look back in time. Picture yourself as a ship’s captain hundreds of years ago, sailing through dangerous, uncharted seas. Your survival — and your crew’s — didn’t hinge on luck. It came down to meticulous, disciplined record-keeping.

That’s the entire idea behind a ship’s logbook, and it’s surprisingly similar to a modern trading journal. Every single day, the captain would jot down the vitals: their position, the wind’s direction, the ship’s speed, and any major events. This wasn’t just a diary; it was a tool for making critical decisions that could mean the difference between safe passage and disaster.

Just as a captain logged the weather, a trader needs to log market sentiment. Where the captain noted the ship’s course, a trader notes their setup and strategy. Each entry was a single piece of a much larger puzzle, helping the navigator learn from past voyages to ensure future ones were safer and more successful.

Timeless Principles of Disciplined Data

If you look at these old logs, you see an incredible dedication to consistency. Early ship logbooks, some from as far back as the 1700s, weren’t just random notes scribbled on a page. They were highly structured records with specific columns for everything from latitude and longitude to weather conditions, creating a goldmine of data for later analysis. You can explore more about how these detailed historical logs tell a story through data.

This historical perspective teaches us a huge lesson. The challenges might have changed — we’re dealing with market volatility instead of ocean squalls — but the core solution is exactly the same: disciplined data collection.

A ship’s log turned a perilous journey into a calculated voyage. In the same way, a trading log turns speculative gambling into a structured business. The goal isn’t just to reach a destination but to understand exactly how you got there.

Charting Your Course in the Markets

This age-old practice really drives home the importance of long-term thinking. A single day’s entry in a logbook might seem pretty minor on its own. But stack up months of those entries, and you’ve got an invaluable map. They showed which routes worked, which were filled with danger, and why.

Your daily log book does the exact same thing. It lets you chart your own performance, pinpointing the “safe passages” (your most profitable strategies) and the “hidden reefs” (the mistakes you keep making). It’s easy to feel lost in the day-to-day noise of the market, but your log gives you the navigational charts you need to stay on course.

It’s proof that sustainable success is rarely an accident; it’s meticulously recorded, reviewed, and repeated.

How to Build Your Ultimate Trading Log Book

Building a powerful daily log book isn’t about downloading some generic, one-size-fits-all template. It’s about creating a tool that’s uniquely yours — one that reflects your specific trading style, strategies, and personal goals. Whether you prefer a physical notebook or a spreadsheet, the core principles are the same.

The real magic happens when you move beyond just tracking profit and loss. True, lasting improvement comes from capturing the full story behind every single trade. This means recording not just the hard numbers, but also the subtle, human elements that drove your decisions. You want to build a record so clear that you can look back at a trade from weeks ago and instantly remember what you were thinking and feeling.

The Two Types of Essential Data

To be truly effective, your log book needs to balance two very different but equally critical categories of information. Think of them as the “what” and the “why” of every trade you take.

- Quantitative Data (The What): This is the objective, numerical information. It’s the black-and-white data — entry price, exit price, P/L — that gives you a factual baseline of your performance. Jargon Buster: Think of this as the “hard data.”

- Qualitative Data (The Why): This is the subjective context surrounding the trade. It captures your mindset, your rationale, and your emotional state. This is often where the real reasons for your wins and losses are hiding. Jargon Buster: This is the “story” behind the numbers.

One of the most common mistakes traders make is focusing only on the quantitative. Sure, the numbers are important, but they’ll never tell you why you decided to ignore your stop-loss or revenge-trade after a loss. Capturing the qualitative side is how you start to master your own trading psychology, which is essential for long-term consistency.

Essential Fields for Your Daily Log Book

So, what should you actually be tracking? The key is to start simple and then add more detail as the habit of logging becomes second nature. Don’t try to track 20 different things on day one.

Here’s a breakdown of fields that can help, split between what a beginner needs versus what a more advanced trader can use for deeper analysis.

| Field Category | Beginner Log Entry (The Essentials) | Advanced Log Entry (For Deeper Insights) |

|---|---|---|

| Trade Setup | Trade Rationale: Why did you take this trade? (e.g., “Price broke above key resistance on high volume”) | Strategy/Setup: Name the specific strategy used (e.g., “Breakout Pullback”). |

| Execution | Entry & Exit Price: The exact prices you bought and sold. | Execution Quality: Rate your entry/exit from 1-5. Did you get slippage? |

| Risk | Position Size: How many shares/contracts. | Risk/Reward Ratio: What was the R:R at entry? |

| Management | Stop-Loss & Take-Profit: Where were your planned exits? | In-Trade Decisions: Did you move your stop? Why? (e.g., “Moved stop to breakeven after 1R profit”) |

| Outcome | Profit/Loss (P/L): The final result in dollars and %. | Maximum Favorable/Adverse Excursion (MFE/MAE): How far did the trade go in your favor or against you? |

| Psychology | Emotional State: How did you feel? (e.g., confident, anxious). | Psychological Triggers: Note specific feelings like FOMO, greed, or impatience. |

| Review | Post-Trade Notes: What went right? What went wrong? | Lessons Learned: A concrete takeaway or rule to implement for next time. |

Starting with the “Beginner” column is more than enough to build a solid foundation. As you get more comfortable, expanding to the “Advanced” fields will unlock a whole new level of insight into your trading patterns.

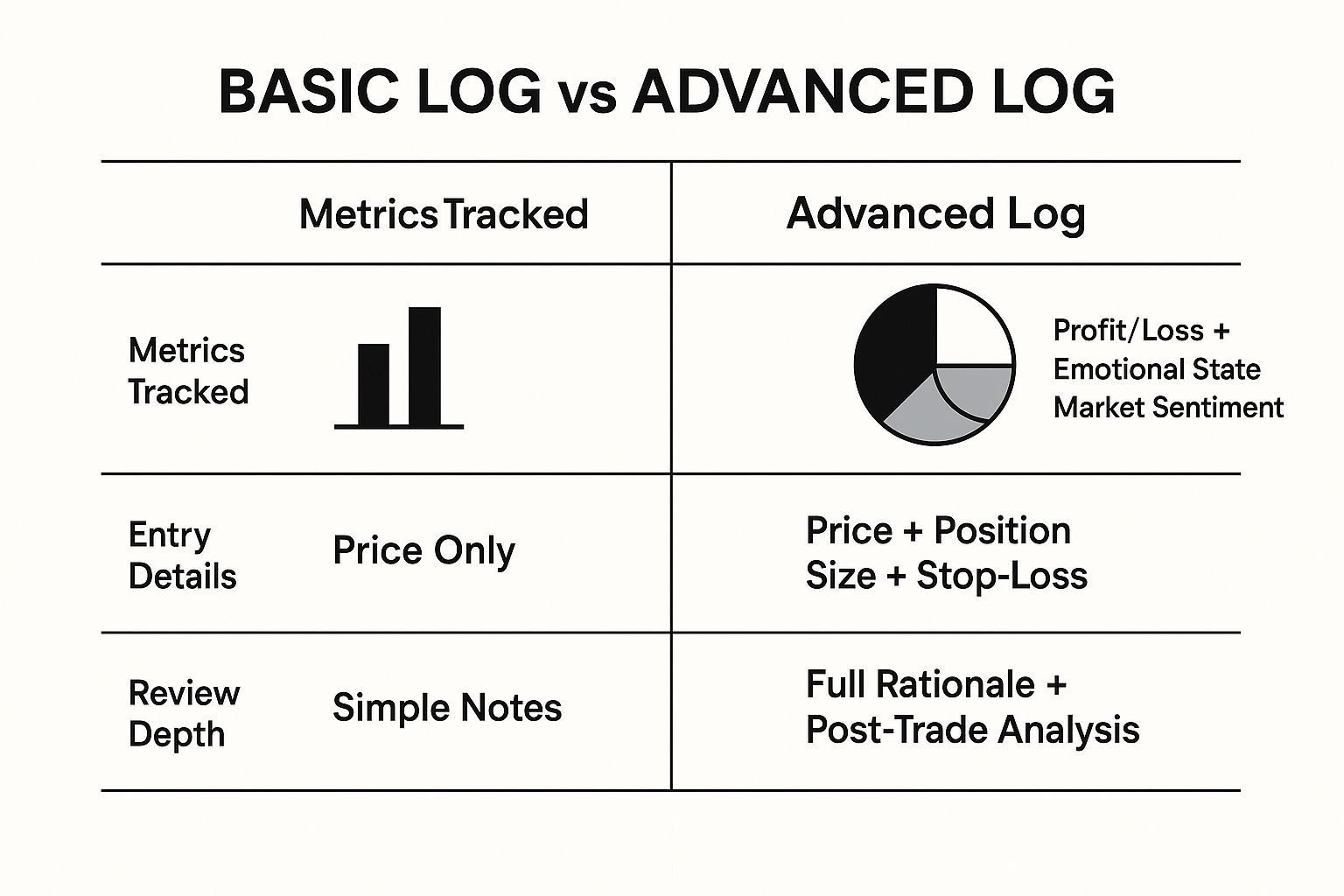

This infographic does a great job of showing that evolution — from a basic log to a more sophisticated one designed for serious analysis.

As you can see, advanced logging isn’t about adding more columns just for the sake of it. It’s about adding layers of context that bring your behavioral patterns to the surface.

If you’re ready to get started with a digital log, our guide on a trading journal template for Excel is a fantastic place to begin. Remember, building this habit is a journey, not a sprint, and your log book should grow and evolve right alongside you.

Turning Your Data Into Actionable Trading Insights

Keeping a detailed daily log book is a huge win, but its real power isn’t in the recording. It’s in the review.

Just collecting data without ever looking at it is like filming every practice session but never watching the tape to see where you’re going wrong. The goal isn’t just to have a history of your trades; it’s to learn from that history so you don’t keep making the same expensive mistakes.

This is where the real work — and the real growth — kicks in. We’ve all been there. You take a bad trade, feel that pit in your stomach, and swear you’ll “do better next time.” But without a structured review, that’s just an emotional reaction, not an actual plan for improvement.

Your log book is the objective proof you need to turn those vague promises into concrete, actionable trading rules. It’s the bridge between knowing you have a problem and actually fixing it.

The Power of the Weekly Review

Discipline is built on routine. The single most effective way to start using your data is to schedule a weekly review and treat it like a non-negotiable appointment.

This is your time, away from the blinking lights of the live market, to calmly and objectively break down your performance. No distractions, no excuses.

During this review, you’re not just glancing at your profit and loss. You’re putting on your detective hat, hunting for the clues and patterns hidden in your own trading data. Your mission is to answer the tough questions.

- Which of my setups actually made money this week?

- What was I feeling on my biggest losing trades? Was it FOMO? Revenge?

- Did I stick to my plan on every single trade? If not, why not?

Your weekly review is where you stop being a player in the market and become an analyst of your own behavior. This shift in perspective is what separates traders who get better from those who just spin their wheels.

Identifying Your Hidden Trading Habits

Over time, your log book will start to paint a brutally honest picture of your trading personality. You’ll begin to spot patterns you were completely oblivious to in the heat of the moment. These insights are pure gold because they show you exactly what you need to work on.

Practical Example:

- Time-Based Errors: You see a clear pattern that 80% of your impulsive, rule-breaking trades happen on Friday afternoons. The fix? You create a new rule: “Stop trading after 1 PM on Fridays or reduce position size by 50%.”

- Strategy Performance: You realize your “mean reversion” strategy is just churning your account, while your “breakout” strategy is a consistent winner. The insight here is to put more of your focus and capital behind the strategy that has a proven edge. You can learn how to formally test these ideas in our guide on how to backtest trading strategies.

- Emotional Triggers: By tagging your trades with how you felt (“Anxious,” “FOMO,” “Confident”), you might notice that every single trade you took out of FOMO ended up being a loser. The new rule? “If I feel FOMO, I must step away from the screen for 10 minutes. No exceptions.”

This is how your daily log book transforms from a simple record into your personal performance coach. It helps you build a playbook based on your own data, letting you systematically weed out your weaknesses and double down on what actually works.

Overcoming the Most Common Journaling Pitfalls

Let’s be honest: even with the best intentions, actually keeping up with a daily log book is tough. Life happens. A string of red days makes you want to shut down your computer and walk away. The initial burst of motivation starts to fizzle out.

This is a completely normal part of the process, and every successful trader has been there. It’s a struggle we all face.

The secret isn’t about being perfect; it’s about building a habit that can survive the chaos of real life. So, let’s tackle the most common roadblocks head-on with some practical solutions. Your log is meant to be a tool for growth, not another source of stress.

When Consistency Feels Impossible

“Ugh, I totally forgot to log my trades today.” We’ve all said it. The number one reason traders ditch their log is that they miss a day or two and feel like they’ve already failed. The all-or-nothing mindset is a killer here.

Instead of aiming for a flawless record, the goal is to make the process as easy and frictionless as possible.

- Set a specific time. Block out just 15 minutes at the end of your trading day. Put it on your calendar like any other appointment. Treat it with that same level of importance.

- Keep it simple. Feeling overwhelmed? Strip your log down to the bare essentials: entry, exit, P/L, and one quick sentence on your thinking. You can always flesh it out later when you have more energy.

- Follow the “Two-Day” Rule. This is a game-changer for building long-term discipline. You can miss one day. It happens. But never miss two days in a row. This simple rule stops a small slip-up from turning into completely abandoning the habit.

Dealing with the Pain of Recording Losses

Logging a winning trade is fun. It feels great. Logging a loss? That’s a whole different beast. It can feel like you’re just pouring salt in a fresh wound, forcing yourself to relive a mistake you’d much rather forget.

But this is precisely where the real growth happens. We know it’s hard, but facing these losses is the only path forward.

Think of your losses not as failures, but as tuition you’ve paid to the market. Each losing trade you record and analyze is a lesson you’ve paid for — don’t let that lesson go to waste.

When you reframe it like that, the act of logging a loss becomes an investment in your future. It’s a professional habit that directly helps you sidestep bigger, more painful mistakes down the road. This mental shift takes you from an emotional gut reaction (“I can’t believe I did that!”) to a cool, logical analysis (“Why did I do that, and what can this teach me?”). Acknowledging and documenting your mistakes is the fastest way to get rid of them for good.

The Evolution from Paper Logs to Digital Analysis

The jump from a simple paper notebook to a powerful digital daily log book is a huge milestone in any trader’s career. It’s part of a much bigger story about how we’ve learned to work with data. Not long ago, trying to pull real insights out of a stack of physical records was an absolute grind, requiring an almost obsessive level of dedication.

This isn’t a new problem. Just look at the monumental effort in the 1930s to digitize old maritime logs. Teams of people were hired to manually transfer handwritten ship data onto punch cards. — one of the earliest ways to store machine-readable information. This painstaking work created the foundation for large-scale data analysis, turning a bunch of disconnected records into something searchable and powerful. You can read more about the long history of logbooks as data if you’re curious.

From Manual Entry to Automated Insight

That leap from paper to punch card is the perfect metaphor for today’s trader. A handwritten journal is fantastic for building discipline, but a digital tool takes its potential and multiplies it by a thousand.

Instead of spending your evenings hunched over a calculator trying to figure out your performance metrics, modern journaling software crunches the numbers for you instantly. This tech doesn’t get rid of the core reason we keep a log; it just supercharges it.

The point of a digital log book isn’t just to store your trades more neatly. It’s to free up your mental bandwidth so you can focus on what actually moves the needle — analyzing your behavior and improving your strategy.

The Benefits of a Digital Daily Log Book

When you make the switch from pen and paper to a digital platform, you unlock a whole new world of capabilities that are just impossible to do by hand. The advantages show up right away and have a direct impact on how fast you can improve.

- Automated Data Sync: Many platforms connect straight to your broker, which means no more manual entry mistakes and a lot more time back in your day.

- Advanced Performance Analytics: You can instantly see your equity curve, win rate by strategy, and dozens of other key metrics without lifting a finger.

- Effortless Searching and Filtering: Need to find every trade where you had a “FOMO entry” or traded on a “news-driven” event? A few clicks and you can spot those repeating patterns in seconds.

At the end of the day, a digital log book takes over the boring data collection, so you can pour your energy into analysis and execution. It’s the perfect blend of timeless discipline and modern precision.

Common Questions About Daily Log Books

Let’s tackle a few of the practical questions that pop up when traders start building their daily log book. The goal here is to give you clear, straightforward answers so you can get started with confidence.

Physical Notebook or Digital Software?

Honestly, this comes down to what works for you. Both have their pros and cons, and there’s no single “right” answer.

A physical notebook is simple and direct. The act of physically writing things down can force you to slow down and think more deeply about each trade. On the flip side, digital tools — like a basic spreadsheet or a dedicated journaling app — are incredible for sorting, filtering, and running analytics automatically.

A good path to take? Start with a simple spreadsheet to get the habit down. Once you’re consistent and find yourself wanting more powerful insights, you can start looking into specialized software.

How Often Should I Review My Log Book?

The real magic of a log book comes from consistent review. It’s not just a data dump; it’s a tool for learning.

You should be logging every single trade right after it closes. Don’t wait. The details, especially your emotional state and the “why” behind the trade, are freshest in that moment.

Then, set aside time for analysis. A deep dive at the end of each week is perfect for catching short-term patterns in your performance. Beyond that, a monthly review is crucial for seeing the bigger picture, tracking progress toward your goals, and spotting those larger strategic flaws you might miss day-to-day.

This review process is where the real growth happens. It’s how you turn raw data into an actionable plan for the next trading week, systematically leveling up your decision-making over time.

What’s the Single Most Important Thing to Track?

While all the numbers matter, the one field that will change your trading more than any other is your Trade Rationale.

Before you even think about hitting the “buy” or “sell” button, write down exactly why you’re taking this trade. What in your strategy is telling you to act right now? Example: “Price is pulling back to the 20 EMA in an uptrend, forming a bullish hammer candle. This is my ‘Trend Pullback’ setup.”

After the trade is over, go back and compare the outcome to what you wrote down. This simple habit is the fastest way to shine a light on emotional decisions, catch yourself when you’re drifting from your strategy, and refine your approach based on what actually works. It creates a powerful feedback loop that builds true discipline.

Ready to stop guessing and start analyzing? TradeReview offers a powerful, free platform with performance analytics, a visual trade calendar, and automatic broker sync to make your logging process seamless. Take control of your trading performance by signing up for your free journal today.